How much money do you get for child tax credits

The Child Tax Credit - The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

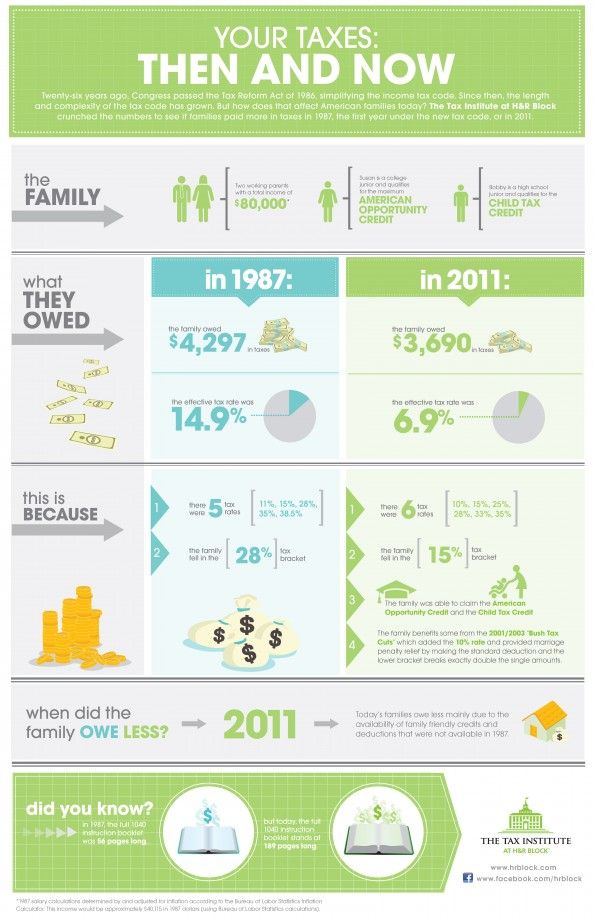

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

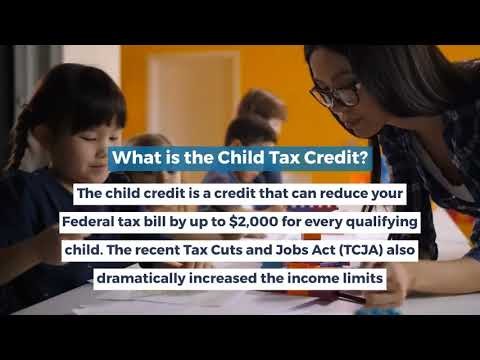

This tax credit helps offset the costs of raising kids and is worth up to $3,600 for each child under 6 years old and $3,000 for each child between 6 and 17 years old. You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return. You can get the tax credit even if you don’t have recent earnings and don’t normally file taxes by visiting GetCTC.org through November 15, 2022 at 11:59 pm PT. Learn more about monthly payments and new changes to the Child Tax Credit.

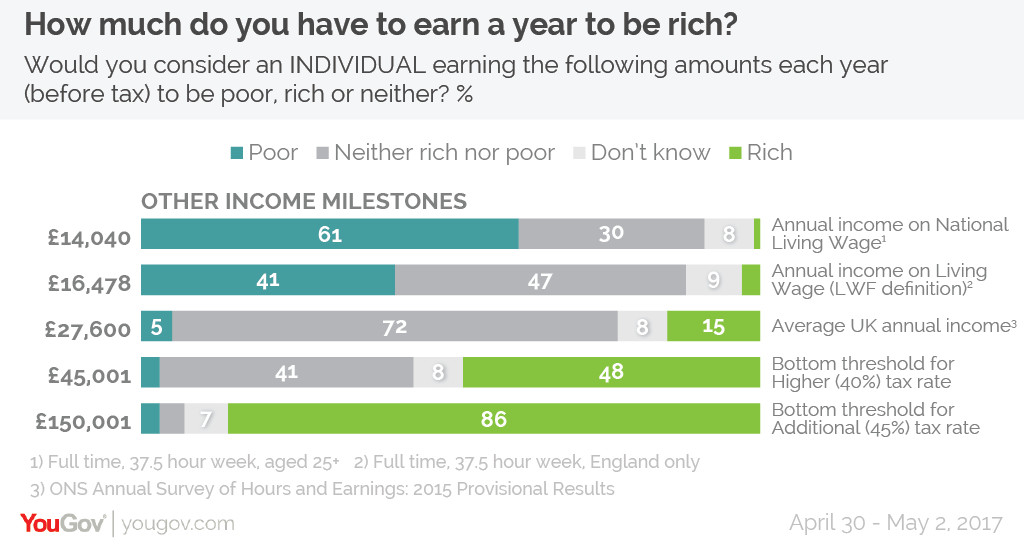

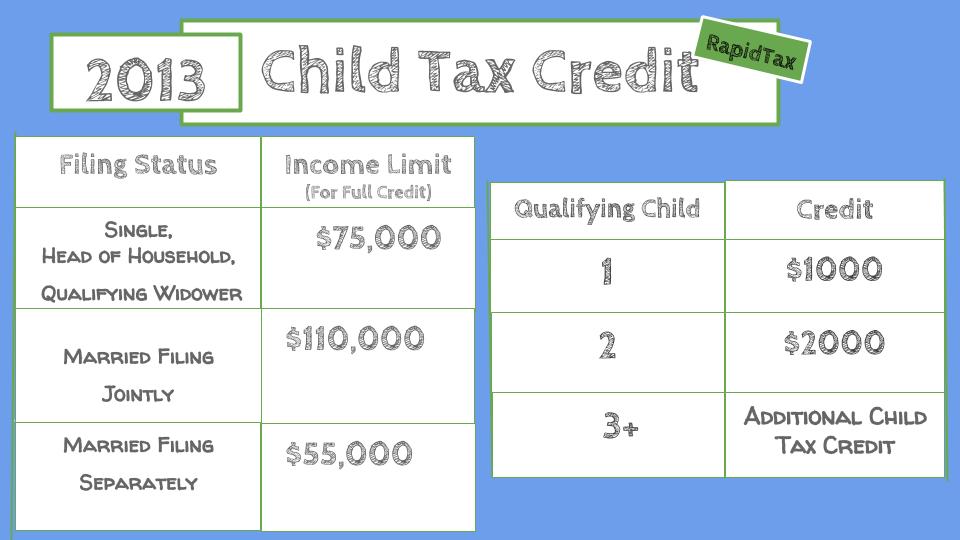

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

- How to claim the CTC

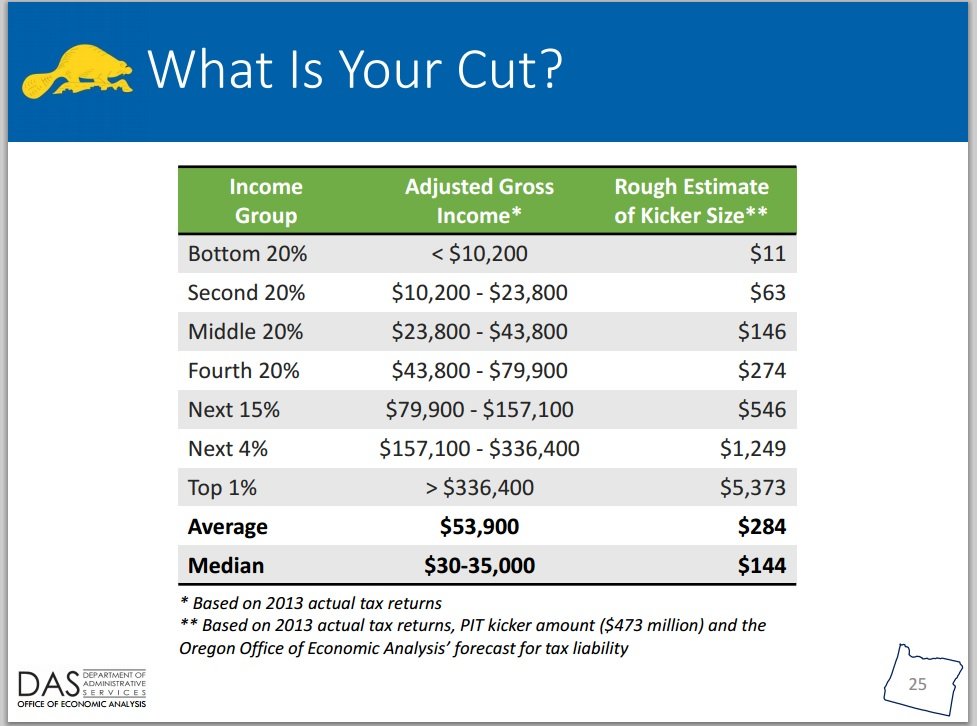

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 ($150,000 for married couples and $112,500 for heads of households). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

There are three main criteria to claim the CTC:

- Income: You do not need to have earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”. See below for details.

- Taxpayer Identification Number: You and your spouse need to have a social security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be 17 or under on December 31, 2021.

- Residency: The child must live with you in the U.

S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required). - Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an Individual Taxpayer Identification Number who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes (which you file in 2021) or submitted your info to the IRS through the 2021 Non-filer portal (this tool is now closed) or GetCTC.org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return (which you file in 2022), you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

The latest

By Christine Tran, 2021 Get It Back Campaign Intern & Reagan Van Coutren,…

Internet access is essential for work, school, healthcare, and more. The Affordable Connectivity…

If you receive unemployment compensation, your benefits are taxable. You will need to…

Earned Income Tax Credits

What is the Earned Income Tax Credit?

The Earned Income Tax Credit (EITC) is a low-income credit that allows you to receive money from the federal government. Even if you don't earn enough to be taxable, you can still get a one-time earned income tax credit! To receive credit, you must file a federal income tax return and send it to the IRS.

Even if you don't earn enough to be taxable, you can still get a one-time earned income tax credit! To receive credit, you must file a federal income tax return and send it to the IRS.

Massachusetts also has an Earned Income Tax Credit (EIC) that helps low earners get a refund from state government. To receive credit, you must file a state income tax return and mail it to the Massachusetts Department of Revenue.

You may be able to get a refund from both the federal and state governments if you file your tax returns and declare that you are entitled to these credits.

How much money can you get?

Federal credit

If you had no children living with you in 2014, you can receive up to $496.

If one child lived with you in 2014, you can receive up to $3,305.

If you had two children living with you in 2014, you can receive up to $5,460.

If you had three or more children living with you in 2014, you can receive up to $6,143.

Staff credit

If you receive a federal credit, the State of Massachusetts will also pay you a credit. It will be 15% of what the federal government pays you.

For example, if you receive $496 from the federal government, the state will pay you another $74.40.

How do I get these credits?

You must have earned income from working for an employer, full-time or part-time in 2014; You must have a valid Social Security Number and:

- In 2014, you must be between the ages of 25 and 64, with no children living with you, and earning less than $14,590.

or

- In 2014, you had one child living with you and earned less than $36,511

or

- In 2014, you had two children living with you and earned less than $43,756.

or

- In 2014, you had three or more children living with you and earned less than $46.

997.

997.

This amount is for unmarried adults. If you are married and filing jointly, add $5,340 to each of the above amounts.

To get a higher tax credit because a child lived with you, how old must the child be?

As a general rule, the child must be 19 or younger in 2014.

but if the child is under 24 in 2014 and is a full-time student.

also , children of any age are counted if they are completely incapacitated, even if they are adults.

What if you are not a US citizen? Is it possible to receive these credits?

Even if you are not a US citizen, you may be entitled to credits if you are a legal permanent resident. You also have the option to get them if you are married to a US citizen or legal permanent resident of the US.

How soon can I get the money?

You will be able to receive the money from 7-10 days after filing your tax return.

Will receiving money reduce other public benefits you already receive, such as welfare or food stamps (SNAP/Food Stamps)?

No. Getting tax credits will not affect your receipt of welfare (welfare) or food stamps (SNAP/Food Stamps), SSI, Medicaid, or community housing programs. But some programs may have rules about how long you can keep that money in the bank without spending it. See Tax refunds and credits.

Getting tax credits will not affect your receipt of welfare (welfare) or food stamps (SNAP/Food Stamps), SSI, Medicaid, or community housing programs. But some programs may have rules about how long you can keep that money in the bank without spending it. See Tax refunds and credits.

Can I get help filing a tax return to get money for these credits?

Yes. If there is a program called the Volunteer Tax Assistance Program (VITA), which will provide you with free assistance in filling out all the necessary paperwork.

You can search (VITA) by the name of your place of residence or the zip code of a free tax precinct near you, or call 1-800-829-1040.

What if you file your tax return late?

You will still be entitled to tax credits even if you file your tax return late, but in some cases you will have to pay a late filing penalty. If you are unable to file your tax return by April 15, 2015, seek advice from a tax preparer. You can speak to a free specialist at a free tax help office near you.

Tax deductions for foreign parents in Germany

From babysitting to moving expenses, here are some of the major and often overlooked deductions foreign families in Germany can make from their taxes.

Tax deductions for foreign parents in Germany have been around for a long time, but not all interested parties know about it. Today, whether it's the rise in the price of gasoline or the increase in the cost of fruits in the supermarket, everyday life in Germany is becoming more and more expensive. This is especially true for those who also need to cover the costs of supporting children and families.

See also: How to get tax deductions in Germany if you work from home

However, there are a number of tax incentives in the country that help reduce these costs.

The Local spoke with Munich-based tax advisor Thomas Zitzelsberger about key tax deductions for parents, including some often overlooked by foreign residents.

Tax deductions for foreign parents in Germany: Kinderfreibetrag vs.

Kindergeld

Kindergeld Imagine that you receive money every month just for having a child or children. This is exactly what Kindergeld (children's allowances) are.

From 2021, parents receive 219 euros per month for each child up to two years old, 225 euros for the third child and 250 euros for the fifth.

Payments usually continue until the child's 18th birthday, and sometimes until the 25th birthday if there are additional education costs (Ausbildungskosten) for studying at a university or vocational school.

Parents must apply for these benefits through their nearest family benefit (Familienkasse) and can only claim retroactive monthly payments for six months.

“Expats for some reason think they don't qualify for these benefits…and then they get furious that they can only get paid for the previous six months—everything else is a waste of time,” says Zitzelsberger. "It's really a shame."

If you receive Kindergeld, you also qualify for Kinderfreibetrag. Every resident of Germany has the right to receive a tax exemption for a certain amount, calculated on the basis of the cost per child. This amount is called Kinderfreibetrag.

Every resident of Germany has the right to receive a tax exemption for a certain amount, calculated on the basis of the cost per child. This amount is called Kinderfreibetrag.

Unlike Kindergeld, there is no need to apply here - the finance department will independently check whether a person or a married couple is eligible for such a benefit.

For 2021 and 2022, the tax credit is €5,460, which is credited to either married couples filing taxes together or single parents.

Child care costs

It does not matter to the German tax authority (Finanzamt) whether parents use babysitting services for a date or because their kindergarten is closed, as long as the payment of Betreuungskosten (child care costs ) is documented.

Parents can deduct up to two thirds of their annual child care costs (under 14) per year, up to a maximum of 6,000 euros. This means that the maximum you can expect is 4,000 euros per child per year.

Tax deductions for foreign parents in Germany: tuition fees

Whether kindergarten or high school, the vast majority of educational institutions in Germany are free or heavily subsidized.

But what if you pay for private tuition out of your own pocket? In this case, you can claim up to 30% of the tuition costs, up to a maximum of 5,000 euros per child per year.

However, the tax office strictly treats "tuition" as payment for school education, not for extracurricular activities.

“If your child plays music or football or whatever, it's your private pastime and there's no deduction,” says Zitzelsberger.

Single parents

In Germany, about two million mothers and fathers who raise children alone are called Alleinerziehende (literally "those who raise children alone").

The government recognizes the particularly high financial burden they bear and grants them a special tax credit (Entlastungsbetrag).

From 2021, single parents can deduct 4,008 euros from their income plus 280 euros per month for each child.

In some cases, single parents can also deduct Unterhaltszahlungen (maintenance payments) from their income up to 8820 euros per year. This may include, for example, the cost of a room for a child to live in if he lives in two houses.

This may include, for example, the cost of a room for a child to live in if he lives in two houses.

But the maximum deduction can only be received if the parent does not also receive Kindergeld or Kinderfreibetrag.

Health & Medical

“These expenses may be claimed as long as Finanzamt considers they are medically necessary,” says Zitzelsberger.

This does not apply, for example, to over-the-counter aspirin.

“However, if you have a doctor's prescription that says you need this drug and your health insurance does not fully cover it, then you can make that claim,” he added.

But there is one catch. While most other expenses come with a maximum deduction clause, health care costs require a minimum deduction of 2% to 4% of your income per year for all medical expenses for both the parent and their children.

A typical medical deduction that Zitzelsberger often faces for children is dental services. Parents can opt for special orthodontic treatment in addition to the basic rate already covered by insurance.

If it costs, for example, an additional 1,000 euros, parents can claim this deduction.

Tax deductions for foreign parents in Germany: relocation expenses

If a family gets a dream job or the opportunity to move to Germany and boards a plane before terminating the old lease, then this rent can be counted as a tax deduction, says Zitzelsberger.

However, sometimes one family member moves to Germany while the rest stay, at least temporarily.

To help reduce costs, the law allows such families to account for housing costs for a family member who has moved, as well as for round-trip travel.

One of the frequently asked questions is: “Is there a limit on the amount for this purpose?” Zittelberger says.

“There is no limit on travel expenses. But family members can only travel back and forth once a week.”

"Travel expenses" means everything related to a door-to-door trip, including a taxi to the airport.

The cost of living in Germany can also be deducted, but no more than 1,000 euros per month.

If a partner with children is not working or has a low income in another EU country, then Ehegattensplitting, a mechanism for taxing married couples, is applied to their situation.

"They can claim all the tax benefits to which all taxpayers resident in Germany are entitled, even if they have never set foot in this country before."

Good tax investment

In Germany, the first €10,000 of income is tax-free. However, most parents believe that this can only benefit them, not their children.

However, from birth, parents can open a savings account in their child's name. Up to 10,000 euros in interest - for example, that comes from a portfolio of shares in which their child participates - in this case, they are completely exempt from taxes.

"Many parents pay income tax every year on these investments, which are actually meant to be passed on to their children when they are adults," says Zitzelsberger.

"What you can do is pass this investment directly on to your children.