How to clear child support debt

Debt Reduction - HRA

There is one aspect of the Child Support Program that is barely discussed: child support debt. This issue is large in scale and complexity and mostly owed by people with little to no recorded income. Child Support debt is owed to the government or to the child's other parent, and in some cases to both.

People owe child support to the government because money is retained by the government to pay back public cash assistance (most commonly, TANF benefits) received by that parent’s child. Overwhelmingly, it is low-income fathers, a very large percentage of them Black or Latino, who feel the greatest effects of this policy and the indebtedness that it creates.

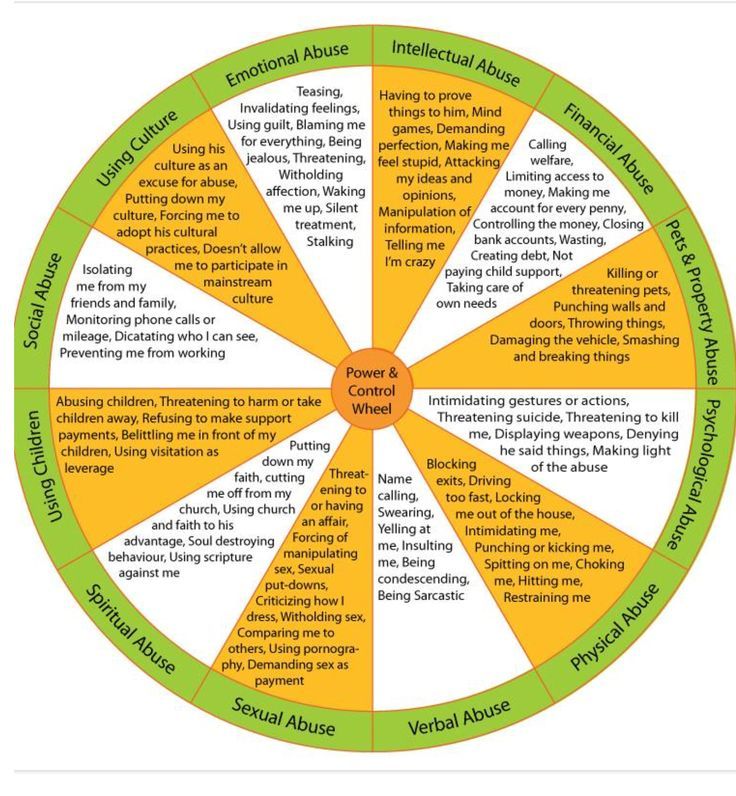

The New York City Office of Child Support Services (OCSS) understands that debt from any source can have a negative effect on an individual’s mental and physical health, but research suggests that it can also affect whole families. When that debt comes from unpaid child support, it can even undermine the primary goal of the program—getting children the financial support they need—by potentially discouraging employment among noncustodial parents and causing them to disengage from their children’s lives.

Noncustodial parents who owe DSS child support arrears can improve their future, and their children's, by taking the necessary steps to lower their debt or to bring their child support order into line with their income. Many parents qualify for the programs described below but few take advantage of them. To date, OCSS has reduced over $225 million of debt owed to the government and what we have seen is that reducing debt leads to increased child support payments.

For noncustodial parents with debt owed to the child’s other parent, free or low-cost mediation services can help both parents work out an agreement on whether they want to reduce the arrears and under what conditions.

If you have questions about any of these programs, email us at [email protected] with the program’s name, for instance, “MOTS” or “Arrears Cap,” in the email subject line.

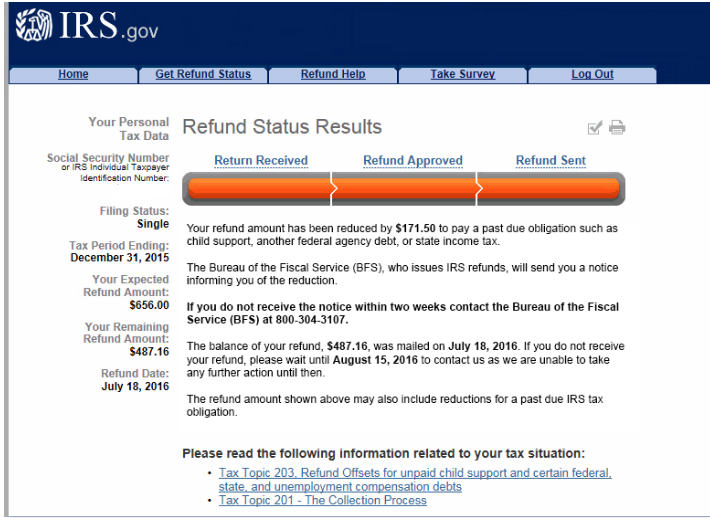

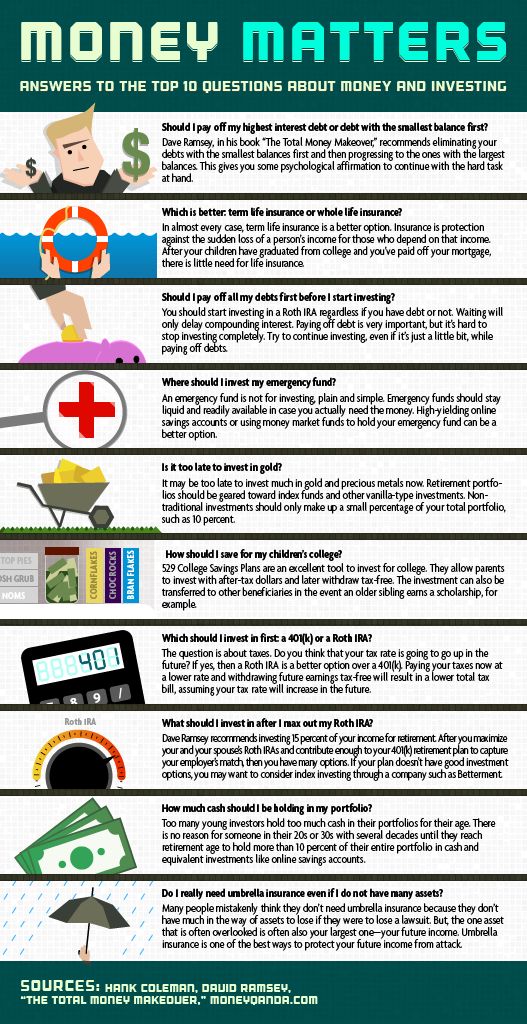

In addition, the Earned Income Tax Credit (EITC) helps low- to moderate-income parents get a tax break on their federal tax return. The City offers free financial counseling through the Department of Consumer and Worker Protection. One-on-one professional counselors can help with managing money and minimizing debt.

The City offers free financial counseling through the Department of Consumer and Worker Protection. One-on-one professional counselors can help with managing money and minimizing debt.

Arrears Cap can put a limit on the amount of child support debt that a noncustodial parent owes to the government. The amount of arrears can be reduced to as low as $500. To qualify, noncustodial parents must owe child support debt to the NYC Department of Social Services (DSS). The parent's income must have been below the federal poverty level when their DSS arrears accumulated. Noncustodial parents can apply by mail.

The Arrears Credit Program is open to noncustodial parents who owe DSS child support arrears and do not have more than $3,000 in the bank or more than $5,000 in property. Parents can qualify for a yearly credit of up to $5,000 on their DSS debt. They can also take advantage of this program up to three years – for a credit of up to $15,000 on DSS debt for each eligible case. There are two ways to participate: 1) by paying the full amount of child support owed each month for one year, or 2) for those without a current order, by paying the full amount of the last child support order each month for one year toward the debt owed on the account. Noncustodial parents can apply by mail.

There are two ways to participate: 1) by paying the full amount of child support owed each month for one year, or 2) for those without a current order, by paying the full amount of the last child support order each month for one year toward the debt owed on the account. Noncustodial parents can apply by mail.

The new Parent Success Program is designed to help noncustodial parents by supporting their well-being and strengthening their ability to provide for their children. In the first phase of the program, parents can eliminate up to $10,000 in DSS child support debt by completing a qualifying substance use treatment program. The treatment program must be certified by the New York State Office of Alcoholism and Substance Abuse Services (OASAS). Once parents have completed the course, they must submit a completion certificate or letter from their service provider to OCSS to qualify for the Parent Success Program's DSS debt reduction.

Pay It Off is a time-limited program that enables noncustodial parents to pay off New York City DSS child support debt twice as fast – by matching their payments that total a minimum required amount (up to the amount of DSS child support arrears they owe). This year, the program is offered October 17 - 31, 2022.

This year, the program is offered October 17 - 31, 2022.

Modifying Orders Through Stipulation (MOTS) gives parents the opportunity to discuss modifying their order with an OCSS worker and to enter into an agreement voluntarily before an appearance in court. For a stipulated agreement:

- An OCSS worker drafts the agreement using the same guidelines as the court and helps the parents gather the required documents.

- The approved stipulated agreement package is filed in court for a hearing to be scheduled.

- Usually only one court appearance is required for the Support Magistrate to make sure the parents understand their rights and responsibilities and to issue a modified order on consent.

Can I get rid of my past, overdue child support debt?

It depends, but probably not entirely.

IMPORTANT: The process for changing or lowering your PAST, OVERDUE child support debt (“arrears”) is different than the process for changing your CURRENT child support payment amount. This question will explain how to change your past, overdue child support debt. To learn about changing your current child support payments, see PG. 782.

This question will explain how to change your past, overdue child support debt. To learn about changing your current child support payments, see PG. 782.

!

This question will explain how to change your past, overdue child support debt.

First, figure out whether you owe overdue child support payments to the other parent (or caregiver) or to the state.

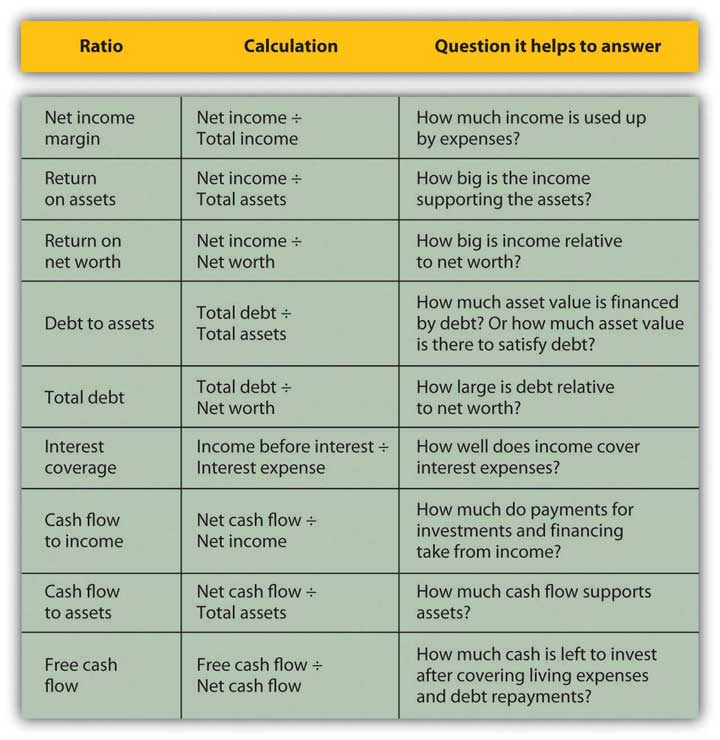

To find out, you can contact the LCSA and ask for a breakdown (detailed list) of your arrears. This will show how much you owe to the other parent and/or to the state. The chart below can also help you figure out whom you owe child support to—but it’s always best to get a breakdown from the LCSA to be sure!

Once you know whom you owe money to, use the following chart to figure out your next steps:

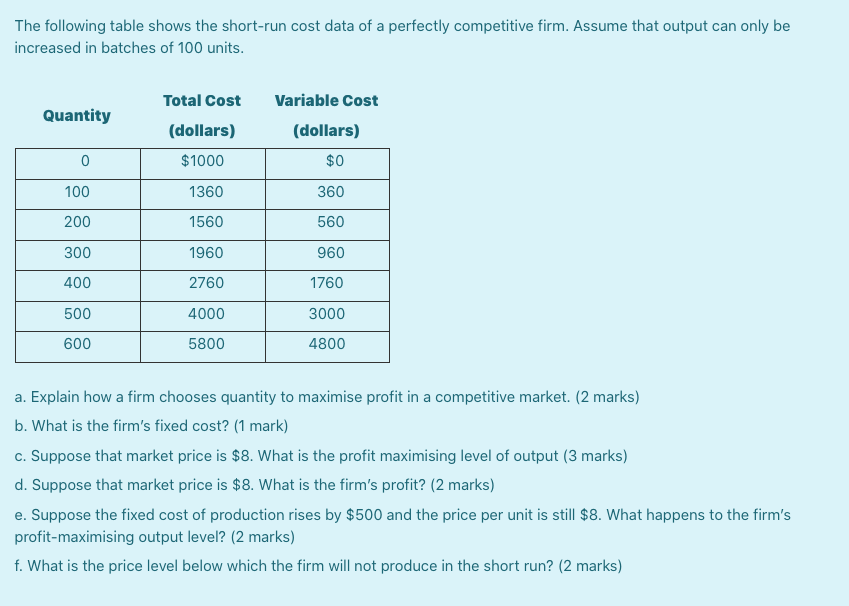

CHANGING OR LOWERING YOUR PAST, OVERDUE CHILD SUPPORT DEBT (ARREARS) | ||

TO WHOM DO YOU OWE CHILD SUPPORT MONEY? | I OWE CHILD SUPPORT TO THE STATE (CALIFORNIA) | I OWE CHILD SUPPORT TO THE OTHER PARENT (OR CAREGIVER) |

How do I know whom I owe? | If the other parent (or caregiver) is receiving public benefits for your child, or if CPS has taken your child, you owe child support to the State of California. | If your child support order was part of a divorce or family law case, you will probably owe child support directly to the other parent. |

What should I do? | Apply for the Compromise of Arrears Program (COAP) (see PG. 722 for more information).[2579] If you qualify, the COAP program will reduce (but not completely eliminate) the amount of child support debt that you owe to the State, so you will not have to pay as much.[2580] | Try to work out an agreement (called a “settlement”) with the other parent (or caregiver). You may be able to work out an agreement to forgive some or all of the overdue child support, in exchange for your paying off the remaining amount right away. For example, you could offer to make—and the other parent (or caregiver) could agree to accept—a single lump sum payment all at once, rather than making many smaller payments over time and having the debt drag out. |

Important Information to Know: | If you miss any of your current child support or COAP payments, your COAP agreement will be cancelled AND you will owe all the debt that was previously reduced. You may not receive a refund for any of the COAP payments that you’ve already made, and you will be unable to reapply to the COAP program for 2 years.[2581] | If you reach an agreement with the other parent, you should make sure to put it in writing for the LCSA and the judge.[2582] |

- 2578

Electronic communication from Brittany Stringfellow Otey, Assistant Professor of Law / Directing Attorney, Pepperdine Legal Aid Clinic, Jan. 21, 2015 (1:22 PM). ↑

- 2579

Cal. Fam. Code § 17560. ↑

- 2580

This is child support debt you owe if your child received public assistance (welfare) or was in foster care at the time payments were due. The COAP program will NOT reduce child support debt you owe to the other parent.

Cal. Fam. Code § 17560(d). ↑

Cal. Fam. Code § 17560(d). ↑ - 2581

Cal. Dep’t of Child Support Svcs., Compromise of Arrears Program (COAP) ( Nov. 13, 2014), http://www.childsup.ca.gov/payments/compromiseofarrearsprogram.aspx. ↑

- 2582

Electronic communication from Brittany Stringfellow Otey, Assistant Professor of Law / Directing Attorney, Pepperdine Legal Aid Clinic, Jan. 16, 2015. ↑

How Do Bailiffs Calculate Alimony Arrears?

The procedure for calculating the debt for alimony based on the debtor's income The procedure is simple: bailiff determines the average monthly income, guided by documents on the alimony payer's wages. From this amount, 13% of income tax is deducted, then the percentage of alimony -25% is calculated.

Bailiffs work exclusively on writ of execution, court decisions, and notarial agreements. Alimony debt bailiffs calculate , taking into account the information presented here, and then work on the basis of their powers . How does a child support debtor get a debt through the court:

How does a child support debtor get a debt through the court:

What is alimony debt?

Alimony arrears are formed in case of untimely/incomplete/lack of payment of alimony. Not always the debtor deliberately evades payment. In some cases, the reasons may be: ⦁ lack of information from the payer about the location of the recipient, or its change;

What to do if the debtor did not pay alimony without good reason?

If alimony is not paid without good reason, the debtor may be held administratively and criminally liable. If the debtor did not pay alimony for good reasons, and at the same time his financial situation does not allow repaying the delay, the debt can be written off.

What is meant by maintenance?

According to the Family Code, alimony means funds that are directed to the maintenance of children by parents and adult relatives by children or spouses. At the legislative level, a mechanism is provided for the appointment, calculation and payment of alimony.

At the legislative level, a mechanism is provided for the appointment, calculation and payment of alimony.

How to work with bailiffs?

How do bailiffs work? Bailiff is a civil servant who enforces judgments . The debtor is notified of the initiation of enforcement proceedings and is given time for the voluntary execution of judgment .

Who does the calculation of maintenance debts?

Calculation of alimony arrears - Federal Bailiffs Service

What should alimony bailiffs do?

Duties and rights bailiff in cases of alimony

- provide a period of up to 5 days for the debtor to voluntarily pay his debt;

- carry out field activities at the place of residence or work to determine the reasons for non-payment of alimony ;

- Establish ways to generate income for the payment of alimony ;

When do bailiffs transfer alimony?

Then the alimony received to your account from the father of the child, the bailiff bailiff -executor will be obliged, in accordance with the above article 110, to transfer within 5 business days from the date of receipt of funds to the deposit account of the bailiff bailiff .

How long does the bailiff's debt hang?

Statute of limitations for credit debt at bailiffs in accordance with the legislation of the Russian Federation is equivalent to 3 years. However, the interests of the creditor are protected by the state, as a result of which enforcement proceedings after the end of the allotted time may be resumed.

How to pay bailiffs in installments?

The only ironclad way to legally pay off debt to bailiffs for parts is an installment / deferment of execution of a court decision issued in court. To do this, you need to apply to the same court that made the decision, or to the court at the address of the Judicial bailiffs (place of execution).

Where to apply for maintenance debts?

How is collecting alimony arrears

- Contact the district bailiff service. The bailiff cannot trace the fact of evasion from paying alimony, so it is better for you to report it immediately in person or by letter.

- Apply to the court.

How do I apply for the calculation of child support arrears?

Application for calculation of debt is written in free form. Prepare a copy of application , on which, when submitting to the bailiff service, mark the date of filing application . Application for calculation of debt must be considered by a bailiff within 10 days.

Who can fulfill the maintenance obligation?

Subjects maintenance obligation are the person obliged to pay alimony and the recipient of alimony (respectively, parents and their minor children, under certain conditions - parents and their adult disabled children, grandparents, grandchildren, etc.).

How can the percentage of deductions on the writ of execution be reduced?

In order for the amount of deduction to be reduced, the debtor needs to apply to the territorial bailiff service, which conducts enforcement proceedings on it, with a written request to reduce the amount of deductions, attaching documents confirming the difficult financial situation.

What to do if the bailiffs have arrested the alimony account?

To make a claim, the following steps should be taken:

- Obtain a copy of the order from bailiffs or at the bank where is arrested account.

- Write a complaint to the head of the department or a lawsuit outlining the circumstances of the case.

- Supporting documents must be attached to the document:

How much can bailiffs deduct from salary if there is alimony?

According to the Labor Code of the Russian Federation, the amount of salary withheld on account of debt is calculated in the following proportions: according to the law - 20% of salary ; under federal law or a court decision - 50% of salary ; exceptions to the rules (for example, alimony ) - 70%.

How can I find out whether alimony was transferred or not?

The easiest and most convenient way to check the debt on alimony is to use the database of enforcement proceedings on the official website of the bailiffs. https://fssp.gov.ru/iss/ip – database of enforcement proceedings.

https://fssp.gov.ru/iss/ip – database of enforcement proceedings.

How long does alimony go through public services?

It takes at least 3 days to process and transfer funds.

How to view child support payments?

You can find out the debt for alimony at the branch of the Federal Bailiff Service (FSSP) or by calling the hotline. Also, the debt for alimony can be viewed via the Internet on the official website of the FSSP, through the State Services portal or the State Debts mobile application.

If alimony debts have accumulated...

Salnikova Veronika

Lawyer, partner of Yakovlev & Partners

June 16, 2021

Tips

Pay attention to the date of publication of the material: the information may be out of date due to changes in legislation or law enforcement practice.

How to collect them, what threatens the parent-debtor and in what case will he be released from liability?

Through which court to collect alimony from a father of many children?

“In 2018, the Magistrate's Court ruled to recover alimony from her husband for the maintenance of two minor children. In 2020, we had twins. Currently, the marriage is not dissolved. Tell me where to apply (to the world or district court) and how to file an application to collect alimony for twins?

In 2020, we had twins. Currently, the marriage is not dissolved. Tell me where to apply (to the world or district court) and how to file an application to collect alimony for twins?

Alimony (funds for the maintenance of minor children) can be collected through the court in the order of writ or action proceedings. Writ proceedings are a simplified procedure for collecting alimony in the Magistrate's Court. When filing an application, the court issues a court order without summoning the plaintiff and the defendant. Claim proceedings are carried out in the district court with the summons of the parties.

As a general rule, if the parent-debtor already pays child support, then they should be collected on other children through the district court. The mother of twins needs to apply to the district court at her place of residence or the defendant.

You can file a claim with an attorney. In addition, sample applications are often placed in courts. You can use this sample, detailing your situation and attaching supporting documents.

(Answers to other questions of alimony recipients and their payers can be found in the articles “On child support - in detail”, “On the payment of alimony - on real examples”, “Cross-border alimony”).

What threatens a parent for non-payment of alimony?

For late payment or non-payment of alimony in full, the debtor parent may be held liable - administrative (Article 5.35.1 of the Code of Administrative Offenses of the Russian Federation) or criminal (Article 157 of the Criminal Code of the Russian Federation).

Bailiffs bring to administrative responsibility negligent parents. This is possible in the event of non-payment without good reason of funds for the maintenance of children according to a judicial act, a court order or an agreement on the payment of alimony. The court already attracts criminal liability for malicious evasion from the fulfillment of maintenance obligations of parents.

On April 27, 2021, the Plenum of the Supreme Court of the Russian Federation approved a resolution stating that “violation of a judicial act or agreement on the payment of alimony should be understood as non-payment of alimony in the amount, on time and in the manner established by this decision or agreement. ” Partial payment of alimony cannot exclude the application of liability measures (read about this also in the news “The Plenum of the Supreme Court clarified the nuances of administrative responsibility for non-payment of alimony”) .

” Partial payment of alimony cannot exclude the application of liability measures (read about this also in the news “The Plenum of the Supreme Court clarified the nuances of administrative responsibility for non-payment of alimony”) .

In which case will the debtor parent be released from liability despite the maintenance debt?

If the parent-debtor has good reasons for which he cannot pay child support in the prescribed amount, he has the right to go to court and ask to change the procedure for collection. In the presence of such reasons, the debtor may be released from liability.

Valid reasons may be recognized such circumstances in which non-payment of alimony occurred regardless of the will of their payer: his illness (incapacity for work), his military service on conscription, force majeure circumstances, the fault of other persons, for example, non-payment of wages by the employer, delay or incorrect transfer bank of funds to the recipient of alimony.

The list of reasons that may be recognized as valid for exemption from liability is not exhaustive. In all cases, the judge must assess whether specific circumstances can be attributed to the number of good reasons for non-payment of alimony.

How do bailiffs force persistent non-payers to fulfill maintenance obligations?

If the parent does not just evade the payment of alimony, but hides and prevents their collection, i.e. becomes a malicious defaulter, the bailiffs start the procedure for searching for the debtor. But they can do this only if there is a statement from the alimony claimant. During the search, bailiffs try to locate the debtor and his property in order to bring him to justice and force him to fulfill maintenance obligations. How do they do it?

Bailiffs are endowed with special powers. They have the right:

- to receive personal data from the internal affairs authorities, tax authorities, the Pension Fund, registry offices, traffic police;

- check information through the customs authorities;

- check in banks information about accounts, deposits, securities;

- to interview relatives, friends, colleagues - everyone who has information about the non-payer;

- to carry out a visit to the location of the debtor's property for its examination and evaluation;

- use information obtained through the involvement of a private detective bureau or from open sources, including those posted on personal pages on social networks.

[2578]

[2578]