How much child support will i owe

Wisconsin Child Support Calculators & Worksheets 2022

Wisconsin uses overnights, or where the children sleep, to determine how much child support should be paid by the non-residential parent. Joint custody payments vary depending on overnights, but for sole custody, the court uses the standard percentage model based on the number of children.

- For 1 child, it is 17%

- For 2 children, it is 25%

- For 3 children it is 29%

- For 4 children, it is 31%

- For 5 children, it is 34%

Book My Consult

Calculate Child Support

Use the calculators below to estimate child support payments.

Shared Custody Child Support Calculator

Sole Custody Child Support Calculator

Be aware when using the phrase, child custody, legally we are not talking about spending time with the child(ren) nor does child custody impact child support payments. The phrase child custody from the court's perspective is defined as decision-making responsibility. The correct legal term for time with the child(ren) is placement. Placement or time spent with the child(ren) does directly impact child support obligations, while child custody or decision-making does not impact child support obligations.

How To Calculate Child Support in Wisconsin

Every state has set child support guidelines as well as several different child support worksheets you can fill out. There are also options when determining child support. In Wisconsin, our support order guidelines help determine the amount due from one spouse to the other in the event of a divorce or legal separation. Below you will find the type of information you need to as well as the percentages required for payment based on Wisconsin DCF 150. First, we need to calculate the paying party's net income. To determine net income we need to add up monies considered income like the following:

- Wages

- Overtime work

- Commissions

- Tips

- Bonuses

- Rental income

- Interest income

Once the gross income is determined the court will determine the net income of the paying party. This is not done by using tax returns rather the court will deduct social security taxes, federal income taxes based on the tax rate for a single person claiming one personal exemption and the standard deduction, state income tax, union dues, and expenses for the cost of health insurance for the child. It is also worth mentioning that child support is not taxable by the spouse receiving it, so it will not be a tax-related issue for the recipient of it.

This is not done by using tax returns rather the court will deduct social security taxes, federal income taxes based on the tax rate for a single person claiming one personal exemption and the standard deduction, state income tax, union dues, and expenses for the cost of health insurance for the child. It is also worth mentioning that child support is not taxable by the spouse receiving it, so it will not be a tax-related issue for the recipient of it.

Wisconsin Child Support Guidelines for Shared Custody

Yes, one parent will be obligated to pay child support unless both parents spend the exact amount of time with the child and earn the exact same income, which is rare. Wisconsin child support laws say that a shared placement formula can be used if certain guidelines are met. Typically the court will approve the use of this formula when:

- if the parenting plan states that both parents will have the children at least 92 overnights per year

- if the parenting plan states each parent will pay for the child’s basic needs proportionately to the time each parent has placement of the child.

The Wisconsin 50/50 Child Support formula is based on the Percentage Standard guideline in conjunction with the time spent with each parent. The Percentage Standards guidelines are as follows:

For a detailed worksheet on how the Wisconsin Shared-Placement formula works download the worksheet here.

To refer directly to DCF 150 review the section labeled DCF 150.035(2)(b) Support Orders. Above is a worksheet we put together to help calculate the amount child support payers will pay in child support. If you need further assistance please contact us we would be happy to help.

For Immediate help with your family law case or answering any questions please call (262) 221-8123 now!

Wisconsin Shared Custody Child Support Calculator

These are estimates based on the statutory guidelines. Please also note child support payments may be different than displayed below based on the circumstances of your individual case.

Loading...

Enter Parent A's YEARLY gross income (before taxes)

Income Parent A *

Enter Parent B's YEARLY gross income (before taxes)

Income Parent B *

Parent A Zero Out Subtotal

Parent A Child Support Percentage

Parent A Obligation Subtotal

Parent B Zero Out Subtotal

Parent B Child Support Percentage

Parent B Obligation Subtotal

How many minor children? * 1 Child2 Children3 Children4 Children5+ Children

Percent of time the Children spend with Parent A * 25%30%35%40%45%50%55%60%65%70%75%

Percent of time the Children spend with Parent B * 75%70%65%60%55%50%45%40%35%30%25%

150 Multiplier

Parent A: 274 Overnights

Parent B: 91 Overnights

Example: Forty six weekends (Friday night & Saturady night) throughout the year.

Parent A: 255 Overnights

Parent B: 110 Overnights

Example: Every weekend (Friday night & Saturady night) throughout the year.

Parent A: 237 Overnights

Parent B: 128 Overnights

Example: Every weekend (Friday night & Saturady night) plus one weekday night every other week (i.e. Wednesday night) throughout the year.

Parent A: 219 Overnights

Parent B: 146 Overnights

Example: Every weekend (Friday night & Saturady night) plus two weekday nights twenty two weeks (i.e. Wednesday night & Thursday night) throughout the year.

Parent A: 200 Overnights

Parent B: 165 Overnights

Example: Every weekend (Friday night & Saturady night) plus two weekday nights every other week (i. e. Wednesday night & Thursday night) throughout the year.

e. Wednesday night & Thursday night) throughout the year.

Parent A: 183 Overnights

Parent B: 182 Overnights

Example: Alternating weeks where the first week parent A has three overnights (i.e. Wednesday, Thursday & Friday night) and during the second week four overnights (i.e. Wednesday, Thursday, Friday & Saturday night).

Parent A: 165 Overnights

Parent B: 200 Overnights

Example: Every weekend (Friday night & Saturady night) plus two weekday nights every other week (i.e. Wednesday night & Thursday night) throughout the year.

Parent A: 146 Overnights

Parent B: 219 Overnights

Example: Every weekend (Friday night & Saturady night) plus two weekday nights twenty two weeks (i. e. Wednesday night & Thursday night) throughout the year.

e. Wednesday night & Thursday night) throughout the year.

Parent A: 128 Overnights

Parent B: 237 Overnights

Example: Every weekend (Friday night & Saturady night) plus one weekday night every other week (i.e. Wednesday night) throughout the year.

Parent A: 110 Overnights

Parent B: 255 Overnights

Example: Every weekend (Friday night & Saturady night) throughout the year.

Parent A: 91 Overnights

Parent B: 274 Overnights

Example: Forty six weekends (Friday night & Saturady night) throughout the year.

Parent A's Estimated Payment to Parent B

Parent B's Estimated Payment to Parent A

Subtotal A-B Zero Out

Subtotal A-B

Estimated Monthly Support Payment

Subtotal B-A Zero Out

Subtotal B-A

Estimated Monthly Support Payment

* Required

Are you ready to move forward? Call

(262) 221-8123

to schedule a strategy session with one of our attorneys.

Wisconsin Child Support Guidelines for Sole Custody

The court will then use a standard percentage model based on the number of children when one parent has the children for less than than 92 overnights throughout the year. A typical example of this type of arrangement is every other weekend. When these placement arrangements are in place the court will use the percentage standard model shown below.

- For 1 child, it is 17%

- For 2 children, it is 25%

- For 3 children it is 29%

- For 4 children, it is 31%

- For 5 children, it is 34%

Sole Custody Child Support Examples

| Monthly Income | 1 child (17%) | 2 children (25%) | 3 children (29%) | 4 children (31%) | 5 children (34%) |

|---|---|---|---|---|---|

| $1,500 | $255 | $375 | $435 | $465 | $510 |

| $2,000 | $340 | $500 | $580 | $620 | $680 |

| $2,500 | $425 | $625 | $725 | $775 | $850 |

| $3,000 | $510 | $750 | $870 | $930 | $1,020 |

| $3,500 | $595 | $875 | $1,015 | $1,085 | $1,190 |

| $4,000 | $680 | $1,000 | $1,160 | $1,240 | $1,360 |

For more examples download the pdf here.

To refer directly to DCF 150 review the section labeled DCF 150.03 Support Orders. Above is a worksheet we put together to help calculate the amount child support payers will pay in child support. If you need further assistance please contact us we would be happy to help.

Wisconsin Sole Custody

Child Support Calculator

These are estimates based on the statutory guidelines. Please also note child support payments may be different than displayed below based on the circumstances of your individual case.

Loading...

Enter the non-custodial parent's YEARLY gross income (before taxes) *

How many minor children with the custodial parent? * 1 Child2 Children3 Children4 Children5+ Children

Subtotal1

Subtotal

Subtotal

Monthly Support Payments

$0

* Required

For Immediate help with your family law case or answering any questions please call (262) 221-8123 now!

Frequently Asked Questions

How do you calculate child support in Wisconsin?

To calculate child support in Wisconsin first the type of custody needs to be determined. If each parent has more than 92 overnights per year, then the State of Wisconsin has determined those parents are in a joint custody scenario and they must use a joint custody calculator to determine child support payments. If both parents do not have 92 overnights per year then the State of Wisconsin has determined the parent with the greater number of overnights has sole custody of the child. To determine child support in a sole custody scenario the parents must use a percentage standard to determine child support payments.

If each parent has more than 92 overnights per year, then the State of Wisconsin has determined those parents are in a joint custody scenario and they must use a joint custody calculator to determine child support payments. If both parents do not have 92 overnights per year then the State of Wisconsin has determined the parent with the greater number of overnights has sole custody of the child. To determine child support in a sole custody scenario the parents must use a percentage standard to determine child support payments.

What is child support percentage in Wisconsin?

The percentage of child support paid in Wisconsin is determined by the type of custody arrangement. If the custody arrangement is sole custody, then the following are the percentages used to calculate child support payments.

- 17 percent of gross income for 1 child

- 25 percent of gross income for 2 children

- 29 percent of gross income for 3 children

- 31 percent of gross income for 4 children

- 34 percent of gross income for 5 or more children

If the custody arrangement is joint custody, meaning both parents have the child more than 92 overnights a year, then child support payments are determined based on gross income and time spent with both parents. The shared placement child support calculator found on this page is a great way to estimate shared child custody payments.

The shared placement child support calculator found on this page is a great way to estimate shared child custody payments.

Does a father pay child support with 50/50 custody?

In a shared custody scenario, where both parents have the children 182.5 overnights per year and both parents make the same gross income no child support payments would be required. However, if one parent makes substantially more than the other parent in the same scenario where both parents have 182.5 overnights then the higher-earning parent will pay child support to the other parent. The shared placement child support calculator found on this page is a great way to estimate shared child custody payments.

Is child support based on gross income or net income?

In the State of Wisconsin, child support is determined using estimated annual gross income.

Can child support take your whole paycheck?

In the State of Wisconsin, law limits the amount that can be garnished for a child support order as follows. 50% of disposable income if the payer has an intact family living with her or him (a spouse and/or child) and has no arrears 55% of disposable income if the payer has an intact family living with her or him (a spouse and/or child) and has arrears 60% of disposable income if the payer has no intact family (a spouse and/or child) living with her or him and has no arrears 65% of disposable income if the payer has no intact family (a spouse and/or child) living with her or him and has arrears The State of Wisconsin defines gross income as all of the employee’s income from all sources before mandatory deductions for federal, state, local, and Social Security taxes are deducted. Gross income also includes employee contributions to any employee benefit program or profit-sharing and voluntary contributions to any pension or retirement account whether or not the account provides for tax deferral or avoidance. The State of Wisconsin defines disposable income as the part of the earnings of the employee remaining after deducting federal, state, and local withholding taxes, and Social Security taxes.

50% of disposable income if the payer has an intact family living with her or him (a spouse and/or child) and has no arrears 55% of disposable income if the payer has an intact family living with her or him (a spouse and/or child) and has arrears 60% of disposable income if the payer has no intact family (a spouse and/or child) living with her or him and has no arrears 65% of disposable income if the payer has no intact family (a spouse and/or child) living with her or him and has arrears The State of Wisconsin defines gross income as all of the employee’s income from all sources before mandatory deductions for federal, state, local, and Social Security taxes are deducted. Gross income also includes employee contributions to any employee benefit program or profit-sharing and voluntary contributions to any pension or retirement account whether or not the account provides for tax deferral or avoidance. The State of Wisconsin defines disposable income as the part of the earnings of the employee remaining after deducting federal, state, and local withholding taxes, and Social Security taxes. Deductions for Individual Retirement Accounts, medical expense accounts, etc. do not reduce disposable income.

Deductions for Individual Retirement Accounts, medical expense accounts, etc. do not reduce disposable income.

References: Child Support Guidelines Wisconsin, DCF 150.03 Support Orders, DCF 150.035(2)(b) Support Orders

Easy-to-use Wisconsin Child Support Calculator 2022

Easy-to-use Wisconsin Child Support Calculator 2022 | Divergent Family Law WisconsinFREE INITIAL CONSULT

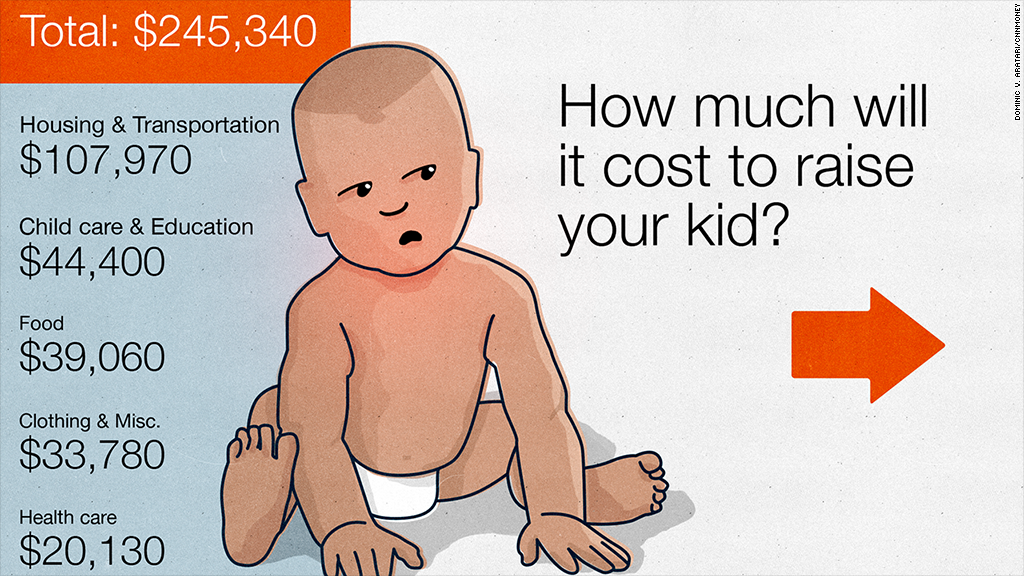

Child Support Rates

According to the United States Census Bureau, the national average child support payment was $430 per month in 2010. This means you could end up spending around $100,000 or more over the course of your child’s adolescence. Other factors unique to your situation could inflate that number even higher, such as number of children, the parents’ incomes, placement schedules, and more.

Minimize the cost spent on child support payments by contacting the professional Milwaukee Family law firm, Divergent Law. Our attorneys specialize in child support and child custody laws in Wisconsin. Use our free 2022 Wisconsin child support calculator for primary or shared placement schedules to estimate your monthly Wisconsin child support payments. Our child maintenance calculator uses statistics and rates found in DCF 150. Select different child custody arrangements to see how 50/50, 60/40 and 70/30 placement schedules would affect the child support amount.

Our attorneys specialize in child support and child custody laws in Wisconsin. Use our free 2022 Wisconsin child support calculator for primary or shared placement schedules to estimate your monthly Wisconsin child support payments. Our child maintenance calculator uses statistics and rates found in DCF 150. Select different child custody arrangements to see how 50/50, 60/40 and 70/30 placement schedules would affect the child support amount.

Child support is just one of the many aspects to consider when determining the cost of divorce in Wisconsin. Our Milwaukee divorce attorneys offer flat-fee quotes & flexible payment plans. See also: How much does a divorce cost in Wisconsin?

Divorce Cost Calculator

How Wisconsin Calculates Child Support Rates

Child custody and child support laws in Wisconsin are complex and hard to follow at times. Many factors can play into determining child support rates such as joint vs sole placement, the yearly gross income of the parents, special needs of the child(ren), and more. A 50:50 placement schedule would result in a very different child support payment than a 70:30 child custody schedule.

A 50:50 placement schedule would result in a very different child support payment than a 70:30 child custody schedule.

Guidelines exist for given situations for the courts to follow. The courts are required to follow these child support guidelines but they can deviate from them and increase or decrease payments based on other factors.

Divergent Law attorneys can help you navigate the complex landscape of Wisconsin child support and placement laws, codes, regulations, and violations to make sure your child support payments are fair.Contact Milwaukee child support attorneys at Divergent Law today for a free initial consultation.

FREEInitial Consult Get started now! Because it's worth it. KNOWThe Real Costs

Guidelines for the following placement situations are suggested for use by the courts:

Primary Placement

Shared Placement

Low-Income

High-Income

How Wisconsin Calculates Primary Placement Child Support Rates

When the non-residential parent has less than 92 (less than 25% of the time) overnight visits with the child(ren), Wisconsin considers the case to be of primary placement to the residential parent. The child(ren)’s primary residence and supervision are provided by the residential parent, while the non-residential parent is entitled to visitation, which may or may not include overnights.

The child(ren)’s primary residence and supervision are provided by the residential parent, while the non-residential parent is entitled to visitation, which may or may not include overnights.

Wisconsin uses the standard percentage formula, set by DCF 150 of our State Legislature. The percentage is based on the number of kids to be in primary placement of a parent. The paying parent will make child support payments based on the following percentages:

- For 1 child, it's 17% of gross income

- For 2 children, it's 25% of gross income

- For 3 children, it's 29% of gross income

- For 4 children, it's 31% of gross income

- For 5+ children, it's 34% of gross income

In Wisconsin, the courts may use their discretion in evaluating other factors to increase or decrease monthly child support payments. Additionally, percentages vary based on low or high-income of either party.

Use Divergent Law’s Wisconsin child support calculator with overnights to estimate child support payments for shared custody, split custody or full custody situations. These calculations should only be used as estimates to determine your monthly child support based on time spent with the child(ren).

These calculations should only be used as estimates to determine your monthly child support based on time spent with the child(ren).

Wisconsin Child Support Percentage Conversion (Examples)

| Monthly Income | 1 child (0.17) | 2 children (0.17) | 3 children (0.17) | 4 children (0.17) | 5+ children (0.17) |

|---|---|---|---|---|---|

| $2,000.00 | $340.00 | $500.00 | $580.00 | $620.00 | $680.00 |

| $2,100.00 | $357.00 | $525.00 | $609.00 | $651.00 | $714.00 |

| $2,300.00 | $391.00 | $575.00 | $667.00 | $713.00 | $782.00 |

| $2,500.00 | $425.00 | $625.00 | $725.00 | $775.00 | $850.00 |

| $2,900.00 | $493.00 | $725.00 | $841.00 | $899.00 | $986.00 |

View the WI Child Support Percentage Conversion Table (Chapter DCF 150 APPENDIX A) for more examples.

*Gross income is the sum of all wages, tips, profits, salaries, interest payments, and other forms of earnings, before any taxes and other deductions.

How Wisconsin Calculates Shared Placement Child Support Rates

To qualify for shared placement in Wisconsin, both parents are required to have at least 92 (25% of the time) overnight visits with the child(ren). Both parents have a significant amount of contact and time with their child(ren).

Wisconsin uses a Shared Placement formula based on the percentage standard as well as time spent with each parent. Child support in Wisconsin is determined by each parent’s gross monthly income, the standard percentage based on the number of children (see table below), and the percentage of time each parent spends with the child(ren).

In Wisconsin, the use of the shared placement formula for shared placement is at the discretion of the courts. The courts may also use other factors in increasing or decreasing monthly child support payments.

Use Divergent Law’s free online Wisconsin child support calculator for joint custody to determine an estimate of your monthly child support payments. These calculations should only be used as estimates to determine your monthly child support cost.

Wisconsin Child Support Standard Percentage

| 1 child | 2 children | 3 children | 4 children | 5+ children |

|---|---|---|---|---|

| 17% of gross income | 25% of gross income | 29% of gross income | 31% of gross income | 34% of gross income |

View the WI Shared Placement Worksheet.

*Gross income is the sum of all wages, tips, profits, salaries, interest payments, and other forms of earnings, before any taxes and other deductions.

How Wisconsin Calculates Low-Income Child Support Rates

If you’re gross monthly income is less than $1,485/month (75% to 150% of the 2022 Federal Poverty Guidelines), your child support obligation may be based off the low-income formula for primary placement or shared placement.

In Wisconsin, the use of the low-income formula for primary placement or shared placement is at the discretion of the courts. The courts may also use other factors in increasing or decreasing monthly child support payments.

Use Divergent Law’s easy-to-use online Wisconsin child support calculator to determine an estimate of your monthly child support payments. Our child support formula should only be used as estimates to determine your monthly child support cost.

Child Support Obligation of Low−Income Payers (Examples)

| Gross Monthly Income Up To: | Child Support for 1 child | Child Support for 2 kids | Child Support for 3 kids | Child Support for 4 Kids | Child Support for 5+ children | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Percent | Child Support Amount | Percent | Child Support Amount | Percent | Child Support Amount | Percent | Child Support Amount | Percent | Child Support Amount | |

| $781. | 11.22% | $88 | 16.50% | $129 | 19.14% | $149 | 20.46% | $160 | 22.44% | $175 |

| $808.00 | 11.43% | $92 | 16.80% | $136 | 19.49% | $157 | 20.84% | $168 | 22.85% | $185 |

| $889.00 | 12.05% | $107 | 17.71% | $157 | 20.55% | $183 | 21.97% | $195 | 24.09% | $214 |

| $1,057.00 | 13.28% | $140 | 19.54% | $206 | 22.66% | $240 | 24.22% | $256 | 26. | $281 |

| $1,309.00 | 15.14% | $198 | 22.27% | $291 | 25.83% | $338 | 27.61% | $361 | 30.28% | $396 |

| $1,485.00 or higher | – No longer eligible for Low Income formula – | |||||||||

View the WI Low-Income Payer Guidelines (Chapter DCF 150 – APPENDIX C) for more examples.

*Gross income is the sum of all wages, tips, profits, salaries, interest payments, and other forms of earnings, before any taxes and other deductions.

How Wisconsin Calculates High-Income Child Support Rates

If the paying parent’s gross income is $7000/month ($84,000/year) or more, your child support obligation may be based on the high-income payer worksheet for primary placement or shared placement.

In Wisconsin, the use of the high-income formula for primary placement or shared placement is at the discretion of the courts. The courts may also use other factors in increasing or decreasing monthly child support payments.

Use Divergent Law’s free online Wisconsin child support calculator to determine an estimate of your monthly child support amount per child.

Child Support Obligation of High-Income Payers

|

| 1 child | 2 children | 3 children | 4 children | 5+ children |

|---|---|---|---|---|---|

| The first $7,000/month of income | 17% of gross income | 25% of gross income | 29% of gross income | 31% of gross income | 34% of gross income |

| Portion of income between $7,000/month and $12,500/month | 14% of gross income | 20% of gross income | 23% of gross income | 25% of gross income | 27% of gross income |

| Portion of income that is more $12,500/month | 10% of gross income | 15% of gross income | 17% of gross income | 19% of gross income | 20% of gross income |

View the WI High-Income Payer Worksheet.

*Gross income is the sum of all wages, tips, profits, salaries, interest payments, and other forms of earnings, before any taxes and other deductions.

Frequently Asked Child Support Questions in Wisconsin

I don’t think my child(ren)’s parent is using the child support the way it should be. What can I do?

Child support is intended to go toward your child(ren)’s welfare, which includes rent, food, clothes, etc. Some of these things such as rent and food overlap where the other parent may benefit from. If you are concerned your child(ren) is being neglected, you could try to contact the Department of Health and Human Services to see what can be done. However, the paying parent does not have the right to decide how the support is spent on the child(ren).

If the other parent is refusing to let me see our child(ren), can I stop paying child support?

Your obligation first and foremost is to care for your child(ren), so do not stop paying. The issue of placement of the child(ren) and child support are considered two entirely different issues with the court and if you stop paying your child support, you could be held in contempt of court. If your court-ordered child placement schedule is being violated, you can file a motion to enforce physical placement against the other parent. Contact our attorneys today to find out all your options going forward.

The issue of placement of the child(ren) and child support are considered two entirely different issues with the court and if you stop paying your child support, you could be held in contempt of court. If your court-ordered child placement schedule is being violated, you can file a motion to enforce physical placement against the other parent. Contact our attorneys today to find out all your options going forward.

Can I just use the Child Support Calculator to determine the monthly child support payment?

Using the Child Support Calculator can give a calculated estimate to determine the monthly child supported cost. Though the calculator is based on guidelines determined by the State of Wisconsin courts, specifically DCF 150. The courts can deviate from these guidelines and increase or decrease payments based on other factors. A child support lawyer in Wisconsin can help you determine more accurate child support payment estimations.

How is child support determined?

Child support determination is based on the needs of the child, income and needs of the custodial parent, the paying parent's ability to pay and the child's standard of living before divorce or separation.

How many overnights is every other weekend?

Custody of your child(ren) every other weekend results in 52 overnights per year.

How many overnights is joint custody?

To qualify for joint physical custody, Wisconsin requires that each parent host more than 92 overnights per year. Use our child support shared custody calculator to see how many overnights for various joint custody arrangments.

How much child support will I pay for one child?

For one child, you will pay 17% of your gross income in child support. Percentages vary for low-income payers.

How do I apply for child support in Wisconsin?

To apply for child support in Wisconsin, you should visit your local child support agency. Filing for child support in Wisconsin can take place by downloading an application form online at the Wisconsin DCF website and returning the completed application to the child support agency.

How do I determine the first weekend of the month?

To determine the first weekend of the month, look at the first Friday of the month. If the 1st of the month is on or before Friday, that is the first weekend. However, if the 1st of the month is on Saturday, the following weekend will be the first weekend of the month.

If the 1st of the month is on or before Friday, that is the first weekend. However, if the 1st of the month is on Saturday, the following weekend will be the first weekend of the month.

What percentage of income do you pay for child support?

Wisconsin uses the standard percentage formula, set by DCF 150 of our State Legislature. The percentage is based on the number of kids to be in primary placement of a parent: For 1 child, it's 17% of gross income; For 2 children, it's 25% of gross income; For 3 children, it's 29% of gross income; For 4 children, it's 31% of gross income; For 5+ children, it's 34% of gross income.

BROKENHEARTED?

USE YOUR BRAIN.

WE'LL HANDLE THE DETAILS

GET STARTED NOW!Alimony from self-employed citizens of the Russian Federation in 2022

Alimony from self-employed citizens of the Russian Federation in 2022 is withheld in the manner prescribed by the Family Code. In the article we will tell you how self-employed citizens in Russia pay alimony, what needs to be done in order for the child to receive a payment, and what will change if a self-employed person gets a permanent job under an employment contract.

In the article we will tell you how self-employed citizens in Russia pay alimony, what needs to be done in order for the child to receive a payment, and what will change if a self-employed person gets a permanent job under an employment contract.

Alimony from the self-employed: what the law says

A self-employed citizen is an individual who is a tax payer on professional income. The essence of self-employment is simple: if the taxpayer has income, he pays tax on it. If there is no income, there is no tax to pay. This tax regime is designed specifically for those who do not have regular customers and receive money irregularly - in case of downtime, you will not have to make mandatory payments from your own pocket.

The question arises: how can a self-employed person pay child support? He does not have a stable income, which means that it will not be possible to establish alimony as a percentage of the income received - in months without income, the child may be left without money. In this case, you should be guided by the rules of Art. 83 of the RF IC - it provides the possibility of collecting alimony in a fixed amount of money.

In this case, you should be guided by the rules of Art. 83 of the RF IC - it provides the possibility of collecting alimony in a fixed amount of money.

How the amount of alimony is calculated

The amount of alimony is determined by the court. The basis for the calculation is the subsistence minimum established in the region where the child lives - a certain percentage of this amount will be paid as alimony.

When calculating, the amount of mandatory expenses for a child is taken into account - they should be indicated in the statement of claim. If the child needs regular expensive treatment or additional education, the court may increase the amount of the payment. In addition, the court takes into account the standard of living of the payer - the higher it is, the greater the alimony will be assigned.

The subsistence minimum is quarterly adjusted by the regional authorities - the amount of alimony for the self-employed changes after it.

Assignment of child support

ConsultantPlus has many ready-made solutions, including how to collect child support for minor children. If you don't have access to the system yet, sign up for a trial online access for free. You can also get the current K+ price list.

If you don't have access to the system yet, sign up for a trial online access for free. You can also get the current K+ price list.

Alimony from self-employed citizens in a fixed amount of money is assigned in court (clause 1, article 83 of the RF IC). To do this, the parent with whom the child remains must file a lawsuit with the relevant requirement in court. In it, according to Art. 131 Code of Civil Procedure of the Russian Federation, you must specify:

- name of the court to which the plaintiff applies;

- information about the plaintiff and the defendant - full name, address, contact phone number;

- description of the circumstances of the current situation, information about the child, grounds for going to court;

- a request for a fixed amount of support due to the fact that the defendant is self-employed and has irregular, fluctuating earnings;

- list of documents attached to the claim.

If the parents were able to agree on the amount of alimony

If the parents were able to independently determine the amount that one of them will transfer to the other to meet the needs of the child, you can not go to court. The agreement must be sealed with an agreement (clause 1, article 80 of the RF IC). The agreement must be certified by a notary - otherwise it will be considered invalid (clause 1, article 100 of the RF IC).

The agreement must be sealed with an agreement (clause 1, article 80 of the RF IC). The agreement must be certified by a notary - otherwise it will be considered invalid (clause 1, article 100 of the RF IC).

The agreement must include the following information:

- procedure for calculating the amount of alimony;

- frequency and timing of money transfers;

- enumeration method.

How money is transferred

A self-employed person can transfer money to pay child support in the following ways:

- personally into the hands of the other parent with whom the child lives;

- by transfer to a bank account;

- postal order.

Documents confirming the transfer of money should be kept. If disputes arise in the future, it will be much easier to prove your good faith as a payer of alimony. If the money is transferred in cash, it is worth taking a receipt from the other parent for receiving it.

What to do if a self-employed person does not pay alimony

If the alimony payer refuses to fulfill his obligations, the other parent (with whom the child remains) can apply to the bailiffs or to the bank where the payer has an account. Unpaid money will be forcibly withheld. But to receive payments through the employer (this is often done by bailiffs, sending a writ of execution to the accounting department of the enterprise) will not work, because the self-employed does not have an employer.

You need to apply to the bailiffs with a writ of execution - it is issued by the court. If there was no court, and the amount of alimony was established by an agreement on the payment of alimony, certified by a notary, submit this agreement to the bailiffs - it also has the force of a writ of execution (clause 2, article 100 of the RF IC).

If the self-employed person has taken up employment

If the self-employed person has entered into an employment contract, but has not ceased to be a payer of professional income tax, the amount of alimony may be recalculated. The payout will be calculated in one of the following ways:

The payout will be calculated in one of the following ways:

- as a percentage of the payer's income - 25% for one child, 33% - for two children, 50% - for three or more children;

- by the combined method - part of the payment will be calculated as a percentage of the payer's permanent income, and part will be accrued as a fixed amount.

In order to recalculate, you will have to reapply to the court - it will take into account the circumstances that have arisen and establish a new procedure for calculating the amount of alimony.

Results

So, self-employed citizens do not have a permanent income, so the alimony they must pay is assigned in a fixed amount of money - for this you will have to go to court. If the parents of the child were able to agree on the amount of alimony on their own, you don’t have to go to court - it’s enough to conclude an agreement, fix the amount of the monthly payment in it and certify it with a notary.

the size and who will pay them

The Verkhovna Rada adopted amendments to the legislation that increase the minimum amount of alimony to 50% of the subsistence minimum (hereinafter - PM). In addition, people's deputies equalized all family members: grandparents, brothers, sisters and other relatives who will pay child support at the same level as their parents. Consider the changes in the Family Code (hereinafter referred to as the FC) regarding the payment of alimony in Ukraine and tell you who will pay them if the parents evade this.

What is child support?

Alimony is a monthly payment for the maintenance of a child from a parent who lives separately from the child, awarded by court order from a part of the income of another person or in a clearly defined amount.

According to Art. 180 of the UK, parents are required to support a child until he reaches the age of majority, that is, up to 18 years.

There is also an obligation for parents to pay child support for an adult child until they reach the age of 23, provided that they need financial assistance due to disability or continue their education, and parents have the opportunity to provide such assistance.

How did the minimum amount of child support increase?

According to Part 2 of Art. 182 of the UK, the amount of alimony must be necessary and sufficient to ensure the harmonious development of the child. But not less than half of the PM determined for children of the corresponding age category.

Parents can determine the amount of maintenance voluntarily. To do this, the employee indicates the desired amount of deductions and the identity of the recipient in a personal statement. And the accountant must keep and transfer this amount in a timely manner.

If there is no voluntary consent, alimony can be collected through the court, and this will already be a forced payment. The amount of such payment can be determined as a percentage of income or as a fixed amount.

New Law of January 26, 2022 No. 2008-IX “On Amendments to the Family Code of Ukraine regarding an increase in the minimum amount of alimony that is collected for a child from other family members and relatives, and the introduction of a minimum amount of temporary state assistance to children whose parents evade payment of alimony” legislative provisions were improved and discriminatory discrepancies that arose in Art. 181 and 272 UK.

181 and 272 UK.

The new law raises the minimum amount of alimony and equalizes payments for all family members. Previously, in Ukraine, alimony was paid according to the following scheme:

- Parents paid at least 50% of the monthly allowance for a child of the corresponding age;

- other family members could pay at least 30%.

From 2022, the total amount of alimony that is collected for a child from other family members cannot be less than 50% of the PM (part 2 of article 182 of the UK)

If the parents are absent or unable to pay child support for good reasons, then other family members and relatives are responsible for supporting the child. That is, to pay child support at the level with parents can:

- grandparents;

- great-grandparents;

- brothers and sisters;

- stepmothers or stepfathers.

The amount of alimony to be collected from other family members and relatives for one child may be awarded by the court if the alimony payer's earnings (income) are sufficient. When determining the amount of alimony, the court takes into account the financial and marital status of the alimony payer and recipient.

When determining the amount of alimony, the court takes into account the financial and marital status of the alimony payer and recipient.

In accordance with Part 5 of Art. 183 of the UK, the court may issue an order to collect alimony for one child in the amount of one quarter, for two children - one third, for three or more children - half of the alimony payer's earnings.

In case of forced recovery of alimony, their amount is indicated in the court decision, court order, writ of execution and the decision of the executor issued in their execution. The employer must deduct only this amount of alimony from the employee's salary. The employer does not have the right to change this amount on his own.

In accordance with the Law on the State Budget for 2022, the PM for children is (see Table 1):

Period Payment PM for children under 6 years of age: - from 01/01/2022 to 06/30/2022 – from 07/01/2022 to 11/30/2022 2 201 - from 01. 2272 PM for children aged 6 to 18: - from 01/01/2022 to 06/30/2022 – from 07/01/2022 to 11/30/2022 2833 - from 01.12.2022 to 31.12.2022 2744 The minimum amount of maintenance for a child from one of the parents is (see Table 2): Table 2 (UAH) Period Payment Alimony for children under 6 years of age: - from 01/01/2022 to 06/30/2022 – from 07/01/2022 to 11/30/2022 1 100.50 - from 01.12.2022 to 31.12.2022 1,136. Alimony for children aged 6 to 18 years old: - from 01/01/2022 to 06/30/2022 1,309.00 – from 07/01/2022 to 11/30/2022 1,372.00 - from 01.12.2022 to 31.12.2022 1416.50 Attention! The maximum amount of alimony is 10 RM per child of the corresponding age (part 5 of article 183 of the UK). The maximum amount of alimony cannot exceed one of the parents per child (see Table 3). Table 3 (UAH) Period Payment For children under 6 years of age: - from 01/01/2022 to 06/30/2022 – from 07/01/2022 to 11/30/2022 22 010 - from 01. 22 720 For children aged 6 to 18: - from 01/01/2022 to 06/30/2022 – from 07/01/2022 to 11/30/2022 27 440 - from 01.12.2022 to 31.12.2022 28 330 By law, the child is also provided with state assistance under the following conditions: In these cases, the state provides temporary assistance, taking into account the material condition of the family in which the child of the corresponding age lives. The amount of assistance will also be at least 50% of the PM.

2 100  12.2022 to 31.12.2022

12.2022 to 31.12.2022

2618

1050.00  00

00

21 000  12.2022 to 31.12.2022

12.2022 to 31.12.2022

26 180

Who pays if parents evade child support?

00

00 57%

57%