How much is taken out for child support

Child Support Calculator NY | Calculating Child Support in NY

By Sari M. Friedman, Legal Counsel

Fathers' Rights Association – NYS & Long Island

In New York State, who pays child support in a 50/50 joint custody arrangement since there there is no one "custodial parent"? Generally, the lower-earning parent will be treated as the “custodial parent” and the higher-earning parent will end up paying child support. Continue reading for more details about child support in NYC, Long Island, and all of New York.

In an earlier article we wrote about the Court of Appeals decision in Bast v. Rossoff 91 N.Y.2d.723. In this case, the Court held that shared custody arrangements do not alter the scope and methodology of the Child Support Standards Act (CSSA).

The act, passed in 1989, states that the three-step statutory formula for calculating NY child support must be applied in all shared custody cases.

Related Reading:

- Child Support & Extra Curricular Activities

- Child Support & College Expenses

- Interstate Child Support Laws

- New Child Support Law

- When Is My Child Emancipated?

Contact a Child Support Lawyer Today! Serving Long Island, NYC & All of NYS.

How Much Is Child Support in NY?

New York State child support is calculated using the NY child support calculator formula. NYC.gov also has an online NY child support calculator. You can use their child support calculator to help you get an idea of how much child support may be required for your case in NY.

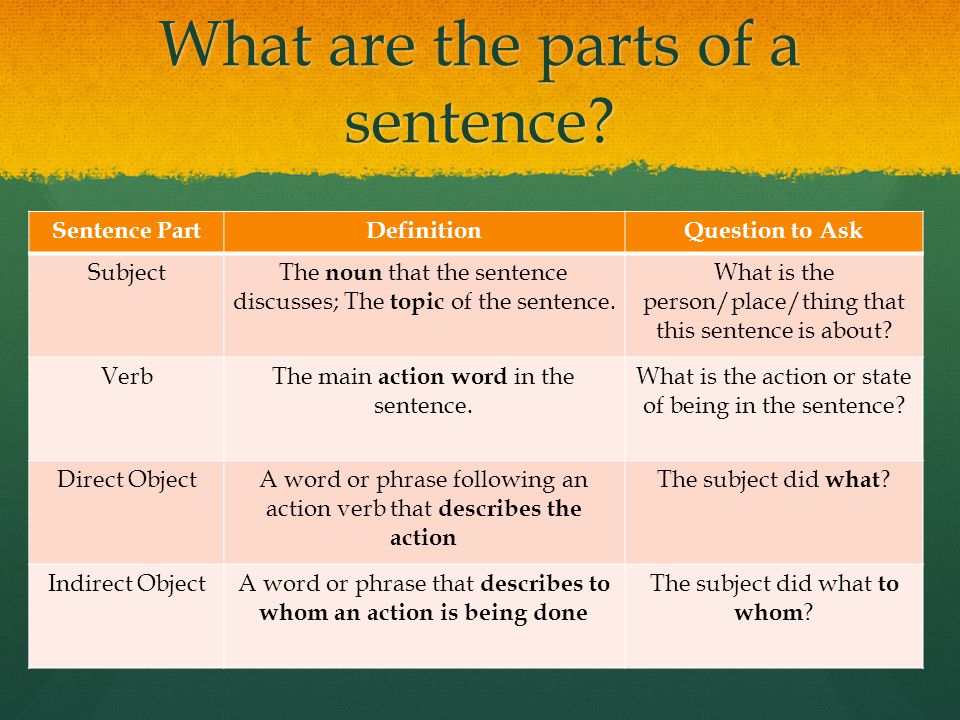

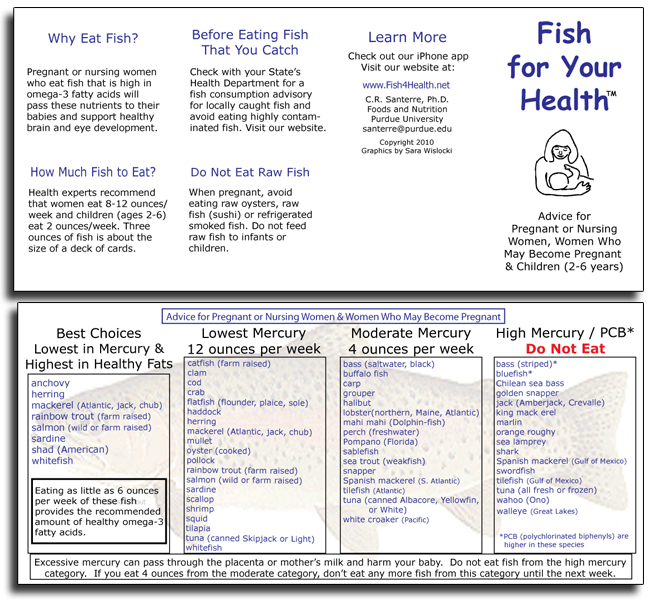

The three-step formula for calculating NY child support is:

- Calculate the combined income and each parent's pro-rata share of the same

- Use the correct percentage of total income CSSA says should be devoted to child support:

- 17% for one child

- 25% for two children

- 29% for three children

- 31% for four children

- 35% for five or more children

- Calculate each parent's share thereof.

The non-custodial parent is directed to pay a pro-rater share of the child support obligation unless the court finds the amount to be unjust or inappropriate based on consideration of specified factors in Section F of CSSA.

The problem is that Bast (in Bast v. Rossoff) does not specifically address how to apply the CSSA in cases of equal shared custody. Indeed, the Bast case did not recognize cases of equal shared custody.

In Equal Shared Custody, Who Is the Custodial Parent?

The Appellate Division, 3rd Department did address the shared custody issue in Baraby v. Baraby 250 A.D 2d 2201, and the Appellate Division, 4th Department addressed it again in Carlino v. Carlino 277 A.D. 22d 897.

In Baraby, the third department stated the parent with the larger income would be deemed the non-custodial parent for purposes of calculating support under CSSA. The parent with the non-custodial designation must be directed to pay his or her pro rata share of the child support obligation to the other parent unless the statutory formula yields a result that is unjust or improper. In that situation, the trial court can resort to the "Paragraph F" factor in CSSA and order an amount that is just and appropriate under the circumstances.

The parent with the non-custodial designation must be directed to pay his or her pro rata share of the child support obligation to the other parent unless the statutory formula yields a result that is unjust or improper. In that situation, the trial court can resort to the "Paragraph F" factor in CSSA and order an amount that is just and appropriate under the circumstances.

The 4th department in Carlino, citing the Baraby case, which said in a 50/50 shared custody arrangement, if the parent with the larger income demonstrates that expenses incurred in having equal time substantially reduces the cost the parent with the lesser income has to bear as non-custodial parent, then the court should find that it would be unjust or inappropriate to award the statutory amount. Instead, the court should determine a proper support amount based on the specific expenses and the degree such expenses have been substantially reduced as a result of the time spent with the non-custodial parent. That court, as in Baraby, also remanded the case to the Trial Court for a hearing to calculate support in accordance with its decision. It found the Trial Court record lacked sufficient requisite information necessary to make the calculation.

That court, as in Baraby, also remanded the case to the Trial Court for a hearing to calculate support in accordance with its decision. It found the Trial Court record lacked sufficient requisite information necessary to make the calculation.

What Does This Mean To You?

If you live in New York State in the first or second Judicial Department, chances are the principles laid out in Baraby as well as in Carlino will be adhered to. This further means that if you are the larger wage earner and thus the non-custodial parent for purposes of CSSA in a case of equal time, then you should be prepared to demonstrate how your time with the child reduces the custodial parent's expenses for things such as, but not limited to, food, electricity, telephone, transportation, entertainment, etc.

Prior to these decisions, Bast made clear the statutory formula should be applied and courts were quite reluctant to deviate from the Act on the principle of "unjust or inappropriate". These two cases may well have provided a platform for arguing that people with close to 50/50 time should obtain the same treatment of analyzing to what extent the custodial parent's expenses are reduced by the substantial time the non-custodial parent spends with the child.

These two cases may well have provided a platform for arguing that people with close to 50/50 time should obtain the same treatment of analyzing to what extent the custodial parent's expenses are reduced by the substantial time the non-custodial parent spends with the child.

What If You Do Not Have 50/50 Time, but More Than Standard Visitation Time?

The unknown question at this point is how far the New York courts, as a parochial matter, will extend their willingness to deviate from CSSA based upon the time each parent spends with the child. An environment has been created where individual treatment of each case, based on its unique set of acts, has been discouraged in favor of applying a uniform standard.

| Request a Case Evaluation |

Up to this point, courts have been reluctant to find that the statutory formula produced a result that is unjust or improper, and therefore, to permit deviation. The Baraby and Carlino cases would re-encourage a case by case analysis by the trial courts based upon the sensitivity of its own individual facts. This possibly results in a wide variance of case decisions because of un-uniform discretion applied by different judges. Elimination of this discretion was what was originally sought when CSSA was enacted. It was felt that there should not be similar cases decided differently because two different judges chose to exercise discretion differently

The Baraby and Carlino cases would re-encourage a case by case analysis by the trial courts based upon the sensitivity of its own individual facts. This possibly results in a wide variance of case decisions because of un-uniform discretion applied by different judges. Elimination of this discretion was what was originally sought when CSSA was enacted. It was felt that there should not be similar cases decided differently because two different judges chose to exercise discretion differently

Conclusion

Hopefully, we are coming full circle with Baraby and Carlino in recognizing that justice cannot be dispensed without consideration of the individual facts of each case. The CSSA Act was passed when most men were the sole or primary wage earners. It does not recognize the two wage earner household where wives may indeed earn as much as - or more - than their husbands. New arguments and decisions on this issue will help to change the current standard rules to conform to current societal practices. Until then, you and your attorney will have to work to establish these changes. The good news is that you can.

Until then, you and your attorney will have to work to establish these changes. The good news is that you can.

Call Friedman & Friedman at (516) 688-0088 for further information about New York State child support or divorce.

The Easiest Tennessee Child Support Calculator

How many children? i

Your number of overnights i

Your monthly pay i

Other parent's pay i

Child support = $0 monthly i

Not in Tennessee? Use your location's child support calculator.

Tennessee child support overview

Child support is meant to ensure both parents financially contribute to their child's care.

Tennessee uses a formula to give judges a guideline for how much child support to award. The formula assumes each parent should contribute to the child in proportion to their share of the combined parental income.

The formula assumes each parent should contribute to the child in proportion to their share of the combined parental income.

Parents can agree on an amount, and with the judge's approval, it becomes the support obligation. The court won't allow parents to waive child support and generally disapproves of any amount below the guideline.

Estimating parenting time could cost you thousands a year in child support. Let Custody X Change calculate your time.

Calculate My Parenting Time Now

The alternative residential parent (ARP), who spends less time with the child, typically pays support to the primary residential parent (PRP). If the PRP has a significantly higher income, they may owe the ARP support. In rare cases where parents have identical parenting time, child-rearing expenses and income, there will not be a support obligation.

Most commonly, child support is subtracted from the parent's paycheck, but it's also possible to pay support online.

Factors in the guideline child support formula

The court considers the factors below to determine child support. To get an estimate of your obligation, use a calculator from the Department of Human Services — either the Excel worksheet, iOS app or Windows program — or the calculator above.

To get an estimate of your obligation, use a calculator from the Department of Human Services — either the Excel worksheet, iOS app or Windows program — or the calculator above.

Number of eligible children

A parent can receive support on behalf of any minor children they have with the other parent in the case.

Generally, support payments cease when the child graduates from high school or when their high school class graduates, whichever comes later. If the child has a disability, payment may continue to age 21 (or longer if their condition is severe).

Parenting time

Parents receive credit for the number of days they spend with their child annually.

A "day" is more than 12 consecutive hours within a 24-hour period. (The 24-hour period does not have to be the same as a calendar day.) Shorter recurring visits that add up to more than 12 hours may count as a single day if parents agree or the court chooses.

You can calculate parenting time with the Custody X Change app or count manually.

To use the app, make sure your settings are set to "overnights" and "year." If you have visits that last less than 12 hours but span two days, temporarily delete them for the calculation. If you have visits that last over 12 hours but don't span two days, temporarily extend each one into the next day by clicking and dragging.

The numbers above your custody calendar (next to the people icons) will immediately reflect each parent's days with the child that year.

Income

The court adds together each parent's adjusted gross income (earnings after taxes and deductions, as listed in the Child Support Guidelines) so it can set the basic child support obligation, or how much parents are expected to spend together on their child before special circumstances and expenses are accounted for.

The amount of the basic support obligation a parent is expected to contribute equivalent to their percentage of the combined income. For example, a parent making 40 percent of the income pays 40 percent of the obligation.

If the parent paying support only has income from government programs meant for low-income people (as listed on page 21 of the guidelines), neither parent will have to pay support.

Additional expenses

The support obligation is adjusted for the following expenses:

- The child's health insurance premium

- Recurring uninsured medical expenses

- Work-related childcare expenses

The court can consider adding other costs (like tuition and extracurricular fees). In addition, parents can agree to include any cost in the obligation. Extracurricular fees must equal more than seven percent of the basic child support obligation to be considered.

Deviating from the guideline formula

A judge can order more or less child support than the state's formula suggests when circumstances make it necessary. In fact, Tennessee guidelines lay out specifically how a judge should handle parents with especially high or low income.

High income

When combined monthly parental income is greater than $28,250, the guideline says parents should pay the highest basic child support obligation (listed on page 71 of the Child Support Guidelines), plus a percentage of their income over $28,250:

- One child: 6.

81 percent

81 percent - Two children: 7.22 percent

- Three children: 7.77 percent

- Four children: 8.05 percent

- Five or more children: 8.66 percent

Low income

The court must make sure paying support does not affect a parent's ability to support themself.

When a parent's income falls in the shading on the Child Support Schedule (page 58 of the guidelines), the court does a second child support calculation using only that parent's income. If the result is less than when the formula includes combined parental income, this lower result becomes the guideline payment.

Retroactive child support

Retroactive child support is the amount a parent owes for child-related expenses incurred before there was a support order.

If parents were married, it covers expenses dating back to their separation. Otherwise, it covers expenses back to the child's birth.

The court uses the guideline formula to calculate the total owed. Each parent's income is based on their average adjusted gross income from the past two years. The parent paying support may receive credit for past child-related expenses if they provide sufficient proof.

The parent paying support may receive credit for past child-related expenses if they provide sufficient proof.

The amount owed gets broken into monthly payments, usually to last less than five years. The monthly retroactive payment is added to the monthly child support obligation throughout that period.

Requesting, modifying and enforcing child support

Child support is automatically part of divorce and separation cases. Unmarried parents have to complete a child support application, which also starts a case to establish the child's paternity if parents have yet to do so.

To modify a support order, there must be a significant change in circumstances, such as loss of employment. File a Petition to Modify Child Support, which you can get from the court clerk or your local child support office.

If a parent misses support payments, contact your local child support office. It will add a fraction of the owed money (called arrears) to the monthly support amount. Arrears may accrue interest. Arrears payments continue until the parent has no outstanding child support payments, even if the support order ends before that time.

Arrears may accrue interest. Arrears payments continue until the parent has no outstanding child support payments, even if the support order ends before that time.

If a parent continues to neglect payments, they risk seizure of their income, suspension of their licenses and, in severe cases, incarceration.

Parents cannot withhold visitation because of missed payments or withhold support because of denied visits.

Using technology to get an accurate child support order

Estimating your parenting time can impact your support order by thousands of dollars a year.

Still, lawyers and the court usually estimate because manually calculating is tedious and time-consuming.

The Custody X Change app lets you quickly and accurately calculate your exact parenting time.

With Custody X Change, you can tweak your schedule to see how even little changes affect your number of days with the child. And you can see how your number of days changes each year due to holidays and other events.

Whether you are the one paying or receiving child support, make sure your parenting time calculation is exact. The number will affect you, your child and the other parent for years to come. It's not a job for estimation.

Estimating parenting time could cost you thousands a year in child support. Let Custody X Change calculate your time.

Calculate My Parenting Time Now

Estimating parenting time could cost you thousands a year in child support. Let Custody X Change calculate your time.

Calculate My TimeAmount of maintenance per child \ Acts, samples, forms, contracts \ Consultant Plus

- Main

- Legal resources

- Collections

- Amount of maintenance for one child

A selection of the most important documents upon request The amount of maintenance per child (legal acts, forms, articles, expert advice and much more).

- Alimony:

- Maintenance obligations of children to support their parents

- Alimony obligations of spouses

- Alimony in 6-NDFL

- Alimony in a solid amount of

- Alimony of individual entrepreneur

- more .

..

..

Judicial practice : the amount of alimony per child

register and get test access to the survivor system ConsultantPlus free for 2 days

Open the document in your system ConsultantPlus:

Selection of court decisions for 2020: Article 120 "Termination of maintenance obligations" of the RF IC

(R.B. Kasenov) The court satisfied the plaintiff's claims to invalidate the decision of the bailiff on the calculation of alimony arrears. As the court pointed out, by virtue of paragraph 2 of Art. 120 of the Family Code of the Russian Federation, the payment of alimony, collected in court, stops when the child reaches the age of majority or in the event that minor children acquire full legal capacity before they reach the age of majority. In the case under consideration, one of the two children of the plaintiff, for the maintenance of which alimony was payable, had reached the age of majority. Thus, alimony for the maintenance of one child was subject to withholding, however, the bailiff-executor calculated the amount of alimony based on 1/3 of the plaintiff's earnings, which is not based on the law. nine0015

nine0015

Articles, comments, answers to questions : the amount of alimony per child

Register and receive trial access to the consultantPlus system free 2 days

Open the Consultant Pluss:

Situation: Whoever Do I have to pay child support and how much?

("Electronic journal "Azbuka Prava", 2022) If an agreement on the payment of alimony for minor children has not been concluded, they can be collected in court. The amount of alimony that must be paid monthly will be determined by the court. As a general rule, the amount of alimony is: for one for a child - one quarter, for two children - one third, for three or more children - half of the earnings and (or) other income of the parents. the court may increase or decrease the amount of these shares.

Normative acts : The amount of alimony per child

"Family Code of the Russian Federation" dated 12/29/1995 N 223-FZ

(as amended on 12/19/2022)1. In the absence of an agreement on the payment of alimony, alimony for minor children is collected by the court from their parents on a monthly basis in the amount of: for one child - one quarter, for two children - one third, for three or more children - half of the earnings and (or) other income of the parents.

Should a mobilized person pay alimony and from what income, November 2, 2022 | 59.ru

1

To whom can a mobilized person be obliged to pay alimony?

We are used to the fact that alimony is usually paid to their minor children, but this is only a special, albeit often occurring, case.

“The issue of alimony between family members is regulated in section 5 of the Family Code of the Russian Federation, where obligations are regulated in the relevant chapters,” Magomed Kantaev tells a 59.RU correspondent. - So, except for a minor child, alimony can be paid to disabled needy parents, spouses and former spouses, other family members (brothers and sisters, grandparents, stepsons and stepdaughters, etc.). nine0045

Share

2

Should a mobilized person pay alimony?

Even in the case of mobilization, a man will continue to pay alimony, because as a parent he is obliged to support his minor children, says Magomed Kantaev. This obligation is established by Article 80 of the Family Code of the Russian Federation, according to which parents can independently agree on the amount of payments, or they are determined by the court. The same applies to alimony to parents, spouses, former spouses, grandparents, grandchildren, etc. nine0015

This obligation is established by Article 80 of the Family Code of the Russian Federation, according to which parents can independently agree on the amount of payments, or they are determined by the court. The same applies to alimony to parents, spouses, former spouses, grandparents, grandchildren, etc. nine0015

There is an exemption from maintenance obligations. The list of grounds for terminating the payment of alimony is established by Article 120 of the Family Code of the Russian Federation.

So, if alimony was collected in court, then payments stop: when the child becomes an adult or fully capable before the age of 18, if the child was adopted or adopted, if the one who paid the alimony, or the one who was paid, died. Also - already in the case of adults - if the court recognized the restoration of the ability to work or the termination of the need for assistance of the recipient of the alimony, if the disabled ex-spouse in need of assistance entered into a new marriage. If the alimony is paid by agreement, then the obligations under them cease due to the death of one of the parties, as well as "the expiration of this agreement or on the grounds provided for by this agreement." nine0015

If the alimony is paid by agreement, then the obligations under them cease due to the death of one of the parties, as well as "the expiration of this agreement or on the grounds provided for by this agreement." nine0015

Mobilization is not included in the list of reasons for exemption from payment and is not a basis for this, the lawyer emphasizes.

Share

3

From what income will the mobilized person pay alimony?

Lawyer Magomed Kantaev explains: according to Article 12 of the Federal Law “On the Status of Servicemen”, servicemen are provided with monetary allowances.

“Consequently, alimony can be deducted from this allowance,” says the lawyer. nine0045

Earlier, the military commissar of the Perm Territory, Alexander Kokovin, told how much the mobilized would be paid for participating in the SVO, and explained in what dates the mobilized should be paid monetary allowances.

Share

4

If a mobilized person cannot pay alimony and there is a debt, then what?

Magomed Kantaev says that if a person has a debt on alimony obligations, the court can release him from paying it. nine0015

nine0015

This is regulated by article 114 of the RF IC - it states in which cases a person can be released from paying a debt: in case of mutual agreement of the parties - but not when it comes to paying alimony to minors, or by a court decision, if the one who must pay alimony, for example, was ill or his financial or marital status changed.

As Magomed Kantaev explains, potentially all of the listed criteria can be proved.

- You can prove it, for example, with income certificates, marriage certificates, birth certificates of a child and others, - says the lawyer. - It seems that the criterion as a guideline [if we talk about the financial situation] is the established minimum wage. nine0045

In addition, Magomed Kantaev suggests that participation in the SVO may be a valid reason for paying alimony debt. That is, if a man cannot pay alimony during a special operation and a debt arises during this time, the court can consider this case and release the man from the debt. Upon returning from the CBO, the person will simply continue to pay child support as usual. True, the lawyer notes that so far no one knows how law enforcement practice will develop.

Upon returning from the CBO, the person will simply continue to pay child support as usual. True, the lawyer notes that so far no one knows how law enforcement practice will develop.

Share

5

Can a mobilized person be sued for non-payment of alimony?

- If he is in the SVO, the ex-wife (or person entitled to alimony. - Note ed. .) will be able to sue for alimony, since the man has an obligation to support his minor children (or needy relatives - Note ed .) and monetary allowance is provided for the serviceman, - the lawyer explains. nine0045

Share

6

If a person did not pay alimony before mobilization, can they be sued for those debts?

As we wrote above, if a mobilized person cannot pay alimony, as he is on a special operation, then the court can recognize his participation in it as a good reason and release the person from the debt (but not from paying alimony when he finishes serving).