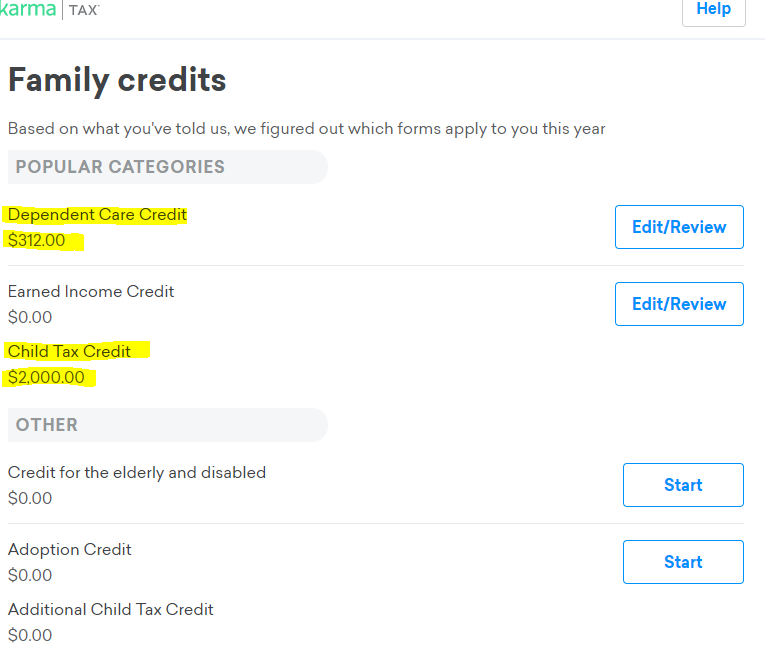

How to get child tax credit form

Child Tax Credit | U.S. Department of the Treasury

The American Rescue Plan increased the Child Tax Credit and expanded its coverage to better assist families who care for children.

Overview

The American Rescue Plan’s expansion of the Child Tax Credit will reduced child poverty by (1) supplementing the earnings of families receiving the tax credit, and (2) making the credit available to a significant number of new families. Specifically, the Child Tax Credit was revised in the following ways for 2021:

- The credit amount was increased for 2021. The American Rescue Plan increased the amount of the Child Tax Credit from $2,000 to $3,600 for qualifying children under age 6, and $3,000 for other qualifying children under age 18.

- The credit was made fully refundable. By making the Child Tax Credit fully refundable, low- income households will be entitled to receive the full credit benefit, as significantly expanded and increased by the American Rescue Plan.

- The credit’s scope has been expanded. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. Previously, only children 16 and younger qualified.

- Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December. Families caring for children were able to receive financial assistance on a consistent monthly basis from July to December 2021, instead of waiting until tax filing season to receive all of their Child Tax Credit benefits.

File your taxes to get your full Child Tax Credit — now through April 18, 2022. Get help filing your taxes and find more information about the 2021 Child Tax Credit.

In addition, the American Rescue Plan extended the full Child Tax Credit permanently to Puerto Rico and the U.S. Territories. For the first time, low- income families residing in Puerto Rico and the U.S. Territories will receive this vital financial assistance to better support their children’s development and health and educational attainment.

Recent Updates

- New and Improved ChildTaxCredit.gov

- This website exists to help people:

- Get the Child Tax Credit

- Understand how the 2021 Child Tax Credit works

- Find out if they are eligible to receive the Child Tax Credit

- Understand that the credit does not affect their federal benefits

- This website provides information about the Child Tax Credit and the monthly advance payments made from July through December of 2021. Every page includes a table of contents to help you find the information you need.

- This website exists to help people:

- Code for America’s Non-Filer Tool

- Code for America partnered with The White House and the Treasury Department to create a website and mobile-friendly tool, in English and Spanish, to assist families claiming their Child Tax Credit and missing Economic Impact Payments.

- The GetCTC tool is currently closed for the season, but you can access information about the Child Tax Credit on the website.

- Community organizations and volunteer navigators seeking to help hard-to-reach clients access the Child Tax Credit or Economic Impact Payments can access training materials and resources on the navigator website.

- IRS Non-Filer Tool

- Most families will automatically start receiving the new monthly Child Tax Credit payments on July 15th.

- Families who normally aren’t required to file an income tax return should use this Non-Filers Tool to register quickly for the expanded and newly-advanceable Child Tax Credit from the American Rescue Plan.

- Child Tax Credit Portal

- Use this tool to:

- Check if you’re enrolled to receive payments

- Unenroll to stop getting advance payments

- Provide or update your bank account information for monthly payments starting with the August payment

- Use this tool to:

- Child Tax Credit Eligibility Assistant

- Check if you may qualify for advance payments.

- Check if you may qualify for advance payments.

Spread the word

- Key Messaging about the Child Tax Credit

- Child Tax Credit Toolkit: Download all CTC Info Sheets and Social Media slides

- Info Sheet: How Has the CTC Changed This Year

- Info Sheet: How to Make Sure You Get the CTC Payment

- Info Sheet: The Expanded Child Tax Credit: Explained

- Social Media slides: How Has the CTC Changed This Year

- Social Media slides: How to Make Sure You Get the CTC Payment

- Find more information at ChildTaxCredit.gov

RESOURCES

- Child Tax Credit FAQs

- Child Tax Credit Press Release

- Economic Impact Payment Info

- Need to file a tax return? Find free options and information here

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

This tax credit helps offset the costs of raising kids and is worth up to $3,600 for each child under 6 years old and $3,000 for each child between 6 and 17 years old. You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return. You can get the tax credit even if you don’t have recent earnings and don’t normally file taxes by visiting GetCTC.org through November 15, 2022 at 11:59 pm PT. Learn more about monthly payments and new changes to the Child Tax Credit.

You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return. You can get the tax credit even if you don’t have recent earnings and don’t normally file taxes by visiting GetCTC.org through November 15, 2022 at 11:59 pm PT. Learn more about monthly payments and new changes to the Child Tax Credit.

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

- How to claim the CTC

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 ($150,000 for married couples and $112,500 for heads of households). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

CTC amounts start to phase-out when you make $75,000 ($150,000 for married couples and $112,500 for heads of households). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

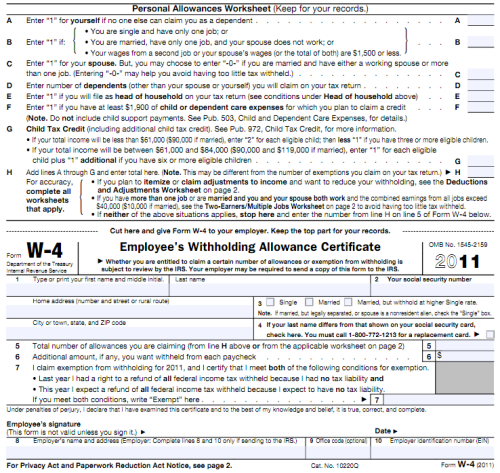

There are three main criteria to claim the CTC:

- Income: You do not need to have earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”. See below for details.

- Taxpayer Identification Number: You and your spouse need to have a social security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be 17 or under on December 31, 2021.

- Residency: The child must live with you in the U.S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

- Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an Individual Taxpayer Identification Number who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes (which you file in 2021) or submitted your info to the IRS through the 2021 Non-filer portal (this tool is now closed) or GetCTC.org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return (which you file in 2022), you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

The latest

By Christine Tran, 2021 Get It Back Campaign Intern & Reagan Van Coutren,…

Internet access is essential for work, school, healthcare, and more. The Affordable Connectivity…

If you receive unemployment compensation, your benefits are taxable. You will need to…

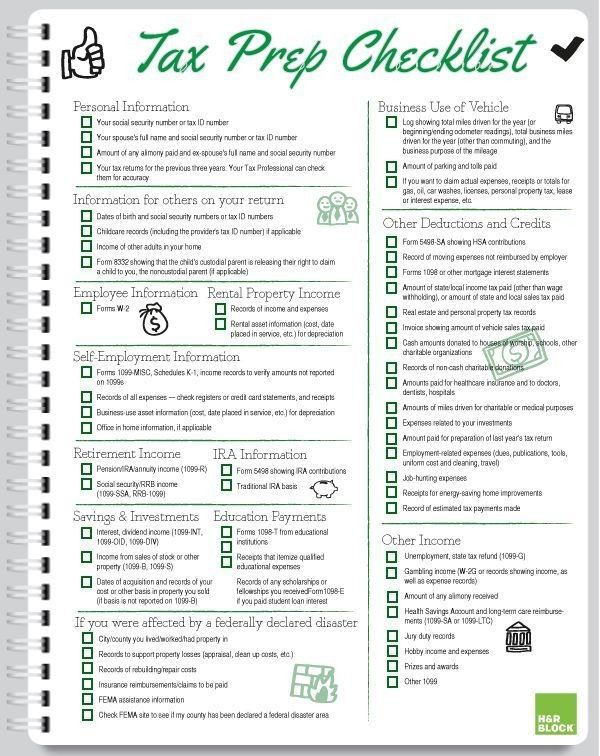

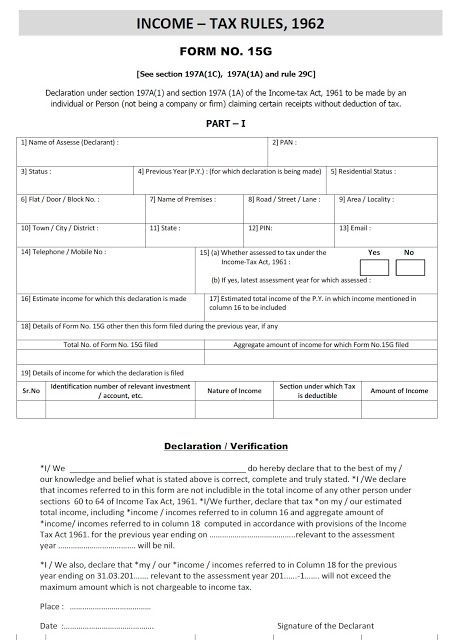

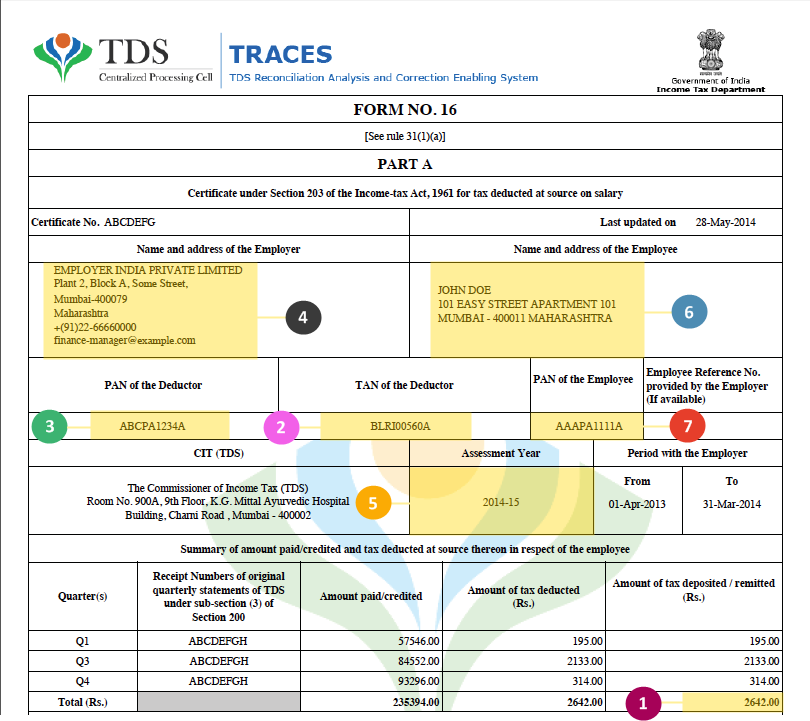

What documents are needed to apply for a mortgage in 2021

For life

Small business

Applying for a mortgage loan can be divided into several stages: preliminary approval, selection of real estate and mortgage confirmation, transaction, registration of ownership. At each stage, a package of documents is required to confirm the intentions and solvency of the borrower, as well as the cleanliness of the facility.

Become a customer

Many documents have a limited validity period. In order not to redo them several times, it is better to prepare the entire package in advance. An incomplete package of papers is a reason for refusing to apply for a mortgage.

You will need:

- Documents confirming the identity of the borrower, co-borrower and guarantor

- certificates of income, place of employment and availability of any

- assets of the applicant

- for the apartment and certifying the legitimacy of the transaction

We will consider the main stages mortgage registration and what documents are needed for each of them.

List of documents for obtaining a mortgage

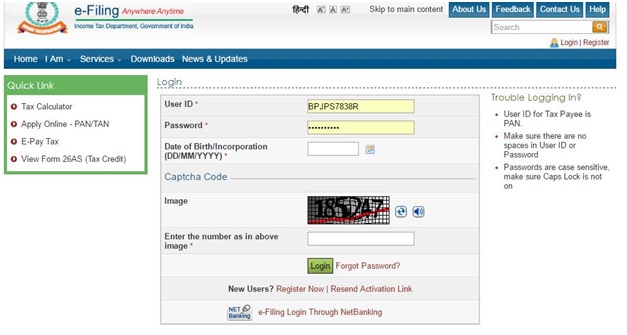

Pre-approval of a mortgage can be obtained by filling out the form on the bank's website: select the appropriate program and fill out the application. This can be done through a confirmed State Services entry or in standard mode. A typical package of documents for obtaining a preliminary mortgage decision includes:

- passport;

- SNILS;

- documents confirming income.

If you have a co-borrower or guarantor, similar documents must be provided for him.

Further, to clarify your status, income level, total financial burden, the bank may request information about children, information about property that can be pledged, certificates of additional income.

In addition, there are special requirements for the package of documents for individual entrepreneurs, military, pensioners and other categories of citizens.

Documents for registration of a mortgage by individual entrepreneurs

If a citizen is registered as an individual entrepreneur and carries out commercial activities, the following must be attached to standard documents:

- certificate of registration of an individual entrepreneur with the Federal Tax Service if an individual entrepreneur submits reports every quarter, then for the last 2 quarters

- a license to conduct the declared type of activity, if the law provides for licensing

Tax returns must be marked by the Federal Tax Service that the document has been accepted.

Mortgage apartment for military personnel

All citizens employed in military service belong to the preferential category. To purchase real estate under a preferential mortgage program, you need to draw up a report. On its basis, the accounting department will issue a certificate that is attached to the standard set of documentation.

Instead of a copy of the work book, you can provide a duplicate of the contract, confirmed by a certificate of length of service or service life.

Also, the wife of a serviceman must make a written consent to receive a mortgage.

List of documents for obtaining a mortgage for a large family

Large families attach a birth certificate for each child, passports of both parents to the standard list of documents.

According to the legislation of the Russian Federation, families with many children are those that meet the following criteria:

- both parents are citizens of the Russian Federation

- parents are officially married

- the family has two or more children who have not reached the age of majority

Please note that the number of minor children may vary depending on the region of residence.

Mortgage for people of retirement age

When issuing a mortgage for pensioners, the conditions of the bank depend on whether the citizen is employed or not. If a pensioner works, a standard package of documents is needed to obtain a mortgage. If the pensioner does not work, 2 personal income tax and a copy of the labor are not required.

But additional are needed:

- Pension certificate

- Certificate from the Pension Fund on the amount of pension deductions

- Confirmation of real estate ownership if it is

- certificate confirming additional income, if it is

Documents for registration Mortgage apartments for young families

Families where the age of one of the spouses is between 21 and 35 years old can apply for a mortgage apartment under this program. This category also includes citizens with the status of a single mother or father. The family must confirm that they need housing - they must not have registered ownership of residential property. Another mandatory condition is that the family has one or two young children - their birth certificates are attached to the application.

The specified information is supplemented by a document confirming the availability of money for the down payment. This can be a bank statement from a personal account or a certificate for receiving maternity capital.

What you need to complete the transaction

After making a positive decision on the mortgage, you need to collect documents for the apartment. Their list depends on the type of housing.

Their list depends on the type of housing.

To purchase an apartment in a new building, you need:

- an equity participation agreement in the name of the borrower;

- document substantiating the emergence of ownership of the purchased apartment;

- developer's documents - permission to build a house, a project declaration, an extract from the Unified State Register of Real Estate for a plot of land and a certificate of ownership of this plot;

- written consent of the second of the spouses to purchase housing in a new building.

When buying an apartment on the secondary market, you will need:

- contract of sale;

- certificate from BTI;

- appraisal of the market value of an apartment by an independent expert;

- identity document of the seller and a certificate of his ownership of real estate;

- cadastral, technical passport for an apartment;

- act on the absence of housing encumbrance.

If the seller's family has children under the age of 18, he must provide permission from the guardianship authorities to sell housing.

The bank also issues a mortgage for the construction of a house. In this case, the borrower provides:

- certificate of ownership of the land plot;

- a document that confirms the emergence of such a right - a contract of sale, donation, inheritance;

- cadastral plan of the site;

- extract from the USRN;

- permission to build a residential building;

- contract with a contractor for the construction of a building.

It is necessary to provide a full package of documents within 120 days.

What you need to register ownership

The final stage of buying an apartment with a mortgage is registration of ownership. To carry out the procedure, you need:

To carry out the procedure, you need:

- an application from each participant in the transaction;

- passport of each of the applicants;

- bank mortgage lending agreement;

- contract of sale for an apartment;

- State duty checks.

Throughout the entire repayment period of the mortgage loan, the purchased apartment will be encumbered - pledged to the bank. After repayment of the debt, the borrower draws up the removal of the encumbrance. To do this, he must submit an application to the MFC, as well as:

- a mortgage from a bank confirming the full payment of the debt;

- mortgage lending agreement;

- passports of all owners of an apartment purchased with borrowed funds.

It is necessary to provide a full package of documents within 120 days.

Conclusion

Applying for a mortgage is a lengthy process that requires careful preparation. The final decision of the bank depends on the correctness of filling out the documents and the completeness of the list.

Raiffeisen Bank offers various loan terms for preferential categories of citizens. You can buy housing in the primary or secondary market. It is also possible to receive capital for the construction of a private residential building from scratch.

Is this page helpful? 100% of customers find the page useful blog

© 2003 – 2022 AO Raiffeisenbank

Bank of Russia General License No. 3292 dated February 17, 2015

Information on interest rates under bank deposit agreements with individuals

RBI Group Code of Corporate Conduct

Disclosure Center Disclosure of information in accordance with the Instruction of the Bank of Russia dated December 28, 2015 No. 3921-U

By continuing to use the site, I agree to the processing of my personal data

Follow us on social networks and blog

+7 495 777-17-17

For calls within Moscow

8 800 700-91-00

For calls from other regions of Russia

– © 20222 Raiffeisenbank.

General license of the Bank of Russia No. 3292 dated February 17, 2015.

Information on interest rates under bank deposit agreements with individuals.

RBI Group Code of Corporate Conduct.

Corporate Information Disclosure Center.

Disclosure of information in accordance with Bank of Russia Directive No. 3921-U dated December 28, 2015.

By continuing to use the site, I agree to the processing of my personal data.

Additional Child Tax Credit - Financial Encyclopedia

What is the Additional Child Tax Credit?

The Supplemental Child Tax Credit was a refundable portion of the Child Tax Credit. It may be claimed by families who owe the IRS less than their respective Child Tax Credit amount. taxpayer credit.1 This provision was removed from 2018 to 2025 by the 2017 tax bill. 2 However, the new form of child tax credit includes some provisions for reimbursable credits.3

2 However, the new form of child tax credit includes some provisions for reimbursable credits.3

Highlights

- The Child Tax Supplement is the refundable portion of the Child Tax Credit.

- An additional child tax credit may be claimed by families that owe the IRS less than their qualifying child tax credit amount.

- This provision was removed from 2018 to 2025 by the 2017 tax bill, but the new form of the Child Tax Credit includes refundable credit provisions.

What is the Additional Child Tax Credit

The tax credit is a benefit given to taxpayers to help reduce their tax liability. If Susan's tax bill is $5550 but she is eligible for the $2500 tax credit, she will need to pay the government only $5,550 – $2,500 = $3,050. Some tax credits are refundable, which means that if the amount of the tax credit exceeds the amount owed in tax, the individual will receive a refund. If Susie’s tax credit is $6,050 and is refundable, she a check will be issued for $6,050 - $5,550 = $500. Depending on which tax group a taxpayer belongs to, they may be eligible to claim a tax credit for that group. For example, taxpayers with children may be eligible for a child tax credit which helps to compensate l the cost of raising children.4

Depending on which tax group a taxpayer belongs to, they may be eligible to claim a tax credit for that group. For example, taxpayers with children may be eligible for a child tax credit which helps to compensate l the cost of raising children.4

The 2018 Child Tax Credit allows tax filers to reduce their tax liability to $2,000 per child. To be eligible for the child tax credit, the child or dependent must:

- be 16 or younger by the end of tax year

- be a US citizen, citizen or permanent resident alien

- lived with a taxpayer for more than half of tax year

- be claimed as a dependent on a 9 federal tax return0016

- failed to provide more than half of its financial support

- have a social security number (new regulation)5

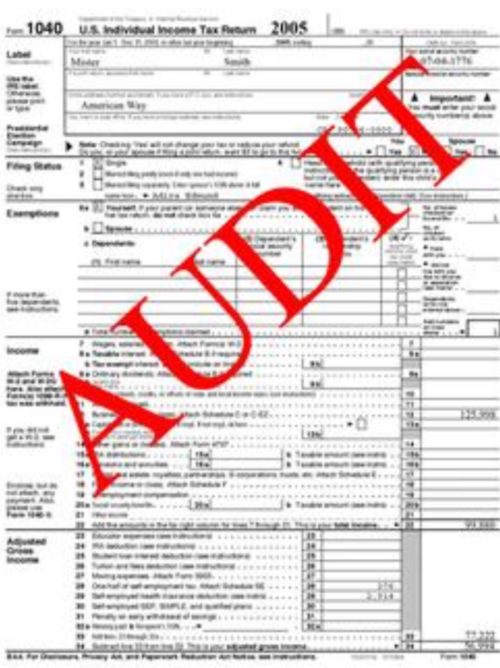

The child tax credit was previously non-refundable, which meant that it could reduce a taxpayer's bill to zero and any overdraft would not be refunded.36 A person who owed the government $800 but claimed a $2,000 tax credit for their two children, will eventually have to pay nothing, but the surplus of $1,200 will be lost.

Families who wanted to keep the unused portion of the Child Tax Credit were able to take advantage of another available tax credit called the Supplemental Child Tax Credit. The Supplemental Child Tax Credit was a refundable tax credit that families could claim if they were already eligible. on a non-refundable child tax credit. The Supplemental Child Tax Credit was ideal for families who owed less than the child tax credit and wanted to be reimbursed for the excess credit.7

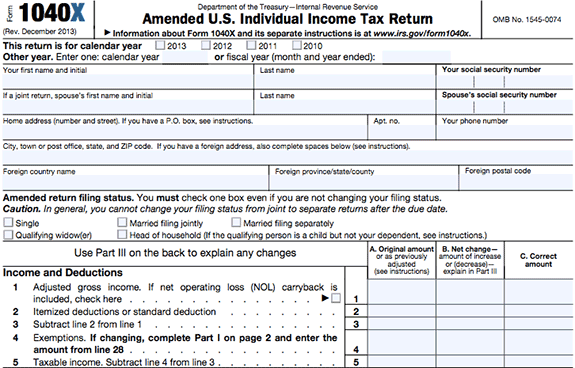

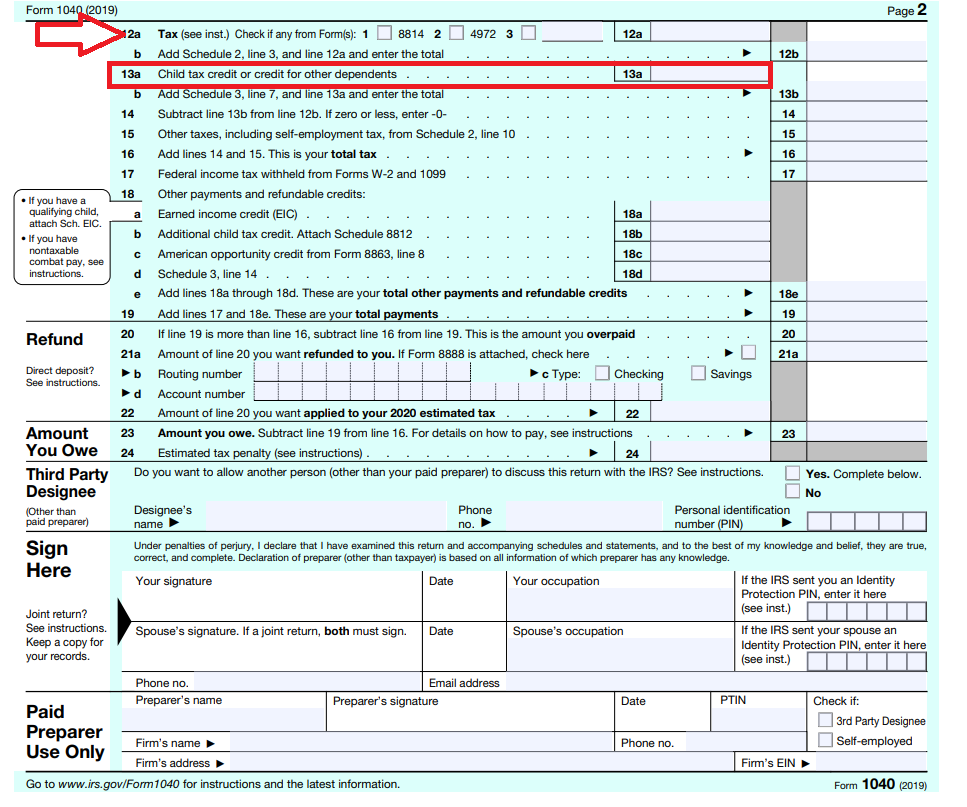

Form 1040 Schedule 8812 was used to find out if a person qualifies for an additional tax credit and to what level they are. Additional tax credit per child. The tax credit was based on how much the taxpayer earned and was calculated by taking 15% of the taxpayer's taxable income in excess of $3,000 up to the maximum credit amount, which was then $1,000 per child. The total amount exceeding $3,000 ( adjusted for inflation annually) was recoverable.8

For example, a taxpayer with two dependents is eligible for a child tax credit.