How long can i cover my child on insurance

How Long Can You Stay On Your Parent’s Health Insurance? – Forbes Advisor

Published: Nov 2, 2022, 7:00am

Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors' opinions or evaluations.

Getty

If you have health insurance through your parents, you can typically stay on their plan until you turn age 26, though there are exceptions.

Losing your parent’s health insurance doesn’t mean you should forgo coverage, but that’s what many 26-year-olds decide. The U.S. Census says 18% of 26-year-olds are uninsured, which is nearly 4 percentage points higher than 25-year-olds, and is the highest uninsured rate of any age.

There are plenty of ways to get your own health insurance once you turn 26, including through your employer, a subsidized plan through the Affordable Care Act (ACA) marketplace or a government program like Medicaid.

How Long Can You Stay on Your Parent’s Insurance?

Young adults are allowed to stay on a parent’s health insurance policy until they turn 26, according to the Affordable Care Act (ACA). In most cases, you can remain on your parent’s health insurance plan even if you:

- Get married

- Give birth or adopt a child

- Start or leave school

- Live elsewhere

- Aren’t claimed as a tax dependent by your parents

- Can qualify for employer-sponsored coverage at a job

Depending your parent’s health insurance, you may lose coverage the moment you turn 26, the end of that month or the end of that calendar year. If your parents have health insurance through their employer, you could be removed as a dependent on your 26th birthday (but it depends on the state and plan).

If your parent’s coverage is through the ACA marketplace, you won’t lose coverage right away. You can remain on a parent’s ACA health insurance plan through Dec. 31 of the year you turn 26. That means if you turn 26 in the middle of the year, you will still have coverage until the end of that year.

Featured Health Insurance Partners

1

Aetna

1

Aetna

Learn MoreOn Healthcare Marketplace's Website

2

Blue Cross Blue Shield

2

Blue Cross Blue Shield

Learn MoreOn Healthcare Marketplace's Website

3

Cigna

3

Cigna

Learn MoreOn Healthcare Marketplace's Website

How Can I Stay on My Parent’s Health Insurance Until I’m 30?

Some states, like New York and Florida, allow young adults to stay on a parent’s health insurance plan until age 30. Many states also allow disabled dependents to remain on their parent’s health plan indefinitely.

Many states also allow disabled dependents to remain on their parent’s health plan indefinitely.

Each state has its own requirements for children over age 26 who want to stay on their parent’s health insurance. Below are the states that allow dependent children to stay on a parent’s health insurance past age 26 and the eligibility requirements.

States where you can stay on your parent’s insurance past age 26

| Florida | 30 | Children must be unmarried and have no dependents of their own, and live with their parents or are students. | ||

| Georgia | No age limit | Disabled dependents not capable of self-sustaining employment can stay on their parents’ health insurance indefinitely. | ||

| Idaho | No age limit | Disabled dependents can stay on their parents’ health insurance indefinitely. | ||

| Illinois | 30 | Applies to veterans only. | ||

| Indiana | No age limit | Disabled dependents not capable of self-sustaining employment can stay on their parents’ health insurance indefinitely. | ||

| Iowa | No age limit | Disabled dependents and full-time students can stay on their parents’ health insurance indefinitely. | ||

| Massachusetts | No age limit | Disabled dependents not capable of self-sustaining employment can stay on their parents’ health insurance indefinitely. | ||

| Minnesota | No age limit | Disabled dependents can stay on their parents’ health insurance indefinitely. | ||

| Missouri | No age limit | Disabled dependents not capable of self-sustaining employment can stay on their parents’ health insurance indefinitely. | ||

| Nevada | No age limit | Disabled dependents not capable of self-sustaining employment can stay on their parents’ health insurance indefinitely. | ||

| New Jersey | 31 | Children must be unmarried and have no dependents of their own. | ||

| New York | 30 | Children must be unmarried and a resident of New York. There is no age limit for unmarried, disabled dependents not capable of self-sustaining employment. | ||

| Ohio | No age limit | Disabled dependents not capable of self-sustaining employment can stay on their parents’ health insurance indefinitely. | ||

| Oregon | No age limit | Disabled dependents can stay on their parents’ health insurance indefinitely. | ||

| Pennsylvania | 30 | Children must be unmarried, have no dependents of their own, and be a Pennsylvania resident or a full-time student. | ||

| Rhode Island | No age limit | Disabled dependents can stay on their parents’ health insurance indefinitely. | ||

| South Carolina | No age limit | Disabled dependents not capable of self-sustaining employment can stay on their parents’ health insurance indefinitely. | ||

| South Dakota | 29 or no age depending on situation | Full-time student until the age of 29. Disabled dependents not capable of self-sustaining employment can stay on their parents’ health insurance indefinitely. | ||

| Wisconsin | 27 | Children must be unmarried and don’t have the option to get health insurance through their employer. | ||

| Source: National Conference of State Legislatures | ||||

Health Insurance Options for 26-year-olds

There are multiple health insurance options if you’re losing your parent’s health insurance coverage. Your coverage options after age 26 depends on factors like your employment status, income and budget.

Your coverage options after age 26 depends on factors like your employment status, income and budget.

Health insurance through an employer

One of the easiest ways to get health insurance as a 26-year-old is through your employer if your company offers group health insurance as an employee benefit.

One of the biggest benefits of group health insurance is that it’s usually more affordable than an individual health plan unless that plan is heavily subsidized. In most cases, your employer pays a large portion of the monthly premium (or the entire premium), and the rest gets taken out of your paycheck.

Companies pay an annual average of $6,440 for single coverage premiums, while employees pick up $1,299 a year on average, according to the Kaiser Family Foundation. That’s an average of $108 a month.

Health insurance through the ACA marketplace

When the Affordable Care Act (ACA) was passed in 2010, it led to the formation of the health insurance marketplace, where individuals and families can compare available health insurance plans. You can also qualify for premium tax credits and subsidies to reduce your costs if your income is below 400% of the federal poverty level. That’s $54,360 for an individual, $73,240 for a couple and $92,120 for a family of three.

You can also qualify for premium tax credits and subsidies to reduce your costs if your income is below 400% of the federal poverty level. That’s $54,360 for an individual, $73,240 for a couple and $92,120 for a family of three.

Without those subsidies, ACA marketplace plans can be costly. The average unsubsidized ACA plan costs $386 monthly for a 27-year-old and $412 for a 30-year-old.

Most adults can only enroll in a marketplace plan during open enrollment, which is Nov. 1 to Jan. 15 in most states. Turning 26 and losing coverage through a parent is a qualifying life event that also allows you to purchase a plan via a special enrollment period (SEP) at any point during the year.

Health insurance outside the ACA marketplace

It’s possible to purchase health insurance outside the ACA marketplace, directly through a health insurance company. Some insurance companies sell individual health insurance plans directly to consumers. The same health plans may or may not be available through the marketplace, too.

Finding a health insurance company that sells private individual plans can be challenging. You may need to work with an insurance broker to find a company that sells private health insurance policies in your state. But you can’t qualify for premium tax credits and subsidies if you buy a plan outside the ACA marketplace.

Catastrophic health insurance

Catastrophic health insurance plans can be an affordable way for young adults to get health insurance after age 26. These plans are sold through the health insurance marketplace.

Catastrophic plans aren’t available to everyone. Catastrophic health plans are only for people under age 30, or people over age 30 who have a hardship exemption or affordability exemption and can’t afford a marketplace or job-based plan.

Catastrophic health plans have low premiums, but the deductibles are extremely high. You must meet your deductible before your plan will start covering certain medical services, so you end up paying for most of your medical care out-of-pocket. On the plus side, some routine and preventative care is covered for free before your deductible is met.

On the plus side, some routine and preventative care is covered for free before your deductible is met.

The average monthly cost for catastrophic health insurance is $247 for a 27-year-old and $267 for a 30-year-old.

COBRA health insurance

COBRA health insurance, which is an acronym for the Consolidated Omnibus Budget Reconciliation Act, is a federal law that allows you to keep your group health insurance plan if you experience certain life events, such as getting laid off. Examples of qualifying events include:

- Losing your job (voluntary or involuntary)

- Leaving your job

- Reduction in the number of hours you work

- Losing coverage through death or divorce

COBRA usually allows you to keep your health benefits for 18 or 36 months, but it depends on the qualifying event. Not all group health insurance plans are COBRA-eligible, such as health plans from small employers.

The premiums can be very expensive since COBRA premiums aren’t subsidized. You instead usually pay the full monthly premium yourself. For instance, using the average $7,739 annual cost for overall premiums for single coverage in the employer-sponsored health insurance market, you would pay an average of $645 monthly with no help from the employer and that doesn’t include a 2% administrative fee that the COBRA law allows.

You instead usually pay the full monthly premium yourself. For instance, using the average $7,739 annual cost for overall premiums for single coverage in the employer-sponsored health insurance market, you would pay an average of $645 monthly with no help from the employer and that doesn’t include a 2% administrative fee that the COBRA law allows.

Medicaid

Medicaid is a health insurance program that is jointly funded by states and the federal government. Medicaid benefits are available to low-income individuals and families, pregnant women and people with disabilities. If you meet the income requirements in your state, you can apply for Medicaid through the health insurance marketplace or your state’s Medicaid agency. Medicaid costs are based on household income.

Medicaid plans cover a variety of medical services, including hospitalization, doctor’s visits, diagnostic testing and imaging, home health services, prescription drugs and physical therapy. All Medicaid plans provide dental coverage for children under 21, but not all plans have dental coverage for adults.

Short-term health insurance

Short-term health insurance can help you get temporary coverage during a transitional period, like turning 26 and losing coverage through your parents, or waiting to start a new full-time job with health benefits.

Short-term health insurance can be a cheap option for people who don’t expect many health care needs, but there are a few downsides. Pre-existing conditions aren’t usually covered, deductibles are usually high and short-term health plans often don’t cover many services that are basic in an ACA plan like prescription drugs and mental health.

Health insurance cost comparison for 27-year-olds

| Employer-sponsored health plan | $108 | |

| Catastrophic health insurance | $247 | |

| Unsubsidized ACA health plan | $386 | |

| COBRA health insurance | $645 | |

Employer-sponsored and COBRA plans don’t base costs on age, so these averages are overall for group coverage. The COBRA average doesn’t include a possible 2% administrative fee. The COBRA average doesn’t include a possible 2% administrative fee. | ||

When a 26-year-old Needs to Apply for Their Own Health Insurance Plan

If you’re currently on your parent’s’ health insurance plan and are about to turn 26, you’ll need to start applying for your own health plan unless you’re in a state that allows you to stay on the plan longer.

One exception is if your parents get coverage through the ACA marketplace. In that case, you have until the end of the calendar year to get other health insurance.

If you enroll in your own marketplace plan during open enrollment, you must apply before the end of the year to get coverage starting Jan. 1 of the following year. For example, you must enroll in a marketplace plan by Dec. 15 to get coverage that starts on Jan. 1.

It’s a different story if your parents’ have group health insurance through their employer. In that case, you may lose coverage when you reach age 26 or at the end of the month when you turn 26. In this case, you can qualify for a special enrollment period, which gives you 60 days after you lose coverage to enroll in your own marketplace plan.

In this case, you can qualify for a special enrollment period, which gives you 60 days after you lose coverage to enroll in your own marketplace plan.

Find The Best Health Insurance Companies Of 2023

Learn More

How to Compare Health Insurance Plans

Purchasing your own health insurance plan for the first time can be challenging, especially if you’re unfamiliar with the plan types, terminology and cost structure. Once you have a general understanding of how health insurance works, you can compare providers to find the best option for your needs.

When you get a plan, you’ll pay a monthly health insurance premium, which is the cost of having a health plan. Most plans also have out-of-pocket costs, like a deductible, coinsurance and copayments. Plans with higher premiums usually have lower out-of-pocket costs, meaning your insurance company pays more of your qualifying medical expenses.

If you’re looking to spend less on health insurance and don’t expect to have many health care needs, a high-deductible health plan (HDHP) may be a wise decision. On the ACA marketplace, Bronze plans typically have the highest out-of-pocket costs and lowest premiums, so they might be a good bet.

On the ACA marketplace, Bronze plans typically have the highest out-of-pocket costs and lowest premiums, so they might be a good bet.

Related: Bronze, Silver, Gold or Platinum Health Insurance

Most health insurance plans work with a network, which is a large group of doctors, specialists (like dermatologists and cardiologists) and hospitals. Depending on your health insurance plan, you may only get coverage for medical services received in-network.

Preferred provider organization (PPO) plans allow you to go out-of-network, but you may pay higher premiums and more for out-of-network care than in-network care.

Some plans like health maintenance organization (HMO) plans require you to work with a primary care provider and get a referral to see a specialist.

There are many different health insurance plans available. Here are some of the most common plans and their key features:

- HMO: An HMO limits coverage to in-network providers and requires a referral to see a specialist.

These are often cheaper than PPOs.

These are often cheaper than PPOs. - PPO: A PPO allows you to get care in-network or out-of-network (usually at a higher cost), and referrals are not required.PPOs are often the most expensive types of health plans because they offer fewer restrictions.

- EPO: An exclusive provider organization (EPO) plan only allows you to get coverage in-network, and you must get a referral to see a specialist. EPOs are similar to HMOs, but EPOs typically have a larger network.

- POS: A point of service (POS) plan lets you visit doctors in-network or out-of-network, but referrals are required if you want to see a specialist.

Regardless of the type of plan, emergency services are always covered, and you won’t be charged more for going to an out-of-network hospital or clinic for emergency care.

How Long Can You Stay on Your Parent’s Insurance FAQ

Can you have two health insurances?

Yes, it’s possible to have two health insurance plans. For example, if you’re under age 26 and your parents cover you in two separate plans, one acts as the primary plan and the other acts as the secondary plan.

For example, if you’re under age 26 and your parents cover you in two separate plans, one acts as the primary plan and the other acts as the secondary plan.

When you receive medical care, the primary insurance company submits the claim, and the secondary insurance company covers its portion (if the medical service is covered). Having two health insurance plans doesn’t provide double the benefits.

You don’t get to choose which plan is primary and which one is secondary. The health insurance companies’ coordination of benefits decides which plan is primary and which is secondary. That includes the so-called birthday rule when both parents cover you on separate plans. In that case, the health plan of the parent with the earlier birthday within the calendar year is considered primary.

Can I have my own insurance and be on my parent’s policy at the same time?

Yes, you can have your own health insurance plan while staying on your parents’ policy. This is called having dual coverage.

If you have two health insurance plans, one health plan is designated as the primary plan and the other is the secondary plan. If you have your own insurance, that policy is usually the primary plan and your parents’ plan is the secondary plan.

Can I stay on my parents insurance if I file taxes independently?

If you file your taxes independently, you’re still allowed to stay on your parent’s health insurance plan until age 26 (or the age limit in your state). Your ability to stay on your parents’ health insurance is only based on your age and is separate from your tax filing status.

Is health insurance mandatory?

Health insurance is not mandatory at the federal level. Prior to 2018, uninsured individuals paid a tax penalty, but that’s no longer in effect.

But there are states that require health insurance. Residents of California, District of Columbia, Massachusetts, New Jersey, Rhode Island and Vermont are mandated to maintain health insurance coverage throughout the year per individual state laws.

Do young people need health insurance?

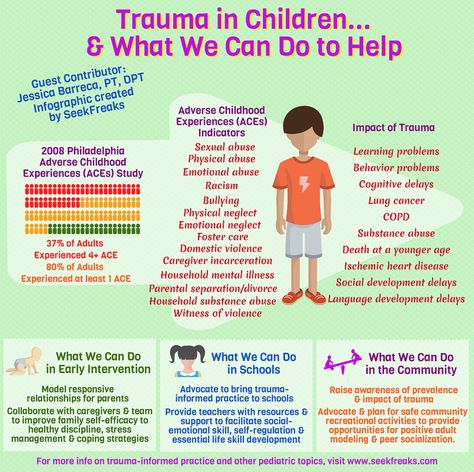

All young people can benefit from health insurance. Even when you’re young and healthy, accidents can still happen.

Between routine care, like vaccines and annual checkups, and potentially more serious situations, like an unexpected trip to the emergency room, paying for your medical expenses without insurance can get very expensive.

Health insurance plans help you pay for these expenses and provide financial peace of mind. If you needed surgery or wound up in the hospital, your health insurance plan would cover a large portion of the bill once you reach your deductible. That can help you avoid medical debt.

Was this article helpful?

Rate this Article

★ ★ ★ ★ ★

Please rate the article

Please enter valid email address

CommentsWe'd love to hear from you, please enter your comments.

Invalid email address

Thank You for your feedback!

Something went wrong. Please try again later.

More from

Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. Past performance is not indicative of future results.

Forbes Advisor adheres to strict editorial integrity standards. To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners.

Elizabeth Rivelli is a freelance writer with more than three years of experience writing about insurance. She has extensive knowledge of various insurance lines, including life insurance, property insurance, car insurance, and health insurance. In addition to her contributions to Forbes Advisor, Elizabeth’s writing has appeared in many online publications, including Investopedia, Money Under 30, Bankrate, and NextAdvisor. She has also published content for several insurance carriers, like Ethos Life.

The Forbes Advisor editorial team is independent and objective. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. This compensation comes from two main sources. First, we provide paid placements to advertisers to present their offers. The compensation we receive for those placements affects how and where advertisers’ offers appear on the site. This site does not include all companies or products available within the market. Second, we also include links to advertisers’ offers in some of our articles; these “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Here is a list of our partners who offer products that we have affiliate links for.

This site does not include all companies or products available within the market. Second, we also include links to advertisers’ offers in some of our articles; these “affiliate links” may generate income for our site when you click on them. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Forbes Advisor. While we work hard to provide accurate and up to date information that we think you will find relevant, Forbes Advisor does not and cannot guarantee that any information provided is complete and makes no representations or warranties in connection thereto, nor to the accuracy or applicability thereof. Here is a list of our partners who offer products that we have affiliate links for.

Are you sure you want to rest your choices?

How Long Can I Stay on My Parent’s Insurance?

Your Health Insurance Options

If you turn 26 and do not qualify to stay on your parent’s health insurance plan, it’s crucial to know how to get your own insurance coverage. Luckily, when you get off your parents’ insurance, there are other options available:

Luckily, when you get off your parents’ insurance, there are other options available:

- Employer-Sponsored Health Insurance: Your employer may offer health insurance options. These plans may be able to offer you a decent premium payment depending on your coverage goals. However, you may not be able to take this insurance coverage with you if you switch jobs.6

- School-Sponsored Health Insurance: If you are in college, your institution may offer you school-sponsored health insurance with low copays. This depends on each school, so we recommend chatting with an advisor on your campus.77

- The Health Insurance Marketplace: If you can’t get coverage through your employer or school, there is a health insurance marketplace where you can apply for the insurance coverage that best meets your needs. You can explore your options based on your state’s individual marketplace or at https://www.healthcare.gov/.8

- Medicaid: Medicaid is a type of health insurance offered through federal and state governments to help low-income adults, families, people with disabilities, elderly adults, children and pregnant women.

Medicaid coverage is administered according to federal guidelines. Eligibility for Medicaid is based on how much income you receive and you must typically be a resident in the state that you apply.9

Medicaid coverage is administered according to federal guidelines. Eligibility for Medicaid is based on how much income you receive and you must typically be a resident in the state that you apply.9

What to Do When You Are 25 on Your Parent’s Health Insurance

If you turn 26 within the coverage year, you may want to have a backup insurance plan mapped out. When you do turn 26, you’ll no longer qualify for your parent’s insurance coverage and need to have a new plan ready. Let’s visit a visualization to see how this pans out.

Alex is currently 25 years old, and he turns 26 on April 15th, 2023. His father’s open enrollment begins on June 1st, 2022, so he can still sign up under his parent’s coverage. The following coverage year starts on January 1st and ends on December 31st, 2023. This means he will be able to stay on his dad’s plan for the first four months of the coverage cycle, but he will no longer qualify after April 15th, 2023.

For context, you can only sign up for an insurance plan during a specific time of the year, otherwise known as open enrollment, unless you fall under a qualifying event. 10 Luckily, no longer qualifying for a parent‘s insurance plan is considered a qualifying event and Alex can sign up for new insurance coverage outside of the typical open enrollment period.11

10 Luckily, no longer qualifying for a parent‘s insurance plan is considered a qualifying event and Alex can sign up for new insurance coverage outside of the typical open enrollment period.11

Aflac Offers Supplemental Health Insurance

Once you exceed the age a child can remain on a parent’s health insurance plan, you have access to many health and supplemental insurance options. If you have a primary health insurance plan in place, you can utilize our supplemental plan to get more coverage.

Sometimes, significant expenses are expected to be paid out-of-pocket within primary health insurance plans. Aflac offers supplemental support and pays you cash benefits for various categories to help minimize financial stressors. Some of the categories we provide support for are cancer, critical illness, accident insurance, hospital and short-term disability.

We understand how stressful it can be to lose insurance coverage or not get the coverage you need. That’s why Aflac is here. Chat with an agent to better understand your supplemental health insurance options.

That’s why Aflac is here. Chat with an agent to better understand your supplemental health insurance options.

How to get an injury insurance payment

12/29/2021

When we buy an insurance policy, we hope that nothing will happen. But if trouble happened and you got injured, you need to do everything right. If you follow simple instructions, then receiving an insurance payment will not be a problem.

Contacting doctors

Your injury must be recorded in order to receive payment. Therefore, do not self-medicate. If the injury is mild, go to the nearest emergency room. According to the legislation of the Russian Federation, you are required to be accepted there, even if you do not have a policy or other documents with you. If the injury is serious and it is difficult to move, call an ambulance. It is important that your injury is officially registered and described. All examinations, including x-rays and MRI, must be prescribed by a doctor. Follow all doctor's orders during treatment. Getting an insurance payout is important, but recovering from an injury is a must.

All examinations, including x-rays and MRI, must be prescribed by a doctor. Follow all doctor's orders during treatment. Getting an insurance payout is important, but recovering from an injury is a must.

Insured event

Before applying for an insurance claim with a company, it is important to understand whether your injury relates to an insured event that is covered by your policy. You can specify this in your contract. If you do not have a policy on hand, then download a new copy from your Personal Account.

Insured event — an event that occurred during the period of insurance and is specified in the insurance policy. After an insured event, the obligation of the insurance company to pay compensation to the insured person, his representative or another person (the Beneficiary) appointed by the contract

If you find your injury on the list, it's time to apply for an insurance payment.

Procedure for receiving an insurance payment

Step 1: Notify the company

Contact us to report your injury.

How can this be done?

- Through Personal Account

- By phone 8 495 981-2-981

- Via notification on website

- Through your financial adviser

Important to know!

You must report the incident to the insurance company as soon as possible. Insured events have a statute of limitations. And if no one reported an injury in a certain period, the company may refuse to pay.

Step 2: Complete application

Application form for payment can be downloaded here Download form .

To make it easier to fill out, use the sample Application for payment

Step 3: Prepare the required documents

- A copy of the insurance contract;

- Application for insurance payment;

- Copy of the passport of the Russian Federation: all pages with marks and seals;

- A copy of the power of attorney confirming the authority to conduct business in the insurance company on behalf of a relative and another person or on the basis of a birth / adoption certificate, if the parents represent the interests of the children.

In the event that the guardian represents the interests of the client, documents from the guardianship authorities will be required;

- Original or copy of medical records certified by a polyclinic or hospital indicating the diagnosis, anamnesis of the disease and the period of treatment;

- Original or copies of sick leave certificates (including electronic ones), certified by a polyclinic or hospital;

- Copies of documents in case of temporary disability;

- A copy of the act of an accident at work in the form of H-1, certified by the seal of the employer organization.

Please note!

The list of documents may differ for different cases. You can clarify the documents required to receive an insurance payment in a special section on the website.

Also, the list of documents required for payment is specified in the insurance rules or policy conditions. You can always download a copy of it in your Personal Account.

Important to know!

The insurance company has the right to request information about the incident from medical institutions, law enforcement agencies and other institutions. And also organize a medical or other examination at your own expense.

Step 4. Send documents to us

You can send documents by mail or bring them yourself to the address: Russia, 115114, Moscow, Derbenevskaya embankment, 7, building 22, floor 4, office 13, com. eleven marked in "Department of insurance payments and expertise" You can also submit documents through employees of regional offices.

When is the payment due?

For each case, the period for consideration of the application is individual. We have already written that the company, before paying out money, can make inquiries to various government agencies to clarify the circumstances of the insured event. This may increase the duration of the insurance payment. The status of the application can be checked in the Personal Account. At the end of this period, you will be informed whether you will receive a payment.

Under what conditions can an insurance payment be denied

There are a number of reasons why an injury claim may be denied, for example:

- Violation of the terms of the contract. This is the most common reason.

- Providing false information or forged documents.

- Late or incomplete payment of insurance premiums by the client.

The client can apply to the court, where he will have to prove that, according to the terms of the contract, he should receive compensation. Payment may be denied for good reasons, so before going to court, you need to get legal advice. You can also contact the financial ombudsman.

We are ready to answer your questions at any of the stages of processing the insurance payment. You can contact us in a way convenient for you:

Via Personal Account

WhatsApp+7 495 9812981

Telegram @renlife_bot

By phone: 8 (495) 981-2-981

Through the contact form on the website

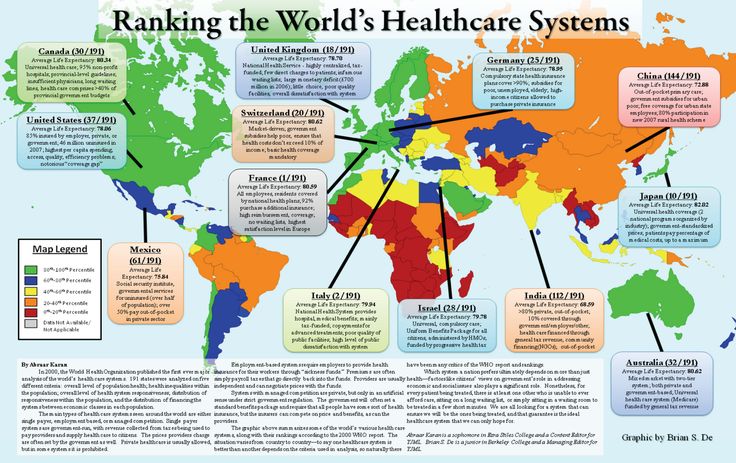

Private health insurance in Germany

Benefits of private health insurance in Germany. Who benefits from private insurance? The amount of contributions. Comparison of health insurance services on the Internet.

Who can take out private insurance in Germany

Shorter waiting times for a doctor's appointment, better service conditions, expensive medicines, separate hospital rooms - such benefits are constantly listed in advertising leaflets for private health insurance in Germany.

Not all residents of Germany can take out private health insurance. Civil servants, students, entrepreneurs of liberal professions and private entrepreneurs have the right to independently decide what type of insurance is most beneficial for them. Employees are eligible to switch to private health insurance if their annual income is more than €66,600 in 2023. Currently, 8.7 million people are privately insured in Germany.

A small digression about the income boundary. There is also a limit on the amount of income per year, upon reaching which insurance premiums for compulsory health insurance stop growing. The amount is below the private insurance income limit. For 2023 - 59850€. The maximum amount of the national insurance premium per month is approximately €807.98, half of which is paid by the employer. If the salary of an employee is above the border, but less than the limit for going private, he pays the maximum contributions.

Features of private health insurance in Germany

The main difference between private and compulsory state health insurance is that contributions do not depend on income at all. The cost of private insurance is calculated based on age, general health, profession and scope of services. The younger the employee, the cheaper the insurance will be. Upon reaching the maximum insurance premium for compulsory health insurance in 2023, the employee pays 403.99€ per month. For a private thirty year old employee pay 180-200€ per month, plus 300€ per year in self-payments.

Doctors in Germany always welcome patients with private insurance

Healthy people who rarely get sick and do not need medical services often. You can save 1200-1500€ per year by getting more service. For example, treatment by the head doctor upon admission to the hospital, double rooms, 100% payment for medicines, reimbursement for dental prosthetics, glasses, alternative treatments, physiotherapy, for which compulsory insurance does not pay at all or pays small amounts.

You can adjust the amount of monthly installments by including or excluding individual risks. But up to a certain level, since the general package of services cannot be worse than in a regular state one. The presence or absence of self-payment of part of the costs also affects the amount of contribution to private health insurance. It is rarely more profitable for those who are ill to pay smaller monthly deductions, and when they get sick, they are treated on their own.

Private insurance, unlike public insurance, does not automatically include family members. The amount of the monthly installment is calculated separately for each. It is more profitable for family people to stay in the German health care system paid by the state.

How to switch to German private insurance

The transition to private health insurance from the state should be carefully, having examined each clause of the contract, preferably together with the insurance agent, and also discussing the state of health with the attending physician. It is easy to conclude private services, but it is difficult to get back into compulsory insurance. It is not possible to do this at will. You need to lose your job through no fault of your own, or receive less than 5362.50 € per month during the year. Resourceful Germans reduce working hours by 10-20%, while at the same time starting to receive less in order to get out of the private medical service.

Our health insurance services.

Our insurance broker will help you sort out the situation free of charge, compare existing rates in Germany from dozens of German private insurance companies and suggest suitable options. Or he will advise you to stay in public insurance, because it is unprofitable to go into private insurance. We do not just help to conclude a contract, but we accompany the client in the future, answer questions and solve problems. Our goal is to help the applicant to insure in the most optimal way.

CONTACT

To facilitate the decision to switch to private insurance, sickness funds have been obliged to offer "basic" rates. They are a package of services provided by the regular state Krankenkasse. They cost no more than the maximum contribution to state insurance. Additional private insurance services are excluded. Depending on the state of health, age and profession, services may cost less than compulsory insurance premiums. Interestingly, sometimes packages of medical services with a large number of services are cheaper than basic rates. Insurers by law cannot refuse to conclude private insurance at such a rate and do not have the right to request a health check from the attending physician. Increased risks are offset by higher prices.

With private health insurance in Germany, the wait for a doctor's appointment will not last long.

The quality of private health insurance services cannot be judged by the amount of the monthly premium. Medical journals and online publications publish articles that analyze and compare aspects of obtaining private insurance services in detail. They warn: cheap rates are not good enough to recommend to readers. It is possible that the German press is engaged or simply paid and advertises expensive packages in order to earn money.

If you plan to take out private health insurance, you need to compare the offers of different private health insurances. At the initial stage, you need to get an idea of the amount of monthly payments and get offers on tariffs from insurance. Then you need to contact the insurance agent and clarify the terms of the contract in detail. It is worth figuring out whether certain medical services need to be included in the insurance. If there are no vision problems, the reimbursement for the purchase of glasses from the insurance can be removed.