On average how much does it cost to raise a child

Cost of Raising a Child

How much does it cost to have a baby and raise them? A 2015 study done by the USDA found that it cost an estimated $233,610 to raise two children from birth to age 17 in a middle-income family with two parents. That figure, adjusted for inflation, is just over a quarter of a million dollars at $286,000 in 2022. Shouldering the cost of raising children can be an additional pressure on parents, especially as costs continue to rise. Here’s what you need to know.

How much does it cost to have a baby?

Having a child is an undeniably major life change. Women and families today may be more anxious to understand how life and their financial situation might change with a baby, whether anticipated or unplanned. Here are just some of the expected costs related to having and raising a baby:

Insurance Life- The average cost of powdered formula is around $400-$800 per month for babies who are exclusively fed on formula. This cost could be different depending on your situation, such as if your baby needs special formula, if there is a formula shortage or recall or if your baby is also fed breast milk.

(Babycenter.com)

- A study by the Kaiser Family Foundation found that the total costs associated with being pregnant, experiencing childbirth and postpartum care averaged $18,865. (Kaiser Family Foundation)

- That same study found that average vaginal deliveries cost $14,768, with $2,655 paid out of pocket, while the average cesarean section cost $26,280, with $3,214 paid out of pocket.(Kaiser Family Foundation)

- A home birth could cost between $1,500 to $5,000, but typically isn’t covered by health insurance. (Healthline)

- Adoption and in vitro fertilization (IVF) costs can also vary. One cycle of IVF could range between $4,900 to $30,000 depending how the procedure is performed, while private adoption fees could be between $20,000 to $45,000.

(Healthline)

(Healthline) - The annual cost of childcare for infants to four years old averages about $10,000 per child for center-based care and $8,000 for home-based care. (S. Treasury Department)

- A survey from CNBC found that the weekly cost of a nanny for a single child in 2021 was $694, up from $565 in 2019. An after school sitter in 2021 was $261, slightly higher than the 2019 figure of $243. (CNBC)

- That same study found that parents reported spending more than 20% of their household income on childcare, although 72% reported spending 10% or more. (CNBC)

- With babies going through 6-12 diapers per day, this could mean up to $936 per year, or $18 a week, spent on disposable diapers. (Healthline)

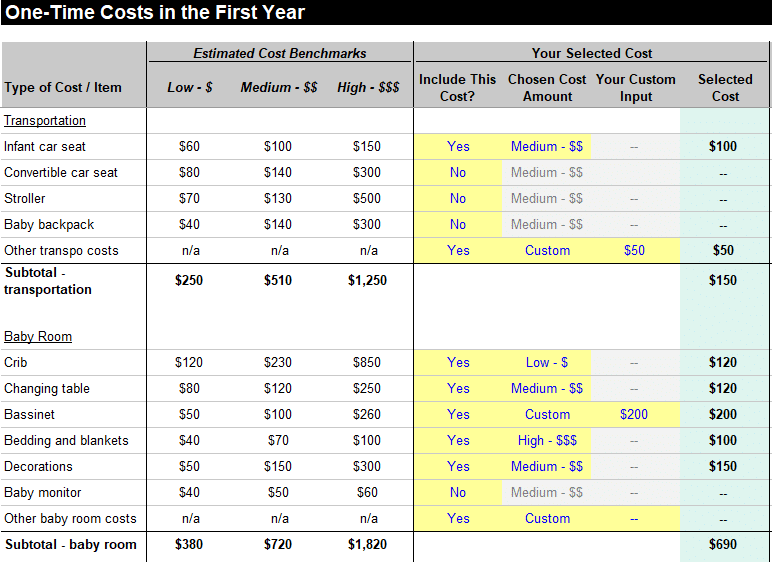

- Getting all the necessary gear for a baby, like strollers, car seats, play pens and carriers, can cost anywhere from $425 to nearly $3,000.

(The Bump)

(The Bump)

How much do school expenses cost?

A major expense when it comes to raising children is the cost of education. Starting with preschool, the average cost per year of tuition can range from $4,460 to $13,158 per year, or about $372-$1,100 per month.

When it comes to kindergarten through high school, parents can choose between public and private schools. For private schools, the Education Data Initiative estimated that tuition costs an average of $12,350 per year. Associated costs, like technology, textbooks, back-to-school supplies and more, could bring that up to $16,050. For a child to be in private school from kindergarten through eighth grade, the estimated cost could be around $208,650.

Public schools don’t charge a tuition fee like private schools, but that doesn’t mean there aren’t costs as well. In 2016, the University of Michigan estimated that it cost $302 per student to play sports, $218 for arts like music, theater or yearbook, and $124 for other clubs. These figures included costs like participation fees, equipment and travel, and may have been increased since due to inflation.

These figures included costs like participation fees, equipment and travel, and may have been increased since due to inflation.

Paying for college

Currently, the average cost of full-time undergraduate tuition for a public university ranges from $10,740 for in-state students and $27,560 for out-of-state students. Parents who choose to pay for college can take advantage of savings plans like the 529 plan. Starting early in your kids’ lives allows you to leverage time to build up savings for your child’s post-high school education.

The school that your child attends matters, too. While they may receive a lower tuition for attending an in-state public school, they may want to go out-of-state as well. Below are the most expensive and cheapest states for out-of-state students attending a 4-year public university:

Insurance LifeFive cheapest states for out-of-state students attending a 4-year public university

- Florida: $4,463 per year

- Wyoming: $4,747 per year

- District of Columbia: $6,020 per year

- Nevada: $6,023 per year

- Utah: $6,700 per year

Five most expensive states for out-of-state students attending a 4-year public university

- New Jersey: $14,360 per year

- Illinois: $14,455 per year

- Pennsylvania: $15,565 per year

- New Hampshire: $16,679 per year

- Vermont: $17,083 per year

Other costs of raising a child

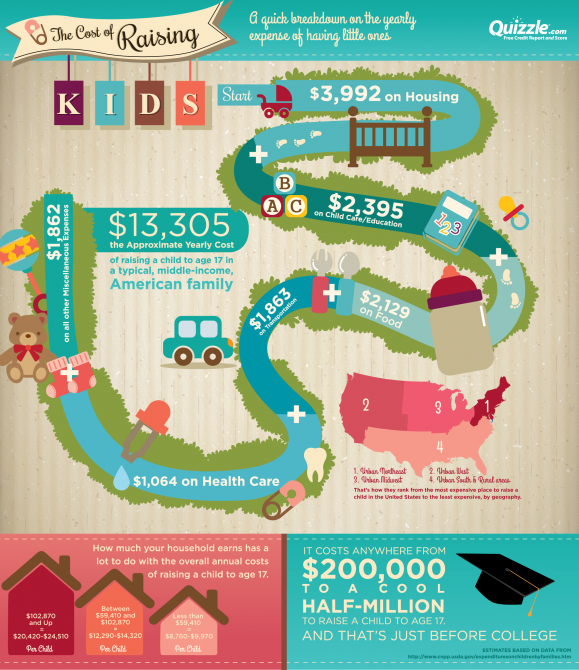

Though housing, food and child care are the highest cost categories related to raising a child to age 18, they are not the only expenses to consider. Other necessities like clothing, education and health care can be expensive. All of these categories should also be considered when factoring in the costs of having and raising a child.

Other necessities like clothing, education and health care can be expensive. All of these categories should also be considered when factoring in the costs of having and raising a child.

As your child gets older and earns their driver’s license, for instance, this could be a significant expense — Bankrate’s research found that adding your 16-year-old to your car insurance policy runs an average of $2,531 per year, although there are some relatively affordable car insurance options available for teens.

Housing

Housing is arguably the most significant expense associated with raising a child. In the USDA report, housing costs make up 29% of the overall cost of raising a baby. The cost of housing varies widely by location and the type of housing you choose. Many parents dream of a suburban house with a white picket fence and enough bedrooms for the entire family.

Based on a $250K dwelling coverage amount, the average cost of home insurance is $1,383 per year, according to 2021 Quadrant Information Services data. This is just one factor in the cost of owning a home; you will also have to consider the cost of a mortgage, utilities and maintenance.

This is just one factor in the cost of owning a home; you will also have to consider the cost of a mortgage, utilities and maintenance.

Food

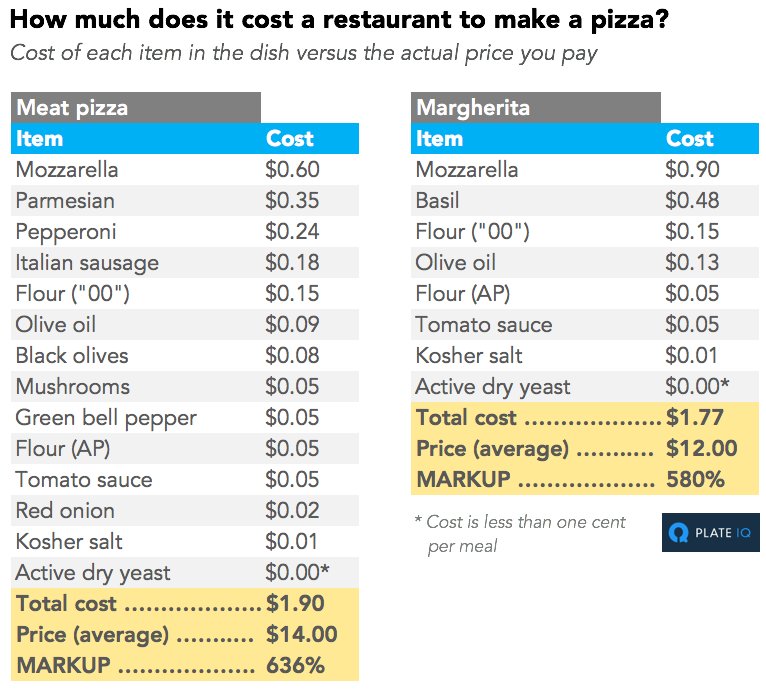

The cost of food is the second-largest expense, at 18% of the overall cost of raising a child. Over time, food prices have trended up, with food-at-home pricing increasing 12.1% and food-away-from-home pricing increasing by 7.7% from June 2021 to July 2022. The USDA expects rising costs for 2022, with increases as high as 10.0% and 7.5%, respectively.

To eat healthy foods, like high-quality meats and fresh fruits and vegetables, food expenses increase even more. In 2022, the costs for all food categories are expected to increase:

- Meats: +9.0%-10.0%

- Processed fruits and vegetables: +8.5%-9.5%

- Cereals and bakery products:0%-13.0%

Life insurance

Life insurance is crucial for families, especially if your income cannot be easily replaced if the unexpected were to happen. Funeral costs, living and education expenses and more can quickly add up even for those who budget carefully. Because of this, it’s also important to have a plan in the event that you or your partner are no longer able to financially support your children. Some parents rely on life insurance to ensure that, if they were to pass away, their family would be able to maintain their lifestyle and have some financial cushion for the future.

Funeral costs, living and education expenses and more can quickly add up even for those who budget carefully. Because of this, it’s also important to have a plan in the event that you or your partner are no longer able to financially support your children. Some parents rely on life insurance to ensure that, if they were to pass away, their family would be able to maintain their lifestyle and have some financial cushion for the future.

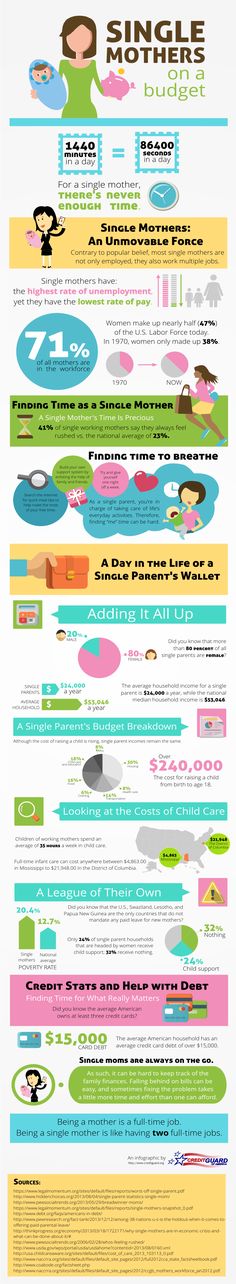

Both parents should consider purchasing adequate life insurance to replace their salary, even for a stay-at-home parent. A recent survey completed by Salary.com estimates the annual salary of a stay-at-home parent at $184,820 per year. In addition, life insurance is typically the least expensive when you are young and healthy, especially if you choose term instead of permanent life insurance.

The bottom line

Raising children is rewarding and fulfilling to many people. But it’s also very expensive these days. Infancy to age 18 is likely to cost you close to a quarter of a million dollars or more as a parent. But by preparing mentally and implementing financial planning strategies, you can be well-equipped to raise your child to adulthood comfortably, even on a budget. Given the ever-growing costs of raising a child, parents thinking of having a baby might want to consider some of the following tips: start early with a budget, try to live below your means, save money wherever possible, shop around for home and auto insurance each year for the best deal and purchase life insurance when you are young and healthy.

But by preparing mentally and implementing financial planning strategies, you can be well-equipped to raise your child to adulthood comfortably, even on a budget. Given the ever-growing costs of raising a child, parents thinking of having a baby might want to consider some of the following tips: start early with a budget, try to live below your means, save money wherever possible, shop around for home and auto insurance each year for the best deal and purchase life insurance when you are young and healthy.

The Cost of Raising a Child

Posted by Mark Lino, Economist at the Center for Nutrition Policy and Promotion in Food and Nutrition

Feb 18, 2020

Families Projected to Spend an Average of $233,610 Raising a Child Born in 2015.

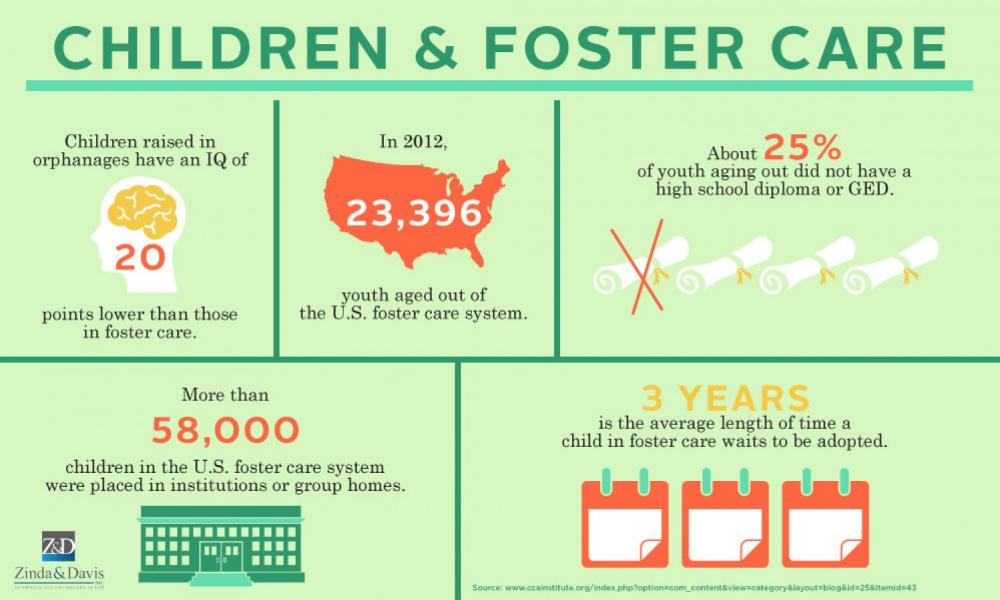

USDA recently issued Expenditures on Children by Families, 2015. This report is also known as “The Cost of Raising a Child.” USDA has been tracking the cost of raising a child since 1960 and this analysis examines expenses by age of child, household income, budgetary component, and region of the country.

Based on the most recent data from the Consumer Expenditures Survey, in 2015, a family will spend approximately $12,980 annually per child in a middle-income ($59,200-$107,400), two-child, married-couple family. Middle-income, married-couple parents of a child born in 2015 may expect to spend $233,610 ($284,570 if projected inflation costs are factored in*) for food, shelter, and other necessities to raise a child through age 17. This does not include the cost of a college education.

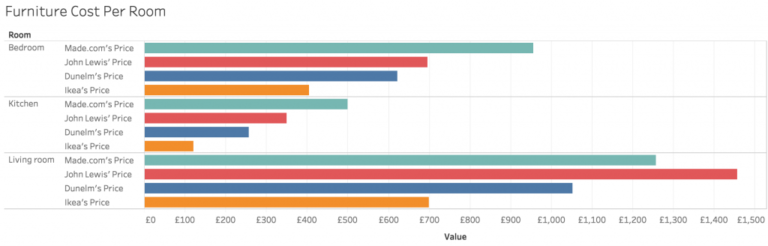

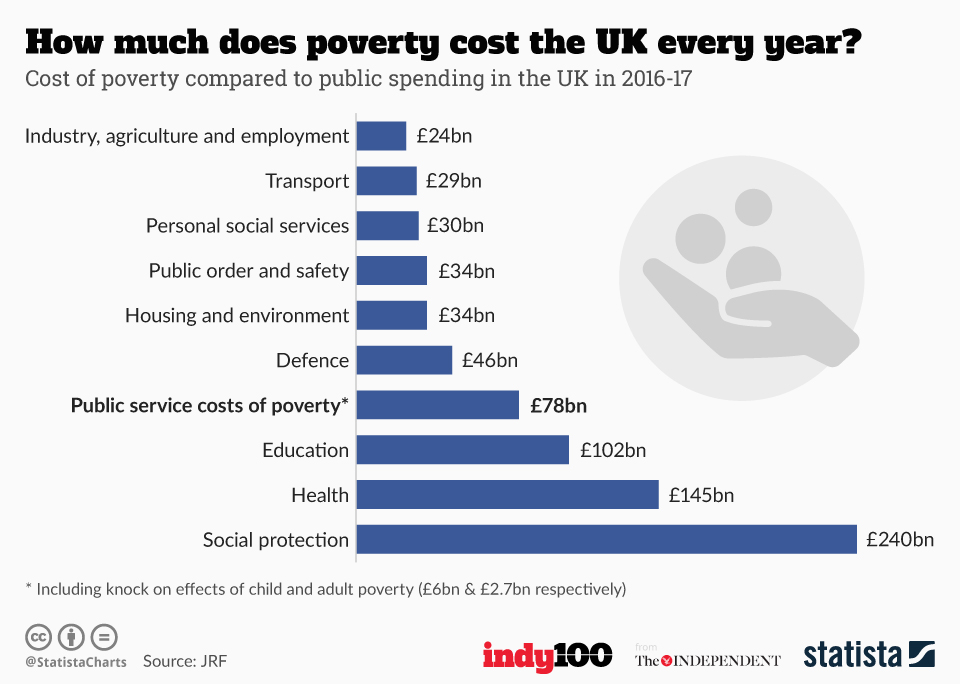

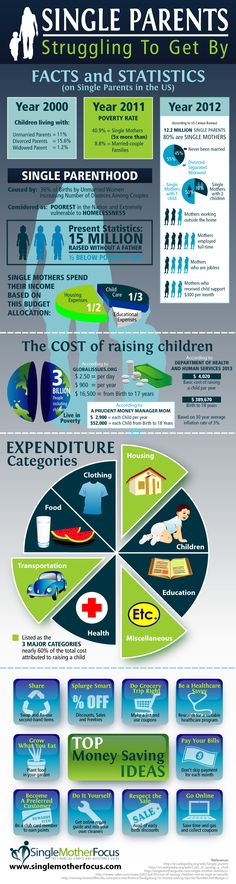

Where does the money go? For a middle-income family, housing accounts for the largest share at 29% of total child-rearing costs. Food is second at 18%, and child care/education (for those with the expense) is third at 16%. Expenses vary depending on the age of the child.

Expenses vary depending on the age of the child.

We did the analysis by household income level, age of the child, and region of residence. Not surprising, the higher a family’s income the more was spent on a child, particularly for child care/education and miscellaneous expenses.

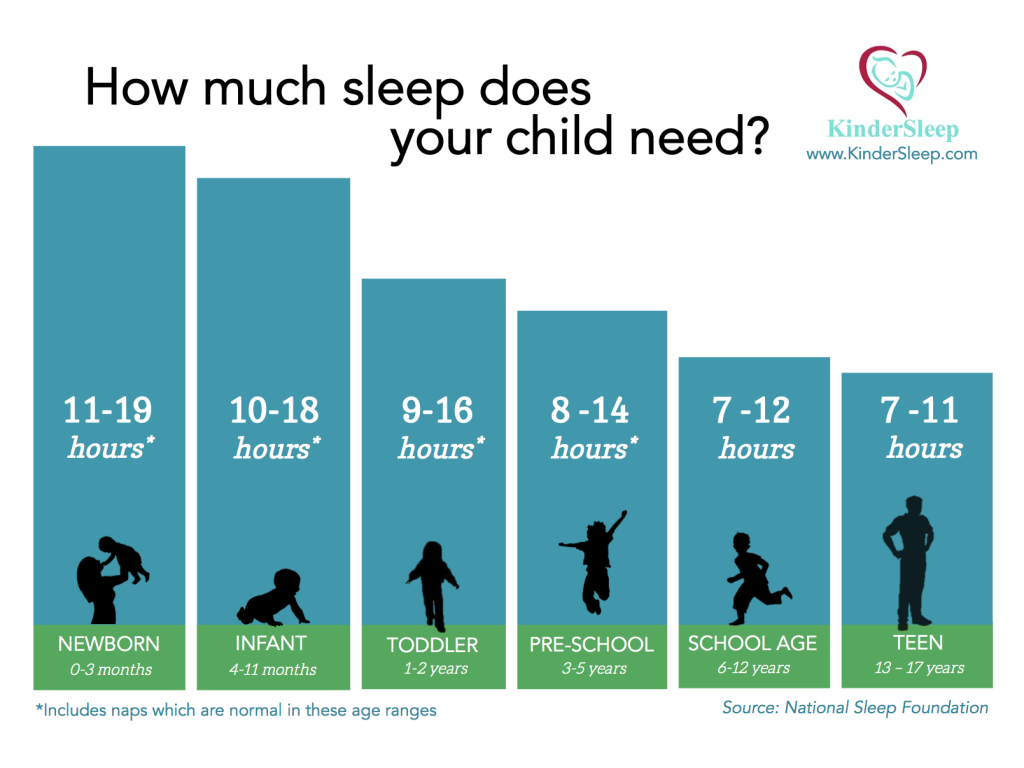

Expenses also increase as a child ages. Overall annual expenses averaged about $300 less for children from birth to 2 years old, and averaged $900 more for teenagers between 15-17 years of age. Teenagers have higher food costs as well as higher transportation costs as these are the years they start to drive so insurance is included or a maybe a second car is purchased for them.

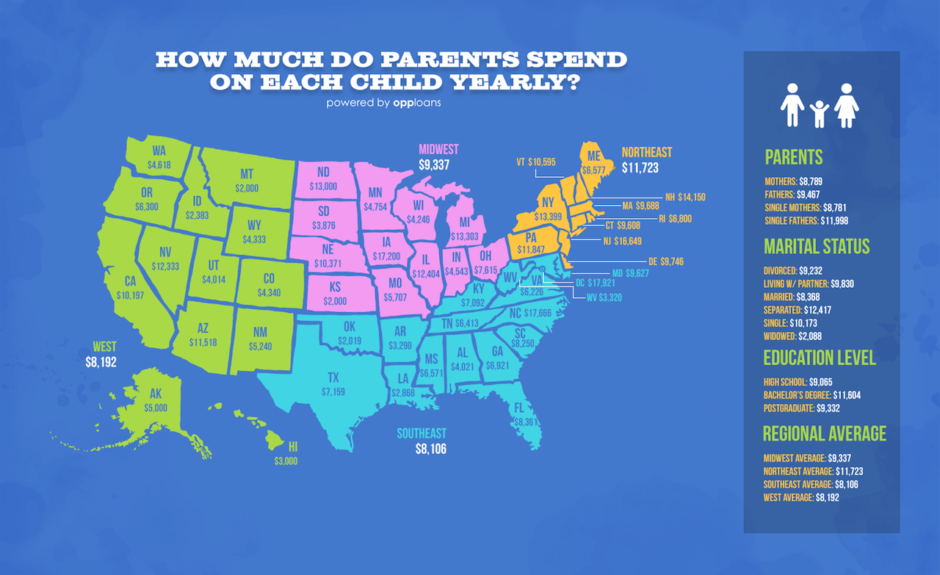

Regional variation was also observed. Families in the urban Northeast spent the most on a child, followed by families in the urban West, urban South, and urban Midwest. Families in rural areas throughout the country spent the least on a child—child-rearing expenses were 27% lower in rural areas than the urban Northeast, primarily due to lower housing and child care/education expenses.

Child-rearing expenses are subject to economies of scale. That is, with each additional child, expenses on each declines. For married-couple families with one child, expenses averaged 27% more per child than expenses in a two-child family. For families with three or more children, per child expenses averaged 24% less on each child than on a child in a two-child family. This is sometimes referred to as the “cheaper by the dozen” effect. Each additional child costs less because children can share a bedroom; a family can buy food in larger, more economical quantities; clothing and toys can be handed down; and older children can often babysit younger ones.

Food costs have decreased over the years thanks to increased efficiency in American agriculture.This report is one of many ways that USDA works to support American families through our programs and work. It outlines typical spending by families from across the country, and is used in a number of ways to help support and education American families. Courts and state governments use this data to inform their decisions about child support guidelines and foster care payments. Financial planners use the information to provide advice to their clients, and families can access our Cost of Raising a Child calculator, which we update with every report on our website, to look at spending patterns for families similar to theirs. This Calculator is one of many tools available on MyMoney.gov, a government research and data clearinghouse related to financial education.

Courts and state governments use this data to inform their decisions about child support guidelines and foster care payments. Financial planners use the information to provide advice to their clients, and families can access our Cost of Raising a Child calculator, which we update with every report on our website, to look at spending patterns for families similar to theirs. This Calculator is one of many tools available on MyMoney.gov, a government research and data clearinghouse related to financial education.

This year we released the report at a time when families are thinking about their plans for the New Year. We’ve been focusing on nutrition-related New Year’s resolutions – or what we are referring to as Real Solutions - on our MyPlate website, ChooseMyPlate.gov. This report and the updated calculator can help families as they focus on financial health resolutions. This report will provide families with a greater awareness of the expenses they are likely to face while raising children.

In addition to the report and the calculator, we also have a dedicated section on ChooseMyPlate.gov that provides tips and tools to aid families and individuals in making healthy choices while staying on a budget. For strategies beyond food, our friends at MyMoney.gov offer a wealth of information to help Americans plan for their financial future.

For more information on the Annual Report on Expenditures on Children by Families, also known as the cost of raising a child, go to: www.fns.usda.gov/resource/expenditures-children-families-reports-all-years.

*Projected inflationary costs are estimated to average 2.2 percent per year. This estimate is calculated by averaging the rate of inflation over the past 20 years.

Editor’s Note (March 8, 2017): The comparison of rural vs. urban northeast child care and education value has been updated.

Visit the U.S. Department of the Treasury’s MyMoney.gov for more resources to ensure financial well-being this New Year’s season!Category/Topic: Food and Nutrition

Tags: children choosemyplate. gov CNPP Cost of Raising a Child economics Expenditures on Children by Families Food and Nutrition mymoney.gov MyPlate Research

gov CNPP Cost of Raising a Child economics Expenditures on Children by Families Food and Nutrition mymoney.gov MyPlate Research

Write a Response

Comments

SEB survey: how much does it cost to raise one child

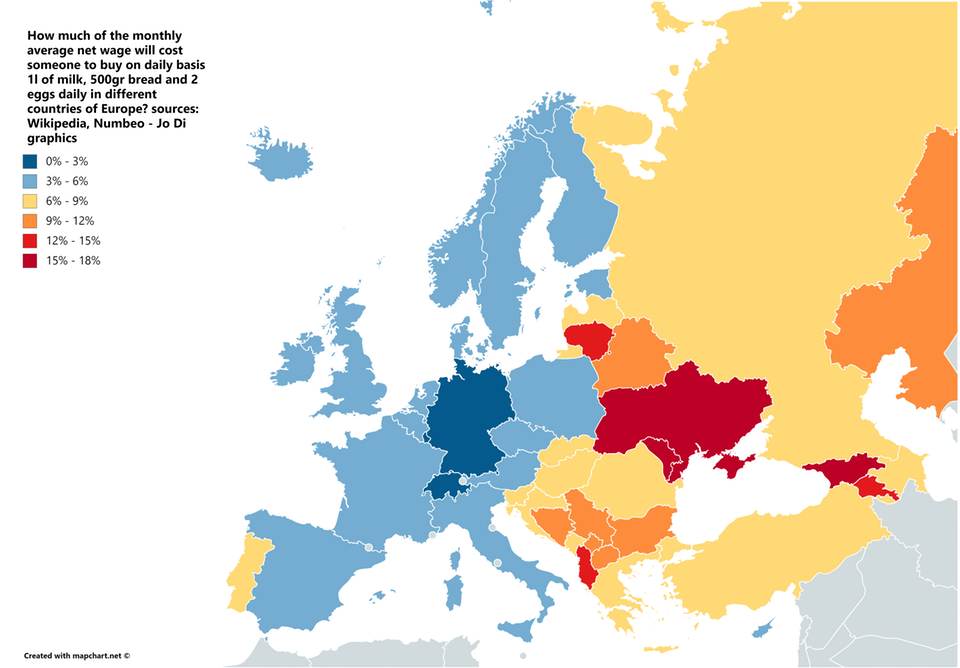

40 per cent. of interviewed parents, who calculated how much it costs to support a child under 18, indicated that the amount ranges from 3,000 to 5,000 euros per year. Another 13 percent indicated that the costs amounted to more than 5,000 euros per year. With monthly expenses of 500 euros or more for 18 years, an amount of more than 100,000 euros is generated, SEB said in a statement.

True, if the child attends a private school, these amounts can increase significantly. A year of education in a private school costs an average of about 6,000 euros per year. And this is without taking into account school meals, which average 5.5-6.5 euros per day, additional paid circles, expenses for excursions, etc. In this case, the amount for raising a child can reach 200 thousand euros.

A year of education in a private school costs an average of about 6,000 euros per year. And this is without taking into account school meals, which average 5.5-6.5 euros per day, additional paid circles, expenses for excursions, etc. In this case, the amount for raising a child can reach 200 thousand euros.

These expenses increase every year due to inflation. Especially they jumped this year. According to the Department of Statistics in July, the prices of almost all goods and services related to the upbringing of children increased: school meals (17 percent), stationery (14 percent), recreation and culture services, mugs (11 percent), books (5.9 percent), shoes (3.9 percent), clothes (0.9 percent). Many parents have already felt this when in September the children returned to educational institutions and circles.

If the family has not one, but two or more children, the costs will be even higher. True, it’s not worth multiplying by two, because raising a second or third child usually costs parents less than the first - and because of the necessary things already available, clothes, furniture that can be reused, and because of the increase in benefits, discounts.

Mugs are an investment in future abilities

Mugs, whose prices have increased by at least one tenth, according to statistics, are an important part of raising a child. According to the study, half of the parents send their children to one paid circle, a quarter - to two paid circles, and only 7 percent. three of those surveyed. Almost a fifth say they cannot afford to send their children to children's clubs.

"Although education should not be saved, as it is one of the most important areas to invest in when thinking about the future of the child, circles, especially paid ones, should be chosen responsibly so that they not only do not create a financial burden, but also in fact in fact, were related to the child's abilities that you want to develop and which will be useful in the future, "says S. Strotskite-Varne.

In addition to clubs, don't forget about additional expenses for concerts, performances, special equipment or clothing, etc.

Food to school from home is still rare

On average, a student spends about 3 euros a day on food at school. True, recently a lunch for one child has risen in price by about 30 percent due to rising food prices. and reaches up to 4 euros (the specific cost of lunch, of course, depends on the school and the chosen dish). Therefore, for a family, meals for a child cost about 60-70 euros per month. If a child stays at school all day and eats several times, the costs can increase by a third.

Half of the parents surveyed say that their children always buy food at school, a third say they occasionally bring food from home, and only 13 percent. always wears his food.

Children are indifferent to fashion - let's use it

Although according to statistics, the prices of clothes and shoes have increased relatively the least, children grow up very quickly, so spending on their clothes and shoes always makes up a large part of the family budget.

More than half of the parents surveyed say they need to update their children's wardrobe every month, a third say they make such purchases three to four times a year, but in this case they spend more money.

Clothing is one of those categories on which we often spend more than we should. According to the study "Household Budget 2021" published by the Department of Statistics, a statistical family of four spends about 104 euros per month on clothes and shoes, and the amount of clothes thrown into textile containers reaches about 1,800 tons in Vilnius alone.

"Young children often don't care what they look like, whether they're wearing new clothes or second-hand clothes, which in many cases can cost five or even ten times less than new," says the SEB expert.

By saving money in this area, we could spend more money on clubs and education, which can have a much greater impact on a child's future than just another new sweater or blouse, emphasizes S. Strockite-Varne.

Commissioned by SEB Bank, the study was conducted by Norstat. In August of this year, 300 parents raising children aged 7-17 (inclusive) were surveyed throughout Lithuania.

The cost of raising a child in the USA - Financial Encyclopedia

No one wants to value a child financially like buying a car or a house, but by the time the child reaches 18, they will cost their parents more than some houses. Be prepared to pay a lot of money for this cute little package. For example, according to the USDA, parents who have a child today will spend an average of $284,570 by the time the child turns 18.

The figure shown is for a middle-income couple with two children, and the USDA assumes they had childcare and education expenses. Knowing these numbers will allow parents to better control their spending.

Key takeaways

- On average, middle-income parents will spend $284,570 by the time their child turns 18.

- Housing costs are highest, followed by food.

- The cost of childcare varies greatly depending on where you live.

- The good news is that each additional child costs less thanks to economies of scale.

Highest cost: Housing

The biggest expense is housing. Expenses include mortgage or rent, taxes, repairs, insurance, utilities, and all the “things” that parents buy for their home. According to a USDA study, these expenses account for 29% on the cost of a child. But take heart. If you have more children, you will not double or triple the cost of one child, because many resources are shared. You may need to add an extra bedroom, but not a kitchen or living room.

Naturally, you have to divide housing costs by the number of people in the house and take into account that the use of these resources is uneven among family members. A 30-year-old father probably uses more water and electricity than his six-month-old daughter. Of course, these adjustments are made by the authors report has already been submitted.

There are even more variables that contribute to higher or lower housing costs. First, housing costs vary widely by region. According to the USDA, spending was highest in cities in the Northeast and lowest in rural areas of the country.

Executive summary

Single parents will spend on average 7% less than families with two parents because they are more likely to be in a lower income group. But the percentage of single parents' income that goes to their children is higher.

Food costs

If you already have kids, you know they eat a lot, so it's no surprise that this is the second highest cost of raising a child. If you had one dollar for every time your child said: "I'm hungry," you could probably offset most of your annual food expenses. Food expenses accounted for about 18% of the total from birth to age 171.

The USDA breaks down spending into four spending tiers. For low-income families or those who can stretch their budget, there is an inexpensive "thrift plan. " Followed by "low cost plan", "moderate cost plan " and finally "liberal plan".

" Followed by "low cost plan", "moderate cost plan " and finally "liberal plan".

Costs range from $96.40 to $177.70 per month for a 1-year-old, with a moderate plan of $146.60 per month. By the time your child is nine years old, this moderate-cost plan will rise to $273.70 dollars. Under the same plan, an 18-year-old man eats $311 worth of food every month, and a woman eats $248.50 worth of food.

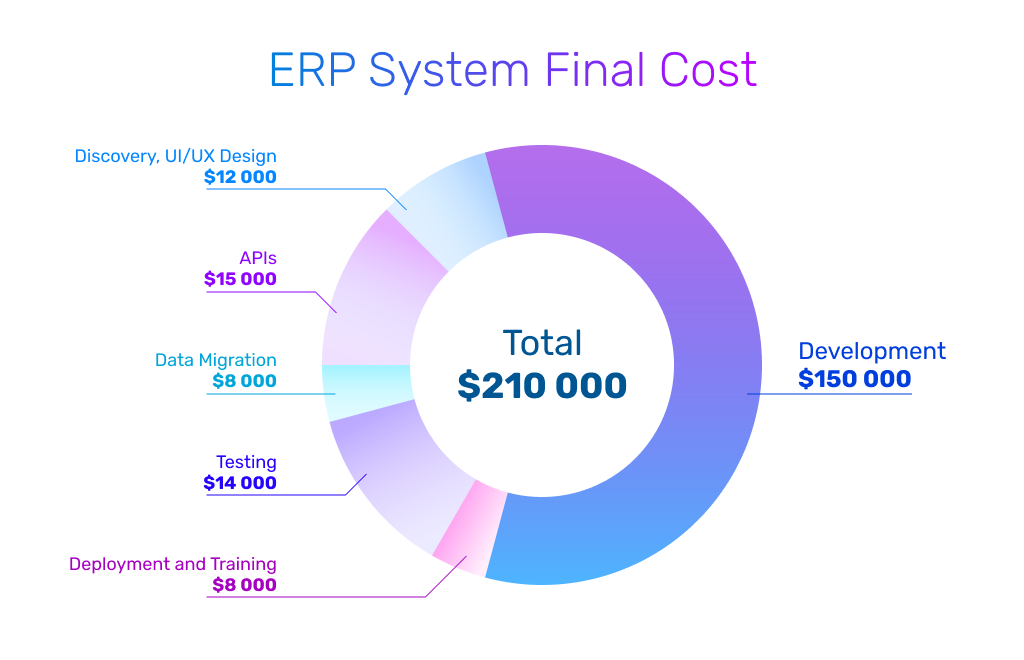

Childcare and Education

According to the USDA, childcare and education for parents who bear these costs is 16% of the cost of raising a child. The cost of childcare in the US ranges from 5,436 to 24 $243 per year, according to the Economic Policy Institute (EPI). Needless to say, the cost of childcare depends on where you live.

Top paying Washington residents. Baby care costs 19$112 a year and $24,243 for a four-year-old. EPI data shows a four-year public college education in the state costs much less, $5,756.

Parents in Mississippi pay the lowest annual child care cost, which costs $5,436 for an infant and $4,784 for a four-year-old.

Quick Overview

If you have more than two children, babysitting may be more economical than daycare because babysitters typically don't charge twice as much as some daycares. On the other hand, kindergartens may offer a discount if you have more than one child enrolled.

Total amount

For other expenses the breakdown is as follows:

- Transport, 15%

- Health care, 9%

- Clothes, 6%

- All other expenses, 7%

Overall, when a child reaches the age of majority (18), parents will spend an average of $284,570. According to USDA inflation-adjusted data, this is significantly higher than the $233,610 for parents who had a child in 2015 year.

Good news: economies of scale

There is good news when it comes to the cost of raising a child in America. Economies of scale also extend to the number of children you have. The USDA notes that each additional child costs less because siblings can share the same bedroom and the family can buy food in larger and more cost-effective quantities.