Tax benefit a

Tax Benefit: Definition, Types, IRS Rules

What Is a Tax Benefit?

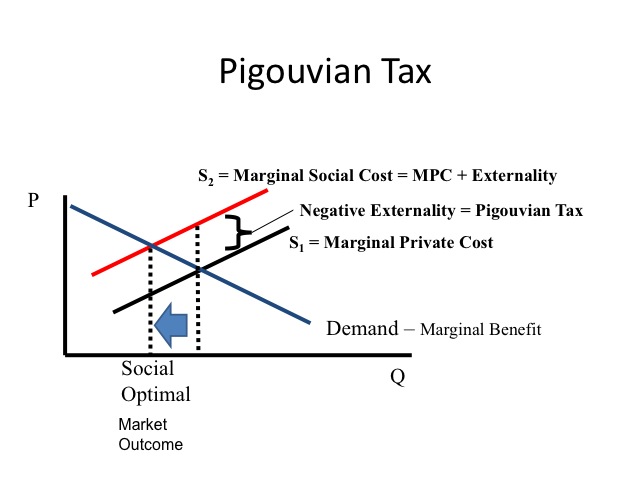

The term tax benefit refers to any tax law that helps you reduce your tax liability. Benefits range from deductions and tax credits to exclusions and exemptions. They cover various areas, including programs for families, education, employees, and natural disasters.

Some tax benefits are related to the ability to pay taxes. For example, the child tax credit and the earned income tax credit (EITC) recognize the cost of raising a family. Other tax benefits, including mortgage interest and charitable donation deductions, are incentives designed to further social policy goals.

Key Takeaways

- Tax benefits create savings for individual and business taxpayers.

- Common tax benefits include deductions, credits, exclusions, and shelters.

- You can take standard or itemized deductions plus any available above-the-line deductions.

- To qualify for tax benefits, you must meet specific requirements, such as income limits, filing status, and dependent status.

- Be sure to stay abreast of any tax benefits you may be eligible for so you don't miss out on tax savings.

Understanding Tax Benefits

Tax benefits help individuals and corporations reduce their overall tax bills. These benefits are a significant part of the tax regulations and legislation set by local, state, and federal governments.

Tax benefits like deductions, credits, exemptions, and exclusions reduce the amount you owe annually to federal and state governments. On the other hand, tax shelters help lower taxes through particular investments. These are legal vehicles that provide favorable tax treatment. Common examples of tax shelters include municipal bonds and employer-sponsored 401(k) plans.

You must be eligible for tax benefits to claim them. For instance, to qualify for head of household status, you must be unmarried, have a qualifying dependent who lives with you, and pay more than half of the household expenses for the year. And tax benefits for educational expenses can only be claimed by those who spend money on tuition and other related costs during the tax year.

It makes financial sense to learn about any tax benefits you might be eligible for. Without the proper knowledge, you could end up paying more in taxes than you owe. It can be helpful to consult a tax professional, such as an accountant, to maximize your tax savings.

Types of Tax Benefits

As noted above, tax benefits come in all shapes and sizes. We've highlighted some of the more common ones below.

Tax Deductions

A tax deduction reduces your taxable income. When you file your annual income tax return, you have the option to take the standard deduction or itemize your deductions:

- Standard Deduction: The standard deduction is a fixed dollar amount that reduces taxable income. For 2022, the standard deduction is $12,950 for single filers and married taxpayers filing separately, $19,400 for heads of household, and $25,900 for married couples filing jointly and surviving spouses. For 2023, these figures increase to $13,850, $20,800, and $27,700, respectively.

- Itemized Deductions: Itemized deductions are qualified expenses allowed by the Internal Revenue Service (IRS) to decrease your taxable income by listing them on Schedule A of your tax return. The sum of your itemized deductions reduces your adjusted gross income (AGI). There is no limit on itemized deductions for tax years between 2018 to 2023 due to the Tax Cuts and Jobs Act.

Itemizing your deductions makes sense if the sum of your qualified expenses is greater than your standard deduction. For example, if a single taxpayer's itemized expenses total $13,000, they would likely itemize rather than take the $12,550 standard deduction. However, if the same filer's qualified expenses total just $8,000, they would save money by taking the standard deduction.

Even if you don't itemize, you can take certain above-the-line deductions with the standard deduction. These include student loan interest, traditional individual retirement account (IRA) contributions, contributions to health savings accounts, and more. All these deductions lower taxes by reducing taxable income and possibly lowering your tax bracket.

All these deductions lower taxes by reducing taxable income and possibly lowering your tax bracket.

Say, for example, a single filer has $42,000 of taxable income for the 2022 tax year, landing them in the 22% marginal tax bracket. Therefore, they pay 22% on any income over $40,525 (the beginning of the 22% tax bracket). However, if they qualify for $2,000 in above-the-line tax deductions, they will be taxed on $42,000 - $2,000 = $40,000, giving them a marginal tax rate of 12%.

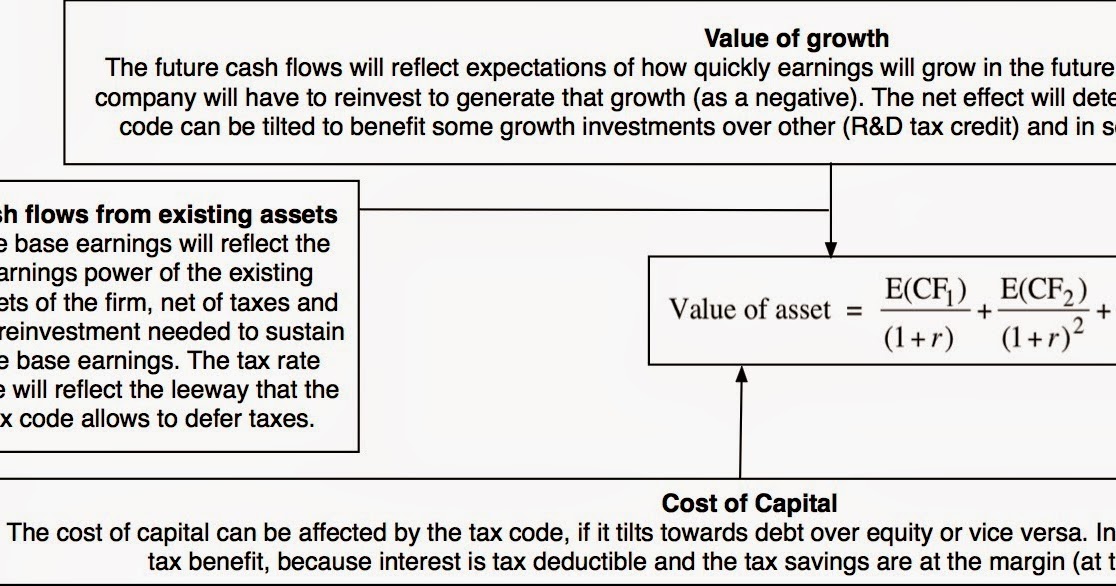

Tax deductions often reduce the total amount of income earned for businesses. Most companies use a standard income statement to calculate their taxable obligations, with taxation falling on the last line.

Tax Credits

Tax credits also save you money, but they work differently than deductions. A tax credit is applied to the amount of tax you owe after all tax calculations are made. For example, if you owe $3,000 after taking deductions and calculating taxes with your marginal tax rate, a $1,000 credit would reduce your tax bill to $2,000.

There are many types of tax credits available for individuals and businesses. For individuals, some of the most common tax credits include the child tax credit, the EITC, and the premium tax credit.

Tax credits are either refundable or non-refundable. A refundable tax credit results in a refund check if the tax credit exceeds your tax bill. For example, say you apply a $3,400 tax credit to your $3,000 tax bill. Your bill would be reduced to zero, and you would receive the remaining portion of the credit as a refund. In this case, it would be $400.

A non-refundable tax credit does not result in a refund because it only reduces the tax owed to zero. Using the example above, if the $3,400 tax credit were non-refundable, you would owe nothing to the government but would forfeit the $400 that remains after the credit is applied. Some examples of non-refundable tax credits include the saver’s credit, adoption credit, child care credit, and mortgage interest tax credits.

Tax credits do not impact your taxable income or marginal tax bracket. They are subtracted from your tax bill to directly reduce the amount of tax you owe.

Exemptions and Exclusions

The Tax Cuts and Jobs Act (TCJA) suspended the personal tax exemption for 2018 through 2025, but some tax exclusions still apply. Tax exclusions usually arise in pretax payments that help you lower your taxable bottom line. Income excluded for tax purposes usually does not show up on your tax return at all.

One of the most common exclusions is the employer-based health insurance payment program. If an employer takes healthcare payments on a pretax basis, an employee’s taxable income is lowered at the end of the pay period, which reduces the amount of tax owed.

The annual gift tax exclusion is $16,000 for 2022 and increases to $17,000 for 2023. You can gift up to that amount tax-free to as many people as you wish without using up any of your lifetime gift and estate tax exemption.

Tax Shelters

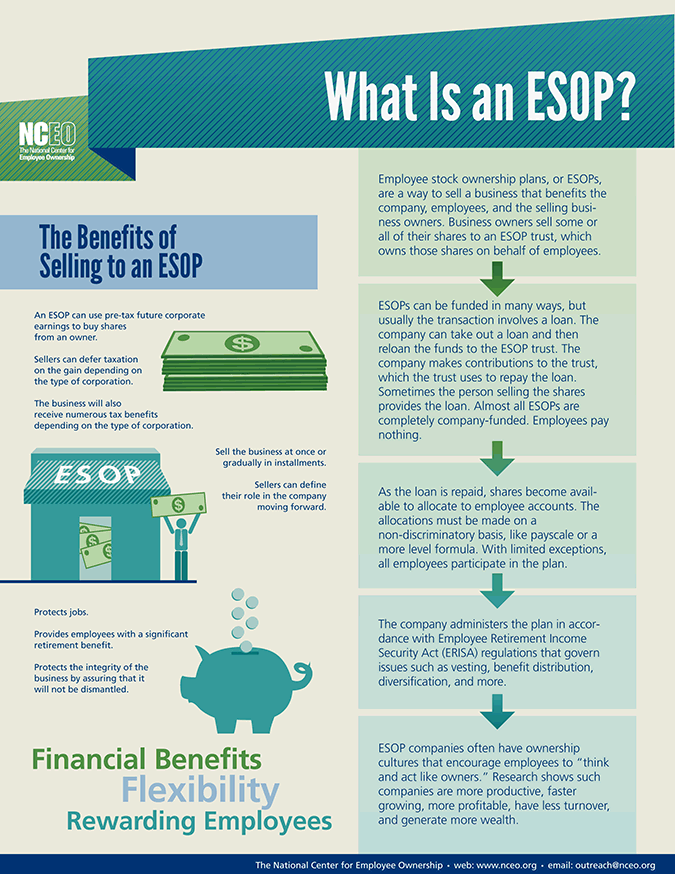

A tax shelter provides a variety of tax advantages. It is generally a vehicle with lower or no tax requirements if you abide by the contracted terms. One of the most popular tax shelters is the 401(k). That's because investors are sheltered from paying a higher tax rate during their higher-earning years than they are likely to pay in retirement when their income (and tax rate) is lower.

Tax havens can also be a type of tax shelter. These are often used by businesses. Companies may incorporate in certain regions to lower their business tax bill. Some of the most popular tax havens include Bermuda, the Bahamas, and the Cayman Islands.

Not all tax shelters are legal and legitimate. The IRS treats illegal tax shelters as fraudulent activities. Taxpayers who use illegal tax schemes may face penalties, criminal prosecution, and prison time.

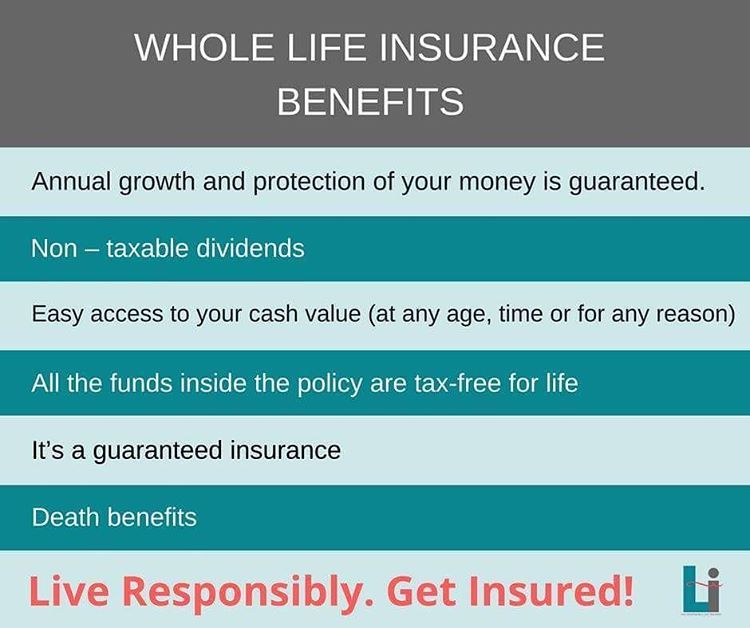

Certain investment products may offer a tax shelter or tax exemption in and of themselves. Municipal bonds, for example, are exempt from federal and state taxes if aligned with the state in which the bondholder lives. Other tax-advantaged investments include tax-free savings accounts, municipal mutual funds or exchange-traded funds (ETFs), and some life insurance policies.

Other tax-advantaged investments include tax-free savings accounts, municipal mutual funds or exchange-traded funds (ETFs), and some life insurance policies.

What Is the Difference Between a Tax Credit and a Tax Deduction?

Tax credits and tax deductions both reduce the amount of tax you owe, but they work in different ways. Tax credits directly lower the amount of tax you owe, while tax deductions decrease your taxable income.

Say you're eligible for a $1,000 tax credit and a $1,000 tax deduction. The tax credit reduces your tax bill by that same $1,000. So, if you owed $1,500 in taxes and then took a $1,000 credit, your tax bill would be $500 ($1,500 - $1,000). On the other hand, the tax deduction reduces your taxable income by $1,000. So, if you fall into the 22% tax bracket, the $1,000 deduction would save you $220 ($1,000 × 22%). Tax credits are more favorable because they save you more money than tax deductions.

What Is the Estate Tax Exemption for 2022?

The estate tax is the amount below which a decedent's estate is not subject to taxes. For 2022, the exemption is $12.06 million. For 2023, it increases to $12.920 million.

For 2022, the exemption is $12.06 million. For 2023, it increases to $12.920 million.

How Much Is the Earned Income Tax Credit for 2022?

The earned income tax credit is a refundable tax credit for low- and moderate-income households. If you're eligible for the EITC, the amount you receive depends on your filing status, income, and the number of dependents you can claim. For 2022, the maximum earned income tax credit is $560 if you have no dependents, $3,733 for one dependent, $6,164 for two dependents, and $6,935 for three or more dependents. These amounts increase to $600, $3,995, $6,604, and $7,430, respectively, for 2023.

The Bottom Line

It's important to know where you stand with respect to your tax bill even if it isn't tax season. Keeping on top of the tax benefits that apply to you can spell the difference between a refund and a huge tax bill—or at least breaking even when it comes time to file. These benefits range from tax credits and deductions to exclusions and exemptions. Be sure to speak to a tax professional if you're unsure about how they may work for you.

Be sure to speak to a tax professional if you're unsure about how they may work for you.

20 Popular Tax Deductions and Tax Credits for 2023

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

A deduction cuts the income you're taxed on, which can mean a lower bill. A credit cuts your tax bill directly.

A credit cuts your tax bill directly.

By

Tina Orem

Tina Orem

Assistant Assigning Editor | Taxes, small business, retirement and estate planning

Tina Orem is an editor at NerdWallet. Prior to becoming an editor, she covered small business and taxes at NerdWallet. She has been a financial writer and editor for over 15 years, and she has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Previously, she was a financial analyst and director of finance for several public and private companies. Tina's work has appeared in a variety of local and national media outlets.

Learn More

and

Sabrina Parys

Sabrina Parys

Content Management Specialist | Taxes, investing

Sabrina Parys is a content management specialist on the taxes and investing team. Her previous experience includes five years as a project manager, copy editor and associate editor in academic and educational publishing. She has written several nonfiction young adult books on topics such as mental health and social justice. She is based in Brooklyn, New York.

Her previous experience includes five years as a project manager, copy editor and associate editor in academic and educational publishing. She has written several nonfiction young adult books on topics such as mental health and social justice. She is based in Brooklyn, New York.

Learn More

Updated

Reviewed by Lei Han

Lei Han

Professor of accounting

Lei Han, Ph.D., is an associate professor of accounting at Niagara University in Western New York and a New York state-licensed CPA. She obtained her Ph.D. in accounting with a minor in finance from the University of Texas at Arlington. Her teaching expertise is advanced accounting and governmental and nonprofit accounting. She is a member of the American Accounting Association and New York State Society of Certified Public Accountants.

Learn More

At NerdWallet, our content goes through a rigorous

editorial review process. We have such confidence in our accurate and useful content that we let outside experts inspect our work.

We have such confidence in our accurate and useful content that we let outside experts inspect our work.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Tax deductions — also known as tax write-offs — and tax credits for 2023 can be huge money-savers if you know what they are, how they work and how to pursue them.

Tax benefits are generally broken into two major categories: tax deductions and tax credits. As you examine programs that could potentially apply to you, its a good idea to know the differences in how tax savings can work.

In short, a credit gives you a dollar-for-dollar reduction in the amount of tax you owe. A tax write-off provides a smaller benefit by allowing you to deduct a certain amount from your taxable income. Another consideration with tax deductions is that they won't do you much good unless you itemize your deductions, which only makes sense for people with a considerable amount of deductible expenses.

Another consideration with tax deductions is that they won't do you much good unless you itemize your deductions, which only makes sense for people with a considerable amount of deductible expenses.

Tax Planning Made Easy

Take the stress out of tax season. Find the smartest way to do your taxes with Harness Tax.

Visit Harness Tax

There are hundreds of 2023 itemized deductions and credits out there. Here's a list of the 20 popular ones and links to our other content that will help you learn more.

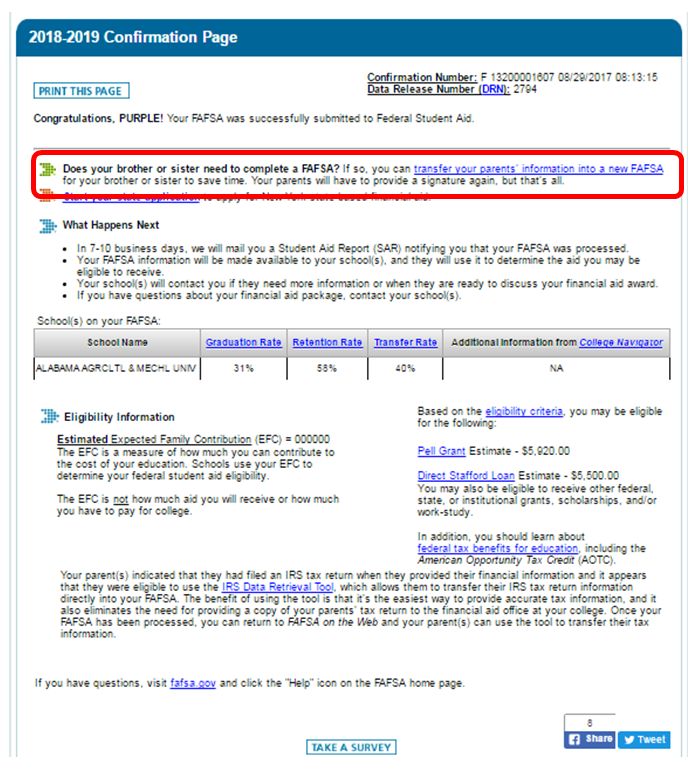

1. Child tax credit

The child tax credit, or CTC, could get you up to $2,000 per child, with $1,500 of the credit being potentially refundable.

2. Child and dependent care credit

The child and dependent care credit, or CDCC, is meant to cover a percentage of day care and similar costs for a child under 13, a spouse or parent unable to care for themselves, or another dependent so you can work. Generally, it's up to 35% of $3,000 of expenses for one dependent or $6,000 for two or more dependents.

Generally, it's up to 35% of $3,000 of expenses for one dependent or $6,000 for two or more dependents.

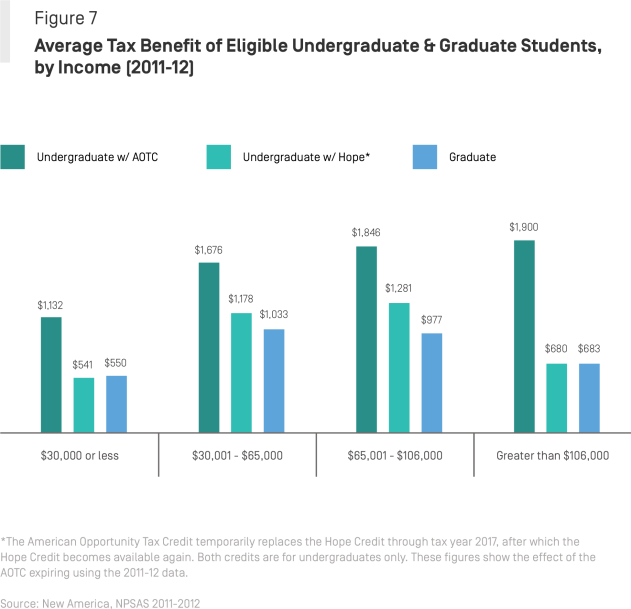

3. American opportunity tax credit

The American opportunity tax credit, sometimes shortened to AOC, lets you claim all of the first $2,000 you spent on tuition, books, equipment and school fees — but not living expenses or transportation — plus 25% of the next $2,000, for a total of $2,500.

4. Lifetime learning credit

The lifetime learning credit lets you claim 20% of the first $10,000 you paid toward tuition and fees, for a maximum of $2,000. Like the American opportunity tax credit, the lifetime learning credit doesn’t count living expenses or transportation as eligible expenses. You can claim books or supplies needed for coursework.

5. Student loan interest deduction

The student loan interest deduction lets borrowers write off up to $2,500 from their taxable income if they paid interest on their student loans.

6. Adoption credit

This item covers up to $14,890 in adoption costs per child. The credit begins to incrementally decrease at certain income levels and completely phases once if your 2022 modified adjusted gross income exceeds $263,410.

7. Earned income tax credit

This earned income tax credit, or EITC, can get you between $560 and $6,935 depending on how many kids you have, your marital status and how much you make. It’s something to explore if your AGI is less than about $59,000.

8. Charitable donations deduction

If you itemize, you may be able to write-off the value of your charitable gifts — whether they’re in cash or property, such as clothes or a car — from your taxable income. Per the IRS, you can generally deduct up to 60% of your adjusted gross income.

9. Medical expenses deduction

In general, you can write off qualified, unreimbursed medical expenses that are more than 7. 5% of your adjusted gross income for the tax year.

5% of your adjusted gross income for the tax year.

11. Mortgage interest deduction

The mortgage interest tax deduction is touted as a way to make homeownership more affordable. It cuts the federal income tax that qualifying homeowners pay by reducing their taxable income by the amount of mortgage interest they pay.

12. Gambling loss deduction

Gambling losses and expenses are deductible only to the extent of gambling winnings. So, spending $100 on lottery tickets isn’t deductible — unless you win, and report, at least $100, too. You can’t write off more than the amount you win.

13. IRA contributions deduction

You may be able to deduct contributions to a traditional IRA, though how much you can deduct depends on whether you or your spouse is covered by a retirement plan at work and how much you make.

14. 401(k) contributions deduction

The IRS doesn’t tax what you divert directly from your paycheck into a 401(k). In 2022, the contribution limit was $20,500 ($27,000 if you were 50 or older). These retirement accounts are usually sponsored by employers, although self-employed people can open their own 401(k)s.

In 2022, the contribution limit was $20,500 ($27,000 if you were 50 or older). These retirement accounts are usually sponsored by employers, although self-employed people can open their own 401(k)s.

15. Saver’s credit

The saver's credit runs 10% to 50% of up to $2,000 ($4,000 if filing jointly) in contributions to an IRA, 401(k), 403(b) or certain other retirement plans. The percentage depends on your filing status and income. (How it works.)

16. Health savings account contributions deduction

Contributions to HSAs are tax-deductible, and the withdrawals are tax-free, too, as long as you use them for qualified medical expenses.

17. Self-employment expenses deduction

There are many valuable tax write-offs for freelancers, contractors and other self-employed people. (How it works.)

18. Home office deduction

If you use part of your home regularly and exclusively for business-related activity, the IRS lets you write off certain self-employment deductions for associated rent, utilities, real estate taxes, repairs, maintenance and other related expenses.

19. Educator expenses deduction

If you’re a school teacher or other eligible educator, you can deduct up to $300 spent on classroom supplies in 2022.

20. Residential energy credit

The residential energy credit can get you up to 30% of the installation cost of solar energy systems, including solar water heaters and solar panels.

Bonus: Electric vehicle tax credit

The nonrefundable EV tax credit ranges from $2,500 to $7500 for tax year 2022 and eligibility depends on the vehicle’s weight, the manufacturer, and whether you own the car. For tax year 2023 (taxes filed in 2024), the credit is greatly expanded and also includes used vehicles.

Frequently asked questions

What are tax deductions?

A tax deduction lowers your taxable income and thus reduces your tax liability. You subtract the amount of the tax deduction from your income, making your taxable income lower. The lower your taxable income, the lower your tax bill.

The lower your taxable income, the lower your tax bill.

The IRS allows taxpayers to lower their taxable income by choosing either the standard deduction or itemized deductions. Before that, you can also make certain adjustments to your gross income by taking above-the-line deductions in order to arrive at what's called your adjusted gross income.

Above-the-line deductions

Contributions to a retirement account, health savings account contributions or student loan interest payments are referred to as "above-the-line" deductions, but it may be easier to think of them as "adjustments" to your income. These deductions are subtracted from your gross income to determine your adjusted gross income, or AGI. If you qualify, you can take them regardless of whether you itemize or take the standard deduction. Your AGI is important because it is the starting point for calculating your tax bill and also the basis on which you might qualify for many deductions and credits.

Below-the-line deductions

Below-the-line deductions, on the other hand, are qualified expenses that are subtracted from your adjusted gross income to help determine your taxable income. The IRS lets you take either the standard deduction or itemize. There are dozens of itemized deductions available to taxpayers and all of them have different rules. Examples of itemized deductions include deductions for unreimbursed medical expenses, charitable donations, and mortgage interest. Whether you choose to itemize or take the standard deduction depends largely on which route will save you more money.

The IRS lets you take either the standard deduction or itemize. There are dozens of itemized deductions available to taxpayers and all of them have different rules. Examples of itemized deductions include deductions for unreimbursed medical expenses, charitable donations, and mortgage interest. Whether you choose to itemize or take the standard deduction depends largely on which route will save you more money.

What are tax write-offs?

The IRS doesn't use the term "tax write-offs" anywhere in the Internal Revenue Code, but the phrase has gained popularity as a synonym for "tax deduction" over the years. If you hear someone talking about a tax write-off, they're probably referring to certain qualified expenses — or deductions — that itemizers can take to lower their taxable income. (Note that you'll generally only wind up using itemized deductions if you don't use the standard deduction discussed below.)

What is a tax credit?

A tax credit is a dollar-for-dollar reduction in your actual tax bill. A few credits are refundable, which means if you owe $250 in taxes but qualify for a $1,000 credit, you’ll get a check for the difference of $750. Most tax credits, however, aren’t refundable.

A few credits are refundable, which means if you owe $250 in taxes but qualify for a $1,000 credit, you’ll get a check for the difference of $750. Most tax credits, however, aren’t refundable.

A tax credit can make a much bigger dent in your tax bill than a tax deduction.

How do you claim tax deductions?

Generally, there are two ways to claim tax deductions: Take the standard deduction or itemize deductions. You can’t do both.

The standard deduction basically is a flat-dollar, no-questions-asked reduction in your adjusted gross income (AGI). The amount you qualify for depends on your filing status. You can learn more about standard deduction amounts here. People over age 65 or who are blind get a bigger standard deduction.

Itemized deductions let you cut your taxable income by taking any of the hundreds of available tax deductions you qualify for. The more you can deduct, the less you’ll pay in taxes.

The standard deduction has gone up significantly in recent years, so you might find that it's the better option for you now even if you've itemized in the past. Your tax software or tax advisor can run your return both ways to see which method produces a lower tax bill.

Your tax software or tax advisor can run your return both ways to see which method produces a lower tax bill.

About the authors: Tina Orem is an editor at NerdWallet. Before becoming an editor, she was NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

Sabrina Parys is a content management specialist at NerdWallet. Read more

POPULAR ON NERDWALLET

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

Unjustified tax benefit

Lost profit article 15 of the Civil Code of the Russian Federation

Lost profit is one loss in civil law. Peculiarities of recovery, proof and methods of calculation in arbitration practice are considered

Read article

Unilateral termination of the contract

Commentary on the draft resolution of the plenum of the Supreme Arbitration Court of the Russian Federation on the consequences of termination of the contract

Read article

Recovery of damages from the director

Commentary on the decision of the plenum of the Supreme Arbitration Court of the Russian Federation on compensation for losses by persons who are members of the bodies of a legal entity.

Read article

Legal protection of business and assets. Organization of protection

On ways to protect business and assets, rights and interests of owners (beneficiaries) and management. Possible options for the structure of the business and companies involved in the business

Read the article

Business fragmentation: dealing with other people's mistakes

Business fragmentation is one of the private problems and a constant topic in judicial practice. Tax evasion has attracted and continues to attract the attention of the tax authorities. What mistakes are made by taxpayers and can they be corrected? Read material on site

Read article

Liability of the former director and founder

Bringing former directors, founders, participants of limited liability companies (LLC) to liability. Conditions, arbitration practice for bringing to responsibility, recovery of damages

Read the article

How the ASK VAT-2 program works and ways to bypass it

ASK VAT-2 is an object of close attention. There is a desire to find out how it works, whether there are ways to bypass it, or options to minimize the consequences of its use. Therefore, we analyzed some points related to it

There is a desire to find out how it works, whether there are ways to bypass it, or options to minimize the consequences of its use. Therefore, we analyzed some points related to it

Read article

Collecting debts from controlling persons without going bankrupt

Tearing off the corporate veil is an option to bring controlling persons to justice. No bankruptcy proceedings. Suitable for thinking and well-considered creditors in a debt collection situation

Read article

Two members in a limited liability company

A limited liability company with two members: difficulties in making decisions and conducting business activities of a company in a corporate conflict, exclusion of a member, liquidation society. Equal and unequal distribution of shares.

Read the article

Business structuring as a working business tool

Business structuring is one of the necessary tools for businesses and their beneficiaries in order to create conditions for tax security when doing business. More details on the website of the law firm Vetrov and Partners.

More details on the website of the law firm Vetrov and Partners.

Read article

Unjustified tax benefit | Time for an accountant

During the year following the conclusions of the Supreme Court of the Russian Federation, district arbitration courts considered 1,286 cases on issues of unjustified tax benefits (decisions for the period from October 12, 2006 to October 10, 2007 were taken into account).

As a result, 73.8 percent of decisions were made in favor of companies. However, at present, the statistics of litigation in cases of tax evasion is not in favor of business. It has become more difficult for companies and individual entrepreneurs to defend the reality of a transaction, its business purpose, and to confirm the validity of the choice of a counterparty.

During an audit, tax inspectors most often pay attention to the reality of the transaction, the business purpose, the choice of counterparty, and the fragmentation of the business. To avoid problems, it is necessary to carry out preliminary work on each of these points.

To avoid problems, it is necessary to carry out preliminary work on each of these points.

How to confirm the reality of the transaction.

Inspectors often check the reality of the transaction. In particular, inspectors pay attention to who actually fulfilled the obligations under the contract. The impossibility of execution of the transaction by the party specified in the agreement may be evidenced by the following facts:

• lack of settlements with the counterparty under the transaction;

• the counterparty does not have the resources to execute the transaction — personnel, tangible assets, mandatory permits, licenses, vehicles, warehouses;

• officials of the counterparty refused to sign invoices and primary documents;

• operations on the settlement account of the counterparty do not correspond to the activity within which the transaction was concluded;

• the counterparty did not file tax returns and did not pay taxes for the relevant period.

If the tax authorities prove that the transaction is unrealistic, they will refuse to deduct VAT and expenses in full. To confirm the reality of the transaction, it is necessary to prove that the counterparty could execute it and that it actually took place.

Collect and store properly all contracts, source documents and invoices for transactions. A set of documents on the transaction will confirm its actual execution. If inconsistencies and errors are found in the documents, ask the counterparty to eliminate them.

Mistakes and wrong signatures in the documents do not prove the unreality of the transaction. But in combination with other circumstances, they will indicate that the company is working with a one-day company (clause 7 of the letter of the Federal Tax Service of the Russian Federation dated March 10, 2021 No. BV-4-7 / 3060).

In addition to the contract, invoices and "primary", additional evidence that the deal was executed by the one specified in the contract, or companies attracted by the counterparty, can serve as:

• invoices, powers of attorney, protocols of negotiations;

• photo and video reports, presentations, business correspondence by e-mail;

• testimonies of witnesses, court decisions on disputes with a counterparty;

• documents of carriers, letters from buyers, certificates of product conformity;

• licenses, costing of works and services, work schedules.

For example, photo and video filming can confirm the fact and moment of shipment of goods from the supplier's warehouse. Personnel documents will help prove that the counterparty has a storekeeper on staff who checked the quality of the goods and controlled its shipment.

How to confirm the business purpose of the transaction.

In order to confirm the business purpose of the transaction, it is necessary to assess its profitability from an economic point of view, that is, in such a way if the transaction was carried out only for business reasons without tax advantages (paragraph “d”, paragraph 2, paragraph 25 of the letter of the Federal Tax Service of the Russian Federation March 10, 2021 No. BV-4-7/3060).

To justify a business goal, you can fix it in documents, for example, in a marketing policy, a discount order, memos, economic calculations confirming the feasibility of a transaction.

The purchase of goods at inflated prices can be justified by the fact that the cost of the goods includes delivery and assembly. When selling products at a discount, explain the benefits of providing them. For example, that they are received only by large, new or regular customers, so the income from the sale of one unit is reduced, but the supply volumes are growing.

When selling products at a discount, explain the benefits of providing them. For example, that they are received only by large, new or regular customers, so the income from the sale of one unit is reduced, but the supply volumes are growing.

In addition, it is necessary to monitor the marketability of prices in transactions with related parties, even if they do not relate to controlled transactions (clause 8 of the letter of the Federal Tax Service of the Russian Federation dated 11.04.2018 No. SA-4-7/6940, clause 9 of the letter of the Federal Tax Service of the Russian Federation dated 09.07.2018 No. SA-4-7/13130).

How to check the counterparty and confirm commercial (due) diligence.

For a qualitative check of the counterparty, it is necessary to collect and analyze information about him. The procedure for obtaining documents from the counterparty confirming commercial prudence, write in the regulation on contractual work or fix it in the contract. Responsible for such a check appoint an order for the company.

Responsible for such a check appoint an order for the company.

During the inspection, it is necessary to take into account the points that inspectors evaluate during the inspection:

• information about the actual location of the counterparty, its production and storage facilities;

• information about the financial position of the counterparty, including the use of the services of the Federal Tax Service;

• other publicly available information about the counterparty.

The tax authorities will not have grounds for refusing VAT deductions and expenses if the company confirms commercial prudence and does not know that the counterparty is a one-day company, and the transaction was executed by another person (clause 2 of the letter of the Federal Tax Service of the Russian Federation dated 10.03.2021 No. BV-4-7/3060).

Inspectors will refuse VAT deductions and expenses in full only if they prove that the taxpayer knew about the unreliability and violations of the counterparty and benefited from this (clauses 20, 21 of the letter of the Federal Tax Service of the Russian Federation dated 10. 03.2021 No. BV-4-7 /3060).

03.2021 No. BV-4-7 /3060).

To justify your choice, ask counterparties for constituent documents, powers of attorney, licenses and other documents that are not available in open sources. Also check the partner through the services of the Federal Tax Service. An extract from the Unified State Register of Legal Entities, information about inactive organizations, disqualified directors and mass addresses is public information.

Analyze the counterparty and document the following data:

• the actual location of the counterparty, its production, storage, retail or other areas;

• the counterparty has production facilities, qualified personnel, property, licenses, permits, certificates of membership in SROs;

• contact details of the head of the counterparty, its responsible employees or other persons who are authorized to conduct transactions;

• availability of advertising of the counterparty in the media, website, recommendations of partners or other persons.

Document the results of the verification as a counterparty verification report.

How to explain the fact of business splitting.

To justify the business purpose of splitting, one must evaluate it from the point of view of tax inspectors. Some of the signs of splitting for tax savings are listed in paragraph 27 of the letter of the Federal Tax Service of the Russian Federation of March 10, 2021 No. BV-4-7 / 3060.

For example, tax officials see artificial splitting, if counterparties are controlled by the taxpayer, do not operate in their own interests and at their own risk, do not perform real functions. They only draw up documents on their own behalf in the interests of the taxpayer.

If inspectors prove artificial splitting for the purpose of tax savings, they must calculate the actual size of the tax liability of the company being inspected, as if it did not commit violations.

If you have created a group of companies, clearly articulate the business goal of splitting, fix it on paper. In particular, such goals may be opening a new direction for business development, introducing a new member to the founders, changing the type of activity, reducing operational risks, simplifying management or increasing its efficiency.

In particular, such goals may be opening a new direction for business development, introducing a new member to the founders, changing the type of activity, reducing operational risks, simplifying management or increasing its efficiency.

Evaluate the tax risks of the group of companies, including those applying special tax regimes, according to the circumstances listed in the letter of the Federal Tax Service of the Russian Federation dated 11.08.2017 No. SA-4-7 / 15895. For example, such circumstances include:

• the conduct of entrepreneurial activities by the taxpayer independently, at his own peril and risk, the availability of his own labor, material, production resources;

• implementation of inextricably linked activities that make up a single production process aimed at obtaining a common result;

• direct or indirect interdependence of the participants in the business splitting scheme. For example, family relations, participation in governing bodies, official accountability;

• availability of a unified profit management center;

• expenses incurred by scheme participants for each other.