How to get an itin number for a child

ITIN and the Child Tax Credit

Editor’s Note: Even if you don’t have a Social Security number, you may be required to file a U.S. tax return. To do that, you need an Individual Taxpayer Identification Number (ITIN). There is some confusion about what ITIN filers are allowed to claim, or not, including the Child Tax Credit. Read on to learn more about ITIN and the Child Tax Credit.

Who Needs a Tax ID Number, Or ITIN Number?Many people from foreign countries are required to file U.S. tax returns due to claiming income in the U.S., but may not qualify for a Social Security number. Since an identification number is required to file a tax return, the alternative for these individuals is an Individual Taxpayer Identification Number, or ITIN. The IRS will also issue ITINs to dependents who can be claimed on a tax return but do not qualify for Social Security numbers.

ITIN vs.SSNs belong to U.S. citizens and authorized residents, while an ITIN is a tax number issued by the IRS for certain individuals who are not eligible for an SSN, but are required to file certain federal tax returns.

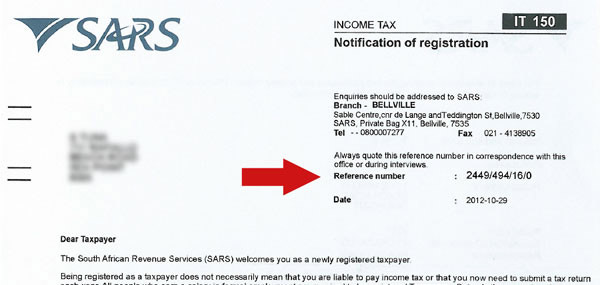

An ITIN and SSN both follow a nine-digit format – like this: XXX-XXX-XXXX. ITINs can be easily identified because they always begin with the number 9.

Tax Benefits You Can Claim With an ITINThere are some common misunderstandings around what tax benefits you can claim when you file with an ITIN.

An ITIN filer can’t claim the Earned Income Tax Credit, which specifically requires a Social Security number. Similarly, any children using an ITIN instead of a Social Security number can’t be taken into account when an otherwise qualified individual claims the credit.

ITIN Limitations Around Dependent CreditsThis limitation doesn’t apply to the Child Tax Credit (CTC) or the Additional Child Tax Credit (ACTC). So, ITIN filers can’t claim the EITC, but they can claim the CTC or the ACTC. However, there are still requirements that must be met. To claim these CTC or the ACTC, your child (or children) must:

So, ITIN filers can’t claim the EITC, but they can claim the CTC or the ACTC. However, there are still requirements that must be met. To claim these CTC or the ACTC, your child (or children) must:

-

- Live in your home for over half the year (limited exceptions to this rule apply)

- Be your child, stepchild, adopted child, or foster child, or your brother or sister or stepsibling (or a descendant of any of these)

- Be under 17 years old at the close of the year

- Not provide over half of his or her own support for the year

- Be a U.S. citizen or resident

- Have an SSN issued to them by the due date of the return, and

- Not file a joint return (with exceptions).

One of the changes with tax reform is that children are now required to have an SSN by the due date of their return to be qualifying children for the CTC and the ACTC. This rule is effective for tax years 2018 through 2025.

This rule is effective for tax years 2018 through 2025.

Before 2018, children with ITINs could qualify taxpayers for the CTC and ACTC but only if they had an ITIN by the due date of their return for that tax year.

New Other Dependent Credit Available for ITIN HoldersThe TCJA added the new Other Dependent Credit (ODC) which is a $500 credit for each dependent who doesn’t qualify for the CTC. This means a taxpayer can claim the ODC for a dependent who meets all the rules to be a qualifying child for the CTC except for the SSN requirement.

Children Who Live Outside the U.S. Can be Qualifying ChildrenA child with an ITIN that lives in the U.S. can qualify for the ODC, and children with ITINs that live outside of the U.S. generally will not qualify. Children that live outside the US generally can qualify for the CTC if they live in your home for more than half of the year and meet the other requirements, including the SSN requirement.

U.S. citizens will almost always have SSNs and therefore qualify for the CTC regardless of where they live so long as they meet the other tests. Also, note that special rules apply to children of divorced and separated parents.

Need more information on ITINs? Check out these links:

- ITIN Application

- ITIN Renewal Process

For help with ITINs and tax credits like the Child Tax Credit, find your H&R Block Tax Office today.

How Do You File Taxes with an Individual Taxpayer Identification Number (ITIN)? – Get It Back

Updated September 20, 2022

Click on any of the following links to jump to a section:

- What is an ITIN?

- Why should I get an ITIN?

- How do I file taxes with an ITIN?

- Can I claim tax credits with an ITIN?

- How do I apply for an ITIN?

- What if I don’t have an immigration status that authorizes me to live in the U.

S.?

S.? - What are Acceptance Agents?

- Resources

The Internal Revenue Service (IRS) issues Individual Taxpayer Identification Numbers (ITINs) to people who are required to have a U.S. taxpayer identification number but who do not have, and are not eligible for, a Social Security number (SSN).

An ITIN does not:

- Allow you to receive Social Security benefits

- Allow you to claim the EITC

- Permit a child to be claimed for the EITC or CTC. A child must have a valid SSN and authorization to legally work in the U.S. to be claimed for the EITC and CTC.)

- Change your immigration status

- Mean that you are an undocumented worker

- Give you the right to work in the U.S. Any individual who is eligible to be legally employed in the U.S. must have an SSN. If you have an ITIN you should not provide it to an employer in place of an SSN, since this would indicate to your employer and to the Social Security Administration that you are not authorized to work.

The ITIN is used in place of an SSN on a tax return to identify you, your spouse, or dependent without an SSN, on the tax return. For example, if you are an immigrant in the U.S. who has applied for legal status to work or reside in the U.S., you would need an ITIN to file a tax return while waiting for a decision.

If you have an ITIN that was issued before 2013, it has expired and you should have already received a notice from IRS to renew it. If you haven’t used your ITIN on a U.S. federal tax return in the last three years (2018-2020) you will need to renew it. For more information, visit ITIN Renewals.

Some of the benefits to getting an ITIN include:

1. Filing taxes.

This can serve as proof of “good moral character” in immigration cases. Filing taxes can be helpful in your immigration case if you are able to adjust your status in the future.

2. Opening a personal bank account.

In some cases, an ITIN can be used as a substitute for an SSN to open a personal checking or savings account. A bank account is a safe place to store your money and allows you to establish a financial history.

A bank account is a safe place to store your money and allows you to establish a financial history.

3. Building credit.

Some credit cards require you to have an established bank account to apply. By developing a good credit history, you may be able to do things like buy a house, purchase a car, or borrow money to start a business in the future.

4. Claiming tax credits.

Filing taxes also means that you can claim tax credits that you are eligible for. These credits can reduce the amount of taxes you owe or can provide you a tax refund that can be put towards things like the cost of raising kids or to cover daily living expenses. Learn more about specific tax credits available if you have an ITIN.

5. Purchasing health insurance.

When you purchase health insurance for your US-born children through the Health Insurance Marketplace, you may be eligible for the Premium Tax Credit (PTC), which can help lower how much you spend on insurance. To get the PTC, parents with ITINs are required to file their taxes.

To get the PTC, parents with ITINs are required to file their taxes.

6. Securing identification.

Some state governments accept ITINs as proof of identification when applying for a state issued ID. Having state issued identification can expand your traveling options. In eligible states, you can apply for your driver’s license, and you can use your ID to pass through TSA at airports.

To file a tax return, you must enter your ITIN in the space for the SSN on the tax form, complete the rest of the return, and submit the tax return (along with any additional forms) to the IRS.

Yes. There are some tax credits that you may be eligible to claim with an ITIN.

This tax benefit is worth up to $3,000 for each child under 17. (It is worth up to $3,600 for children under 6 years old.) Eligibility for claiming the CTC depends on the status of your children. You can only claim the CTC if your qualifying children have Social Security Numbers. You and your spouse (if married) can have an ITIN or SSN.

You and your spouse (if married) can have an ITIN or SSN.

The 2021 American Rescue Plan temporarily expanded the CTC, including offering advance payments that were issued between July and December 2021. Learn more about the expanded CTC here.

- To claim the CTC, you will enter your ITIN and your children’s SSNs on Schedule 8812 “Additional Child Tax Credit.” Qualifying children for the CTC must be either a U.S. citizen or a resident alien living in the U.S. (While children with ITINs living in Mexico or Canada can be a dependent for tax filing purposes, they cannot be claimed for the CTC.)

- If your ITIN has expired, you can still claim the 2021 expanded CTC if you meet the other eligibility requirements. Renew your expired ITIN by submitting a completed IRS Form W-7. You must submit the application by mail with your 2021 tax return. It can take up to 11 weeks for the IRS to process an ITIN renewal.

Note: The SSN requirement for children is set to expire at the end of 2025. Unless legislation is enacted, CTC eligibility will revert to prior rules—the credit will be worth up to $1,000 per child, and you, your spouse, and your qualifying child can have an SSN or ITIN to claim the CTC using Schedule 8812.

Unless legislation is enacted, CTC eligibility will revert to prior rules—the credit will be worth up to $1,000 per child, and you, your spouse, and your qualifying child can have an SSN or ITIN to claim the CTC using Schedule 8812.

2. Credit for Other Dependents (OCD)

A $500 non-refundable credit is available for families with qualifying relatives. This includes children over 17 and children with an ITIN who otherwise qualify for the CTC. Additionally, qualifying relatives who are considered a dependent for tax purposes (like dependent parents), can be claimed for this credit. Since this credit is non-refundable, it can only help reduce taxes owed. If you are eligible for both this credit and the CTC, this will be applied first to lower your taxable income.

Being able to claim a dependent may also allow people who are unmarried to claim the Head of Household filing status. Claiming “Head of Household” as your filing status (versus filing as single or married filing separately) may reduce the amount of income taxes owed.

If you didn’t get your third stimulus check, you can still claim it as the RRC when you file a 2021 tax return in 2022. The third stimulus check is worth up to $1,400 for each eligible adult and each qualifying dependent in a household. Any family member that has an SSN can qualify for the third stimulus check, even if the tax filer has an ITIN. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents don’t.

Learn what to do if you missed your first or second stimulus check.

The Child and Dependent Care Credit is a federal tax benefit that can help you pay expenses for child or adult care that is needed to work or to look for work. The 2021 American Rescue Plan temporarily expands the credit for tax year 2021 (which you file taxes for in 2022), making it fully refundable. This means the credit can provide money back even if you don’t owe taxes. It is worth up to $4,000 for one dependent or up to $8,000 for two or more dependents. Learn more here.

Learn more here.

This credit is worth up to $2,500 and can help reduce educational expenses to attend college. The credit is only available for the first four years of a student’s post-secondary education. Eligible students must be pursuing a degree or another recognized credential.

This non-refundable credit is worth up to $2,000 per household. It can be used to help reduce any post-secondary educational expenses (such as job training) and isn’t limited to people attending college.

Note: You CANNOT claim the Earned Income Tax Credit (EITC) with an ITIN.

If you want to file a tax return but cannot obtain a valid SSN, you must complete IRS Form W-7, “Application for IRS Individual Taxpayer Identification Number.” Form W-7 must be submitted to the IRS with a completed tax return and documents verifying identity and foreign status. You will need original documents or certified copies from the issuing agencies. The instructions for Form W-7 describe which documents are acceptable.

Parents or guardians may complete and sign a Form W-7 for a dependent under age 18 if the dependent is unable to do so, and must check the parent or guardian’s box in the signature area of the application. Dependents age 18 and older and spouses must complete and sign their own Forms W-7.

You can use this checklist to help prepare your application.

There are three ways you can complete the ITIN application:

- Taxpayer Assistance Centers: Certain IRS Taxpayer Assistance Centers have staff who can help you prepare W-7 forms, determine which documents are acceptable, and verify the validity of identification documents. You must schedule an appointment.

- Acceptance Agents: An Acceptance Agent authorized by the IRS can examine identification documents, certify that they are valid, and send the application to the IRS. For dependents applying for an ITIN, Agents send the original documents (or copies certified by the original issuing agency) to the IRS.

Some Acceptance Agents also offer free tax preparation to help you file a tax return.

Some Acceptance Agents also offer free tax preparation to help you file a tax return. - Self-preparation: You can apply directly to the IRS. Form W-7’s must include original documentation or copies of these documents certified by the issuing agency. Photocopies and notarized copies of documentation are not accepted. All documents must be mailed with the tax return to the IRS Service Center in Austin, Texas (the address is in the Instructions for Form W-7 and is different from the address to mail tax returns only for processing). This office can be reached at (800) 829-1040.

Note: There is risk of delay in the IRS returning the supplied documentation, or it being lost, so applying through an IRS Taxpayer Assistance Center or with the help of a Certifying Acceptance Agent is recommended.

Currently, it takes an estimated 11 weeks for the IRS to process an ITIN application. Upon approving the application for the ITIN, the IRS will process the tax return and send a letter to the taxpayer, or the Certified Agent, containing the ITIN number(s) for use on subsequent tax returns.

Many people who are not authorized to live in the United States worry that filing taxes increases their exposure to the government, fearing this could ultimately result in deportation. If you already have an ITIN, then the IRS has your information, unless you moved recently. You are not increasing your exposure by renewing an ITIN or filing taxes with an ITIN.

Current law generally prohibits the IRS from sharing tax return information with other agencies, with a few important exceptions. For instance, tax return information may in certain cases be shared with state agencies responsible for tax administration or with law enforcement agencies for investigation and prosecution of non-tax criminal laws. The protections against the disclosure of information are set in law so they cannot be rescinded by a presidential executive order or other administrative action unless Congress changes the law.

Knowing the potential risks and benefits involved, only proceed with an ITIN application or tax filing if you feel comfortable. This information does not constitute legal advice. Consult with an immigration attorney if you have any concerns.

This information does not constitute legal advice. Consult with an immigration attorney if you have any concerns.

Acceptance Agents are authorized by the IRS to assist you in completing your ITIN application. Some Acceptance Agents do not prepare tax returns. In that case, you must take the completed Form W-7 certified by the Agent to a VITA site or commercial tax preparer and submit it with the tax return.

Acceptance Agents are often found at colleges, financial institutions, accounting firms, nonprofit agencies and some Low Income Taxpayer Clinics. Commercial tax preparers who are Acceptance Agents often charge a fee that can range from $50 to $275 for completing the Form W-7. There is no fee for applying directly with the IRS.

Visit the Acceptance Agent Program on the IRS website for a list of Acceptance Agents by state that is updated quarterly. Low Income Taxpayer Clinics (LITCs) may also be able to help identify local Acceptance Agents.

Note to organizations:

You may want to become an Acceptance Agent. To do so, your organization must:

- Submit the Application IRS Form 13551, IRS Application to Participate in the IRS Acceptance Agent Program (this applies to both new and renewing applicants)

- Complete an Acceptance Agent training

- Attach the certification form for each authorized representative

- Complete forensic training and submit certificate of completion

For more information on becoming an Acceptance Agent, see How to Become an Acceptance Agent for IRS ITIN Numbers.

- IRS Publication 1915, “Understanding Your IRS Individual Taxpayer Identification Number”

- IRS ITIN Information

- Individual Taxpayer Identification Number Fact Sheet (English and Spanish): This fact sheet from UnidosUS, the National Immigration Law Center, and CLASP provides immigrants who need to apply for Individual Taxpayer Identification Numbers (ITINs) information on how to do so.

Get a TIN for a child - Portal of State Services of the Russian Federation — LiveJournal

?- Get a TIN for a child

-

- Gosuslugi

- October 24TH, 2017

You can also get a TIN for a child who has not reached the age of 14 years.

- TIN may be asked to present the educational authorities;

it may be needed to register an inheritance for a child;

- TIN is required for parents to receive tax deductions when buying real estate for a child, undergoing spa treatment, etc.;

- needed to apply for a job or start your own business.

Confirm your portal account in one of the Service Centers and submit an electronic application at https://service.nalog.ru/zpufl/. Follow the status of the application online and receive the TIN for the child at the appointed time.

-

Happy New Year!

Send the Snow Maiden to school, register a sleigh, pay a tax on a house in Veliky Ustyug and book a reindeer for a doctor - all this is possible ...

-

Cultural life of the city

What to do during the holidays? Relax, enjoy life and attend the most interesting events of the city! Together with the Ministry of Culture, we…

-

Healthy Russia: How to quit smoking?

No matter how correct the lifestyle, no matter how good the genetics and the environment, a person who smokes simply cannot be considered healthy! .

..

..

Comments have been disabled for this post.

How to get a TIN for a child through the State Services? — President of Russia

What documents are needed to obtain a TIN?

To obtain a TIN for a child, the following documents will be required:

- passport of the parent/legal representative;

- child's birth certificate;

- certificate of registration at the place of residence.

How to issue a TIN for a child through the State Services?

First of all, it is worth noting that only parents can issue a TIN for a child under 14 years old. Whereas a child who has received a passport can issue a TIN on his own.

In addition, on the State Services portal, you can only make an appointment with the Federal Tax Service, where you will have to receive the above document.

To make an appointment with the Federal Tax Service for issuing a TIN, a child needs to do the following:

- enter the personal account of the State Services portal;

- in the catalog of services, select the section "Taxes and finances";

- choose the electronic service "Tax registration of individuals";

- click "Make an appointment";

- on the opened page with your personal data, you need to select the branch of the Federal Tax Service that you want to visit, as well as the date and time;

- confirm the entry by pressing the corresponding button;

- then you will need to come to the department of your choice with a package of documents.

Thanks to such an appointment, you will not have to spend hours in tedious queues, and the document you need will be quickly processed.

How to apply for a TIN for a child via the Internet?

To save even more time, it is possible to order a TIN certificate for a child through the official website of the Federal Tax Service using the account of the State Services portal. This method also involves visiting the department of the Federal Tax Service, but it has an advantage. The fact is that by filling out an application on the website of the Federal Tax Service, you can track the result on it. And, when the document on your application is ready, come to the department of the Federal Tax Service and immediately receive it.

So, what to do:

- go to the official website of the Federal Tax Service;

- hover the "mouse" on the section "Individuals";

- in the window that opens, select "Submit applications for registration";

- then a page with information about this service will open, after reading which, in the authorization window on the right, select the login method - “public services portal account” and click “login”;

- enter the login and password from the account of the State Services portal;

- we agree with the processing of personal data by ticking the appropriate box and clicking "continue";

- fill in all the required lines in tabs No.