How to purchase stock for a child

Best Ways To Give Stock As A Holiday Gift

Klaus Vedfelt/Getty Images

3 min read Published November 28, 2022

Bankrate logoHow is this page expert verified?

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

About our Review Board

Bankrate logoThe Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict , this post may contain references to products from our partners. Here's an explanation for .

Stock can be the gift that keeps on giving, appreciating in value well beyond the initial gift amount. And it can still be quite valuable long after a typical birthday or Christmas gift has been thrown out or spent.

“Gifting stocks can be a great way to teach children or grandchildren about saving and investing, or a fun way of creating interest in the stock market, a company, or a particular industry,” says Eva Victor, senior director high net worth wealth planning attorney at Northwestern Mutual.

But giving stock is not quite as easy as placing an order from Amazon, and would-be givers need to pay attention to a few rules so that they stay on the right side of the law.

Giving stock as a gift: How to gift stock to a child

If you’re thinking of giving stock to a child, there a few options for how to do so:

- Purchase stock specifically for a child: You can do that via a custodial account over which you have or another family member has control.

- Give stock from an existing investment account: Contact your broker to help make the transfer electronically or by stock certificate.

- Give stock with an app: Find an online app that allows you to give stock.

In any case, the recipient should have a brokerage account to receive the stock. A minor child should have a custodial account, while an of-age child may have a regular account. While you could transfer the stock as physical certificates, it’s merely a novelty and pricey to do so, too.

Either way, you’ll want to stay under legal thresholds that could cause tax headaches.

You can safely give stock to a child (or to anyone) under the annual gift exclusion, which allows individuals to give up to $16,000 annually (for 2022) or $17,000 (for 2023) to any number of recipients without incurring a gift tax. A married couple filing jointly can give up to double that individual amount annually. To qualify for this year’s exclusion, you need to make the gift before the end of the calendar year. Otherwise, your gift will count toward next year’s exclusion.

It can require time and paperwork to go through a broker, so if you’re looking for a simpler way to gift stock, there are some online apps that can help. One option is Stockpile.

One option is Stockpile.

Stockpile allows you to give a gift card for a preset amount (ranging from $1 to $200) redeemable for stocks or ETFs. You can buy fractional shares, so you don’t need the money for a full share. If you’re looking to get started investing, you can also use the app. Users should note that the app charges $4.95 per month for ongoing access.

Tips for gifting stock to family members

To optimize the gift and avoid other potential complications, you should pay attention to the fine print, especially if your gift is particularly large.

Going over the gift exclusion

If you go over your gift exclusion in any given year, you can use your lifetime gift exclusion – worth $12.06 million in 2022 ($12.92 million in 2023) – to shelter the excess giving, says Victor. But using that shelter is less tax-efficient overall, because of how gifts are taxed relative to inherited stock.

“Recipients will carry over the donor’s cost basis for gifts made during the donor’s lifetime, and will then realize and pay capital gains tax upon sale of the stock,” says Victor. “Whereas appreciated stock included in the donor’s gross estate and passed [down] at death will typically receive a step-up in basis, so that capital gain will not be realized on a sale.”

“Whereas appreciated stock included in the donor’s gross estate and passed [down] at death will typically receive a step-up in basis, so that capital gain will not be realized on a sale.”

In short, inheriting appreciated stock is more tax-efficient than receiving it as a gift.

Consider a trust

If you’re looking to give a gift of substantial value, you might consider using a trust. The trust structure can help you “postpone the recipient’s access and control beyond the age of majority,” says Victor.

By placing some constraints on the money, the trust may help ensure that the gift ends up being used more judiciously later in life.

If you’re thinking of going this route, you’ll probably want to consult a lawyer who’s experienced in estate planning, since trusts are a complex area of the law.

Make a charitable donation

While you’re in the gift-giving spirit, you may also consider giving stock to a charity and securing a tax write-off for the stock’s fair market value in the process. If you donate appreciated property, you’ll avoid the tax hit on the gains, take a tax deduction and help out someone, too.

If you donate appreciated property, you’ll avoid the tax hit on the gains, take a tax deduction and help out someone, too.

“Applicable adjusted gross income limits are 30 percent of adjusted gross income for gifts of stock held for more than one year, with a five-year carryforward for any unused deduction,” says Victor.

Make sure your favorite charity qualifies for tax-deductible contributions and get any donations in by the end of the year to secure a write-off. If you’re not quite sure what you want to fund but want to take advantage of a tax write-off this year, look into donor-advised funds, which can allow you to take a large deduction this year but distribute the funds over a multi-year period.

Bottom line

Giving stock can be a good way to teach younger relatives about business and how to invest. However, be sure that you consider the tax and estate repercussions if you’re making a sizable gift and turn to an advisor if you have questions.

How To Give Kids The Gift Of Stock (For Christmas Or Other Occasion)

When you ask a parent what their kids want for Christmas, they’ll likely start with a long sigh followed by, “Well… She really likes Ninjago and Dress Up. ”

”

If you press further, you’ll find out that the parent is overwhelmed by the toys that the kid has, and they really aren’t all that excited about giving more plastic crap to their kid.

Enter, the gift of stock and investments. Giving a share of stock to kids is a fantastic way to avoid stressing out parents, help prepare a kid for their financial future, and teach a few lessons along the way.

Plus, as a millennial family, I'm personally tired of receiving all this junk. Think about it. Your child might receive upwards of 20 gifts every holiday season (Mom, Dad, Siblings, Grandparents, Santa, etc.). But by the middle of January, what they actually play with is down to 1-2 toys.

So, instead of wasting all that money on gifts (and then having a bunch of junk laying around the house), why not use that same money to invest in your child's future. This is a great option for extended family who may want to gift.

If that's you, then these are the best ways to give a share of stock to a kid, gifting investments, and even teaching them financial literacy topics in a fun way!

If you want to give a real share certificate to a child (and they become an investor as well), check out GiveAShare. You can purchase a framed share of stock (which makes the perfect gift), and they become a shareholder as well. Check out GiveAShare here >>

You can purchase a framed share of stock (which makes the perfect gift), and they become a shareholder as well. Check out GiveAShare here >>

Promo: $10 Free From Backer! Backer helps you invest in your kids' future by helping you easily setup a 529 plan and allowing friends and family to "back" it by making gift contributions simple! You will be surprised how many people will want to support you and your family if you just ask them to (especially in-lieu of physical gifts). Right now, Backer will be adding $10 to your fund for every new backer that joins! Check out Backer here >>

How To Gift Investments To Kids

Ask To Contribute To A 529

Buy A Share Of Stock

Set Up A DRiP Plan

Don't Forget The Teaching Opportunities

Ask To Contribute To A 529

In my opinion, the single best way to give stock to kids is to contribute to their 529 or ABLE accounts. Many parents have a few hundred or a few thousand dollars invested for their kids future, and they will appreciate every extra dollar that can be invested on behalf of their kids.

Many parents have a few hundred or a few thousand dollars invested for their kids future, and they will appreciate every extra dollar that can be invested on behalf of their kids.

If you plan to give thousands of dollars to a special kid, you can set up a 529 account on your own and name the kid as a beneficiary, but for most people that’s an excessive gift.

Here's a breakdown of the best 529 plan in your state:

A more practical way to contribute to a 529 plan is to ask the parents if they have one set up. If they respond positively, you can ask them to invest your $20 or $50 gift on your behalf. This sounds like a measly gift, but it adds up over time. I have two kids, and they both have 529 plans that we’ve funded through cash they received for birthday and Christmas gifts. Their accounts each have several thousand dollars in them.

A great way to give the gift of college via a 529 plan is to use a service like Backer. Backer makes it easy to setup and contribute to a 529 plan! After you set it up, your child get's a unique URL - for example backer.com/childsname. Plus, you can get $10 for every new backer that joins!

Backer makes it easy to setup and contribute to a 529 plan! After you set it up, your child get's a unique URL - for example backer.com/childsname. Plus, you can get $10 for every new backer that joins!

You can share that URL with your family, and they can easily gift into a 529 plan! In our family, this is the #1 way that grandma and grandpa give money to our kids, and it really goes a long way! Check it out here.

A close runner-up to Backer is Upromise. Upromise has been around a long time and they let you link a 529 to a bunch of rewards programs, shopping rebates, and even a credit card. This is a great tool for grandparents to use to help save for a grandchild's college.

Related: How Grandparents Can Save And Gift Money To Grandchildren For College

Buy A Share Of Stock

If a contribution to a 529 plan isn’t a realistic option (or your preferred choice for whatever reason), consider giving an actual share of the kid’s favorite stock (or an ETF). There are a number of websites dedicated to this exact option.

There are a number of websites dedicated to this exact option.

GiveAShare allows you to buy one share of stock and have the actual certificate (or replica certificate) framed as a gift. Your share is electronically registered as well - so you're a real share holder. Check out GiveAShare here >>

Public recently announced the ability to buy fractional shares and give them as a gift (they call them Stock Slices). Public charges $0 commissions to buy a stock slice. And then you can gift it to someone for the holidays (whether your children or someone else)!

If you want to look at all your options, check out our list of the best custodial investment accounts to open for kids.

Right now, there are a growing number of fractional share companies, but most of these companies don’t offer custodial accounts or they have high maintenance fees for people with small account balances.

Related: Where to Invest in Fractional Shares Of Stock

Set Up A DRiP Plan

Another way to buy a share of stock for a kid is to buy a Dividend Reinvestment Plan (DRiP) directly from a company.

To set up a DRiP, you have to buy a share of the company stock, and then sign up for automatic reinvestments of dividends. Plenty of kid-friendly companies like Hershey’s and Hasbro offer no-fee DRiP plans for shareholders.

Furthermore, most of our favorite free places to invest, such as TD Ameritrade, offer free dividend reinvestment within your account.

Don't Forget The Teaching Opportunities

Giving a share of stock is a good way to help a kid get on solid financial footing, but the lessons that come with it are even more important. When you give a special child a share of stock, consider giving them tools for financial literacy too.

If you feel comfortable with it, you could teach them how to evaluate a stock on Yahoo Finance, or you could give them a book that would teach them age appropriate lessons.

These are our top financial books by age range:

Age 0-4 Money A to Z by Scott Alan Turner

Age 5-8 A Chair For My Mother by Vera Williams

Age 9-11 The Secret Millionaires Club by Andy and Amy Heward

Age 12-14 The Young Entrepreneur's Guide to Starting and Running a Business by Steve Mariotti

Age 15-17 The Money Savvy Student by Adam Carroll

Age 18+ I Will Teach you To Be Rich by Ramit Sethi

Are you planning (or have you in the past) given the gift of stock to your kids?

How to secure a child's future: 5 shares to buy in a children's portfolio

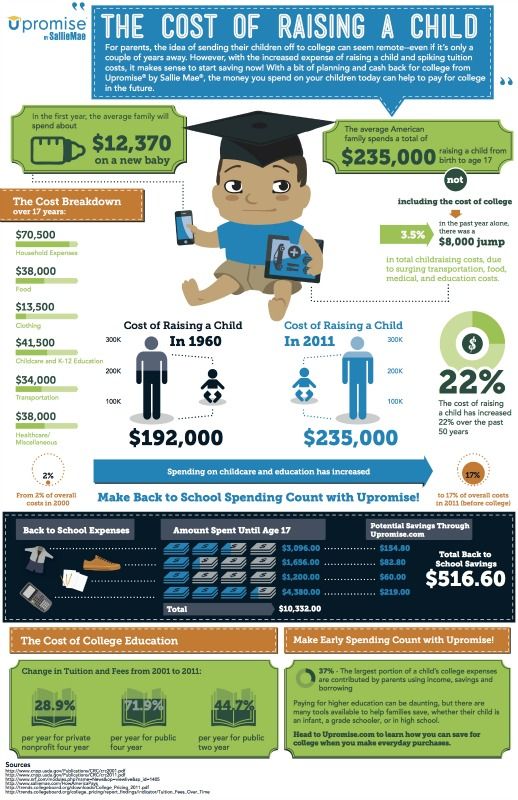

September 1 is an occasion to think about what savings your child will get. If he just went to first grade, then there is enough time. Experts told which stocks can bring good returns in 10 years . On average, they need ₽7.6 million for a worthy future, Russians surveyed believe. The three most popular savings goals are education, buying an apartment, and medical treatment. nine0003

On average, they need ₽7.6 million for a worthy future, Russians surveyed believe. The three most popular savings goals are education, buying an apartment, and medical treatment. nine0003

According to the author of investment courses Olga Sabitova, investment portfolio It is better to start shaping from the very birth of the child. But if your child is already in first grade, you have more than ten years before they reach adulthood.

Sabitova believes that you need to choose those securities in which you are confident for the next decade. Experts told what five stocks can be picked up in a child's portfolio so that in the future the child will see a decent return, and what rules should be followed when compiling it. Our selection includes the largest Russian and foreign companies. nine0003

www.adv.rbc.ru

According to Yevgeny Mironyuk, an analyst at the Freedom Finance investment company, it is difficult to predict which sectors of the economy will be promising in five to ten years. However, attention can be paid to biotechnology, renewable energy, the semiconductor industry and the "stable oil and gas sector in the long term in Russia."

However, attention can be paid to biotechnology, renewable energy, the semiconductor industry and the "stable oil and gas sector in the long term in Russia."

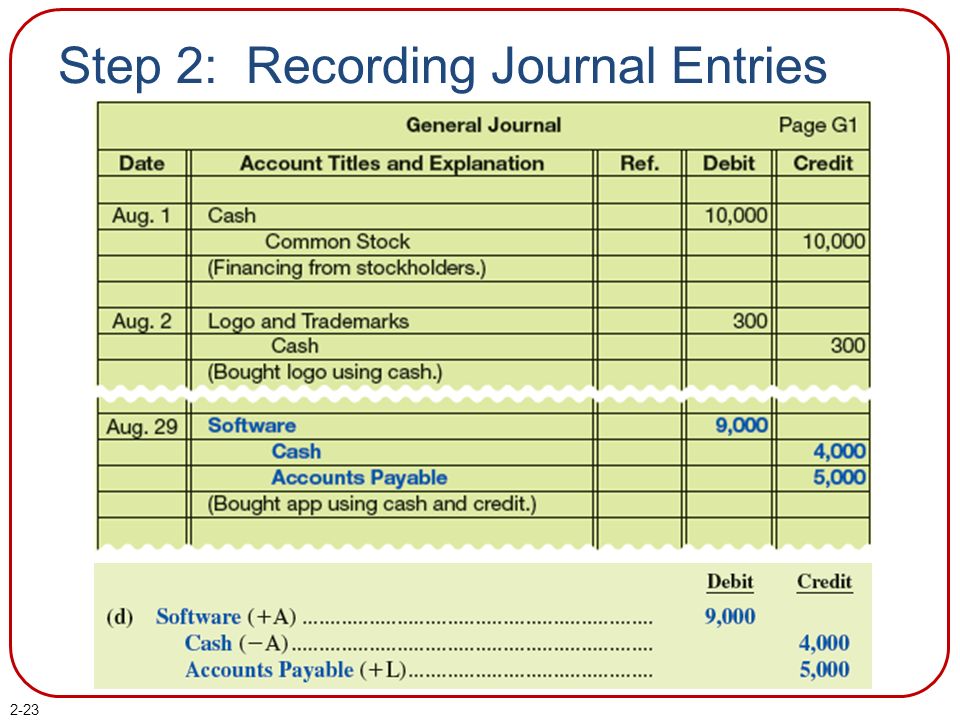

From the last sector, Alexei Korenev, an analyst at the Finam investment holding, turned his attention to the papers of Gazprom. According to him, the shares in the children's portfolio should belong to highly reliable companies with stable operating and financial performance. On such an investment horizon, nothing will surely happen to them. nine0003

Gazprom is a global energy company that is part of the group of the same name. It is engaged in exploration, production and transportation of natural gas, as well as the production and sale of heat and electricity. The company's share in world gas reserves is 16%, and in Russian — 71%. Gazprom also accounts for 12% of global and 68% of Russian gas production. It supplies it to consumers not only in Russia, but also abroad.

Analysts surveyed by Refinitiv advise:

- buy: 12 experts

- keep: 1 expert

- target price for the year: ₽359.

5 (+17.74%)

5 (+17.74%)

According to Vasily Karpunin, Head of Information and Analytical Content at BCS Mir Investments, Sberbank shares can be sustainable in Russia in the long term. Finam's analyst Aleksey Korenev made a similar choice. Sberbank is the largest bank in the country and the CIS, the main shareholder of which is the Ministry of Finance of Russia, that is, the state. nine0003

Sberbank's birthday is November 12, 1814, when Emperor Nicholas I signed a decree establishing savings banks in the country. The bank is considered their successor. Thus, its history spans more than two centuries. Now more than 14,000 Sberbank units are located throughout Russia, and there are its branches, representative offices and subsidiary banks in 18 other countries.

In addition to financial services, the bank is developing an ecosystem that includes applications for delivering food, groceries, medicines, cargo, receiving online medical consultations, watching movies and series, and many others. nine0003

nine0003

Analysts polled by Refinitiv advise (common stock):

- buy: 16 experts

- hold: 2 experts

- target price for the year: ₽388.57 (+18.3%)

Photo: Manuel Velasquez / Getty Images

Karpunin also singled out the Russian investment corporation AFK Sistema among interesting papers. Its portfolio includes mainly Russian companies from different sectors of the economy - in particular, the Ozon online retailer, the MTS mobile operator, the Segezha Group timber industry holding, the Etalon development group, and many others. The total assets of AFK Sistema are estimated at ₽1.4 trillion. In 2020, the corporation invested ₽167.2 billion

Analysts interviewed by Refinitiv advise:

- to buy: 7 experts

- target price for the year: ₽45.83 (+51.04%)

Microsoft is one of the largest US software companies and is a member of the trillion dollar club. In June, its capitalization exceeded $2 trillion for the first time. As of August 31, it was $2.276 trillion.

As of August 31, it was $2.276 trillion.

Among its most popular software is the Windows operating system. In addition, the company produces software for developers, Xbox game consoles, owns the Microsoft Edge browser, the Azure cloud platform and much more. nine0003

Analysts surveyed by Refinitiv advise:

- to buy: 38 experts

- hold: 2 experts

- Target price for the year: $330.41 (+9.08%)

How to teach kids about investing: what to read, what to play and how to behave

Personal finance , Financial literacy , Stock , Children and money , Forecasts

Amazon is one of the largest e-commerce companies in the world with a capitalization of approximately $1. 74 trillion. More than 1.9 million small and medium-sized businesses place goods on its platform. However, Amazon is not limited to online retail.

74 trillion. More than 1.9 million small and medium-sized businesses place goods on its platform. However, Amazon is not limited to online retail.

The company is engaged in delivery and logistics, including owning a fleet of aircraft and developing Amazon Scout autonomous delivery devices. It also develops a cloud platform, releases its own series and films, owns an Internet video service for watching movies, Prime Video, and much more. nine0003

Analysts surveyed by Refinitiv advise:

- to buy: 52 experts

- keep: 1 expert

- target price for the year: $4152.7 (+21.55%)

Photo: Dmitry Feoktistov / TASS

According to Sabitova, when choosing shares for their children's investment portfolio, parents can focus on companies from the S&P500 and Moscow Exchange indices, giving preference to issuers with the largest shares in these indices.

However, for more diversification, you can buy shares of exchange-traded funds (ETFs), she noted. Mironyuk added that the funds are suitable for those who are not professionals in investments. AT nine0009 ETF include securities of many large companies. Such funds can include both the securities of the general market and individual countries and industries. In addition, they can be bought for different currencies, which will also add diversification.

Mironyuk added that the funds are suitable for those who are not professionals in investments. AT nine0009 ETF include securities of many large companies. Such funds can include both the securities of the general market and individual countries and industries. In addition, they can be bought for different currencies, which will also add diversification.

“In my opinion, the continued growth of cybersecurity is inevitable. There are ETFs on the market that invest in the largest stocks in the sector. Such an instrument may be of interest for a long-term portfolio,” said Karpunin.

According to Mironyuk and Karpunin, mutual investment funds (PIFs) can be added to the portfolio. However, Sabitova noted that their management companies can unilaterally change the composition of funds, so ETFs are more suitable, since their structure is more strictly regulated. nine0003

Photo: Pexels

Sabitova believes it is better to focus on growth stocks, that is, stocks of companies that are constantly growing in revenue, profits and cash flows. Such companies either have no dividends, or payouts are small, as they most often invest in their development. According to Sabitova, this can even help save on taxes.

Such companies either have no dividends, or payouts are small, as they most often invest in their development. According to Sabitova, this can even help save on taxes.

Karpunin singled out a different approach to compiling a portfolio. If we analyze its structure, then out of ten stocks, the expert recommended choosing four growth stocks (two each in Russia and the US), four value stocks, and two stocks that can be classified into both groups. According to one of the rules of investing, the older a person gets, the more conservative his approach to investments should be. However, since we are compiling a portfolio for a child, we can focus only on stocks, Karpunin noted. nine0003

“The downside of the current moment is that all of the key global equity markets are near all-time highs. As global central banks tighten monetary policy in 2022-2023, we will probably no longer see the growth rate of the stock market that is observed in 2021,” he said.

Other experts, on the contrary, believe that the children's bag should be protected from volatility . According to Mironyuk from Freedom Finance, in this case, there is no need to focus on profitability. “The conservative nature of investing means that funds between equity and bond funds are best split at a ratio of 60% to 40% or 50% to 50%,” he says. nine0003

According to Mironyuk from Freedom Finance, in this case, there is no need to focus on profitability. “The conservative nature of investing means that funds between equity and bond funds are best split at a ratio of 60% to 40% or 50% to 50%,” he says. nine0003

Aleksey Korenev from Finam believes that it is better if highly reliable financial instruments in the children's portfolio bring a stable income in the form of dividends or coupon payments that can be reinvested. Thus, it is possible to increase the overall profitability of the portfolio, the analyst noted. In his opinion, in what shares to distribute tools is a personal matter for everyone, but the main thing is that there is no strong bias towards one thing.

You don’t need to make frequent transactions on a children’s brokerage account, as it is aimed at long-term nine0009 investments . With a more active investment strategy and frequent rebalancing, you can lose profitability. You can review the portfolio no more than once a year, Sabitova believes. Karpunin also recommended rebalancing once a year, as many events can occur in ten years that will change the investment potential of companies.

Karpunin also recommended rebalancing once a year, as many events can occur in ten years that will change the investment potential of companies.

You can rebalance the children's portfolio by buying more securities or by selling part of the shares that have grown in price in order to reduce the risks of their fall and their share in the portfolio. The money received from the transaction can be used to purchase other shares or funds that have growth potential, Sabitova believes. nine0003

Event analysis, unpacking of companies, portfolios of top funds - in our YouTube channel

An exchange-traded fund that invests participants' funds in stocks according to a certain principle: for example, in an index, industry, or region. In addition to shares, the fund may also include other instruments: bonds, commodities, etc..jpg) Change in price over a certain period of time. Financial indicator in financial risk management. Characterizes the trend of price volatility - a sharp drop or rise leads to an increase in volatility. More Investment is the investment of money to generate income or to preserve capital. There are financial investments (purchase of securities) and real ones (investments in industry, construction, and so on). In a broad sense, investments are divided into many subspecies: private or public, speculative or venture, and others. More a set of assets collected in such a way that the income from them corresponds to the specific goals of the investor. The portfolio can be formed both in terms of the timing of achieving the goal, and in terms of the composition of the instruments. The idea of forming an effective portfolio is in the area of competent distribution of risks and profitability. Read more

Change in price over a certain period of time. Financial indicator in financial risk management. Characterizes the trend of price volatility - a sharp drop or rise leads to an increase in volatility. More Investment is the investment of money to generate income or to preserve capital. There are financial investments (purchase of securities) and real ones (investments in industry, construction, and so on). In a broad sense, investments are divided into many subspecies: private or public, speculative or venture, and others. More a set of assets collected in such a way that the income from them corresponds to the specific goals of the investor. The portfolio can be formed both in terms of the timing of achieving the goal, and in terms of the composition of the instruments. The idea of forming an effective portfolio is in the area of competent distribution of risks and profitability. Read more

Educate an investor, or how to give shares to a child

How to give a child a gift that will not only evoke emotions, be remembered for a long time, but awaken interest in the adult world of investments and develop a conscious attitude to money? give shares to a child

In this context, giving shares of well-known companies to a child is much more interesting than another toy, interest in which will disappear in a week.

The child will appreciate more what he himself has encountered and what he knows well - he has known Coca-cola, McDonald's, Walt Disney, Apple, Google and others since childhood. The business of these giants looks stable on the horizon for several years, so they are interesting for long-term investments. give shares to a child

The child will follow with great interest the news of the company whose shares he now owns. Such a gift can be the first and important step for a child on the path to financial freedom.

If you want your child to learn the value of money and become an owner of capital in the future, then buying shares in his name may be the best solution.

Once an adult, your child can sell shares and pay for a prestigious university, buy an apartment, use the money to start his own business, or continue to invest to build capital for a living on passive income. nine0003

Time is of the essence, and while your child is growing up, well-chosen stocks can rise in value well.

![]()

Let's imagine how much capital would have grown if 15 years ago you had invested USD 100 in stocks of promising companies.

- Netflix Inc. (NFLX ticker, Communication Services) – $13,121

- MarketAxess Holdings Inc (ticker MKTX, Financials) – $4,309

- Abiomed Inc. (Ticker ABMD, Health Care) – $2,219

- Amazon.com Inc. (Ticker AMZN, Consumer Discretionary) – $9,470

- Apple Inc. (ticker AAPL, Information Technology) – $6.024

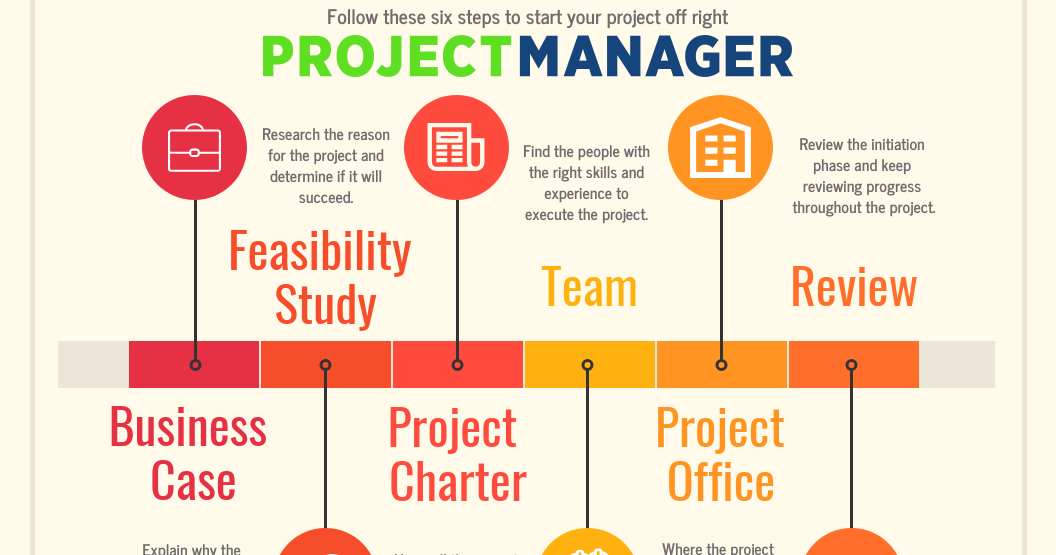

How to buy shares? donate shares to a child

The shares of many international companies are traded not only on foreign stock exchanges, but also on the St. Petersburg and Moscow stock exchanges, and it is not difficult for Russian investors to buy them.

You can buy shares through an intermediary: through a broker (both Russian and foreign), through an insurance company (English way) or through a bank. nine0003

For example, if you decide to invest through a broker, you need to consider his choice thoroughly, and consider the issue of reliability comprehensively.

The broker must be licensed.

The broker must be licensed. Having a license means that the broker's activity is controlled by a regulator (in Russia, for example, the Central Bank of the Russian Federation acts as a regulator). This reduces the potential risks of clients, but does not guarantee 100% protection against broker bankruptcy.

Therefore, additionally pay attention to the broker's rating, which reflects its ability to fulfill financial obligations in the present and future. For example, in Russia, the reliability ratings of brokers can be found on the NRA website. nine0003

An important factor in choosing a broker is access to exchanges and, as a result, the choice of financial instruments. donate shares to a child

For example, if you want to buy shares of foreign issuers in Russia, then you need to choose a broker that provides access to at least the St. Petersburg Stock Exchange. Here you can buy the most highly liquid stocks from the S&P 500 list.

The last but not least criterion for choosing a broker is the fees. For those who want to make money on the stock market, it is important to calculate the size of all broker commissions so that these expenses do not “eat up” investment income. nine0003

For those who want to make money on the stock market, it is important to calculate the size of all broker commissions so that these expenses do not “eat up” investment income. nine0003

That is, you need to sum up commissions for transactions, depository commissions for account maintenance, for using terminals and other commissions, having studied the details of tariff plans.

Opening an account with large brokers is not difficult - it can be done online, without visiting the office. You will need a scan of your passport, email and phone number for SMS confirmation.

How to give shares to a child?

The donation procedure depends on the age of the child.

Securities (shares, shares, etc.), like any other property, parents can acquire in the name of the child from his birth. But liquid shares are usually bought on the stock exchange through a broker. nine0003

Not all brokers open accounts for children from the moment a child receives a passport, that is, from the age of 14, for fear of complex document flow and recognition of transactions as null and void. And those who agree are required to provide at least a passport of one of the parents, a passport and a birth certificate of the child.

And those who agree are required to provide at least a passport of one of the parents, a passport and a birth certificate of the child.

Shares can also be given to a child who does not have a passport. In this case, the securities must be kept in the donor's brokerage account. Upon reaching the age of majority, the child will be able to open his own brokerage account and he will be credited with the donated shares. nine0003

A gift agreement can be signed by the child himself, but this does not occur in practice. In our country, it is customary that parents sign everywhere on behalf of the child. donate shares to a child

The procedure for transferring shares to relatives involves a package of documents and may seem complicated at first glance. Here is a list of the main documents required for registration of a deed of gift:

- documents proving the identity of both parties to the donation transaction;

- personal information of the parent and child - full name, place of residence/registration; nine0026

- TIN of persons who are participants in a transaction under a share donation agreement;

- certificate confirming the ownership of securities for donation;

- transfer order signed by the shareholder, certified by a notary or an authorized person appointed by the registrar.

In addition to the main documents, additional documents may be required:

- consent of both parents or guardian - if the share recipient is a minor child; nine0026

- consent of the second parent - if the shares were acquired by the parents jointly in marriage.

It is important to explain to the child that stocks are an investment instrument that needs attention.

Although the selected stocks have performed very well over the past 15 years, it is difficult to predict their future behavior and it is impossible to say for sure whether they are suitable for inclusion in a portfolio today. give shares to a child

Some stock issuers may become overvalued or face competition in a booming industry, as is the case with Netflix.

In order not to lose your money, it is important to audit your portfolio at least once a year, to decide which shares to buy and which to sell. It is necessary to consider the financial result from investments, and if a good amount of dividends has accumulated, then decide where to reinvest them.

However, if you approached the choice of stocks correctly, studied the reports of companies, then your child will be able to fully enjoy the power of the "buy-and-hold" strategy. nine0003

If you are a cautious investor, want to protect your child from unjustified expectations and are not ready to invest in shares of individual companies, pay attention to stock funds that follow the dynamics of indices.

For example, $100 invested in the S&P 500 index, which reflects the dynamics of the securities of the 500 largest corporations in the world, would earn $335 over the same 15 years.

. nine0240

Investing in the S&P 500 can be done through, for example, the S&P 500 SPDR ETF (SPY), the Vanguard S&P 500 ETF (VOO) or the iShares Core S&P 500 ETF (IVV).

Those investors who do not have the opportunity to buy ETFs can purchase the recently appeared on the Russian market BPIF Alfa Capital (S&P 500) АКSP, BPIF Sberbank - S&P 500 (SBSP), VTB fund of shares of American companies (VTBA), Tinkoff S&P500 (TSXX).

It should be taken into account that the results in the past do not guarantee their repetition in the future, but they can help with the choice of an appropriate strategy. nine0174

If your child is in elementary school (6-9 years old), start with simple steps – open a simple savings account for him.

Take it with you to the bank so that your child understands how to open a deposit and, in the future, an investment account. Although today it can all be done online.

Summarize every month: study the account report to understand how much money has been deposited, how much interest has been accrued, what income has been received.

The child will know the mechanism of how to save up for a dream, and you will help him figure out complex issues. As the child grows older, as soon as the child starts earning, help him open an investment account and give him the opportunity to make investment decisions on his own.

Parents should allow their children to make their own investment decisions, make mistakes and learn from them.