How to stop child support bank levy

What can I do if DOR/CSE seizes -“levies” my bank account?

If you do not pay your child support, the Department of Revenue Child Support Enforcement Division (DOR/CSE) can seize your bank account to pay for the child support you owe. Seizing your bank account to pay a debt is called “levying.”

Before the DOR/CSE can levy your bank account it must send you a Notice of Child Support Delinquency. The notice tells you

- the amount you owe and

- that you have 30 days

- to pay the full amount, or

- send in the form that asks DOR/CSE /CSE to review its decision that you owe back child support. This is an Administrative Review.

If you send in a written request for an Administrative Review, the DOR/CSE can only start to levy your bank account after they send you the results of the review.

If you do not pay the money or you do not ask DOR/CSE to review its decision the DOR/CSE can levy your accounts.

Can the DOR/CSE freeze all of the money in my bank accounts?

The DOR/CSE cannot freeze money in your bank account if it comes from:

- Transitional Assistance to Families with Dependent Children (TAFDC),

- Transitional Aid to Needy Families (TANF),

- Emergency Assistance for Elderly, Disabled, and Children (EAEDC), Supplemental Security Income (SSI), or

- State Veterans' benefits.

And, the DOR/CSE cannot freeze money that does not belong to you.

For example

If you are a court-appointed guardian for someone and have money in your account that belongs to that person, the DOR/CSE cannot take those funds.

If the DOR/CSE freezes this kind of money, you can send in a bank levy response form. Use this form to tell DOR/CSE to “unfreeze” money they should not have frozen.

How long is the bank levy in effect?

The bank levy is in effect for 60 days or until the back child support is paid, which ever comes first.

How does DOR/CSE start a levy of my bank account?

The DOR/CSE sends a Notice of Levy to the bank. The Notice tells the bank to “freeze” money in your account for 21 days. After 21 days, the bank must send the child support you owe to DOR/CSE.

Does DOR/CSE let me know that they levied my bank account?

Yes.

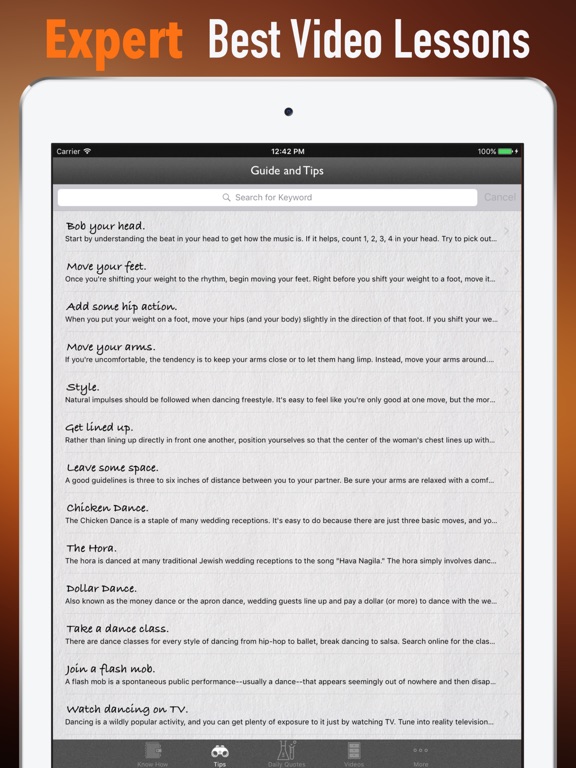

After they levy your bank account, DOR/CSE sends you a Bank Levy Response Form.![]() At the top of the Form it says, “Your bank account has been levied by the Child Support Enforcement Division of the Department of Revenue (DOR/CSE) to collect past-due child support.”

At the top of the Form it says, “Your bank account has been levied by the Child Support Enforcement Division of the Department of Revenue (DOR/CSE) to collect past-due child support.”

They also send you a copy of the Notice of Levy that they sent to the bank. See the Bank Levy section in the DOR/CSE child support enforcement brochure

Can I stop DOR/CSE from seizing my bank account?

You can stop DOR/CSE from seizing your bank account if:

- The amount of past-due support in the Notice of Levy is more than you owe.

- Some or all of the money in your account comes from benefits like Supplemental Security Income (SSI), Transitional Assistance to Families with Dependent Children (TAFDC), Transitional Aid to Needy Families (TANF), or Emergency Aid for Elderly, Disabled, and Children (EAEDC).

- The money does not belong to you. For example, if you are keeping money for someone else in your account because you are their legal guardian.

- The levy causes you a severe hardship.

Hardship

If your life is incredibly difficult because the DOR/CSE freezes your money, you can check the box on the bank levy response form that says, “The levy of my account causes me a severe hardship for the reasons stated below.”

Some reasons that the bank levy might cause a severe hardship for you are that the levy:

- keeps you homeless, or makes homeless,

- keeps you from buying food,

- makes your home’s water or electricity get shut off,

- keeps you from going to work or looking for work,

- makes you lose your job,

- keeps you from getting medical help for yourself or your children,

- keeps you from getting education services for your child with special needs,

- keeps you from buying basic clothing,

- keeps you from paying your employees,

- makes you lose your business or go into bankruptcy, or

- keeps you in an abusive relationship.

How can I stop DOR/CSE from seizing my bank account?

Fill out the Bank Levy Response Form within 15 days from the date on the Notice of Levy.

On the Bank Levy Response Form check your reasons for stopping the levy.

Important

You need to include documentation for any reason you have checked.

Send in the Bank Levy Response Form within 15 days from the date on the Notice of Levy.

When DOR/CSE gets your Bank Levy Response Form they review the decision to levy your accounts.

After DOR/CSE reviews the decision to levy your account, they send you a letter. They may decide the levy was wrong. If it was wrong, DOR/CSE will undo the levy.

What can I do if DOR/CSE decides it was right to levy my bank account and I disagree?DOR/CSE may decide they were right to levy your account. If you think that DOR/CSE’s decision to levy your bank account was illegal, you can ask a court to review what DOR/CSE did.

Asking a court decide if the bank levy is legal is asking for “judicial review.”

Judicial review is a complicated process. Talk to a lawyer to find out about judicial review of DOR/CSE’s decision to seize your bank account

To get a judicial review, you must file a Complaint for Judicial Review within 45 days of the date of the DOR/CSE’s written decision.

Note

DOR/CSE’s decision on hardship claims is final. You cannot get the court to review hardship decisions.

But, there is another option. It is a “Complaint for Equitable Relief.” It is a very difficult and complex court process. Talk to a lawyer to find out about equitable relief.

Understanding a Bank Levy and What You Can Do About It

Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

In a Nutshell

If a creditor can establish that you have an unpaid debt, they may be able to use a collection action called a bank levy. This allows them to seize the funds you owe directly from your bank account. Most creditors will have to jump through some legal hoops to do this, but some government agencies don’t need to go to court before levying your bank account.

Written by Attorney William A. McCarthy.

Updated October 24, 2021

If a creditor can establish that you have an unpaid debt, they may be able to use a collection action called a bank levy. This allows them to seize the funds you owe directly from your bank account. Most creditors will have to jump through some legal hoops to do this, but some government agencies don’t need to go to court before levying your bank account.

A bank levy can be especially harsh if it cleans out your account, but there may be ways to protect some or all of your money. Learning about the rules, including your defenses, will help you know what to do and when to seek additional help.

What Is a Bank Levy?

A bank levy is a tool that creditors can use to seize funds from a debtor’s bank account to satisfy an unpaid debt. This debt could be from an unsecured loan, a medical bill, or a student loan. The IRS can even use a bank levy to collect unpaid taxes.

To initiate a levy, creditors will serve documents on the bank or financial institution where your account is held. The bank then freezes or puts a hold on the funds subject to the levy. This will typically be the money you have stored in your checking or savings accounts. You should have the opportunity to challenge a levy in court. If the challenge isn’t successful, the bank will send the funds to the creditor to satisfy the debt.

It takes time and money for lenders to seize funds from an account. They also don’t know your account balance before heading into the levy process. Because of this, creditors usually only use a bank levy once they’ve exhausted all other means to collect the unpaid debt.

How Do Bank Levies Work?

The levy process starts with a past-due debt and a creditor looking for ways to collect. It usually follows less formal collection efforts, like collections calls. Most lenders have to get court approval to levy an account. Court approval generally begins with the creditor filing a lawsuit against you. If they are successful, the court will issue an order stating how much you legally owe. This is called a money judgment. This is the best, and sometimes only, time for you to challenge the actual amount owed.

If they are successful, the court will issue an order stating how much you legally owe. This is called a money judgment. This is the best, and sometimes only, time for you to challenge the actual amount owed.

The money judgment gives the lender various ways to collect, including placing a levy on your accounts. State law will determine exactly how they can get money from an account and if there are any limits to how much money they can take or any funds that are exempt. To levy an account, a creditor must have the necessary legal documents. This includes the money judgment and anything else required by state law. Some states, for example, require a separate writ of execution (similar to a court order) identifying the accounts that will be levied.

Once the creditor provides the bank with the levy documents, the bank will freeze the account. This will stop all withdrawals. If you have more funds in your account than what you owe on the debt, the lender can only the funds in the amount that you owe. The freeze will be in place for several weeks, generally 21 days. You may or may not be notified that the levy is in progress. As if the levy itself isn’t bad enough, banks may even charge you a fee to process the levy as well.

The freeze will be in place for several weeks, generally 21 days. You may or may not be notified that the levy is in progress. As if the levy itself isn’t bad enough, banks may even charge you a fee to process the levy as well.

Some bank levies remain on an account until the debt is paid or the levy is lifted. And a levy can be used more than once, even on the same account. If sufficient funds aren’t available on the creditor's first attempt, they can retry as many times as needed to repay the debt.

To remove or lift the levy, you must either pay the debt in full or show that the funds in the account are exempt from the levy. Similar to wage garnishment exemptions, certain types of income in bank accounts may be exempt or excepted from levy.

Agencies That Don’t Need Court Approval to Levy Funds

Some government agencies, such as the Internal Revenue Service (IRS) and the Department of Education, don’t need a court judgment to place a levy on an account. This is also the case if the federal government is collecting on a student loan. But they are legally required to give you plenty of notice. The IRS, for example, will mail you a final notice of intent to levy at least 30 days before it serves a tax levy on a bank.

But they are legally required to give you plenty of notice. The IRS, for example, will mail you a final notice of intent to levy at least 30 days before it serves a tax levy on a bank.

Other Ways Judgment Creditors Can Try To Collect on a Debt

Levying your bank account is just one way a judgment creditor can collect an outstanding debt. Levies have the advantage of giving the lender access to a potentially large sum of cash. They do have other options, though. The items they can seize and the ways you can protect yourself vary by state. Some examples include:

Wages: Creditors can levy a portion of an employee’s wages. This is called wage garnishment. As with other collection actions, lenders generally need to get the proper legal documents from a court before garnishing your wages. If they do, an employer may have to turn over a portion of your wages. But they can’t take it all. Federal and state laws determine the maximum amount that can be garnished.

It’s often capped at around 25%. It can vary by the type of debt and the governing state law.

It’s often capped at around 25%. It can vary by the type of debt and the governing state law. Real Property: Mortgage lenders can also force the sale of real property. They can place a lien on your home and either force a sale, called a foreclosure sale, or get paid when you sell the home. After the sale, the proceeds are paid to “lift” the lien. The mortgage lender has to jump through a lot of hoops to force a sale and you may be able to protect your home from foreclosure.

Personal property: Lenders can also obtain a writ of execution from a court to seize personal property. The writ authorizes a sheriff or other public official to go to your home or business and seize assets (such as cash register, boats, jewelry, etc.). They can even take your car in certain situations. The property can then be sold at a public auction and the proceeds are applied to the debt. The IRS refers to this as a “writ of entry.” Not all property can be seized, though.

If a creditor has a judgment against you, it can be helpful to know what types of personal property are exempt and what personal property can be seized.

If a creditor has a judgment against you, it can be helpful to know what types of personal property are exempt and what personal property can be seized.

Lenders have options when collecting on an unpaid debt and many factors come into play. Foreclosing on real property and seizing (and selling) personal property can be time-consuming and have an uncertain payoff. This may encourage debt collectors to negotiate with you on a repayment plan or even write the debt off as uncollectible. You may have options too, including some defenses to collection efforts.

Misa

★★★★★ 5 months ago

It was very easy. They guided me through everything.

Read more Google reviews ⇾

Charles Sullivan

★★★★★ 5 months ago

I am very pleased with the services,and guidence that Upsolve give me

Read more Google reviews ⇾

Cheyenne Neeley

★★★★★ 5 months ago

Amazing

Read more Google reviews ⇾

Get Started with Upsolve

What Can You Do To Dispute a Bank Account Levy?

Knowing what to do if your bank account is levied could save all or part of your funds from being seized. You may need those funds for living expenses, like a roof over your head and food. If the lender has followed the proper procedure, you should have an opportunity to dispute the levy on your account.

You may need those funds for living expenses, like a roof over your head and food. If the lender has followed the proper procedure, you should have an opportunity to dispute the levy on your account.

If a creditor is required to obtain a writ of execution from the court, it generally comes with the requirement to give you notice. You’ll likely have to act within a few days (usually 10) of receiving the notice. This will allow you to raise the defenses and exemptions discussed below. A few states further protect consumer accounts by requiring both the judgment creditor and the bank to take certain steps before the account can be frozen or levied.

Even if you don’t receive notice, because it’s not always required, you’ll likely learn about the levy by trying to withdraw funds since your funds will be frozen for several weeks. A levy isn’t the only reason your funds may be frozen, though. Your bank may freeze your account if they detect suspicious activity. If your funds are frozen, you should contact your bank and ask why. They should be able to explain the problem. If it is a levy, you’ll need to act fast to defend against it.

They should be able to explain the problem. If it is a levy, you’ll need to act fast to defend against it.

Defenses Against a Bank Levy

In response to a levy on your account, you should consider all defenses. Presenting a valid defense will help protect the money in your account.

Look for errors in the judgment. Determine if you actually owe the money and that the amount levied is correct. Look for other errors as well, like levies against accounts that aren’t listed in the writ of execution. Everybody makes mistakes.

Show you’re the victim of identity theft and the debt isn’t valid. This is sometimes the case with credit card debt.

Object for lack of notice. If you’re not given the required notices it may be possible to lift the levy. The creditor may be able to repeat the process and give you the required notice, but this will still give you more time to prepare other defenses. And remember, not all lenders are required to give you notice.

Examine the statute of limitations. Lenders are generally required to collect on a judgment within a certain time, often 4-10 years. If they don’t, they’re out of luck. This will depend on applicable state law, the credit agreement, the type of debt (credit card, car loan, tax levy, etc.), and other factors.

File for bankruptcy. Filing for bankruptcy will put a hold on collection efforts. It may be a temporary hold, but it allows a court to step in and determine which assets may be used to satisfy debts. It may also be a way to get the debt discharged that’s the source of the levy.

Negotiate with the creditor. Consider negotiating with the lender to lift the levy. They often want to avoid costly and time-consuming collection efforts. They may be willing to accept a repayment plan, for example.

Present a case for financial hardship. IRS levies should give you time to voice any defenses.

Check for errors, as they do make mistakes. If you can, make other arrangements for payment of the back taxes. It’s also possible the IRS will release the levy if it determines the process is causing a taxpayer serious financial hardship.

Check for errors, as they do make mistakes. If you can, make other arrangements for payment of the back taxes. It’s also possible the IRS will release the levy if it determines the process is causing a taxpayer serious financial hardship. Use another account. You’re not required to keep using an account subject to a levy. Not using the account may not cause the lender to lift or not refile the levy. But it can limit your losses while you decide what to do. This can also help protect exempt funds if they are directly deposited into your account.

Funds That Are Exempt From Bank Levy

In response to a bank levy, you’ll want to consider all exemptions. Exempt funds will not be seized from the account. A court or the bank will determine if your account contains funds that are protected. Funds that may be protected include, but are not limited to:

Federal payments and benefits, including Social Security benefits, Supplemental Security Income (SSI) benefits, federal employee pensions, and veteran’s benefits.

You may lose protection for these payments if the federal government initiated the levy.

You may lose protection for these payments if the federal government initiated the levy. Money you’ve received for child support payments.

Unemployment compensation benefits, though there are exceptions, including if you owe child support. Past due child support is a high-priority debt and it can be withheld directly from unemployment insurance benefits. It can also be seized from a bank account. The rules vary by state.

Some states also protect a minimum amount in your bank account. For example, New York sets two separate minimum baseline balances that cannot be frozen or levied, one based on exempt income and the other based on wages. If any exempt funds were deposited into an account within the past 45 days, a certain amount is deemed exempt (currently around $3,000). The wage exemption may be even higher.

Like defenses to a levy, the exemptions are only effective if the bank or court knows about them. Banks may be required to check and see if funds deposited electronically are exempt. But it can’t hurt to make sure you do all you can to get the information to the bank or the court.

But it can’t hurt to make sure you do all you can to get the information to the bank or the court.

Also, keep in mind that identifying exempt funds can get complicated if deposits from several different sources are combined in one account. This may lead the bank to make mistakes in identifying protected funds. Don’t assume the right funds will be levied upon and taken from your account. It might be useful to set up an alternate account where you can deposit all of your exempt funds to avoid the risk of confusion.

Get Professional Help if You're Faced With a Bank Levy

When faced with a levy on your account, seek advice from a local attorney who is familiar with both state and federal law. Laws applicable to bank levies vary from state to state, and the rules can change over time. Fighting a levy can be a complicated process, and it might be necessary to take your case to court.

Finding an attorney can be difficult, but having the right attorney in your corner can make a big difference. As indicated, filing for bankruptcy puts a hold on collection efforts and gives you some time to work with a court in prioritizing or discharging your debts. If you decide to pursue bankruptcy, Upsolve can help you find the right attorney

As indicated, filing for bankruptcy puts a hold on collection efforts and gives you some time to work with a court in prioritizing or discharging your debts. If you decide to pursue bankruptcy, Upsolve can help you find the right attorney

Let’s Summarize...

A bank levy is often a last-resort collection tool creditors use to collect outstanding debts. Most creditors have to go to court to get a money judgment before they can levy your account. When the bank receives the levy, it freezes funds in the account up to the amount of unpaid debt.

You can protect your account funds if you have a good defense such as there was an error in levy documents or the statute of limitations has expired. You can also stop the levy, at least temporarily, by filing bankruptcy. Some funds may also be exempt from the levy, such as federal benefits and child support. The rules surrounding bank levies are determined by state law and can vary from state to state.

Seeking advice from a local attorney familiar with your state and local laws can help you if you’re facing a bank levy.

↑ Back to topShare Article [⬈]

Written By:

Attorney William A. McCarthy

LinkedInWilliam (Bill) started his legal career with a small firm in Southern California where he handled real estate matters, corporate acquisitions, and tax planning. After a few years, he decided on a different career path and took a job with the Office of Chief Counsel, a branch of t... read more about Attorney William A. McCarthy

Read About the Upsolve Team

How to transfer child support directly to the child, including to his bank account? - Lawyer in Samara and Moscow

The child has the right to receive maintenance from his parents and other family members (clause 1, article 60 of the RF IC). The amounts due to the child, in particular as alimony, are at the disposal of the parents (persons replacing them) and are spent by them on the maintenance, upbringing and education of the child. At the same time, the court, at the request of a parent who is obliged to pay alimony for minor children, has the right to make a decision on the transfer of no more than 50% of the amount of alimony payable to accounts opened in the name of minor children in banks (clause 2, article 60 of the RF IC; p. 15 Decisions of the Plenum of the Supreme Court of the Russian Federation dated 25.10.1996 No. 9).

15 Decisions of the Plenum of the Supreme Court of the Russian Federation dated 25.10.1996 No. 9).

The main reason for transferring maintenance directly to the child's account is usually the fear of the transferring parent that the receiving parent may use the maintenance amounts for other purposes.

Target spending of alimony should be understood as the direction of funds for the maintenance, upbringing, education of the child and the preservation of the material level, which allows for its full development (clause 1, section III of the Review of judicial practice, approved by the Presidium of the Supreme Court of the Russian Federation on May 13, 2015).

Alimony can be transferred not only on the basis of a court decision, but also on the basis of a notary agreement. In such an agreement, parents have the right to establish that part of the alimony (or the entire amount) is transferred directly to the child into his account.

Please note!

The transfer of funds to a child, including to an account, without a court decision or without a notarized agreement on the payment of alimony is not considered alimony and can be regarded as a gift of money to a child.

If you want to transfer child support directly to the child, we recommend that you follow the following algorithm.

Step 1. Discuss with the other parent the possibility of signing a notarized child support agreement or modifying it (if the agreement is already in place) to include a condition that a portion of the child support be transferred to the child's account.

If the parents have agreed among themselves, they should apply to a notary to certify the agreement on the payment of alimony (art. 99 - 101 RF IC). In a notarial agreement, parents can establish that part of the alimony is placed at the disposal of the second parent (for the maintenance of the child), and part is transferred directly to the child's account.

The agreement can be changed at any time by mutual agreement of the parties, including if the parents agreed to transfer part of the amount of alimony to the child's account later (clause 2, article 101 of the RF IC).

Step 2. In case of failure to reach an agreement to conclude or change a notarial agreement on the payment of alimony, apply to the court.

A request to change the agreement on the payment of alimony can be filed with the court only after receiving the other parent's refusal to propose to change the agreement or not receiving a response within 30 days, unless a different period is specified in the agreement itself (clause 1, article 101 of the UK Russian Federation; Article 452 of the Civil Code of the Russian Federation).

If alimony was collected on the basis of a court decision or order, then the alimony payer submits an application to change the order of execution of the decision to the court that made the decision to collect alimony (Article 203 of the Code of Civil Procedure of the Russian Federation; clause 15 of the Resolution of the Plenum of the Supreme Court of the Russian Federation N 9).

Keep in mind that a court decision on the transfer of part of the alimony to the accounts of minors is possible, in particular, in the event of improper performance by the parent receiving alimony of the obligation to spend it on the maintenance, upbringing and education of the child and preserving with this method of execution of the court decision the level of material support of the child, sufficient for its full development.

In this regard, a parent who insists on transferring a part of the amount of alimony to the child's account must prove that the other parent is spending the alimony inappropriately (Articles 56, 57 of the Code of Civil Procedure of the Russian Federation).

Please note!

If a parent pays child support, he is entitled to receive a tax deduction for personal income tax for children (clause 4, clause 1, article 218 of the Tax Code of the Russian Federation).

Remember, at any stage of a family dispute, the Legal Center for Family Affairs of Attorney Anatoly Antonov is ready to provide you with legal support. Call us by phone in Samara + 7 (846) 212-99-71 right now and sign up for a consultation at a convenient time for you.

Lawyer Anatoly Antonov Family Affairs Center provides the following legal services on issues of paying child support for minor children, as well as other family members:

- legal advice;

- drawing up an agreement on the payment of alimony;

- drawing up a statement of claim for the issuance of a court order;

- preparation of a statement of claim for the recovery of alimony and attachments to it, as well as filing it with the court;

- preparation of objections regarding claims for the recovery of alimony, for a reduction in the amount of alimony;

- familiarization with the materials of the case on the recovery of alimony, on the reduction of the amount of alimony;

- participation in court hearings (possibly without the presence of the principal) for the recovery of alimony;

- obtaining a court decision on the recovery of alimony;

- appeal against the decision of the court in a higher instance.

The original article is taken from the website of the Electronic Journal "Azbuka Prava"

Relevance date of the material: 01/06/2016

To sign up for a consultation, call the round-the-clock number +7 (846) 212-99-71 or leave a request below

How to pay child support

I am divorced, my ex-wife and I have three children. I want to open an account for them and transfer alimony there so that the children can use this money in the future. Can I not transfer alimony to my ex-wife?

Elizaveta Vasilieva

lawyer

Author profile

Alimony can be transferred to the children's settlement account if you agree on this with your ex-wife and formalize the agreement. I'll tell you how to do it.

How to get child support

Parents are required to support their minor children. They can determine the order and form of the content themselves and conclude an agreement. If you cannot reach an agreement, you will have to go to court.

If you cannot reach an agreement, you will have to go to court.

By law, a father or mother must give one quarter of their income to one child, and one third to two children. If there are three or more children, half of the income will have to be shared. A parent without a permanent income is assigned a fixed amount of alimony per month - Tinkoff Magazine talked about this in more detail in another article.

Clause 1 Art. 81 SK RF

If the financial or marital status of one of the parties has changed, the court may change the amount of alimony and even completely release the parent from payments.

Clause 1 of Art. 119 SK RF

When there are no disagreements, you can do without a court. In this case, they conclude a written agreement in an arbitrary form and certify it with a notary. This document has the force of a writ of execution. That is, if one of the parents stops paying child support, the bailiff will forcibly oblige to comply with the terms of the agreement.

The document can be changed or terminated at any time by mutual agreement. All changes must also be recorded in writing and certified by a notary. It is impossible to refuse the agreement or change its terms unilaterally.

/divorce-deti/

“The child must not be separated from the mother”: 10 questions for a lawyer about the rights of parents in a divorce

When concluding an agreement, the parents themselves determine the amount of alimony. But in any case, this amount should not be less than the amount of alimony that they could receive in court.

item 2 art. 103 SK RF

How to transfer child support to the account of children

Usually, alimony goes to the account of the parent with whom the child lives. One of the former spouses must spend this money on the maintenance, upbringing and education of children.

Parents can prescribe in the agreement that the alimony will be transferred to the child's current account. To do this, the document must indicate the account number and the amount to be paid.

To do this, the document must indicate the account number and the amount to be paid.

/prava/soderzhite-detei/

Rights when paying child support

The agreement must be registered with a notary, otherwise the money sent will be considered a gift. The amount that the father or mother will transfer to the child may be more than the alimony required by law - there are no restrictions unless the parties have agreed on this.

The bank account must be opened in the name of the minor. Parents will not be able to manage the child's money and withdraw it at will. The exception is emergency cases, for example, an illness of a child. In such a situation, you need to contact the guardianship authorities and get permission, otherwise the bank will not allow you to withdraw money. Also, guardianship officials will ask parents to report on expenses.

What to do if the other parent is against

If the parent with whom the child lives does not want the child support to go to the child's account, the issue will have to be resolved in court. First you need to get a written refusal from the parent, as well as open a bank account in the name of the child.

First you need to get a written refusal from the parent, as well as open a bank account in the name of the child.

But the court will satisfy the application only if the parent still receives part of the money - in your case, the ex-wife. The fact is that can be transferred to the children's account no more than half of the total amount that you are required to pay monthly. And if the part of the alimony that the ex-spouse receives is less than the subsistence minimum for each child, the court will not allow the money to be transferred to the children's accounts.

paragraph 2 of Art. 60 SK RF

At the same time, the Supreme Court considers that the high income of a parent who must pay alimony cannot in itself be a reason to transfer half of the amount to the child's account. For example, it is also necessary that the parent with whom the children live should spend payments for other purposes. And the amount that remains after the transfer of part of the alimony to the children's accounts should be enough for their food, education and upbringing.

In Ulyanovsk, the world court ordered a man to pay alimony to a minor child on a monthly basis. My father wanted to change the way and procedure for the execution of the court decision. He applied to the world court, referring to the fact that he has a high income.

The man thought that the amount he was obliged to pay monthly was also too large and that he would take better care of the future of the child by transferring half of the alimony to his account. But the world court left the application without satisfaction.

The complaint to the district court did not help either. They agreed that the man did not have enough grounds to transfer half of the alimony to the child.

para. 14, paragraph 1, section III of the review of the judicial practice of the Supreme Court of the Russian Federation dated May 13, 2015

Case No. 11-13 / 2015

In order for the court to allow the transfer of the entire amount of alimony to the account, it is necessary to prove that the other parent spends money education and development of the child.