How much can a child earn without paying taxes

Understand the Kiddie tax | Fidelity

Key takeaways

- If you have a child with earned income or unearned income above certain thresholds, you may need to help them file a tax return.

- The kiddie tax applies to unearned income, and amounts over $2,500 are taxed at the parents' marginal tax rate.

- If this process seems complicated, you might consider consulting with a tax advisor or financial professional.

If you've got kids who aren't old enough to vote yet, that doesn't mean they are exempt from paying taxes. In fact, no matter how much they make from jobs or earnings from investments, the IRS wants to know about it. Depending on the amounts involved, they may even end up owing the IRS an amount based partially on what the parents earn.

Welcome to the complicated world of the kiddie tax.

The kiddie tax technically pertains to only the unearned portion of your child's income—from investments and savings. But if your child has any sort of earned income from a job, receiving either an official W-2 wage statement from an employer, a 1099 for freelance work, or just cash, you might have questions about their tax liability as well. Here are some answers to the most common concerns parents have.

Does my child need to file their own tax return?

The answer is generally yes if your child had unearned income of more than $1,250 or earned income over $13,850 (for the 2023 tax year). Those may sound like big numbers for mowing lawns or racking up interest at today's rate on a few hundred dollars in a savings account, but your child could have a more lucrative job or made a bundle investing in meme stocks. "The 2 most common scenarios we see are a child who had an internship during college and is still a dependent, or a child who has an invested custodial account with a substantial balance that will throw off income," says Chris Williams, a principal at the accounting firm EY.

Those may sound like big numbers for mowing lawns or racking up interest at today's rate on a few hundred dollars in a savings account, but your child could have a more lucrative job or made a bundle investing in meme stocks. "The 2 most common scenarios we see are a child who had an internship during college and is still a dependent, or a child who has an invested custodial account with a substantial balance that will throw off income," says Chris Williams, a principal at the accounting firm EY.

What tax rate will my child pay?

The IRS sets specific limits on the type of income and the tax rates. Earned income will be taxed at the child's rate above their applicable standard deduction, which is equal to their earned income plus $400 (or $1,250, whichever is greater), up to a maximum of $13,850 in 2023. But investment income is a more complicated formula. Unearned income from interest, dividends, and capital gains are taxed in tiers defined by the IRS.

Unearned income from interest, dividends, and capital gains are taxed in tiers defined by the IRS.

- For a child with no earned income, the amount of unearned income up to $1,250 is not taxed in 2023.

- The next $1,250 is taxed at the child's rate.

- Any amount above $2,500 is taxed at the parents' rate.

These rules cover children under the age of 18, and also those up to the age of 24 who are full-time students.

Can my child complete their own tax return?

Given how hard most adults find it to file taxes, it's unlikely your industrious babysitting 12-year-old is going to be able to handle the forms on their own. An older teen might be able to follow the prompts of an online tax preparation program but still will likely require adult supervision. Williams suggests making them part of the process when you decide it's age-appropriate, even if you do it for them. "I do my teenage son's with commercial software, but I make him sit there while I do it, and I'll do the same with my daughter next year when she's old enough to have earnings," says Williams.

Williams suggests making them part of the process when you decide it's age-appropriate, even if you do it for them. "I do my teenage son's with commercial software, but I make him sit there while I do it, and I'll do the same with my daughter next year when she's old enough to have earnings," says Williams.

How much can the bill be?

If your child has a significant investment portfolio in a custodial account (like an UGMA or UTMA in the child's name, or a child-owned brokerage account like Fidelity's Youth Account) or a trust, the amounts can add up. "If you have trust income such as interest and dividends flowing through to a child that could very much impact their tax rate," says Williams.

An investment account above, say, $20,000 might generate enough income to tip the child's rate on unearned income over into the parent's tax rate, and this is especially true if the account is invested in mutual funds that make taxable distributions.

How can my child manage their assets for tax efficiency?

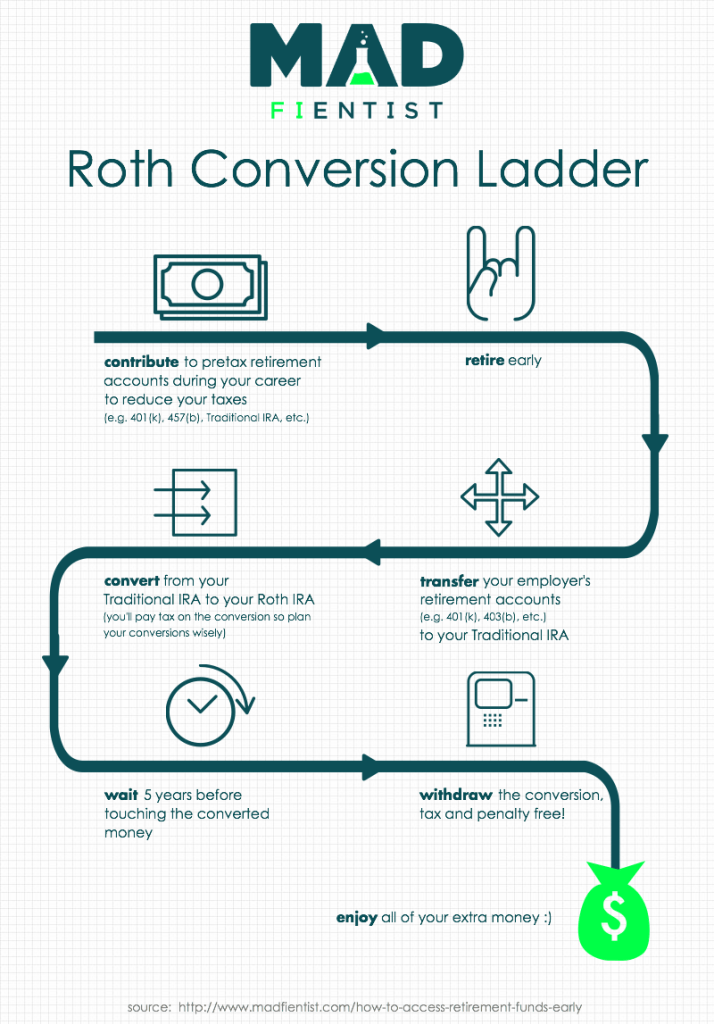

If your child has earned income, you can invest that income (up to $6,500 per year) in a Roth IRA for kids. The same rules apply to a Roth IRA for this age group as for adults. Contributions can always be withdrawn tax- and penalty-free. The growth is potentially tax-free, if you follow all the distribution rules. An added bonus: Assets in retirement accounts do not generally count as assets for college financial aid calculations.

You may also want to consider using a 529 savings account for educational savings instead of, or in addition to, a custodial account. While money is in the 529 account, no taxes will be due on investment earnings. When you take money out for qualified education expenses, withdrawals are federal income tax-free. You may also get a state tax deduction for your contributions, and the account will be counted as a parental asset (rather than a student asset) which can be beneficial when determining financial aid for college.

Bottom line

Your child's tax situation can be more complicated than you imagine, so consider consulting a tax advisor or financial professional to figure out your responsibilities and the best strategies to help address the kiddie tax.

Next steps to consider

Tips on taxes

Ideas to help reduce taxes on income, investments, and savings.

How to Claim Child Tax Credits | What Are Child Tax Credits?

If you have children you support, there are two different tax credits you should know about.

Children are expensive. To offset some of this expense, Congress provides two special tax credits to people who have children:

- a child tax credit, and

- a child and dependent care tax credit.

If you qualify, you can get both credits in the same year. In the past, the child tax credit was limited to middle and lower-income taxpayers. No longer: you can earn up to $400,000 and qualify for the full credit.

What Is the Child Tax Credit?The child tax credit is only available if you have what the IRS calls a "qualifying child. " A qualifying child is a child who qualifies as a dependent for tax purposes. A qualifying child can be your son, daughter, stepchild, adopted child, foster child, brother, sister, stepbrother, stepsister, or a descendant of any of them—for example, your grandchild, niece, or nephew. A qualifying child must:

" A qualifying child is a child who qualifies as a dependent for tax purposes. A qualifying child can be your son, daughter, stepchild, adopted child, foster child, brother, sister, stepbrother, stepsister, or a descendant of any of them—for example, your grandchild, niece, or nephew. A qualifying child must:

- live with you for over half the year

- provide less than half of their own support

- be a U.S. citizen, resident, or national, and

- have a Social Security number which you must provide on your tax return.

Normally, the child tax credit may be claimed only if you have a qualifying child under age 17 at the end of the year. You get no credit if a child turned 17 during the year. However, for 2021 only, the age of a qualifying child is increased to children under age 18 at the end of the year.

The IRS has an online questionnaire you can complete to determine if you have a qualifying child. Visit the Does My Child/Dependent Qualify for the Child Tax Credit? page at the IRS website.

Before you get too excited about how much money Junior is going to save you on your taxes, read on. The child tax credit is subject to an income threshold and the amount of credit you can take each year goes down as your income approaches that threshold amount.

The Regular Child Tax Credit Rules

Under the regular child tax credit rules in effect during 2018 through 2025 (but not for 2021), everyone with a qualifying child starts out the tax year entitled to a $2,000 credit per child for the tax year. This credit is gradually phased out for taxpayers whose incomes rise up to and above the annual threshold amount specified for the year. Specifically, for each $1,000 that your modified adjusted gross income exceeds the income threshold level, the total child tax credit for a family (not the amount per child) is reduced by $50. If you make too much money, you won't get any credit at all. However, the Tax Cuts and Jobs Act greatly increased the amount you can earn and still receive the credit. Indeed, only a small fraction of all taxpayers are unable to obtain the credit.

Indeed, only a small fraction of all taxpayers are unable to obtain the credit.

The child tax credit starts to be reduced only when your adjusted gross income reaches the following levels:

- $400,000 for married couples filing separately, and

- $200,000 for all other taxpayers.

For example, a married couple filing jointly with one qualifying child gets no child tax credit if their adjusted gross income exceeds $440,000. The $2,000 credit they started the tax year with would be whittled down to zero by 40 $50 reductions.

The child tax credit is partly refundable—that is, you may collect it even if you owe no taxes for the year. The maximum refundable amount is $1,400 per child. But the actual refundable amount you can collect if you owe no tax for the year depends on your earned income (generally, wages, salary, tips, or net earnings from self-employment). The refundable amount is equal to 15% of your earned income over $2,500, up to the maximum $1,400 credit. For example, if your earned income is $10,000, your refundable credit would be 15% x ($10,000 - $2,500) = $1,125.

For example, if your earned income is $10,000, your refundable credit would be 15% x ($10,000 - $2,500) = $1,125.

If you have three or more qualifying children and receive the earned income credit, you can use a different formula to figure your refundable credit. With this formula, your refundable credit is equal to the amount your Social Security taxes exceed your earned income credit. You should use this formula if it will result in a larger credit.

The Tax Cuts and Jobs Act also established a new $500 nonrefundable child care credit for dependents who are not qualifying children (also called the "family care credit"). For example, you may claim this credit for parents or grandparents if they are your dependents for tax purposes. Because this credit is nonrefundable, you may benefit from it only if you owe income taxes for the year.

Special Child Tax Credit Rules for 2021

To help families struggling in the wake of the COVD-19 pandemic, the child tax credit was expanded for 2021. For 2021 only, the child tax credit is increased to:

For 2021 only, the child tax credit is increased to:

- $3,600 for every child under age 6, and

- $3,000 for children between the ages of 6 and 17 (one year older than the regular credit rules).

For example, a family with two children under age 6 will receive a $7,200 tax credit for 2021.

The increased credit amount is phased out for married couples with incomes over $150,000 and single parents who earn over $112,500. The credit is reduced $50 for each $1,000 your adjusted gross income exceeds these levels. For example, if you have one child over age 5, you're entitled to a $1,000 increased credit for 2021. This amount gets reduced to 0 if you have 20 $50 reductions.

Once the increased amount is phased out, the amount of the credit remains $2,000 until the $400,000/$200,000 phaseout limits under the regular rules apply.

The entire credit is refundable—you get the full amount even if you owe no taxes.

In addition, starting July 15, 2021, the IRS began paying 50% of the credit each month to eligible families by direct deposit. This will result in 50% of the credit being paid by the end of 2021. For example, if you're entitled to a $6,000 credit, you'll be paid $500 each month from July through December 2021. The IRS payments are based on the most recently filed return and should be sent to you by the IRS automatically. For more information or to update your banking information with the IRS, visit the IRS Child Tax Credit Update Portal.

This will result in 50% of the credit being paid by the end of 2021. For example, if you're entitled to a $6,000 credit, you'll be paid $500 each month from July through December 2021. The IRS payments are based on the most recently filed return and should be sent to you by the IRS automatically. For more information or to update your banking information with the IRS, visit the IRS Child Tax Credit Update Portal.

Unlike the child tax credit (which you get simply by having a qualifying child), you can use the child and dependent care credit only if you spend money for child care so that you and your spouse, if any, can work. There is no income ceiling on the child and dependent care credit (which is also different from the child tax credit). People with higher incomes get a smaller credit than those with more modest incomes. Here's how it works.

You qualify for the credit if:

- you have a qualifying child or other dependent under the age of 13, or your spouse is disabled and physically or mentally incapable of caring for him or herself, or you have any disabled dependent who has income of less than $4,000 per year

- you incur child care expenses to enable you and your spouse, if any, to earn income

- you and your spouse file a joint tax return (applicable only if you're married), and

- you and your spouse, if any, both work either full or part-time and have earned income for the year, unless you or your spouse is a full-time student or disabled.

(Looking for work counts as being employed.)

(Looking for work counts as being employed.)

The amount of the credit is based on a percentage of the child care expenses you incur on the days that you and/or your spouse work. Under the regular rules, the credit is equal to 35% of childcare expenses up to $3,000 for one child, or $6,000 for two or more. But the credit is reduced by 1% for every $2,000 in household income over $15,000, until reaching 20%. Thus, the credit is 20% of childcare expenses if your household income is $45,000 or more.

However, for 2021 only, the child dependent care credit is 50% of childcare expenses up to $8,000 for one child and $16,000 for two or more. Also, the credit is reduced by 1% for each $2,000 of household income over $125,000. The credit percentage is not further reduced below 20% until household income reaches $400,000 at which point the reduction of the credit percentage continues until reaching zero. Thus, when income does not exceed $125,000, the credit is usually $4,000 for taxpayers with one child ($8,000 x 50%), and $8,000 for taxpayers with two or more ($16,000 x 50%)

If you're fortunate enough to have an employer that reimburses you for child care expenses, you must deduct the reimbursed amount from your annual child care expenses.

Starting 2021, the child and dependent care credit is fully refundable--that is, you're paid the full amount as a tax refund by the IRS even if you owe no taxes for the year. For 2020 and earlier, the credit is not refundable--it is limited to your tax liability for the year.

Obviously, you need to keep track of everything you spend on child care during the year and be sure to keep receipts and canceled checks. Child care expenses include expenses both in and outside your home, such as:

- babysitting

- daycare

- nursery school, and

- day camp (but not if the child sleeps overnight at the camp).

The costs of sending a child to school in the first grade or beyond are not included. Nor can you hire your spouse, child, or another dependent as a daycare provider. If your child turns 13 during the year, you can only include those expenses you incur before that child 13th birthday.

To claim the credit, you'll have to list on your tax return the name, address, and Social Security number or Employer Identification number of the people you pay for dependent care, so be sure to get this information. You must also file IRS Form 2441, Child and Dependent Care Expenses with your tax return.

You must also file IRS Form 2441, Child and Dependent Care Expenses with your tax return.

The IRS has an online questionnaire you can complete to determine if you qualify for the child and dependent care credit. Visit the Am I Eligible to Claim the Child and Dependent Care Credit? page at the IRS website.

90,000 individual entrepreneurs without income: how much to pay taxes?It often happens that a person registers an individual entrepreneur, but the business never starts. The main thing you need to know is that even a non-working entrepreneur accumulates debt on annual insurance premiums. Other debts on an inactive individual entrepreneur are not always there. But we will be paranoid and tell you how to check all possible ones.

To stop the accumulation of debt, it is necessary to close the IP. Since the end of 2020, the tax office has been doing it itself. But with this outcome, a person will be banned from being an entrepreneur for three years.

Now about everything in order.

A non-working individual entrepreneur always accumulates a debt on insurance premiums

An individual entrepreneur without employees pays insurance premiums for himself to receive an old-age pension and medical assistance under the policy. Contributions go to the Social Fund of Russia. But they pay them in one window - to the tax office.

The amount of contributions for individual entrepreneurs without employees consists of two parts. Fixed - its state establishes for each year. And additional - it is paid in the amount of 1% of income exceeding 300,000 rubles. A non-working individual entrepreneur has exactly a fixed part of the contributions for each year. But the tax authority can collect debt only for the last three years - this is a restriction from Art. 113 of the Tax Code of the Russian Federation.

The fixed part of contributions for 2023 is 45,842 rubles. You can see the contributions for previous years here. You can calculate the amount for all the years of the existence of an individual entrepreneur in the calculator on the tax website. If the IP was not opened at the beginning of the year, the amount of contributions is reduced in proportion to calendar days. If it is closed before the end of the year - the same. This follows from Art. 430 of the Tax Code of the Russian Federation.

If the IP was not opened at the beginning of the year, the amount of contributions is reduced in proportion to calendar days. If it is closed before the end of the year - the same. This follows from Art. 430 of the Tax Code of the Russian Federation.

The due dates for payment of fees are as follows. The fixed part is paid every year until December 31st. Additional part - until July 1 of the next year. When an individual entrepreneur is closed, debts are paid within 15 days after deregistration with the tax office. It says so in Art. 432 of the Tax Code of the Russian Federation.

For violation of the deadlines for paying contributions, the tax authority charges penalties. The size is 1/300 of the key rate. But more than the body of the debt, penalties cannot be calculated - Art. 75 of the Tax Code of the Russian Federation.

Penalty calculator

If an individual entrepreneur did not sell anything, did not open an account and did not hire employees, he still pays insurance premiums. Entrepreneurs asked if it was legal in the Constitutional Court. They said so. A person opens an IP voluntarily. This means that he has the necessary money, education and skills to work and fulfill tax obligations - Definition No. 164-O.

Entrepreneurs asked if it was legal in the Constitutional Court. They said so. A person opens an IP voluntarily. This means that he has the necessary money, education and skills to work and fulfill tax obligations - Definition No. 164-O.

However, there are still periods for which insurance premiums may not be paid. They are spelled out in paragraph 7 of Art. 430 of the Tax Code of the Russian Federation:

- service in the army;

- care for a child up to 1.5 years old, but not more than 6 years old for all children;

- caring for a disabled person of group I, a disabled child or an elderly person over 80 years old;

- the period of residence with a spouse in a military unit or abroad in a diplomatic mission. but within 5 years.

In order for the tax authorities to cancel the contributions, you must bring documents that confirm these circumstances. Automatic accrual will not be canceled.

Other life circumstances are unlikely to get rid of the debt. For example, the court refused to cancel contributions to an entrepreneur who had been in prison for 6 years and did not work. The refusal was explained by the fact that even from places of deprivation of liberty it is possible to close an individual entrepreneur through a representative, and not accumulate debt - case No. A34-10340/2019.

For example, the court refused to cancel contributions to an entrepreneur who had been in prison for 6 years and did not work. The refusal was explained by the fact that even from places of deprivation of liberty it is possible to close an individual entrepreneur through a representative, and not accumulate debt - case No. A34-10340/2019.

If there was no income, it is necessary to submit a zero declaration

Usually, when registering, an entrepreneur chooses a special taxation regime - the simplified tax system or a patent. They do this because special regimes pay less taxes. But if the application does not reach the hands, the individual entrepreneur remains on the general taxation system and pays personal income tax, VAT and property tax.

The only way to find out your tax regime is to call or go to the tax office.

Entrepreneurs on the simplified tax system and the general system once a year or quarter submit a declaration to the tax office, even if they did not earn. So before the inspectors they confirm that there was no income and no tax should be paid. A declaration without income is called zero. For each failure to file a tax return, the tax authority fines 1,000 rubles under Art. 119 of the Tax Code of the Russian Federation. But you can fine only for the last three years.

So before the inspectors they confirm that there was no income and no tax should be paid. A declaration without income is called zero. For each failure to file a tax return, the tax authority fines 1,000 rubles under Art. 119 of the Tax Code of the Russian Federation. But you can fine only for the last three years.

The penalty for non-delivered zero declarations is added to the debt for unpaid insurance premiums and penalties to them.

🧮 It turns out that the tax debt of a non-working individual entrepreneur is the sum of insurance premiums for the last three years + penalties for late payment + fines for declarations.

How to find out about all the debts of an individual entrepreneur to the tax office

You can find out the full and exact amount of the debt through Internet services or by going personally to the tax office at the place of residence.

You can see the address of your tax office and make an appointment here. At the reception, it is worth asking the inspector for a Statement of the status of settlements and an extract of operations on settlements with the budget. These documents show the total amount of the debt and due to what payments and fines it appeared.

These documents show the total amount of the debt and due to what payments and fines it appeared.

You can find out about debts without leaving your home and immediately pay them off on the Internet:

- In the Tax Debt section through your personal account on Public Services;

- In the personal account of the individual entrepreneur on the website of the Federal Tax Service. You can enter the account through an account from the State Services or using an EDS, if any.

Tax debts do not just hang out in the personal account of an individual entrepreneur. First, the tax office sends a demand for payment, and then tries to write off money from all known accounts and personal cards of the entrepreneur. Inspectors can do this - art. 76 of the Tax Code of the Russian Federation.

If the inspectors do not find money in the accounts, the debt is transferred to the bailiffs. They can come home and take the property. You can find your business in the data bank of enforcement proceedings.

New IP - the year of the Elbe as a gift

Year of online accounting at the Premium rate for sole proprietors under 3 months

Try for free

Litigation involving individual entrepreneurs

Sometimes the situation with a business develops like this. They opened an individual entrepreneur, did a little work, but the business didn’t work, and everyone was abandoned.

Even if an entrepreneur did not sell goods or rent premises for a very short time, he could still have debts to clients and contractors. The pre-trial claims they sent in the mail are easy to miss. And perhaps the entrepreneur has already been sued.

You can find out about court cases with suppliers, contractors and landlords in the file of arbitration cases. This is the basis of all litigation between entrepreneurs.

If there is a danger that claims from individual clients remain against individual entrepreneurs, it is worth checking the database of courts of general jurisdiction in the GAS Justice service.

If you find out that you are a participant in a court case, you should immediately connect. Go to court, photograph the statement of claim and evidence in the materials. Then go to court sessions, argue or try to go to the world.

How to deal with an unnecessary IP

An idle IP should be closed. This will stop the accumulation of debts on contributions. But the debts themselves are not going anywhere. Debts will remain hanging on individuals, and sooner or later they will have to be paid off.

If you close the IP on your own, in the future it will be possible to open a new one. Closing an IP without employees is simple, fast and almost free. Check out our article on this.

It is impossible to sell or re-register an individual entrepreneur to another person.

Non-working individual entrepreneurs are closed by the tax authorities themselves, but this is not always good

From the end of 2020, the tax authorities will close non-performing individual entrepreneurs Speaking in legal terms, it excludes an entrepreneur from the unified state register under Art. 22.4 of Law No. 129-FZ.

22.4 of Law No. 129-FZ.

Individual entrepreneurs are considered non-working if two conditions are met:

- they have not submitted calculations and declarations for more than 15 months or have not renewed the patent,

- there is an outstanding debt for taxes or contributions.

Before exclusion, the tax office is trying to find creditors for individual entrepreneurs. To do this, a message is published in the journal "Bulletin of State Registration" about the upcoming closure of the IP. If within a month none of the suppliers, customers or former employees make their claims, the IP will be liquidated.

Exclusion from the unified state register stops the accumulation of debts. But, as in the case of voluntary closure, all accrued taxes and contributions are transferred to an individual.

Leaving an individual entrepreneur and waiting for the tax authorities to deal with it is not beneficial for everyone and not always. Over the next three years, a person whose IP was closed by the tax office will not be able to open a new one. And also - it is not known when the inspectors will get specifically to your individual entrepreneur. And all this time, the amount of debt will grow like a snowball.

And also - it is not known when the inspectors will get specifically to your individual entrepreneur. And all this time, the amount of debt will grow like a snowball.

The article is relevant to

Taxes in Israel: how much to pay and how to save

Read more about the country's business ecosystem in the RB.RU review: Where to go for startups in Israel Taxes for individuals Tax resident status in Israel is assigned if a person spends 183 or more days a year in the country. “If your family lives in Israel, if you spend more time here than in any other country in the world, it makes no sense to count the days and try to spend less than six months a year in Israel, this will not get rid of the status of a tax resident” , explains Eli Gervits, attorney and president of the Israeli Russian-language bar association Eli (Ilya) Gervits. Income tax applies to all personal income of individuals: wages, business income (except for agricultural production), pension benefits and others. Progressive tax rate depending on the amount of income: Taxes for individuals

Tax resident status

There is also the principle of the "center of vital interests", which takes into account family, social and economic ties with Israel. If you have confirmed connections, it is enough to be in Israel only 30 days a year.

There is also the principle of the "center of vital interests", which takes into account family, social and economic ties with Israel. If you have confirmed connections, it is enough to be in Israel only 30 days a year. Income tax (“mas akhnasa”)

Monthly income (shekel) Annual income (shekel) Rate Up to 6 290 Up to 75 480 10% 6 291 - 9 030 75 481 - 108 360 14% 9 031 — 14 490 108 361 - 173 880 20% 14 491 - 20 140 173 881 - 241 680 31% 20 141 - 41 910 241 681 - 502 920 35% Over 41 911 Over 502 921 47%

Individuals whose annual income exceeds NIS 647,640 pay an additional 3% on this amount. This is the so-called tax on especially high income with a total rate of 50%.

This is the so-called tax on especially high income with a total rate of 50%.

An example of income tax calculation for a salary of 100,000 shekels per year:

75,480 x 10% + (100,000 - 75,480) x 14% = 7,548 + 3,433 = NIS 10,981

their employer. You need to file a tax return yourself in the following cases:

- if you have several jobs or sources of income;

- if your annual earnings exceed NIS 590,000;

- if you are a non-resident and income tax is not withheld at source.

In general, the principles of taxation of residents and non-residents are the same, but they have different benefits. There are also additional rules for new immigrants, returnees and expats.

Benefits for residents

Israel has a system of "preferential tax units" ("nekudot zikuy"), which allows you to reduce income taxes.

Certain categories of persons are entitled to tax units, each of which in 2021 gives a tax deduction of 218 shekels per month or 2616 per year.

Basic tax units:

- Israeli citizen - 2.25

- Woman - 0.5

- Minor worker (16-18 years old) - 1

- Benefits for children - from 0.5 to 2.5 depending on the age of the child

- Soldiers - 1 to 2 depending on service life

Thus, every citizen of Israel has at least 2.25 points, which gives 5,886 shekels per year. If your income tax does not exceed this amount, then it is actually repaid at the expense of "nekudot zikuy".

Benefits for immigrants and repatriates

Special tax rules apply to immigrants and repatriates who return to Israel after 10 years of absence.

During the first 18 months of their stay in the country, they are entitled to 3 preferential units of “nekudot zikui”, the next year - 2 and the third - 1.

An important benefit is a 10-year tax exemption on most types of passive income earned abroad.

These include dividends, interest, rent, royalties, pensions, and so on.

For example, if you moved to Israel, but at the same time you rent an apartment in Russia, you do not need to pay rental income tax.

Capital gains from the sale of foreign assets will not be taxed for the first 10 years. If you become a tax resident in 2021 and sell an apartment in Russia, say, in 2026, then you will not pay income tax.

Benefits for qualified expats

Invited experts and lecturers from abroad also receive benefits. This applies to highly specialized knowledge and skills that Israeli specialists do not possess.

The confirmed status of a foreign expert allows you to pay no more than 25% tax on a certain amount of income for 3 years, with a possible extension of up to 5 years.

During the first 12 months of employment in Israel, living expenses (up to NIS 330 per day or 50% of wages) and some utilities can also be deducted from taxation. To do this, you must keep the lease agreement, hotel bills and utility bills.

To do this, you must keep the lease agreement, hotel bills and utility bills.

Insurance contributions (Bituach Leumi)

In addition to income tax, individuals pay contributions to the national insurance system and health insurance tax.

Taxes for investors

Special rules apply to passive income of individuals: from interest, dividends, royalties and rent.

For tax residents of other countries with which Israel has tax treaties, tax rates may be lower than for Israelis. You can read more about the terms of the Russian-Israeli agreement here.

Interest

Interest income is taxed at a rate of 25%. If you invest in listed securities or financial institutions, the rate can be reduced to 15%.

Dividends

Dividends are taxed at 25%. For some businesses that are subject to the Capital Investment Encouragement Act, a reduced rate of 20% may apply.

Royalties

Income from the sale of the right to use intellectual property is subject to taxation at the rate of 26.5%.

Purchase of real estate

Purchased real estate is subject to tax, the rate of which depends on the type of object, value, status of the buyer (resident, returnee or non-resident) and the presence of other objects in the property. The tax is called "mas rehisha".

For residents and non-residents, there is a progressive tax rate starting from 5% on real estate worth up to 1.3 million shekels (about $400,000). The maximum tax can reach 10% (for an object more expensive than 17.8 million shekels).

When a resident purchases a first home, up to NIS 1.7 million will not be taxed. “The state supports Israelis who want to solve their housing problem - transactions worth up to half a million dollars are exempted from taxes,” says Anastasia Faley, an analyst at the Prian. ru portal. - But it is important to understand: if in Russia housing of such a cost belongs to the premium segment, then in Israel it is the middle class.

ru portal. - But it is important to understand: if in Russia housing of such a cost belongs to the premium segment, then in Israel it is the middle class.

By 2021, the cost of a 4-room apartment (and this is the most common type of housing in Israel) was 1.65 million shekels on average in the country, and, for example, in expensive Tel Aviv - 3.5 million shekels, that is about $1 million."

For new immigrants, the tax on real estate worth up to 1.8 million shekels is 0.5%, more - 5%. According to Anastasia Faley, in some cases, especially when buying expensive real estate, it is more profitable to be a new repatriate than a native citizen of the country.

Interestingly, even those who have not actually moved to Israel yet, but are going to do so in the next two years, can apply for a tax break.

No tax is charged if you purchase real estate on the primary market from a licensed developer.

Property maintenance

In Israel, there is a municipal fee for property owners. Its size depends on the location and area of the object and may vary several times. An average apartment costs about 200 shekels per month.

Another tax that you will have to pay if you significantly improve your home, thereby increasing its value, is the tax on improvements. It is 50% of the amount by which the value of the object has increased.

Renting

Rental income is taxed on a progressive scale in the same way as the active income of an individual, only in this case the minimum rate will be 31% (for people over 60 years old - 10%). From the taxable amount, you can deduct the cost of maintaining housing: repairs, depreciation, and so on.

However, if the rental is not a business and the property is rented by one individual to another for living, then you can choose the second option - pay only 10% tax, but without deducting current expenses. In this case, it is important to pay the tax within 30 days after the end of the tax year.

When renting out several apartments, you can choose only one taxation option. For the rental of overseas property, a flat tax rate of 15% applies without the possibility of deducting related costs.

Income up to NIS 5,070 per month (for 2021) is not taxed. If it exceeds this amount by no more than twice, that is, within 10,140 shekels, then you can apply for a partial exemption. In this case, the mechanics of calculating the tax-free amount is not the most obvious, so we will show it right away with an example.

Let's say your income from renting out an apartment is NIS 6,000. The maximum amount exempt from tax in 2021 is NIS 5,070. It is not final yet - your amount will be less. We subtract 5,070 from your income and get the difference - 930 shekels. Next, subtract this amount from the "ceiling" (5,070) and get your tax-free amount - 4,140 shekels. Accordingly, you will pay tax only on the remaining 1,860 shekels.

Tel Aviv

Sale of real estate

When selling a property, capital gains tax (“maschevah”) is charged - 25% of net profit, after deducting related expenses.

Israeli residents who sell property every 4 years or their only home are exempt from tax. In the second case, it is important that in the previous 18 months a person did not sell either this or any other apartment.

Corporate taxes

The main form of business organization for a corporation is a limited liability company, Ltd.

Companies pay corporate tax at a rate of 23%. For firms registered in Israel, all worldwide income is subject to taxation, for foreign companies with local branches - only accrued in Israel.

Dividends received from another Israeli company as a result of its income accrued in Israel are exempt from tax. Dividends from abroad, or dividends derived from a company's overseas income, will be taxed at a rate of 25%.

Insurance payments for employees (Bituah Leumi) total from 3.5 to 17.5%. You can use a calculator to calculate them.

Goods and services are subject to VAT at the standard rate of 17%. There is no tax on some tourist services and the sale of vegetables and fruits.

Preferred Enterprise

Preferred enterprise status can be obtained if the company contributes to the development of the productive potential of the economy and employment opportunities. The corporate tax rate is 7.5% (in priority regions) or 16% (in all other regions).

Special Preferred Enterprise

This is a special treatment for very large companies that invest dynamically in productive assets, R&D and job creation.

Such a company must demonstrate high income (from 1 billion shekels per year, as well as participation in a group of companies with a gross income of 10 billion per year) and a serious contribution to the national economy.

For the first 10 years, the tax rate will be 5% or 8% depending on the region. Further, if the company does not provide a new investment program, the Preferred Enterprise mode will be applied to it.

Further, if the company does not provide a new investment program, the Preferred Enterprise mode will be applied to it.

Taxes for small businesses

There are two forms of IP: “osek patur” and “osek murshe”. Only a resident can register them. There is a small exception for foreigners who acquire citizenship. In this case, it is allowed to register a joint business with a local representative, who will temporarily become a tax guarantor. After obtaining citizenship, it will already be possible to re-register the business for yourself.

Entrepreneurs pay income tax from 10 to 50% and insurance premiums. "Esek Patur" is more beneficial in terms of taxes, as it allows you not to pay VAT, and also involves simpler tax reporting. It is suitable for entrepreneurs who sell goods or services to individuals.

An accountant, consultant or dentist can register this way, for example. In this case, the business turnover is limited, the maximum amount changes annually, on average it is 100,000 shekels.

Fruit shop in Tel Aviv

If the business exceeds the maximum allowable turnover, it will go under the rules of taxation "esek murshe" with the need to pay VAT on all goods and services. At the same time, part of the funds spent for business development (purchase of raw materials, maintenance of transport, and so on) can be returned.

“In Israel, the principle of tax neutrality is preached, therefore, apart from low income levels, there is no significant difference between the different ways of “withdrawing” profits: through corporate income tax and dividend tax, through your salary from your company or through an individual entrepreneur. In the last two cases - with the payment of social tax and income tax, - says Eli Gerwitz.

Taxes for innovative companies

The active development of Israel's technology cluster, among other things, is due to government grants and tax incentives for businesses and investors.

Companies investing in R&D are eligible for a deduction for these expenses in the first 2 or 3 years, depending on the industry. The priorities are industry, transport, agriculture and energy.

Individuals investing in R&D companies can deduct the invested funds from taxation of any other income - up to NIS 5 million for each company. If the investor is a foreign company with an Israeli subsidiary, then it can deduct the investment amount over a three-year period.

In addition, there are special tax regimes for large enterprises:

Preferred technological enterprise

Preferred technological enterprise status is granted if an IT company spends more than 7% of its income on R&D or is approved by the national technology innovation authority.

The corporate tax rate ranges from 7.5 to 12% depending on the region. Dividend tax - 20%, a reduced rate of 4% may apply to dividends paid to a foreign parent company that owns at least 90% shares.