How does child support

Guidelines for Child Support

Child support is financial support that a noncustodial parent pays to a custodial parent to meet the basic needs of a shared child. This money is paid from one parent to the other, rather than directly to the child, and is separate from any spousal support that might also be paid. Child support can be court-ordered or administratively ordered, but parents can also establish informal agreements between themselves for the payment of support.

If you’re receiving—or paying—child support via a court order, it’s important to understand how those payments are calculated.

Key Takeaways

- Child support is a type of financial support that’s paid from one parent to another for the care and keeping of a shared child.

- Child support can be court-ordered or administratively ordered, though parents can also establish agreements for the payment of child support between themselves.

- Court-ordered child support payment amounts are determined by the income guidelines used by the state where the case is filed.

- Child support payments are neither tax deductible for the person who makes them nor included as taxable income for the person who receives them.

Child Support Basics

Child support is financial assistance that’s paid by one parent to another for the care of one or more children whom they share. State laws govern child support payments, including:

- Who must pay child support

- When it’s required

- How much child support is to be paid

- When support payments must end

Every state has different rules for child support. In New York, for example, the law states that both parents are financially responsible for children until the age of 21. You can file a child support case in New York if:

- You’re a custodial parent (meaning you have physical custody) and the child lives with you most of the time

- You’re the child’s guardian or caregiver (not a parent) and the child lives with you

- You’re not an emancipated child but you don't live with either parent

The Department of Social Services can also pursue child support claims on behalf of children who are living in foster care.

Parents don’t need to be married to one another to file a claim for child support, and there doesn’t have to be a formal custody order in place. Parents don’t need to live in the same state for one party to request child support. However, depending on the state, parentage may need to be established before a child support claim can be filed.

This is a requirement in New York, and it’s usually done by both parents completing an Acknowledgement of Paternity document or filing a court petition. The court can order a DNA test when parentage is unclear or disputed. In the case of same-sex couples, New York law allows courts to use their own discretion in determining parentage.

Talking to a divorce attorney or a family law attorney in your state can help you clarify the rules and requirements for filing a child support claim.

How Child Support Is Determined

Every state sets its own rules for determining how child support payments are calculated. Some of the things that can influence child support include:

- With whom the child primarily lives

- How much visitation time the child has with the other parent

- Incomes of the custodial parent and the noncustodial parent

The race, gender, and sexual orientation of either parent don’t have a direct impact on how much child support is ordered. There are, however, disparities in who pays and receives child support along those lines.

There are, however, disparities in who pays and receives child support along those lines.

For example, four out of five custodial parents are female. Among those parents, 28.1% are Black women, while 24.1% are of Hispanic origin. Custodial fathers are more likely to be non-Hispanic White men than Black or Hispanic men. The majority of outstanding child support in the U.S. is owed by low-income fathers, including many Black men who are at a disadvantage to meet their obligations due to racial inequalities.

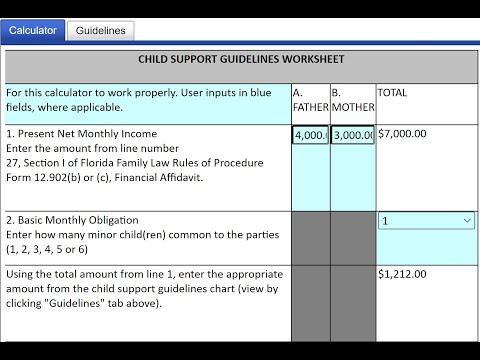

With that in mind, there are different formulas that courts can use to calculate child support payments. They include the income shares model, the percentage of income model, and the Melson Formula.

Income shares model

The income shares model assumes that a parent should receive the same percentage of support from a noncustodial parent that they would receive if both parents lived together. This model takes the incomes of both parents into account when determining how much should be paid. Forty-one states, Guam, and the Virgin Islands use the income shares model for child support calculations.

Forty-one states, Guam, and the Virgin Islands use the income shares model for child support calculations.

For example, say you earned 60% of the income in your household, while your partner or spouse earned 40%. As the noncustodial parent, the amount that you would pay would be 0.60 multiplied by a baseline amount for care, as determined by your state. If that baseline amount was $500, then you’d pay $300 per month in child support.

Percentage of income model

The percentage of income model sets child support as a percentage of the noncustodial parent’s income. The percentage that’s used is determined by the state’s guidelines and can be applied as a flat or varying rate. Four states use the flat-rate model for child support determinations, while two states use the varying-rate model.

For example, assume you make $3,000 per month and your state assesses a flat 20% child support rate. You would owe $600 per month using the percentage of income model.

Melson Formula

The Melson Formula is a variation on the income shares model that attempts to ensure that the financial needs of the parents and the child are both met. Delaware, Hawaii, and Montana use this model, while the District of Columbia uses a hybrid model that starts with a varying percentage of income, then reduces it using a formula that’s based on the custodial parent’s income.

Delaware, Hawaii, and Montana use this model, while the District of Columbia uses a hybrid model that starts with a varying percentage of income, then reduces it using a formula that’s based on the custodial parent’s income.

Once a child support order is issued, it generally can’t be modified without the court’s approval, based on what’s allowed under state law.

How to Apply for Child Support

Depending on where you live, you should be able to apply for child support with your Department of Social Services or Child Support Services division. You may be able to apply online or in person. When you apply, you’ll need to provide certain information, including:

- Proof of your identity

- Proof of income

- Copy of your child’s birth certificate

- Photo of the noncustodial parent

- Verification of marital status

- Legal documents relevant to your claim—which can include a divorce decree, an affidavit of parentage, a domestic violence protective order, and voluntary agreements signed between you and the noncustodial parent

If English is not your first language—or if you have a disability that prevents you from applying for support online—then your Social Services department should be able to help you with filing a child support claim.

If you’re eligible to receive child support, then the amount that you should be paid is determined using one of the models mentioned above. Aside from income, the court can also consider individual costs of raising a child, including childcare, medical expenses, and insurance and educational expenses.

Once a child support order is established, the noncustodial parent may be able to make payments to the Department of Social Services. It would then distribute them to the custodial parent. Alternatively, your state laws might require automatic wage garnishment for child support payments. You don’t have to include on your taxes child support payments that you receive, and if you’re paying child support, you can’t write it off as a deductible expense.

Failing to pay court-ordered child support could lead to enforcement actions, including jail time and fines.

The Bottom Line

Child support is designed to cover the needs of children after the end of a marital or nonmarital relationship. Navigating who should pay and who should receive child support can be tricky, especially if that issue is also connected to a custody battle. Understanding what your rights and obligations are with regard to providing for the care of children can help if child support is part of your financial picture.

Navigating who should pay and who should receive child support can be tricky, especially if that issue is also connected to a custody battle. Understanding what your rights and obligations are with regard to providing for the care of children can help if child support is part of your financial picture.

How A Child Support Case Works

Either parent can open a child support case, as can a child’s legal guardian. Having an order from a judge for child support to be paid does not automatically open a child support case.

To open a case in California, fill out the online application or visit your local child support agency – agency locations can be found here.

After an application is submitted, the applicant will be contacted by their local office to assist with the process of obtaining a child support order with the court.

There are many benefits to opening a child support case:

- If you do not yet have an order, we provide assistance to both parents through all steps of the process.

- In certain situations, we can help you avoid court completely.

- Once you have an order, we keep official records, protecting both the payer and the recipient.

- We can assist recipients with enforcement of the order.

- We can help payers avoid or resolve negative enforcement actions if you are unable to pay.

See our instructional video below, “How To Open A Child Support Case” for more details on this process.

More Important Information

For information about changes in family status please see: FamiliesChange.ca.gov

Before a child support order can be made, both parents of the child need to be located. There is no guarantee they will be found, but the more information we have, such as the parent’s date of birth and Social Security Number, the easier it will be.

Watch our “Locating a Parent” Quick Tip video below for more detailed information about this step.

After the case is opened, the parent being asked to pay child support will be given a Summons and Complaint packet. This is legal notification that you have been named in a child support case.

You only have 30 days to respond, or a “default” child support order may be ordered by the judge without your financial situation being considered.

See our instructional video below, “I Received a Summons and Complaint – What Do I Do?” for more information about this very important package of documents.

If you have been served with a Summons and Complaint, and you do not believe you are legally responsible for the child or children you are being asked to pay child support for, you have the right to request proof and we will assist you free of charge. This is either DNA testing to determine parentage (which is more than 99% accurate), or proof that the parents were legally married at the time of the child’s birth.

This is either DNA testing to determine parentage (which is more than 99% accurate), or proof that the parents were legally married at the time of the child’s birth.

If you do not request proof, you can still be assigned legal parentage without your consent.

If you would like to avoid going to court, some local agencies offer “Family Meetings” that allow both individuals to meet with a child support caseworker, either together or separately. If both parents can agree on an amount, their signed document becomes the “Stipulated Agreement,” which is filed with the court.

This option may not be offered in all child support offices.

For more on the benefits of this, see our “Family Meetings” instructional video below.

If there is no Stipulated Agreement, a court date will be set. The judge will review the financial and other relevant information from both parties and decide on an appropriate amount of child support to be ordered.

The judge will review the financial and other relevant information from both parties and decide on an appropriate amount of child support to be ordered.

If either parent can get medical insurance, the court will consider that cost in deciding the amount of child support ordered.

Below, our instructional video “How Does the Court Determine a Child Support Amount” includes more information on this decision, which becomes the official child support order.

After a child support order is set, payments are scheduled to begin. There are many options for payment but if the parent ordered to pay is employed, their employer will be required to make those payments by withholding the funds from their paycheck. This is mandated under Federal law for child support orders and does not imply a failure to pay.

All payments are recorded and this can provide security for the parent paying support in case there is any disagreement.

A child support order is a legal court order. Parents who refuse to pay or delay paying their child support face enforcement actions that can include:

- Suspension of their driver’s license or passport

- Revocation of professional and occupational licenses

- Bank and property liens

- Interception of tax refunds

- Interception of lottery winnings

Also, by California state law, unpaid court orders get charged 10% interest.

As a last resort, civil contempt charges may also be filed. If you have trouble paying your child support, talk to your local agency right away. There are programs available to help parents who are trying in good faith to pay their support.

For more on the consequences of unpaid child support, see our instructional video, “My Driver’s License has been suspended due to child support. How can I get a release?”

How can I get a release?”

If either parent or guardian has a change in circumstances after a child support order is set, which could be losing a job, changing jobs, or a change in custody or visitation, the order may qualify for modification.

Your local agency or the Family Law Facilitator at your county courthouse can assist with this.

There are many reasons why a child support case can be closed. The usual one is that the youngest child reaches the age of 18, is no longer a full-time high school student, and no past-due balances are owed. At that time both parents are notified by the child support agency, and the case stays open for 60 days after this notification.

All records are maintained for at least four years and four months in accordance with federal law.

For more information about the Child Support Process, visit and follow our YouTube channel:

For more information on changing family status please see: FamiliesChange.ca.gov

Who is obliged to pay alimony?

home

Free legal assistance and legal information for the population

Legal information and legal education of citizens

Alimony obligations

Who is required to pay child support?

1. Parents

In accordance with Article 80 of the Family Code of the Russian Federation, parents are required to support their minor children. nine0003

Parents must pay child support

- minor children;

- children left without their care;

- Disabled adult children who need help.

Parents have the right to conclude an agreement on the maintenance of their minor children ( agreement on the payment of alimony ), which must be notarized. The agreement establishes the amount of alimony at the discretion of the parties, but it cannot be less than the amount that can be recovered in court. nine0003

nine0003

In the event that parents do not provide maintenance for their minor children, funds for the maintenance of minor children (alimony) are collected from parents in court.

In the absence of an agreement on the payment of alimony, alimony for minor children is collected by the court from their parents monthly in the amount of: for one child - one quarter, for two children - one third, for three or more children - half of the earnings and (or) other parental income. nine0044

In accordance with article 83 of the Family Code of the Russian Federation p in the absence of an agreement between the parents on the payment of alimony for minor children and in cases where the parent obliged to pay alimony has irregular, fluctuating earnings and (or) other income, or if this parent receives earnings and (or) other income in whole or in part in kind or in foreign currency, or if he has no earnings and (or) other income, as well as in other cases, if the recovery of alimony in a share of earnings and (or) other income of the parent is impossible, difficult or materially violates the interests of one of the parties, the court has the right to determine the amount of alimony collected on a monthly basis, in a fixed amount of money or simultaneously in shares (in accordance with Article 81 of this Code) and in a fixed amount of money.

The amount of a fixed sum of money based on is determined by the court from the maximum possible preservation of the child's previous level of his security, taking into account the financial and marital status of the parties and other noteworthy circumstances.

Article 84 of the Family Code of the Russian Federation fixes that alimony for children left without parental care are collected only through the court . The court determines the amount of alimony in the same manner as the amount of alimony for minor children. They are paid to the guardian or custodian of the child, his adoptive parents or transferred to the account of the organization in which the child is (educational, medical organizations, social service organizations, etc.).

In accordance with article 85 of the Family Code of the Russian Federation, alimony in favor of disabled adult children who need assistance can be obtained on the basis of a notarized child support agreement. In the absence of an agreement, alimony can be collected through the court. In this case, their amount in a fixed amount of money is established by the court based on the financial and marital status of the parties, as well as other circumstances. When recovering alimony for such children, the amount of alimony determined within the established limits to earnings and (or) other income is not applied. nine0003

In the absence of an agreement, alimony can be collected through the court. In this case, their amount in a fixed amount of money is established by the court based on the financial and marital status of the parties, as well as other circumstances. When recovering alimony for such children, the amount of alimony determined within the established limits to earnings and (or) other income is not applied. nine0003

2. Able-bodied adult children

In accordance with Article 87 of the Family Code of the Russian Federation, able-bodied adult children are required to support their disabled parents who need help. An exception is made by parents deprived of parental rights, to whom children are not obliged to pay alimony.

Alimony can be paid either on the basis of a notarized agreement between parents and children, or on the basis of a court decision. The court sets the amount of alimony in a fixed amount of money , payable monthly, taking into account all the circumstances of the case, including taking into account the financial and marital status of parents and children.

3. Spouses, including former spouses

This issue is regulated by chapter 14 of the Family Code of the Russian Federation.

Spouses or ex-spouses may enter into an agreement on the payment of alimony, which must be certified by a notary. In this case, the amount of alimony is determined in the agreement at the discretion of the parties. nine0003

If such support is refused and there is no agreement between the spouses on the payment of alimony, the right to demand the provision of alimony in court from the other spouse who has the necessary means for this, have:

- disabled needy spouse;

- wife during pregnancy and within three years from the date of birth of a common child;

- a needy spouse caring for a common disabled child until the child reaches the age of eighteen years or for a common child disabled from childhood of group I. nine0003

In accordance with Article 90 of the Family Code of the Russian Federation, the right to demand the provision of alimony in court from a former spouse who has the necessary funds for this has:

- ex-wife during pregnancy and within three years from the date of birth of a common child;

- a needy ex-spouse caring for a common disabled child until the child reaches the age of eighteen years or for a common child disabled from childhood of group I; nine0003

- a disabled needy ex-spouse who became disabled before the dissolution of the marriage or within a year from the date of the dissolution of the marriage;

- a needy ex-spouse who has reached retirement age no later than five years after the dissolution of the marriage, if the spouses have been married for a long time.

In the absence of an agreement between the spouses (former spouses) on the payment of alimony, the amount of alimony collected on the spouse (former spouse) in a judicial proceeding is determined by the court based on the financial and marital status of spouses (former spouses) and other noteworthy interests of the parties in a fixed amount of money payable monthly.

4. Other family members who may be required to pay child support

- able-bodied adult brothers and sisters

In accordance with Article 93 of the Family Code of the Russian Federation, able-bodied adult brothers and sisters may be payers of alimony to the following persons: nine0003

- minor brothers and sisters, provided that they do not have the opportunity to receive maintenance from their parents;

- disabled adult brothers and sisters, provided that they are unable to receive maintenance from their able-bodied adult children, spouses (former spouses) or parents.

- grandparents

In accordance with Article 94 of the Family Code of the Russian Federation, the following have the right to receive alimony in court: nine0003

- minor grandchildren in need of assistance in case of impossibility to receive maintenance from their parents;

- adult disabled grandchildren in need of assistance, if they cannot receive maintenance from their spouses (former spouses) or from their parents.

- tons able-bodied adult grandchildren

In accordance with Article 95 of the Family Code of the Russian Federation, able-bodied adult grandchildren may be payers of alimony disabled grandparents in need of assistance , provided that the latter are unable to receive maintenance from their adult able-bodied children or spouses.

- t able-bodied adult pupils

In accordance with Article 96 of the Family Code of the Russian Federation, able-bodied adult pupils (except for those who were under guardianship or guardianship, as well as being raised in foster families) may be payers of alimony to disabled persons who carried out the actual upbringing and maintenance of pupils until they reach 18 years of age with provided that they do not have the opportunity to receive maintenance from their adult able-bodied children or from spouses (former spouses). nine0003

nine0003

The prosecutor explains - Prosecutor's Office of the Saratov region

nine0165 Prosecutor explains

- December 20, 2021, 09:43

I pay child support to my ex-wife. I think that she mismanages this money - she doesn’t buy what her son needs, but spends it on all sorts of nonsense. Can I pay them directly to the child? The senior assistant to the prosecutor of the Volzhsky district of the city of Saratov O.O. Emich

Text

Share

According to the family legislation of the Russian Federation, a child has the right to receive maintenance from his parents and other family members.

The most common reason for transferring alimony directly to a child is the distrust of the parent paying the alimony that the recipient will spend the money for other purposes, that is, not for the maintenance, upbringing and education of the child, and so on.

The law provides for the possibility of transferring funds directly to the child. For this you need:

1. Discuss with the other parent the possibility of concluding an agreement on the payment of part of the child support.

If an agreement is reached on the procedure for paying alimony in accordance with Articles 99-101 of the Family Code of the Russian Federation, parents should contact a notary to certify the agreement on the payment of alimony. In a notarial agreement, parents can, for example, establish that part of the alimony goes to the second parent (for the maintenance of the child), and part is transferred directly to the child's account. nine0003

It is worth noting that without such a notary agreement or a court decision, the transfer of funds to a child is not regarded as alimony, but as a donation of money.

2. In case of failure to reach an agreement, a parent who is obliged to pay alimony has the right to apply to the court.

Thus, according to paragraph two of Article 60 of the Family Code of the Russian Federation, based on the interests of children, the court has the right to make a decision to transfer no more than 50% of the amount of alimony payable to an account opened in the name of a minor child in a bank. nine0003

nine0003

Such an application may be filed with the court only after the other parent refuses to enter into or change a support agreement, or if a response is not received within 30 days.

It should be borne in mind that the parent submitting such an application, by virtue of Articles 56, 57 of the Code of Civil Procedure of the Russian Federation, must prove that the other parent is spending child support improperly.

I pay child support to my ex-wife. I think that she mismanages this money - she doesn’t buy what her son needs, but spends it on all sorts of nonsense. Can I pay them directly to the child? The senior assistant to the prosecutor of the Volzhsky district of the city of Saratov O.O. Emikh

According to the family legislation of the Russian Federation, a child has the right to receive maintenance from his parents and other family members.

The most common reason for transferring alimony directly to a child is the distrust of the parent paying the alimony that the recipient will spend the money for other purposes, that is, not for the maintenance, upbringing and education of the child, and so on.

The law provides for the possibility of transferring funds directly to the child. For this you need:

1. Discuss with the other parent the possibility of concluding an agreement on the payment of part of the child support.

If an agreement is reached on the procedure for paying alimony in accordance with Articles 99-101 of the Family Code of the Russian Federation, parents should contact a notary to certify the agreement on the payment of alimony. In a notarial agreement, parents can, for example, establish that part of the alimony goes to the second parent (for the maintenance of the child), and part is transferred directly to the child's account. nine0003

It is worth noting that without such a notary agreement or a court decision, the transfer of funds to a child is not regarded as alimony, but as a donation of money.

2. In case of failure to reach an agreement, a parent who is obliged to pay alimony has the right to apply to the court.

Thus, according to paragraph two of Article 60 of the Family Code of the Russian Federation, based on the interests of children, the court has the right to make a decision to transfer no more than 50% of the amount of alimony payable to an account opened in the name of a minor child in a bank.