How to write a money order for child support

How to Pay Child Support in Texas

Under Texas law, a non-custodial parent is typically required to provide financial assistance to the custodial parent by paying child support on a regular basis. This arrangement ensures that the burden of raising the child does not fall on the state.

In this article, we tell you how to pay child support in Texas and why you must be careful not to fall behind on your child support payments. If you need an Austin child support attorney near you, contact our office for a consultation.

Where to Send Child Support Payments in Texas

The first thing you should know about paying child support in Texas is that the payments must be made to the Office of the Attorney General (OAG). Under Texas law, the Attorney General has the authority to collect and distribute child support payments and enforce child support orders as and when needed to ensure that the children are cared for.

Moreover, any payment made directly to the custodial parent can be considered a gift, which means it will not be counted as child support. So, make sure every single payment you make goes through the OAG.

Ways to Pay Child Support in Texas – 6 Options Available for You

If you are wondering how to pay child support in Texas, you will be happy to know that there are several options available for you. These include:

- Debit or credit card payments

- Checks

- Money orders

- Cash

- Wage withholding

- Automatic bank draft

How to Pay Child Support in Texas Using Credit or Debit Card?

There are four ways in which you can pay child support using your credit card or debit card.

- Pay online through Smart e-Pay

- Pay by phone through Smart e-Pay

- Pay online through Moneygram

- Pay through a Touchpay Kiosk

If you choose to pay through Smart e-pay or Moneygram, you will have to pay a convenience fee.

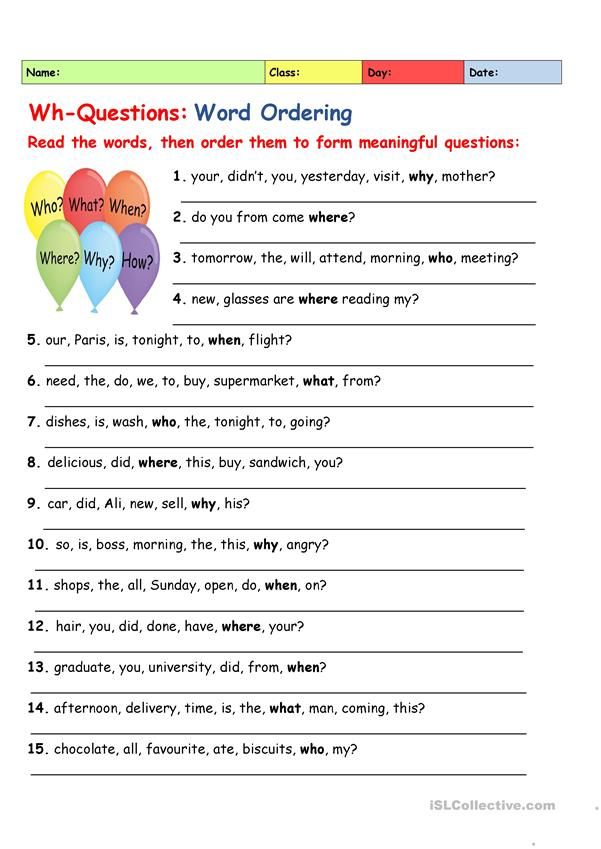

Can I pay Child Support in Texas with a Check or Money Order?

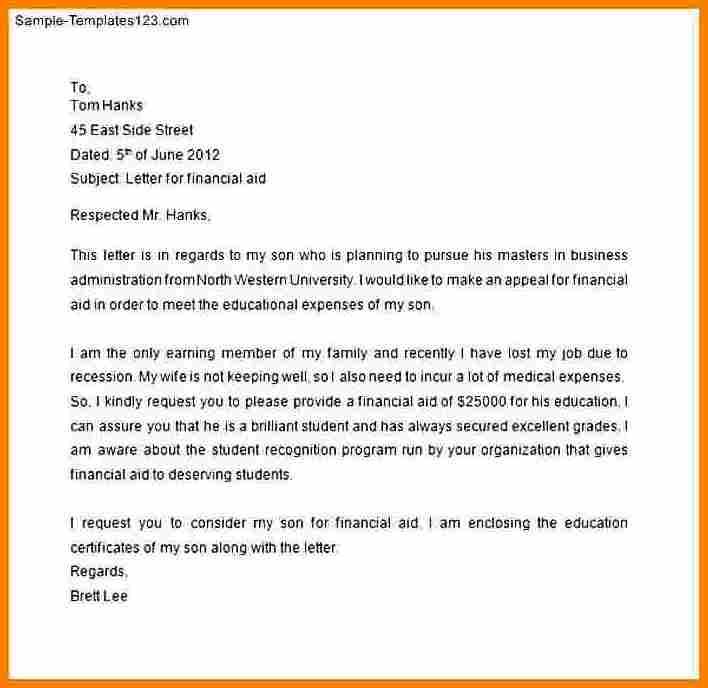

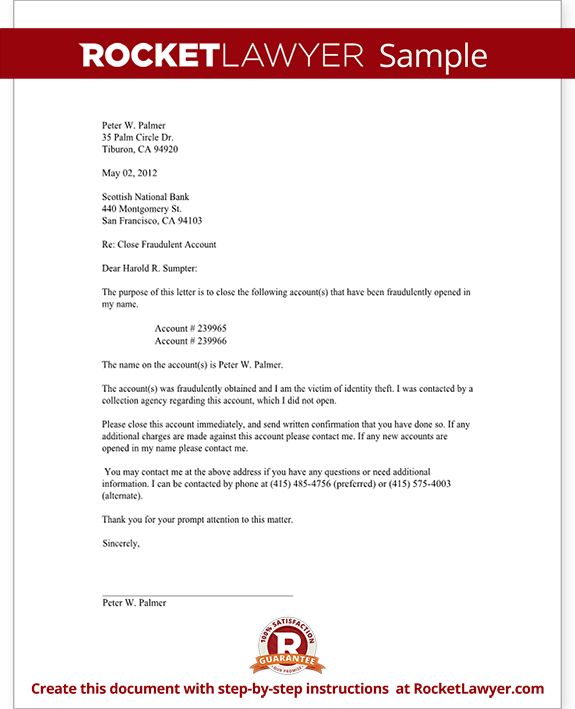

Yes, you can pay child support in Texas with a money order. You can send a check or money order by mail to the Texas State Disbursement Unit (SDU). The check or money order should be made to the Office of the Attorney General. Make sure you mention your name, your ex-spouse’s name, your cause number, and your 10-digit case number.

You can send a check or money order by mail to the Texas State Disbursement Unit (SDU). The check or money order should be made to the Office of the Attorney General. Make sure you mention your name, your ex-spouse’s name, your cause number, and your 10-digit case number.

If you’re paying child support by mail, the address you mail it to is listed here.

How to Pay Child Support through Wage Withholding?

This is the most common method to pay child support in Texas. You can provide your employment information to the OAG and request them to deduct child support from your weekly or monthly paycheck.

The OAG will send an ‘order to withhold income for child support’ to your employer. Upon receiving this, your employer will start deducting the amount from your paycheck on a regular basis. Your employer will send the deducted payment to the OAG, who will then send it to your ex-spouse. You may need to contact the nearest Texas child support office.

How to Pay Child Support in Texas through Automatic Bank Draft?

Using the Smart e-Pay tool, you can make sure that child support payments are automatically debited from your bank account on a weekly or monthly basis.

Looking for a Child Support Attorney in Texas? Eric M. Willie Can Help You!

Whether you are a non-custodial parent who wants your child support order reviewed or modified or a custodial parent who wants the child support order enforced, Eric M. Willie can help you.

An experienced family law attorney, Eric Willie can guide you through the process of paying or receiving child support and provide you with legal assistance as and when needed regarding the enforcement of the order.

If you have any questions regarding how to pay child support in Texas, call the Law Office of Willie & Dasher today at 512-982-0714 or fill out this contact form to schedule an appointment with one of our divorce attorneys.

Client Reviews

“Eric has represented me on multiple occasions in matters of child support modification, modification of visitation orders, and estate planning. On every occasion, he has been straight-forward and honest with me about my options. He always takes the time to patiently answer my many questions, either in person, by phone, or via email. Issues of visitation and child support are always emotionally charged, and I appreciate Eric’s quick responses – he understands that while a case in family court may just be a number on a docket to many, it represents an important and stressful unanswered question in his client’s life. ” – Jeannette Montgomery, Rating: 5/5

Issues of visitation and child support are always emotionally charged, and I appreciate Eric’s quick responses – he understands that while a case in family court may just be a number on a docket to many, it represents an important and stressful unanswered question in his client’s life. ” – Jeannette Montgomery, Rating: 5/5

We have a 4.6 average and 176 reviews on Google

NC Child Support Centralized Collections

General Information

The NC Child Support Centralized Collections (NCCSCC) operation collects and processes all child support payments in North Carolina at one central location. North Carolina has contracted with a private vendor for the operation of NCCSCC. Federal regulation 42 U.S.C. 654B and North Carolina General Statute 110-139(f) mandated the implementation of the NCCSCC operation.

All new support orders specify that payments be made to the NCCSCC operation. If an individual owes child support in more than one case, payments are automatically prorated among those cases, per federal regulations.

In situations where the trial court sets a purge condition for an obligor to pay child support by a certain date, the obligor must make the payment to the Clerk of Superior Court in person, and indicate where and how the payment should be applied. Clerks of Court then send these payments to NCCSCC.

NCCSCC Information for Obligors/Noncustodial Parents

Income withholding from paychecks is required by law for most child support cases. You can make a web-based payment when the court has not ordered income withholding or if you need to supplement existing income withholding payments. Existing income withholding orders cannot be terminated and replaced with web-based payments. Web-based payments will not prevent the implementation of an income withholding order.

If you need to report the availability of income withholding with a new employer, please log in or create a login on the Parents Portal at https://ncchildsupport.ncdhhs.gov/ecoa/login.htm and select "Manage My Personal Information," under the Parents pulldown menu in the navigation bar near the top of the page, to update your employment. You may still make a payment using any of the other methods listed on this page until payments are withheld by your employer to avoid missing any payments.

You may still make a payment using any of the other methods listed on this page until payments are withheld by your employer to avoid missing any payments.

Pay by Mail

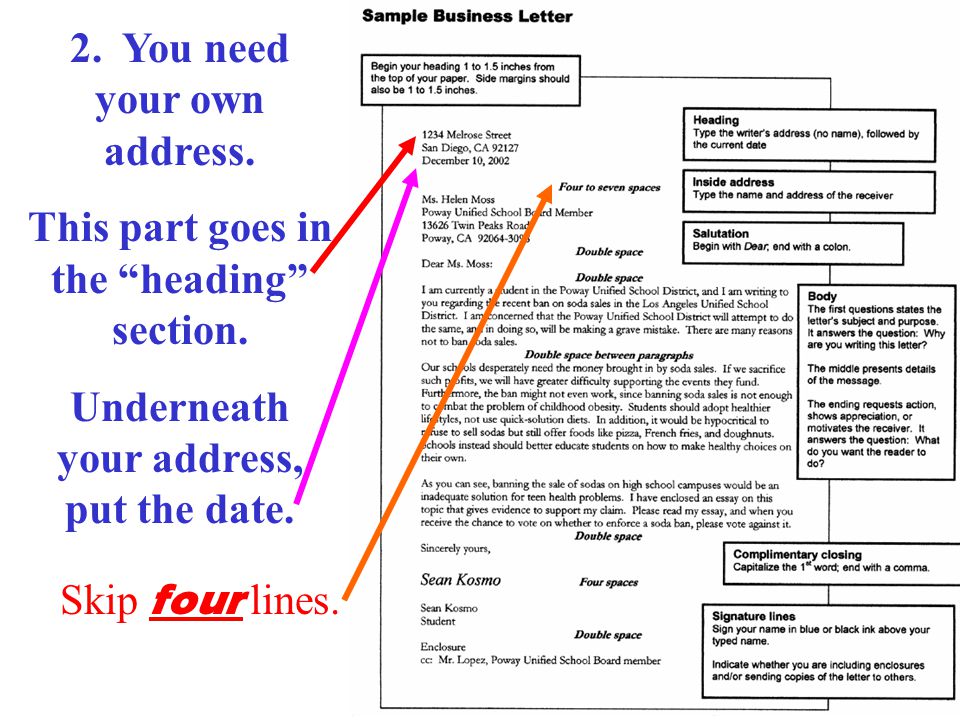

To pay your child support by mail make your check or money order payable to NC Child Support. Include your check or money order with your payment coupon in the provided self-addressed envelope. If you have not yet received your coupons by mail you are still obligated to make your payment.

Include your Master Participant Index number (MPI), docket number, name, and address on a blank sheet of paper with your payment or fill out a blank coupon. If you do not know these numbers contact the local Child Support Agent or Clerk of Court handling your case. Blank payment coupons can be found at https://www.ncdhhs.gov/media/8333/download. Mail your payment to:

NC Child Support Centralized Collections

PO Box 900006

Raleigh, NC 27675

For all others (out-of-state Payors, liens, bonds, etc. )

)

NC Child Support Centralized Collections

PO Box 900020

Raleigh, NC 27675

Pay Online

You may use your Mastercard®, Visa®, Discover Card®, or American Express® to make a child support payment. The service fee for using this service is 2.5% and is separate from your child support obligation. You can register to pay by credit or debit card at https://ncchildsupport.ncdhhs.gov/ecoa/smartpayopt.htm If you have questions about this pay method, contact Smart e-Pay Customer Service at 1-877-361-5437.

Pay with Automatic Bank Draft

Parents and employers can schedule automatic bank drafts by registering an account and scheduling payments. A valid email address is required for communication.

You may sign up for a bank draft online or by submitting a registration form to the NC Child Support Centralized Collections Operation by US mail or fax. A form may be requested by calling Customer Service at 1-800-992-9457 or downloading if from this website: https://ncchildsupport. ncdhhs.gov/ecoa/smartpayopt.htm

ncdhhs.gov/ecoa/smartpayopt.htm

NC Child Support Centralized Collections Operation

PO Box 900020

Raleigh, NC 27675-9020

OR

Register at https://ncchildsupport.ncdhhs.gov/ecoa/smartpayopt.htm

Pay by Phone

You can make a non-recurring payment by calling 1-800-992-9457 or 1-855-702-2268.

You may use your Mastercard®, Visa®, Discover Card®, or American Express® credit or debit card to make a child support payment via phone. The service fee for using this service is 2.5% and is separate from your child support obligation.

E-Wallet

You can make your child support payment using Apple Pay, Google Pay, PayPal, or Venmo if you have your credit/debit card linked to an e-wallet account. The service fee for using this service is 2.5% and is separate from your child support obligation.

Register an account to make payments or add an e-wallet pay method at https://ncchildsupport.ncdhhs.gov/ecoa/smartpayopt.htm

Pay at Walmart

You can make NC Child Support Services support payments at any Walmart nationwide. Visit the Walmart Money Center or Customer Service Desk, request to make a bill payment to NC Child Support, and provide the representative with your picture ID, name and MPI number (without the leading zeroes). Payments can be made with cash or debit card. A $2.00 service fee applies in addition to the payment amount.

Visit the Walmart Money Center or Customer Service Desk, request to make a bill payment to NC Child Support, and provide the representative with your picture ID, name and MPI number (without the leading zeroes). Payments can be made with cash or debit card. A $2.00 service fee applies in addition to the payment amount.

NCCSCC Information for Employers

Federal and state laws require all child support payments be processed at one central location. For North Carolina this location is the NCCSCC. This operation simplifies the wage withholding process allowing employers to send one check to one address for North Carolina support payments.

Employers can also submit wage withholding payments by Electronic Funds Transfer/Electronic Data Interchange (EFT/EDI). This efficient method of remitting child support payments offers an alternative to preparing checks and remittance documents. If you are interested visit the EFT/EDI web page.

Income Withholding

Child support payments must be made payable to NC Child Support. Payments must be mailed to the following address or submitted by EFT/EDI.

Payments must be mailed to the following address or submitted by EFT/EDI.

NC Child Support Centralized Collections

PO Box 900012

Raleigh, NC 27675

Checks that are unacceptable for deposit, such as an unacceptable payee name on the payment document, are returned to the sender. Support payments must include the obligor’s docket number and Master Participant Index (MPI) number. The telephone number of the contact person for the employer must accompany payments.

Employers who fail to submit payments in a timely manner are subject to enforcement action for noncompliance. Employers who submit checks that are returned for insufficient funds lose their check writing privileges and could face enforcement action.

Tools for Employers

Employers can call the NCCSCC Customer Service Center for Employers at 1-877-280-3675. This unit is staffed on business days between 7:30am and 5:30pm. Employers can also contact the NCCSCC via e-mail or by sending mail to:

North Carolina Child Support Services

PO Box 20800

Raleigh, NC 27619-0800

Everything about the field "Purpose of payment" - correct filling

The correct purpose of the payment will help the counterparty to correctly take into account your payment: as payment for a product or service, repayment of a debt or loan. But this field is visible not only to the recipient of the money, but also to the bank. When checking payments, he follows the rules of internal control against money laundering and terrorist financing (according to the law 115-FZ).

But this field is visible not only to the recipient of the money, but also to the bank. When checking payments, he follows the rules of internal control against money laundering and terrorist financing (according to the law 115-FZ).

If the purpose of the payment is not specified, the bank cannot to identify. From this, questions may arise regarding settlement operations. business accounts. 115-FZ gives banks the right to request supporting documents, if the economic meaning of the payment is unclear. Business is at risk with restrictive measures.

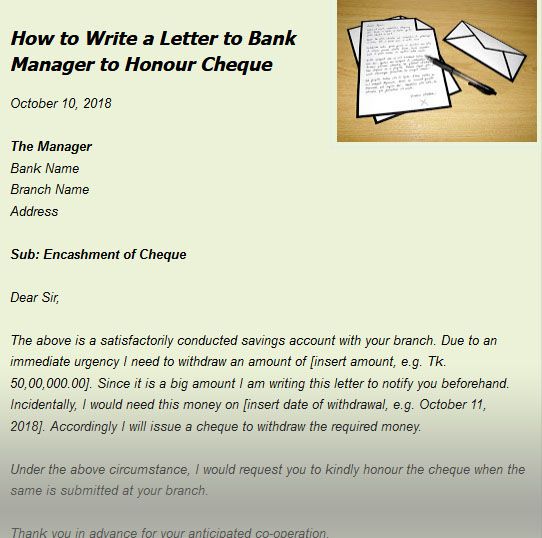

Regardless of the amount for which you create a payment order, always correctly fill in the field "purpose of payment" and demand the same from counterparties. Submit this article to your accountant or employee who creates payment orders. Here three basic rules:

Submit this article to your accountant or employee who creates payment orders. Here three basic rules:

- Please refer to the agreement or invoice number.

- Specify what exactly the payment is for - name goods or services.

- Try to avoid formal appointments "Payment under the contract" or Delivery Payment.

Payment examples

Wrong

Right

Payment under contract No. С58VP dated January 15, 2022 No VAT

С58VP dated January 15, 2022 No VAT

Payment under contract No. С58VP dated January 15, 2022 for the supply of goods (boards) VAT is not a subject to a tax

Payment by account No. 189 dated January 10, 2022, incl. VAT

Payment by account No. 189 from 01/10/2022 for transport services including VAT 20% 1564.89

To identify a payment, the bank looks at the following details:

- Specified purpose of payment.

- The name of the goods, works or services for which the payment is made.

- Number, date of contracts and other commercial documents, if any.

- VAT amount.

- Other information required for verification.

There are no strict requirements for the text of the payment order. The main thing is to describe in detail the essence of the operation: to whom, for what and in accordance with what documents.

Detailed rules for filling out a payment order are set out in Bank of Russia Regulation No. 762-P dated June 29, 2021 “On the Rules for Transferring Funds”.

The Risk blocking", and consult on the results of the analysis of operations for the last 12 months - "Compliance Assistant".

For more articles on online banking suspensions, see How to Avoid Restricting Your Account.

The article was updated on July 12, 2022

Payment of the state duty is confirmed by a receipt | Federal Tax Service of Russia

68 Tambov region

Publication date: 09/26/2017

Edition: Tambovskaya Zhizn newspaper dated 07/26/2017

Subject: State duty payment Source:

http://tamlife.ru/gazeta/index.php?option=com_k2&view=item&id=19868=56

The state duty is collected from both legal entities and individuals when they apply to state bodies, local governments and other bodies for the commission of legally significant actions in relation to them, provided for by the provisions of Chapter 25.3 of the Tax Code of the Russian Federation "State Duty". The state fee is paid at the place where the legally significant action was performed in cash or non-cash form.

The fact of payment of the state fee by the payer in a non-cash form is confirmed by a payment order with a note from the bank or the Federal Treasury. When paying in cash, a receipt from the bank where the payment was made is required. If there is information on the payment of the state duty contained in the State Information System on State and Municipal Payments, additional confirmation of payment is not required.

The amount of the state fee, benefits and features of its payment in cases, considered by the courts, for state registration of acts of civil status, for the performance of legally significant actions by authorized bodies, for the performance of notarial acts, and the procedure for the return of overpaid state duty is established by the norms of Chapter 25.3 of the Tax Code of the Russian Federation . An application for the return of the overpaid amount of the state fee shall be submitted by the payer of the state fee to the body authorized to perform legally significant actions for which the state fee has been paid. The application for a refund shall be accompanied by original payment documents if the state fee is refundable in full, and if it is refundable in part, copies of the specified payment documents.

The application for a refund shall be accompanied by original payment documents if the state fee is refundable in full, and if it is refundable in part, copies of the specified payment documents.

The decision to return to the payer the overpaid amount of the state fee is made by the body that performs the actions for which the state fee was paid. The return of the overpaid amount of the state fee is carried out by the Federal Treasury. An application for the return of the overpaid amount of the state fee in cases considered in courts, as well as justices of the peace, is submitted by the payer of the state fee to the tax authority at the location of the court in which the case was considered.

An application for the refund of the overpaid amount of the state fee may be submitted within three years from the date of payment of the said amount. The refund of the overpaid amount of the state fee is made within one month from the date of submission of the said refund application.