How to report missed child support payments

Collect A Child Support Payment

How Do I Collect Child Support?

- Checkbox

Get Prepared

Either parent can Open a Child Support Case online, call the DCSS office at 1-844-MYGADHS (1-844-694-2347) or print, fill out and mail in their application packet. You can also complete the application online, then print it out and bring it with all required and supporting documents to your local Child Support Office.

However, to get a support order, establish paternity, or enforce a support order, DCSS must know where the noncustodial parent (NCP) lives and/or works. There is no guarantee the other parent will be found, but the more information you provide, the easier it will be.

DCSS will order a paternity test to be conducted if paternity has not been established or if it is disputed.

- Checkbox

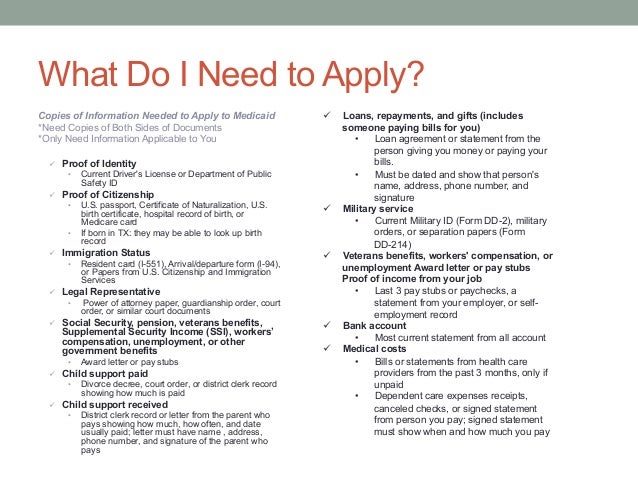

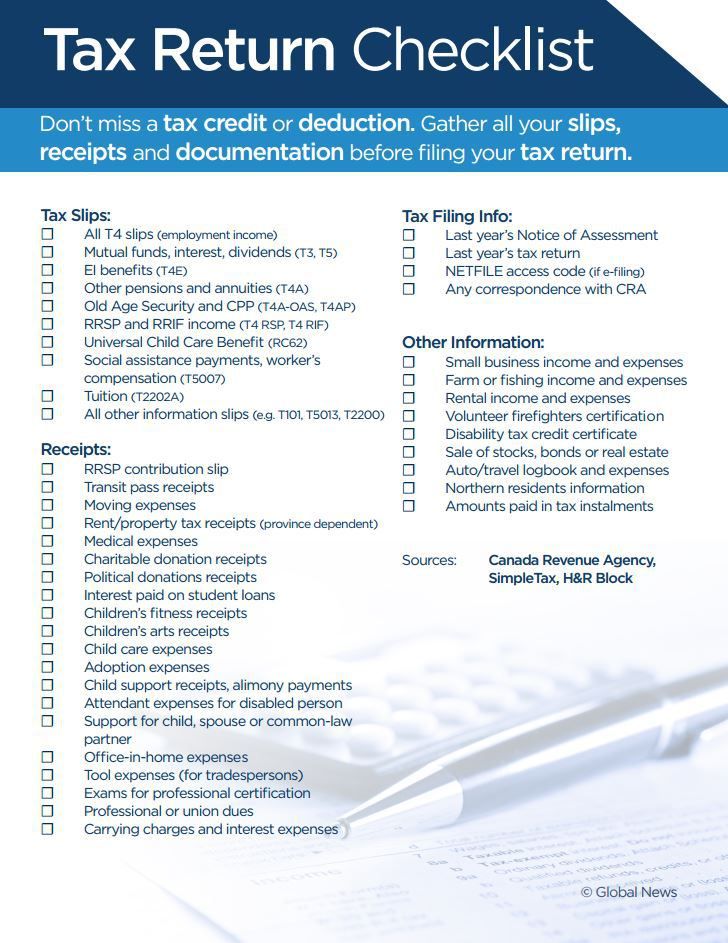

Gather What You’ll Need

-

One form of government-issued picture ID (Valid driver’s license, passport, Green Card, Visa)

-

Birth certificates for children born OUTSIDE of Georgia

-

School enrollment verification

-

Photocopy of all existing support orders, including the divorce decree that contains spousal with child support

-

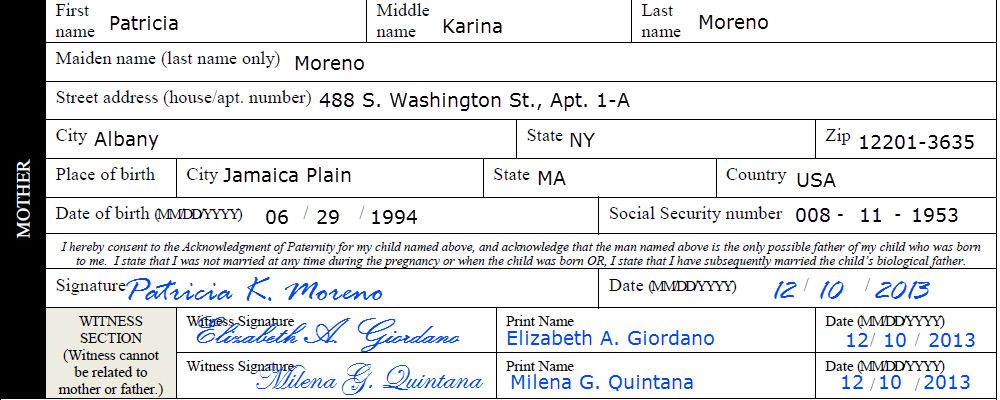

Paternity Acknowledgement- Unwed parents are given a chance to sign a Voluntary Paternity Acknowledgement form at or near the time of the child’s birth

-

- Checkbox

- Checkbox

Apply

Fill out the application completely, then mail it and any applicable fees to the child support office in your county.

Call the DCSS Communications Center at 1-844-MYGADHS (1-844-694-2347) if you need further information on the application process.

- Checkbox

Set Up Payments

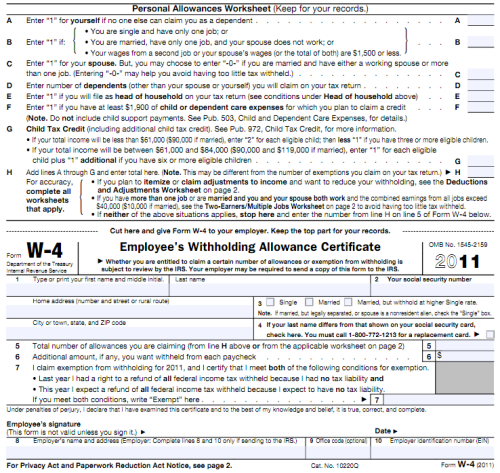

You can receive payments through either a debit card or direct deposit. State law requires income withholding, and in most cases the support amount can be deducted from the NCP's paycheck.

- Checkbox

Enforce the support order

If a parent does not obey a support order, he or she may be found in contempt of court. A contempt action may be filed against the NCP who fails to make support payments or does not maintain the required medical insurance. NCPs found in contempt of court may be fined, sentenced to jail, or both.

The judge may order the NCP who is unable to pay to be enrolled in the Fatherhood Program or in the Parental Accountability Court program. In addition to being enrolled in one of these programs, the NCP is still obligated to pay the full amount of current and past-due support.

The child support order may also be enforced through one of the following actions:

The child support order may also be enforced through one of the following actions:-

Withholding child support from paychecks, unemployment or weekly worker's compensation benefits

-

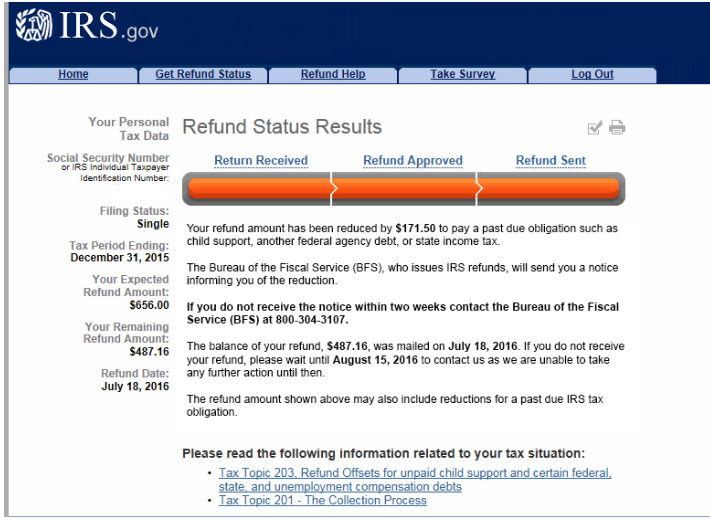

Offsetting federal and/or state income tax refunds

-

Reporting the parent’s delinquent child support payments to the three credit reporting bureaus

-

Suspension or revocation of a NCP’s drivers’, professional, occupational or recreational hunting or fishing licenses for their failure to pay child support as ordered

-

Intercepting lottery winnings when they exceed $2,500

-

Filing contempt actions in the superior court which may result in a jail sentence if the NCP is found to be in contempt of court

-

Filing of liens to seize matched bank accounts, lump sum worker's compensation settlements and real or personal property

-

Denial, suspension or revocation of the passport of someone who owes more than $2,500 in child support

-

Contact

Press 1 to receive Automated Case Information

Press 2 to speak with an Agent, or

Press 3 for Outreach Services

Find a Local Office

Find a Child Support Services Location

Search by city, county, or zip code

This information was prepared as a public service of the State of Georgia to provide general information, not to advise on any specific legal problem. It is not, and cannot be construed to be, legal advice. If you have questions regarding any matter contained on this page, please contact the related agency.

It is not, and cannot be construed to be, legal advice. If you have questions regarding any matter contained on this page, please contact the related agency.

Enforce Support

The Friend of the Court is responsible for enforcing child support orders. Many enforcement methods (described below) can be used if a parent does not follow terms of the order.

Income WithholdingAn income withholding order can be used to collect both current and past-due support (arrearages). All new and modified child support orders are required to include income withholding, unless both parents and the court agree on other payment methods.

Under income withholding, child support and medical support payments are deducted from the non-custodial parent's paycheck. The employer sends the support payments directly to the Michigan State Disbursement Unit (MiSDU). Federal and state laws require employers to honor income withholding orders.

A parent's income from other sources, such as unemployment benefits, Social Security benefits, independent contracting, workers' compensation claims, and insurance claims are also subject to income withholding.

If the amount of past-due support (arrearages) reaches a certain level (threshold), both federal and state tax refunds can be intercepted to pay support.

The past-due threshold for state tax refund offset is $150. The federal past-due threshold is $150 for cases that receive cash assistance; the non-cash assistance threshold is $500.

For both state and federal tax refund offset, the person who owes the support receives a notice explaining his or her right to object to the tax refund offset and reasons to object. In a joint tax return, a spouse may make a claim to retain his or her portion of the refund.

Show Cause/Bench WarrantA person who has not paid child support or has not provided medical support can be ordered to appear before the court to explain to the court why he/she should not be held in contempt. This is called a show cause hearing.

If the person ordered to appear at a show cause hearing does not show up, the court may order a variety of enforcement actions, including issuing a bench warrant for the arrest of the person who did not show up for the show cause hearing.

The Friend of the Court or the Office of Child Support can initiate a lien/levy against real or personal property, financial assets, or insurance claims for collection of child support.

License SuspensionDriver's licenses, recreational or sporting licenses (hunting, fishing, etc.), and professional licenses can be denied, suspended or revoked if a parent is behind more than two months in payments.

Credit ReportingIf a parent is behind more than two months in payments, he or she is automatically reported to a consumer credit reporting agency.

Passport DenialA parent's passport may be denied or revoked when he or she reaches the past-due support threshold of $2,500.

National Medical Support NoticeEnforcement of medical support is done through the National Medical Support Notice for employer-provided insurance or through any of the other enforcement methods listed if cash payments are required.

A Qualified Domestic Relations Order (QDRO) is a support order against a private pension account. An Eligible Domestic Relations Order (EDRO) is a support order against a state or federal government pension plan. A QDRO or EDRO can be issued for current support or past-due support (arrearages).

SurchargeA judge may order a surcharge be added to a case that has arrearages. If a surcharge is ordered, it will be added to the case every January 1st and July 1st and become a part of the total amount of support owed.

The surcharge is a variable rate tied to five-year United States Treasury Notes, plus 1%.

Criminal/Felony ChargesThe Friend of the Court can refer the case to the county prosecutor, who may charge the person who owes support with the crime of felony non-support. In some counties, the case may be referred to the Attorney General for criminal prosecution of felony non-support. Felony non-support charges are generally issued after other child support collection methods have not been successful. Custodial parents may also ask the county prosecutor or Attorney General for felony non-support prosecution.

Felony non-support charges are generally issued after other child support collection methods have not been successful. Custodial parents may also ask the county prosecutor or Attorney General for felony non-support prosecution.

For additional enforcement detail, review the Child Support Policy manuals.

State organizations inform - Official website of the Nizhnyaya Salda city district administration

16+

Official website of the Nizhnyaya Salda city district administration

Version for the visually impaired

1224

News

Popular materials

Unified allowance issued to parents of 22 thousand children from new regions of Russia

From September 1, 2023, the law on the procedure for providing public gas supply services comes into force

The Social Fund of Russia updated the number of the contact center

Information about the World Consumer Rights Day and competitions held

Almost 9. 5 thousand disability pensions were assigned to Sverdlovsk residents without application in 2022 The Center for Hygiene and Epidemiology in the Sverdlovsk Region asked a consumer to return money for a low-quality jewelry item.

5 thousand disability pensions were assigned to Sverdlovsk residents without application in 2022 The Center for Hygiene and Epidemiology in the Sverdlovsk Region asked a consumer to return money for a low-quality jewelry item.

The tax authorities annually implement measures to calculate property taxes for individuals. The amounts of property taxes calculated by individuals are included in tax notices, on the basis of which citizens pay property taxes. In 2023, the tax authorities will calculate taxes for 2022.

Department of the Federal Tax Service of Russia No. 16 for the Sverdlovsk Region during March conducts webinars for taxpayers online:

Interdistrict IFTS of Russia No. 16 for the Sverdlovsk Region reminds that no later than May 2, 2023, it is necessary to submit a declaration of income of individuals. You can submit a declaration at the place of your registration to the tax office or to the MFC. This can also be done online - in the Taxpayer's Personal Account for individuals or through the "Declaration" program. To do this, fill out the form 3-NDFL, approved by order of 29.09.2022 No. ED-7-11/880@.

To do this, fill out the form 3-NDFL, approved by order of 29.09.2022 No. ED-7-11/880@.

From January 1, 2023, a new mechanism for settlements with the state began to operate in Russia - the Unified Tax Account (UNS). It is designed to make the fiscal system more convenient and transparent, as well as to prevent various errors when making mandatory payments to the budget. How the new system works, what is the Single Tax Payment (UTP) is explained by specialists from the Interdistrict Federal Tax Service of Russia No. 16 for the Sverdlovsk Region.

In the period from 03/27/2023 to 03/31/2023, the city prosecutor's office organized a personal reception of citizens on issues of preferential drug provision.

There are two ways to deliver the insurance pension at the pensioner's choice: through a credit institution by crediting the insurance pension to the pensioner's account with this credit institution, or through the federal postal service by handing the insurance pension at home or at the box office of the federal postal organization.

It is envisaged, in particular, that in the case of the provision in an apartment building, which is managed by a residential complex or HOA, a utility gas supply service, the charter of the managing organization should provide for the obligation to conclude an agreement with a specialized organization on the maintenance and repair of in-house gas equipment (if such equipment installed).

Tuberculosis is an airborne infectious disease caused by Mycobacterium tuberculosis. The main source of the pathogen is a person who has a bacillary (pulmonary) form of tuberculosis and secretes mycobacteria from the respiratory tract when coughing, sneezing, talking. A person only needs to inhale a small amount of these bacteria to become infected.

The Nizhny Tagil Department of the Rospotrebnadzor Administration for the Sverdlovsk Region informs that in January-February 2023, 1 case of chronic hepatitis C was detected in the city district of Nizhnyaya Salda - an indicator of 5. 80 per 100 thousand of the population, which is 20% more than the average regional level.

80 per 100 thousand of the population, which is 20% more than the average regional level.

The Social Fund of Russia provides more than half a million services a year in Crimea and Sevastopol. They are received by pensioners, the disabled, families with children, as well as residents of the peninsula who are eligible for federal support measures.

State support for employers in 2023 in 2023, the Social Fund of Russia provides for the provision of subsidies by the Social Fund of Russia to legal entities, including non-profit organizations, and individual entrepreneurs in the employment of certain categories of citizens .

Starting from June of this year, a single date for payments from maternity capital for children under 3 years old will be introduced. Families that have signed up for this support measure will begin receiving funds on the 5th of each month. They will come not for the current, but for the previous month.

Members of the Civic Chamber of the Russian Federation invite residents of the Sverdlovsk region - scientists, agronomists, volunteers, teachers and social workers, as well as gardeners and gardeners to take part in the All-Russian action.

Branch of the Social Fund of Russia in the Sverdlovsk region exchange information with educational organizations so that parents can quickly and easily dispose of maternity capital for the education of children.

Citizens are required to make timely and full payments for housing and utilities (Part 1, Article 153 of the LC RF).

In order to maintain a certain standard of living of the alimony recipient in the conditions of inflation, alimony indexation is carried out.

Residential premises may be withdrawn from the owner in connection with the withdrawal for state or municipal needs of the land plot on which such residential premises or an apartment building (hereinafter referred to as the MKD) in which the premises are located are located.

In the period from 03/14/2023 to 04/28/2023, the city prosecutor's office organized a personal reception for the families of citizens mobilized in connection with a special military operation.

In the period from March 13 to March 24, 2023, the Nizhny Tagil Department of Rospotrebnadzor for the Sverdlovsk Region and the Nizhny Tagil Branch of the FBUZ "Center for Hygiene and Epidemiology in the Sverdlovsk Region" as part of World Consumer Rights Day 2023 under the motto "Empowering consumers through the transition to consumption of environmentally friendly energy and products” the All-Russian “hot line” for consumers is being held.

Waste bin parking: more than 30 times in February, waste collection was delayed due to cars in front of the sites.

On the portal "Open Government of the Sverdlovsk Region", in pursuance of the Decree of the Governor of the Sverdlovsk Region dated April 21, 2014 No. 202-UG, sociological surveys of the population are conducted according to the criterion "Satisfaction of the population: the level of organization of heat supply (supplying the population with fuel), water supply (water disposal), electricity, gas supply.

March 15 is celebrated annually as World Consumer Rights Day as the day of the international consumer movement.

News, announcements

5

Like

Add a comment

Only registered And authorized users. The comment will appear after verification by the administrator site.

Login

Up/down

Basic unemployment benefit Bürgergeld

Social support in Germany for the unemployed and family members. Benefit Bürgergeld. What is included in helping the German poor.

5.4 million people in Germany receive Bürgergeld benefits.

Prior to 2023, support was called Hartz 4 - this is the informal name for basic unemployment benefit of the second level . Also gone are the names Arbeitslosengeld 2, ALG II, ALG 2.

In the early 2000s, Volkswagen's German manager Peter Hartz led the development of a concept for reforming social laws. Part IV of the proposals formulated concerned the payment of basic support to those who found themselves out of work for a long time. Hence the manual was popularly nicknamed Hartz-4.

Unemployed able-bodied residents of Germany are first eligible to receive ALG 1 insurance benefits if they have worked at least 12 months out of the last 24. If the right to the first level of assistance is not earned or ends and no work is found, it is allowed to apply for Bürgergeld.

If the right to the first level of assistance is not earned or ends and no work is found, it is allowed to apply for Bürgergeld.

“The benefit is not poverty, it is our answer to poverty” (Former German Minister of Health Jens Spahn).

Right to Bürgergeld

Assistance is provided to able-bodied low-income residents of Germany who do not independently ensure the minimum financial well-being for themselves and their families.

Performance is determined by the conditions:

- Able to work at least 3 hours a day.

- Over 15 years old.

- Younger than the German retirement age 65-67.

Minor children living with Bürgergeld-receiving parents also receive benefits.

To apply for benefits, able-bodied unemployed submit a request to the local Jobcenter - labor exchange. Forms are available for download on the job center website. An initial application for assistance may be submitted without a form.

Unemployable burghers apply to Sozialamt for social assistance Sozialgeld.

After filing an entree, the poor must come to an appointment at the labor exchange.

After the application has been submitted, the processing officer, Sachbearbeiter, invites the applicant for an interview. The further process takes several months.

If is approved, support starts retroactively from the first day of the month when the request is submitted.

Not receiving support:

- Adult students, schoolchildren and other students - they are not considered job seekers.

- EU citizens residing in the country for less than 5 years if they have worked in Germany for less than a year.

- Citizens of other countries, if they do not have a residence permit, which implies a stay in Germany, regardless of income.

Community in need - Bedarfsgemeinschaft

Direct relatives of the unemployed who live together are also considered to be in need of support if their financial condition depends on the income of the head of the family.

Distinguish between cohabitation and separate housekeeping. If adults and children live together but are financially independent, they do not legally form a community.

The family of an unemployed person includes:

- self applying for support;

- spouse or partner, if the joint management of the household lasts more than a year;

- unmarried children under 25 years of age without their own income;

- parents who have reached retirement age.

When calculating the amount of assistance, the income of each family member included in the community is taken into account. Two adults living together get 90% benefit, not the full amount.

The monetary component of support for the poor and unemployed in Germany is not the most important.

Benefit amount

It is impossible to give a specific amount in euros without considering the individual situation. Assistance to the poor unemployed consists of several components :

- Financial support according to the Regelsatz level.

- Payment for adequate housing and heating.

- Taking over the collection of state health insurance or part of the contribution to a private insurance fund.

- Required additional support.

Regelsatz

The needy falls into one of 6 categories , according to which financial support is paid.

Base benefit rates are adjusted regularly based on a “mixed index”. The index depends on the rise in prices for goods and services.

The last increase in payments occurred in January 2023.

| Category of recipient of social assistance | Amount |

|---|---|

| 1. Single adults | 502€ |

| 2. Adults in the community | 451€ |

| 3. Disabled persons in a care facility or adult children living with their parents | 402€ |

4. Teenagers from 14 to 17 Teenagers from 14 to 17 | 420€ |

| 5. Children from 6 to 13 | 348€ |

| 6. Children under 5 | 318€ |

The money part of the Hartz-4 is designed to ensure a decent living in Germany.

The benefit is intended to meet minimum human needs . The distribution by item of expenditure is assumed to be as follows:

| Need | Share |

|---|---|

| Food, soft drinks | 34.86% |

| Entertainment | 9.59% |

| Internet and telephone | 8.94% |

| Clothing, footwear | 8.76% |

| Housing maintenance, electricity | 8.87% |

| Furniture, household appliances | 6.16% |

| Other goods and services | 7. 93% 93% |

| Transport | 8.33% |

| Hygiene | 3.8% |

| Leisure | 2.49% |

| Education | 0.26% |

To receive money, the unemployed must open an account with a German bank. The amount is transferred monthly. In the usual case, there is no control over what exactly the funds are spent on.

Additional payments for Mehrbedarf

Certain categories of unemployed are allowed to apply for other essential needs . The allowance increase is limited by the Regelsatz. The beneficiary is entitled to a maximum of doubling the benefit, regardless of the actual cost.

In order for the labor exchange to pay money, you will have to submit an application and fill out a questionnaire.

Pregnant

Unemployed women receive a 17% supplement from the 13th week of pregnancy in Germany. Jobcenter will require a certificate from a doctor or obstetrician.

The right to the supplement begins at the end of the 12th week and ends after the birth. Then the parents have the right to include the newborn in the number of those in need.

Single parents

Single parents in Germany who are on unemployment benefits are entitled to request a supplement of 12-60%.

| Children | Addendum to allowance |

|---|---|

| One to 7 years | 36% |

| One over 7 | 12% |

| Two to 16 | 36% |

| Two, but one or both older than 16 | 24% |

| Three | 36% |

| Four | 48% |

| Five or more | 60% |

Additional assistance is issued if:

- child lives with parent,

- the father or mother takes care of the child alone.

There is no extra charge for adult children.

Decentralized water heating

If an internal heater, such as a boiler, is used in the home of the beneficiary to heat the water, it is allowed to ask for a surcharge to compensate for the increased costs.

The supplement is calculated as a percentage of the regular allowance and depends on age.

| Regelsatz | Surcharge |

|---|---|

| 1-3 | 2.3% |

| 4 | 1.4% |

| 5 | 1.2% |

| 6 | 0.8% |

Officials check the actual consumption and the average for the city. A positive decision is only possible when the costs are above average.

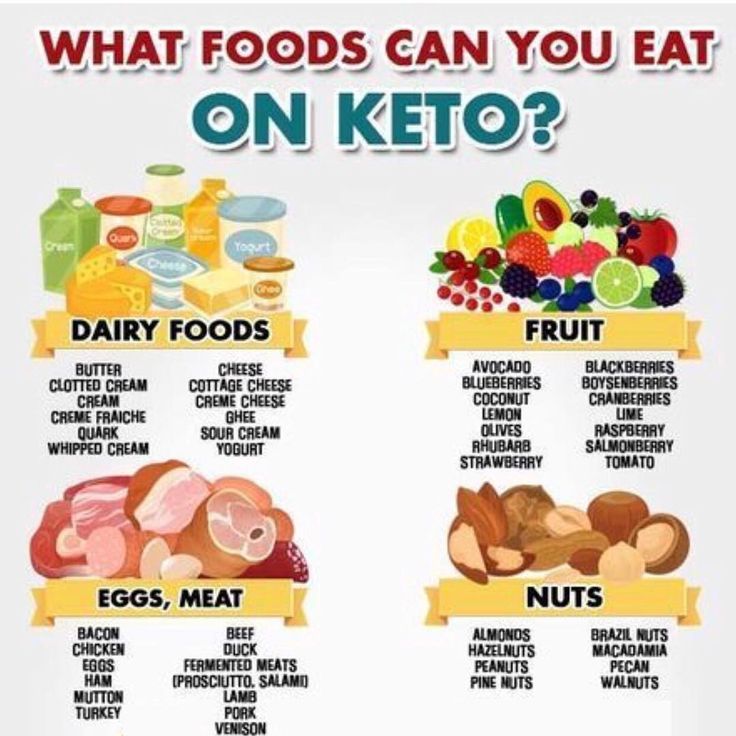

Special nutrition for chronic diseases

Certain diseases are aggravated or threatened with death if a certain diet is not followed. For example, gluten intolerance implies a ban on conventional flour products.

For example, gluten intolerance implies a ban on conventional flour products.

If a doctor issues a medical opinion that a diet is necessary, resulting in higher food costs, the beneficiary may apply for a supplement.

On average, the increase in payments for special meals is 10-20%.

Disabled

Able-bodied disabled people participating in education and adaptation programs are entitled to a bonus of up to 35%.

The main condition for increasing payments is that after learning or mastering new skills, a disabled person will have a better chance of finding a job.

Disabled persons marked “G” (Gehbehinderung) on their certificates receive an additional 17%.

Payment for housing

ALG2 beneficiaries are provided with accommodation paying rent and utilities other than the electricity contract.

Housing is paid directly from the Jobcenter to the landlord. Less often, money for rent is given to the unemployed.

Before making a decision, the official checks the compliance of housing parameters with social support standards. Norms of payment for an apartment for the unemployed are set at the level of the city or region. There are no federal German standards. Key parameters: living area per person and the average price per square meter in the city.

If the official considers the size of the apartment or the cost of living to be inconsistent with the norms, support is refused partially or completely. An unemployed person is forced to look for a more suitable apartment.

In recent years, real estate in Germany is rapidly becoming more expensive. And departments are in no hurry to revise the standards. Using information about the cost of rent in the city 2-3 years ago, the bureaucracy often makes refusals without looking at reality. The lack of housing that meets social norms is one of the main problems in Germany. Therefore, until the end of 2024, the norms will not be checked and the Jobcenter is obliged to take over the actual costs!

The standard area is 50 m² for 1 person plus 15 m² for each next person in the family. Newborns do not count.

Newborns do not count.

For example, a family of 4 can count on payment from Jobcenter if they find an apartment up to 50 + 15*3 = 95 square meters.

Area norms are more adequate. Therefore, for those who have lost their jobs, it is more important to look at the allowable price than the size of the apartment when looking for rental housing in Germany.

Caution

Typically, the security deposit for renting a home in Germany is paid by the labor exchange in the form of an interest-free loan. Then, until the loan is repaid, 10% is deducted from payments.

If the beneficiary has his own funds, the Jobcenter will force a personal money deposit.

Own property

If the person who lost his job lives in his own home, it is necessary that the labor exchange recognize the property as suitable . The owner of an expensive house will not be helped. The allowance is paid only to the poor and those in need of state support.

When it comes to suitable housing, the Jobcenter takes over part of the costs of maintaining the property:

- mortgage interest, but not a contribution to the body of the loan,

- property tax,

- utility costs,

- building insurance contributions.

Standards for eligibility of private property for ALG II recipient status are determined locally and the decision is made on an individual basis.

Primary construction - Erstausstattung

A beneficiary has the right to request additional money to furnish new housing at the first move.

Typical cases:

- Moving to Germany on the line of late settlers or Jewish immigrants.

- An unemployed adult child moves out of the parental home.

- The family is expected to replenish and it is required to equip a children's room.

- Divorce and exit from the previous place of residence.

- Exit from prison.

- Return to normal life after a period of vagrancy.

- Change of housing with the permission of the Jobcenter.

Settlement support varies by case. The unemployed person presents evidence of expenses incurred, for example, checks for the purchase of furniture, household appliances, kitchen furnishings. The official confirms the legitimacy of claims for compensation. You can not count on the reimbursement of unreasonably expensive purchases.

It is allowed to agree on expenses for entry into the apartment in advance. The recipient of the support indicates what he wants to buy, and the official guarantees payment or gives the money in hand.

An average cost of 1000€ per adult is considered reasonable.

Income of the unemployed

Support for job seekers in Germany is provided only to poor burghers. After the application is submitted, the income and capital of the applicant and family members living with him in the same household are checked.

How income is counted:

- Salary.

- Profit from entrepreneurship.

- Elterngeld child care allowance.

- Kindergeld Child Benefit.

- Interest on investments.

- Renting out real estate or property.

- Receiving child support.

- Pension payments.

- Tax refund after filing a tax return in Germany.

- Recalculation of prepayment for electricity.

Not considered income:

- Hartz-4 payments.

- Labor exchange support for training.

- Grundrente basic pension.

- Disability pensions or benefits.

- Earning less than 10€ per month.

When filling out request , you must indicate all sources of income , even if they do not fall under the definition of income. Hiding earnings is punishable by deprivation of support and return of illegally paid funds.

Family income is not a barrier to receiving ALG2 benefits. But a significant part of the earnings is deducted from the amount of assistance.

But a significant part of the earnings is deducted from the amount of assistance.

The deduction from the monetary part of the support is calculated on the basis of gross income.

- First deduct 100€.

- 20% is deducted from amounts between €100.01 and €1000.

- From €1000.01 to €1200 10% deducted. The limit of 1200€ increases to 1500€ if there are minor children in the family.

- The total is subtracted from the allowance.

Example for Minijob

In Germany, there are tax breaks for the minimum employment of a Minijob with a salary of up to 450€.

If the beneficiary of the Hartz-4 support has taken a minijob, the amount by which the benefit is reduced is calculated as follows:

- Gross income 450€

- First €100 deducted, €350 left

- 20% deducted from 350€ – 70€.

- ALG II payments are reduced by the resulting balance of 280€.

As a result, the unemployed with minimum employment will receive a salary of 450€ and a benefit reduced by 280€. Real income will increase by 450€ - 280€ = 170€.

Real income will increase by 450€ - 280€ = 170€.

It turns out that it makes no sense to work with pay below the allowance plus the cost of living.

On the other hand, if a resident of Germany works and the income is not enough for a family up to the subsistence level according to Regelsatz, the ALG 2 assistance can be regarded as additional support.

Property of the unemployed

A support seeker is required to use personal capital for self-sufficiency before applying for an allowance.

Officials calculate the value of the property of the applicant, as well as family members living with the unemployed.

There are limits on the monetary equivalent of property that does not interfere with the receipt of benefits - 150 € per year of life .

For adults, the upper limit is set at 9750€-10050€. For minors, the limit is lower - 3100 €.

In the first year of payments, you are allowed to have up to 40,000€.

Anything that the applicant can use, sell or rent is considered valuable property:

- money savings;

- cash;

- real estate;

- securities.

Adult pension savings can be registered as old age security. The limit is determined by age multiplied by 750€ . The maximum depends on the year of birth.

| Date of birth | Basic | For old age |

|---|---|---|

| until 01/01/1958 | 9750€ | 48750€ |

| after 12/31/1957 | 9900€ | 49500€ |

| after 12/31/1963 | 10050€ | 50250€ |

| Children under 18 | 3100€ |

A personal car or motorcycle may be retained and not counted as valuable if the estimated value of is less than 7500€ at the time of application.

Own housing that is used for personal living is not considered if the area does not exceed the standard norms.

| Family members | Apartment m² | House m² |

|---|---|---|

| 1-2 | 80 | 90 |

| 3 | 100 | 110 |

| For each additional family member | +20 | +20 |

However, the rules are not rigid. Depending on the specific life situation, an increase in the permitted area is allowed.

Personally used plots of land are not counted up to area:

- 500 m² in the city;

- 800 m² in the countryside.

If the capital of the unemployed is worth more than the prescribed level, the official of the labor exchange will ask you to “eat” the savings first.

Recipient's obligations

An unemployed person is obliged to make every possible effort to find work in Germany.

To increase chances in the labor market, retraining, learning German, or other ways of acquiring in-demand skills may be required.

Rejection of job offers or promotions results in the reduction or withdrawal of support for .

The second important part of the duties of the unemployed is to report changes in the financial situation. It is required to notify even about cash gifts with a total amount of more than 50 € per year.

The official has the right to reduce payments for missed appointments at the Jobcenter.

Illnesses that impede the search for employment, confirmed by a doctor. Failure to appear for a medical or psychological examination, appointed by the labor exchange, leads to sanctions.

Repeated errors are punished more severely, up to long-term or permanent termination of assistance. But severe penalties are imposed after repeated warnings.

Imposed sanctions may be challenged in writing within one month after receipt.

Temporary departure

Beneficiary is required to continually seek employment or complete an assigned training plan. Therefore, the unemployed is prohibited from being absent from the place of residence for no good reason.

By law, departures are allowed on 21 calendar days per year upon agreement with the Jobcenter. The labor exchange authorizes temporary absence and a break in search of employment in writing.

To obtain the right to leave, an application must be submitted 7 days before the start of the trip. The officer makes sure that the absence will not harm the ongoing training plan.

If a life situation requires a break for more than three weeks, this is possible in agreement with the Jobcenter. But for the period between the third and sixth week, the monetary part of the support is not paid. An absence of more than 6 weeks completely cancels the right to assistance during departure.

Departure without permission means deprivation of money for the period of absence and subsequent sanctions.

After returning unemployed is obliged to report the arrival of . The official has the right to force the recipient of the allowance to come personally. Late or missed reports are subject to a 10% penalty.

Only able-bodied unemployed persons are subject to sanctions for unauthorized departure.

1-Euro-Job - voluntary-compulsory employment

As a measure to integrate a person into the labor market, Jobcenter has the right to prescribe occupational therapy . The people called such employment “ work for 1 euro ”. Forced labor is paid at a rate of 1-2€ per hour, which is significantly less than the minimum wage in Germany.

The measure applies to long-term unemployed people who have received Hartz-4 assistance for 2-3 years and have no other employment. The duration of a 1-Euro-Job is a maximum of 36 months in 5 years.

If the beneficiary refuses to work without good reason, sanctions apply. Therefore cannot be rejected in the standard case .

Therefore cannot be rejected in the standard case .

Jobs for part-time jobs are sent by German employers. Employment does not imply qualifications or special skills. The job should be suitable for a person who has spent a couple of years at home.

Occupational therapy job examples:

- Cleaning of streets and parks.

- Garbage removal.

- Grass and bush mowing, lawn care in urban areas.

- Assistance in the care of the sick, children and the elderly.

The purpose of forced employment is to prevent the unemployed from staying at home, to develop the habit of working regularly, and to establish social contacts. Therefore, remuneration is not called salary. Money for "1-euro-work" is intended to compensate for the increased costs and is not deducted from the allowance. And the opportunity to work is provided free of charge.

Working conditions, except for pay, do not differ from ordinary employment.