How do i file my child tax return

Filing 2021 Taxes | How You Receive Child Tax Credit Payments

Español Español

Filing a tax return is how you’ll get all of your 2021 Child Tax Credit

File taxes to get the rest of your Child Tax Credit or if you didn’t get the advance payments and are eligible, file to claim the full credit.

When you file your 2021 tax return, you will receive all of the 2021 Child Tax Credit that you are eligible for.

Use the Get Your Child Tax Credit tool to find out how to get assistance and file your taxes for free.

Any amount of monthly Child Tax Credit payments received last year will reduce the amount of remaining Child Tax Credit you are eligible for when filing your tax return this year.

If you did not receive monthly Child Tax Credit payments last year, it is not too late - when you file a tax return for 2021, you will receive the full amount of the Child Tax Credit that you are eligible to receive.

If you are not required to file tax returns, you can still get your Child Tax Credit.

Getting the Child Tax Credit if you haven’t filed tax returns

Even if you do not normally file tax returns, you are still eligible to claim any Child Tax Credit benefits you are eligible for. If you did not file a tax return for 2019 or 2020, you likely did not receive monthly Child Tax Credit payments in 2021. This was because the government did not know how many qualifying children you have and how much money to send you per child. But you are still able to receive the full amount of the 2021 Child Tax Credit. To get assistance filing for the Child Tax Credit, click here.

You can get more when you file

When filing your taxes, you will get the full amount of Child Tax Credit, even if you received less in monthly payments last year than you may have been eligible for.

You will be able claim the full amount of any remaining Child Tax Credit benefits you are eligible for against any 2021 tax liability you owe and receive any leftover amount as a refund payment.

Any amount of monthly Child Tax Credit payments received last year will reduce the amount of remaining Child Tax Credit benefit you are eligible for when tax filing.

Why you haven’t received the full amount of your Child Tax Credit

You need to file your 2021 tax return to get all of the Child Tax Credit for which you are eligible.

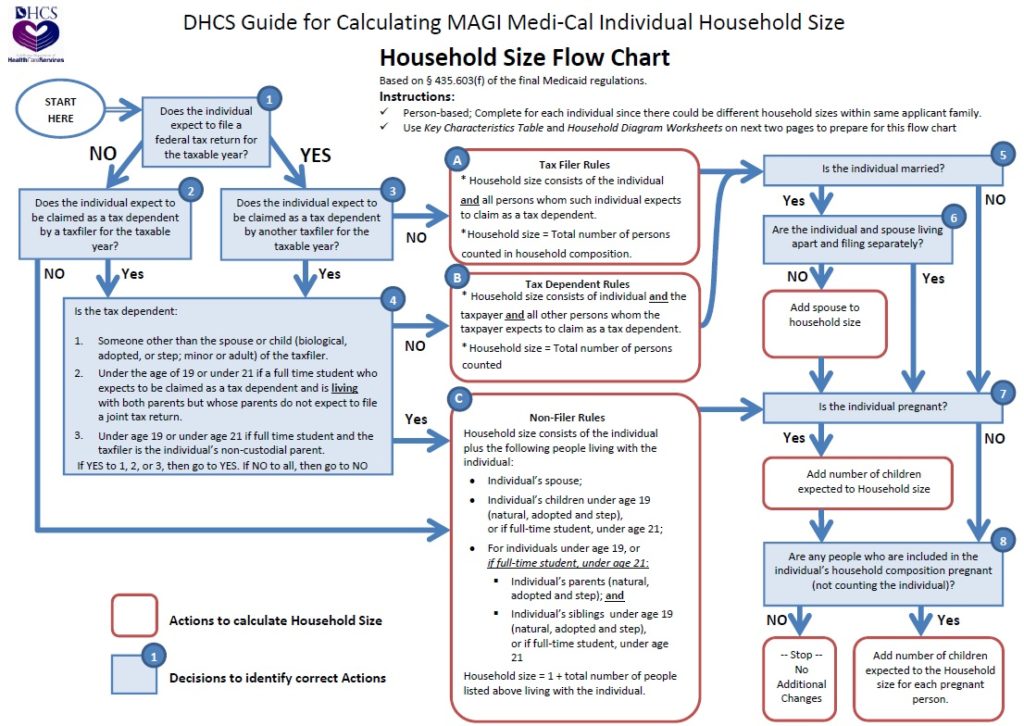

Filing a tax return is how you can tell the government about your family and the number of qualifying children you are claiming. The IRS used the information from your 2019 or 2020 tax return to estimate your eligibility for monthly Child Tax Credit payments in 2021 and send payments equal to half of the amount of Child Tax Credit that the IRS estimated you would be able to properly claim on your 2021 tax return.

Any remaining Child Tax Credit benefits will be paid when eligible parents and guardians file their tax returns for 2021 and claim the Child Tax Credit.

To get free assistance filing for the Child Tax Credit, go here.

If you had any life events such as an income change or the birth of a child during 2021, this may have an impact on the remaining amount of Child Tax Credit that you can properly claim.

Read more about how life events can impact your Child Tax Credit payment.

Determining your remaining credit

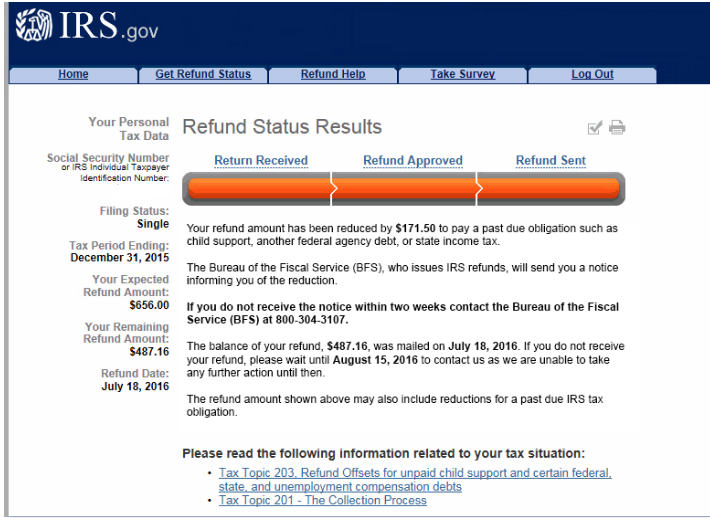

When filing your tax return, you will have to tell the IRS the value of the advanced monthly payments you received. The advanced payments will be deducted from the amount of remaining Child Tax Credit benefit you are eligible for when filing taxes.

In December 2021, the IRS started sending letters to families who received advance Child Tax Credit payments. The letter says “2021 Total Advance Child Tax Credit (AdvCTC) Payments” near the top and “Letter 6419” on the bottom righthand side of the page. This is what it looks like (PDF). The letters can help families determine how much Child Tax Credit payments they are still eligible to receive.

- For people who filed jointly with their spouse on their last tax return, each spouse will receive a separate letter from the IRS.

Each letter will list half of the total amount of advance payments the IRS sent from July through December 2021.

Each letter will list half of the total amount of advance payments the IRS sent from July through December 2021. - If you file jointly again this year, you should add the amounts of each letter and list the total amount on your joint tax return.

- Take, for example, a family that received a total of $1,800 in advance Child Tax Credit payments for their two-year-old child. If they filed jointly as a married couple in 2020, each spouse should have gotten Letter 6419 from the IRS saying they received $900 in advance Child Tax Credit payments.

- If that couple files jointly again this year, they should add the amounts ($900) from each of their letters and list $1,800 ($900 plus $900) in advance payments on their tax return.

- Alternatively, if they file separate returns this year, each spouse should list $900 on their tax return.

People who received advance CTC payments can also check the amount of their payments by using the CTC Update Portal as well as their IRS Online Account. For more information about Letter 6419 or if you have questions about the payment amount listed in your letter, visit our Help page.

For more information about Letter 6419 or if you have questions about the payment amount listed in your letter, visit our Help page.

Some families that qualify for the Child Tax Credit did not receive advanced payments for a variety of reasons, including:

- They didn’t file taxes in 2019 or 2020

- A new child joined their family in 2021

- They opted out of receiving advanced payments

- Another taxpayer claimed their children

Filing taxes will allow qualifying families to get the whole values of the credit they are eligible to receive.

Why non-filers should file a 2021 tax return

If you haven’t filed a tax return before or don’t file every year and are eligible for the Child Tax Credit, it’s not too late to file to receive the expanded CTC.

For those who received advance Child Tax Credit payments after using a simplified filing tool, you can file a 2021 tax return and potentially receive thousands of additional dollars in tax credits when you file. These additional credits include:

These additional credits include:

- Any remaining Child Tax Credit benefits

- The 2021 Recovery Rebate Credit

- The Earned Income Tax Credit

- The Child and Dependent Care Credit

If you are eligible for the Child Tax Credit but did not get any advance payments in 2021, you can still get a lump-sum payment by claiming the Child Tax Credit benefit when you file. Finally, if the qualifying children you listed in a Non-Filer Tool in 2020 or 2021 are the same qualifying children you had in 2021, you probably only received half of your benefit. You need to file a 2021 tax return to claim the remaining 2021 Child Tax Credit.

The Child Tax Credit does not affect your other Federal benefits

Having received monthly Child Tax Credit payments in 2021, and any refund you receive as a result of claiming the Child Tax Credit, is not considered income for any family. Therefore, it will not change the amount you receive in other Federal benefits. These Federal benefits include unemployment insurance, Medicaid, SNAP (formally food stamps), SSI, SSDI, TANF, WIC, Section 8, or Public Housing.

These Federal benefits include unemployment insurance, Medicaid, SNAP (formally food stamps), SSI, SSDI, TANF, WIC, Section 8, or Public Housing.

Free resources to help you file

If you are new to tax filing, or even if you’ve filed before but would like some help this year, there are places located across the country that can support you as you file your tax return. Many of these organizations offer both in-person and virtual support.

Get Free Filing Options

Additionally, many individuals file their tax returns with an accountant or tax preparer for a fee and you can search for an authorized IRS e-file Provider to find support near you. The above are all no-cost solutions.

Child Tax Credit | U.S. Department of the Treasury

The American Rescue Plan increased the Child Tax Credit and expanded its coverage to better assist families who care for children.

Overview

The American Rescue Plan’s expansion of the Child Tax Credit will reduced child poverty by (1) supplementing the earnings of families receiving the tax credit, and (2) making the credit available to a significant number of new families. Specifically, the Child Tax Credit was revised in the following ways for 2021:

Specifically, the Child Tax Credit was revised in the following ways for 2021:

- The credit amount was increased for 2021. The American Rescue Plan increased the amount of the Child Tax Credit from $2,000 to $3,600 for qualifying children under age 6, and $3,000 for other qualifying children under age 18.

- The credit was made fully refundable. By making the Child Tax Credit fully refundable, low- income households will be entitled to receive the full credit benefit, as significantly expanded and increased by the American Rescue Plan.

- The credit’s scope has been expanded. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. Previously, only children 16 and younger qualified.

- Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December. Families caring for children were able to receive financial assistance on a consistent monthly basis from July to December 2021, instead of waiting until tax filing season to receive all of their Child Tax Credit benefits.

File your taxes to get your full Child Tax Credit — now through April 18, 2022. Get help filing your taxes and find more information about the 2021 Child Tax Credit.

In addition, the American Rescue Plan extended the full Child Tax Credit permanently to Puerto Rico and the U.S. Territories. For the first time, low- income families residing in Puerto Rico and the U.S. Territories will receive this vital financial assistance to better support their children’s development and health and educational attainment.

Recent Updates

- New and Improved ChildTaxCredit.gov

- This website exists to help people:

- Get the Child Tax Credit

- Understand how the 2021 Child Tax Credit works

- Find out if they are eligible to receive the Child Tax Credit

- Understand that the credit does not affect their federal benefits

- This website provides information about the Child Tax Credit and the monthly advance payments made from July through December of 2021.

Every page includes a table of contents to help you find the information you need.

Every page includes a table of contents to help you find the information you need.

- This website exists to help people:

- Code for America’s Non-Filer Tool

- Code for America partnered with The White House and the Treasury Department to create a website and mobile-friendly tool, in English and Spanish, to assist families claiming their Child Tax Credit and missing Economic Impact Payments.

- The GetCTC tool is currently closed for the season, but you can access information about the Child Tax Credit on the website.

- Community organizations and volunteer navigators seeking to help hard-to-reach clients access the Child Tax Credit or Economic Impact Payments can access training materials and resources on the navigator website.

- IRS Non-Filer Tool

- Most families will automatically start receiving the new monthly Child Tax Credit payments on July 15th.

- Families who normally aren’t required to file an income tax return should use this Non-Filers Tool to register quickly for the expanded and newly-advanceable Child Tax Credit from the American Rescue Plan.

- Child Tax Credit Portal

- Use this tool to:

- Check if you’re enrolled to receive payments

- Unenroll to stop getting advance payments

- Provide or update your bank account information for monthly payments starting with the August payment

- Use this tool to:

- Child Tax Credit Eligibility Assistant

- Check if you may qualify for advance payments.

Spread the word

- Key Messaging about the Child Tax Credit

- Child Tax Credit Toolkit: Download all CTC Info Sheets and Social Media slides

- Info Sheet: How Has the CTC Changed This Year

- Info Sheet: How to Make Sure You Get the CTC Payment

- Info Sheet: The Expanded Child Tax Credit: Explained

- Social Media slides: How Has the CTC Changed This Year

- Social Media slides: How to Make Sure You Get the CTC Payment

- Find more information at ChildTaxCredit.

gov

gov

RESOURCES

- Child Tax Credit FAQs

- Child Tax Credit Press Release

- Economic Impact Payment Info

- Need to file a tax return? Find free options and information here

Is it necessary to file 3-personal income tax for a minor child \ Acts, samples, forms, contracts \ Consultant Plus

- Home

- Legal resources

- Collections

- Is it necessary to file 3-personal income tax for a minor child

A selection of the most important documents upon request Is it necessary to file 3-personal income tax for a minor child (legal acts, forms, articles, expert advice and much more).

Question: About personal income tax on the sale of real estate acquired with the use of maternity (family) capital, registered in the common ownership of parents and children with determination of the size of shares.

(Letter of the Federal Tax Service of Russia dated December 14, 2021 N BS-19-11 / 420@) Attention is drawn to the fact that parents (adoptive parents, guardians, trustees), as legal representatives of minor children who own real estate subject to taxation, fulfill the obligation to payment of personal income tax in respect of the income received from the sale of this property, in particular, from the sale of shares in an apartment owned by minor children, and on behalf of the children submit tax returns form 3-NDFL to the tax authority.

Register and get trial access to the ConsultantPlus system for free for 2 days

Open a document in your ConsultantPlus system:

Situation: What is the procedure for taxing income received by a minor child from the sale of a share in an apartment?

("Electronic journal "Azbuka Prava", 2022) As a general rule, the calculation and payment of personal income tax on income received from the sale of real estate is carried out by the taxpayer on the basis of the 3-personal income tax return submitted to the tax authorities at the place of residence no later than April 30 of the next year (clause 2, clause 1, clause 3, article 228, clause 1, article 229Tax Code of the Russian Federation).

Regulations : Is it necessary to file 3-personal income tax for a minor child

Order of the Federal Tax Service of Russia dated October 15, 2021 N ED-7-11 / 903@

"On approval of the tax return form for personal income tax (form 3 - personal income tax), the procedure for filling it out, as well as the format for submitting a tax return for personal income tax in electronic form "

(Registered with the Ministry of Justice of Russia on October 28, 2021 N 65631) The amount of the standard tax deduction for a single parent (adoptive parent), adoptive parent, guardian , a trustee, as well as one of the parents (adoptive parents) if the other parent (adoptive parent) refuses to receive a tax deduction for a disabled child under the age of 18, for a full-time student, graduate student, intern, intern, student under the age of 24 years old, disabled of I or II group

step-by-step instructions on how to return the money

Ekaterina Kondratyeva

received a tax deduction for treatment

I hate being treated in state clinics.

It's easier for me to pay than to stand in line to see a tired doctor grandmother. Therefore, for any disease, I go to a paid clinic.

In 2015, I spent 18,800 R on diagnostics, consultations and procedures. In 2016, I filed a tax deduction for treatment and returned 2500 R. I'll tell you how to do the same.

A treatment deduction is when you get back a portion of the income tax you paid. If you spent up to 120,000 R per year for treatment, the state is ready to exempt these expenses from personal income tax and return 13% from them - this is 15,600 R.

This limit is common for the costs of medical services, education, fitness, voluntary insurance, passing independent assessment of qualifications. If during the year there were different expenses from the limit, you can choose for yourself which of them to present for deduction. There is no limit for expensive treatment: 13% is returned from the entire amount spent.

What do you learn

- What is a tax deduction for treatment

- Who can receive a deduction

- How much money will be returned

- How to get a deduction for treatment

What is a tax deduction for treatment

Tax deduction - this the state returns you from the personal income tax you paid if you do something useful for the state. There are tax deductions for buying an apartment and tuition. Today we will talk about the deduction for paid medical services.

There are tax deductions for buying an apartment and tuition. Today we will talk about the deduction for paid medical services.

Under medical services, the tax code includes doctor's appointments, diagnostics, medical examination, testing, hospitalization, day hospital treatment, dentistry, prosthetics. The list includes everything that a sick person usually encounters. It also mentions palliative care at home and IVF with the help of donation and surrogacy.

Government Decree No. 458 of April 8, 2020

Operations, including plastic ones, are classified as expensive treatment. They get another deduction for them, but more on that next time.

So what? 02/13/20

How to get a deduction for drugs without a prescription for tax

You can also get a deduction for voluntary health insurance if you paid for the policy yourself. If it was paid by the employer, then the deduction will not be given.

You can also get a deduction for prescription drugs.

The amount of the deduction depends on the cost of treatment: the more you spend, the more you get back. But the maximum cost of treatment, which is taken into account when calculating the deduction, is 120,000 R. This is the general limit for almost all social deductions, in particular for treatment and education costs. Even if you paid a million at the hospital, you will receive a deduction as if you paid 120 thousand.

Who can receive the deduction

If you receive a salary or have income from which you pay personal income tax, you can receive a deduction. Non-working pensioners, students and women on maternity leave do not have such income, they do not pay personal income tax, so they do not specifically claim this deduction.

There may also be problems with the deduction if:

- you have issued an IP and do not work according to the BASIC, but, for example, pay tax when simplified. If you, as an individual entrepreneur, work according to the main taxation system, then you pay personal income tax to the budget, which means you can get a deduction;

- you are self-employed and do not work under an employment contract.

At the same time, you do not have income that is subject to personal income tax;

At the same time, you do not have income that is subject to personal income tax; - An unofficial employer does not deduct personal income tax for you, and you have no other taxable income.

What to do? 03/18/19

How can an individual entrepreneur on the simplified tax system receive a deduction for an apartment and treatment?

If a person does not work, but, for example, rents an apartment and pays personal income tax, then he can also count on a deduction.

You will also receive a refund if you paid for the treatment of your parents, spouse, children under 18 years of age. To do this, you need a document confirming kinship: a marriage certificate, a birth certificate. You will not be given a deduction for paying for the treatment of your mother-in-law or father-in-law.

For whom the contract for treatment and payment documents are drawn up - it does not matter, the main thing is that the certificate of the clinic must be issued for the one who will receive the deduction.

/3-ndfl/

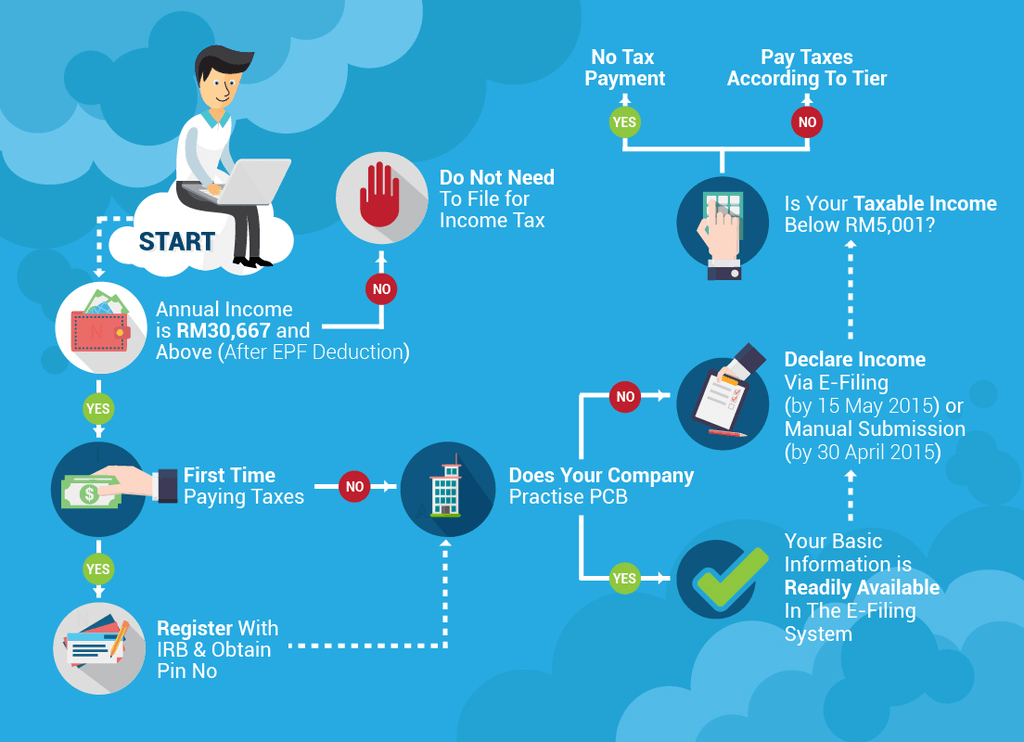

How to pay personal income tax on your own

For example, an elderly father was hospitalized and his daughter wants to make a deduction for his treatment. The contract can be drawn up either for the father or for the daughter, and it is better to ask the clinic in advance how to draw up payment documents. The clinic will issue a certificate for the deduction - check there whether they will give the daughter a certificate if the payment documents are issued to the father. It is best if both the contract and the payment papers contain the data of the person who plans to draw up the deduction. In our example, daughters.

The tax deduction for treatment will be denied in any of these cases:

- you are not a tax resident of the Russian Federation;

- you claimed the deduction for something other than yourself or a close relative;

- The certificate of payment for treatment was not issued to you or your spouse.

How much money will be returned

The amount of the deduction depends on your salary and the cost of treatment. In any case, the tax office will not return more money than the personal income tax paid for the year. Calculate the amount of your deduction on the calculator.

How to get a deduction for treatment

To receive money, first collect evidence that you have been treated and paid: contracts, receipts and certificates from the clinic. A mandatory document is only a certificate, because it simultaneously confirms both the treatment and payment for it. But to get it, contracts and checks can come in handy. Then choose the method of receipt: through the employer or tax.

Letter of the Federal Tax Service dated March 25, 2022 No. BS-4-11/3605

Through the employer deduction can be received already in the current year and without filing a declaration. We made a separate analysis about this method.

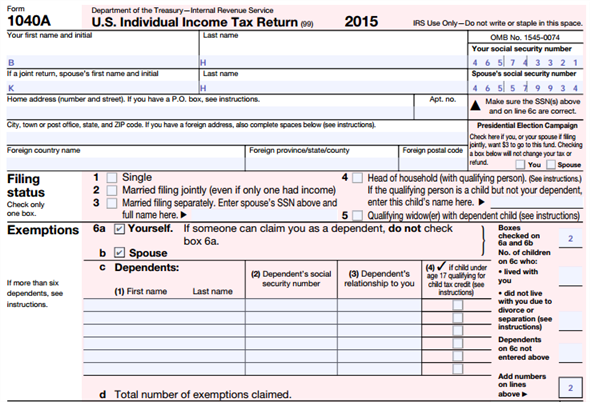

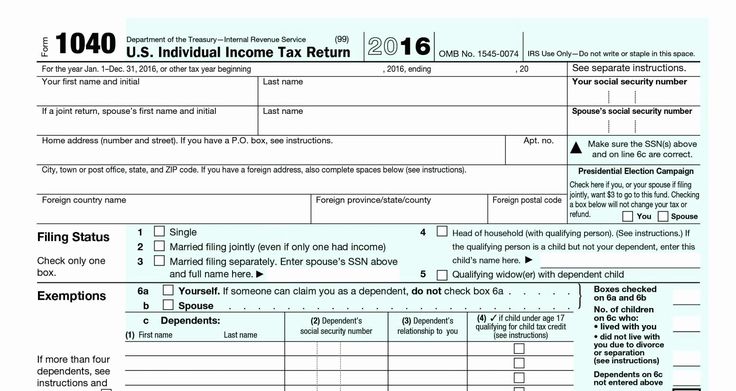

Through the tax deduction can be received in the next year after paying for medical services, but no later than three years later. You will need to fill out a 3-NDFL declaration on the tax website and send it along with scanned documents for verification.

You will need to fill out a 3-NDFL declaration on the tax website and send it along with scanned documents for verification.

In the process of filling out or after the declaration is approved, you must write an application for a refund. In the first case, they must come within four months. In the second, according to the law, one month after filing the application, the tax office must transfer money to your account.

/vychet-shmychet/

Tax deduction for a new apartment

You can do everything gradually. I was in no hurry and prepared the documents for about three months.

Step 1

Collect receipts and contracts for treatment You will be given a contract and a receipt at the cash desk or clinic reception. Save these documents: they confirm the fact that the clinic has paid for the treatment, so that it can then issue you a certificate. Attach the check to the agreement with a paper clip or stapler. Then you are tormented to look for which contract for which check.

Then you are tormented to look for which contract for which check.

Step 2

Get a certificate from the clinicGo to the registry or accounting department and ask for a tax certificate. Present your passport, TIN, agreement with the clinic, all receipts.

Before signing an agreement with a clinic, we recommend asking if it has a license and if the clinic will provide a certificate for the deduction. It is too late to check the license after paying for the treatment. You can check the license on the Roszdravnadzor website. It is enough to enter the TIN of the clinic.

Passport, agreement with the clinic and TIN - take these documents with you when you go to get a tax certificate Some clinics do not require checks. They take information about the services provided from their database. But not everyone does this. I lost several checks, and the girl at the reception did not include them in the amount of the certificate.

If you are making a deduction for the treatment of relatives, bring your marriage certificate or birth certificate along with the documents and ask for a certificate in your name.

In the clinic that I visited, a certificate is made in a maximum of 5-7 days. I came at a deserted time, so I got a certificate in half an hour.

Help for tax. Pay attention to the service code: it should be 1 or 2If you doubt that the certificate is issued correctly, check whether it complies with the instructions of the Ministry of Health. Usually this problem does not occur. If the clinic has a license, it must issue a properly executed certificate.

Instructions: how to fill out a certificate of payment for medical services for tax

Along with the certificate, you may be given a copy of your medical license. If the clinic does not have a license or its validity period has expired, the tax office will not return anything to you. A copy of the license remains with you, it does not need to be sent to the tax office.

Step 3

Prepare documents for the declarationScan a certificate from the clinic to send it to the tax office remotely. If you receive a deduction for the treatment of parents, spouse, children under 18, then scan your marriage or birth certificate. You can also scan and send the contract.

I recommend scanning documents to a multi-page PDF file. First the certificate, then the contract. The file must be less than 2 MB in size, otherwise you will not be able to upload it to the tax website.

The tax website accepts .txt, .doc, .docx,

.pdf, .gif, .bmp, .jpg, .jpeg, .png,

.tif, .tiff, .zip, .7z, . rar, .arj, .xls, .xlsx

Agreement, license and checks are not required for deduction

Tax inspectorates sometimes require agreements and a license, although they should not do this, and even more so to refuse due to lack of documents.

The tax code does not require contracts and licenses. The tax authority is able to check the data on the license itself by the name of the clinic: all this is in the registers. Tax checks for medical services are not needed at all, because without a certificate they will not be suitable for deduction. And in the certificate, all information about payments is already there.

Get a certificate of income and tax amounts of an individual in the accounting department at work or download it in your personal account on the tax website, if it appeared there. To find out, go to the "Income" tab. Information about last year's income usually appears in the taxpayer's personal account before April of the next year, but after June it will be accurate.

Data from the income statement will be needed to fill out the declaration. It doesn't need to be scanned.

In my personal account on January 17, 2022, the income statement for 2021 has not yet been uploaded - there are only statements for 2020 and earlier years. They can be downloaded

They can be downloaded Step 4

Submit documents to the tax officeDocuments can be submitted in four ways:

- In person at the nearest tax office.

- By mail with a valuable letter with a description of the attachment.

- On the site nalog.ru.

- On the public services portal. To do this, open the service page or enter "tax declaration" in the search on the site. The completed declaration will need to be signed with an enhanced qualified electronic signature - UKEP, which can be obtained free of charge at one of the accredited centers.

The first two methods did not suit me: I did not want to stand in lines. I don’t have a UKEP, so I can’t send a declaration through the public services website. Since you can get a signature on the website of the Federal Tax Service without leaving home, I spent the evening and submitted documents on the website of the Federal Tax Service.

/guide/e-signature/

How to get an electronic signature

How to apply for a deduction on the tax website

The general logic is as follows: get an unqualified electronic signature, indicate income and upload proof of medical expenses. So that you do not get confused, we have prepared instructions.

So that you do not get confused, we have prepared instructions.

Get an electronic signature. This is a simplified ES - it can only sign documents on the tax website. Go to the taxpayer's personal account, then to the profile and select the "Get ES" tab. You will be asked to enter a password to access the electronic signature certificate, the main thing is to remember it. Submit a request. Wait for the tax office to generate an electronic signature. If you have done EP before, skip this step.

This electronic signature will only be valid on the tax websiteFile a declaration through a simplified form, if you have a deduction for treatment only. To do this, from the taxpayer's personal account, select the section "Income and deductions" → "Declarations" → "Get a deduction" → "For treatment and purchase of medicines".

/guide/vychet-za-zuby/

How to get a deduction for dental treatment

Income and personal income tax withheld will be pulled up from the tax agent’s reporting - all that remains is to indicate the deduction and fill out an application for a tax refund. We described in more detail how to use the simplified form for filling out the declaration in the article on the deduction for dental treatment.

We described in more detail how to use the simplified form for filling out the declaration in the article on the deduction for dental treatment.

Find the tax return page on the tax website if you are going to receive a deduction for more than just medical treatment. Go to the "Life situations" section → select "Submit a 3-NDFL declaration"

Select the year for which you are filing a declaration.

You are a resident of the Russian Federation if you have stayed on its territory for at least six months Add source of income: indicate the employer, code and amount of income. Here you will need proof of income. The first paragraph of the certificate contains information about the employer (TIN, KPP and OKTMO). If the employer has already submitted annual reports, income data can be downloaded from the data that he submitted to the tax office. To do this, tick the employer and click the "Fill from the certificate" button. If your employer has not yet submitted reports, you will have to fill out the section manually based on your income statement.

Select the deduction you want to receive. The medical treatment deduction is in the "Social tax deductions" group. Enter the amount you spent in the "Amount of expenses for treatment, excluding expensive" window.

Please note: the cost of treatment, the cost of medicines and the cost of expensive treatment are different things. We are only talking about the treatment deductionForm an application for a deduction. This step is called "Dispose of the overpayment". You can skip it and apply later, but we will do it right away.

You will see the amount of the overpayment - this is the deduction. Click on the "Order" button and enter account details Add scanned certificates and contracts. After that, you need to enter the password for the ES and send the declaration to the tax office.

Step 5

Apply for a refundThis is an additional step for those who missed it when they filed their return. Some time after sending the 3-NDFL declaration, information about the amount of overpayment for taxes will appear in the "My taxes" section of your personal account. In the same line there will be a special button - "Dispose".

We dispose: you need to enter the details of the account to which you want to receive money, and click the "Confirm" button Check the data and re-enter the password for your electronic signature certificate. After that, the documents will fly to the tax officeSee details in your personal account on the bank's website. In Tinkoff Bank, go to your personal account on the "About" tab:

The tax authorities consider the application within a month - plus the three that go to check the declaration.