How much should i save for college per child

How much to save for college

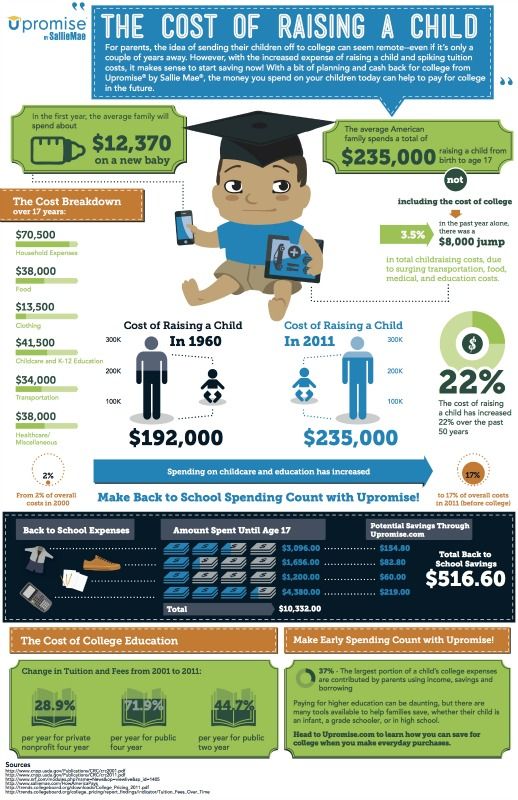

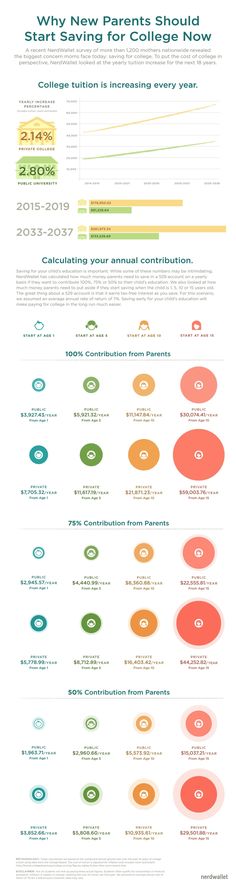

College is expensive. Hold on, let’s be honest: College is very expensive. Higher education costs as much as a small mortgage, but without owning a home. Even at in-state public four-year colleges, the average cost of a bachelor’s degree will soon break into the six figures. And, in 17 years, the most expensive college will cost more than half a million dollars. Yikes!

Saving for college can help you pay for college costs and reduce student loan debt. The more you save, the less you need to borrow. But, how much should you save for college?

The 1/3 Rule

The 1/3 Rule is based on the idea that people rarely pay for a major expense in one big lump sum. Rather, they spread out the costs over time by combining savings and debt with current income. One third of the cost might come from past income (savings), one third from current income and one third from future income (loans).

The one-third ratio provides a rough cut of a split. It is possible that some parents will save more and therefore need to borrow less. Other parents don’t save as much, and may be forced to borrow more or to send their children to less expensive colleges.

Most families plan to save about a third of future college costs for each child. On average, however, families save only about 10% of college costs by the time the child turns age 18, falling short of the goal.

See also: What You Can Pay For with a 529 Plan

The 3X Rule

Based on historical college cost data, the cost of a college education roughly triples over any 17-year period from birth to college enrollment.

That’s the equivalent of an average college cost inflation rate of 6.6%. Tuition and fees tend to grow faster than the total cost of attendance, which includes room and board. Tuition inflation rates are lower at private non-profit four-year colleges than at public four-year colleges, in part because private college costs are higher.

FREE TOOL: Calculate how much you should be saving per month

How to set your college savings goal

Since 3 x 1/3 = 1, that suggests that the college savings goal should be equal to the complete cost of a college education the year the baby was born. Saving this amount will yield enough money to cover about a third of the future college costs.

You might not be able to predict the specific college in which your child will enroll 17 years from now, but you might be able to predict the type of college, such as an in-state public four-year college or a private four-year college.

The College Board’s annual Trends in College Pricing publication reports an average cost of attendance (tuition, fees, room and board) in 2017-2018 as follows:

- Public four-year college (In-State): $20,770

- Public four-year college (Out-of-State): $36,420

- Private Non-Profit four-year college: $46,950

Assuming that the current inflation rates of 3. 1%, 3.2% and 3.5% continue, the complete cost of a college education for this year’s college freshmen will be about $87,000, $153,000 and $198,000.

1%, 3.2% and 3.5% continue, the complete cost of a college education for this year’s college freshmen will be about $87,000, $153,000 and $198,000.

FREE TOOL: Calculate the cost of sending your child to college with our College Savings Calculator

Monthly contribution amounts

These figures can be converted into equivalent monthly 529 plan contribution amounts, assuming 17 years from birth to matriculation.

For a child born this year, parents should save at least $250 per month for an in-state public four-year college, $450 per month for an out-of-state public four-year college and $550 per month for a private non-profit four-year college, from birth to college enrollment.

Start by taking baby steps

You don’t have to save the full cost of college. If you set your goal to save 100% of your child’s college education costs, you may get sticker shock. The sheer magnitude of the cost of attendance might cause you to give up in dismay.

Instead, set your sights a little lower and break up the college savings goal into baby steps, such as how much you need to save per month instead of one big lump sum. If you start saving from birth, the monthly contribution is about 0.3% of the college savings goal.

If you start saving from birth, the monthly contribution is about 0.3% of the college savings goal.

If you can’t save even $250 per month, start with a less ambitious amount. For every $10,000 in college costs, you need to save only about $25 to $35 per month from the day your baby is born.

Once you get started with saving, you’ll find it easier to increase the amount you save per month. You will quickly get used to having less money in your checking account.

There are also natural opportunities to increase the amount you save. For example, once the baby is potty trained, you can contribute the money you were previously spending on diapers to the baby’s college fund. You can also invest windfalls, such as income tax refunds, inheritances and lottery winnings.

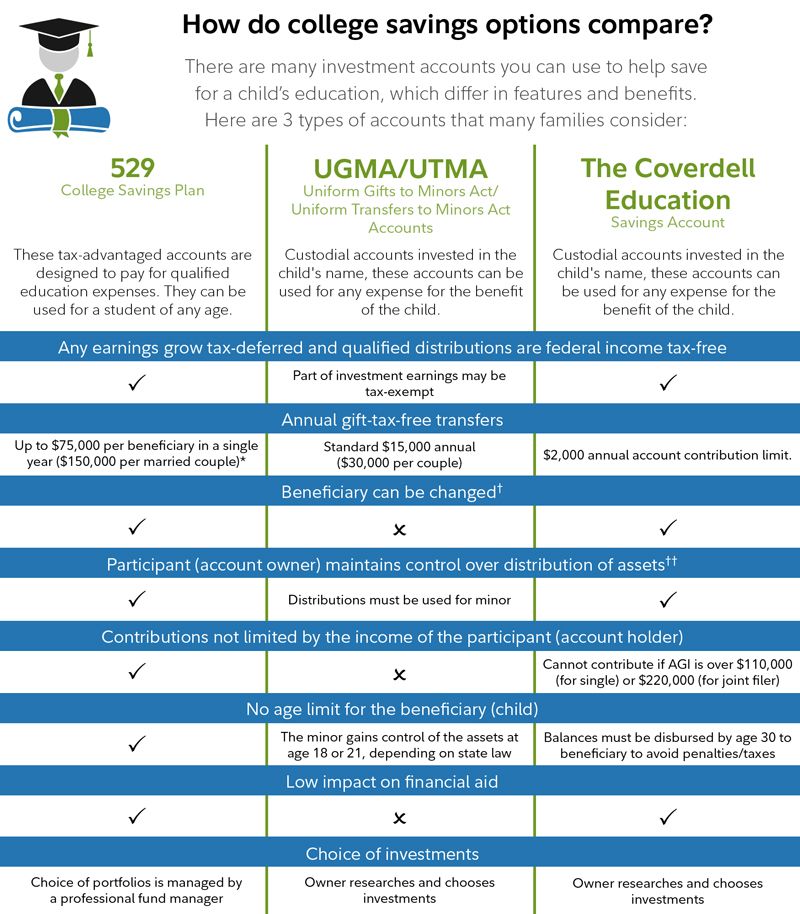

Consider opening a 529 planMost 529 college savings plans will let you set up an automatic investment or payroll deduction with as low as $25 per month.

529 plans have an added advantage over an everyday savings account. When you save in a 529 plan, your money grows on a tax-free tree, causing it to accumulate quicker. Your state may also offer an additional tax benefits such as tax credit or deduction for 529 plan contributions.

When you save in a 529 plan, your money grows on a tax-free tree, causing it to accumulate quicker. Your state may also offer an additional tax benefits such as tax credit or deduction for 529 plan contributions.

Withdrawals from a 529 savings plan are also typically tax free when used for qualifying college expenses, such as college tuition and other qualified education expenses.

Wondering how your 529 plan may impact financial aid? Use our Financial Aid Calculator to estimate the expected family contribution (EFC) for FAFSA and your financial need.

Benchmarking progress in saving for college

It’s never too late (or too early) to start saving for college since every dollar you save is a dollar less you’ll have to borrow. But, it is easier to save the sooner you start, since the monthly contributions will be smaller and there’s more time for the earnings to compound.

For example, if you start saving for college when the baby is born, about a third of your college savings goal will come from the earnings. If you wait until the child enters high school, however, less than 10% of the college savings goal will come from earnings and you’ll need to save six times as much per month to reach the save college savings goal.

If you wait until the child enters high school, however, less than 10% of the college savings goal will come from earnings and you’ll need to save six times as much per month to reach the save college savings goal.

If you want to check how much you should have saved based on your child’s age, multiply the child’s current age by $3,000 for an in-state public four-year college, $5,000 for an out-of-state four-year public college and $7,000 for a private non-profit four-year college.

See also: How to Help Pay for College Without Impacting Financial Aid

Fine-tuning college savings

For a personalized estimate of how much to save for college, use the World’s Simplest College Cost Calculator.

Next Steps

- 7 Myths and Realities of 529 Plans

- What is a 529 Plan?

- How to Open a 529 Plan

- How Much Can You Contribute to a 529 Plan?

- What You Can Pay For with a 529 Plan

Upromise is a program that allows you to earn cash back to your 529 plan by simply shopping through their online portal, dining out, or signing up for their cash back credit card. CollegeBacker also has a cash back shopping portal, as well as an easy-to-use gifting page for family and friends to make a contribution to your child’s college fund.

CollegeBacker also has a cash back shopping portal, as well as an easy-to-use gifting page for family and friends to make a contribution to your child’s college fund.

At Savingforcollege.com, our goal is to help you make smart decisions about saving and paying for education. Some of the products featured in this article are from our partners, but this doesn’t influence our evaluations. Our opinions are our own.

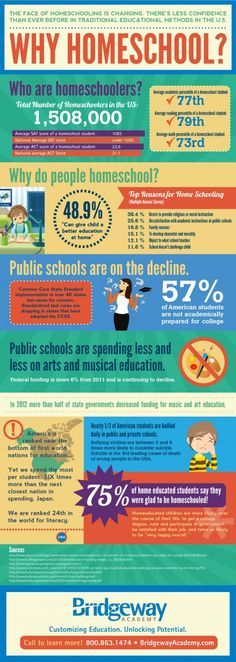

How Much Should You Be Saving for Your Child's College Education?

Seeing the price of college education today can cause sticker shock for a lot of parents, and rightfully so — if you're willing to spend money on attending a four-year public college, it will cost $10,560 on average per year, according to the College Board. The sticker price of one year at a four-year private college will cost you a whopping $37,650 on average. Though the average cost of attending college is less than the sticker price because of college scholarships and grant aid, paying for higher education is still no small feat.

The sticker price of one year at a four-year private college will cost you a whopping $37,650 on average. Though the average cost of attending college is less than the sticker price because of college scholarships and grant aid, paying for higher education is still no small feat.

It can be hard to know where to start, especially when you have more immediate financial priorities like paying for childcare and rent. However, having a plan and investing early is crucial in making sure that you or your child won't be forced to take out student loans and then be on the hook for paying off that debt down the line.

Select spoke to higher education expert and author of How to Appeal for More College Financial Aid Mark Kantrowitz about how much money parents should aim to invest for their child's education, when they should start and where they should put their money.

Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign-up here.

Sign-up here.

Start early and with whatever you can

The most important part of saving for college is investing as early as possible. Since compound interest is interest earned on both the initial investment and the interest you've accumulated, your gains will be much larger if you start investing at birth.

You can think about it like this: With compound interest, an initial investment of $1,000 will yield earnings of $100 after one year if there's a 10% interest rate that's compounded annually. Your second year, you'll earn an additional $110 because you'll be receiving 10% interest on the $1,100 you've accumulated.

Kantrowitz recommends the one-third rule as a rough guide for how much parents should be saving: one-third of the cost of a four-year college education will come from parent's income and financial aid, one-third from savings and investments and one-third from student loans. Once you decide what percentage of your child's college education you're willing to fund, you'll have to figure out how much that will cost you each month.

According to Kantrowitz, about one-third of your college savings will come from your investments if you start investing at birth. However, if you start investing when your child is in high school, only one-tenth of your college savings will come from your investments. In other words, your college savings will be nearly three times bigger if you started investing at birth than if you started in high school.

The cost of college rises by roughly a factor of three every 17 years, so if your child is a baby now, you should aim to invest the current cost of a four-year college education over the span of the next 18 years.

For example, if you want your child to attend a four-year in-state public college, the current cost of attendance (this includes tuition, fees and room and board) for one year is $26,820, according to the College Board. You'll have to invest roughly $300 every month starting at birth to send your child to a four-year in-state public college (assuming a 3% inflation rate), according to Kantrowitz. For a private non-profit college, you'll have to invest $600 a month.

For a private non-profit college, you'll have to invest $600 a month.

If your investments yield a 6% rate of return each year, you'll earn roughly enough money to cover 1/3 of your child's total college costs once they're 18.

While this may seem like a lot, investing any amount of money each month is a good idea. Set up automatic transfers to your investment account so you don't have the temptation to spend the money once it's in your checking account. And if you can't put a lot away right now, over time, you can ramp up your monthly contributions — it's essential to start investing early to take advantage of compound interest.

Where should you invest your money?

If you're investing for college you should consider opening a 529 savings plan or a state-sponsored investment account exclusively used for investing for school. With 529 savings plans, individuals can use the money they withdraw for college and K-12 tuition and other qualified educational expenses without paying income tax on any investment gains.

529 savings plans contain a variety of different funds such as mutual funds, bonds funds and ETFs. They are generally recommended for investing for college because of the tax benefits people get from them: You can contribute up to $15,000 tax-free (for single tax-filers) and your earnings will grow tax-free.

States offer different 529 savings plans, and you don't need to be a resident of that state in order to qualify for an account. However, certain states may offer tax benefits for in-state contributions. For example, in New York, in-state residents have tax-deductible contributions, so residents can reduce the amount of their taxable income if they invest in a 529 savings plan.

You can also opt to invest for your child's education using a brokerage account or a 529 prepaid tuition plan. These, however, are less popular options.

If you opt for a 529 prepaid tuition plan, you pay for tuition at certain colleges at today's rate. By doing so, you're hedging against inflation and rising tuition costs. While you can transfer your funds if your child chooses to attend a different college, prepaid tuition plans have their drawbacks: there are only 18 state-sponsored plans that offer this, you have to be an in-state resident and they don't cover additional educational expenses like 529 savings plans do.

While you can transfer your funds if your child chooses to attend a different college, prepaid tuition plans have their drawbacks: there are only 18 state-sponsored plans that offer this, you have to be an in-state resident and they don't cover additional educational expenses like 529 savings plans do.

You might also consider investing your money in a brokerage account through companies like TD Ameritrade, E*TRADE or Vanguard. If you go this route, however, you'll forgo some of the tax benefits that you'd get if you invested in a 529 savings plan. Namely, you'll have to pay tax when you sell any of your funds or stocks that have grown in value.

Bottom line

There's no denying that the cost of college is rising rapidly — even the thought of paying it can be daunting for many parents. However, parents should start saving as early as they can so they can reap more profits from their investments.

Once parents determine what percentage of their child's college education they're willing to pay for, they can create a plan for their monthly contributions. They'll have the option of investing in a 529 savings plan, a brokerage account or a prepaid tuition plan, but they'll likely get the most tax benefits and flexibility from a 529 savings plan.

They'll have the option of investing in a 529 savings plan, a brokerage account or a prepaid tuition plan, but they'll likely get the most tax benefits and flexibility from a 529 savings plan.

Catch up on Select's in-depth coverage of personal finance, tech and tools, wellness and more, and follow us on Facebook, Instagram and Twitter to stay up to date.

Read more

Editorial Note: Opinions, analyses, reviews or recommendations expressed in this article are those of the Select editorial staff’s alone, and have not been reviewed, approved or otherwise endorsed by any third party.

how to get, documents, new rules for graduates of colleges and universities

On March 29, three more types of deferment from the army appeared in the law on conscription. Those who graduate from school, study at technical schools and enter the master's program will be able to use them. Previously, it was possible to get into the army right after school, now graduates and students were given the opportunity to get an education, and only then repay their debts to their homeland.

Those who graduate from school, study at technical schools and enter the master's program will be able to use them. Previously, it was possible to get into the army right after school, now graduates and students were given the opportunity to get an education, and only then repay their debts to their homeland.

Source:

Federal Law No. 39-FZ of March 18, 2019

On April 1, the President announced another conscription to the army. If you or your children may receive a subpoena, read how to get a deferral given the new law.

What's changed in the deferment rules

Here's what students and their parents need to keep in mind:

- 18-year-old students will be given a deferment to finish school.

- And then - for admission to a university, technical school or college, until October 1.

- And while studying at a university, technical school or college.

- And again - for master's degree after bachelor's degree. Regardless of previous delays at school.

- Spring draft began on April 1, 18-year-old students and schoolchildren can receive subpoenas.

- To get a deferment, you need to go to the military enlistment office with documents.

- Students from other cities can do this at their place of study - they don't have to go to their city.

- To confirm the postponement, a certificate from the educational institution is required.

These rights for all conscripts in Russia achieved 19-year-old guy from St. Petersburg. Remember his last name - Solovyov.

Whom does it concern?

This applies to men of military age - from 18 to 27 years old - who may receive a summons to the army. That is, they are subject to compulsory conscription and must serve in the army. But some men are legally entitled to a delay. Although they are 18 years old, they will not be called up to the army in the near future: you can get a summons, go to the draft board with her and get permission not to serve for a good reason yet.

Ekaterina Miroshkina

economist

Author profile

There are several types of such deferrals in the law. For example, those who have two children, who have been declared temporarily unfit, or who have become a deputy, will not be drafted into the army. There is a separate deferral for studies: Russia wants men to get an education, so it allows them not to serve while studying at a school or university. There have been changes in the rules of this study delay.

Since changes in the terms of deferment from the army affect graduates and students, this also applies to their parents, who take part in the choice of a university, technical school and form of education after school.

/you-are-in-the-army/

I am a contract soldier, that's what Russia gives me

What was the problem with deferment from the army?

Pupils who turned 18 in high school were given a deferment from the army to finish school. This was the first postponement, that is, the guys did not get into the spring draft. If a graduate entered a university, he was given another deferment - for the duration of his undergraduate studies. But if a young man wanted to study at a college or graduate school, he could no longer get a deferment. Because for vocational education they didn’t give a second one, and for master’s programs a third one was needed, which is not required by law.

This was the first postponement, that is, the guys did not get into the spring draft. If a graduate entered a university, he was given another deferment - for the duration of his undergraduate studies. But if a young man wanted to study at a college or graduate school, he could no longer get a deferment. Because for vocational education they didn’t give a second one, and for master’s programs a third one was needed, which is not required by law.

At the same time, if the graduate turned 18 after school, he could receive a deferral for both the technical school and the master's program. The opportunity to get an education depended on how old the boy went to school and when he graduated.

Parents had to look for alternative deferral options. And a man could be left without a master's degree and the necessary diploma because of the army. Some college students were drafted into the army straight from their studies. For example, on September 1 he entered, and on December 1 he went to serve.

The Constitutional Court is against such laws

One student did not accept the norms of the law: they say, for some reason they do not give me a deferral for the duration of my studies. The military registration and enlistment office considered that one deferral was given at school when the student turned 18, and another one until October 1 after graduation from grade 11. And there are no more college deferrals, so join the army.

Instead of the army, a 19-year-old guy went to the Constitutional Court and won the right for all graduates and students to study without the threat of being drafted into the army. The chief judges of the country said that the law is unconstitutional and violates the rights of people - it must be changed. Here they changed.

Who will be given a study deferment

Items that were considered the first deferment for 18-year-old schoolchildren were removed from the article on deferrals. Now this will not prevent you from completing a master's degree or studying at a technical school.

Types of postponement for graduates and students

| Who will receive a deferment | on what conditions |

|---|---|

| 18-year-old schoolboy | until school |

| 18-year-old graduate with a certificate | Until October 1 of the same year |

| Applicant who is a full-time student of preparatory courses at the expense of the budget | Maximum for a year - and provided that enrollment in the year of graduation |

| Until graduation, even if there was a delay at school and after exams | |

| Undergraduate and specialist student | Before graduation - and if there is no bachelor's, specialist's or master's degree yet |

| Magistrates Student | once before the end of the study, not counting the postponement at school, and then in the undergraduate and specialty |

| graduate student, Officer, Internet, assistant status | still does not finish studying. under the state program under the state program |

| Seminary student, if she has a license | Until the end of training |

Who will receive a deferment

on what conditions

18-year-old schoolboy

will not finish the school

18-year-old graduate with a certificate of

until October 1 of the same year

applicant, who is in person at preparatory courses at the expense of the budget

Maximum for a year - and provided that the enrollment is in the year of graduation

Full-time student of a college or technical school

Until the end of training, even if there was a delay in school and after exams

Student of the undergraduate and specialty

until the graduation of the university - and if there is no bachelor's diploma, specialist or master

Students

once before the end of study, , not counting the deferment at school, and then in the undergraduate and specialty

Postgraduate student, resident, intern, assistant trainee

Until he graduates from the terms of the state program

Seminary attendee, if he has a license

Until the end of studies

University students who study for a bachelor's degree can safely continue their studies at a master's degree. Even if they were given a deferment at school, and then at a university, now they will give another one for a master's degree.

Even if they were given a deferment at school, and then at a university, now they will give another one for a master's degree.

But such deferments are given to bachelors and masters only once. In two universities, a conscript fit for service will not have time to unlearn: he will have to serve during a break.

You can't get a college deferral after college. Because these are deferrals of the same type - and after school it is only allowed once.

/redarmy/

How not to join the army before graduate school

How to get a deferment from the army

To get a study deferment, you need to personally come to the recruiting office with documents. It is not provided in absentia: if you receive a summons, collect documents and take them to the commission. The military registration and enlistment office does not know that the conscript is studying at school or enrolled in a university.

What documents confirm the deferment from the army

Here is a short instruction for those who are studying and cannot serve:

- Get a certificate from an educational institution: school, college or university.

This is a special form, they know. Tell me what you need at the military registration and enlistment office for a delay.

This is a special form, they know. Tell me what you need at the military registration and enlistment office for a delay. - Diploma and school license may be required.

- Go to the military enlistment office within the time specified in the agenda. Now there is a call wave from April 1 to July 15. The next one is from October 1st to December 31st.

- Wait for the decision of the draft board. She will check the grounds for the postponement and issue an extract from the protocol. There are five days for this, the statement can be sent by mail.

What happens when the grace period ends?

If there is no reason for the delay or it has ended, you will have to serve. But only if by this time they have not yet turned 27 years old. If a conscript turns 27, he is enrolled in the reserve and does not need to serve in the army.

If you don’t go anywhere after school, then there will be no reason for a delay - it will be given until a maximum of October 1, and a summons will be sent to the autumn draft. And if you don’t enter a master’s program after a bachelor’s degree, you will also have to go to the army. And without a smartphone: only a push-button phone can be taken from this call.

And if you don’t enter a master’s program after a bachelor’s degree, you will also have to go to the army. And without a smartphone: only a push-button phone can be taken from this call.

/dengi-v-armii/

How much money does a conscript need in the army

What if I want to save up for my child's education?

What if I want to save

for my child's education?

Manshuq Finance Special Project

What if

I want to save up for my child's education?

Manshuq Finance special project

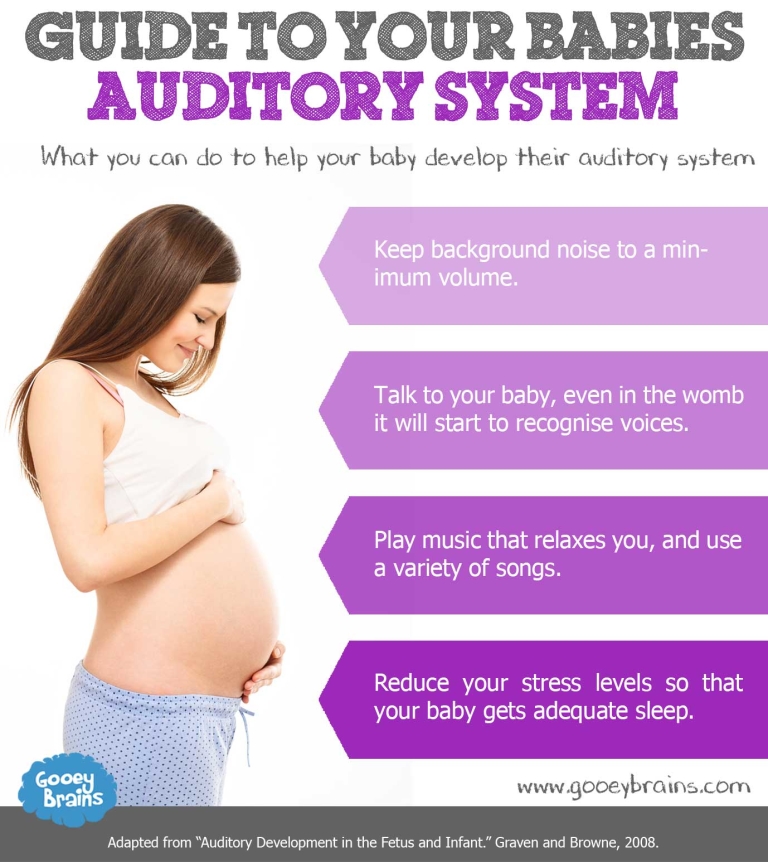

Every parent thinks about the future of their child. And one of the aspects that parents begin to worry about almost from the very birth of their son or daughter is where and how will they study? Especially when it comes to higher education. We turned to Home Credit Bank experts for clarification - what investment instruments and strategies are most suitable if there is a goal - to save up for a child's education?

When should one start thinking about saving for a child's education? How long will it take to save?

In this matter, a lot will depend on the higher education institution that you choose, and on the total amount of tuition for the entire period.

Of course, it is worth thinking about savings in advance - it is best to do this when the child goes to first grade. Then you will have enough time to accumulate the necessary amount by the end of school.

For accumulation, it is best to use a deposit with a good interest rate and the possibility of monthly replenishment. So you can not only save and accumulate your savings, but also increase the amount.

What amount of savings should be calculated?

The amount of savings for your child's education will depend on the chosen university and specialty. It is worth considering that a future student can choose a university outside of Kazakhstan - then, in addition to tuition fees, it is necessary to take into account the cost of flights twice a year (summer and winter holidays), living in a hostel or in a rented apartment, pocket money.

Therefore, in order to roughly calculate the amount that you will need in the future, you need:

· determine whether your child will study in Kazakhstan or abroad. If the choice fell on an educational institution abroad, then determine the country;

If the choice fell on an educational institution abroad, then determine the country;

· study all the institutions of higher education that are in the country you have chosen to understand the "dispersion" of prices in one year. Then it makes sense to add 20-30% to the amount for the entire training period in order to predict a possible price increase.

For example, a year of study at a Kazakh university N costs 1,000,000 tenge. The training period lasts 4 years. Plus, we add 30% to each year of study. In total, we get the amount of 6,187,000 tenge, which will be required for accumulation.

How much money per month will you need to set aside?

The amount of monthly savings will depend on how much you currently have, on the total amount you want to save, and on the accumulation period.

It is convenient to make it a rule that you will save 10–20% of your monthly salary as a deposit.

There are several ways to accumulate money:

Deposits

You can choose the best option for yourself by studying the offers of different banks.

Certificate of Deposit

This product has an advantageous rate of 15%. However, the minimum amount to purchase a certificate is 500,000 tenge, and there is no possibility to report or withdraw funds. Also, this product does not fall under the protection of the Kazakhstan Deposit Guarantee Fund - that is, if something happens to the bank, your savings will simply “burn out”.

Opening a metal account that is tied to the value of precious metals

Here it is important to take into account that the market value of a precious metal may either increase or decrease and, accordingly, your account balance may also decrease or, conversely, increase. Also, this type of deposit, as well as a certificate of deposit, is not insured by the Kazakhstan Deposit Guarantee Fund.

How to choose the right savings method?

There is no correct answer to this question, because it all depends on personal preference.

If you decide to contact the bank to open a deposit, we advise you to pay attention to the following points:

Bank and conditions

It is important to study not only the bank, but also carefully read the conditions that it is ready to offer. Now banks provide various deposit programs with which you can not only save, but also significantly increase your capital.

Now banks provide various deposit programs with which you can not only save, but also significantly increase your capital.

Currency

It is important to decide in which currency to open a deposit, as this may vary the interest on the deposit and other conditions. Today, Kazakhstani banks offer opening deposits both in tenge and various foreign currencies - rubles, dollars, euros, British pounds and even Japanese yens.

Interest rate

This indicator should be paid attention first of all. The higher the rate, the higher the return on your investment and the ability to save money from inflation. The interest rate varies not only depending on the type of currency, but also on the term of the deposit, as well as on special conditions that the bank can offer. The longer the term of your deposit, the higher the reward will be. However, it is worth checking with the deposit manager about the possibility of early withdrawal of the deposit without penalties and with the preservation of remuneration.

Additional conditions

Be sure to ask the manager about additional conditions. For example, is capitalization possible when interest is charged on interest. This option can significantly increase the stated interest rate of remuneration. The ability to replenish your account also contributes to the effective process of accumulating the necessary amount for specific expenses or for saving and increasing free funds.

What points are important to consider when saving?

· Firstly, it is important to take into account your income and the ability to regularly save 10-20% of your salary for a deposit.

· Secondly, you need to take into account your monthly expenses and expenses. Here it is important to learn how to correctly allocate the budget and keep track of expenses - for example, using various mobile applications that will structure and manage your budget and give an understanding of your expenses.

The so-called 50/20/30 formula can also help spread costs, where 50% is your regular expenses (food, utilities, transport, etc. ), 30% is your savings that you can put aside for a deposit , and 20% - optional, but significant expenses (gifts, recreation, entertainment).

), 30% is your savings that you can put aside for a deposit , and 20% - optional, but significant expenses (gifts, recreation, entertainment).

As an experiment, try following this formula for several months, and then you will be able to figure out what % of your monthly income you can save for your child's education.

It should be remembered about the growth of cents, inflation and possible devaluation - on average it can be from 30 and even up to 50%.

What are the conditions for opening a savings deposit in a bank?

Each bank has its own conditions for opening each specific deposit.

"Savings" deposit in Home Credit Bank provides the following conditions:

interest rate up to 14% per annum

deposit term from 6 months

daily capitalization

Minimum opening amount – from 1000 tenge.

It is important to note that our bank has two savings deposit options - Savings Home and Savings Home +.

More details about each of the contributions can be found HERE.

Are there special offers for education savings?

Yes there is. Here it is worth paying attention to the banks that participate in the state educational savings system.

The list of banks can be found on the website of the financial center of the Ministry of Education and Science of the Republic of Kazakhstan.

In what currency is it profitable to save?

It depends on the initial amount of savings. It should be noted that the interest rate on tenge deposits is always higher than on foreign currency deposits. So, for example, a tenge deposit will bring you up to 14% per annum, and a deposit in foreign currency up to 1%.

Are there incentives for customers who use a bank deposit for a long time?

Each bank has its own privileges for customers - for example, it can be a personal manager, increased bonuses and cashbacks on debit cards, and others.