How much can child support take from my tax refund

Can the IRS Take My Tax Refund for Child Support Arrears?

If you owe child support, the IRS might take your tax refund and coronavirus stimulus check.

Updated By Lina Guillen, Attorney

The Treasury Offset Program

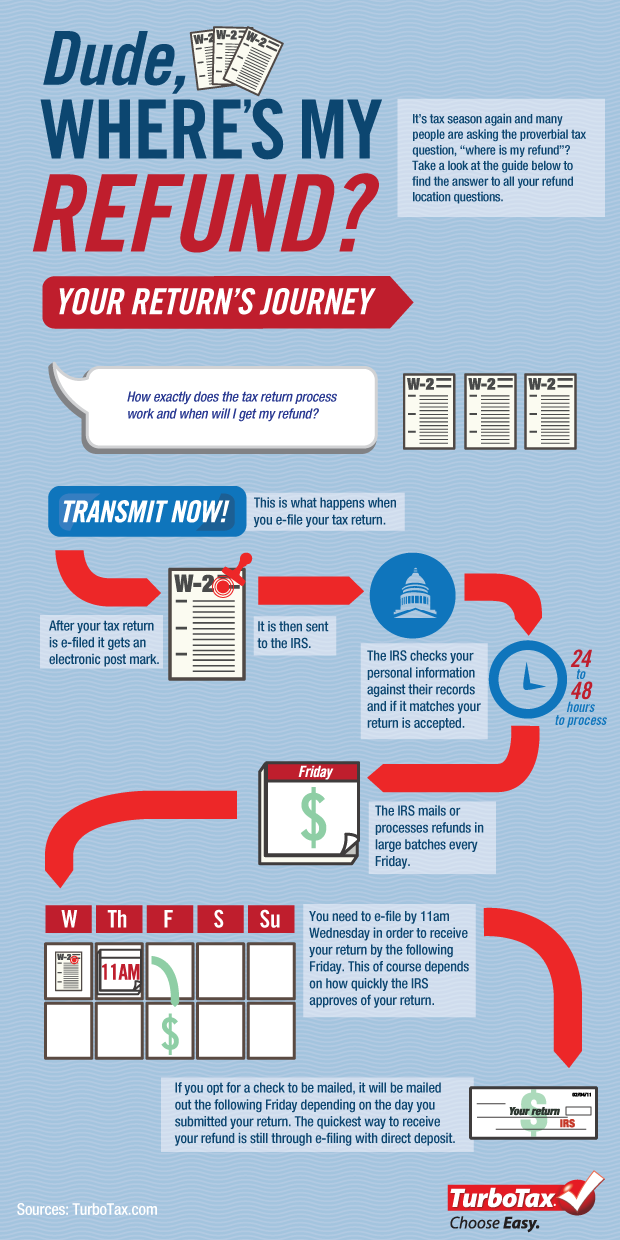

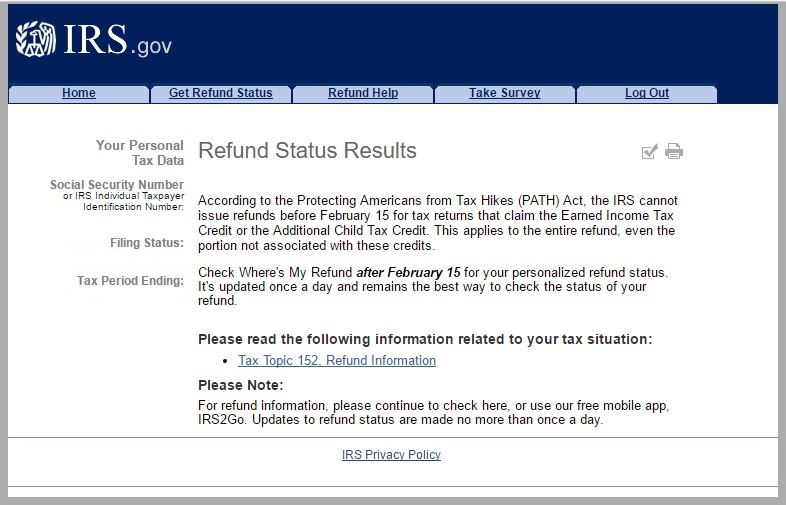

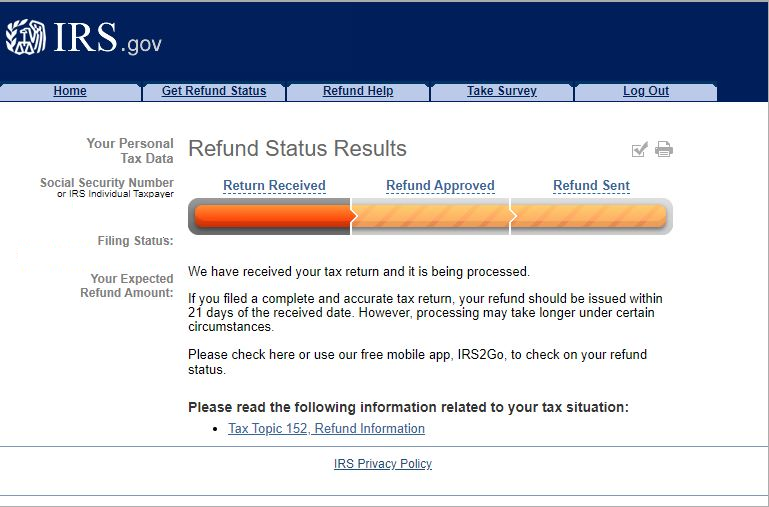

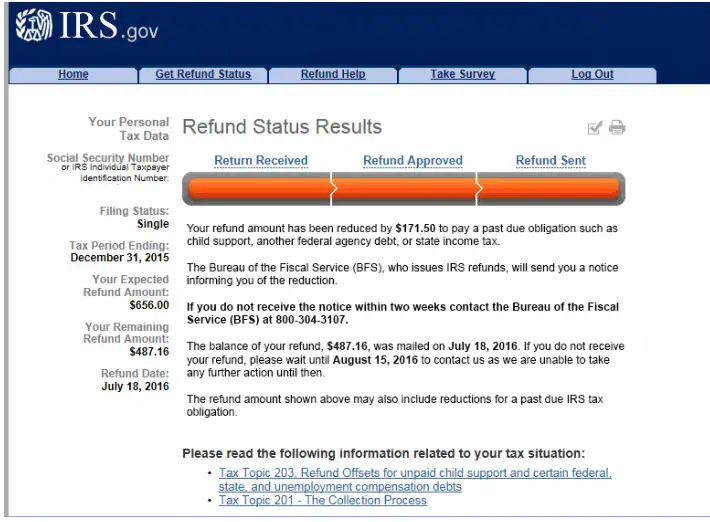

Under the federal Treasury Offset Program, state child support enforcement agencies share information with the Treasury Department regarding parents that are behind on child support. With this information, the agency can intercept (take) federal tax returns and other payments to offset overdue child support.

If your state child support enforcement office has reported your overdue child support to the Treasury Department, the IRS will take your tax refund to cover the arrears (often called a tax refund seizure). The IRS will then give the money to the appropriate child support agency.

This same rule applies to coronavirus stimulus payments.

The Coronavirus Relief Act, Stimulus Checks, and Overdue Child Support

In March, Congress passed the Coronavirus Aid, Relief, and Economic Security Act (the CARES act), which is a $2 trillion stimulus package to provide financial relief to businesses and individuals dealing with the COVID-19 economic fallout.

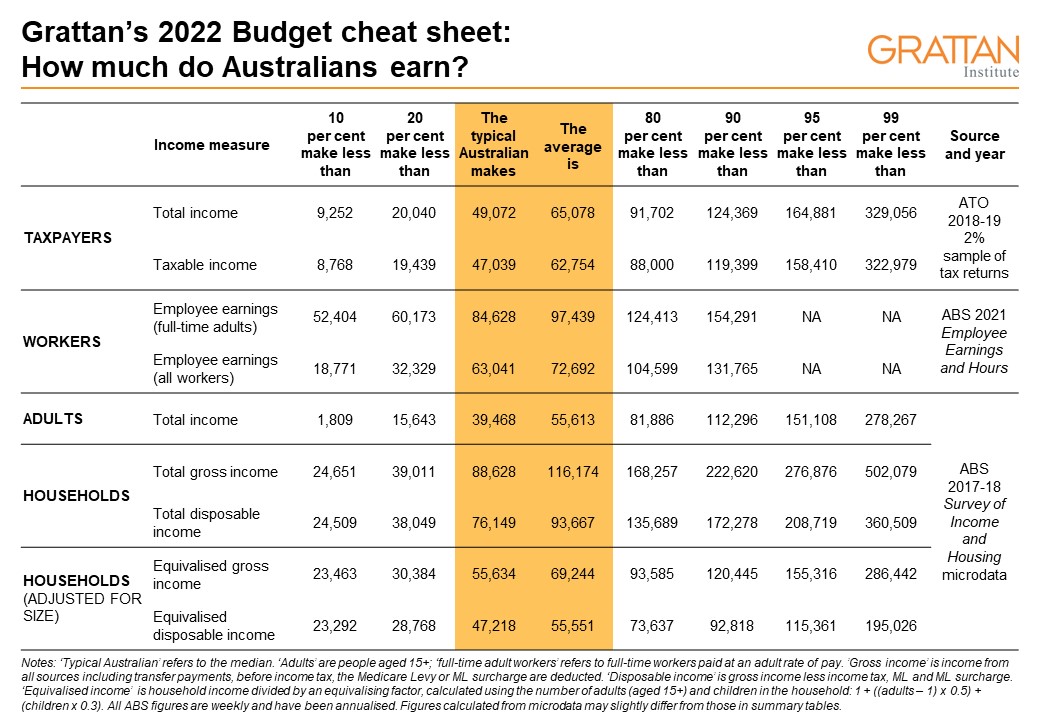

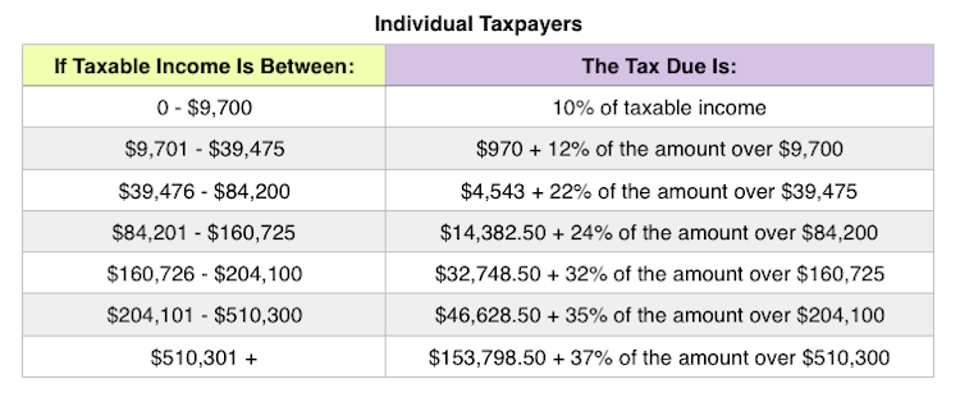

Under this package, American households will receive stimulus checks based on annual income: up to $1,200 per person, $2,400 for couples, and $500 per child under 17. You can see how much you'll receive using Nolo's online stimulus calculator.

However, if you're on the Treasury Offset list for unpaid child support, your stimulus check will be reduced by the amount you owe. It's unclear if you'll receive a notice in advance—to find out if your name is on the Treasury Offset list, call the toll-free IRS number at 1-800-304-3107.

Other past due debts to the government, like back taxes or overdue student loans will not trigger an automatic offset.

What to Do If You Receive Notice of an IRS Tax Refund Seizure

The Financial Management Service division of Treasury Department will send you a notice of a proposed tax refund seizure before it happens. Take this opportunity to address the proposed tax refund offset to decide on a course of action—you might be able to minimize the effect of the seizure on your finances.

The best way to avoid receiving a notice of an IRS Tax Refund Seizure is to pay child support on time. If you've lost your job or or are having trouble making your payments on time, you must take action. Contact your local child support agency for help or go back to court to see if you can modify child support based on your current income.

Ignoring your child support obligation or failing to make payments on time can subject you to contempt of court proceeding, fines, and other sanctions, like a tax refund seizure.

If you receive an IRS notice of tax refund seizure to cover child support arrears, here are some options:

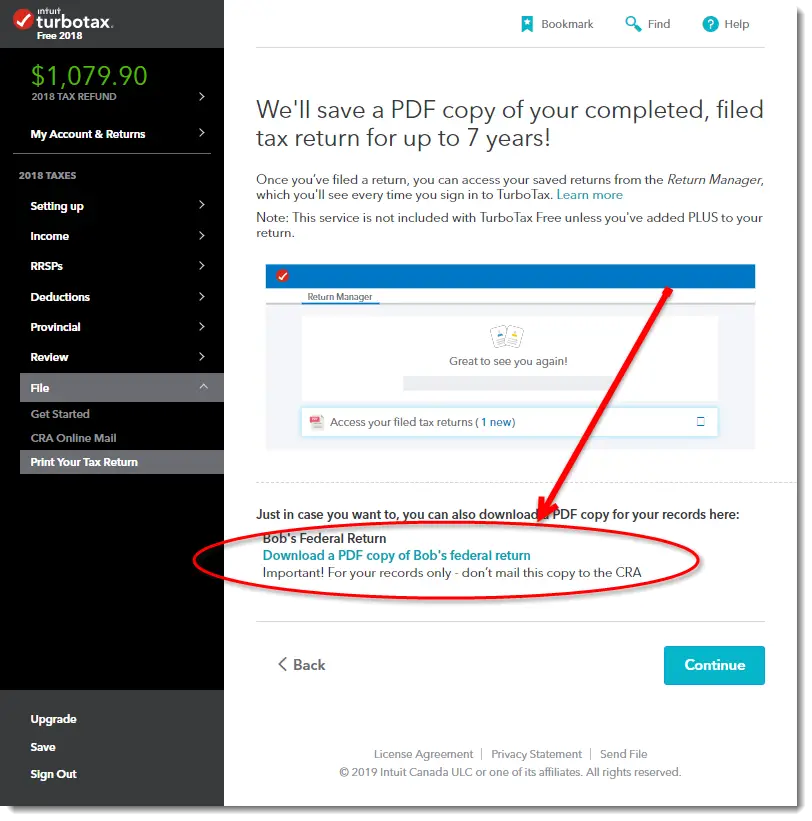

If married, file an "Injured Spouse Allocation" form. If you're married to someone who owes child support—and you're not responsible for the debt—you can file an "Injured Spouse Allocation" form with the IRS. If you submit this properly, the IRS may allow you to keep your portion of the tax refund.

The IRS typically calculates this amount based on how much money your employer withheld from your wages for taxes the previous year. File this form with your return or immediately after receiving a notice of seizure.

File this form with your return or immediately after receiving a notice of seizure.

File Chapter 13 bankruptcy. The bankruptcy code does not allow you to erase your child support arrears but it does allow you to restructure that arrearage and pay it down over a three to five year period. The bankruptcy court considers child support arrears a priority debt that gets paid before any other debt. (Learn more about paying child support in a Chapter 13 bankruptcy.)

What to Do If You Are Owed Child Support

If you want the IRS to seize the refund of the person who owes you child support, it will do so automatically if the state child support enforcement office collects payments from your child's other parent.

However, if the child support enforcement office doesn't collect child support funds on your child's behalf, then you need to petition the court to request it be collected this way. That way, if your child's other parent falls behind on payments, the child support enforcement office will automatically report it to the Treasury Office to begin the process of intercepting tax refunds.

Talk to a Lawyer

Need a lawyer? Start here.

Your Child Support, the Federal Stimulus Payments and Tax Returns

Javascript must be enabled for the correct page displaySkip to main content

- Español

Back to top of menu

Back to top of menu

Back to top of menu

Back to top of menu

Job Listings

All Divisions

Opinions

Initiatives

About

Contact us

- Español

Search Keywords

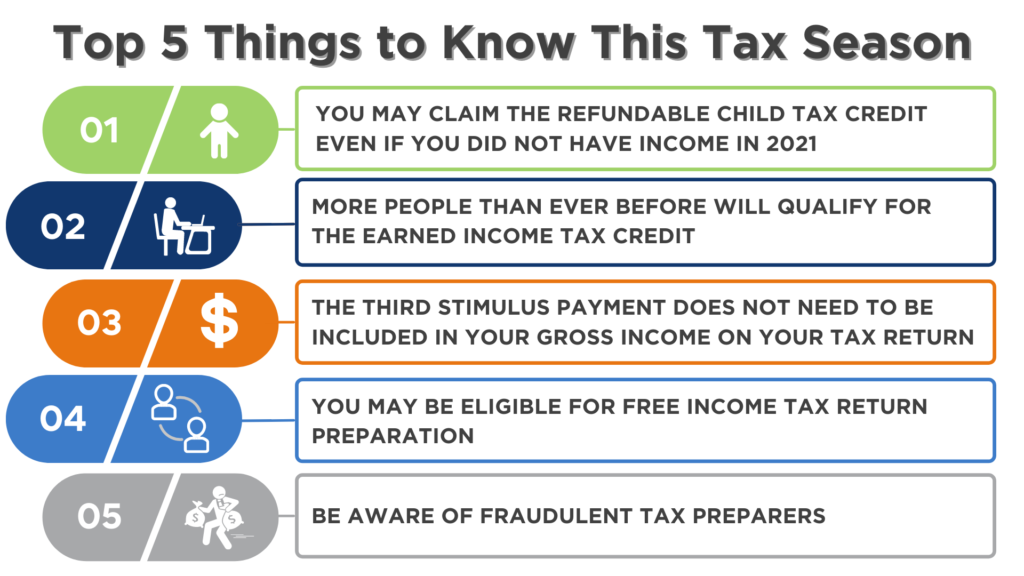

2nd and 3rd Stimulus Payments (COVID Relief Bill)

Your 2nd stimulus payment (approved January 2021) and 3rd stimulus payment (approved March 2021) cannot be garnished to pay child support. Under the CARES Act, your 1st stimulus payment (approved April 2020) could be garnished, but the rule was changed for the 2nd and 3rd payments.

Under the CARES Act, your 1st stimulus payment (approved April 2020) could be garnished, but the rule was changed for the 2nd and 3rd payments.

I did not receive my stimulus payments from the IRS and am expecting to receive them in my tax return, can my tax return and stimulus payments be withheld by the IRS for unpaid child support debt?

-

Yes, if you owe more than $150 in a public assistance case or more than $500 in a non-public assistance case, federal law requires that the IRS withhold some or all of your unpaid stimulus payment and tax return, when you file your taxes.

Will the federal stimulus rebate payments be withheld by the IRS for unpaid child support debt?

If I owe child support, will my tax return be applied to my child support arrears?

-

If TANF has been received for your child, the total amount of past due support on all of your child support cases must be at least $150

-

If TANF has not been received for your child, the total amount of past due support on all of your child support cases must be at least $500

If I owe child support, will I be notified that my tax return is going to be applied to my child support arrears?

What if I am married to someone who owes child support, will my tax return be applied to the child support arrears they may owe?

-

Yes, unless you are eligible for relief.

If you do not owe child support but you are married to someone who owes child support, you may need to file an Injured Spouse Claim and Allocation - Form 8379

If you do not owe child support but you are married to someone who owes child support, you may need to file an Injured Spouse Claim and Allocation - Form 8379 -

In some instances, the IRS offsets a portion of the payment sent to a spouse who filed an injured spouse claim if it has been offset by the non-injured spouse’s past-due child support. The FAQ on the IRS stimulus FAQ www.irs.gov/coronavirus/economic-impact-payment-information-center website states: The IRS is aware that in some instances a portion of the payment sent to a spouse who filed an injured spouse claim with his or her 2019 tax return (or 2018 tax return if no 2019 tax return has been filed) has been offset by the non-injured spouse’s past-due child support. The IRS is working with the Bureau of the Fiscal Service and the U.S. Department of Health and Human Services, Office of Child Support Enforcement, to resolve this issue as quickly as possible. If you filed an injured spouse claim with your return and are impacted by this issue, you do not need to take any action.

The injured spouse will receive their unpaid half of the total payment when the issue is resolved.

The injured spouse will receive their unpaid half of the total payment when the issue is resolved.

If I am the custodial parent, and I’m currently receiving or have ever received TANF or Medicaid for my child, will I receive any money from a tax return intercepted by the federal government from the noncustodial parent on my case?

-

Maybe. Federal law dictates how monies received by a state child support agency under the Federal Tax Refund Offset Program are distributed. In Texas, federal tax offsets are applied first to assigned arrears, or arrears owned by the state, and then to arrearages owed to the family. If there is money owed to the state in your case, the intercept stimulus payments up to the amount owed to the state will be retained by the state. The remainder of money will be sent to you, up to the amount of unassigned arrears owed to you by the noncustodial parent. The amount of the money you are entitled to receive will depend on a number of factors, including the amount of the tax refund intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears.

You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted tax return.

You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted tax return.

If I am the custodial parent, and I’ve never received TANF or Medicaid for my child, will I receive any money from a tax return intercepted by the federal government from the noncustodial parent on my case?

-

Maybe. If the noncustodial parent owes you child support arrears and the total arrears on all of the noncustodial parent’s cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parent’s tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

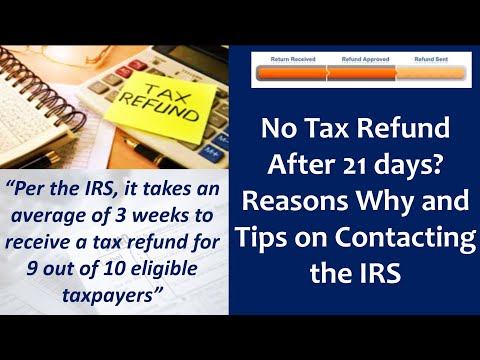

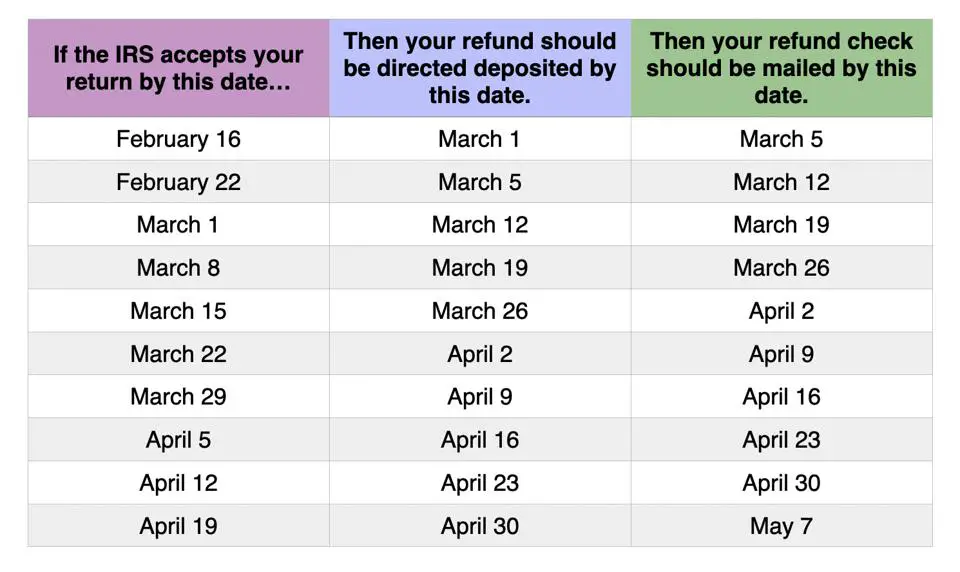

How long will it take for me to receive the payment?

Back to top

Back to Top

Alimony from self-employed citizens of the Russian Federation in 2022

Alimony from self-employed citizens of the Russian Federation in 2022-2023 is withheld in the manner prescribed by the Family Code. In the article we will tell you how self-employed citizens in Russia pay alimony, what needs to be done in order for the child to receive a payment, and what will change if a self-employed person gets a permanent job under an employment contract.

Alimony from the self-employed: what the law says

A self-employed citizen is an individual who is a tax payer on professional income. The essence of self-employment is simple: if the taxpayer has income, he pays tax on it. If there is no income, there is no tax to pay. This tax regime is designed specifically for those who do not have regular customers and receive money irregularly - in case of downtime, you will not have to make mandatory payments from your own pocket. nine0003

nine0003

The question arises: how can a self-employed person pay child support? He does not have a stable income, which means that it will not be possible to establish alimony as a percentage of the income received - in months without income, the child may be left without money. In this case, you should be guided by the rules of Art. 83 of the RF IC - it provides the possibility of collecting alimony in a fixed amount of money.

How the amount of alimony is calculated

The amount of alimony is determined by the court. The basis for the calculation is the subsistence minimum established in the region where the child lives - a certain percentage of this amount will be paid as alimony. nine0003

When calculating, the amount of mandatory expenses for a child is taken into account - they should be indicated in the statement of claim. If the child needs regular expensive treatment or additional education, the court may increase the amount of the payment. In addition, the court takes into account the standard of living of the payer - the higher it is, the greater the alimony will be assigned.

The subsistence minimum is quarterly adjusted by the regional authorities - the amount of alimony for the self-employed changes after it. nine0003

Assignment of child support

ConsultantPlus has many ready-made solutions, including how to collect child support for minor children. If you don't have access to the system yet, sign up for a trial online access for free. You can also get the current K+ price list.

Alimony from self-employed citizens in a fixed amount of money is assigned in court (clause 1, article 83 of the RF IC). To do this, the parent with whom the child remains must file a lawsuit with the relevant requirement in court. In it, according to Art. 131 Code of Civil Procedure of the Russian Federation, you must specify:

- name of the court to which the plaintiff applies;

- information about the plaintiff and the defendant - full name, address, contact phone number;

- description of the circumstances of the current situation, information about the child, grounds for going to court;

- a request for a fixed amount of support due to the fact that the defendant is self-employed and has irregular, fluctuating earnings;

- list of documents attached to the claim.

nine0026

nine0026

If the parents were able to agree on the amount of alimony

If the parents were able to independently determine the amount that one of them will transfer to the other to meet the needs of the child, you can not go to court. The agreement must be sealed with an agreement (clause 1, article 80 of the RF IC). The agreement must be certified by a notary - otherwise it will be considered invalid (clause 1, article 100 of the RF IC).

The agreement must include the following information:

- procedure for calculating the amount of alimony;

- frequency and timing of money transfers;

- enumeration method.

How money is transferred

A self-employed person can transfer money to pay child support in the following ways:

- personally into the hands of the other parent with whom the child lives;

- by transfer to a bank account;

- postal order.

Documents confirming the transfer of money should be kept. If disputes arise in the future, it will be much easier to prove your good faith as a payer of alimony. If the money is transferred in cash, it is worth taking a receipt from the other parent for receiving it. nine0003

If disputes arise in the future, it will be much easier to prove your good faith as a payer of alimony. If the money is transferred in cash, it is worth taking a receipt from the other parent for receiving it. nine0003

What to do if a self-employed person does not pay alimony

If the alimony payer refuses to fulfill his obligations, the other parent (with whom the child remains) can apply to the bailiffs or to the bank where the payer has an account. Unpaid money will be forcibly withheld. But to receive payments through the employer (this is often done by bailiffs, sending a writ of execution to the accounting department of the enterprise) will not work, because the self-employed does not have an employer. nine0003

You need to apply to the bailiffs with a writ of execution - it is issued by the court. If there was no court, and the amount of alimony was established by an agreement on the payment of alimony, certified by a notary, submit this agreement to the bailiffs - it also has the force of a writ of execution (clause 2, article 100 of the RF IC).

If the self-employed person has taken up employment

If the self-employed person has entered into an employment contract, but has not ceased to be a payer of professional income tax, the amount of alimony may be recalculated. The payout will be calculated in one of the following ways:

- as a percentage of the payer's income - 25% for one child, 33% - for two children, 50% - for three or more children;

- by the combined method - part of the payment will be calculated as a percentage of the payer's permanent income, and part will be accrued as a fixed amount.

In order to recalculate, you will have to reapply to the court - it will take into account the circumstances that have arisen and establish a new procedure for calculating the amount of alimony.

Results

So, self-employed citizens do not have a permanent income, so the alimony they must pay is assigned in a fixed amount of money - for this you will have to go to court. If the parents of the child were able to agree on the amount of alimony on their own, you don’t have to go to court - it’s enough to conclude an agreement, fix the amount of the monthly payment in it and certify it with a notary.

If the parents of the child were able to agree on the amount of alimony on their own, you don’t have to go to court - it’s enough to conclude an agreement, fix the amount of the monthly payment in it and certify it with a notary.

Alimony - Help for Paying Parents

This guide will answer questions about child support that a non-custodial parent may have. The following information is useful for both – custodial parents and non-custodial parents

Definitions of basic terms

Custodian parent (cus-TO-di-al PER-ent): Parent who lives with the child.

Non-custodial parent : Separated parent.

Why did I get paperwork telling me that I have to appear in court?

Someone filed a petition (pe-ti-shan) to the court to force you to pay child support. A petition is a written appeal to the court.

Who is eligible to petition for child support?

Petition for child support can be filed by:

- The person who cares for the child

- New York City if the child is or has received public assistance (welfare)

- Child (however, this usually only applies to adult children)

What happens when I go to court?

On the day of the trial, you will meet with the welfare magistrate (sup-PORT MAD’J-is-trait) who will hear the case and issue child support order (OR-der for child sup-PORT) . The court's decision is a piece of paper detailing the amount you owe, how often you must pay, and where to send the money. The welfare magistrate is like a judge and has the power to decide child support and paternity cases (pe-TURN-ee-tee) . A paternity case is a case to establish who is the real father of a child.

The court's decision is a piece of paper detailing the amount you owe, how often you must pay, and where to send the money. The welfare magistrate is like a judge and has the power to decide child support and paternity cases (pe-TURN-ee-tee) . A paternity case is a case to establish who is the real father of a child.

When does child support end? nine0005

In New York State, a child may receive child support until the age of 21. Sometimes child support payments may end earlier; for example, this can happen if the child joins the army or gets married.

Can I use a lawyer for my child support case?

In child support cases, the family court is not required to provide counsel to the parents, except in cases where the non-custodial parent faces jail time for non-payment; however, you are free to hire a lawyer if you wish. The welfare magistrate may appoint a lawyer for the child, called a legal guardian or child advocate, to ensure that the best interests of the child are protected. It doesn't happen in every case. nine0003

It doesn't happen in every case. nine0003

What happens if I don't show up on court day?

If you do not appear on the day of the hearing, the welfare magistrate may issue a default judgment (de-FOLT D'JAD'J-mant) . A default judgment is an order issued if the defendant fails to appear in court. In child support cases, the default decision automatically becomes a child support order against the non-custodial parent. This court decision is based on information provided by the custodial parent. nine0003

If you wish to contest this decision, you must file a motion to set aside the default decision (MO-shan tou WEI-cate e de-FOLT D'JAD'J-ment) . This is a written petition to the court asking for the annulment of the decree. You must give the court a good reason for not appearing in court.

How is the amount of maintenance determined?

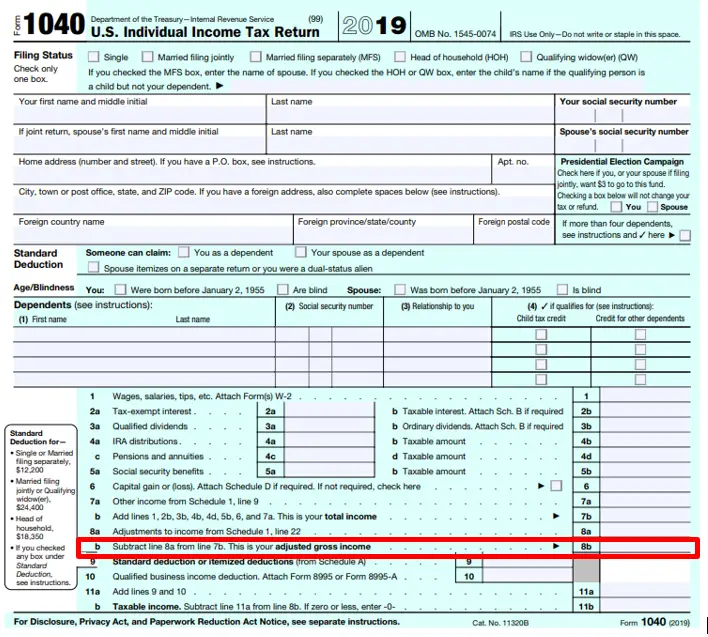

Support amount based on Support Standards Act . First, the court establishes total total income of for both parents. Total income is the sum of all money earned before taxes. (For incomes of $143,000 or more, the court sometimes applies different rules.) Some special expenses (ex-PEN-ses) will reduce your income for child support. Ordinary expenses are expenses that you pay on a regular basis, such as electricity bills, credit cards, or living expenses. These costs do not reduce your child support income After the court determines both parents' income, it uses the following formula to determine the amount you need to support a child:

Total income is the sum of all money earned before taxes. (For incomes of $143,000 or more, the court sometimes applies different rules.) Some special expenses (ex-PEN-ses) will reduce your income for child support. Ordinary expenses are expenses that you pay on a regular basis, such as electricity bills, credit cards, or living expenses. These costs do not reduce your child support income After the court determines both parents' income, it uses the following formula to determine the amount you need to support a child:

1 child 17% of your income

2 children 25% of your income

3 children 29% of your income

4 children 31% of your income

5 children or more 35% of your income

help.

You may be asked to pay an extra amount for government and child care. Or you may be assigned to include the child in your health insurance.

What if the child support has not yet been paid? nine0005

The court may also order the payment of retroactive child support (re-tro-ek-tiv sup-PORT) for the maintenance of the child. This means that you must pay child support from the time the petition is filed, even if it is long before you appear in court. Retroactive child support usually does not accrue from the date the child was born, but this can happen if the petition was filed as soon as the child was born. Accrual occurs from the time the custodial parent first files a petition for child support. nine0003

This means that you must pay child support from the time the petition is filed, even if it is long before you appear in court. Retroactive child support usually does not accrue from the date the child was born, but this can happen if the petition was filed as soon as the child was born. Accrual occurs from the time the custodial parent first files a petition for child support. nine0003

If you don't pay child support, you will have arrears (e-RIRS) . Debt means non-payment of alimony. If you become indebted, the court may add a set amount to your child support until the entire amount owed is paid.

What if my income is unofficial?

If you work informally or do not receive a stable salary, the court may determine your income based on the following:

- How much did you earn in the past

- How much does the court think you could earn

- What are your family's standards of living

The amount determined by the court is called conditional income (im-PYU-ted In-kam) . The court then uses the amount of conditional income to determine the amount of support you will have to pay.

The court then uses the amount of conditional income to determine the amount of support you will have to pay.

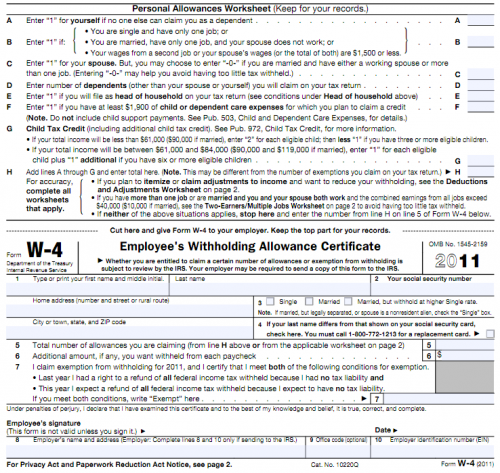

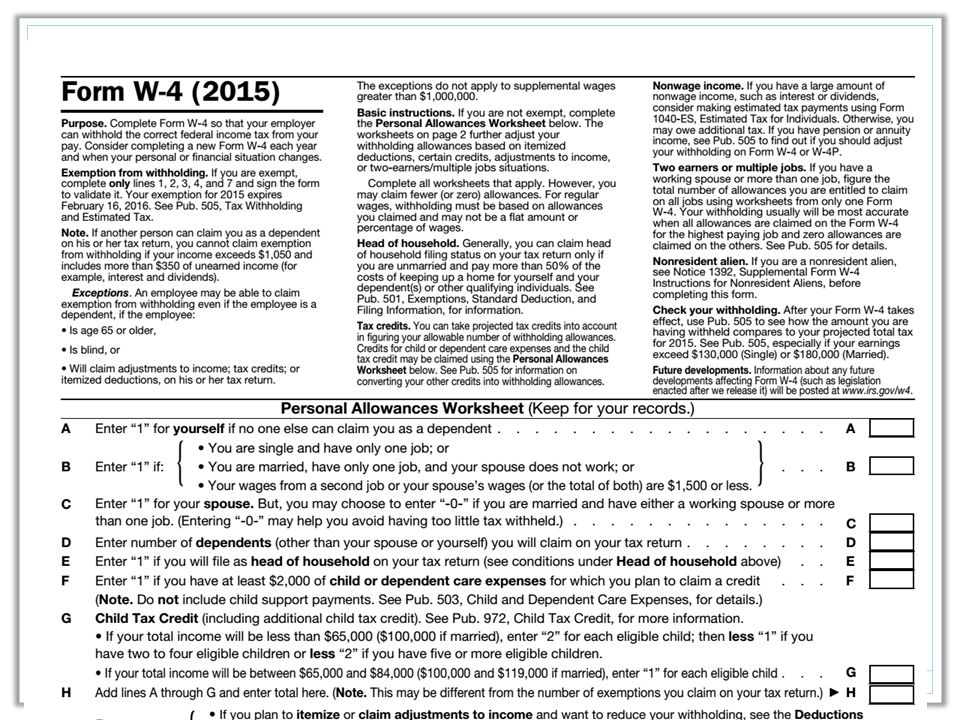

What should I bring to court?

- Carefully completed Financial Disclosure Affidavit

- Proof of your income, such as check stubs from your paycheck

- Documentation showing Social Security or disability payments, workers' compensation, unemployment benefit, veterans' benefit, pension funds, investment, scholarships, or annuity.

- Information about the “SSI,” “Medicaid,” “Home Relief,” or “Food Stamps,” you get.

- Proof of expenses such as FICA and city taxes. These expenses will be deducted from your income before the court determines the amount of child support. nine0026

- If you are paying support for another child, bring a copy of the court order and proof of payments you have already made. As proof, you can use money order receipts, voided checks, or paycheck stubs showing support was paid.

What if I am not the father of the child?

If you were married to the mother when the child was born, the law implies that you are the child's father. If you were married to the mother but believe you are NOT the father of the child, notify the benefits magistrate immediately. It's called denial of paternity (con-TEST-ing p-TURN-and-tee) . The court must determine paternity (find out who the real father is) before determining child support. To establish paternity, the court may order a DNA test (DNA test) . If the analysis confirms your paternity, the court will issue Decree of Descent (OR-der of fil-i-EI-shan) . This is an official court document that determines who is the father of a child.

If you were married to the mother but believe you are NOT the father of the child, notify the benefits magistrate immediately. It's called denial of paternity (con-TEST-ing p-TURN-and-tee) . The court must determine paternity (find out who the real father is) before determining child support. To establish paternity, the court may order a DNA test (DNA test) . If the analysis confirms your paternity, the court will issue Decree of Descent (OR-der of fil-i-EI-shan) . This is an official court document that determines who is the father of a child.

Will the court give me a lawyer for my paternity case? nine0005

If someone opens a paternity case against you and you are unable to hire a lawyer, you can ask the magistrate to appoint a lawyer for you free of charge. You can also hire your own lawyer. If you open a paternity case, the court may not provide you with a lawyer, even if you are unable to pay for one.

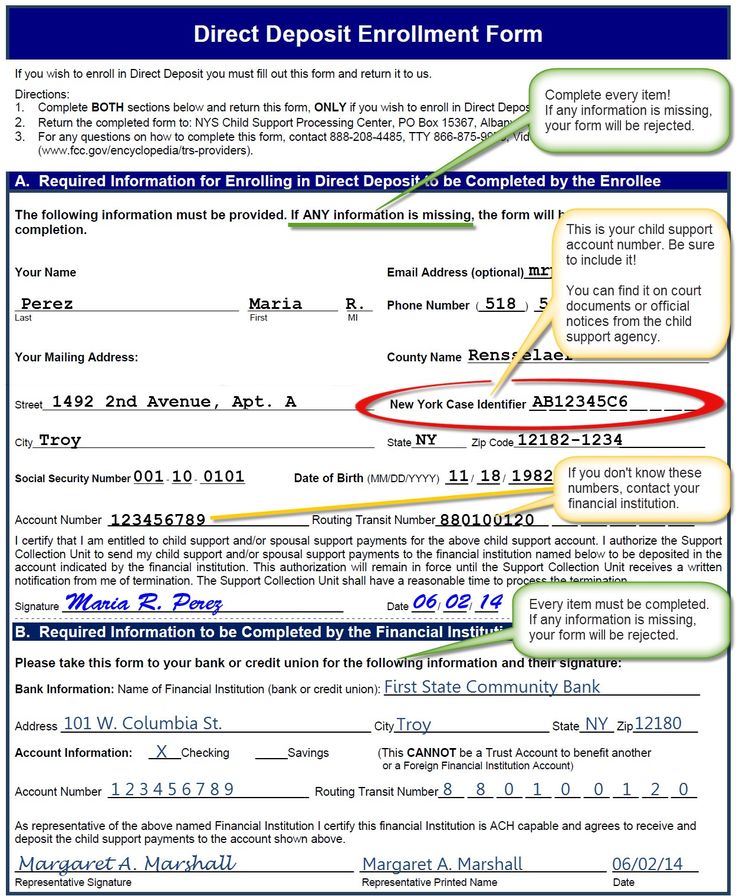

How can I pay child support?

You can pay directly to the other parent or through Child Support Collection Unit (SCU) at the address below. If the custodial parent receives public assistance, SCU will automatically deduct child support from it. SCU services are free and they will keep track of all payments.

Please remember: Always include the case number on your SCU payments to ensure your payment is recorded. Don't use cash - especially if you're paying directly to the other parent! Always pay by money order or check. nine0101

What if the SCU makes a mistake?

You need to go to the SCU office (located at 151 West Broadway, 4th floor in Manhattan) and speak to a customer service representative. You can also call the Support Enforcement Office at (888) 208-4485.

How long is the benefit order valid?

Once a benefit order is issued, it remains in effect until someone asks the court to reverse it, your child is 21, or your child is independent (e-MAN-C-Pay-ted) . Children are considered independent if they live separately from the custodial parent, are self-supporting, married, or in the military.

Children are considered independent if they live separately from the custodial parent, are self-supporting, married, or in the military.

If you pay through SCU, they automatically review your case every three years. When they review the case, the SCU may add a living wage allowance (COLA). SCU is free to do so without going to court. If they make changes, they will send you an email.

What if I do not agree with the allowance order? nine0005

You have the right to tell the court if you disagree with the order. This is called objection (ob-D' JEK-shan) . If you receive a copy of the order on the day the order was issued, you have 30 days to file a written objection. However, if the order was mailed, you have 35 days (from the date the letter was sent) to file a written objection. You can file an objection through the clerk of the Family Court where the decision was made. The judge will decide on your case. You may not have to go to court for a new hearing, but you must continue to pay child support until the court changes the order. The decision will be mailed to you. For more information, see the Family Legal Care booklet – “How to File an Objection or Rebuttal Against a Child Support Order”

The decision will be mailed to you. For more information, see the Family Legal Care booklet – “How to File an Objection or Rebuttal Against a Child Support Order”

If you lose your job or are unable to pay for another reason—for example, your income changes or you go to jail—the court will not automatically change your child support amount. If you are unable to pay child support, you must immediately report to the Family Court where the decision was made and file a Petition for Change for Deterioration shan) . This is a written request to the court to reduce the amount of your child support. To convince the court to reduce your child support, you must provide evidence to the court of evidence of a significant change in circumstances (sig-NIF-i-kant change of ser-kam-STEN-ses) that have occurred in your life since the magistrate on the allowance made the final decision.

- An example of a significant change in circumstances would be imprisonment, provided that the imprisonment is not related to non-payment of support or a crime against the custodial parent or child.

- You can also ask for a change in your child support amount if it has been 3 years since the last order was made. nine0026

- Also, if your or the custodial parent's income has changed (up or down) by 15% or more since the last instruction, you can petition for a change due to the downside.

Learn more about what to do if you can't pay

When you go to court, you must show evidence of a significant change in your income. You must ask the court to reduce your child support from the date of the petition. Until the court decides otherwise, you must continue to pay the original amount of support. nine0003

The court may look at your previous earnings and determine that you can earn more than you currently earn. In this case, the court may leave the order unchanged.

What happens if I don't pay?

If there is a court order for child support, you must pay. If you don't pay, your debts will continue to pile up. This debt WILL NOT DISAPPEAR, even if your child turns 21. Declaring bankruptcy will also not cancel the payment of debt. nine0003

Declaring bankruptcy will also not cancel the payment of debt. nine0003

The SCU can force you to pay in a variety of ways.

- SCU can force your employer to calculate child support from your wages/cheque. (Your employer is required by law to do this, but they can't fire you for it.) This is called withholding your paycheck (GAR-nish-ing yor WAID'J-es).

- SCU can collect your federal and state tax refund before you receive it. SCU can also take money directly from your bank account.

- If your debt exceeds a few months, SCU may suspend your driver's license or other professional licenses until you pay off the debt. nine0026

- If you owe a very large amount of money and the SCU or custodial parent asks the court to check for willful violation (WIL-ful-and WAI-0-lay-ting) of child support payments, you may be SENT IN JAIL for up to 6 months. Intentional violation means willful disobedience to a court order.

What if I support my children?

Make sure you keep all receipts for any child support payments. Paying for services or buying gifts is not a substitute for paying child support. You must pay regularly. You are also required to pay any accumulated debt. nine0003

Paying for services or buying gifts is not a substitute for paying child support. You must pay regularly. You are also required to pay any accumulated debt. nine0003

Who gets the money if my children get public assistance and I pay child support?

If the custodial parent receives public assistance, SCU will automatically collect support. If you are not in debt, $100 of your monthly payment will go to the custodial parent. This $100 per month is for the maintenance of the household, not for each child. If you are in debt, the alimony will go towards paying off the debt in the first place. The city will continue to pay child support even if you give money directly to the custodial parent. The city may also reduce the child support budget to account for the extra money received by the family. nine0003

Can I withdraw my child from public assistance?

A non-custodial parent cannot withdraw their child from public assistance. Only the custodial parent who started the public assistance case can do so.

Why might a custodial parent want to remove their child from public assistance?

If your income is high enough, your children may receive more cash assistance from you than from government assistance. For example, if you are the father of all the children in your mother's house, and she can certify that you support them, there should be no problem getting the children off state aid. If a mother has children from other fathers in her public assistance budget, the process will be more complicated. The state wants all children in the home to have the same income. Therefore, it is possible that the mother will not be able to remove only your children from public assistance. nine0003

If I pay child support, can I also get visitation?

Optional. Alimony and visits (vi-zi-TAI-shan) are not interconnected. If you are not allowed to see your children, you must file a petition to visit with the court. Whether you see your child or not, you remain responsible for paying child support.