How does child care work

Child Care Services — Program Overview — TWC

The child care services program provides financial aid (also known as subsidy) for child care to families who meet income requirements, promoting long-term self-sufficiency by enabling parents to work or attend education activities. This program strives to educate parents about the availability of quality child care, enhance children’s early learning, and support early learning programs working to improve the quality of child care services.

On this page:

Spotlight: Child Care Relief Funding 2022

In early 2022, TWC offered another round of the Child Care Relief Fund (CCRF) to help child care business build back strong and thrive in the post-pandemic economy! The CCRF 2022 was a one-time funding opportunity that offered a total of $3.4 billion for eligible child care providers.

To learn more, please see our page on the Child Care Relief Funds and view the status of applications and award amounts.

For questions, please contact [email protected].

Return to Top

Texas Rising Star

About Texas Rising Star

The Texas Rising Star program is a voluntary quality rating and improvement system (QRIS) for child care programs participating in the Texas Workforce Commission’s (TWC) child care program. Texas Rising Star is an excellent option for parents who are looking for high quality child care for their children. To learn more about Texas Rising Star and the services it offers parents, look through our brochure in English, Spanish, or Vietnamese.

Texas Rising Star certification is available to regulated child care programs (centers and homes) that meet the certification criteria. Learn more about how child care programs can be a part of Texas Rising Star.

In 2021, the Texas legislature enacted legislation that requires all providers in TWC's Child Care Services program to participate in Texas Rising Star. TWC is currently implementing this new requirement through modifications to TWC's administrative rules and will be moving toward a mandatory Texas Rising Star program for the Child Care Services program.

Commonly Asked Questions:

What is a Texas Rising Star-certified program?

An early learning program that has an agreement to accept referrals from the TWC Child Care Services program and meets quality requirements that exceed the State’s Child Care Regulation minimum standards, receiving a certification level of Two-, Three-, or Four-Star.

How can I find a Texas Rising Star early learning program in my area?

The Texas Child Care Availability Portal helps match families that need child care with early learning programs that have available spots. While not all programs are Texas Rising Star-certified, Texas Rising Star-certified programs will show up higher on the search list. Parents can easily access information about early learning programs in their area that have current openings, which are updated on a weekly basis. In this portal, parents can also view:

- Quality certifications and accreditations (Texas Rising Star-certified programs will have a unique indicator

- Available spots by age

- Links to the program’s licensing safety and health inspection reports and history

Additionally, The Parent’s Guide to Choosing Quality Child Care can be used to assist you in starting your search, knowing what key questions to ask, look for signs of quality, and help guide you through the selection process.

How can I ask more questions about Texas Rising Star?

Do you have a question about the Texas Rising Star program? Use their contact form to get your answer! Your question will be received by local Workforce Solutions partners that serve your area of residence.

Texas Rising Star Four-Year Review

Every four years, TWC conducts a comprehensive review of the Texas Rising Star program. TWC’s most recent review was completed in 2021. To help inform the review, TWC established a Texas Rising Star workgroup. For more information on the most recent review, please visit the Texas Rising Star Workgroup webpage.

Return to Top

Customers

The Texas Workforce Commission and its local Workforce Solutions partners serve parents and child care programs. The following sections are intended for parents and child care programs.

Return to Top

Parents

The Texas Workforce Commission and its local Workforce Solutions partners offers many benefits to parents!

These benefits include:

- Child Care Scholarships to access child care while you work or go to school

- Access to programs that meet your needs

- Options for a family member to care for your child

- Access to workforce supports and other resources

- Information about quality educational opportunities for your child to attend

Resources for Parents

Family Resources in Texas

To find support organizations and programs near you, visit Family Resources.

Child Care Scholarships (Financial Aid)

To find out how eligible families of children under the age of 13 may receive child care scholarships so that parents can work, attend school, or participate in training, visit Texas Child Care Solutions. If your child has a disability, visit Children with Disabilities for additional information on how the Child Care Services program may assist your child.

Texas Child Care Availability Portal

The Texas Child Care Availability Portal is a mapping search tool to help parents find child care. This also includes programs that are certified quality through Texas Rising Star, as well as their addresses, available seats by age, and links to their Child Care Regulation safety and health inspection reports and history.

Texas Child Care Solutions

Texas Child Care Solutions provides parents and child care providers access to resources and information to assist them in making informed choices to meet their child care and program needs.

Texas Prekindergarten Guidelines

The Texas Prekindergarten Guidelines follow child development and give teaching strategies for each of the guidelines. The new guidelines offer information and support to prepare all children for success in Kindergarten.

Texas Early Learning Guidelines

The Texas Infant, Toddler, and Three-Year Old Learning Guidelines include important information about how to support your child’s development from birth through three years old.

Texas Rising Star Program

Children who attend high-quality early learning programs can make significant gains in their knowledge, skills, and abilities. Texas Rising Star certification helps parents know if a program is high quality. Texas Rising Star also offers many resources for parents of young children. Learn more about Texas Rising Star, by viewing the parent brochure.

Return to Top

Child Care Programs

The Texas Workforce Commission and its Workforce Solutions partners offer many benefits to both parents and child care programs!

These benefits include:

- Ability for parents enrolled in the Child Care Services program to select your program

- Ability to enroll in the Texas Rising Star certification program, a Quality Rating and Improvement System

- Access to extensive training resources

Resources for Child Care Programs

Business Coaching, Funding, and other Business Resources

The Texas Workforce Commission is providing FREE business coaching and other resources to help your child care business. Learn more at www.childcare.texas.gov.

Learn more at www.childcare.texas.gov.

Skills for Small Business for Employers

Child care programs with fewer than 100 employees can apply to TWC Skills for Small Business program for training offered by their local community or technical college. The purpose of the program is for small businesses to enhance their business operations by obtaining training needed to upgrade their new and current employee’s skills.

The program reimburses up to $900 per existing employee and up to $1,800 per newly hired worker per 12-month period. Training funded through the program is intended to enhance the performance of the entire business rather than advance an individual’s pursuit of a degree. The program can reimburse providers for training opportunities such as:

- Entry level certificates in Infant and Toddler or Preschool

- Child Development Associate programs

- Occupational skills courses

- Required annual training by Child Care Regulation

Currently, there are 11 colleges participating in the Child Care Skills for Small Business program: Alamo Community College District, Angelina College, Austin Community College, Collin County Community College, Odessa College, Paris Junior College, San Jacinto College, South Texas College, Texas Southmost College, Vernon College, and Western Texas College.

Funding for child care programs is available through 2024. For more information on the program, including how to apply, visit the TWC Skills for Small Business for Employers webpage, or email [email protected].

Minimum Standards for Child Care

If you are regularly caring for children other than your own, you most likely need to be regulated with the State of Texas. Read the benefits of regulation, your different options for regulation, and what requirements are needed at the Child Care Regulation website, available in English or Spanish.

Participate in the State's Child Care Services Program

Whether you are a child care center, child care home, or if you are caring for a family member’s child, you can use the contact form on the Texas Child Care Solutions website to find out how to accept children who are in the Child Care Services program. You would be reimbursed by Workforce Solutions for caring for these children. Learn more about reimbursement rates available to child care programs, at Child Care Rates.

T.E.A.C.H. Early Childhood Texas Scholarship Program

T.E.A.C.H. Early Childhood Texas Scholarship Program is a research based comprehensive strategy to educate and retain early childhood practitioners, positively impacting outcomes for the children in their care. To learn more and see if you are eligible, visit TXAEYC.

Texas Child Care Availability Portal

Advertise your child care program in the Texas Child Care Availability Portal, a mapping search tool to help parents find child care. To be sure you will show up more visibly on the map and higher in search results, regularly update your availability at Texas Child Care Availability Portal.

Texas Child Care Quarterly

Texas Child Care was a quarterly journal for early childhood educators that is no longer in publication. To read previous editions focused on varying early childhood topics, browse through their archives.

Texas Early Learning Guidelines

The Texas Infant, Toddler, and Three-Year Old Learning Guidelines include important information about how to support the development of the children you serve.

Texas Infant-Toddler Specialist Network

The Texas Workforce Commission has funded a statewide network supported by Children’s Learning Institute that is aimed at improving the quality of infant and toddler experiences in classrooms, particularly those in underserved communities. This network of early childhood specialists includes coaches, mentors, trainers, and other personnel who can support teachers that work with infants and toddlers. Learn more at Texas Infant-Toddler Specialist Network.

Texas Prekindergarten Guidelines

The Texas Prekindergarten Guidelines follow child development and give teaching strategies for each of the guidelines. The new guidelines offer information and support to prepare all children for success in Kindergarten. Learn more at Texas Prekindergarten Guidelines.

Texas Rising Star Program

The Texas Rising Star program is a voluntary quality rating and improvement system for child care programs participating in the Texas Workforce Commission’s Child Care Services program. Texas Rising Star certification is available to licensed centers and licensed and registered child care home facilities that meet the certification criteria. Learn more about registering your program with Texas Rising Star. Download the Texas Rising Star provider brochure.

Texas Rising Star certification is available to licensed centers and licensed and registered child care home facilities that meet the certification criteria. Learn more about registering your program with Texas Rising Star. Download the Texas Rising Star provider brochure.

Texas Trainer Registry

The Texas Early Childhood Professional Development System (TECPDS) users have access to the Texas Trainer Registry, a statewide system that lists approved early childhood trainers and their trainings that child care programs can choose from. Learn more at TECPDS.

Texas Workforce Registry

The Texas Workforce Registry is a web-based application for early childhood professionals to keep track of all of their education and employment history, as well as the clock hours of training they have accrued. Learn more at Texas Workforce Registry.

Training Resources (Agrilife)

Choose from a variety of free and low-cost online courses that count as training hours for professional development for child care programs. Courses specifically for CDA Training and CDA Renewal are also available. Learn more at Agrilife.

Courses specifically for CDA Training and CDA Renewal are also available. Learn more at Agrilife.

Return to Top

Child Care Quality Improvement

Texas Rising Star

The Texas Rising Star program offers three levels of quality certification (Two-Star, Three-Star, and Four-Star) to encourage child care and early learning programs to attain progressively higher levels of quality. These certification levels are tied to graduated enhanced reimbursement rates for children enrolled in the Child Care Services program. The statewide revenue calculator template for Texas Rising Star can help you determine your revenue at different levels of Texas Rising Star. Access the calculator.

Texas Rising Star Entry Level Designation

Texas Government Code, §2308.3155 requires all CCS child care and early learning programs be included in the Texas Rising Star program at an Entry Level designation and requires TWC to establish a maximum length of time (24-months) that a child care and early learning program can participate at Entry Level designation.

To qualify for Entry Level designation, a child care and early learning program must meet the minimum quality standards outlined below and will receive technical assistance and support under the Texas Rising Star program:

- licensed or registered with CCR (may have an initial permit) or regulated by the United States Military;

- not on Corrective or Adverse Action with CCR; and

- meets the points threshold of 75 for high- and medium-high-weighted CCR deficiencies (based on a review of CCR licensing history within the most recent 12 months)

The timeline below shows the milestones during the 24-month Entry Level period for current CCS programs.

- October 3, 2022 Determine if meeting Entry-Level designation

- March 31, 2023 Deadline for meeting Entry-Level designation

- September 30, 2023 Screening review for initial star-level certification

- March 31, 2024 If not meeting Texas Rising Star certification, no new CCS family referrals

- September 30, 2024 Deadline for attaining Texas Rising Star certification

The following documents and recorded webinar provides more information about Entry Level designation.

Partnership Matching Grant Program

TWC’s Child Care Industry Partnership (CCIP) and Matching Investments for Child Care Quality Improvement (MICCQI) programs foster collaborations by supporting public-private investments in projects that improve the quality of child care and early learning. Learn more at Partnership Matching Grant Programs.

Child Care and Public Prekindergarten Partnerships

A child care/pre-K partnership is a collaboration between a public-school pre-K program and one or more quality-rated child care programs to provide high-quality care and education to three- and four-year-old children. This is also called an “early learning partnership.” Texas Rising Star Three- and Four-Star certified programs are eligible for pre-K partnerships. Learn more at Public Prekindergarten Partnerships.

Local Workforce Solutions Partners

A Local Workforce Solutions Partner, also identified as a Local Workforce Development Board, is a group of community leaders appointed by local elected officials and charged with planning and oversight responsibilities for workforce programs and services in their area. Learn more about the 28 boards in Texas on our Workforce Development Boards webpage.

Learn more about the 28 boards in Texas on our Workforce Development Boards webpage.

Return to Top

Stakeholder Input

Texas Workforce Commission Meetings

Stakeholders can learn about upcoming policy and funding decisions by virtually attending TWC’s three-member Commission meetings, which also offer the public an opportunity to provide input during any of its posted public meetings. To view meetings, agendas and materials, visit TWC Commission.

Additionally, the Commission works with staff to provide opportunities for:

- child care and early learning stakeholders to offer input on the Child Care Services program

- TEA, school districts, open-enrollment charter schools, relevant businesses, and the public to offer input on coordination between TWC's Child Care Services program and pre-K;

- child care programs to offer input on existing health and safety regulations that could be more efficient or less costly without reducing health and safety outcomes; and

- child care programs to offer input on burdens relating to complying with existing Child Care Services program regulations that could be mitigated, reduced, or eliminated while maintaining the intent, objective, or purpose of the underlying regulation.

TWC notifies stakeholders of opportunities to attend regional meetings and of other child care updates. Stakeholders interested in receiving updates should Sign up to receive workforce updates you can use by entering your email address and selecting the child care topic areas of their interest.

Stakeholders may also provide input to TWC’s Child Care and Early Learning Division at any time. Email: CC&EL Stakeholder Feedback.

Child Care Workforce Strategic Plan

In 2021, Texas’ 87th Legislature passed House Bill 619, to amend Texas Labor Code §302.0062. Pursuant to the amended Texas Labor Code §302.0062, the Texas Workforce Commission (TWC) must prepare a strategic plan for improving the quality of the infant, toddler, preschool, and school-age child care workforce. TWC is partnering with the University of Texas at Austin’s Lyndon B. Johnson School of Public Affairs to conduct data collection and analysis and convene and facilitate input from a workgroup to assist in developing the strategic plan.

TWC will deliver the final plan to the Legislature in December 2022.

Strategic Plan

The plan must include recommendations for:

- local workforce development boards to improve, sustain, and support the child-care workforce;

- increasing compensation for and reducing turnover of child-care workers;

- eliminating pay disparities in the child-care workforce;

- increasing paid opportunities for professional development and education for child-care workers, including apprenticeships;

- increasing participation in the Texas Early Childhood Professional Development System;

- public and private institutions of higher education to increase the use of articulation agreements with school districts and open-enrollment charter schools, and assist in the education and training of child-care workers; and

- for improving the infant and toddler child-care workforce.

Additionally, the plan must include:

- best practices from local workforce development boards in this state and other programs designed to support child-care workers; and

- a timeline and benchmarks for TWC and local Workforce Solutions partners to implement recommendations from the strategic plan.

Strategic Plan Workgroup

Under state statute, the Child Care Workforce Strategic Plan must consider input from various stakeholders via a workgroup that consists of child care providers, community stakeholders, and child care workers. The following individuals have been nominated and selected to serve on the workgroup which will convene April through November 2022.

| Name | Organization/Business |

|---|---|

| April Crawford, Ph.D | Co-Director at Children’s Learning Institute, UT Health Science Center |

| Bethany Edwards | Director at Early Learning Alliance |

| Carolyn Griffin | Owner of Grace Place Child Development Center |

| Cathy McHorse | Vice President at Success by 6, United Way ATX |

| Christina Hanger | Retired, previously CEO at Dallas Afterschool |

| Cody Summerville | Executive Director at Texas Association for the Education of Young Children |

| Cynthia Pearson | President and CEO at Day Nursery of Abilene |

| Edna Diaz | Program Director at Alphabet Playhouse Too |

| Ernestina Fauntleroy | Program Director at Abrahams Seed Daycare |

| George Argullion Ovalle | Workforce Solutions Capital Area, Texas Rising Star Mentor |

| Gloria Marmolejo | Education Supervisor at Project Vida Early Childhood Center |

| Heather Torres | Learning Center Director at Hope Lutheran Learning Center |

| Jerletha McDonald | Founder and CEO at Arlington DFW Child Care |

| June Yeatman | Early Childhood Educator at Austin Community College Children’s Lab School |

Katherine Abba, Ph. D. D. | Teacher Education/Child Development Faculty at Houston Community College |

| Katherine Pipoly | Chief Operating Officer at Workforce Solutions Alamo |

| Kim Kofron | Director of Early Childhood Education at Children at Risk |

| Lyn Lucas | Senior Vice President of Early Education and Program Evaluation at Camp Fire First Texas |

| Melanie Johnson, Ed.D. | President and CEO at Collaborative for Children |

| Melanie Rubin | Independent Policy Consultant; Director at North Texas Early Education Alliance |

| Melissa Hoisington | President’s Council of the Texas Licensed Child Care Association |

| Sheila Matthews | Director of Operations at Open Door Preschools |

| Teresa Granillo, Ph.D | CEO at AVANCE |

| Tim Kaminski | Co-Owner and Director of Gingerbread Kids Academy |

| Tobitha Holmes | Owner and Director of W. I.S.E. Academy I.S.E. Academy |

| Tori Mannes | President and CEO at Child Care Group |

| Tracy Anne Jones, Ed.D. | Assistant Director at Texas Early Childhood Professional Development System |

Work Recommendations

In November 2022, the Prenatal-Three Policy Impact Center submitted the HB 619 Workgroup's recommendations to TWC for the Commission's consideration in forming a strategic plan to submit to the legislature:

Return to Top

Authority & Funding

Data

Child Care by the Numbers

TWC has developed Child Care by the Numbers, which provides both current information (for the most recent 15 months, which is updated quarterly), and historical information (back to 2015), on the Child Care Services program, including:

- Number of children served in Texas Rising Star and in non-Texas Rising Star programs

- Number of child care programs in TWC's Child Care Services program serving children both Texas Rising Star and non-Texas Rising Star

TWC publishes the following reports regarding the Child Care Services program's plans and activities:

TWC publishes the following reports regarding the Child Care Services program's reimbursement rates and parent share of cost:

Additionally, the Texas Early Learning Council has published the following reports:

Child Care and Development Fund Annual Quality Progress Report (ACF-218)

The Administration for Children and Families uses the annual Quality Progress Report (QPR) to collect information from states to describe investments to increase access to high quality child care for children from birth to age 13. The annual data provided is used to describe state priorities and strategies to key stakeholders, including Congress, federal and state administrators, child care programs, parents, and the public.

The annual data provided is used to describe state priorities and strategies to key stakeholders, including Congress, federal and state administrators, child care programs, parents, and the public.

Child Care and Development Fund Monthly Case-Level Report (ACF-801)

The Administration for Children and Families (ACF) Office of Child Care (OCC) collects data regarding the children and families served through the Child Care and Development Fund (CCDF). All CCDF lead agencies are required to report this data through the ACF-801 case-level data submission. TWC submits the ACF-801 to OCC 60 days after the end of each quarter of the federal fiscal year.

The following documents are formatted in Excel .

Child Care Deserts

A child care desert is defined in Texas Labor Code §302.0461(b)(2)(A)(i) as an area where the number of children younger than six years of age who have working parents is at least three times greater than the capacity of licensed child care providers in the area.

Funding

New Child Care Funds from Federal Stimulus

Board Texas Rising Star Supports Plans

The following documents are formatted in Excel.

Administration for Children and Families Office of Child Care

The Office of Child Care supports low-income working families through child care financial assistance and promotes children's learning by improving the quality of early care and education and afterschool programs.

TWC Child Care & Early Learning Policy and Guidance

TWC’s Workforce Policy and Guidance webpage provides searchable access to Workforce Development Letters, Adult Education and Literacy Letters, and Technical Assistance Bulletins.

Child Care and Development Fund

Child Care Services is funded through the federal Child Care and Development Fund (CCDF), which is overseen by the U.S. Department of Health and Human Services’ Office of Child Care. The Texas Workforce Commission (TWC) is the lead agency for CCDF in Texas. Workforce Development Boards administer child care services through the Workforce Solutions offices. CCDF is authorized by the Child Care and Development Block Grant Act and Section 418 of the Social Security Act.

Workforce Development Boards administer child care services through the Workforce Solutions offices. CCDF is authorized by the Child Care and Development Block Grant Act and Section 418 of the Social Security Act.

The Texas State Legislature allocates the majority of CCDF funds to TWC to provide direct child care services to eligible families and to support the improvement of child care quality across the state. TWC in turn allocates most of these dollars to the 28 Local Workforce Development Boards (Boards) to oversee service delivery. At the state level, funds are also directed to statewide initiatives to improve child care quality and to the Texas Health and Human Services Commission to administer Child Care Regulation. Learn more at TWC's Financial & Grant Information webpage.

For more information on CCDF Final Regulations:

For more information on Sate Child Care-Related Regulations:

Return to Top

Child Care Works Program

The subsidized child care program helps low-income families pay their child care fees. The state and federal governments fund this program, which is managed by the Early Learning Resource Center (ELRC) office located in your county.

The state and federal governments fund this program, which is managed by the Early Learning Resource Center (ELRC) office located in your county.

If you meet the guidelines:

- The ELRC will pay a part of your child care cost. This is called a subsidy payment.

- You will pay a part of the cost. This is called the family co-pay.

- The subsidy payment and the family co-pay go directly to the child care program.

NOTE: If your child care subsidy does not pay the full amount that your child care program charges, the provider may ask you to pay the difference between the subsidy payment and their private charges.

Guidelines

You must submit an application to the ELRC to see if you meet the guidelines for the subsidized child care program.

The following are the basic guidelines:

- You must live in Pennsylvania

- Have a child or children who need child care while you work or attend an education program

- Meet income guidelines for your family size

- Work 20 or more hours a week - or-

- Work 10 hours and go to school or train for 10 hours a week

- Have a promise of a job that will start within 30 days of your application for subsidized child care

- Teen parents must attend an education program

- The child who needs care must be a citizen of the United States or an alien lawfully admitted for permanent residency

- Have proof of identification for each parent or caretaker in the home.

Income Guidelines

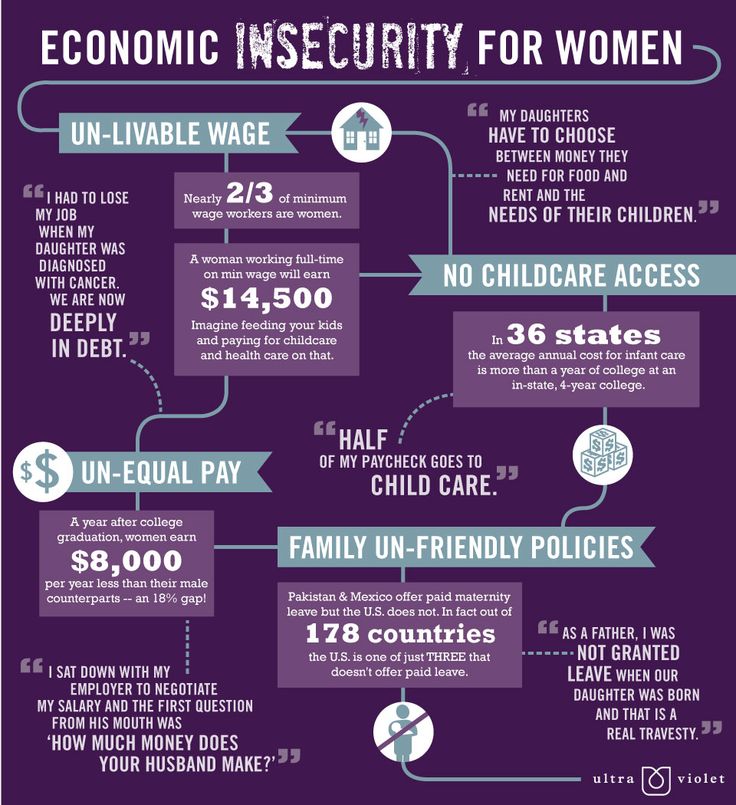

The annual income for a family to be eligible to receive a subsidy is 200 percent or less of the Federal Poverty Income Guidelines:

| Family Size | Maximum Yearly Family Income (May 2022) |

| 2 | $36,620 |

| 3 | $46,060 |

| 4 | $55,500 |

| 5 | $64,940 |

| 6 | $74,380 |

| 7 | $83,820 |

| 8 | $93,260 |

(Note: The above information provides only general guidelines. Other conditions may apply. Please contact your county Early Learning Resource Center to apply for assistance.)

Additional Guidelines

- Each adult family member must work at least 20 hours a week or work at least 10 hours a week and participate in an approved training program at least 10 hours a week.

- The hours that a child may receive subsidized child care must coincide with hours of work, education, or training.

- Children are eligible for care from birth until the day prior to the date of the child's 13th birthday. Children with disabilities may be eligible through age 18.

- The parent is responsible to help pay for child care. This is called a co-payment. The co-payment may be as little as $5.00 per week and varies according to your income and the number of people in your family.

- The parent may choose the provider of his or her choice. The parent may choose a child care center, a small family day care home, a group day care home or even a relative to care for his or her child.

- The parent who is receiving a subsidy must choose an eligible child care provider. Relative providers must complete an Agreement with the ELRC, must comply with the participation requirements listed in the Agreement and must complete CareCheck in order to be eligible to participate in the Subsidized Child Care Program.

CareCheck is the Department of Human Services' program that requires background clearances (see below).

CareCheck is the Department of Human Services' program that requires background clearances (see below). - If funding is not available at the time that a low-income, working parent applies for subsidized child care, the child may be placed on a waiting list.

You can also apply for benefits and renew benefits by using COMPASS, the online resource for cash assistance, Supplemental Nutrition Assistance Program (SNAP), child care, health care coverage, home heating assistance (LIHEAP), school meals, SelectPlan for Women and long-term living services.

Information on child care facilities

You may contact your local Early Learning Resource Center for resource and referral services. Your ELRC can assist you in finding a facility that meets your needs. You can also find a listing of regulated child care providers through the Online Child Care Provider Search. To request information regarding a facility's certification or registration history, current certification status, and verified complaint history you may contact the Regional Child Development Office or review a facility's history online.

Making a complaint/reporting a facility operating illegally without a department license

Contact the appropriate Department of Human Services' Regional Child Development Office. Each regional child day care office is assigned responsibility for certain counties in Pennsylvania. Regional office staff investigates complaints about child care centers, group child care homes, and family child care homes that do not follow the regulatory requirements for operating a facility. You may also register an Online Complaint.

Ensuring your child's Safety

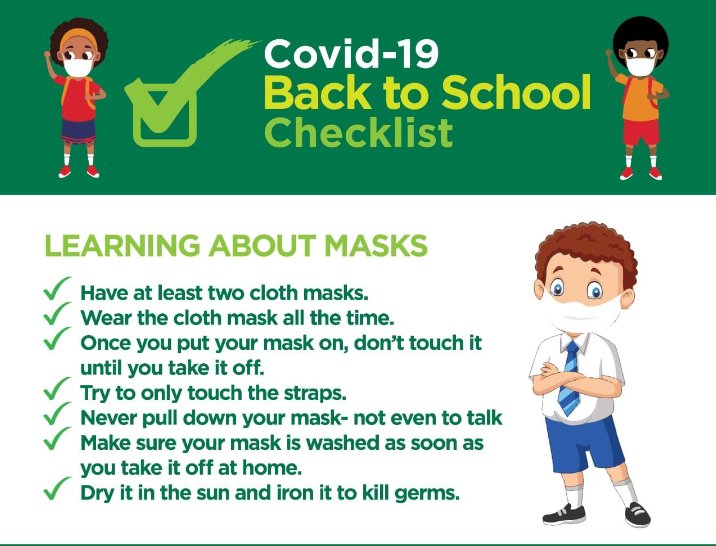

The most important way to be certain that your child is safe and well cared for is to become a partner with your child care provider. Here is a checklist that will provide you with ideas about what to look for at the provider location you choose.

For more information, call the Child Care Works helpline at (877) 472-5437 or find the appropriate ELRC for your county. Click to view the Subsidized Child Day Care Eligibility Regulations.

CareCheck: is the term for required child abuse and State Police background clearances for relatives who care for children whose parents participate in the subsidized child care program.

Relatives who care for three or fewer children, not including their own children, are not required to have a state license but can receive subsidized child care funding. Relatives who participate as providers for the subsidized child care are required to complete CareCheck. CareCheck is the Department of Human Services program that requires State Police criminal history and child abuse background clearances for all relative providers. In addition to CareCheck, relatives must obtain Federal criminal history clearances. The relative provider must pay the cost of the Federal criminal history clearance, which is $23.00. Relatives must complete CareCheck and Federal criminal history clearances in order to be eligible to be paid through the Subsidized Child Care Program. Relatives are defined as grandparents, great-grandparents, aunts, uncles, and siblings. All relative providers must be 18 years of age or older and live in a residence separate from the residence of the child for whom they will provide care.

Relatives are defined as grandparents, great-grandparents, aunts, uncles, and siblings. All relative providers must be 18 years of age or older and live in a residence separate from the residence of the child for whom they will provide care.

To find out more about background clearances, call the Child Care Works helpline at (877) 4-PA-KIDS (1-877-472-5437).

Article 17.2. Deadlines for assigning state benefits to citizens with children \ ConsultantPlus

The amounts of benefits established by this law have been changed due to indexation. See Help Information for indexed benefit amounts.

Article 17.2. Deadlines for assigning state benefits to citizens with children

(as amended by Federal Law No. 207-FZ of 05.12.2006)

(see the text in the previous edition)

Maternity allowance, one-time allowance for the birth of a child, monthly child care allowance, as well as a one-time allowance for the transfer of a child to be raised in a family, are assigned if the application was followed no later than six months, respectively, from the date of the end of the maternity leave, from the date of the birth of the child, from the day the child reaches the age of one and a half years , from the day the court decision on adoption comes into force, or from the day the guardianship and guardianship authority makes a decision to establish guardianship (guardianship), or from the date of the conclusion of an agreement on the transfer of a child for upbringing to a foster family, and a one-time allowance to the pregnant wife of a serviceman undergoing military service by conscription, and a monthly allowance for the child of a soldier undergoing about military service by conscription - no later than six months from the date of completion of military service by military conscription. nine0003

nine0003

(as amended by Federal Laws No. 233-FZ of October 25, 2007, No. 129-FZ of June 7, 2013, and No. 151-FZ of May 26, 2021)

(see the text in the previous version)

child care allowance is paid for the entire period during which the person caring for the child was entitled to the said allowance, in the amount provided for by the legislation of the Russian Federation for the relevant period.

The day of applying for a one-time allowance when a child is placed in a family is considered the day of acceptance (registration) by the body authorized to assign and pay a lump-sum allowance when a child is placed in a family, applications for the appointment of a lump-sum allowance when a child is placed in a family with all necessary documents. nine0003

(Part three was introduced by Federal Law No. 27-FZ of 07.03.2011)

indicated on the postmark of the federal postal organization at the place of sending this application.

(Part four was introduced by Federal Law No. 27-FZ of 07.03.2011)

27-FZ of 07.03.2011)

In the event that not all the necessary documents are attached to the said application, the body authorized to assign and pay a lump-sum allowance when a child is transferred to a family, gives to the person who applied for a one-time allowance when transferring a child to a family, a written explanation of which documents should be submitted additionally. If such documents are submitted no later than six months from the date of receipt of the relevant explanation, the day of applying for a one-time allowance when transferring a child to a family is considered the day of receipt (registration) of an application for the appointment of a lump-sum allowance when transferring a child to a family or the date indicated on the postmark of the federal postal organization at the place of sending this application. nine0003

(Part five was introduced by Federal Law No. 27-FZ of 07.03.2011)

Article 13. Procedure for the appointment and payment of insurance coverage \ ConsultantPlus

Article 13. Procedure for the appointment and payment of insurance coverage

Procedure for the appointment and payment of insurance coverage

(as amended by the Federal Law of 04/30/2021 N 126-FZ (as amended on 05/26/2021))

(see the text in the previous edition)

Federal law, when the payment of benefits for temporary disability is carried out at the expense of the insured), for pregnancy and childbirth, a lump sum allowance for the birth of a child, a monthly allowance for child care are carried out by the insurer. nine0003

agreement on the alienation of the exclusive right to works of science, literature, art, a publishing license agreement, a license agreement on granting the right to use a work of science, literature, art) at the time of the occurrence of the insured event was occupied by several policyholders and in the two previous calendar years was occupied by the same of insurers, benefits for temporary disability, for pregnancy and childbirth are assigned and paid to him by the insurer for each of the insurers with whom the insured person is employed at the time of the insured event, and the monthly allowance for child care for one of the insurers, for the cat The majority of the insured person is employed at the time of the occurrence of the insured event, at the choice of the insured person and is calculated based on the average earnings determined in accordance with Article 14 of this Federal Law for the time of work (service, other activities) with the insured for which the benefit is assigned and paid. nine0003

nine0003

(as amended by Federal Law No. 237-FZ of July 14, 2022)

(see the text in the previous edition)

are the performance of works and (or) the provision of services, an agreement of an author's order or an author of works receiving payments and other remuneration under an agreement on the alienation of the exclusive right to works of science, literature, art, a publishing license agreement, a license agreement on granting the right to use a work of science, literature, art) at the time of the occurrence of the insured event was employed by several insurers, and in the previous two calendar years was employed by other insurers (another insured), temporary disability benefits, pregnancy and childbirth benefits, monthly allowance for child care are assigned and paid to him insurer under one of Art. of the insured, with whom the insured person is employed at the time of the occurrence of the insured event, at the choice of the insured person. nine0003

(as amended by Federal Law No. 237-FZ of July 14, 2022)

237-FZ of July 14, 2022)

(see the text in the previous edition)

are the performance of works and (or) the provision of services, an agreement of an author's order or an author of works receiving payments and other remuneration under an agreement on the alienation of the exclusive right to works of science, literature, art, a publishing license agreement, a license agreement on granting the right to use a work of science, literature, art) at the time of the occurrence of the insured event was employed by several insurers, and in the two previous calendar years it was employed by both these and other insurers (another insured), benefits for temporary disability, for pregnancy and childbirth are assigned and paid to him by the insurer or in accordance with part 2 of this th article for each of the policyholders with whom the insured person is employed at the time of the insured event, based on the average earnings for the time of work (service, other activities) with the policyholder for which the benefit is assigned and paid, or in accordance with part 3 of this article for to one of the policyholders with whom the insured person is employed at the time of the occurrence of the insured event, at the choice of the insured person. nine0003

nine0003

(as amended by Federal Law No. 237-FZ of July 14, 2022)

(see the text in the previous edition)

4.1. If the insured person working under a civil law contract, the subject of which is the performance of works and (or) the provision of services, or under an author's order agreement, or who is the author of works, receiving payments and other remuneration under an agreement on the alienation of the exclusive right to works science, literature, art, publishing license agreement, license agreement on granting the right to use a work of science, literature, art, at the time of the insured event, employed under the specified agreements with several insurers, benefits for temporary disability, for pregnancy and childbirth, monthly allowance for care for the child are assigned and paid to him by the insurer for one of the insurers, with whom the insured person is employed under the specified contracts at the time of the insured event, at the choice of the insured person. nine0003

nine0003

(Part 4.1 was introduced by Federal Law No. 237-FZ of July 14, 2022)

4.2. If an insured person working under a civil law contract, the subject of which is the performance of work and (or) the provision of services, or under an author's order contract, or who is the author of works, receiving payments and other remuneration under an agreement on the alienation of the exclusive right to works of science, literature , art, publishing license agreement, license agreement on granting the right to use a work of science, literature, art, at the time of the occurrence of an insured event is employed by another insurant (other insurers) under an employment contract or other activities during which it is subject to compulsory social insurance in case temporary disability and in connection with motherhood, benefits for temporary disability, pregnancy and childbirth are assigned and paid to him by the insurer for the insured, for whom the insured person is employed under an employment contract or other activity during which it is subject to compulsory social insurance in case of temporary disability and in connection with motherhood, or for each such insurant in accordance with parts 2 and 4 of this article and for one of the insurers in accordance with part 4. 1 of this article, and a monthly allowance for child care is assigned and is paid to him by the insurer for one of the insurers, who employed the insured person at the time of the insured event, at the choice of the insured person. nine0003

1 of this article, and a monthly allowance for child care is assigned and is paid to him by the insurer for one of the insurers, who employed the insured person at the time of the insured event, at the choice of the insured person. nine0003

(Part 4.2 was introduced by Federal Law No. 237-FZ of July 14, 2022)

during which it was subject to compulsory social insurance in case of temporary disability and in connection with motherhood, the temporary disability benefit is assigned and paid by the insurer for the insured for whom such work or activity was carried out. nine0003

6. The basis for the appointment and payment of benefits for temporary disability, pregnancy and childbirth is a certificate of incapacity for work, formed by a medical organization and placed in the information system of the insurer in the form of an electronic document, signed using an enhanced qualified electronic signature by a medical worker and a medical organization, if otherwise not established by this Federal Law. The conditions and procedure for the formation of sick leave certificates in the form of an electronic document are established by the federal executive body responsible for the development and implementation of state policy and legal regulation in the field of health care, in agreement with the federal executive body responsible for developing state policy and regulatory legal regulation in the field of social insurance, and the Pension and Social Insurance Fund of the Russian Federation. The procedure for information interaction between the insurer, policyholders, medical organizations and federal state institutions of medical and social expertise for the exchange of information in order to form a sick leave certificate in the form of an electronic document is approved by the Government of the Russian Federation. nine0003

The conditions and procedure for the formation of sick leave certificates in the form of an electronic document are established by the federal executive body responsible for the development and implementation of state policy and legal regulation in the field of health care, in agreement with the federal executive body responsible for developing state policy and regulatory legal regulation in the field of social insurance, and the Pension and Social Insurance Fund of the Russian Federation. The procedure for information interaction between the insurer, policyholders, medical organizations and federal state institutions of medical and social expertise for the exchange of information in order to form a sick leave certificate in the form of an electronic document is approved by the Government of the Russian Federation. nine0003

(as amended by the Federal Law of July 14, 2022 N 237-FZ)

(see the text in the previous edition)

The form of the statement is approved by the insurer.

8. Insurers, no later than three working days from the date of receipt of data on a closed certificate of incapacity for work, formed in the form of an electronic document, transfer to the information system of the insurer, as part of the information for the formation of an electronic certificate of incapacity for work, the information necessary for the appointment and payment of benefits for temporary disability, for pregnancy and childbirth, signed using an enhanced qualified electronic signature, unless otherwise provided by this article. nine0003

(as amended by the Federal Law of February 25, 2022 N 18-FZ)

(see the text in the previous edition)

register of civil status records, and information requested by the insurer in accordance with Part 1 of Article 4.2 of this Federal Law.

granting parental leave until the child reaches the age of three years. The application form for the appointment of a monthly allowance for child care is approved by the insurer in agreement with the federal executive body responsible for developing state policy and legal regulation in the field of social insurance. The insured person, who at the time of the occurrence of the insured event is employed by several insurers, when submitting an application to one of the insurers for the appointment of a monthly child care allowance, confirms the choice of the insurant, according to which the insurer will assign and pay a monthly child care allowance. nine0003

The insured person, who at the time of the occurrence of the insured event is employed by several insurers, when submitting an application to one of the insurers for the appointment of a monthly child care allowance, confirms the choice of the insurant, according to which the insurer will assign and pay a monthly child care allowance. nine0003

11. Insurers submit the information necessary for the appointment of a monthly child care allowance to the territorial body of the insurer at the place of their registration no later than three working days from the date of submission by the insured person of an application for the appointment of a monthly allowance for child care, unless otherwise not established by this article.

(as amended by Federal Law No. 18-FZ of February 25, 2022)

(see the text in the previous edition)

11.1. Insurers applying the special tax regime "Automated Simplified Taxation System", no later than one working day from the date of submission by the insured person of an application for the appointment of a monthly allowance for child care, send to the insurer in electronic form, including through the personal account of the taxpayer, information about application submitted by the insured person. nine0003

nine0003

(Part 11.1 was introduced by Federal Law No. 18-FZ of February 25, 2022)

when he became aware of the occurrence of such circumstances, sends a notice to the territorial body of the insurer at the place of his registration on the termination of the right of the insured person to receive a monthly child care allowance. nine0003

13. Upon employment or during the period of employment, service, other activities, the insured person shall provide the policyholder at the place of work (service, other activity) with information about himself necessary for the policyholder and the insurer to pay insurance coverage (hereinafter referred to as information about the insured person), the list of which is contained in the form approved by the insurer. Information about the insured person is drawn up on paper or in the form of an electronic document. nine0003

14. The insured person is obliged to notify the policyholder in a timely manner of changes in the information specified in paragraph 13 of this article.

15. Information about the insured person received by the policyholder shall be transferred by him to the territorial body of the insurer at the place of his registration no later than three working days from the date of their receipt.

16. Assignment and payment of insurance coverage are carried out by the insurer on the basis of information and documents submitted by the insured, information available to the insurer, as well as information and documents requested by the insurer from state bodies, local governments or subordinate to state bodies or local governments organizations. nine0003

using a unified system of interdepartmental electronic interaction are established by the Government of the Russian Federation.

18. The procedure and conditions for the submission by the insured in electronic form of information and documents necessary for the assignment and payment of insurance coverage to insured persons are established by the insurer in agreement with the federal executive body responsible for developing state policy and legal regulation in the field of social insurance. The formats for the submission by the insured in electronic form of the specified information and documents are established by the insurer. nine0003

The formats for the submission by the insured in electronic form of the specified information and documents are established by the insurer. nine0003

19. In the event that the insurant ceases to operate or if it is impossible to establish its actual location on the day the insured person applies for benefits for temporary disability, pregnancy and childbirth, a one-time allowance for the birth of a child, a monthly allowance for child care, appointment and payment the specified types of insurance coverage (with the exception of temporary disability benefits paid at the expense of the insured in accordance with Clause 1 of Part 2 of Article 3 of this Federal Law) are carried out by the insurer on the basis of information and documents submitted by the insured person, information available to the insurer, and also information and documents requested by the insurer from state bodies, local governments or organizations subordinate to state bodies or local governments. nine0003

20. If the information and documents necessary for the appointment and payment of insurance coverage are not provided to the insurer in full, the insurer, within five working days from the date of their receipt, sends the policyholder or, in the case specified in paragraph 19 of this article, the insured person a notice on submission of missing information or documents in the form approved by the insurer. The policyholder or the insured person, upon receipt of the said notice, shall submit to the insurer the missing information and documents within five working days from the date of receipt of the notice. nine0003

The policyholder or the insured person, upon receipt of the said notice, shall submit to the insurer the missing information and documents within five working days from the date of receipt of the notice. nine0003

with motherhood in relation to the deceased on the day of his death or in relation to one of the parents (other legal representative) or other family member of the deceased minor on the day of death of this minor, and in the cases provided for by part 23 of this article, by the insurer. nine0003

22. If the insured person was employed by several policyholders at the time of the occurrence of the insured event, the social benefit for burial is assigned and paid by one of the policyholders at the choice of the person who applied for such benefit.

23. If it is not possible for the insured to pay social benefits for burial due to the termination of his activities or insufficient funds in his accounts with credit institutions, or if it is not possible to establish the location of the insured and his property, which may be levied , if there is a court decision that has entered into legal force establishing the fact that such an insurer did not pay benefits to a person entitled to receive it, or if, on the day of the application of a person entitled to receive social benefits for burial, the procedures applied to the insured are carried out in a bankruptcy case, the assignment and payment of social benefits for burial are carried out by the insurer. nine0003

nine0003

Funeral matters are carried out by the territorial body of the insurer at the place of registration of the insured in the manner determined by the insurer in agreement with the federal executive body responsible for developing state policy and legal regulation in the field of social insurance. nine0003

25. Payment of benefits for temporary disability, for pregnancy and childbirth, a one-time allowance for the birth of a child, a monthly allowance for child care is carried out by the insurer through the organization of the federal postal service, credit or other organization specified in the information about the insured person.

26. Payment for banking services for operations with funds provided for the payment of insurance coverage is not charged.

27. Information on the appointment and payment of insurance coverage is posted by the insurer in the Unified State Social Security Information System in accordance with the Federal Law of July 17, 1999 N 178-FZ "On State Social Assistance".

organization in the form of a document on paper. The specifics of the procedure for assigning and paying insurance coverage to the specified categories of insured persons are established by the federal executive body in charge of developing state policy and legal regulation in the field of social insurance, in agreement with the federal executive bodies in charge of developing and implementing state policy and legal regulation in the established field of activity, other federal state bodies and the Pension and Social Insurance Fund of the Russian Federation. nine0003

(as amended by Federal Law No. 237-FZ of July 14, 2022)

(see the text in the previous edition)

mode "Automated Simplified Taxation System", for their confirmation or clarification (addition) are sent by the insurer to the policyholder in electronic form, including through the personal account of the taxpayer. The policyholder, no later than three working days from the date of receipt of the specified information, confirms or clarifies (supplements) them and sends the clarified (supplemented) information to the insurer in electronic form, including through the taxpayer's personal account.