How much is child support in england

How much child maintenance should I pay?

If you and your ex-partner have children, you’re both expected to continue to pay towards their costs after you separate. And often that means one parent will pay the other. You can agree this between you or, if you can’t agree, ask the Child Maintenance Service to calculate the amount.

What’s in this guide

- Arranging child maintenance yourselves

- How much are you expected to pay?

- When does child maintenance stop?

- How your income affects how much you pay

- How the number of children affects how much you pay

- How shared care affects child maintenance

- Paying for children from another relationship

Arranging child maintenance yourselves

If you and the other parent are arranging child maintenance between you, you’re free to decide the amount one parent pays the other. This is referred to as a family-based arrangement.

While the Child Maintenance Service doesn’t need to be involved if you do this, it’s a good idea to check the amount you agree against what they would assess it to be.

It’s important to think about what you’d like to include in this payment and how you’d like to pay:

- Do you want to pay a fixed regular amount or will you vary it to help with extra expenses throughout the year?

- Do you want to cover the cost of things like school uniform, activities or holidays?

- Do you want to pay a percentage of your earnings? If your earnings fluctuate, this might be helpful to you but it would mean the amount of child support is less predictable.

Back to top

How much are you expected to pay?

If you can’t agree how much child maintenance one parent should pay the other, you can ask the Child Maintenance Service to calculate it for you.

They’ll take into account:

- how many children you have

- the paying parent’s income

- how much time children spend with the paying parent

- whether the paying parent is paying child maintenance for other children.

Back to top

When does child maintenance stop?

You’re normally expected to pay child maintenance until your child is 16, or until they’re 20 if they’re in school or college full-time studying for:

- A-levels

- Highers, or

- equivalent.

Child maintenance might stop earlier – for example, if one parent dies or the child no longer qualifies for child benefit.

Back to top

How your income affects how much you pay

There are different child maintenance rates according to the paying parent’s gross weekly income – this means how much you receive before things like tax and National Insurance are taken off.

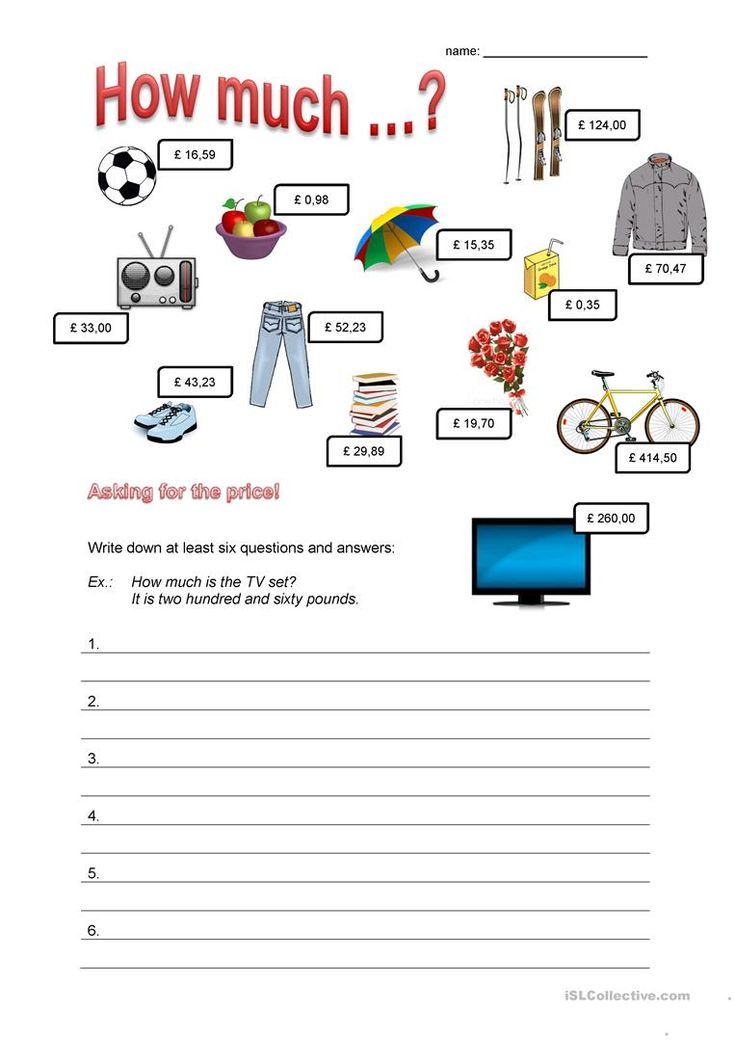

Child maintenance amounts based on weekly pay

|

Unknown |

Default |

£38 for one child, £51 for two children, £61 for three or more children |

|

Below £7 |

Nil |

You don’t pay any child maintenance |

|

Between £7 and £100 or if you’re on benefits |

Flat |

£7 a week |

|

Between £100. |

Reduced |

Use the child maintenance calculator |

|

Between £200 and £3,000 |

Basic |

Use the child maintenance calculator |

(2021 figures - see GOV.UK for more information. )

)

If your gross weekly income is more than £3,000, you can apply to the court to make a child maintenance ‘top-up’ order.

But before the court will deal with your application, they’ll need to see a Child Maintenance Service calculation showing this.

Back to top

How the number of children affects how much you pay

If you’re paying child maintenance and you’re on the basic rate of child maintenance, the amount you pay will depend on the number of children you’re being asked to pay for.

The figures below assume that your children stay with the parent who receives child maintenance all the time.

On the basic rate, if you’re paying for:

- one child, you’ll pay 12% of your gross weekly income

- two children, you’ll pay 16% of your gross weekly income

- three or more children, you’ll pay 19% of your gross weekly income.

Back to top

How shared care affects child maintenance

Many parents decide to share the care of their children.

If your children spend some time with the paying parent, this will reduce the amount of child maintenance he or she pays.

There are different ‘bands’ which determine how much child maintenance is reduced by.

The amount of child maintenance is reduced for each child who spends time with the paying parent.

If over the year your child is with the paying parent between:

- 52 and 103 nights: child maintenance is reduced by 1/7th for each child

- 104 and 155 nights: child maintenance is reduced by 2/7th for each child

- 156 and 174 nights: child maintenance is reduced by 3/7th for each child

- 175 nights or more nights: child maintenance is reduced by 50%, plus an extra £7 a week reduction for each child.

Back to top

Paying for children from another relationship

If the paying parent’s gross weekly income is between £200 and £3,000, and they pay child maintenance for other children, this is taken into account when working out how much they should pay.

The Child Maintenance Service simply reduces the amount of weekly income that it takes into account. For example, if the paying parent is paying for:

- one other child, their weekly income will be reduced by 11%

- two other children, their weekly income will be reduced by 14%

- three or more other children, their weekly income will be reduced by 16%.

Back to top

Thank you for your feedback.

We’re always trying to improve our website and services, and your feedback helps us understand how we’re doing.

Child maintenance rates explained | nidirect

The Child Maintenance Service (CMS) uses the information about your family, circumstances and income to work out how much child maintenance should be paid per week. There are five rates of maintenance. Which rate is paid depends on the paying parent’s circumstances.

Rates

There are five rates of maintenance and you will pay whichever suits your individual circumstances.

Nil rate

If you are a paying parent, you do not have to pay any child maintenance if you:

- have a gross weekly income of less than £7

- are under 16 years old

- are aged 16 to 19 years old and have left school but are registered for certain types of government approved training courses

- are aged 16 to 19 years old and are in full-time education (up to and including A-Level or equal standard)

- are aged 16 or 17 years old and receive Income Support, Income-based Jobseeker’s Allowance or Income-related Employment and Support Allowance

- are aged 16 or 17 years old and are included in your partner’s claim for Income Support, Income-based Jobseeker’s Allowance or Income-related Employment and Support Allowance

- are in prison

- live in a care home or independent hospital (or similar services in Scotland) and are getting help with the fees

Flat rate

You will pay a flat rate of £7 a week child maintenance if your gross weekly income is less than £100 a week or if you, or your partner you live with, receive any of the benefits listed below.

The £7 will normally be taken from either you or your partner’s benefit which will also result in you paying an additional £1.40 per week collection charge, if it is paid by the Department for Communities (DfC). If it is not and is paid, for example, through an Armed Forces Scheme, you should let CMS know.

- Income Support

- Income-based Jobseeker’s Allowance

- Income-related Employment and Support Allowance

- Pension Credit

- Contribution-based Jobseeker’s Allowance

- Contribution-based Employment and Support Allowance

- Category A, B, C or D Retirement Pension

- State Pension

- Incapacity Benefit

- Training allowance (other than work-based training for young people or, in Scotland, Skill-seekers training)

- Armed Forces Compensation Scheme payments

- War Disablement Pension

- War Widow’s Pension, War Widower’s Pension, or Surviving Civil Partner Pension

- Bereavement Allowance

- Maternity Allowance

- Carer’s Allowance

- Severe Disablement Allowance

- Industrial Injuries Benefit

- Widowed Mother’s Allowance

- Widowed Parent’s Allowance

- Widow’s Pension

- a social security benefit paid by a country other than the United Kingdom

- Universal Credit

- Child Maintenance Service

Reduced rate

The reduced rate will apply if your gross weekly income is more than £100 but less than £200. You will pay a standard amount of £7 a week for the first £100 of your income plus a percentage of the gross weekly income for the rest of your income.

You will pay a standard amount of £7 a week for the first £100 of your income plus a percentage of the gross weekly income for the rest of your income.

The percentage you pay depends on:

- the number of children you must pay child maintenance for

- if you are supporting any other children

If you are not supporting any other children, the rates are applied as follows:

If you are supporting other children the rates applied are as follows:

| number of children you pay child maintenance for | number of children you are supporting | standard amount (for the first £100 of income) | percentage of remaining gross weekly income (up to £200) |

|---|---|---|---|

| One | One | £7 | 14.1% |

| One | Two | £7 | 13.2% |

| One | Three or more | £7 | 12. 4% 4% |

| Two | One | £7 | 21.2% |

| Two | Two | £7 | 19.9% |

| Two | Three or more | £7 | 18.9% |

| Three or more | One | £7 | 26.4% |

| Three or more | Two | £7 | 24.9% |

| Three or more | Three or more | £7 | 23.8% |

Example: If you pay child maintenance for one child and also support another child you must pay:

- a standard amount of £7 a week for the first £100 of income

- 14.1 per cent of the rest of your gross weekly income (up to £200)

Basic rate

The basic rate will be applied if your gross weekly income is £200 or more, up to and including £800. The percentage of gross weekly income you pay will depend on the number of children you are paying child maintenance for.

| number of children you pay child maintenance for | percentage of gross weekly income |

|---|---|

| One | 12% |

| Two | 16% |

| Three or more | 19% |

Basic plus rate

The basic plus rate will be applied on top of the basic rate if your gross weekly income is more than £800 up to a limit of £3,000.

This means that on top of the percentages that you pay (set out above) for the first £800 of gross weekly income, you must pay the following additional percentage for any income between £800 and £3000.

| number of children you pay child maintenance for | percentage applied to gross weekly income over £800 (up to a limit of £3,000) |

|---|---|

| One | 9% |

| Two | 12% |

| Three or more | 15% |

Help improve this page - send your feedback

You must have JavaScript enabled to use this form.

report a problem

leave feedback

ask a question

Report a problemWhich problem did you find on this page? (Tick all that apply)

A link, button or video is not working

There is a spelling mistake

Information is missing, outdated or wrong

I can't find what I'm looking for

Another issue

Messages

Tell us more about the problem you're having with the nidirect website.

Enter your feedback

What is your question about?Choose a topic for your question: - Select -AnglingBenefitsBirth certificatesBlue BadgeCareersCompensation due to a road problemChild MaintenanceCivil partnership certificatesCoronavirus (COVID-19)COVID vaccination certificateCriminal record checks (AccessNI)Death certificatesEducational Maintenance AllowanceEmployment rightsHigh Street Spend Local SchemeMarriage certificatesMotoringnidirect accountPassportsPenalty Charge NoticesPensionsPRONI - historical recordsRates or property valuationProblems with roads and streetsSmartpassMy question is about something else

What to do next

Great Britain is the most generous country for divorcees!

Divorce is an unpleasant matter even for the most cynical ladies, because once it all started with great and pure love, a white dress, champagne, falling in love. In a divorce, it is unlikely that you will be able to turn a lemon into lemonade, but a wise and experienced lady is quite capable of sweetening her future life with sugar, and even diamond powder of financial well-being.

In a divorce, it is unlikely that you will be able to turn a lemon into lemonade, but a wise and experienced lady is quite capable of sweetening her future life with sugar, and even diamond powder of financial well-being.

If you are a woman and are going to get a divorce, then you should take your case to an English court (if a man, then better avoid it). The fact is that when you divorce in England, you (the woman) are likely to be able to receive huge alimony in the months following the divorce. Much larger than in other countries, as judges consider a large number of factors that affect the amount.

A comparative study has been conducted showing that, unlike Europe, the US, South Africa and New Zealand, England and Wales stand out on a wide range of issues that a judge can take into account.

In recent years, London has gained a reputation as a capital where divorce provides ex-wives with high rewards.

High-paying divorces include ex-Beatle Sir Paul McCartney, who was ordered to pay Heather Mills £24. 3 million after four years of marriage, and John Charman, an insurance magnate who paid his ex-wife Beverly Charman £48 million.

3 million after four years of marriage, and John Charman, an insurance magnate who paid his ex-wife Beverly Charman £48 million.

Lately Michelle Young and her husband Scott Young had such a devastating divorce, which resulted in her getting £20 million. In a heated argument, Young claimed he didn't have a penny and couldn't repay. She also claimed that the time she spent on him was worth millions.

In another case in August, an unnamed Russian businessman was required to pay £38 million to his ex-wife, with whom he lived in the UK. This payment affected all of the husband's assets around the world.

Judge Eleanor King, who presided over the case, commented: “fantastic charades, with the husband as a puppeteer in the background”, and said that those who helped his wife in this case “searched the length and breadth of the entire globe in an attempt to track down the husband's income, every penny that was received during the course of the marriage."

Judgments in the case were obtained in Cyprus, the British Virgin Islands and the Seychelles, after which the husband was "one step ahead" by transferring his income through Panamanian intermediaries through the Caribbean to Belize.

English courts have also shown their cruelty towards those who do not obey their orders, and also refuse to transfer documents and pay alimony. Mr. Young was imprisoned for contempt of court and for failing to comply with court orders.

Suzanne Kingston, said that payouts in England are largely at the discretion of the judges, compared to other countries where payouts are most often based on formulas.

The German court often uses official guidelines, in particular the Düsseldorf table, which provides confidence in the calculations. The study also showed that England and Wales looks at facts and conditions very broadly on a case-by-case basis.

Some jurisdictions still use the term "divorce originator" and include factors such as unreasonable behavior or infidelity as grounds for denying a maintenance claim.

Ms Kingston said: "France supports this as a discriminatory right, but Malta considers it an important issue when considering the issuance of alimony. "

"

The study found that Malta remains one of the few countries where the behavior of both parties in a marriage is taken into account in divorce; at the same time, the right to issue alimony is lost if the recipient "caused the breakdown of the marriage due to causes, cruelty, serious injuries or treason for two or more years without a good reason."

In France, the court also has the discretion to refuse payments to spouses in cases of fault as the reason for divorce.

Katherine Thomas, a lawyer at the Vardags law firm who represented Ms Young, said that English courts do not pay attention to the distinction between a breadwinner and a housewife in a state of marriage - which makes London an attractive place for wives to divorce.

According to her, “There is a wide range of questions at the judge's discretion. Here they will look at individual factors and cases (and even their great case law). Sometimes the decision of the court is very difficult to predict, which leads to serious consequences. ”

”

She added that the complexity of many international divorce cases and spouses with worldwide incomes in various tax havens has led to an influx of family law lawyers in cities.

"Family law should be seen as fairly benign and less intellectually demanding than corporate law, but it has now attracted lawyers who use their skills exclusively in family law, which is seen as a perfectly normal job."

In general, everyone is trying to make money on stupid husbands - both wives, and lawyers, probably, and judges. And if it is profitable to protect your business under English law, and for this our businessmen take companies offshore and other jurisdictions, then getting divorced under English law is somehow not at all fun, especially if you have something to share and if, God forbid , you have sins for which you can be hung.

This is another reason to be careful, keep your hands clean and your head cold. And draw up a marriage contract, otherwise you can at some point understand that your “beloved and dear” stripped you to the goal, informing the press about your “great adventures” to the side. Do you need it?

Do you need it?

Therefore, a couple of tips: be careful, sign a prenuptial agreement, choose the right jurisdictions for doing business and evaluate all the risks. It is your job as a businessman to evaluate risks. And the family, unfortunately, is also sometimes a risk.

If you do not know how to check the reliability of your protection against such events, then you should contact lawyers and specialists. To kill two birds with one stone, just write to us, and we will provide you with contacts and information on all your questions: [email protected] .

Everything you need to know about child support in the UK

Both parents are responsible for the maintenance of the child. If they are divorced or do not live together, the parent who lives apart from the child will most likely be required to pay maintenance money to the parent who cares for him. This is child support.

Child support is usually in the form of regular cash payments for the child's daily needs. Depending on the circumstances, parents can negotiate support on their own or use a government-sponsored scheme. If the situation is too complicated, a court order may be needed.

Depending on the circumstances, parents can negotiate support on their own or use a government-sponsored scheme. If the situation is too complicated, a court order may be needed.

Types of child support arrangements

- intra-family arrangement;

- government schemes;

- court order.

Family Arrangement

This is the quickest and easiest way to resolve your child support issue. As a rule, such an agreement is not legally binding. Therefore, if payment has not been made, you cannot go to court to force the other parent to pay child support. However, if the agreement is broken, you can take advantage of the government's child support scheme. This is an enforceable contract. That is, a parent who must pay child support can be forced to do so.

If you cannot reach an agreement within the family

For various reasons, the child's parents may not be able to reach an agreement on their own. There are also cases of violation of intra-family agreements. If something went wrong, you can turn to government support schemes.

If something went wrong, you can turn to government support schemes.

Government Support Schemes

There are three government support schemes.

2012 Scheme

The 2012 Child Maintenance Scheme is administered by the government agency Child Maintenance Service (CMS). The scheme is available to all parents who cannot agree on their own. In England (as an administrative and political part of the UK), Wales and Scotland, you will have to pay a certain amount to start using this scheme.

Schemes - 1993 and 2003

Two other schemes are administered by the Child Support Agency (CSA):

- Scheme-1993 is for cases opened before March 3, 2003;

- Scheme-2003 - for cases opened on or after March 3, 2003.

The Child Support Agency has stopped accepting new applications for the 1993 and 2003 schemes. However, the CSA will continue to operate these schemes for as long as they are needed.

Court order

All new child support cases are handled by the Child Maintenance Service. However, in some situations, court intervention is necessary or desirable. For example, if:

However, in some situations, court intervention is necessary or desirable. For example, if:

- you cannot contact CMS because your former partner lives outside the UK;

- you have extra expenses that CMS does not take into account when calculating the amount of child support. For example, you pay for a child's education or incur additional expenses due to a child's disability;

- your former partner has a very high income and you want more child support.

If necessary, the court can force a parent to pay child support if the parent refuses to do so voluntarily.

pixabayDoes child support affect benefits

If you receive child support

Child support does not count towards your income for income based benefits such as Income Support, Income Support Income-based Jobseeker's Allowance and Housing Benefit. This means that child support will not affect income based benefits. Other child support benefits will also not be affected.

01 and £199.99

01 and £199.99