How much is child tax credit for a single parent

The Child Tax Credit - The White House

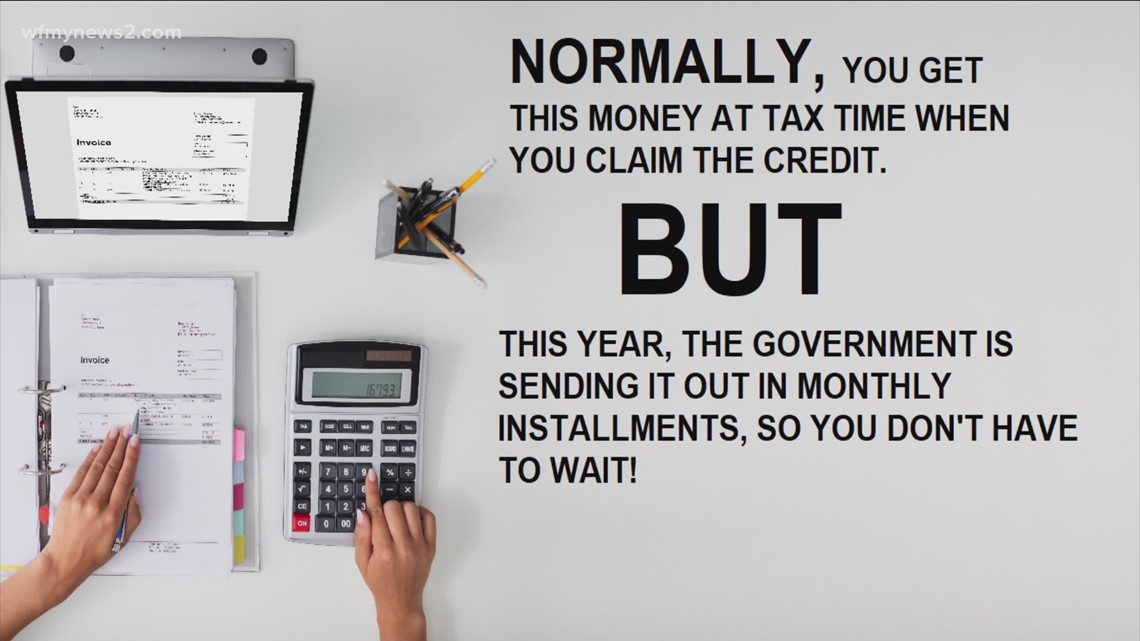

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

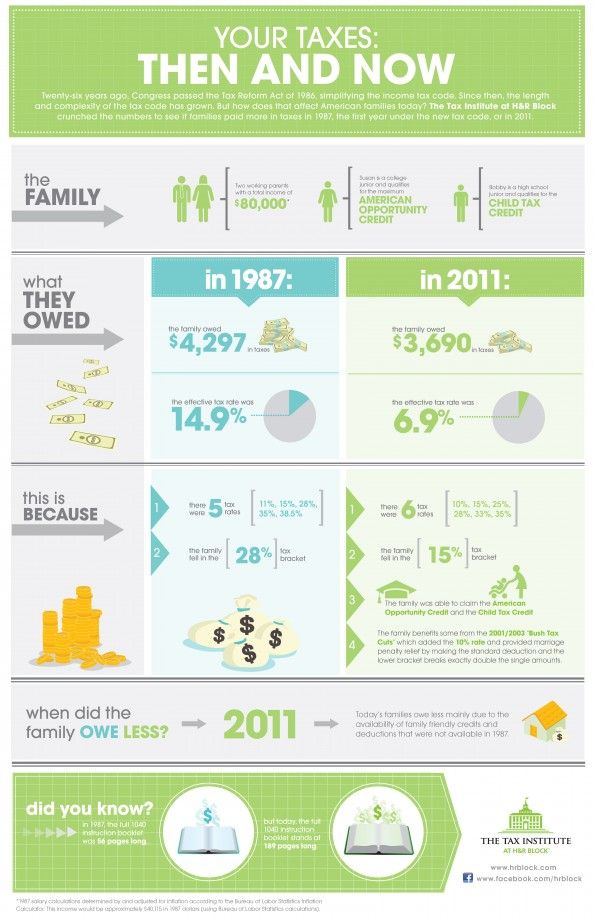

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

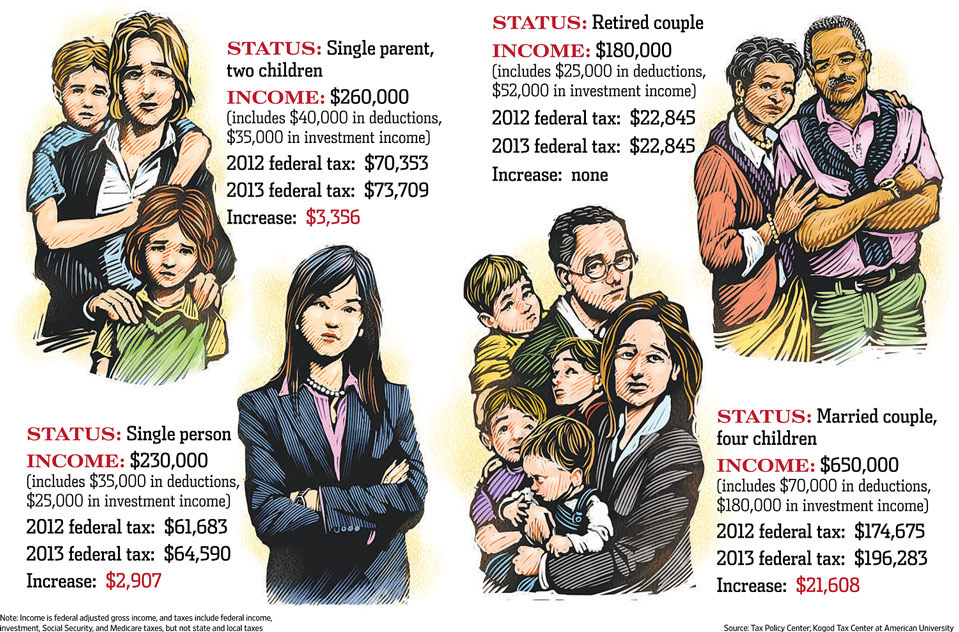

Tax Breaks Every Single Mother Should Know

For millions of American families — especially those headed by single women, tax season is full of stress and number crunching. However, at tax time, being a parent comes with certain perks.

For millions of American families — especially those headed by single women, tax season is full of stress and number crunching.

There are, however, some useful tax credits that can significantly lower the amount of taxes to pay. And, in some cases, give cash refunds to families in jobs that pay too little to live on.

Claiming a tax credit is like putting money back in your pocket, and for single mother, this can make a real difference to the bottom line.

In fact, at tax time, being a parent comes with certain perks.

For example, eligible single mom of two could claim up to $6,728 in EITC, up to $7,200 in Child Tax Credit, plus as much as $8,000 spent on care expenses.

Personal & Dependent Exemption #

Personal exemption has been suspended.

The Tax Cuts and Jobs Act of 2018 has suspended all personal and dependent exemptions for tax years 2018—2025. For the 2018 tax year and beyond, you can no longer claim a personal exemption for yourself, your spouse, or your dependents.

Filing Taxes as a “Head of the Household” #

As a single mother and the sole breadwinner in the family, the first thing you must do is to select “Head of the Household” as your filing status. 1

Filing as “Head of Household” has two benefits. First, you’ll pay less taxes overall; and second, you’ll also be able to claim a larger tax exemption.

| Filing Status | 2021 |

| Single or Married Filing Separately | $12,550 |

| Head of Household | $18,800 |

| Married Filing Jointly or Qualifying Widow(er) | $25,100 |

What is the head of household deduction for 2021?

For tax year 2021, taxpayers who use the head of household filing status may receive an $18,800 annual standard deduction. In comparison, a single filer is only entitled to a $12,550 standard deduction.

In comparison, a single filer is only entitled to a $12,550 standard deduction.

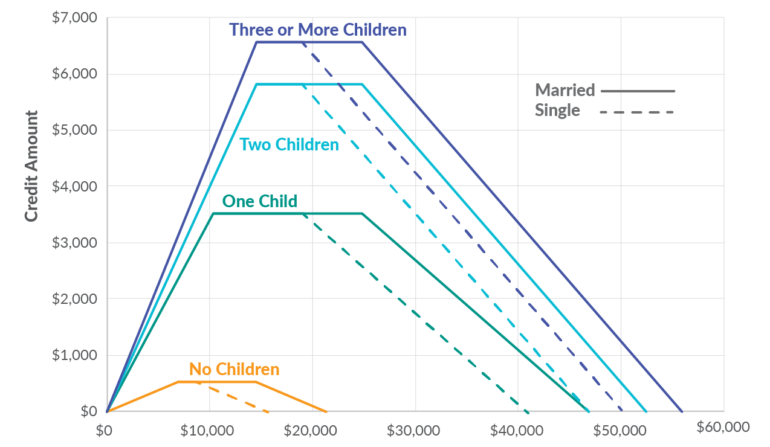

Earned Income Tax Credit #

EITC, the Earned Income Tax Credit is a tax benefit designed primarily to help low- to moderate-income individuals and families whose earned income falls below a certain limit.

It isn’t a welfare handout per se. Only people who work and pay taxes can claim it; creating an incentive for them, including many who are poor, to leave welfare for work. 2

The EITC is “refundable,” which means that when EITC exceeds the amount of taxes owed, it results in a tax refund, whose amount varies by income, family size and filing status. 3

Use the EITC Assistant to find out if you qualify.

EITC FAQ #

What is the maximum income to qualify for earned income credit 2021? #

| CHILD | MAXIMUM CREDIT | SINGLE | MARRIED |

|---|---|---|---|

| None | $543 | $15,980 | $21,920 |

| 1 | $3,618 | $42,158 | $48,108 |

| 2 | $5,980 | $47,915 | $53,865 |

| 3 or more | $6,728 | $51,464 | $57,414 |

How much is the EIC for 2021? #

__

Single parents with two children under age 19 who made less than $47,915 are eligible for a refundable credit of up to $5,980. In contrast, couples with no dependent children earning less than $21,920 can receive no more than $543.

In contrast, couples with no dependent children earning less than $21,920 can receive no more than $543.

How long does it take to get my tax refund? #

__

In general, the IRS will process your refunds and issue payments within 21 days. For paper filers, this can take much longer. However, the PATH Act, passed in 2015, stipulates that the IRS must withhold refunds until February 15.

So if you file before February 15, you’re owed a tax refund and you’re claiming either the ACTC or EITC, your entire refund will be withheld until at least the February 15 deadline.

The IRS has eliminated the guesswork of waiting for your tax refund by creating IRS2Go, an app that allows you to track the status of your return. You can also check the status of your refund with the Where’s My Refund? online portal.

Which states have EITC? #

__

Twenty six 26 states and the District of Columbia, as well as New York City, offer their own version of Earned Income Tax Credits to complement the federal credits — applying a percentage match to the federal allocation.

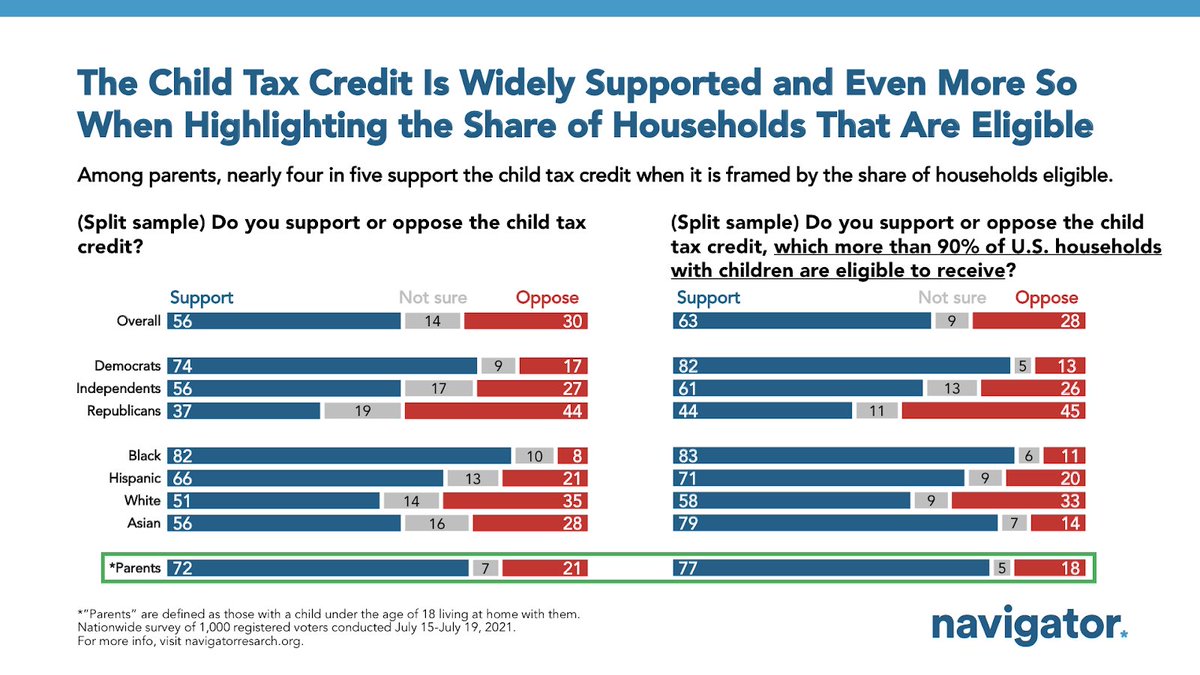

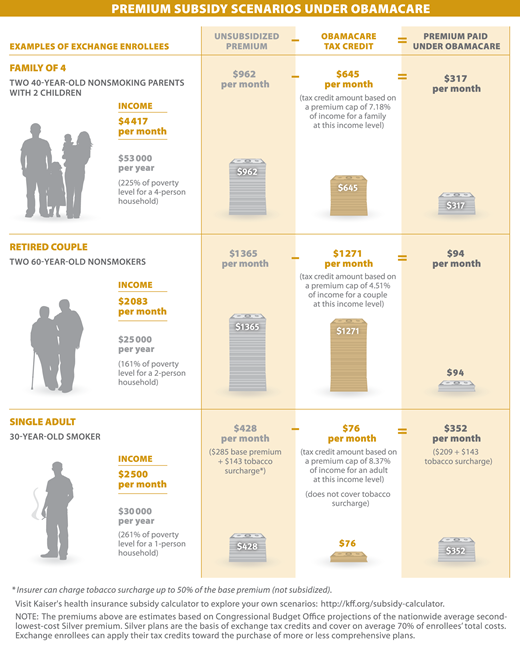

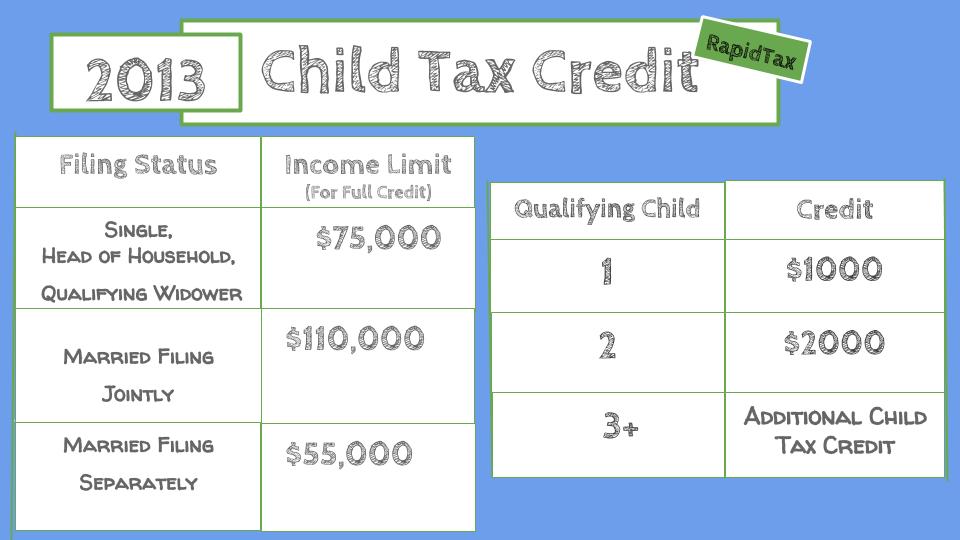

Child Tax Credit #

If your child or children under the age of 17, claimed as dependents and are US citizens with Social Security number, there is a good chance you qualify for the Child Tax Credit.

The Tax Cuts and Jobs Act of 2018 doubled the CTC for children under 17 from $1,000 to $2,000 per eligible child with up to $1,400 of it being refundable. 4

Families whose credit exceeds their tax liability can receive the remainder of the credit in the form of a refund not exceeding 15% of their earnings above $2,500; this refund can be worth up to $1,400 per child. 5

For example, a single mother with two children who earns $14,000 could receive 15% of $11,500, or $1,725, as a refund but no more than $2,800.

How much does each kid get for stimulus 2021? #

__

The American Rescue Plan temporarily expands the CTC for 2021 to $3,600 per child under 6 and $3,000 per child ages 6 to 17, makes it fully-refundable and removes the $2,500 earnings floor. 6

6

If your AGI is $75,000 or less as a single filer, $112,500 as a head of household or $150,000 filing jointly, you'll get the full amount.

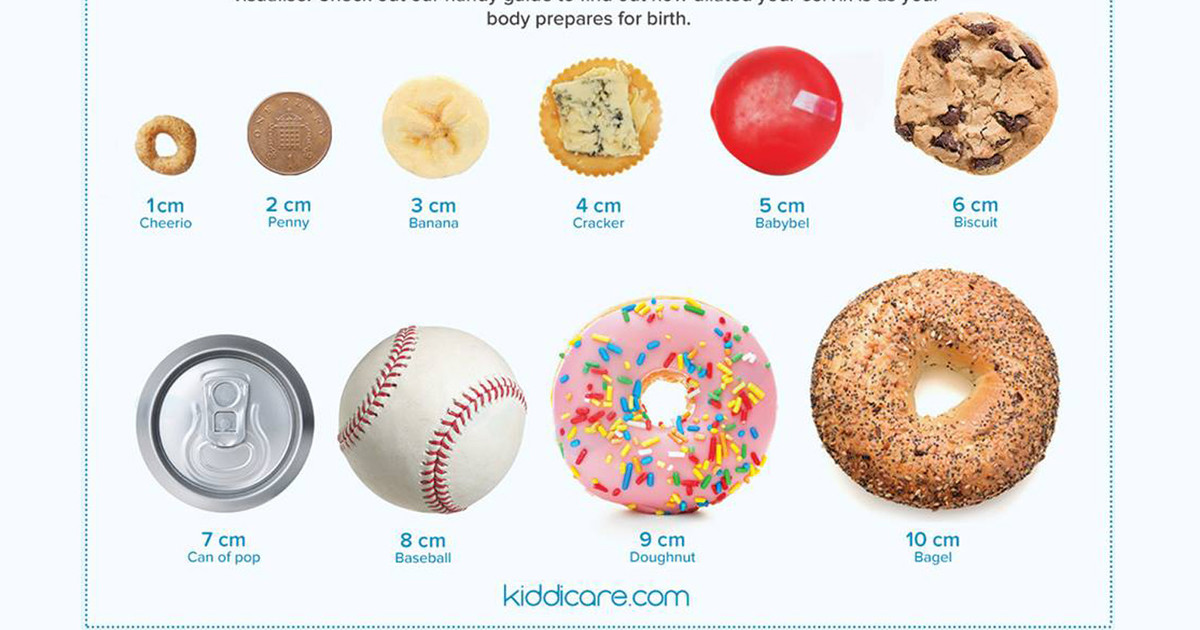

For parents of eligible children up to age 5, the IRS will pay $3,600, half as six monthly payments of $300 and half as a 2021 tax credit. For each child ages 6 through 17, the IRS will pay $3,000.

If you'd rather get your 2021 child tax credit money as one large payment, you'll be able to opt out of monthly payments once the IRS opens its online portal by July 1.

Child and Dependent Care Credit #

Paid a local daycare center to take care of your kid? Did you pay someone to care for your child so that you could work or look for work? If you did, you might be eligible for the Child and Dependent Care Credit.

This credit “gives back” a portion of the money you spend on care up to $8,000 of expenses paid in a year for one qualifying child under 13 or $16,000 max per family. Eligible expenses include the cost of a nanny, preschool, before- or after-school care and summer day camp.

This works best when you file as a “Head of Household”, and can cut your taxes by up to 50% of what you’ve paid for the service. The exact percentage is determined by your income level.

To claim child and dependent care credit, complete and attach Form 2441 to your return. You must file taxes using either Form 1040 or Form 1040A to claim the credit.

Education Tax Benefits #

There are two (2) tax credits available to help you offset the costs of higher education by reducing the amount of your income tax. They are the American Opportunity Credit and the Lifetime Learning Credit.

If you are eligible for both the American Opportunity Credit and the Lifetime Learning Credit, you can choose to claim either credit, but not both.

American Opportunity Tax Credit #

__

The American Opportunity Credit is a tax credit of up to $2,500 of the cost of tuition, fees and course materials, which can be claimed for expenses for the first four (4) years of post-secondary education. 7

7

Benefit Amount

$2,500 tax credit per student 8

40% of credit may be refundable; the rest is nonrefundable

Limit: First 4 years of post-secondary education

Income Phaseout

$90,000 (single) $180,000 (joint)

Lifetime Learning Tax Credit #

__

Unlike the American Opportunity Credit 10, the Lifetime Learning Credit is “non-refundable” so the maximum credit is limited to the amount of tax you owe. There is, however, no limit on the number of years for which you can claim a Lifetime Learning Credit.

Benefit Amount

$2,000 tax credit per student 9

Nonrefundable — credit limited to the amount of tax you must pay on your taxable income

Unlimited number of years

Income Phaseout

$69,000 (single) $138,000 (joint)

Student Loan Interest Deduction #

__

You’re allowed a tax deduction of up to $2,500 per year for the interest paid on qualified student loans, including private student loans that you took out for yourself, your dependent or your spouse. 7

7

--

Can you still claim student loan interest on taxes in 2021?

Yes. The most student loan interest you can claim as a tax deduction is limited to $2,500 as of the 2021 tax year.

--

What is the income limit for student loan interest deduction 2021?

The limit of the amount of income you can make and still qualify for the student loan interest deduction, based on your filing status, for the 2021 tax year is $85,000 if single or $170,000 if married filing jointly.

--

Can a co-signer deduct student loan interest?

Yes, a parent who co-signed student loans may claim the student loan interest deduction too as long as the student is a dependent of the co-signer.

--

What is IRS Form 1098-E?

IRS Form 1098-E is the Student Loan Interest Statement that your federal loan servicer will use to report student loan interest payments to both the Internal Revenue Service (IRS) and to you.

Get Help with Your Taxes #

- Interactive Tax Assistant

If you have tax questions, you should check out the Interactive Tax Assistant on IRS.gov. This tool provides answers to a number of tax questions. It can help determine if a type of income is taxable, if you’re eligible to claim certain credits, and if you can deduct expenses on your tax return.

__

- Volunteer Income Tax Assistance (VITA)

The IRS offers free tax preparation through a program called Volunteer Income Tax Assistance (VITA). These sites are usually open from the end of January through April 15.

In addition to VITA, the Tax Counseling for the Elderly (TCE) program also offers free tax help for all taxpayers, particularly those who are 60 and older, specializing in questions about pensions and retirement-related issues unique to seniors.

To locate the nearest VITA or TCE site near you, call

800-906-9887

__

- Low-Income Taxpayer Clinic

Funded by the IRS, Low Income Taxpayer Clinics (LITCs) represent low income individuals in disputes with the IRS — for free or for a small fee, including audits, appeals, collection matters, and federal tax litigation.

No application is needed to utilize this service. Each LITC will determine if you meet the income guidelines and other criteria before it will agree to represent you.

If you believe you’re eligible — and in need of help with tax matters, find the clinic nearest you 10 and call the numbers listed on the list for an appointment.

- IRS, Publication 501, Exemptions, Standard Deduction, and Filing Information.

- Center on Budget and Policy Priorities, Policy Basics: The Earned Income Tax Credit.

- IRS, Earned Income Tax Credit (EITC) Tables

- The Tax Cuts and Jobs Act of 2018 doubled the CTC for children under 17 from $1,000 per child to $2,000 per child, up to $1,400 of which families can receive as a refundable credit.

- CBPP, Policy Basics: The Child Tax Credit.

- Kiplinger. Child Tax Credit 2021: Who Gets $3,600? Will I Get Monthly Payments? And Other FAQs

- IRS, Chapter 2, Publication 970, Earned.

- IRS, Publication 970, Tax Benefits for Education, Table 2-1

- IRS, Publication 970, Tax Benefits for Education, Table 3-1

- Low Income Taxpayer Clinic List

Official website of the Pyshchugsky municipal district

| 15 September 2021 |

- Author: Administration

- Category: Press service

- Views: 484

sun

- All-Russian population census

| 14 September 2021 |

- Author: Administration

- Category: Press service

- Views: 559

Rosstat summed up the results of the census in the TDR for August 2021. During this period, about tons of the coast of the Kara Sea I to the Yakut taiga, while the weather allowed, census takers visited remote and hard-to-reach areas of seven regions of the country. website of the All-Russian Population Census tells how the routes ran and how the expedition ended.

During this period, about tons of the coast of the Kara Sea I to the Yakut taiga, while the weather allowed, census takers visited remote and hard-to-reach areas of seven regions of the country. website of the All-Russian Population Census tells how the routes ran and how the expedition ended.

Until the main stage, which will take place from October 15 to November 14, the All-Russian population census is being conducted in remote areas of a number of regions of the country. One of the most difficult is the Irkutsk region. Here, 150 places of residence of the population, including weather stations and reindeer herders' camps, are classified as hard-to-reach. They are located in 19 districts of the Angara region. Most of the hard-to-reach settlements and villages are in Kirensky

- All-Russian population census

Read more. ..

..

| 10 September 2021 |

- Author: Administration

- Category: Press service

- Views: 1969

- Election Committee

| 8 September 2021 |

- Author: Administration

- Category: Press service

- Views: 506

On September 10, 2021, from 10.00 am to 12.00 pm, the district prosecutor's office is holding a reception of citizens on the observance of citizens' rights in the field of election legislation in the form of a "hot telephone line".

You can contact the district prosecutor's office hotline by phone: 27-5-79, 26-1-32. The questions received will be answered by acting. Sergei Sergeevich Golyatin, District Attorney, and Lomaeli Zaindovich, Deputy District Attorney, Bertaev.

- Prosecutor's office

| 6 September 2021 |

- Author: Administration

- Category: Press service

- Views: 496

What do we know about Baikal ? The deepest lake in the world0069 UNESCO World Natural Heritage Site . And there is also a special holiday - Baikal Day.

K how the glorious sea unites people of different cultures and nationalities R says website VPN .

If you can describe Baikal in one word, then this word is “unique”: its huge size is unique (the lake surpasses some European countries in area), the record depth – 1642 meters – is unique, the transparent water is unique, which can be seen deep into the tens of meters, as well as a fauna rich in species, many of which are found nowhere else

- All-Russian population census

Read more. ..

..

| 1 September 2021 |

- Author: Administration

- Category: Press service

- Views: 508

On the first days of the school year, all schools in the city of Kostroma held class hours dedicated to the upcoming All-Russian Population Census 2020, where the children learned about the approach of an important and rare event in the life of our country, which takes place only once every ten years.

The key element of this lesson was the educational film “Russia in Numbers for Schoolchildren”, developed by Rosstat and filmed in the style of video blogging popular among children. The video material in an accessible form tells about the population of Russia, the ratio of men and women, about urban and rural residents.

Teachers told the children that they, like their parents, are participants in the census and that

- All-Russian population census

Read more...

| 1 September 2021 |

- Author: Administration

- Category: Press service

- Views: 475

September 1st! Here comes autumn again!

This autumn is special for all of us living in Russia.

One of the most important projects for the country, the twelfth population census, is being prepared for launch.

Without exaggeration, all residents of our country will be able to take part in this historical event, leaving their mark on it.

All you have to do is answer the census questionnaire.

It is important that these data will not only remain in history, they will also become the basis for making strategic decisions.

Based on the results of the census, the state and citizens will receive a detailed socio-demographic portrait of society.

The population census is carried out once every ten years.

- All-Russian population census

Read more...

| 1 September 2021 |

- Author: Administration

- Category: Press service

- Views: 476

09/01/2021

According to the 2010 census, 110.6 million people or 91% of the population over 15 years old received basic general education and higher in our country.

2002 to 2010 adults with education increased by 1.2 million.

About 23% of the population of the country had university diplomas.

One higher is not the limit. Postgraduate education had 707 thousand people, almost twice as many as in 2002.

There were 596,000 candidates of sciences in 2010, 124,000 doctors of sciences. There are 44% more specialists with incomplete higher education, and almost 2/3 of them continue to study.

Modern applicants are increasingly giving

- All-Russian population census

Read more...

| 30 August 2021 |

- Author: Administration

- Category: Press service

- Views: 545

U Pravilich II GU - Kostromsk NIM Regional Branch 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000

069

- calculation and payment of insurance premiums to the budget of the Social Insurance Fund of the Russian Federation;

- compulsory social insurance in case of temporary disability and in connection with motherhood (pregnancy and childbirth allowance, one-time allowance for the birth of a child, one-time allowance for women registered with medical institutions in the early stages of pregnancy (up to 12 weeks), monthly

Read more. ..

..

Official website of the Pyshchugsky municipal district

| 15 September 2021 |

- Author: Administration

- Category: Press service

- Views: 484

sun

- All-Russian population census

| 14 September 2021 |

- Author: Administration

- Category: Press service

- Views: 559

Rosstat summed up the results of the census in the TDR for August 2021. During this period about from the coast of the Kara Sea to the Yakut taiga, while the weather allowed, the census takers visited remote and hard-to-reach areas of seven regions of the country. website of the All-Russian Population Census tells how the routes ran and how the expedition ended.

Before the main stage, which will take place from October 15 to November 14, the All-Russian population census is being conducted in remote areas of a number of regions of the country. One of the most difficult is the Irkutsk region. Here, 150 places of residence of the population, including weather stations and reindeer herders' camps, are classified as hard-to-reach. They are located at 19regions of the Angara region. Most of the hard-to-reach settlements and villages are in Kirensky

One of the most difficult is the Irkutsk region. Here, 150 places of residence of the population, including weather stations and reindeer herders' camps, are classified as hard-to-reach. They are located at 19regions of the Angara region. Most of the hard-to-reach settlements and villages are in Kirensky

- All-Russian population census

Read more...

| 10 September 2021 |

- Author: Administration

- Category: Press service

- Views: 1969

- Election Committee

| 8 September 2021 |

- Author: Administration

- Category: Press service

- Views: 506

On September 10, 2021, from 10.00 am to 12.00 pm, the district prosecutor's office is holding a reception of citizens on the observance of citizens' rights in the field of election legislation in the form of a "hot telephone line".

You can contact the hotline of the district prosecutor's office by phone: 27-5-79, 26-1-32. The questions received will be answered by acting. Sergei Sergeevich Golyatin, District Attorney, and Lomaeli Zaindovich, Deputy District Attorney, Bertaev.

- Prosecutor's office

| 6 September 2021 |

- Author: Administration

- Category: Press service

- Views: 496

What do we know about Baikal ? The deepest lake in the world , it contains the fifth part of the world's fresh water reserves, 300 rivers flow into it, and only one flows out, a UNESCO World Natural Heritage Site 9068. And there is also a special holiday - Baikal Day.

K how the glorious sea unites people of different cultures and nationalities0069 Russian population census ? R says website VPN .

If you can describe Baikal in one word, then this word is “unique”: its huge size is unique (the lake surpasses some European countries in area), the record depth – 1642 meters – is unique, the transparent water is unique, which can be seen deep into the tens of meters, as well as a fauna rich in species, many of which are found nowhere else

- All-Russian population census

Read more...

| 1 September 2021 |

- Author: Administration

- Category: Press service

- Views: 508

On the first days of the school year, all schools in the city of Kostroma held class hours dedicated to the upcoming All-Russian Population Census 2020, where the children learned about the approach of an important and rare event in the life of our country, which takes place only once every ten years.

The key element of this lesson was the educational film “Russia in Numbers for Schoolchildren”, developed by Rosstat and filmed in the style of video blogging popular among children. The video material in an accessible form tells about the population of Russia, the ratio of men and women, about urban and rural residents.

Teachers told the children that they, like their parents, are participants in the census and that

- All-Russian population census

Read more...

| 1 September 2021 |

- Author: Administration

- Category: Press service

- Views: 475

September 1st! Here comes autumn again!

This autumn is special for all of us living in Russia.

One of the most important projects for the country, the twelfth population census, is being prepared for launch.

Without exaggeration, all residents of our country will be able to take part in this historical event, leaving their mark on it.

All you have to do is answer the census questionnaire.

It is important that these data will not only remain in history, they will also become the basis for making strategic decisions.

Based on the results of the census, the state and citizens will receive a detailed socio-demographic portrait of society.

The population census is carried out once every ten years.

- All-Russian population census

Read more...

| 1 September 2021 |

- Author: Administration

- Category: Press service

- Views: 476

09/01/2021

According to the 2010 census, 110.6 million people or 91% of the population over 15 years old received basic general education and higher in our country.

2002 to 2010 adults with education increased by 1.2 million.

About 23% of the population of the country had university diplomas.

One higher is not the limit. Postgraduate education had 707 thousand people, almost twice as many as in 2002.

There were 596,000 candidates of sciences in 2010, 124,000 doctors of sciences. There are 44% more specialists with incomplete higher education, and almost 2/3 of them continue to study.