How long can child be on parents insurance

What to Do if You Can't Stay on Parents' Health Insurance

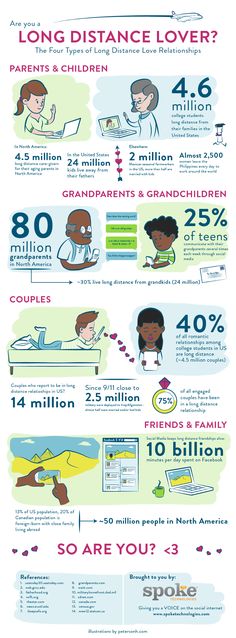

The Affordable Care Act (ACA) mandates that all health insurance providers, in states where coverage is offered, must allow a dependent to remain on a parent's plan until 26 years of age. However, in some states, there are health insurance riders that allow young adults to extend coverage under their parent's policy. If you do decide to get your own health insurance after 26, then there are several options available including employer coverage, marketplace policies and federally funded programs like Medicaid.

- How long can I stay on my parent's health insurance?

- What is the age 29 health insurance rider?

- What are my health insurance options?

How long can I stay on my parent's health insurance?

If you are under 26 years old, then you are eligible to remain covered under your parent's health insurance plan. This is allowed even if you:

- Have started or finished school

- Get married

- Adopt or have a child

- Deny your employer-sponsored health insurance coverage

- Are no longer claimed as a tax dependent

The law, created under the Affordable Care Act (ACA), was established to assist young adults who do not have access to their own employer-sponsored health care in getting qualified coverage.

When will I need to choose a new health insurance policy?

When you will need to choose a new health insurance policy depends on the type of health insurance that your parents have. If your parents have a marketplace health insurance policy, then you will be allowed until the end of the year to enroll in a policy even if you turn 26 midyear. This would require you to submit your own marketplace health insurance application and be aware of the open enrollment dates in your state.

If you were previously covered by your parent's employer policy, then you will have until the end of the month that you turn 26 years old to choose a new health insurance plan. Furthermore, losing your parent's employer-sponsored health insurance coverage will open a special enrollment period (SEP) during which you can buy your own health insurance. Your SEP begins 60 days before and continues 60 days after you lose coverage. During this time you are allowed special access to your state health insurance marketplace and can decide what coverage you would like to purchase.

Find Cheap Health Insurance Quotes in Your Area

It's free, simple and secure.

What is the age 29 health insurance rider?

New York state allows young adults under the age of 29 years old to acquire a health insurance rider that extends their eligibility to stay on a parent's policy. In order to receive the extension, you would need to apply during the open enrollment period between the ages of 26 and 29 years old. You may be eligible for the age 29 health insurance rider if you live in New York and are:

You may be eligible for the age 29 health insurance rider if you live in New York and are:

- Not married

- Not currently eligible for employer-sponsored health coverage

- Under 29 years old

Fortunately, New York is not the only state that provides young adults with an extension for health insurance coverage. Many states, like New Jersey, have programs that can even allow someone to remain covered under a parent's plan until 31 years old if they are eligible. Below, we have provided information for the six states that currently have health insurance riders that provide an extension of coverage.

| Florida |

| 30 |

| Nebraska |

| 30 |

| New Jersey |

| 31 |

| New York |

| 30 |

| Pennsylvania |

| 30 |

| Wisconsin |

| 27 |

Health insurance options for turning-26-year-olds

If you find yourself aging out of your parent's health insurance policy, you have a few coverage options to choose from:

- Employer-offered coverage: If you have a full-time job, then you may be offered a company health insurance policy through your employer.

- School-based coverage: If you are attending a university, then the school may offer its own health insurance policy to full-time students. This can be an affordable option for many graduate school students who may be getting older and aging out of their parents' policies.

- Individual health insurance: If you do not have access to health insurance through work or school, then you can still get affordable coverage through your state health insurance marketplace. Furthermore, you may be within an income threshold to be eligible for premium tax credits.

- Medicaid or the Children's Health Insurance Program (CHIP): When applying through your state health insurance marketplace, you will be asked about your income. Depending on your income level, you may be eligible to enroll in your state's Medicaid program.

Find Cheap Health Insurance Quotes in Your Area

It's free, simple and secure.

What is the best marketplace health insurance for 26-year-olds?

When searching your state health insurance marketplace, you should carefully evaluate the monthly premium and deductible of each plan, as these will directly affect what you will pay for coverage. You will notice that marketplace policies are broken down by tier. Below, we have provided explanations for each tier and when each is the best option. For many young, healthy adults, there are certain plans that will adequately provide health insurance coverage at a cheaper monthly premium.

Gold and Platinum

The most expensive policies on state marketplaces are Gold and Platinum. However, these plans have the lowest deductibles, which allow you to access coinsurance benefits more quickly.

Twenty-six-year-olds, who are often in great health, will find that this type of policy likely ends up costing more compared to the benefits that they receive. For this reason, we would not recommend getting one of these policies unless you have an illness that requires monthly prescription drug refills, which can be costly. For example, people with diabetes who require monthly insulin refills may find that a Gold health insurance policy will save them money.

For example, people with diabetes who require monthly insulin refills may find that a Gold health insurance policy will save them money.

Silver

Silver health insurance policies have average premiums, deductibles and out-of-pocket maximums. These policies are more expensive than the cheapest available but are a great option for individuals in their late 20s who may be starting a family. New families may find that they have an increase in health costs for their kids. The lower deductible of a Silver policy can provide quicker access to coinsurance benefits.

Additionally, a Silver plan offers cost-sharing reductions if your income falls below 250% of the federal poverty level. This can provide valuable benefits for young adults who may not be earning a large income.

Catastrophic and Bronze

Catastrophic and Bronze health insurance plans are the cheapest health policies offered on state health insurance exchanges but have the highest deductibles and out-of-pocket maximums. Cheap plans like these are ideal for healthy individuals in their 20s who do not expect to have significantly high medical costs. However, we would not recommend this type of policy if you are currently responsible for dependents or have large, recurring medical expenses.

Cheap plans like these are ideal for healthy individuals in their 20s who do not expect to have significantly high medical costs. However, we would not recommend this type of policy if you are currently responsible for dependents or have large, recurring medical expenses.

How Long Can You Stay on Your Parent's Insurance?

Under current laws, you can stay on your parent’s health insurance policy until you turn 26 years old.

In some states, it’s even longer.

When the time comes for you to get your own insurance, it’s important to know what your health insurance choices are and how to choose the right plan.

It can be a confusing topic, and sometimes it is difficult to know what your best options are.

This article breaks down what you need to know about your health insurance options, how to choose a plan that’s right for you, and if you even need insurance.

When You Lose Health Insurance Through Your Parents

Currently, the Affordable Care Act (ACA) requires your parent’s insurance plan to cover you until your 26th birthday.

You qualify for coverage under your parents even if you are:

- Married

- Attending school

- Not living with your parents

- Not financially dependent on your parents

- Eligible to enroll in your employer’s plan

If your parents have their insurance plan through an employer, you usually have coverage until the end of your birthday month.

Check with your individual plan to know for sure, as some states and plans have different rules.

If your parents have a Marketplace insurance plan, you have until December 31of the year you turn 26 to get your coverage.

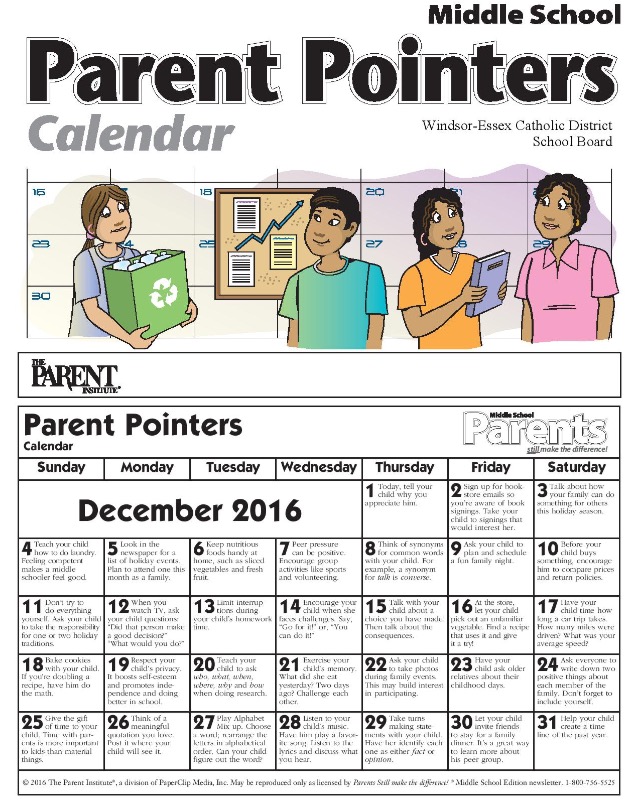

States with an extended age limit

Some states have an extended age limit to remain on your parent’s policy if you meet specific criteria.

To be eligible for extended dependent coverage, you typically can’t be eligible for any other form of comprehensive health coverage.

For example, if you are eligible for your own employer’s health insurance, you may not be able to extend your parent’s coverage. (This does not apply to individuals who have a disability.)

(This does not apply to individuals who have a disability.)

Following are the states that offer exceptions; however, laws are always subject to change, so check with your own state’s laws.

| State | Dependent Age Limit Exceptions |

| Florida | Through age 29 for those who are unmarried, have no dependents, and are residents of the state or enrolled as a part-time or full-time student |

| Georgia | No age limit for persons with a disability incapable of self-support |

| Idaho | No age limit for unmarried persons with a disability |

| Illinois | Through age 29 for unmarried veterans No age limit for persons with a disability incapable of self-support |

| Indiana | No age limit for persons with a disability incapable of self-support |

| Massachusetts | No age limit for persons with a disability incapable of self-support |

| Minnesota | No age limit for persons with a disability |

| Missouri | No age limit for persons with a disability incapable of self-support |

| Nevada | No age limit for persons with a disability incapable of self-support |

| New Jersey | Through age 30 for those who are unmarried, have no dependents, and are residents of the state or full-time students |

| New York | Through age 29 for those who are unmarried and residents of or workers in the state No age limit for persons with a disability who are unmarried and incapable of self-support |

| Ohio | No age limit for persons with a disability incapable of self-support |

| Oregon | No age limit for persons with a disability |

| Pennsylvania | Through age 29 for those who are unmarried, have no dependents, and are residents of the state or enrolled as a full-time student |

| Rhode Island | No age limit for persons with a disability |

| South Carolina | No age limit for persons with a disability incapable of self-support |

| South Dakota | Through age 29 for full-time students No age limit for persons with a disability incapable of self-support |

| Wisconsin | No age limit for full-time students; for full-time students who are National Guard or reservists called into active duty; for those called for federal active duty; or for persons with a disability incapable of self-support |

Health Insurance Options

If you are about to age out of your parent’s insurance policy, you have a few options to choose from.

If you or your spouse are currently employed full-time, you may be able to get health insurance coverage through an employer.

You must request special enrollment within 30 days of your loss of coverage.

Health insurance marketplace

For individual coverage, you may qualify for special enrollment through the Health Insurance Marketplace.

To purchase a Marketplace plan, you must special enroll within 60 days of aging out of your plan. You can find more information here.

You may even qualify for subsidies that can make your coverage more affordable.

COBRA

If your parent’s employer sponsors 20 or more employees on its plan, you may be eligible to purchase a temporary extension of health coverage for up to 36 months under the Consolidated Omnibus Budget Reconciliation Act (COBRA).

Be sure to notify your parent’s employer in writing within 60 days before you turn 26 if you want to elect COBRA coverage.

Medicaid

If you apply for insurance through your state health insurance marketplace, you will be asked to enter your income amount.

Depending on how much you make per year, you may qualify for your state’s Medicaid program.

If you are currently attending a university as a full-time student, you may be able to get health coverage through your school’s insurance policy.

This is a great option for graduate students who are getting older and aging out of their parent’s plan.

Check your symptoms using K Health and talk to a medical provider for a low cost.

Get Started

Choosing the Right Health Insurance

The health insurance plan you choose depends somewhat on your health status.

If you are in good health and don’t require monthly prescriptions or need to have a procedure done, you will want a different plan than someone who does.

Types of plans

Here are the most common types of health insurance plans.

Exclusive provider organizations (EPO): An EPO plan requires you to seek healthcare services from doctors and hospitals within their defined network if you want your costs to be covered, with exceptions for emergency care.

Health maintenance organizations (HMO): HMO plans typically contract with doctors within a specific area to provide services, including preventative measures. Except for an emergency, this type of plan only covers the cost of services provided by in-network healthcare providers.

Point of Service (POS): POS plans offer reduced-cost physician and hospital care when you seek care from their in-network providers. If you need an appointment with a specialist, you’ll need to get a referral from your primary care physician.

Preferred provider organization (PPO): With a PPO, you pay less for healthcare services when you only use in-network providers. This plan does not require a referral to see a specialist.

Marketplace: The health insurance Marketplace offers a few different levels of coverage plans. The plans are broken down by tier:

- Gold and Platinum: These plans have the most expensive premiums (monthly payments), but they also have the lowest deductibles (the amount you need to pay out of pocket).

This means you will have access to coinsurance benefits quickly. If you are in great health, this policy might end up costing more compared to the benefits you will receive. However, if you require monthly medications, this plan would be a great money-saving plan for you.

This means you will have access to coinsurance benefits quickly. If you are in great health, this policy might end up costing more compared to the benefits you will receive. However, if you require monthly medications, this plan would be a great money-saving plan for you. - Silver: These plans have average premiums, deductibles, and out-of-pocket maximums. It is more expensive than the cheapest plan, but it’s a great plan if you are preparing to start a family. In addition, Silver plans offers cost-sharing discounts if your income is below 250% of the federal poverty level.

- Bronze: These plans have low premiums and high deductibles but are only available for people under 30. If you are eligible for subsidies, you can apply them to get a Bronze plan for a low monthly rate. This type of plan is good if you don’t think you’ll have many medical expenses throughout the year.

- Catastrophic: These plans are also only available for people under 30.

They are the cheapest plans available on the Marketplace, but they have the highest deductibles and out-of-pocket maximums. This type of cheap plan is great if you are healthy and don’t expect to have substantial medical costs. You cannot apply subsidies to Catastrophic plans.

They are the cheapest plans available on the Marketplace, but they have the highest deductibles and out-of-pocket maximums. This type of cheap plan is great if you are healthy and don’t expect to have substantial medical costs. You cannot apply subsidies to Catastrophic plans.

Costs

Whatever plan you choose, there is a required monthly premium (how much you pay for the plan each month).

If you don’t require any medical care, your premium is the only payment you can expect.

However, if you do require healthcare services, you will have to pay other costs as well.

- Deductible: This is the amount of money you pay out of pocket before the benefits of the policy start covering costs. For example, if you have a deductible of $2,000, you will need to pay the first $2,000 of any healthcare bills yourself before your insurance starts to pay.

- Copayment: Also called a copay, the copayment is typically a fixed cost for a service (e.

g., $25 to see your primary care physician). Once the deductible has been met, you will only be asked to pay your copay when you visit your doctor.

g., $25 to see your primary care physician). Once the deductible has been met, you will only be asked to pay your copay when you visit your doctor. - Out-of-pocket maximum: This is the maximum amount of money you will pay out of your own pocket for healthcare services in a single year. Until you reach this maximum, you are responsible for all of the out-of-pocket costs.

Check your symptoms using K Health and talk to a medical provider for a low cost.

Get Started

Do I Need Health Insurance?

If you are healthy, you might think that you don’t need health insurance coverage.

But consider that accidents happen all the time, and healthcare services can be expensive without the help of insurance.

According to the U.S. Centers for Medicare and Medicaid Services, the average hospital stay can cost $10,000 per day.

While that may be an extreme case, injury and illness can come as a surprise, and signing up for health insurance is one simple way to help avoid high medical bills if an issue does arise.

It’s always best to plan ahead—you’ll be happy you did.

How K Health Can Help

Did you know you can get affordable primary care with the K Health app?

Download K Health to check your symptoms, explore conditions and treatments, and, if needed, text with a doctor in minutes. K Health’s AI-powered app is HIPAA compliant and based on 20 years of clinical data.

K Health articles are all written and reviewed by MDs, PhDs, NPs, or PharmDs and are for informational purposes only. This information does not constitute and should not be relied on for professional medical advice. Always talk to your doctor about the risks and benefits of any treatment.

K Health has strict sourcing guidelines and relies on peer-reviewed studies, academic research institutions, and medical associations. We avoid using tertiary references.

-

Why Bother with Health Insurance? (n.

d.)

d.)

https://www.healthcare.gov/young-adults/ready-to-apply/ -

Young Adults and the Affordable Care Act: Protecting Young Adults and Eliminating Burdens on Businesses and Families. (2020.)

https://www.cms.gov/CCIIO/Resources/Files/adult_child_fact_sheet -

How to Get or Stay on a Parent’s Plan.

(n.d.)

(n.d.)

https://www.healthcare.gov/young-adults/children-under-26/ -

Health Insurance Marketplace. (n.d.)

https://www.healthcare.gov/glossary/health-insurance-marketplace-glossary/ -

The 2021 Florida Statutes.

(2021.)

(2021.)

http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0600-0699/0627/Sections/0627.6562.html -

Life Events – Child Turns 26. (n.d.)

https://team.georgia.gov/life-events-child-turns-26/ -

Idaho Statutes.

(2021.)

(2021.)

https://legislature.idaho.gov/statutesrules/idstat/title41/t41ch31/sect41-2103/ -

Dependent Coverage. (2017.)

https://www2.illinois.gov/cms/benefits/trail/state/Pages/AddingaDependent.aspx -

Eligibility requirements to enroll.

(n.d.)

(n.d.)

https://www.in.gov/spd/benefits/eligibility/eligibility-requirements-to-enroll/ -

Section 108. (n.d.)

https://malegislature.gov/Laws/GeneralLaws/PartI/TitleXXII/Chapter175/Section108 -

Family Eligibility.

(n.d.)

(n.d.)

https://mn.gov/mmb/segip/family-eligibility/ -

Title XXIII Corporations, Associations and Partnerships. (2008.)

https://revisor.mo.gov/main/OneSection.aspx?section=354.536 -

Chapter 689b - Group and Blanket Health Insurance.

(n.d.)

(n.d.)

https://www.leg.state.nv.us/NRS/NRS-689B.html#NRS689BSec035 -

Coverage of Young Adults in New Jersey Up to Age 31. (n.d.)

https://www.state.nj.us/dobi/division_consumers/du31.html#du31 -

Coverage Expansion Through Age 29.

(n.d.)

(n.d.)

https://www.dfs.ny.gov/consumers/health_insurance/faqs_age29_young_adult_option -

Disabled Dependent 26 Years of Age or Older. (2018.)

http://www.cs.ny.gov/employee-benefits/hba/shared/manuals/pa/pdfs/2.3_disabled_dependent_26_or_older.pdf -

Section 1751.

14. Termination of coverage of child. (2016.)

14. Termination of coverage of child. (2016.)

https://codes.ohio.gov/ohio-revised-code/section-1751.14 -

Eligibility and Dependent Eligibility. (2022.)

https://www.oregon.gov/oha/OEBB/Pages/Eligibility.aspx -

Senate Bill No.

189. (2009.)

189. (2009.)

https://www.legis.state.pa.us/CFDOCS/Legis/PN/Public/btCheck.cfm -

Chapter 41. Health Maintenance Organizations. (2012.)

http://webserver.rilin.state.ri.us/Statutes/TITLE27/27-41/27-41-61.HTM -

Title 38 - Insurance.

(2019.)

(2019.)

https://www.scstatehouse.gov/code/t38c071.php -

58-17-2.3. Dependent coverage termination--Age--Full-time students. (2011.)

https://sdlegislature.gov/Statutes/Codified_Laws/2074932 -

58-17-30.

1. Continuation of coverage for child with intellectual or physical disability--Proof of dependency. (2013.)

1. Continuation of coverage for child with intellectual or physical disability--Proof of dependency. (2013.)

https://sdlegislature.gov/Statutes/Codified_Laws/2074966 -

632.885. Coverage of dependents. (2011.)

https://docs.legis.wisconsin.gov/statutes/statutes/632/vi/885 -

Young Adults and the Affordable Care Act: Protecting Young Adults and Eliminating Burdens on Businesses and Families FAQs.

(n.d.)

(n.d.)

https://www.dol.gov/agencies/ebsa/about-ebsa/our-activities/resource-center/faqs/young-adult-and-aca -

Enroll in or change 2022 plans — only with a Special Enrollment Period. (n.d.)

https://www.healthcare.gov/coverage-outside-open-enrollment/special-enrollment-period/ -

Subsidized Coverage.

(n.d.)

(n.d.)

https://www.healthcare.gov/glossary/subsidized-coverage/ -

COBRA Continuation Coverage Questions and Answers. (n.d.)

https://www.cms.gov/CCIIO/Programs-and-Initiatives/Other-Insurance-Protections/cobra_qna

Article 7. The right to insurance coverage \ ConsultantPlus

Article 7. The right to insurance coverage

The right to insurance coverage

Prospects and risks of disputes in a court of general jurisdiction. Situations related to Art. 7

- The citizen does not agree with the refusal to assign insurance payments in connection with the death of a person due to an accident at work or an occupational disease

1. The right of the insured to insurance coverage arises from the day the insured event occurs.

2. The following have the right to receive a lump sum insurance payment in the event of the death of the insured as a result of an insured event: but not longer than until they reach the age of 23;

parents, spouse of the deceased;

disabled persons who were dependents of the deceased or had the right to receive maintenance from him by the day of his death;

other family member of the deceased, regardless of his ability to work, who does not work and is engaged in caring for his dependent children, grandchildren, brothers and sisters who have not reached the age of 14 or have reached the specified age, but according to the conclusion of the federal institution of medical and social expertise (hereinafter - the institution of medical and social expertise) or a medical organization recognized as needing outside care for health reasons.

N 413-FZ)

(see the text in the previous edition)

2.1. The following persons have the right to receive monthly insurance payments in the event of the death of the insured as a result of an insured event: until they reach the age of 23;

child of the deceased, born after his death;

one of the parents, spouse or other family member, regardless of his ability to work, who does not work and is busy caring for the dependent children of the deceased, his grandchildren, brothers and sisters who have not reached the age of 14 years or have reached the specified age, but according to the conclusion of an institution of medical and social expertise or a medical organization recognized as needing outside care for health reasons;

other disabled persons who were dependents of the deceased or had the right to receive maintenance from him by the day of his death, as well as persons who were dependents of the deceased who became disabled within five years from the date of his death.

(Clause 2.1 was introduced by Federal Law No. 413-FZ of December 2, 2019)

2.2. In the event of the death of the insured, one of the parents, spouse or other family member of the insured, who is unemployed and takes care of the children, grandchildren, brothers and sisters of the deceased and became disabled during the period of care, retains the right to receive monthly insurance payments after the end of care by these persons.

(Clause 2.2 was introduced by Federal Law No. 413-FZ of 02.12.2019)

(see the text in the previous wording)

minors - until they reach the age of 18 years;

students over 18 years of age - until full-time education, but not more than 23 years of age;

(as amended by Federal Law No. 185-FZ of July 2, 2013)

(see the text in the previous edition)

women over 55 years of age and men over 60 years of age - for life;

disabled persons - for the period of disability;

to one of the parents, spouse or other family member, unemployed and busy caring for the dependent children, grandchildren, brothers and sisters of the deceased - until they reach the age of 14 or change their health status.

4. The right to receive insurance payments in the event of the death of the insured as a result of an insured event may be granted by a court decision to disabled persons who had earnings during the life of the insured, in the event that part of the earnings of the insured was their permanent and main source of funds for existence.

5. Persons whose right to receive compensation for harm was previously established in accordance with the legislation of the USSR or the legislation of the Russian Federation on compensation for harm caused to employees by injury, occupational disease or other damage to health associated with the performance of their labor duties, receive the right to on insurance from the date of entry into force of this Federal Law.

Family health insurance in Germany

What are the conditions for free inclusion in the family public health insurance in Germany.

An indisputable advantage of state health insurance in Germany is the possibility of including a spouse and children in the contract without additional fees. Under certain conditions, it is allowed to insure free of charge even grandchildren.

Under certain conditions, it is allowed to insure free of charge even grandchildren.

The only contribution of one employee provides family insurance.

Conditions for including a family in medical insurance

In private health insurance, each additional family member increases the monthly fee. In the state, on the contrary, relatives receive a full range of German medicine services for free.

A child or spouse is included in the insurance if he:

- lives legally in Germany, registered at a German address.

- does not fall under the terms of compulsory insurance due to the presence of own income in excess of the established limits.

- is not a civil servant.

- does not work more than 18 hours a week as a self-employed person.

- does not receive unemployment benefits.

- is not insured in the private box office.

Family member income limits

Spouse or child, in order to remain insured in family health insurance, cannot earn above the norm. The amount of the limit depends on the form of employment.

The amount of the limit depends on the form of employment.

Income limit in 2021, allowing working family members not to take out their own insurance - 455€ per month. But it is not gross salary that counts, but earnings minus labor costs. Therefore, it is allowed to deduct the costs of finding a job from the salary - a minimum of 1000 € per year. Therefore, the real allowed earnings are 538.33 € per month.

Those working under the terms of the Minijob - the minimum employment in Germany - also fall into family insurance.

Not only wages are considered income. The limit covers the total income, including, for example, renting out housing, pensions, interest on capital.

If the insured began to earn more, he is obliged to independently notify the insurance company and draw up a separate contract - in public health insurance or in private.

It is allowed to exceed the limit by any amount due to additional employment lasting no more than 2 months per year. For example, if a student decides to work as a waiter during the holidays.

For example, if a student decides to work as a waiter during the holidays.

Age limits for children

While the child has not started to earn money on his own, it is allowed to be in the parent's contract until the age of 23. Studying at a university or getting a profession in Ausbildung without a salary raises the age bar to 25 years.

It is possible to extend the stay in family insurance for a year if studies were interrupted by voluntary military or volunteer service.

Without age restrictions, it is allowed to remain in the parent's state insurance for dependent disabled people who require constant care and supervision.

How to apply for family insurance

If the conditions for enrolling in family insurance are met, the contributor asks the cash desk for permission to pay. The insurance company sends a questionnaire, also a pdf of the form is available for download on the company's website.

A completed and signed application must be sent to the address of the insurance company or upload a scan on the website in your personal account. The form is accompanied by a German translation of the marriage and birth certificates included in the contract, and passport-sized photographs.

The form is accompanied by a German translation of the marriage and birth certificates included in the contract, and passport-sized photographs.

The cash desk will check the application and send an insurance policy in the form of a card to each new client.

When both spouses work and pay separate fees to the state fund, the question of whom to bring the child in must be decided independently. The size of the salary does not play a role.

Once a year, the fund sends a questionnaire to the employee paying the family contribution with questions about compliance with the rules for the presence of relatives in family insurance. The paper must be filled out, signed and sent back.

Our insurance services

Our insurance broker helps to insure in Germany in Russian with an individual approach to the situation of each client. Complete the questionnaire to find an insurance contract. The service is completely free.

QUESTIONNAIRE

Family where one of the spouses is in private insurance

It happens that in a family one spouse is in state insurance, and the other is in private insurance.