How to save money for child future

How to Save Money for Your Children’s Future

By Kia Jackson • October 03, 2022

We all want the best for our children. We want them to get a great education, live their best and healthiest lives, and reach their fullest potential. One way to give them the greatest opportunity for success is by saving toward their financial future. If you haven’t already mapped out a savings plan for your child, here are a few ideas that can help you find the best way to invest for your child’s future.

6 ways to save for your kids

Every dollar you’re able to set aside for your children’s future can get them closer to financial security as they get older. There are a number of ways to begin building that nest egg, including:

Open a savings account.

Traditional savings accounts offer a tried-and-true way to store money. While your savings won’t earn much in terms of interest, you’ll get peace of mind in a federally insured bank knowing that your money is safe.If you’re not sure how to open a savings account for a child, either ask wherever you currently bank about potential kids bank account options, do a bit of research online or ask your friends and family how they save money for their kids.

Open a custodial account.

When you set up a custodial savings account at a bank or custodial investment account at a brokerage, you get to control and manage the account for your child until they turn 18 (or up to 25, depending on your state). At that point, they may then be eligible to take over and are free to use the funds in the account. This option could be the best type of account to open for a child if you want to make sure they have limited to no access to the funds while they’re young.Start a 529 plan.

Nearly 64% of undergraduate college students take out student loans, with the average amount of loan debt over $26,000 for public colleges and nearly $32,000 for private colleges. 1 Considering that, starting a savings plan for your child to help cover potential future education costs might be a good idea. A 529 plan is an investment account that offers tax advantages when used to pay for education expenses for your child or yourself. Most plans allow you to have contributions automatically deducted from your bank account monthly, or make lump-sum contributions whenever you can. In most cases, others like friends and family members can also contribute to the 529 plan, which could help your child’s college savings grow faster.

1 Considering that, starting a savings plan for your child to help cover potential future education costs might be a good idea. A 529 plan is an investment account that offers tax advantages when used to pay for education expenses for your child or yourself. Most plans allow you to have contributions automatically deducted from your bank account monthly, or make lump-sum contributions whenever you can. In most cases, others like friends and family members can also contribute to the 529 plan, which could help your child’s college savings grow faster.Open a Roth IRA.

Many people view this as only a retirement account, but withdrawals from a Roth IRA can be made to pay for college expenses without the typical early withdrawal penalty of 10%.2 A Roth IRA allows you to contribute up to $6,000 a year of earned income if you’re under 50 years old and up to $7,000 per year of earned income if you’re 50 or older. Earnings on your contributions grow tax-free, and you can withdraw any of the principal (that’s the money you’ve contributed to the fund, not the money earned on it) without penalty. To withdraw any of the earnings, you must be age 59 ½ or older, otherwise, you’ll be charged a 10% penalty. However, withdrawals for college expenses, first-time home purchases or birth/adoption costs may be some potential exceptions to the rule. Since these are major expenses your child may face in adulthood, a Roth IRA may be a great way to save for your child’s future.

To withdraw any of the earnings, you must be age 59 ½ or older, otherwise, you’ll be charged a 10% penalty. However, withdrawals for college expenses, first-time home purchases or birth/adoption costs may be some potential exceptions to the rule. Since these are major expenses your child may face in adulthood, a Roth IRA may be a great way to save for your child’s future.Set up a trust fund.

Much like custodial accounts, trust funds may also allow you to open and manage an account for your child until they are old enough to do it themselves. But a trust fund can give you even greater control over exactly when and how your children access the account. An attorney can help you create a trust fund with the instructions and rules you specify.Teach them how to save for themselves.

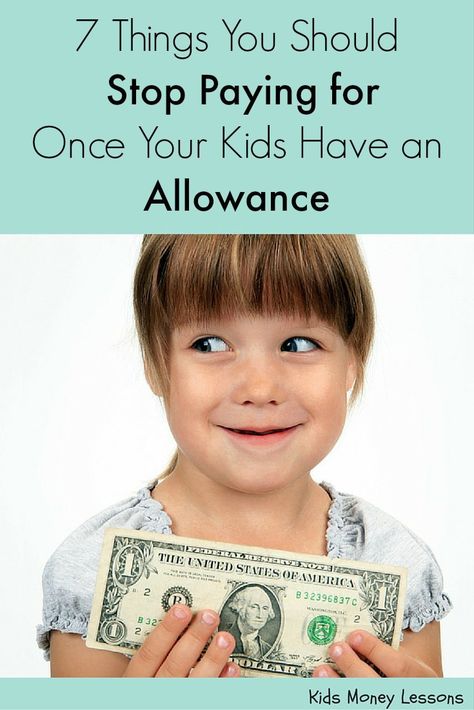

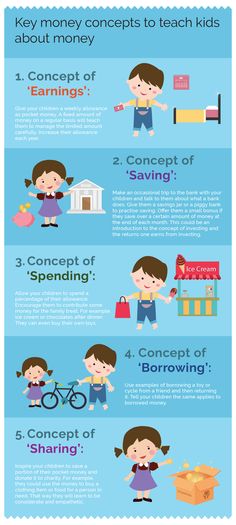

In a recent study, 31% of parents said they never talk to their children about household finances.3 But in order for children to appreciate the value of money and the importance of saving it, conversations about money should happen early and often. There are countless resources online and through local organizations. For example, OneMain offers the Credit Worthy Family Resource Center with articles, videos and other resources to give all age groups real-world financial education.

There are countless resources online and through local organizations. For example, OneMain offers the Credit Worthy Family Resource Center with articles, videos and other resources to give all age groups real-world financial education.

How much should you save for your child’s future?

How much to save depends on your goals for your children. Saving to pay for college education is one of the most common goals for parents. According to one report, to pay for four years at an in-state public college, you would have to invest roughly $300 a month starting at birth to cover tuition, room, board and fees.4 And that number rises to $600 per month for private colleges.5 But if your goal is simply to provide your child with a nice nest egg to pay for milestone events like buying a house, getting married or starting a business, the savings amount you should aim for can vary. A financial advisor can help you map out a savings plan for your child that fits your budget and goals.

The best way to save for a child’s future is to start now

Whether your child is in preschool or high school, you can always take steps to put them in a position to succeed in the future. Even if your finances only allow you to save or invest a small amount each month, every little bit can get your child closer to achieving financial security in adulthood.

1. https://www.usnews.com/education/best-colleges/paying-for-college/articles/see-how-student-loan-borrowing-has-changed

2. https://www.investopedia.com/articles/retirement/02/111202.asp

3. https://www.cnbc.com/2022/04/06/americans-think-parents-should-teach-kids-about-money-yet-many-dont.html

4,5. https://www.cnbc.com/select/how-much-should-you-be-saving-for-your-childs-college-education/

The information in this article is provided for general education and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness or fitness for any particular purpose. It is not intended to be and does not constitute financial, legal, tax or any other advice specific to you the user or anyone else. The companies and individuals (other than OneMain Financial’s sponsored partners) referred to in this message are not sponsors of, do not endorse, and are not otherwise affiliated with OneMain Financial.

It is not intended to be and does not constitute financial, legal, tax or any other advice specific to you the user or anyone else. The companies and individuals (other than OneMain Financial’s sponsored partners) referred to in this message are not sponsors of, do not endorse, and are not otherwise affiliated with OneMain Financial.

How to Invest for Your Children's Future

By Ramsey Solutions

By Ramsey Solutions

Whether your kids are still crawling around the living room floor or getting ready to graduate from high school, there are plenty of ways you can give them a head start on their financial future.

After all, time and compound growth are on their side—and that’s perfect for kick-starting your children's retirement savings. Or maybe you just want to help your kids get a college diploma without taking on any debt.

Those are great goals to have! So, give yourself a high five! Here’s a closer look at all the options you have to invest in your child or grandchild’s future.

Before You Start Investing for Your Kids

We know you’re eager to dive in, but let's pump the brakes for just a second. There’s one ground rule you need to follow. Ready? Here it is: Make sure you’re taking care of yourself before you start investing for your children or grandchildren.

Market chaos, inflation, your future—work with a pro to navigate this stuff.

Whenever you get on an airplane, one of the first things the flight attendants tell you to do in case of an emergency is to put on your own oxygen mask first before you turn around to help others. The same principle applies here, parents. You need to be completely out of debt (everything except your mortgage) with a fully funded emergency fund (enough to cover 3–6 months of expenses) and investing 15% of your income for retirement first. That’s your “oxygen mask”!

Hear us loud and clear here: Do not start investing for your child if you have to stop investing for your own retirement. You need to be prepared financially so you don’t end up depending on your children during your retirement years.

You need to be prepared financially so you don’t end up depending on your children during your retirement years.

Now that that's out of the way, let's take a look at how to invest in your child’s future.

Investing for Your Child’s College Education

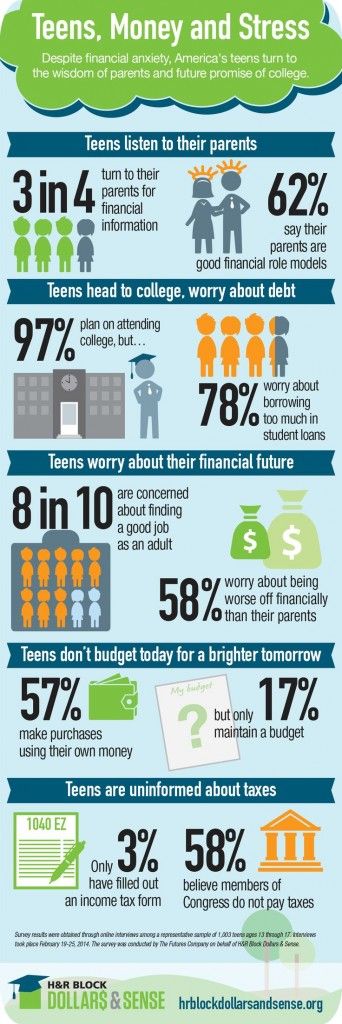

Our research shows more than half (53%) of those who took out student loans to pay for school say they regret that choice, and 43% of them even regret going to college altogether.1

Listen, there’s no law that says parents have to give their kids a paid-for college education. But if that’s important to you and you’re in a position to do it, saving for your kids’ college fund so they can avoid years of student loan payments is the best investment you can make for your kid’s future. They’ll thank you later! Plus, you have some tax-advantaged college savings options similar to your retirement accounts to help you make the most of your savings.

An Education Savings Account (ESA or Coverdell Savings Account) is a great place to start! They’re simple and are similar to an IRA, but there are a couple limitations. First, the maximum you can invest in an ESA is $2,000 a year per child. And second, married couples making more than $220,000 a year and single parents bringing in more than $110,000 a year can’t make contributions to an ESA.2

First, the maximum you can invest in an ESA is $2,000 a year per child. And second, married couples making more than $220,000 a year and single parents bringing in more than $110,000 a year can’t make contributions to an ESA.2

If you want to invest beyond the $2,000 limit or if your income exceeds the ESA income limits, you can also save up for your kid’s college in a 529 plan. This investment account offers tax breaks that allow you to set aside money for qualified educational expenses—things like tuition, books and fees. Sounds like a great option for planning for college, right?

And guess what? With a major update from the Secure Act 2.0 that was recently passed, the 529 plan will soon get even better! See, beginning in 2024, you can rollover any unused money from a 529 into a Roth IRA for the plan’s beneficiary. And no income taxes or penalties on the rollover (as long as the contributions to the 529 plan weren’t made in the last five years). That’s great news if you’re worried about putting more into a 529 than your kid will end up needing for college.

Investing for Your Child’s Future Retirement

Some of you are thinking much further ahead and wondering how you can give your kids a head start on retirement. That’s great! It’s never too early to save for retirement.

But here again, priorities are important. If your child is earning money, they should use some of it to save for college first before they worry about retirement. Having a few thousand bucks in an IRA isn’t going to do your kids much good if they graduate from college with a bunch of student loan debt hanging around their necks.

That being said, you could open a custodial IRA in their name if your teenager is making some money delivering pizzas or mowing lawns. Then, you would manage the account until they’re either 18 or 21 (depending on what state you’re in). With a custodial IRA, you can open a traditional or Roth IRA, but we recommend the Roth IRA. That way, their retirement savings will grow tax-free.

Now, there is a catch: Your child must bring in some kind of earned income in order for you to open an IRA in their name, and allowances don’t count! Plus, they (or you) can’t contribute more than what they make that year. So if your teenager makes $1,000 as a tutor this year, they can’t put more than $1,000 in their custodial IRA. But don’t underestimate the power of small contributions.

So if your teenager makes $1,000 as a tutor this year, they can’t put more than $1,000 in their custodial IRA. But don’t underestimate the power of small contributions.

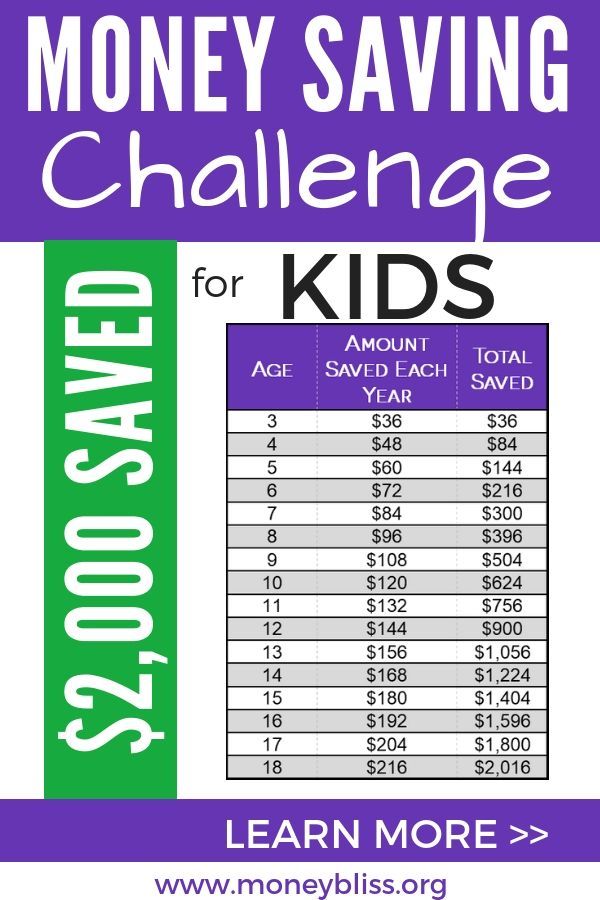

Setting just a few dollars aside each month can help your teen get a jump start on their retirement savings and experience the power of compound growth! Here’s how much that compound growth can affect your teen’s retirement if they start investing at age 16, for example:

| Age | Money Invested | Account Balance |

| 16 | $2,400 | $2,524 |

| 17 | $2,400 | $5,341 |

| 18 | $2,400 | $8,484 |

| 19 | $2,400 | $11,991 |

| 20 | $2,400 | $15,903 |

| 21–Contributions to the Custodial IRA stop. | $0 | $17,743 |

| 22 | $0 | $19,796 |

| 30 | $0 | $47,536 |

| 40 | $0 | $142,093 |

| 50 | $0 | $424,739 |

| 60 | $0 | $1.27 million–Your child could reach millionaire status. |

| Retirement (Age 65) | Total Amount Invested | Total Account Balance |

|

| $12,000 | $2. |

Wow! So if your teen invests just $2,400 from the time they’re age 16 to 20, they could end up with just over $2 million by the time they’re ready to retire. Talk about retiring with dignity! Let’s give these numbers some context:

Let’s say you’ve done really well with your money, and you’ve built up a college fund for your 16-year-old daughter. Awesome! Now you want to open up a custodial Roth IRA for her because she is making bank babysitting on the weekends to earn some cash. She wants to put some of her earnings into the Roth IRA, and you agree to “match” up to $100 each month. (Remember, she can’t put in more than she’s making, so she’s bringing in at least $200 a month.) So when your daughter invests $100 into the account, you also put in $100.

That means $2,400 will go into her custodial IRA each year for five years until she turns 21 and the account transfers to her completely. With an average annual rate of return of 11%, she’ll have almost $16,000 in the Roth IRA when she takes over the account.

And like we said above, even if your daughter doesn’t put in another dime, she could have over $2 million by the time she’s ready to retire!

And since you chose the Roth IRA, which grows tax-free, she won’t be taxed when she takes money out of the account.

Investing for Your Child’s Future Expenses and Experiences

Maybe you’re thinking about investing for things that aren’t too far into the future. After all, your children will go through a lot of important—and expensive—events and milestones in their 20s and 30s.

If you want to save or invest money to help your child cover the cost of a wedding or a down payment on their first house, you’ll want to put that money in an account that’s more accessible than a Roth IRA.

These accounts won’t have the time—or tax breaks—to grow like a Roth account, but your kids will be able to use the money penalty-free when they need it for major life events.

1. Uniform Gifts to Minors Act (UGMA) and Uniform Transfers to Minors Act (UTMA)

If you don’t plan to touch the money in the account you want to open for your child for five years or more, you can consider a Uniform Gifts to Minors Act (UGMA) or a Uniform Transfers to Minor Act (UTMA) account to invest in good growth stock mutual funds. Here are some of the key things you need to know about these accounts:

Here are some of the key things you need to know about these accounts:

- Just like with a custodial IRA, UGMA and UTMA accounts are opened in a child’s name and a custodian is named—usually a parent or grandparent. But you can choose anyone to manage the account.

- The custodian will have full control of the account until the child reaches a certain age.

- UGMA and UTMA accounts are often used to save for college—after ESAs and 529s—but the money can be used for anything.

- There are some tax advantages to using UGMA and UTMA accounts. Since they’re in your child’s name, the accounts will be taxed according to their tax bracket. The lower tax rate for children means they’ll pay less in income taxes.

- There are no contribution limits on UGMA and UTMA accounts.

You probably have some thoughts on how you want your kids to spend the money you’re investing for them. Well, keep this important thing in mind: Once your child is old enough to take custody of the account, they can do what they want with the money. This may be fine with you, but make sure you’re teaching your kids good financial habits so they’ll be prepared when they inherit the account.

This may be fine with you, but make sure you’re teaching your kids good financial habits so they’ll be prepared when they inherit the account.

2. Brokerage Account

If the idea of basically handing your kids a blank check makes you nervous, you can open a brokerage account in your own name and invest over time until you’re ready to gift the money in the account to your kids. Yes, you’ll have to pay capital gains taxes based on your own tax rates. But you’ll also have full control of the account until you decide Junior is mature enough to handle the responsibility of all that cash.

While brokerage accounts don’t have the tax benefits that come with a Roth IRA, they do offer a lot of flexibility. Since there are no contribution limits, you can invest as little or as much as you want—and you can take the money out of the account whenever you like without penalty.

3. Money Market Account

Technically this isn’t investing, but money market accounts are really great for short-term savings goals (as in five years or less). MMAs are very similar to savings accounts, but they come with a slightly higher interest rate and require a higher-than-normal minimum balance.

MMAs are very similar to savings accounts, but they come with a slightly higher interest rate and require a higher-than-normal minimum balance.

They’re safer than most traditional investing accounts, but that also means they have lower interest rates—so don’t expect great returns. And just like with a brokerage account, you’ll be in control of when and how your kids receive the money you plan to gift them.

Investing in Your Child: One Last Thing You Should Know

No matter how you plan on investing for your child’s future, it’s important to sit down with your kids when they’re old enough and share your heart behind your gift. Clear communication about the expectations for this money can save you from dealing with family drama around the dinner table during Thanksgiving!

Giving an immature high school or college grad access to thousands of dollars is like handing over the keys to a Ferrari to someone who just passed their driver’s test yesterday. You’re setting them up for a nasty crash. If you want your financial gift to be a blessing and not a curse, make sure you’re teaching your kids and teenagers the value of hard work and responsibility. They should have the character, maturity and wisdom to be a good steward of the financial gifts you’re entrusting to them.

You’re setting them up for a nasty crash. If you want your financial gift to be a blessing and not a curse, make sure you’re teaching your kids and teenagers the value of hard work and responsibility. They should have the character, maturity and wisdom to be a good steward of the financial gifts you’re entrusting to them.

Work With an Investment Pro

Ready to start investing for your kid’s future? Get the help of an experienced investment professional to walk you through all the options. Our SmartVestor program can connect you with a trustworthy pro who can help you reach your investing goals.

Find your investment pro today!

Share This Article

This article provides general guidelines about investing topics. Your situation may be unique. If you have questions, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

How to save money for a child for the future

03/22/2021

Every parent asks a question: how to save money for a child to achieve all his future goals and desires. In order to provide financial support to children, it is necessary to open a savings account for the child in advance.

How to save money for a child for the future without resorting to loans?

- find the most effective tools to achieve the goal;

- save available funds;

- protect your savings from inflation;

- multiply savings.

It is important to remember that the inflation rate has increased by more than 50% in 15 years. That is, 2000 ₽ set aside "under the pillow" in 2013 lost half of its value. This means that effective financial instruments are needed that will protect money from inflation and bring additional income.

That is, 2000 ₽ set aside "under the pillow" in 2013 lost half of its value. This means that effective financial instruments are needed that will protect money from inflation and bring additional income.

1. Bank account (bank deposit) is an instrument without special financial risks, more suitable for achieving short-term goals.

2. An individual investment account (IIA) is a very risky tool that can leave you without invested funds, but there is a chance to get an income of about 10-15%. In fact, suitable for medium-term goals (3 - 5 years).

3. Cumulative life insurance (LI) is a risk-free tool, suitable only for long-term goals (from 5-15 years) and will allow you to receive a guaranteed income and protect yourself and your child from financial health risks.

Bank deposit

- can be opened online without leaving home;

- amounts up to 1,400,000 ₽ are insured;

- additional income of about 5%;

- when choosing a reliable bank, the risk of financial losses is minimal.

You can find out how to open an account for a child on a savings card at the bank you use, since additional income under such programs is approximately the same in all banks.

Important addition : Read the terms of the contract very carefully. If the word "Investment" appears in the agreement, this means that you will need to distribute your money between the deposit and IIS.

Individual Investment Account (IIA)

An individual investment account is a way of investing, in fact, it is a brokerage account with preferential taxation and some restrictions. There is also an IIS with trust management, where all operations on the account are performed by the management company.

IIS has a number of advantages:

- easy to open and no investment limits;

- With the right tools, you can easily "beat" inflation;

- you have the opportunity to receive up to 52,000 ₽ per year through a tax deduction.

IIS also has a number of significant shortcomings:

1. If you want to withdraw your funds earlier than 3 years, you will need to return the tax deduction.

2. You need to choose instruments, taking into account your willingness to take risks (higher risk - higher income, but also higher probability of being left with nothing).

3. Carefully read the contract with the broker and take into account commissions, otherwise you may lose more than you gain.

But it is important to take into account that the probability of losing funds is 50%, and it is also necessary to deduct commissions to the broker (they are different for each).

Savings programs

Endowment life insurance policy, where the beneficiary is a child, is one of the most common tools for targeted savings today. Most often, parents use it as a guarantee for their children from various risks in the future or as savings for education.

Most often, parents use it as a guarantee for their children from various risks in the future or as savings for education.

With the help of the NSJ you can:

- accumulate and save own funds;

- save for a specific long-term goal;

- independently save up for retirement;

- take care of the future of your family and loved ones;

- to keep or hide your money (funds deposited on the accumulative life insurance account cannot be withdrawn even by a court decision).

How does it happen?

You, with the help of regular insurance premiums, form a final savings fund in the amount of the sum insured for the child, which will be paid at the end of the program.

If an accident occurs and you lose your ability to work, the insurance company will continue to make contributions for you so that by the appointed date the child receives the full amount specified in the contract.

About the benefits of the HOA:

1. According to the HOA program, income is guaranteed, and the amount is fixed in the contract initially.

2. You can recover 13% of the amount paid under the life insurance contract with the help of a tax deduction. For example, if you have opened a funded insurance program for 5 years, and your annual contribution is 120,000 ₽, then you can receive an additional 78,000 ₽ from the state if you are officially employed.

3. Anyone can be a beneficiary, including your child. Payment under such an agreement can be received quite quickly - within a month.

4. NZhS is suitable not only for saving for children, but also for the transfer of inheritance. After all, only the one who is indicated in it as a beneficiary can receive money under such an agreement.

5. Money invested under the UA program cannot be confiscated or frozen even by a court decision. It is also important that when dividing property, money under such programs is not divided between spouses, since it is not jointly acquired property.

6. You can fill the program yourself with additional risks, from which it will financially protect you.

7. Endowment insurance programs often include additional useful tools. For example, our programs are supplemented by the Telemedicine service, with the help of which you can get medical advice 24/7 anywhere in the world.

About pitfalls:

- A mandatory condition of the contract is the regular deposit of funds. If you do not make a contribution within the specified period (you choose it yourself before signing), then the deposited money will be lost.

▶ But, for example, in our company, for many programs, the client has 15 days left to make a payment - a grace period.What to do if you cannot deposit money:

Be sure to notify your insurance company. Everything is individual here, but specialists can offer a way out, for example, reduce the amount of payments or give a deferment.

- If you terminate the contract early, you will receive back only a part of the deposited funds.

Because the insurance company invests money to provide you with a guaranteed additional income. Just as it is unprofitable for a bank that you withdraw money from a deposit ahead of schedule, so early termination is unprofitable for insurance companies.

Because the insurance company invests money to provide you with a guaranteed additional income. Just as it is unprofitable for a bank that you withdraw money from a deposit ahead of schedule, so early termination is unprofitable for insurance companies. - Do not change the terms of the contract in the first three years. In essence, changes in the contract are a new contract. If you resubscribe it, the insurance company will have to recalculate rates and tariffs, and you may lose part of the funds already invested.

Additionally: in case of disability (even on the next day after signing the contract), the insurance company instead of the client will continue to pay premiums until the end of the contract. And the client will eventually receive the amount that he planned to accumulate.

The obligations of the insurance company come immediately after the signing of the contract. Therefore, in all insurance companies, an insurance reserve is formed under accumulative programs. Because of what, in case of early termination, the client does not receive the full amount of the deposited funds. Under the Valuable Asset program, funds are also not returned ahead of schedule.

Endowment life insurance itself is a story about financial planning, about caring for the future and, more importantly, about your loved ones. When choosing a savings program, Zhanna will have her own savings, additional income that will protect money from inflation, as well as a guarantee for the future, if something happens to her, the child will receive the entire amount prescribed in the life insurance contract by the appointed date. Unlike other financial instruments.

step-by-step instructions and expert advice

Minor depositor

You can open a bank deposit in the name of a child at any age. Many banks offer this service. This deposit is almost no different from the usual ones. But there are limitations.

First, a child under 14 cannot use this money. Yes, and parents, as a rule, can withdraw funds only with the written permission of the guardianship authority. This is a requirement of the Civil Code.

Secondly, after the age of 14, the child can manage the money himself (with the written permission of the parents and guardianship authorities). After the age of 18, he can use the accumulated money as he likes.

Separate account - per child

In order not to set artificial limits for themselves, many parents act differently. Open another bank deposit in the name of mom or dad. And they just know that this particular account belongs to the son or daughter and money is being accumulated on it for the child to come of age.

But this strategy has both pros and cons. On the one hand, in case of force majeure, money can be withdrawn without bureaucratic obstacles. On the other hand, there is a danger that the funds will be spent earlier and will not fulfill their purpose.

“It's usually easier to do just that,” says Vladimir Savenok, head of the Personal Capital consulting company, author of the book “A Million for My Daughter”. - Probably, it is better to draw up such an account for my mother: women are more responsible.

When it's not too late to start

Depends on the stated goals. But the sooner the better. Then you can limit yourself to a small amount. And everything else will be done by compound interest and ... tough discipline. For example, to accumulate a large amount, you need to save a little bit, but regularly.

Photo: Ivan Makeev“Many parents start with enthusiasm, and then some financial problems arise, and people forget to make the next contribution,” says Vladimir Savenok. “Discipline is the main element. That's why I love mandatory, automatic programs. For example, you can instruct the bank to take money from your current account and transfer it to a savings account every month.

There are similar programs in insurance companies. Then the money will be debited automatically and invested in various investment instruments. A parent can take out a policy for himself, and a 100% beneficiary (in case of reaching the age of 18 or the death of a parent) will be a child.

How much to save

This question is individual. And rather it depends not on financial capabilities, but on the financial goals of the family. For example, if you want to give your child an apartment by the 18th birthday, this is one amount. And if you want to raise funds for his education in a cool university - another.

It's easy to calculate. Take the current value of the target and multiply by the percentage of possible inflation in the future. Usually it is 5% per year. Then convert the received amount into monthly payments with approximately the same return on invested money. Online calculators to help you. Then you will understand how much money you need to save each month to get the desired amount.

— If your goal is 10-15 years away, then I recommend saving money in dollars or euros, advises Vladimir Savenok. — If less, then it all depends on what currency your goal is in.

Roughly speaking, if we are talking about buying a odnushka in Moscow, then you can save in rubles. And if you want your child to study abroad, you need to save only in foreign currency, even if there are a couple of years left before the entrance exams.

The most important thing is that parents should be consistent. If they said that this is the money of a child, then that is what they should be. Even if the money is urgently needed for other purposes, they can be taken, but then it must be returned to the same account. And better with interest.

Also available on the stock exchange

A period of 15-18 years is ideal for investments on the stock exchange. Any financial adviser will tell you this. During this time, the market will rise and fall several times. But it will still rise more often. If you believe the long-term statistics of the stock markets, the return on investment in the long term usually exceeds the return on bank deposits.

Therefore, a separate brokerage account can be opened for a child. Once a month, quarter or year, charge a certain amount there.

2 million

2 million