How much does welfare give per child

Welfare Examples

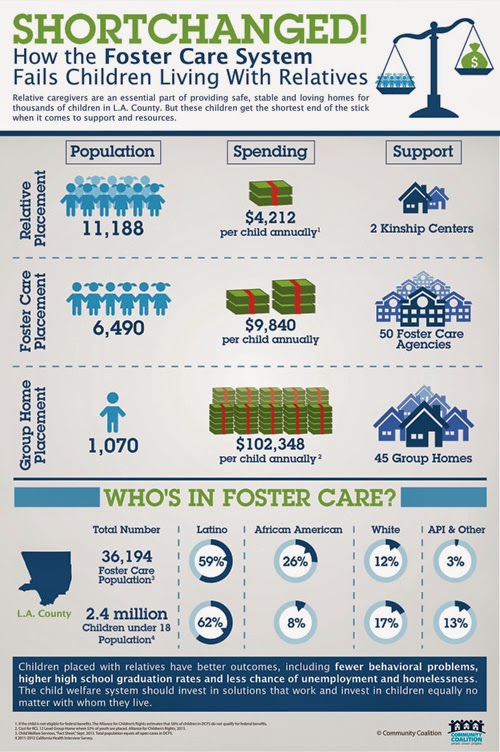

Shown below are welfare examples of three families. Each of the families represents a married couple with two children. The only difference in the families is their outside income from wages. One family makes zero wages yearly, one makes $15,000 a year, and one makes $35,000 a year. The poverty threshold for a family of four in 2021 is $26,496. Therefore, Families 1 and 2 are “in poverty.” This page shows what each family would get in benefits from the top three welfare programs, EITC, SNAP, and Housing Assistance.

Conclusions from the Welfare Examples

Three conclusions stem from the welfare examples:

- The poorest families don’t always get the most benefits. As shown below, the family making $15,000 per year gets slightly higher benefits than the family with no income. Therefore, the focus of the welfare system is unsatisfactory.

- The welfare system can boost moderate-income families well above the poverty threshold. As shown below, it raised the family making $15,000 to an income level including benefits of over $35,000 annually.

- The welfare system discourages work for families and individuals with modest income levels. The loss in benefits can override the gain from additional wages. See the comparison of the family making $15,000 versus the family making $35,000 below. See also the work penalty on the Welfare Issues Page.

The data

The following table presents the welfare payments the three families would receive from the three most extensive welfare programs – EITC, SNAP, and Housing Assistance.

The Analysis

Family 1, with zero income from wages, would receive benefits from SNAP, EITC, and Housing Assistance totaling $22,020. Family 2, with $15,000 in income from wages, would receive benefits of $22,648, slightly higher than Family 1 due to the impact of EITC. Income plus benefits for Family 2 totals $37,648, well above the poverty threshold of $26,496. Family 1 is still $4,476 below the poverty threshold even after welfare benefits, while Family 2 comes out to $11,152 above the poverty threshold.

Family 3 has an income of $35,000 which is $20,000 higher than family 2. But they lose $16,460 in benefits because they don’t qualify for Housing Assistance, and SNAP and EITC are much lower. They come to $41,188 in income plus benefits, but this is only $3,540 higher than family 2, even though they make $20,000 more in wages. Analyzed another way, if a spouse in Family 2 can go to work and earn $20,000 a year, they would only come out $3,540 ahead, or the equivalent of $1.70 an hour [iv]. After payroll tax, the gain is even less. The family could also lose other benefits such as Child Nutrition, Head Start, LIHEAP, Lifeline, and state-level welfare. The dramatic loss in benefits is a disincentive to work.

Work Penalty

The welfare examples above show the poor economics resulting from low-income families obtaining additional wages. Their benefits drop significantly as income rises modestly. These “benefit cliffs” can be very dramatic. It is simply not worth it for an individual to go to work full-time for a marginal increase in income. Therefore, the welfare system does not “make work pay.”

Therefore, the welfare system does not “make work pay.”

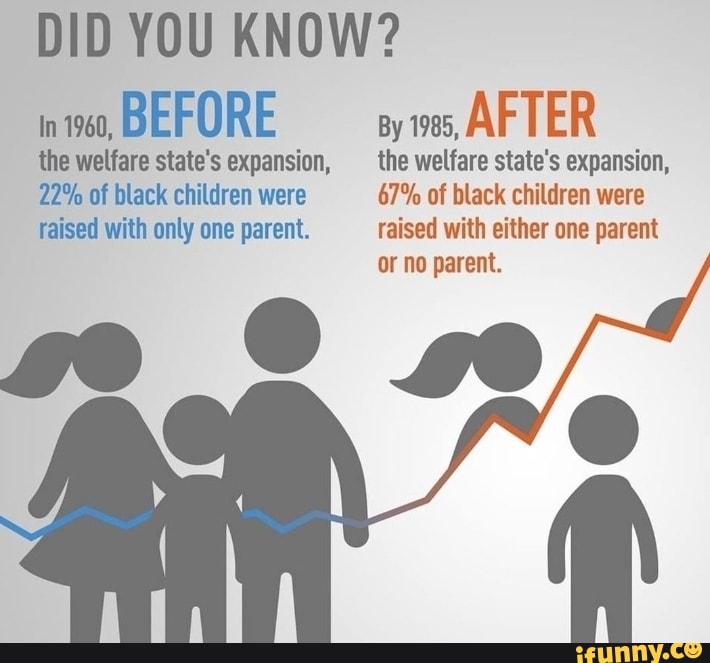

Marriage Penalty

The welfare examples above demonstrate why our welfare system discourages marriage. If a single parent marries an individual with a job and it takes the couple to a level of income above the poverty threshold, they will lose most of the welfare benefits. By remaining single, they can come out ahead economically. Many critics argue that this contributes to the high incidence of unmarried mothers on welfare.

Footnotes

[i] Calculated using the State of Illinois SNAP screening tool [Internet]. Data retrieved May 5, 2022. Data for a family living in Illinois, wages as stated above, a married couple with two dependent children, $1,000 in monthly rent, and no assets and no other sources of income or expense. Available here.

[ii] Calculated using the IRS EITC Assistant for the tax year 2021 [Internet]. Data retrieved May 5, 2022. Data for a married couple filing a joint return with two dependent children, wages as stated above, and no other items of income, expenses, or assets. Available here.

Available here.

[iii] Assumed Families 1 and 2 qualified for Rent Voucher, and Family 3 did not. The Voucher equaled a rental expense of $1,000 per month, less 30% of the family’s income from wages. The rent expense of $1,000 per month approximates the average HUD rent expense for a family of four in the U.S. (see Housing Assistance Program).

[iv] Assumes the spouse worked a standard work year of 2,080 hours to earn $20,000 in wages for the year.

CalWORKs Fact Sheet | EHSD

Program

California Work Opportunity and Responsibility to Kids (CalWORKs)

Purpose

The purpose of the CalWORKs program is to:

- Promote and encourage work to enable families to become self-sufficient

- Provide financial aid for children who lack financial support and care

- Protect and preserve the family unit

- Provide the opportunity for rehabilitation of the family whenever possible

- Make available to children who cannot live in their own homes the kind of care and treatment best suited to their needs

Eligibility Factors

Basic eligibility factors for a child(ren) and a needy parent(s) or caretaker relative include:

Deprivation – The aided child must be deprived of parental support or care because at least one parent is:

- deceased; or

- either physically or mentally incapacitated; or

- the applicant parent is not working or working less than 100 hours per month; or

- continually absent from the home.

Age – Children may be eligible for CalWORKs until their 18th birthday or are 18 years old and in high school or trade school full time and are expected to complete either program before their 19th birthday.

Property – The property of a child and the parent(s) must be under the following limits:

- Families without elderly members may have $10,888 combined personal and real property per family.

- Families with elderly members (those who are 60 years of age or older) may have $16,333 combined personal and real property per family. Furniture, clothing, and appliances are exempt.

- The family home is exempt provided the family lives in the home. The value of one automobile up to $25,483 is exempt.

Residence – There are no durational residency requirements for the CalWORKs program. Families who make their residence in California and who intend to continue to live in California may be eligible. Family members must be legal residents of the United States.

Family members must be legal residents of the United States.

Applying for Aid

The application for CalWORKs includes completion of eligibility forms and an interview with a case-manager. Aid cannot begin until all conditions of eligibility have been verified. These conditions include, but are not limited to:

- Applying for a Social Security number.

- Verifying citizenship, or showing proof of legal immigration status.

- Verifying income and property.

- Applying for potentially available income such as Unemployment Insurance Benefits.

- Cooperating with the District Attorney and securing child support from the absent parent.

To speed the application process, please bring the following items when making application:

- Identification such as Driver’s License or Identification Card for each parent or caretaker in the home

- Social Security cards for every family member for whom aid is requested

- Birth certificates for every family member in the home

- Immunization records for every child under the age of six years for whom aid is requested

- Registrations for each car owned, co-owned or being bought or leased

- Ownership papers for land and/or buildings owned, co-owned or being bought

- Receipts or bills of sale for any recreational vehicles such as boats, trailers, motor homes, etc.

- Proof of the value of mutual funds, stocks, bonds, trust funds or cash surrender value of life insurance policies

- Proof of citizenship or immigrant status such as a birth certificate or document from the United States Citizenship and Immigration Services (USCIS) showing legal resident status.

- Proof of earned and unearned income such as pay stubs and award letters for unemployment benefits, Social Security income, Veteran’s payments, and school grants or loans

Immediate need payments may be made for families with emergency situations while the CalWORKs application is being processed, if eligible. The maximum immediate need payment is $200.

Income Limits for Applicants

CalWORKs regulations provide for a gross income limit which is determined by subtracting $450 from the earned income of each employed person, then adding all remaining earned and unearned income to determine the gross income for family. That amount is then compared to the Minimum Basic Standard of Adequate Care (MBSAC) level for the family size. If the family’s total gross income after the $450 deduction exceeds the MBSAC level for the family size, the family is not eligible.

If the family’s total gross income after the $450 deduction exceeds the MBSAC level for the family size, the family is not eligible.

Client Responsibility

Once aid is granted, the CalWORKs family must report changes in their income, household composition, and property to their Eligibility Worker every 6-months on their Semi-Annual Eligibility Report (SAR 7) or at their annual redetermination. Some other things must be reported within 10 days of the occurrence:

- A member of the household becomes a fleeing felon, is convicted of a drug felony, and/or violates a condition of parole/probation.

- The combined earned and unearned monthly income of the household exceeds the Income Reporting Threshold (IRT) for their household size.

- The household has an address change.

An annual redetermination of eligibility is required for CalWORKs recipients.

Work Disregards

When a cash aid recipient is employed or receives disability based income, CalWORKs regulations allow the following deductions from the monthly gross income:

- $600.

00 from the combined earnings, disability based income or a combination of both.

00 from the combined earnings, disability based income or a combination of both. - 50% of the earnings remaining after the $600 is deducted

Any income remaining after the deductions are subtracted from the monthly gross income is then subtracted from the MAP amount to determine the amount of the CalWORKs grant.

Maximum Aid Payment (MAP) Levels

| Eligible persons | Non-exempt MAP | Exempt MAP |

|---|---|---|

| 1 | $707 | $779 |

| 2 | 895 | 1,000 |

| 3 | 1,100 | 1,264 |

| 4 | 1,363 | 1,519 |

| 5 | 1,597 | 1,780 |

| 6 | 1,830 | 2,043 |

| 7 | 2,065 | 2,305 |

| 8 | 2,299 | 2,569 |

| 9 | 2,532 | 2,828 |

| 10 | 2,767 | 3,094 |

| Each Add’l | 0 | 0 |

The monthly Maximum Aid Payment (MAP) level is established by the California State Legislature based on family size. Families who do not have any income other than CalWORKs receive MAP. MAP levels vary based on whether or not the adults in the household are able to work.

Families who do not have any income other than CalWORKs receive MAP. MAP levels vary based on whether or not the adults in the household are able to work.

- The MAP level for households with adult caretakers who are able to work is lower than the MAP level for households with adult caretakers who are not able to work. This is called the non-exempt MAP level.

- When the adults in the household are not able to work because of a temporary or permanent incapacity, or because the adult is a teen parent who attends high school, the family receives a higher MAP. Child only cases, i.e., cases where no adults are receiving aid, also receive the higher MAP level. This is called the exempt MAP level.

The table above reflects the current NON EXEMPT MAP, and EXEMPT MAP (monthly maximum aid payment) levels effective June 1, 2022.

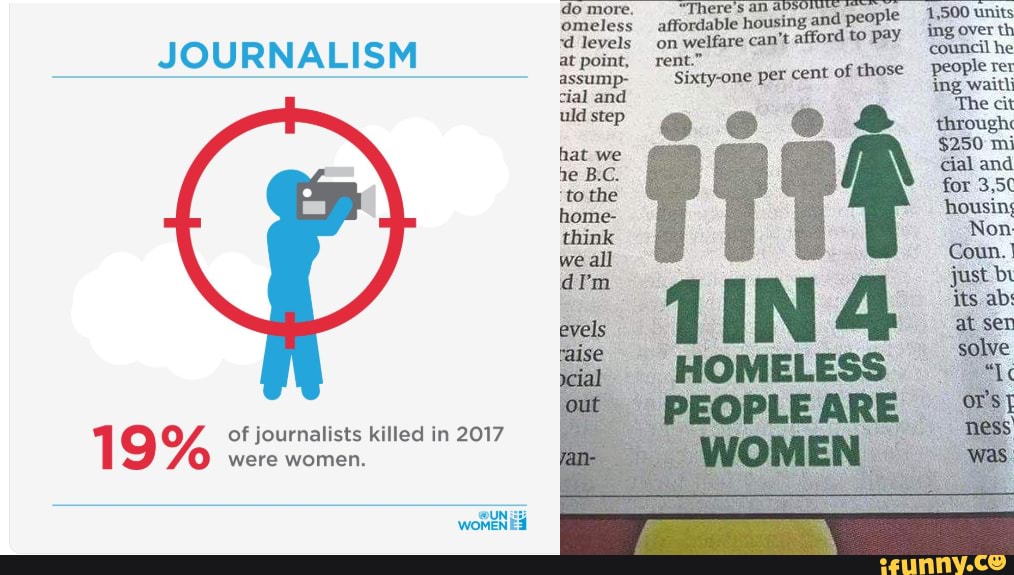

Homeless Assistance

Families who are eligible for CalWORKs and who are homeless can apply for a special need payment to meet their costs for temporary and permanent housing. The Temporary Homeless Assistance payment (usually 16 days) is based on size of the CalWORKs family. The family is responsible for any amount that exceeds the daily allowance. Homeless Assistance is available only once in a 12-month period unless the family is homeless due to domestic violence, natural disaster, inhabitability, or a physical or mental disability. All exceptions must be verified by a third party agency.

The Temporary Homeless Assistance payment (usually 16 days) is based on size of the CalWORKs family. The family is responsible for any amount that exceeds the daily allowance. Homeless Assistance is available only once in a 12-month period unless the family is homeless due to domestic violence, natural disaster, inhabitability, or a physical or mental disability. All exceptions must be verified by a third party agency.

CalWORKs Office Locations

There are five regional CalWORKs offices located throughout Contra Costa County. Office hours are Monday – Friday, 8:00 am to 5:00 pm. For additional information on your eligibility to CalWORKs, contact the office nearest you. By phone: (866) 663-3225

| East County | Central County | West County |

|---|---|---|

| 4545 Delta Fair Boulevard Antioch, CA 94509 | 400 Ellinwood Way Pleasant Hill, CA 94523 | 1305 Macdonald Avenue Richmond, CA 94801 |

| 151 Sand Creek Road Suite A, Building 6 Brentwood, CA 94513 | 151 Linus Pauling Drive Hercules, CA 94547 |

how to get and where to apply for payments for children

Elena Glubko

mother of two children

Author profile

Diana Shigapova

lawyer

This article contains all federal payments and benefits that parents of young children and teenagers can receive.

These are payments from the state. I will tell you what amounts you can count on and what you need for this.

Payments and benefits for a child in 2022

- Allowance for registration in early pregnancy

- Maternity allowance

- One-time payment at the birth of a child

- Monthly allowance for caring for a child up to 1.5 years

- Monthly allowance for the first and second child up to 3 years

- Monthly payment from 3 years to 7 children

- Monthly allowance for children from 8 to 17 years old

- Maternity capital

What benefits we did not mention

The article does not contain information about payments for a child from a large family or from a military family. There is still no information here for families in which a child with a disability is brought up. We talked about federal and regional benefits and payments for such families in separate articles:

- Benefits and benefits for large families

- Benefits for a single mother

- Benefits and benefits for a child with a disability

Pregnancy

Monthly allowance upon registration in the antenatal clinic It is beneficial for the state that children are born healthy. For this, a pregnant woman needs to visit a doctor, take tests, do an ultrasound - all this helps to detect and eliminate problems in the development of the child in time. So that pregnant women do not delay a visit to the doctor, the state is ready to pay them money for early registration for pregnancy - up to 12 weeks, but only for those who have a low level of income.

For this, a pregnant woman needs to visit a doctor, take tests, do an ultrasound - all this helps to detect and eliminate problems in the development of the child in time. So that pregnant women do not delay a visit to the doctor, the state is ready to pay them money for early registration for pregnancy - up to 12 weeks, but only for those who have a low level of income.

So what? 07/01/21

Pregnancy benefit in 2022: basic conditions

How much. 50% of the subsistence minimum in the region where the woman lives. On average, 7586 R, but depending on the region, the amount will be more or less. For example, in the Belgorod region it is 6372.5 R, and in the Krasnoyarsk Territory - 8420.5 R.

Living wages for the able-bodied population by region

Who is supposed to. Pregnant women can count on this benefit if the following conditions are met:

- The 12th week of pregnancy has come.

- The average per capita income for each family member does not exceed the subsistence level.

- The family does not have "excess property". If a family owns several apartments and their total area is such that each family member has more than 24 m², then the allowance will not be given. Three cars in a family is also grounds for denial of benefits.

- Family members have income or objective reasons why they do not have this income. This is called the “zero income rule”: help those who are trying to provide for themselves and their families, and not those who want to live only on benefits. There may be no income, for example, if a woman was on parental leave for up to 3 years. This is a good reason for the lack of income.

Self-employed women can also receive this allowance if they meet the above conditions.

How to get. To do this, you need to go to the local gynecologist in the first three months and get a card. Then you will need to submit an application through the public services website or in person to the FIU branch of your region.

No proof of pregnancy or income is required. The FIU will request information itself, but sometimes confirmation is required if there is not enough information in the databases.

You can apply from the 6th week of pregnancy. But the allowance will come only from the 12th week - monthly until the month of childbirth.

In order to receive benefits on the card, a pregnant woman will have to get a Mir payment system card. Details are indicated in the application.

/pregnancy-money/

All benefits for pregnancy and childbirth

Additional allowance in Moscow for pregnant women. In the capital, pregnant women with a Moscow residence permit who are registered with Moscow medical organizations up to 20 weeks of pregnancy will be paid a lump sum by social security 690 Р.

How parents can get money from the state

We will tell you in the free Glass of Water mailing list: once a week we send a letter about the financial side of parenthood

Pregnancy

Maternity allowance In everyday life, this money is called "maternity". The allowance is paid once before going on maternity leave to compensate the woman for the loss of salary before and after the birth of the child.

The allowance is paid once before going on maternity leave to compensate the woman for the loss of salary before and after the birth of the child.

According to the law, you can go on maternity leave at 30 weeks - this is the seventh month of pregnancy. In some cases, earlier. At the antenatal clinic, they will write out a sick leave, which will need to be given to the employer, and if the sheet is electronic, then report its number.

/guide/dekretnyj-otpusk/

How to apply for maternity leave

How much. The minimum amount of maternity leave for those working under an employment contract is 70,324.8 R for the entire period of sick leave, the maximum for 140 days of maternity leave is 360,164 R.

To receive payments, the expectant mother must bring a sick leave or provide the number of an electronic disability certificate. The accounting department will take the data from the sick leave, transfer the information to the FSS, and the latter will pay benefits. Maternity leave can only be obtained in three ways:

Maternity leave can only be obtained in three ways:

- to the Mir card;

- to a bank account to which no card is linked;

- by postal order.

Who is supposed to. All pregnant women working under an employment contract, full-time students, female civil servants, municipal employees, military personnel.

Women who have been laid off can receive benefits if their employer ceased operations and fired employees, and they were registered with the employment service within a year. True, the amount in this case will be quite symbolic.

How to get. The allowance is issued on the basis of a sick leave issued by an obstetrician-gynecologist. A woman must write an application addressed to the employer and attach a sick leave to it. Since 2022, this allowance has been transferred without any application at all.

RF GD dated November 23, 2021 No. 2010PDF, 1.2 MB

How to receive a salary while on maternity leave. It is impossible to be on maternity leave and work under an employment contract at the same time, but an employer can conclude a civil law contract with a pregnant employee, according to which she has the right to work remotely. You need to choose one thing. A woman may not go on maternity leave if she does not want to. Or get out of it even immediately after giving birth - if, for example, you are ready to work remotely.

It is impossible to be on maternity leave and work under an employment contract at the same time, but an employer can conclude a civil law contract with a pregnant employee, according to which she has the right to work remotely. You need to choose one thing. A woman may not go on maternity leave if she does not want to. Or get out of it even immediately after giving birth - if, for example, you are ready to work remotely.

A woman with IP status can also receive maternity leave, if she voluntarily insured herself with the FSS. This must be done in the previous year before the year of pregnancy and insurance premiums must be paid. To do this, we multiply the minimum wage by 2.9% - this is the percentage rate of the social insurance contribution. Then we multiply the received amount by 12 months.

/dekret-abroad/

How to go on maternity leave from abroad

To go on maternity leave in 2023 and receive benefits, you need to pay 4833. 72 rubles to the FSS in 2022.

72 rubles to the FSS in 2022.

The number 4833.62 was taken from the formula: 13,890 R × 2.9% × 12 months, where 13,890 R is the minimum wage from January 1 to May 31, 2022, 2.9% is the contribution rate to the Social Insurance Fund.

In districts and localities where district coefficients are applied to wages, they are also taken into account when calculating the payment in the FSS.

The contribution can be paid in one payment, or in installments, but not before December 31, 2022. When the time comes to apply for maternity leave, the entrepreneur will submit an application for grants and sick leave to the FSS, and in return she will receive 70,324.8 R or a little more on her card if the minimum wage is increased.

What to do? 07/15/19

How can an individual entrepreneur receive maternity payments?

Maternity benefits are not subject to personal income tax - the expectant mother will receive the entire amount without deducting 13%.

How to get the maximum maternity pay

- You need to work under an employment contract, and the salary should be white, not gray.

- The average monthly salary for two years must not be lower than 78,250 R before deducting personal income tax.

- If you work in several places at the same time, each employer will pay maternity leave, but on the condition that you have worked at another place of work for at least two years. In this case, ask the antenatal clinic to write out a sick leave for each place of work.

- If you have changed jobs in the last two years, take a salary certificate from your previous job in form 182n. Your employer will take this earnings into account when calculating maternity leave.

- If the maternity pay period fell on another maternity or child benefit period, you can replace it with previous years to take into account the salary and get more money.

Certificate of average salary on the form 182nDOC, 74 KB

We have a detailed article on how to independently calculate maternity payments.

At birth

Lump sum at birthWhen a child is born, the state compensates parents for part of the costs. Moreover, one of the parents can receive this money, regardless of who exactly goes on parental leave.

The size of the salary doesn't matter either. Even the unemployed will be paid.

/guide/moneyforborn/

How to get benefits when a child is born

How much. From February 1, 2022 - 20,472.77 R. Guardians, trustees or adoptive parents will receive the same amount. If they take a child over 7 years old, or relatives, or a disabled child, the amount of the payment is 156,428.66 R.

Regional allowances. Regions add their own payments to the lump-sum allowance at the birth of a child. To receive them, one of the parents and the child must be registered in this region.

For example, in the Khanty-Mansiysk Autonomous Okrug - Yugra, when registering the birth of a child in the registry office of the Khanty-Mansi Autonomous Okrug, the region pays 20,000 RUR.

In St. - 46 372 R, for the third and subsequent children - 57 962 R. This card can be used to pay for the purchase of children's goods in most large stores in the city.

Who is supposed to. One of the child's parents. If both work - dad or mom, by choice. If the parents are unemployed, you can also choose who exactly will apply. If only one person works, he will receive the money, there are no options. For example, dad has an employment contract, but mom doesn’t. The allowance will be paid to the father of the child, but the mother will not be able to issue it.

If the parents are not married, the person with whom the child lives will receive the money, regardless of employment.

How to get. The payment is made by one of the parents at the place of work. A certificate is required from the second parent that he did not receive this payment.

If both parents are unemployed, the allowance is issued in the pension fund at the place of residence.

Regional Newborn Boxes

Newborn Box available in select regions. This is a gift set that is given to parents or adoptive parents upon discharge from the maternity hospital. This box contains baby clothes, accessories for feeding, swaddling, bathing.

The package varies by region. The conditions for issuance also differ. In Samara, such a gift is given to mothers who have given birth to their first child. In Tatarstan, the set is given to low-income families. In Vologda, you can get a box for every newborn.

What to do? 02/21/19

How to get the status of a low-income family and why

In Moscow, they give a "Sobyanin's box" to all parents, regardless of their place of residence, but subject to two conditions:

- Their children were born in Moscow maternity hospitals.

- They received their birth certificate in Moscow.

You can pick up a set of things "Our Treasure" not only upon discharge, but also at the department of social protection of the population at the place of residence or stay in Moscow of one of the parents. But the term is limited to two months. You will need to write an application, as well as submit documents that parents did not receive such a set at the maternity hospital.

But the term is limited to two months. You will need to write an application, as well as submit documents that parents did not receive such a set at the maternity hospital.

From February 18, 2020, instead of a set of things, parents can receive compensation of 20,000 R. The amount is paid for each child born. If at least one of the parents has a registration in Moscow, the payment is processed at the regional department of social protection of the population.

If there is no registration, and only the birth of a child is registered in Moscow, then parents should contact the My Documents public services center. The decision on payment is made within 10 days, and the payment itself is transferred in the next month.

Additional benefits in Moscow at the birth of a child

One-time compensation payment for reimbursement of expenses in connection with the birth (adoption) of a child. It can be issued by one of the parents, one of the adoptive parents (the only adoptive parent), the child's guardian - Russians, foreign citizens and stateless persons living in Moscow. To do this, you need to have a Moscow residence permit.

To do this, you need to have a Moscow residence permit.

6313 RUR will be paid for the first child, 16 642 RUR each for the second and subsequent ones. In case of birth or adoption of three or more children at the same time, 57 383 RUR will be paid. If both parents are under 36 at the time of the birth of the child and the family income per person is not more than the subsistence minimum, the city will pay an additional 93,570 R for the first child, 130,998 R for the second, 187,140 R for the third and subsequent. Citizens registered in New Moscow will also receive these payments.

Appendix 1

to the Decree of the Government of Moscow dated May 27, 2021 No. 718-PP

Up to 1.5 years

Benefit for caring for a child up to 1.5 years When a mother's maternity leave is over, the next one may begin - to care for a child. During this period, a parent or other person who sits with a child is assigned an allowance - but only up to one and a half years. Leave with the preservation of the workplace and position can last up to three years.

Leave with the preservation of the workplace and position can last up to three years.

Benefits can be received not only by the employed, but also by the unemployed: difference in amounts and execution. And you can also combine child care and work duties and, in addition to payments from the budget, receive a salary at work.

/guide/iz-dekreta/

How to get out of the decree

How much. 40% of the average salary for the previous two years. The minimum is 7677.81 R. The maximum in 2022 is 31,282.82 R: such a benefit will be paid if your average salary for 2020 and 2021 is more than 78,250 R. In fact, when assigning benefits, they calculate the average daily earnings - the same as well as for maternity leave.

Benefits and their calculation data for 2019-2022 - "Consultant Plus"

Who is supposed to. Mother, father or other adult caring for the child. It could also be a grandmother. Only one person will receive the benefit. Vacation can be taken in turn: for example, first mom, then father, and then grandmother.

Only one person will receive the benefit. Vacation can be taken in turn: for example, first mom, then father, and then grandmother.

How to get. They make payments at the place of work, and if the mother or father is unemployed, an application must be submitted to the social security at the place of residence.

How to get a job and keep your monthly allowance

During parental leave, a mother cannot work full time or she will lose her monthly allowance. At the same time, the law allows you to work part-time or work from home. And there is one trick here.

Judging by article 93 of the Labor Code of the Russian Federation, part-time work can be considered both part-time and part-time work.

Since a full working day is 8 hours and a full working week is 40 hours, the parties must find an option for the employee to work a little or the prescribed 8 hours every day, but not on all days of the week.

Here it is necessary to take into account the position of the FSS and the Supreme Court - the child care allowance compensates for lost earnings. If the mother has not lost her earnings, then she has nothing to compensate. Sometimes the assigned allowance is even cancelled.

If the mother has not lost her earnings, then she has nothing to compensate. Sometimes the assigned allowance is even cancelled.

/vernula-posobie/

I was laid off on maternity leave, but I was able to keep my allowance

the number of working hours for a woman to earn 60% of her previous salary. More about this has already been written in the article "How to reduce the working day and receive benefits."

Instead of a mother, a father can apply for parental leave plus part-time work in exactly the same way.

If both spouses do not want to lose their wages, they can apply for an allowance for working grandparents.

Up to 1.5 years

Putin's payments On January 1, 2018, the law on monthly payments to families with children came into force. According to it, you can receive a monthly payment for the first or second child. This is not maternity leave or a child care allowance, but an additional measure of support.

People call the new allowance "Putin's payments". They do not replace, overlap or cancel other benefits. The payment is not provided as a one-time payment, but is paid every month to the bank card of the mother - or father, if the mother has died or she has been deprived of parental rights.

/money-for-baby/

How I got Putin's payments per child

Putin's allowance is one regional living wage per child per month. When applying for payment in 2022, the allowance will be assigned in the amount of the subsistence minimum for the current year. For example, in Moscow it will be R17,791, in Novosibirsk it will be R14,562, and in Vladivostok it will be R17,628.

- Parents whose first or second child was born or adopted after January 1, 2018 can receive payments. Guardians can also claim payments - in the event of the death of parents or adoptive parents, they are declared dead, deprivation of parental rights, or in case of cancellation of adoption.

- The applicant must be a citizen of Russia and permanently reside on the territory of the Russian Federation.

- The child must be a Russian citizen. For example, if the birth was in the Russian Federation, but both parents are foreign citizens, then by default the child is not granted Russian citizenship.

- The average per capita family income for the billing period is no more than two regional living wages for the current year for the able-bodied population. The billing period is 12 months preceding the 6 months prior to the circulation month.

GD of the Novosibirsk Region dated May 31, 2022 No. 250-p

For the first child, the payment is made in social security. On the second - in the pension fund, because it will reduce maternity capital.

The allowance is granted for up to one year, and then it must be extended to two and three years.

Money can now be received only on the Mir card or on an account that is not linked to any cards.

/benefit-calc/

Calculator of Putin's payments for the first and second child in 2023

Up to 3 years

Monthly allowance for a child up to 3 yearsCompensation for caring for a child up to 3 years is a benefit for parents who care for small children.

How much. 50 R is paid monthly to one of the parents of a child from 1.5 to 3 years.

Who is supposed to. To one of the parents who worked under an employment contract and went on parental leave.

How to get. From January 1, 2020, this payment was canceled, but not for everyone. It will continue to be available to mothers or fathers of children born before January 1, 2020.

If the child was born after January 1, 2020, the parents will not be able to receive this payment.

Over 3 years old

Monthly allowance for a child from 3 to 7 years Specific conditions for granting the payment are established by regional authorities, but these conditions must fit into the federal framework.

So what? 03/12/21

Payments from 3 to 7 years will double, and the increase will be assigned retroactively

How much. 50, 75 or 100% of the subsistence minimum for children in the region - depends on the degree of need.

Decree of the President of the Russian Federation of March 20, 2020 No. 199 "On additional measures of state support for families with children"PDF, 143 KB

Who is supposed to. Families with children from 3 to 7 years old inclusive, subject to a number of conditions:

- Parent is a citizen of the Russian Federation permanently residing in the Russian Federation.

- The child is a citizen of the Russian Federation.

- The average per capita family income is not more than the subsistence minimum per capita in the region.

- The property of the family is not more than the established list. For example, a family has only one car and one apartment.

- Family members had income or good reasons for their absence in the billing period.

How to get. An application for payment can be submitted through public services or social security. To transfer money to the card, "Mir" is suitable. Or you need an account without a card. One of the child's parents can apply for payment.

First, the payment will be assigned for a year, then it can be extended upon application. The money is paid until the child is 8 years old.

Difficult question 04/09/21

How to get a payment for children from 3 to 7 years old in 2022

Over 3 years old

Allowance for a child from 8 to 17 yearsAs of July 1, 2021, the federal allowance for children under 17 years of age has appeared. It is appointed in all regions on the same terms.

How much. The amount of the allowance is 50% of the subsistence minimum for children in the region. In 2022, this is almost seven thousand per month.

In 2022, this is almost seven thousand per month.

The amount of PM in the Russian Federation - "Consultant-plus"

Who is supposed to. Who can get this type of state support:

- The only parent of a child. That is, the second parent died or went missing, the father is listed in the documents according to the mother or is not included in the certificate at all.

- One of the parents in whose favor child support is assigned by court order.

There are also general conditions:

- The applicant has the citizenship of the Russian Federation or a residence permit in Russia.

- The allowance is granted if the average per capita income does not exceed the subsistence level per capita.

- Family property - within the established list.

- Adult family members have proven income or a good reason for not having it.

From May 1, 2022, complete families with low incomes also receive benefits. The amount of payment for them is 50%, 75% or 100% of the subsistence minimum for children in the region.

The amount of payment for them is 50%, 75% or 100% of the subsistence minimum for children in the region.

50% - basic amount, all families receive it. If, after his appointment, the family income does not reach the subsistence minimum, 75% of the subsistence minimum per child will be paid. If this is not enough - 100%. Perhaps the allowance for single parents of children from 8 to 17 years old will be canceled - it is less profitable. A new payment is appointed immediately for two months - April and May, but you can apply for it from May 1.

How to get. You can apply for public services or the FIU. The benefit is assigned for a year, and then extended upon a new application. As part of the verification of the application, documents may be required that will have to be brought in person.

There are also payments for children under 16 in the regions. In practice, such a benefit is not available everywhere, but is usually assigned to low-income families. For example, in Moscow, single mothers can receive such benefits.

For example, in Moscow, single mothers can receive such benefits.

Difficult question 24.08.21

Assets, zero income and deadlines: tricky questions about child support from 8 to 17

One-time payments

Maternal capitalThis type of state support appeared in 2007, and since 2020 it is assigned even for the first child.

The right to maternity capital is confirmed by a personalized certificate. It can be obtained upon application to the FIU or automatically at public services.

So what? 01/13/22

Starting February 1, 2022, mother's capital will grow by 8.4%

How much. The amount depends on the year of birth of the child and what kind of account he is in the family.

Maternal capital in 2022

| When the children were born | Amount from 01.02.2022 |

|---|---|

| First and second - until 2020 | 524 527. 9 R for the second 9 R for the second |

| First - before 2020, Second - in 2020 or later | 693 144.1 R for the second |

| First and second - from 2020 | 524 527.9 R for the first, 168 616.2 R for the second |

when children

were born from 01.02.2022 9000

The first and second - up to 2020

524 527.9 r for the second

The first - until 2020 or later than

693,144.1 R for the second

First and second — from 2020

524,527.9 R for the first, 168,616.2 R for the second

Money can only be used for the specified purposes:

- Improvement of living conditions.

- Children's education.

- Monthly payments for the second child.

- Mom's funded pension.

- Goods for children with disabilities.

/prava/obyazannosti-matkapital/

Responsibilities when using the mother capital

Who is supposed to. Usually, the mother capital is received by a woman who has given birth or adopted a child.

Usually, the mother capital is received by a woman who has given birth or adopted a child.

If the mother has died or is deprived of parental rights, the certificate will be given to the father or adoptive parent.

How and where to apply. In the Pension Fund of the Russian Federation or on the public services portal. First you need to get a certificate, and then you need to apply for an order.

There is also regional maternity capital.

We have articles about maternity capital in order to use state support with profit:

- How to spend maternity capital on a mortgage

- Where you cannot spend maternity capital from 2019

- How to sell an apartment in which maternity capital was invested How to cash out uterus

- How to spend a matkapal for building a house

- How to calculate a deduction when buying an apartment with a uterus of

- How to reduce personal income tax when selling an apartment with a uterus

One -time payment and child allowances in 2022

8 R

8 R Pressure allowance

Minimum size

70 324.8 R

Maximum size

9000 360 164 RAre there any regional allowances

-

-

9000 Payment at birth 9000 9000 size 20,472.77 Р Maximum size — Are there regional allowances Yes. For example, in St. Petersburg - 34,777 R, in Moscow - 6313 R for the first and 16,642 R for the second, as well as "Sobyanin's box" and "Luzhkov's" payments to a young family Maternity capital Minimum size 168 616. The maximum size - Is there any regional allowances . For example, in St. Petersburg, capital is allocated at the birth of a third child Manual when registering in the Wondwater Consultation Minimum size 50%of the regional subsistence minimum Maximum size - Are there any regional overs0003 Payments Depends on the region A allowance for childcare up to 1. Minimum size 7677.81 r for each child Maximum size 31 282.82 R are there regional allowances - "Putin's payments" up to 3 years 0002 Are there any regional allowances Payments depends on the region A child benefit from 1.5 to 3 years old Minimum size 50 p if the child was born until 01.01.2020 maximum size -  2 R, 524 527.9 r or 693 144.1 P

2 R, 524 527.9 r or 693 144.1 P Monthly payments and benefits for a child in 2022

Payment Minimum size Maximum size Are there regional allowances Registration allowance at the antenatal clinic 50% of the regional subsistence minimum for the working-age population - Payouts vary by region Child care allowance up to 1.5 years 7677.81 R per child 31,282.82 R - "Putin's payments" up to 3 years Regional subsistence minimum per child - Payouts vary by region Child allowance from 1.5 to 3 years 50 R if the child was born before 01/01/2020 - - Child benefit from 3 to 7 years 50% of the regional subsistence minimum per child 100% of the regional subsistence minimum per child Payouts vary by region Child benefit from 8 to 17 years 50% of the regional subsistence minimum per child - Payouts vary by region  5 years old

5 years old

Are there regional allowances

—

Allowance for a child from 3 to 7 years

Minimum amount

50% of the regional subsistence minimum for a child

Maximum size

100%of the regional subsistence level for a child

Is there any regional allowances

Payments depends on the region

Children's allowance from 8 to 17 years old

Minimum size

50%of the regional subsistence minimum per child

Maximum amount

-

Are there any regional allowances

The amount of payments depends on the region

What child benefits can you count on

There are many benefits and payments, there are even more conditions for receiving them - it is easy to get confused in all this.

We have made a test for parents: answer a few questions and find out what types of state support you can count on.

Child allowances in 2022: what payments per child will increase from January 1, 2022 - December 15, 2021

Lifestyle benefits for families in various life situations. We will soon find out whether to wait for the development of this policy further Photo: Sergey Syurin / 29.RU

Share

Part of benefits will be indexed from February 1st.

Every year, the amount of allowances and payments is recalculated, this applies to almost all money from the state, including those that are due to families with children. The coming year is also no exception: the authorities have already adopted a number of documents on which the amount of payments next year depends - for example, the minimum wage and the living wage have been established. Let's do the calculations and figure out how much families with children will be paid in 2022.

September 27, 2021, 10:41

September 15, 2021, 10:52

September 13, 2021, 13:02

July 19, 2021, 12:05 pm

July 02, 2021, 03:41 PM

June 14, 2021, 11:31

In Russia, a project of proactive accrual of benefits is developing

In Russia, a project of proactive accrual of benefits is developing June 09, 2021, 11:41

Children's payments and benefits from 3 to 7 Posobiye for lonely parents' capital -based retirement for the care of childhood

Surprisingly0

Comments 3

Read all commentsadd a comment JOIN

The brightest photos and videos of the day are in our groups on social networks

- VKontakte

- Telegram

- Yandex.Zen

See a typo? Select a fragment and press Ctrl+Enter

Media news2

report news

Send your news to the editor, tell us about a problem or suggest a topic for publication. Upload your video and photos here.

- Vkontakte group

Companies

Comments3

Companies news

Confectionery "Troika" launched a collection of sweets by March 8

On a holiday I would like to please their favorite girls, mothers, grandmothers and daughters delicious and beautiful delicacies. Troika Confectionery has prepared a festive collection of cakes and desserts on the eve of March 8th. Cake with floral decor is the perfect sweet gift for the most spring holiday of the year. Cake "For her" in the form of a basket with tulips from "Charlotte" cream and with fillings for every taste: spicy "Honey cake" with cinnamon, delicate "Strawberry", unusual "Hazelnut" with nuts and salted caramel, "Brownie" for chocolate fans , and bright "Raspberry" with...

Troika Confectionery has prepared a festive collection of cakes and desserts on the eve of March 8th. Cake with floral decor is the perfect sweet gift for the most spring holiday of the year. Cake "For her" in the form of a basket with tulips from "Charlotte" cream and with fillings for every taste: spicy "Honey cake" with cinnamon, delicate "Strawberry", unusual "Hazelnut" with nuts and salted caramel, "Brownie" for chocolate fans , and bright "Raspberry" with...

What to present to your beloved woman? Give an unforgettable experience!

On the main spring holiday - International Women's Day - we invite lovely ladies and their companions to visit. On this day, the Troika Restaurant will turn into a blooming garden and, under the seductive aromas of mimosa, all girls and women will be greeted with a compliment. A festive show-variety show with a special program, an exquisite bright interior of the Great Hall and delicious dishes of Russian and European cuisine for every taste will create a wonderful mood. The Small Hall will serve as a backdrop for a photo shoot in stylized Russian costumes inspired by the film...

The Small Hall will serve as a backdrop for a photo shoot in stylized Russian costumes inspired by the film...

One and no less: what will happen to vision if the doctor chooses glasses or lenses incorrectly

.7% of women) use glasses or contact lenses. There are more and more nearsighted people, and other vision problems require correction. The participants of the round table told about what new and modern optics offers today, what type of correction is suitable taking into account the state of health and lifestyle, and how to choose the right glasses and contact lenses.

TOP 5

1An elderly man pushed a teenager under a train in the Moscow metro

323 016

1742A man who pushed a teenager under a train in the Moscow metro said he did it on purpose

145 614

3 The ideologue of QR-resistance led a police colonel to the crypto-farm

83 044

634Investigative Committee finished investigating the case of mobilized people who left the NVO zone in a taxi

61 006

925 “It just blew a little, and we are back to Pulkovo.