How does the state of louisiana determine child support

Louisiana Child Support Laws - Support Calculation, Enforcement, and More

Child support is an ongoing payment by a non-custodial parent to assist with the financial support of their children. Child support payments are often determined during the process of dissolution of a marriage through divorce, though the only requirements for requesting child support payments are establishment of paternity and maternity.

Child support is handled on a state level, and Louisiana has a set of specific child support guidelines. On this page you can learn about how child support is calculated in Louisiana, how custody split and extraordinary costs affect child support payments, and more.

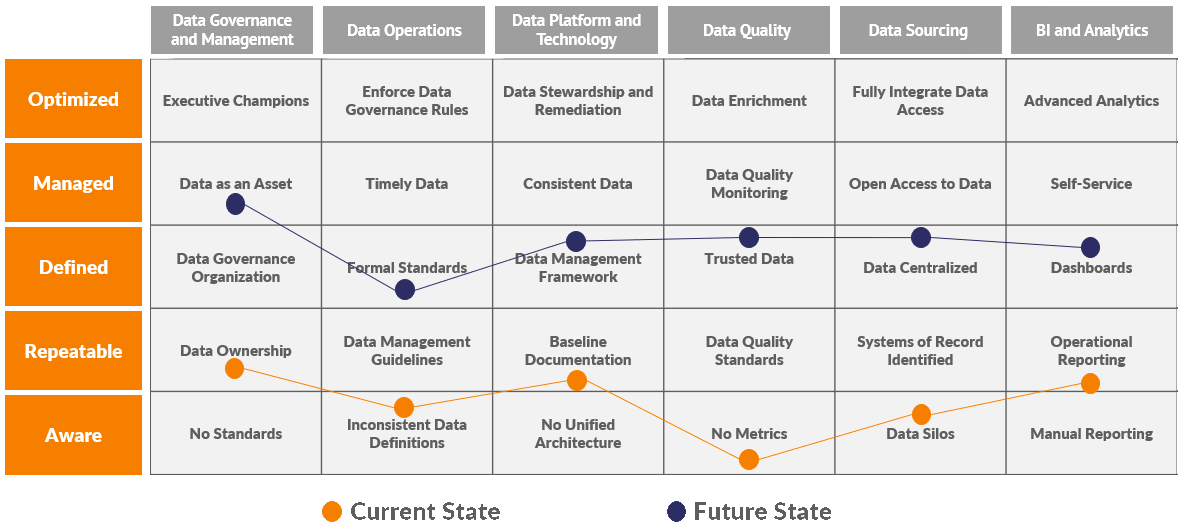

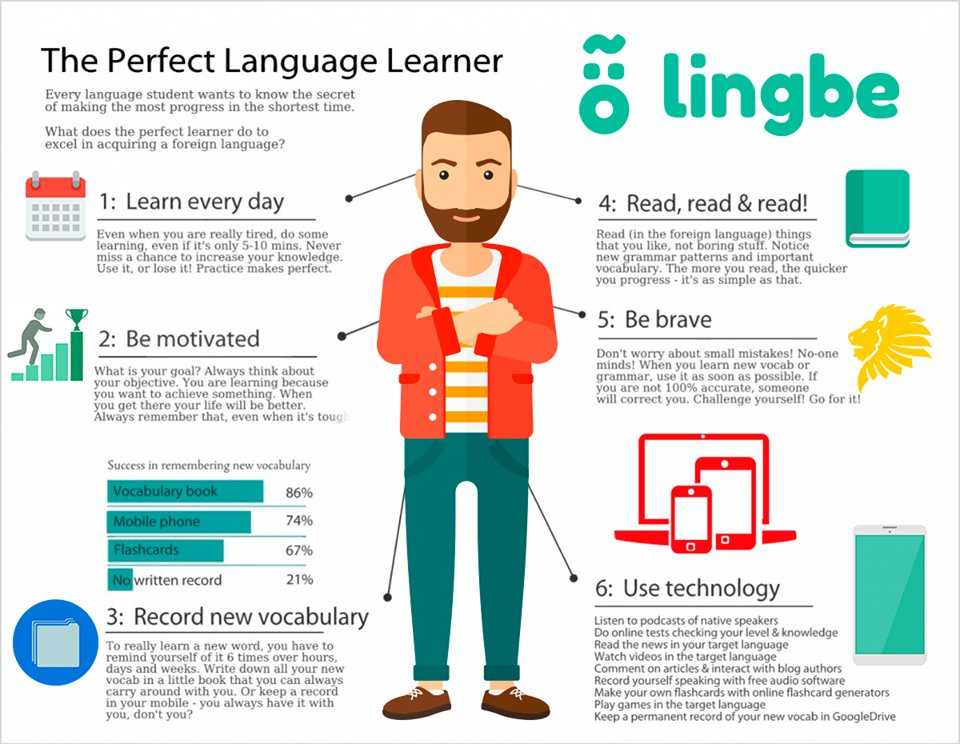

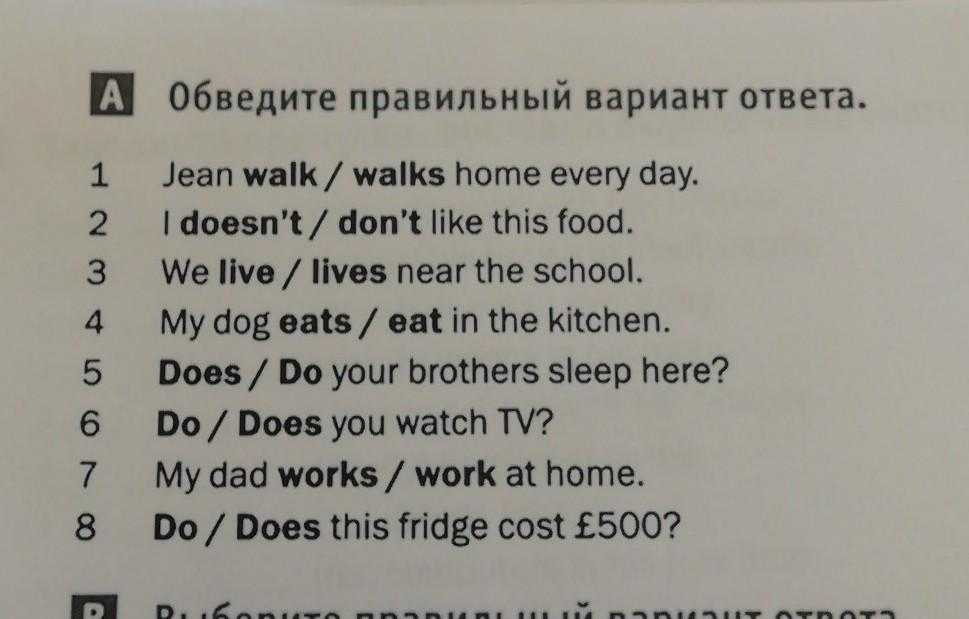

Louisiana uses the "income share" method for calculating child support payments, which is designed to ensure that both the custodial and non-custodial parents contribute to their child's upkeep.

In the event of parents sharing custody of a child, the Louisiana judge who sets child support may deviate from the basic child support formula to account for this. Other special situations accounted for under Louisiana's child support law include childcare costs and extraordinary medical costs. These costs may be additions to the basic Louisiana child support order.

What Constitutes as Gross Income When Determining Child Support?

"Gross income" means:

The income from any source, including but not limited to salaries, wages, commissions, bonuses, dividends, severance pay, pensions, interest, trust income, recurring monetary gifts, annuities, capital gains, social security benefits, workers' compensation benefits, basic and variable allowances for housing and subsistence from military pay and benefits, unemployment insurance benefits, disaster unemployment assistance received from the United States Department of Labor, disability insurance benefits, and spousal support received from a preexisting spousal support obligation; Expense reimbursement or in-kind payments received by a parent in the course of employment, self-employment, or operation of a business, if the reimbursements or payments are significant and reduce the parent's personal living expenses.

Child support can be arranged out of court by a mutual support agreement between the parents, or can be decided in Louisiana family court through a child support order. In Louisiana, a number of factors are taken into account when determining the amount of child support to be paid in court. Here is an explanation of the two most common methods used to calculate basic child support amounts.

Income Share MethodUnder the income share model, the court uses economic tables to estimate the total monthly cost of raising the children. The non-custodial parent pays a percentage of the calculated cost that is based on their proportional share of both parents' combined income.

Example: The non-custodial parent of one child has an income of $2,000 per month, and the custodial parent has an income of $1,000 per month. The court estimates that the cost of raising one child is $1,000 a month. The non-custodial parent's income is 66. 6% of the parent's total combined income. Therefore, the non-custodial parent pays $666 per month in child support, or 66.6% of the total child support obligation.

6% of the parent's total combined income. Therefore, the non-custodial parent pays $666 per month in child support, or 66.6% of the total child support obligation.

Louisiana does use the income share method to calculate child support

Percentage Of Income MethodThis method of calculating child support is simple - a set percentage of the non-custodial parent's income is paid monthly to the custodial parent to cover basic child support expenses. The percentage paid may stay the same, or vary if the non-custodial parent's income changes.

Example: The non-custodial parent of one child has an income of $2,000 per month. The court orders a flat percentage of 25% of the non-custodial parent's income to be paid in child support to the custodial parent. Therefore, the non-custodial parent pays $500 per month in child support. If the non-custodial parent's monthly income changes, the dollar amount they pay in child support will change as well.

Louisiana does not use the percentage of income method to calculate child support

Louisiana Child Support FAQ

- How does having shared custody of the child affect child support in Louisiana?

- How are extraordinary medical costs treated by child support in Louisiana?

- How are child care costs treated by child support in Louisiana?

- Does child support cover college education expenses in Louisiana?

- How is child support enforced in Louisiana?

- What are child support arrears?

- How are child support payments taxed in Louisiana?

How does having shared custody of the child affect child support in Louisiana?

All states have a method of modifying the amount of child support owed in cases where the custody agreement provides for joint or shared custody of a child between both parents.

Louisiana law allows the judge overseeing the child support order to use a shared custody agreement as justification for a variation from the state's general child support calculations. This means that if the non-custodial parent shares parenting time with the custodial parent, the judge might reduce the amount of child support owed to account for the resources spent by the non-custodial parent during their time with the child.

This means that if the non-custodial parent shares parenting time with the custodial parent, the judge might reduce the amount of child support owed to account for the resources spent by the non-custodial parent during their time with the child.

How are extraordinary medical costs treated by child support in Louisiana?

Louisiana has specialized guidelines for the sharing of a child's extraordinary medical care costs that are separate from, and in addition to, basic child support payments. Extraordinary medical costs are generally costs generated by things such as illness, hospital visits, or costly procedures such as getting braces.

Louisiana treats extraordinary medical care costs as a "mandatory deduction" for basic child support. This means that if the non-custodial parent pays child care costs, the portion of the total monthly child care costs attributed to the custodial partner are deducted from the noncustodial partner's monthly child support payment. If the custodial parent pays for child care, the non-custodial parent must pay their share in addition to basic child support.

If the custodial parent pays for child care, the non-custodial parent must pay their share in addition to basic child support.

How are child care costs treated by child support in Louisiana?

Due to the high costs of child care for a single payment, Louisiana has specialized guidelines that consider child care costs separately from the general costs of raising a child for the purposes of calculating child support payments.

Louisiana treats child care costs as a "mandatory deduction" for basic child support. This means that if the non-custodial parent pays child care costs, the portion of the total monthly child care costs attributed to the custodial partner are deducted from the noncustodial partner's monthly child support payment. If the custodial parent pays for child care, the non-custodial parent must pay their share in addition to basic child support.

Does child support cover college education expenses in Louisiana?

While the state of Louisiana has no explicit requirement for college expenses to be covered under child support, support for college expense by the non-custodial parent may be voluntarily agreed to by both parties, after which it is contractually enforceable.

How is child support enforced in Louisiana?

In the state of Louisiana, child support is enforced by the state child support agency. The state agency handles the location of non-custodial parents, enforcement of support orders, and the handling of unpaid child support arrears.

What are child support arrears?

Child support arrears are the amount of child support that is delinquent, or unpaid, by the noncustodial parent to the custodial parent. Child support arrears may be collected by the state through wage garnishment, bank levy. withholding of Louisiana welfare benefits, or other collection methods.

How are child support payments taxed in Louisiana?

Under IRS guidelines, the recepient of child support does not need to pay federal tax on child support payments, and the payer of child support cannot deduct their child support payments. This differs from the federal taxation of alimony payments, which are treated as taxable income by the receiver and are deductible by the payor. Louisiana tax law may vary on tax treatment of child support.

Louisiana tax law may vary on tax treatment of child support.

Child Support Schedule | Louisiana Department of Children & Family Services

Child Support Schedule Updates - 2021

The Louisiana Child Support Schedule was updated on January 1, 2021, in accordance with Federal and State law that requires the State’s Child Support Guidelines to be reviewed every four years. The next quadrennial review is due 60 days before the regular session begins in 2024. The Child Support Program also has the power to re-examine a child support order every 3 years to see if it still meets Louisiana guidelines, even if there has not been a substantial change of circumstance.

In addition, there were changes to the guidelines including a change to the guideline calculation surrounding childcare costs. Your child support order may be eligible for a modification.

2020 Louisiana Child Support Review Committee Report - Explanation of Revisions

The committee thoroughly reviewed various sources of recent data on child-rearing expenditures, various methods for adjusting national data to be more appropriate for Louisiana’s cost of living, and the appropriate self-support reserve. The committee consists of 11 members that meet every four years to revise the guidelines.

The committee consists of 11 members that meet every four years to revise the guidelines.

The child support guideline schedule was mandated during the Regular Session of the 2016 Louisiana Legislature.

Note: The schedule defined support amounts up to $40,000 of combined monthly adjusted gross income. For cases with combined monthly adjusted gross income above $40,000, the child support obligation should be determined on a case-by-case basis.

Additional schedule information:

- The amounts set forth in the schedule in R.S. 9:315.19 presume that the custodial or domiciliary party has the right to claim the federal and state tax dependency deductions and any earned income credit. However, the claiming of dependents for federal and state income tax purposes shall be as provided in Subsection B of the state statute.

- The non-domiciliary party whose child support obligation equals or exceeds fifty percent of the total child support obligation shall be entitled to claim the federal and state tax dependency deductions if, after a contradictory motion, the judge finds both of the following:

- (a) No arrearages are owed by the obligor.

- (b) The right to claim the dependency deductions or, in the case of multiple children, a part thereof, would substantially benefit the non-domiciliary party without significantly harming the domiciliary party.

- (a) No arrearages are owed by the obligor.

- The child support order shall:

- (a) Specify the years in which the party is entitled to claim such deductions.

- (b) Require the domiciliary party to timely execute all forms required by the Internal Revenue Service authorizing the non-domiciliary party to claim such deductions.

- The party who receives the benefit of the exemption for such tax year shall not be considered as having received payment of a thing not due if the dependency deduction allocation is not maintained by the taxing authorities.

lottery and child support by country

Lottery games, the results of which we explain and disclose on this website, do not exist only to give players pleasure and the opportunity to get rich. Their income is usually returned to the community in the form of alimony. and for applications in education, the arts, sports, healthcare and other sectors. In addition, there are so-called charity lotteries that do not collect profits and are aimed solely at returns.

Their income is usually returned to the community in the form of alimony. and for applications in education, the arts, sports, healthcare and other sectors. In addition, there are so-called charity lotteries that do not collect profits and are aimed solely at returns.

We have reunited the most interesting facts and statistics of 2023 about lotteries and their support to the community. . Take the time to review our graphics and lists and understand how your game is redirected to helping other people.

Fast Jump

- Support and Charity Lottery Models

- National Child Support and Charity Contribution Lottery Facts and Statistics

- Characteristics of Charity Lotteries

- Lottery winners who donated their winnings

- Frequently asked questions

- Recommendations

Lottery support and charity models

Lotteries allocate lottery proceeds to good causes in different ways. It depends on the model with which this distribution was configured, which may fall into one of the following four categories, as previously agreed by ICNL:

| Category | How distribution works | Used in |

|---|---|---|

| Government | Distribution by a government or government agency. How much is distributed, and what areas are provided by local law or government. How much is distributed, and what areas are provided by local law or government. | Croatia, Denmark, Finland, Sweden |

| Independent body | Individuals other than the government or the lottery operator decide for themselves in which areas the charity operates. The law may define such distribution, but individual grants are provided by an independent entity. | New Zealand, Republic of South Africa, United Kingdom |

| Lottery operators | Lottery operators determine their level of support and distribution as part of their CSR program. | Romania, Serbia, Slovenia |

| Legally defined | The law determines the recipients of lottery income in the country. | Macedonia |

Some countries channel their lotteries to support multiple departments such as sports, education and health. Others are entirely targeted to a specific area, such as the Health Lottery from the United Kingdom, which sends 20. 3% of ticket revenue to medical needs.

3% of ticket revenue to medical needs.

Facts and Statistics on National Child Support and Charity Lotteries

- The UK National Lottery, responsible for games like Lotto and Thunderball, donates 28% of its revenue to support the community, which is even more than the 20.3% of the Health Lottery .

- 30% of proceeds from the Aktion Mensch lottery in Germany are used to support over 10,000 projects for the disabled and other vulnerable groups.

- 81% of the income of the ONCE Foundation, which is responsible for supporting the social and labor inclusion of people with disabilities, comes from the Pro-blind Cupón Lotto program in Spain.

- Postcode lotteries in the Netherlands, Sweden, Scotland and England give different percentages to charity depending on the country. In the Netherlands - 50%; in Sweden - 22.5%; in the UK - 20%.

UK Lottery

The United Kingdom bets on social lotteries, which are local organizations that offer games with small prizes. Of these, the Health Lottery and the People's Zip Code Lottery are the most popular. .

Of these, the Health Lottery and the People's Zip Code Lottery are the most popular. .

This is the UK National Lottery and is the most famous lottery in the country. and also has the greatest distribution for good deeds. It collects 28% of the proceeds and distributes as follows:

- Health, education and environment: 40%

- Art: 20%

- Legacy: 20%

- Sports: 20%

The most recent data show that t The National Lottery has already raffled over £45bn. according to the structure above.

The UK National Lottery was created in 1993 and was reformed under the National Lotteries Act 1998 and the National Lotteries Act 2006. It is a member of the World Lottery Association and has been regulated by the UK Gambling Commission since October 2013. . In the past, its regulators were the National Lottery Authority (1993–1999) and the National Lottery Commission (1999–2013).

Canada

Each province that allows lotteries has its own idea of the distribution of income from local lotteries. The Lottery Inspection Committee of each province determines where the funds are sent. :

- Ontario Lotteries and Gaming Corporation (OLG) - Healthcare, entertainment, scientific and medical research, responsible gambling, arts and culture, education, local charities.

- Alberta Lotteries and Gaming Commission - Alberta payments target community initiatives and local programs and foundations, including culture, education, agriculture and rural development, health care, social services, tourism, and conservation.

- British Columbia Lottery Corporation - Much of the remaining lottery money goes to the British Columbia government to support government programs, education and community groups. About 20% of this amount goes to health initiatives, and another 20% to support non-profit organizations.

Other areas that receive less revenue include responsible gaming strategies, payments to local governments, economic development initiatives, and gaming policies.

Other areas that receive less revenue include responsible gaming strategies, payments to local governments, economic development initiatives, and gaming policies. - Western Canada Lottery - 47.9% of the proceeds is what's left after the WCLC prizes are paid out. Then 33.1% is accounted for by provinces and territories.

United States of America

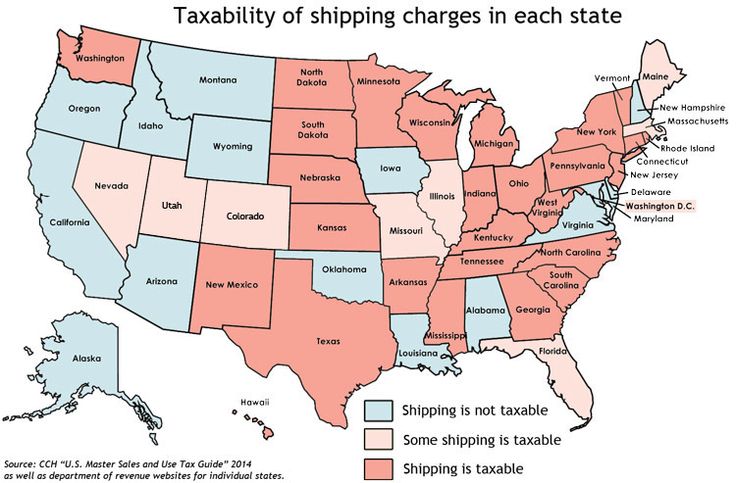

In the US, there is no single rule for lotteries nationwide. Each state makes its own rules, from the age at which people gamble to how much is donated to charity or to support the community. . However, multi-state games that are offered in many states and even available to players from all over the world on top lottery sites apply a single rule:

- Powerball - What's left of the huge millionaire jackpot payouts, Powerball distributes a lot to community initiatives, but a huge amount, around 20%, goes to charity, but each state has to determine if it goes to child support or other form of donation.

. In Pennsylvania, for example, Powerball Litigation caters to the needs of the elderly.

. In Pennsylvania, for example, Powerball Litigation caters to the needs of the elderly. - Mega Millions - 50% off Mega Millions Ticket sales go where each state determines. In total, about 21% goes to charity, like in Powerball. To date, tens of billions of dollars have already been donated, mostly to research and education funds.

New Zealand

Approximately 23% of lottery sales are profits from the lottery, all of which has been returned to the community since the Gambling Act 2003. The lottery is administered by the New Zealand Lottery Commission. As in other countries, the variety of reasons supported is huge and includes :

- Outdoor security services.

- Protection of the environment and heritage.

- Health and community research.

- Utility facilities.

- Connecting communities and promoting well-being and quality of life.

Norway

The Lottery Act in Norway guarantees, among other things, that profits from lottery proceeds go to support good causes. Local Charity Lotteries donate about 40% of their income to charities, including humanitarian, cultural and other charities. . Since the market re-regulation in 2015, the following rules apply to charity lotteries in Norway:

Local Charity Lotteries donate about 40% of their income to charities, including humanitarian, cultural and other charities. . Since the market re-regulation in 2015, the following rules apply to charity lotteries in Norway:

- All profits from the lottery must go to charity and their charity work.

- Only charitable organizations can obtain a license for a period of 9 years.

- A country issues a maximum of five licenses.

- There is an annual turnover limit of NOK 300 million (approximately EUR 30 million) per license.

香港(中國)

The Lottery Fund was established in 1965 to fund social welfare services, and its main source of income is the Mark Six Lottery, but it also raises money from investments and vehicle registration auctions. Between October 1 and 2020, the fund received over $21 billion. The current distribution is distributed as follows:

- Services for the elderly: 79.66%

- Rehabilitation and medical and social services: 11.

38%

38% - Family and child welfare: 6.92%

- Youth: 1.92%

- Social support: 0.11%

- Services for offenders: 0.01%

Israel

Israel National Lottery Mifal HaPais was founded on August 1951 years for the construction of a hospital in Tel Aviv and other medical institutions. He has never stopped contributing to the community and has expanded its projects into the arts, recreation and education. .

Republic of South Africa

According to the National Lottery Commission of South Africa, following rules published back in 2010, The South African Lottery Charity Agency must give at least 50% of the money. after prizes paid to organizations involved in:

- Training and development of infrastructure for the care of the elderly, sick and vulnerable groups, including orphans.

- Provision of educational institutions for the education of children and adults.

- Improving the quality of life of the entire community.

Company six vulnerable groups that can be considered for financing in South Africa are as follows:

| group | How to use: | Doesn't have |

|---|---|---|

| Children | OVC (orphans and vulnerable children) and child-headed households. Includes homeless and homeless children left homeless. | Other children. |

| Youth | Young people involved in Drop-In Center programs or in conflict with the law or ex-offenders involved in diversion programs. Youth who also need help with substance abuse. | Young people who are already participating in ability or skill development programmes. |

| Elderly | People of retirement age studying in kindergartens, boarding schools or similar institutions. | Elderly people who have not reached retirement age and are not participating in eligible programs. |

| Families | Families in need of assistance or intervention with the assistance of a social worker. | Families who did not seek intervention from a registered organization. |

| People with disabilities | People with disabilities in residential areas; day care; incentive and employment or support programs. | Persons with disabilities, but not members of the organization. |

| homeless | Homeless people who are in poverty are abused, abandoned and do not have stable housing. | The homeless are not members of the organization. |

European Union - EL (European Lotteries)

The European Association of Public Lotteries and Sweepstakes (European Lotteries, EL) is the umbrella organization of over 40 national lotteries in the countries of Europe . Some real examples of the use of funds include those mentioned in its Official Website:

- ONCE (National Association of the Blind), Spain - Supports more than 71,000 jobs - 230% of people with disabilities - and provides more than 57 euros per year social support for people with disabilities.

- OPAP, Greece - Two of the largest children's hospitals in the country have been refurbished and the project is still ongoing.

- Loterie Nationale Loterij, Belgium - Funds medical services and cancer research.

- VEIKKAUS, Finland - Almost half of the local Ministry of Education and Culture's budget for arts and culture comes from the lottery.

- Lottomatica, Italy - Also aimed at art and culture, already restored by Moses Michelangelo in 2017.

Characteristics of charitable lotteries

Countries that use lotteries as a fundraising tool for charities tend to have common characteristics and differ from lotteries that collect profits. According to ICNL (International Center for Not-for-Profit Law), it is:

- The purpose is to fund civil society organizations (CSOs) or support their own activities aimed at vulnerable or disadvantaged groups.

- A portion of income is donated to beneficiaries, such as non-profit organizations.

- The company is not making a profit.

- An independent body is responsible for distributing and allocating funds.

- Must have a license issued by the government and local authority responsible for regulation.

Lottery winners who donated their winnings

- South Carolina, USA - One South Carolina woman received an after-tax lump sum of $870 million, a record Mega Millions jackpot in 2019year. At that time, tornadoes hit Alabama. She didn't hesitate and donated part of her prize to the Red Cross and other charities.

- New Hampshire, USA - One lucky winner who won $559.9 million in January 2018 decided to share $50 million in donations. Among the charities that received it were Girls Inc. and End 68 Hours of Hunger.

- France - The winner of the Euromillions game won 72 million euros in January 2014 and decided to donate most of it, approximately 50 million, to more than a dozen organizations.

- New York, USA - It's not just the big winners who donate to charity, as the winner of the $3 million windfall from a secret ticket donated the entire prize to Port Jefferson's True North Community Church. It was planned to be given away annually in the amount of $102,000. The church continued the good work and donated to charitable organizations.

- Iowa, USA - The 2018 Powerball winner of $350 million started her own foundation dedicated to her grandson's memory. She also made official donations to the Travis Mill Foundation of $500,000.

Frequently Asked Questions

Does each country's lottery donate to children or charity?

Generally, lotteries are an additional source of income for the government. Therefore, at least part of the proceeds goes to support the community, as taxes do, and may include charities.

Can I make a deposit when buying lottery tickets?

No, the organization or government in charge of the lottery determines where the proceeds go.

Is it ethical to use lotteries for child support and charity?

This is an ongoing debate. For some people, lotteries are just a way to add unnecessary taxes to citizens. On the other hand, there are lucky winners and some of the proceeds go to the benefit of the community. If donations were made without games, the income would be only a small part of what happens to them.

Were there any frauds in these types of schemes?

Fraud exists in everything related to money, but playing games provided by licensed organizations or national lotteries of countries with a long history is a safe option.

Recommendations

https://www.national-lottery.co.uk/life-changing/where-the-money-goes

https://www.healthlottery.co.uk/blog/how-to- pick-the-best-charity-lottery-to-play/

https://www.gamingpost.ca/canadian-lottery-news/where-does-your-lottery-money-go/

https:// mylotto.co.nz/community-funding

https://augustafreepress. com/which-lotteries-give-most-to-charity/

com/which-lotteries-give-most-to-charity/

http://www.nlcsa.org.za/charity/

https ://www.nlcsa.org.za/wp-content/uploads/2021/04/CDA-Vulnerable-groups-FINAL.pdf

https://www.acleu.eu/charity-lotteries

https://www.icnl.org/resources/research/ijnl/lottery-proceeds-as-a-tool-for-support-of-good -causes-and-civil-society-organizations-a-fate-or-a-planned-concept

Russian Bazaar

affairs of life

#4 (562)

Mikhail Tripolsky

The reader asks...

Dear editors!

My son transfers quite a large amount of his income to his ex-wife in the form of child support. She is a programmer, but has not been working for almost half a year. And not because she was fired. She herself decided to leave her job in order, as she told her son, to devote more time to children. But the children are not babies at all, they are schoolchildren of the 6th and 7th grades. In my opinion, the son does not so much help his children financially as he provides a comfortable existence for the ex-wife, a young, healthy woman. He intends to sue to challenge the increase in alimony. After all, after her voluntary resignation from work, the amount of child support for my son was increased. Does he have a chance to win the case?

He intends to sue to challenge the increase in alimony. After all, after her voluntary resignation from work, the amount of child support for my son was increased. Does he have a chance to win the case?

Yours faithfully, Galina

Before commenting on our reader's letter, I would like to dwell on what the system of financial support for children after their parents' divorce is like.

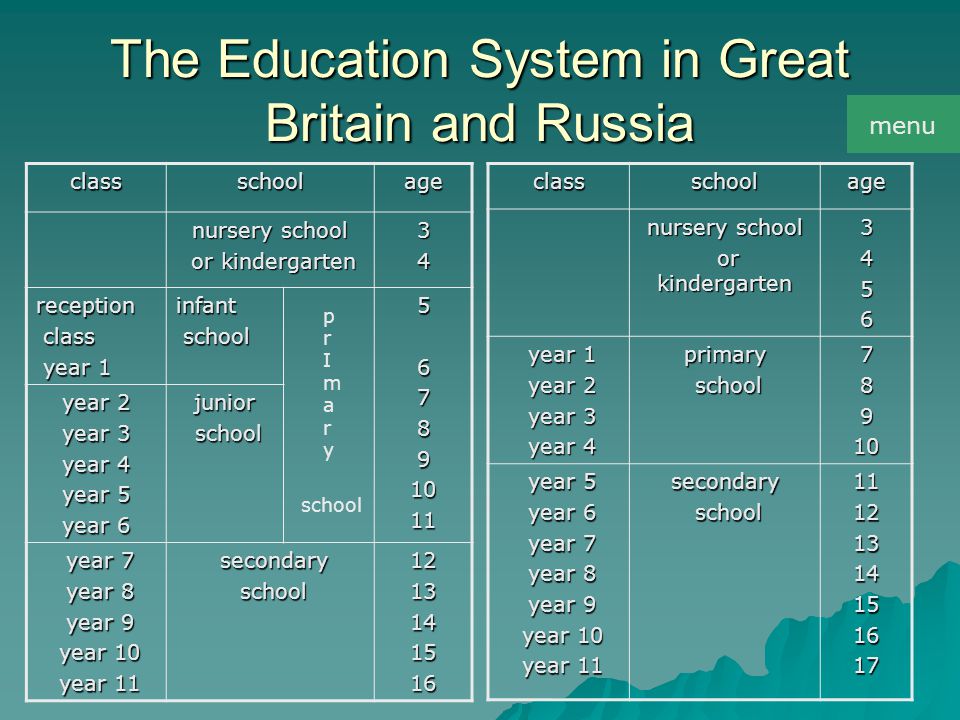

Federal law passed by Congress in 1988 requires each state to have its own law defining the amount of child support that one parent transfers to the other for the maintenance of children left to him (most often the mother) in court.

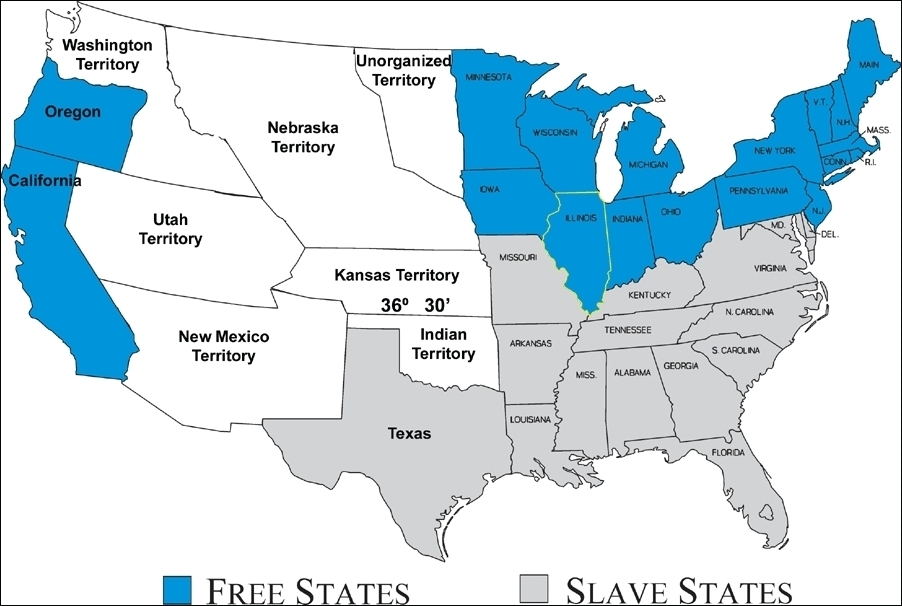

In most states, the so-called. “income-shares” model. It operates in the following way. First, the percentage of the combined parental income is established, and then the share of each of them in the child's allowance is determined - depending on earnings. Such states are: Alabama, Arizona, California, Colorado, Connecticut, Florida, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Michigan, Missouri, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Rod -Island, South Carolina, South Dakota, Utah, Vermont, Virginia, Washington, West Virginia, Wyoming.

States such as Alaska, Georgia, Illinois, Mississippi, Nevada, Tennessee, and Wisconsin use a different variant. A noncustodial parent who does not get a child (children) by court decision (noncustodial parent) pays a fixed fee in the form of a certain percentage of their income (flat percentage of their income), the amount of which depends on the number of children.

Other child support payment models exist, such as the Melson Formula Model (Delaware, Hawaii, Montana). According to this scheme, the amount of expenses that parents must spend on meeting their own needs is first determined, and then the percentage of payments for child support is already established.

DC uses the Hybrid Model, and Arkansas, Minnesota, North Dakota, and Texas use the Varying Percentage of Income Model.

Note that the law of 1988 was passed to ensure that each state had a clear formula for calculating the amount of child support, which the courts had to strictly adhere to.

But let's get back to the letter to the editor.

Our reader Galina's indignation at her daughter-in-law's behavior is understandable. The young woman, according to her, actually lives at the expense of her ex-husband and does not show a desire to work. In this regard, it is interesting to note that until the mid-1970s in the United States, legal responsibility for financial support for a child after a divorce - child support - lay exclusively with ex-husbands. However, later, after the adoption of relevant laws, the responsibility became mutual.

What decision can the court take on the suit of Galina's son?

It is difficult to answer this question, because verdicts in such cases are very different. At the same time, it is known from judicial practice that the voluntary resignation of parents, who are responsible for the material well-being of children, is not welcome. Even in those cases when they justify their actions with a desire to devote more time to children. When considering such cases, the courts often take into account not only the decreased income of the parent, but also the potential opportunity for this person to improve their financial situation by starting to earn money again – earning capacity.

Professor Joanna Grossman of the University of North Carolina School of Law addresses this issue by citing the case of Chen v. Werner as an example. In general terms, it is very similar to the case described by the reader Galina.

Jane Chen and her ex-husband John Werner worked in the same clinic, both received a decent salary. However, Jane suddenly decided that she should take more care of the children and switch from a full-time work week to a shorter one. The administration of the clinic did not meet her halfway, and then Mrs. Chen resigned of her own free will.

When the issue of increasing the ex-spouse's share of the child support payment began to be considered, Mr. Werner noticed that his wife did not have a serious need to quit her job. The children were healthy, they could get to school on their own and return home after school.

“If she wants to return to the clinic,” he declared during the hearing, “her wish will be immediately granted. She will again be able to receive the same salary, if not more, that she had before she was fired.