How do you garnish wages for child support

Paying child support | California Courts

Index: All Pages

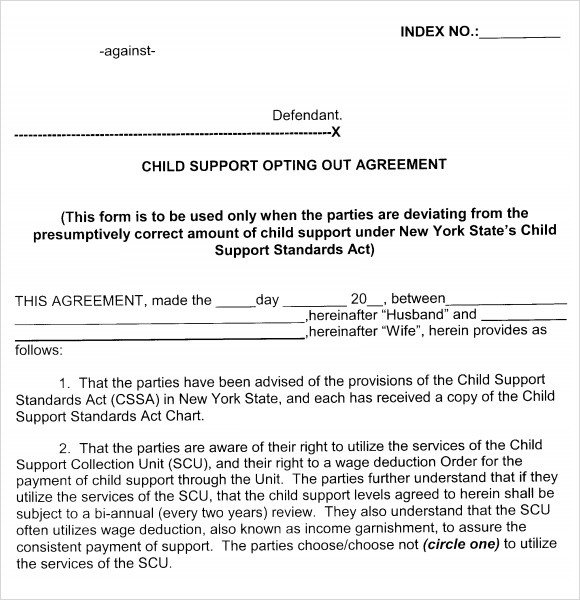

If the judge ordered you to pay child support, it's important to start making payments on time. The court order will include a start date for the child support. Often the payments will come directly out of your paycheck (called income withholding or earnings assignment).

Get free help at your court

Your court's Family Law Facilitator or Self-Help Center can help answer questions about child support and help you with court forms.

Enter your mobile number

Ten digit mobile number starting with the area code (e.g. 4158654200)

Select your mobile carrier Select your mobile carrierBoost MobileCricket WirelessAlltelGoogle FiMetroPCSAT&TRepublic WirelessSprintT-MobileVerizonU.S. CellularVirgin Mobile

We'll only use this mobile number to send this link

Pay support on time

When a judge orders child support, they order a date when payments must start. You must pay beginning on that date. Unpaid support collects interest. The interest rate for unpaid support is 10% per year. It works like interest on a credit card.

Usually, support is taken directly from your pay

An Income Withholding Order is a court order that tells your employer to take the support payments directly from each paycheck and where to send it. It's sometimes called an earnings assignment or wage garnishment.

Once your employer receives the order, they have 10 days to take the money from your next paycheck. Then, your employer must send the money to the

(SDU). The SDU then sends the child support to your child's other parent.

If support is due before your employer has time to take it from your pay, you must pake the payment yourself. It can take few weeks for your employer to start taking out payments. If you owe support before that happens, you must pay the support to the other parent.

How to pay if there's not an

Income Withholding OrderCheck if your Order says how you should make payments. For example, the order may say payments can be made by cash or check.

For example, the order may say payments can be made by cash or check.

If you miss payments and you have a regular employer, your child's other parent can ask the judge to order that payments come directly from your pay.

If you do not pay support, besides having interest added to the amount you owe, there are steps the other parent or the LCSA can take to collect the support.

The LCSA can enforce a child support order in every state in the US and in many countries. They have access to many databases to find where you work or have money. The LCSA can

- Take income tax refunds

- Report the unpaid support to a credit agency

- Have money taken from your bank accounts

- Suspend your driver's license or professional license

- Put a lien on your property (like a house)

- Have your Passport application denied or not renewed

Not paying support can have serious consequences.

If the court finds that a parent has the ability to pay support but is willfully not paying it, it can find the parent in contempt of court. This could mean jail time for that parent. This is rarely done but can happen in cases when all other legal efforts to collect have failed.

Related content

Ask to change child support

Ask to change child support through the LCSA

Child support resources

How Do You Garnish Wages for Child Support?

In child support cases, we find the majority of families being split up, with the children going with one parent. The other parent is ordered to support the raising of the child through child support payments. The idea came about in the 1980s when there was an alarmingly high percentage of single mothers who struggled to make ends meet. They appealed for government assistance. In turn, the courts thought the fathers should be responsible for this, not the taxpayers. Before this, child support cases hardly existed in the court system. This brought on an entirely new brand of cases in the courtrooms.

This brought on an entirely new brand of cases in the courtrooms.

When you have been awarded child support payments from your former spouse or partner, it becomes an obligation they must pay. States often have child support disbursement units, which is where the payments go. It is nothing more than a database ~ an official paper trail that tells who made the payment, how much the payment was for, and when the payment was made. However, what happens when you are not receiving the child support as ordered?

There are steps you can take, and wage garnishment is one of those steps. Wage garnishment is the process, through which, money that is owed to you (on behalf of your child) is automatically withheld from the wages of the opposing parent each payday. By this method, the opposing parent is not given the option or freedom of paying you; they do not see the money at all. It is deducted from their paychecks before they get paid.

After you receive the court order awarding you with child support payments, your next step is to obtain a document from the court authorizing you to collect unpaid child support. In most states, this is called a Writ of Execution. The document permits you to direct the sheriff to seize the wages of the other parent. In reality, the sheriff is not usually involved. A third party, the state authorized child support agency takes this writ and drafts a letter to the employer of the opposing parent.

In most states, this is called a Writ of Execution. The document permits you to direct the sheriff to seize the wages of the other parent. In reality, the sheriff is not usually involved. A third party, the state authorized child support agency takes this writ and drafts a letter to the employer of the opposing parent.

The employer then deducts the wages of their employee and sends the money to the correct child support disbursement unit, who then issues you a check. The purpose of the disbursement unit is to quell any claims of unpaid monies, frequency of payments, and any other questions relating to whether payments have been made or how much has been paid. Once the employer receives the letter of garnishment, they notify their employee of the court order.

The courts have placed limits on the amounts that can be garnished from paychecks. This amount often leaves the other parent crippled, but there are things they can do to object. In child support cases, there is an overwhelming amount of people unhappy when judgments are placed against them, so even they have limited people to the kinds of objections they are willing to hear.

The opposing parent may object to the Writ of Execution if the amount is incorrect, will not leave them with enough money to live on, or if they had custody of the child during the time arrears have accrued. Some states (not all) will revisit a case of the custodial parent hid the child then came out claiming they are owed child support.

The courts will garnish anywhere from 50% to 65% of a paycheck, depending on the circumstances of the situation. For unpaid child support, up to 50% of the paycheck may be garnished, and if you are not currently supporting another child, this amount goes up to 60% in most states, and 65% in others. Even if they have more than one obligation already being garnished, the state may not take more than these amounts.

If the opposing parent does not receive paychecks to satisfy the debt, other methods are taken into consideration, such as property seizure. This includes vehicles, boats, motorcycles, airplanes, houses, corporate stock, livestock, and any other income that falls under accounts receivable, such as tax refunds and rental property income.

If you are not being paid the child support money you are owed, the biggest thing you need to do is speak up. The courts will not deny you payments, and a system is in place to garnish wages. If you are unsure about whom to talk to, find a family law lawyer. Family law lawyers are well versed in child support payments and have the experience to ensure you get what you deserve.

Is it possible to withhold alimony from the salary for the first half of the month (from the advance)? Otherwise, the salary at the end of the month is not enough to pay alimony.

- February 6, 2019

Opportunities: according to an expert of the Ministry of Labor, alimony can be withheld from the advance if it is known that the second part of the salary paid at the end of the month will not be enough for deductions.

Alimony is withheld from salary, vacation pay, financial assistance, severance pay and other employee income (List approved by Government Decree N 841). The total amount of deductions, taking into account alimony, cannot exceed 70% of the employee's income (Article 138 of the Labor Code of the Russian Federation, Parts 1, 3, Article 99 of the Federal Law of 02.10.2007 N 229-FZ).

The total amount of deductions, taking into account alimony, cannot exceed 70% of the employee's income (Article 138 of the Labor Code of the Russian Federation, Parts 1, 3, Article 99 of the Federal Law of 02.10.2007 N 229-FZ).

The organization is obliged to withhold alimony monthly from the employee's income and, no later than three days from the date of payment of wages or other income, transfer the alimony to the recipient. This procedure is provided for in Art. 109 RF IC. In this case, alimony is considered from income already reduced by personal income tax.

Therefore, it is possible to find out the amount from which alimony must be collected only after personal income tax is deducted from the salary. From advances, personal income tax is not calculated and is not withheld. This is confirmed by the Ministry of Finance (Letter dated 12.09..2017 N 03-04-06/58501). In this connection, as a rule, deduction and payment of alimony is made once a month after deduction of taxes.

But at the same time, a situation may arise when the amount of salary paid at the end of the month (taking into account the previously issued advance payment) may not be enough to withhold alimony.

The representative of the Ministry of Labor believes that if it is known that wages are not enough for deductions, then the payment of alimony can also be made from an advance payment.

Some courts believe that alimony must be withheld from both the advance payment and the salary (see, for example, the Decree of the Federal Antimonopoly Service of the West Siberian District of 09/06/2011 in case N A75-1884 / 2011).

Note: A parent who pays alimony for their minor children is entitled to a child income tax deduction. One of the conditions for receiving a standard deduction for children is the fact that the child is supported by the parents or the spouse (wife) of the parent (subclause 4, clause 1, article 218 of the Tax Code of the Russian Federation). The payment of alimony just confirms the fulfillment of this condition. Specialists of the Ministry of Finance of Russia agree with this position (see, for example, Letters No. 03-04-05/46762 dated 10.08.2016, No.2).

The payment of alimony just confirms the fulfillment of this condition. Specialists of the Ministry of Finance of Russia agree with this position (see, for example, Letters No. 03-04-05/46762 dated 10.08.2016, No.2).

Links to documents are available only to users of ConsultantPlus - clients of the company "ELKOD". You can get additional information on the acquisition of SPS ConsultantPlus HERE.

Can an employer withhold alimony only on the basis of an employee's application (in the absence of a writ of execution)? If it is possible, what documents, including statements, should the employee submit in this case?

The employer is not entitled to withhold child support only on the basis of the employee's application.

Related material

What you need to know about payroll deductions

No. 01 / 2016

For information about the procedure for deductions at the initiative of the employee, employer and mandatory deductions made by virtue of law, read the article "What you need to know about deductions from wages"

In accordance with art. 137 of the Labor Code of the Russian Federation, deductions from an employee's salary can be made only in cases provided for by the Labor Code of the Russian Federation and other federal laws.

Article 109 of the Family Code of the Russian Federation (hereinafter referred to as the RF FC) provides that the administration of the organization at the place of work of a person obliged to pay alimony on the basis of a notarized agreement on the payment of alimony or on the basis of a writ of execution is obliged to withhold alimony monthly from wages and (or ) other income of the person obliged to pay alimony, and pay or transfer them at the expense of the person obliged to pay alimony to the person receiving alimony, no later than three days from the date of payment of wages and (or) other income to the person obliged to pay alimony.

As you can see, by virtue of Art. 137 of the Labor Code of the Russian Federation and Art. 109 of the RF IC, the employer is obliged to withhold alimony on the basis of a notarized agreement on the payment of alimony or on the basis of a writ of execution.

Let's note that some specialists consider any deductions from wages possible at the request of the employee. They argue that labor legislation does not contain restrictions on this. It is also noted that such relations are of a civil law nature and are not labor, therefore Art. 137 and 138 of the Labor Code of the Russian Federation do not apply to them.

In our opinion, supporters of this point of view lose sight of the fact that wages from which deductions are made is an element of precisely labor relations, and within the framework of these relations, the legislator has taken measures to protect wages from various deductions.

Article 137 of the Labor Code of the Russian Federation prohibits any deductions from an employee’s salary that are not provided for by the Labor Code of the Russian Federation or other federal law (see the decisions of the Tambov Regional Court dated October 19, 2016 in case No. 7-423 / 2016 and the Volgograd Regional Court dated January 20, 2016 in case No. 07-48/2016, ruling of the Moscow City Court dated September 12.2016 No. 4g-10226/16).

7-423 / 2016 and the Volgograd Regional Court dated January 20, 2016 in case No. 07-48/2016, ruling of the Moscow City Court dated September 12.2016 No. 4g-10226/16).

Therefore, we believe that the employee's application alone does not allow for a withholding. It can be the basis for deductions only when such a procedure is established by a specific norm of federal law. In cases where the possibility of deductions from wages in favor of third parties or in favor of the employer itself is not provided for by any law, the employee's application for such deduction should not entail any consequences.

Thus, in our opinion, the employer is not entitled to withhold child support only on the basis of the employee's application, since the law does not provide for such a possibility.

An employee, having received a salary, can dispose of the money at his own discretion, in particular, transfer part of the salary as a voluntary payment of alimony. The employer, in such a situation, can only help and transfer the money paid by the employee to the cash desk or to a bank account in favor of the third party indicated in the application.

For information

It is not necessary to talk about the existence of an established official position on the issue of the possibility of deduction from the employee's salary at the request of the employee.

In the letter of Rostrud dated July 18, 2012 No. PG / 5089-6-1, it is noted that no other additional deductions from wages by the decision of the employer, in addition to those provided for in Art. 137 of the Labor Code of the Russian Federation are not allowed, except in cases where other federal laws impose on the employer the obligation to make deductions from the wages of employees. Therefore, at the request of the employee, the employer is not entitled to deduct amounts from his salary to repay a bank loan. And already in a letter dated 26.09.2012 No. PG / 7156-6-1 Rostrud expressed the opinion that such a situation (repayment of a loan without receiving funds to an account or on hand) is legitimate, since it is not about retention, but about the will of the employee to dispose of the accrued wages, and that the provisions of Art.