How does child support work in utah

Child Support

Introduction

This page explains what child support is, when it is established and how it is calculated.

Establishing child support may be part of a case for divorce, separate maintenance, temporary separation, annulment, parentage or child welfare. Depending on the type of case, a support order may be entered by a district court or a juvenile court. The Utah Office of Recovery Services (ORS) may issue administrative orders concerning child support outside of court.

Child Support Required

Parents have a legal duty to support their minor children. Unless a minor is emancipated, child support continues until the child is 18 or has completed high school, whichever is later. Child support is for the use and benefit of the child. In some cases, the court may order child support to continue after age 18 for a disabled child who remains a dependent.

Utah Code 78B-12-105(1).

Income and Overnights

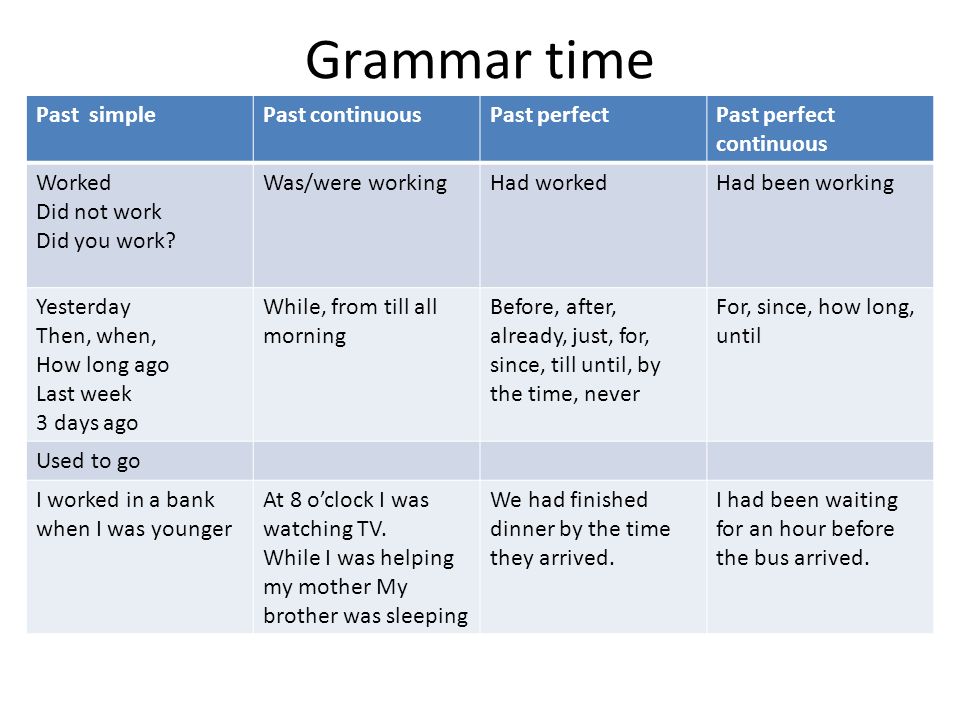

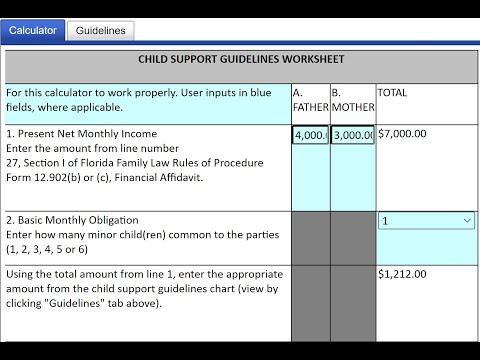

Child support is calculated using the gross monthly income of both parents and the number of overnights the child spends in each household.

Income

Parents are required to provide the court with proof that their current income matches the income used in the support calculator: year-to-date pay stubs or employer statements and complete copies of tax returns from at least the most recent year.

Utah Code 78B-12-201(1) and 78B-12-203(5)(b).

If this proof is not reasonably available, parties can file a Declaration of Other Party's Earnings explaining their income. The Declaration form is available in the Forms section below.

Even if the parent is not working, income may be imputed to that parent. This means the court will assume a parent is capable of earning a certain amount of money each month. Imputed income is usually based on working a 40-hour work week. The amount imputed will depend on various factors including the parent's work history and employment opportunities. If a parent has no recent work history or a parent's occupation is unknown, that parent may be imputed an income at the federal minimum wage for a 40-hour work week.

Utah Code 78B-12-203.

For the court to accept that a party is not earning any income, the court is required to evaluate the party's employment potential and probable earnings based on work history, occupation qualifications, and prevailing earnings for people of similar backgrounds in the community.

Utah Code 78B-12-203(7)(b).

However, income will not be imputed if any of the following conditions exist and the condition is not of a temporary nature:

- the reasonable costs of child care for the parents' minor children approach or equal the amount of income the custodial parent can earn;

- a parent is physically or mentally unable to earn minimum wage;

- a parent is engaged in career or occupational training to establish basic job skills; or

- unusual emotional or physical needs of a child require the custodial parent's presence in the home.

UCA 78B-12-203(7)(d).

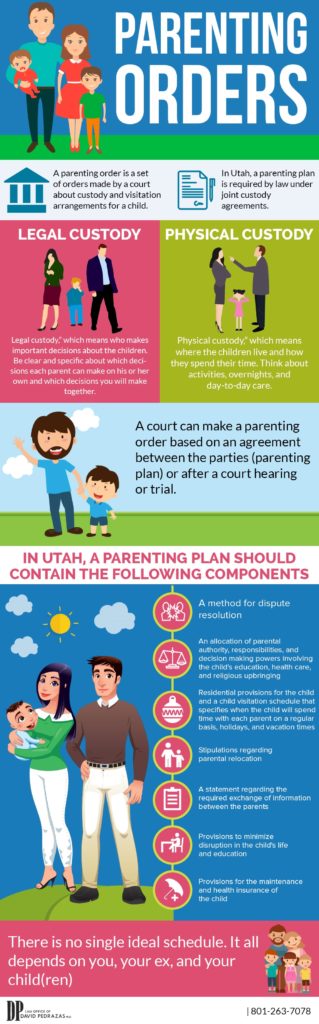

Overnights and Physical Custody

The number of overnights a child spends in each parent's home will also affect child support. There are three basic possibilities:

There are three basic possibilities:

- The child spends at least 111 nights a year in the home of each parent. This is called joint physical custody.

- The child spends over 225 nights a year in the home of one parent. This is called sole physical custody.

- There are multiple children and some live with one parent and some live with the other parent. This is called split custody.

For more information see our page on Custody.

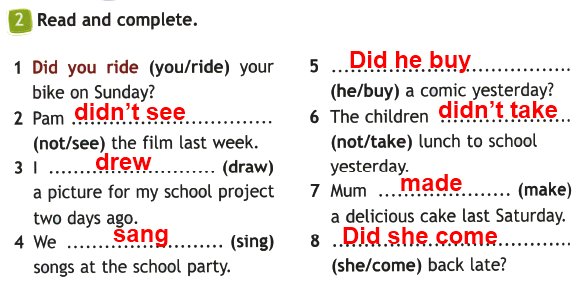

Calculating child support

Utah law establishes Child Support Guidelines to calculate a parent's child support obligation. The guidelines have three components:

- Base child support

- Medical care

- Child care expenses

A table determines the total support obligation for the children, which is shared by the parents according to their incomes. The non-custodial parent pays child support to the custodial parent. Child support is calculated by a formula established by Utah Code Section 78B-12-301.

If you are preparing papers for a divorce, custody or parentage case, the Online Court Assistance Program (OCAP) will calculate child support for you and prepare Child Support Worksheets. For other case types you can use the Child Support Calculator or the fill-in-the-blank forms. Be sure to allow pop-ups in your web browser for both of these tools.

Medical expenses and child care expenses

If a health insurance policy is reasonably available, the cost of the minor children's portion of the premium is shared equally by the parents, as is the cost of any non-insured medical expenses, including deductibles and co-payments.

Parents are also required to share work-related child-care expenses equally.

Award of tax exemption for dependent children

A child support order can establish which parent can claim the child as a dependent for federal and state income tax purposes. Unless the parties agree who can claim the tax exemption, the court will award the exemption. The court will consider as the primary factor the relative contribution of each parent to the cost of raising the child, and among other factors, the relative tax benefit to each parent. The court may not award an exemption to a parent unless the award will result in a tax benefit to that parent. The court may not award an exemption to the non-custodial parent if that parent is not current in their child support payments.

The court will consider as the primary factor the relative contribution of each parent to the cost of raising the child, and among other factors, the relative tax benefit to each parent. The court may not award an exemption to a parent unless the award will result in a tax benefit to that parent. The court may not award an exemption to the non-custodial parent if that parent is not current in their child support payments.

If both parents try to claim the child as a dependent in the same tax year, the Internal Revenue Service will ask the parents for an explanation and may impose penalties.

Deviating from the child support guidelines

Generally, child support is set according to the guidelines. The court can order a different amount if one (or both) of the parties asks for a different amount and shows good reasons for the amount requested. If there are good reasons not to follow the guidelines, the court's worksheets and calculator will not apply. See Utah Code Section 78B-12-202 and Section 78B-12-210.

Paying and collecting child support

Court orders govern how and when the child support payments are made. For example, the court may enter an order requiring a non-custodial parent to make arrangements with their employer to withhold the child support amount from the parent's earnings, unless the parties agree to another method of payment. Child support payments may be made between the parties or through the Office of Recovery Services (ORS). ORS also helps establish and enforce financial and medical support for children. More information is available at Office of Recovery Services - Child Support

Enforcing a child support order

All parties must obey court orders. Custodial parents may not withhold parent time, even if child support is not being paid. A parent may not withhold child support even if parent time is being denied. If a party does not obey a court order, the other party may file a motion asking the court to enforce the order. The enforcement order can include a judgment for money owed. The court may also find a party in contempt of court and order the party to pay a fine or serve time in jail. For information and forms, see our page on Motion to Enforce Order.

The court may also find a party in contempt of court and order the party to pay a fine or serve time in jail. For information and forms, see our page on Motion to Enforce Order.

Modifying a child support order

Either parent can ask the court to increase or decrease the child support obligation, if there have been significant changes in income or in other circumstances since the support order was entered. For information and forms, see our page on Modifying Child Support.

Registering a foreign order

Before an order from another state can be enforced or modified it first must be registered in Utah. For information and forms, see our page on Registering a Foreign Order.

Forms

Child Support Worksheets

- Use the Child Support Calculator to prepare child support worksheets suitable for filing.

- 1929FA

- 1928FA

- 1927FA

- 1023FA

Other Forms

- 1004FA

To be used by either party to tell the court what they know about how much money the other party earns

Child Support in Utah | DivorceNet

Utah's child support guidelines allow courts to make consistent child support orders that are based off of the parents' income, the custody arrangement, and a number of other factors.

Utah law requires both parents to financially support their child (or children). The amount of support that each parent pays depends on the parents' income, custody arrangement, and the number of children involved.

Parents can use the Utah child support calculator to estimate a support obligation. However, there are many factors that are taken into account when determining child support amounts in Utah—and it's ultimately up to a judge to determine the final amount of support.

- How to Apply for Child Support in Utah

- Utah Child Support Guidelines

- How to Calculate the Parents' Adjusted Gross Income

- How to Calculate the Base Combined Child Support Obligation

- Adjustments for Other Expenses

- How Custody Arrangements Can Affect Utah Child Support

- When You Can Deviate From the Utah Child Support Guidelines

- Modifying a Child Support Order in Utah

- Modification Due to Substantial Change in Circumstances

- Modification Due to the Passing of Three Years or More

- How Child Support Is Paid and Received in Utah

- When Does Child Support End in Utah?

How to Apply for Child Support in Utah

Many child support orders are issued during the course of a divorce—when a divorcing couple has minor children, the law almost always requires the court to address issues of child custody and support. Often, courts issue a child support order at the same time they issue the divorce decree. So, if you're going through a divorce, you won't have to apply separately for child support because it will be decided as part of the divorce.

Often, courts issue a child support order at the same time they issue the divorce decree. So, if you're going through a divorce, you won't have to apply separately for child support because it will be decided as part of the divorce.

When the parents aren't married, though, they will have to apply for a child support order. Applications must be submitted to the Utah Office of Recovery Services (ORS).

In any matter in Utah where child support is at issue, the parent seeking the order must submit:

- a completed child support worksheet

- a financial verification

- a written statement indicating whether the amount of child support requested is consistent with the state's guidelines, and

- certain identifying information, such as a driver's license number and employment information.

(Utah Code § 78B-12-201 (2022).)

If you are applying through ORS, you have to submit additional documentation, such as a child's birth certificate or documents establishing paternity for the child to be supported.

Utah Child Support Guidelines

The Utah Child Support Guidelines use complex formulas to establish a uniform fee schedule. Although a court presumes that the number given by the guidelines is the appropriate amount of child support, there are circumstances where the result would be unfair to a parent or the child. In those cases, a court will review a set of factors and may adjust the amount of support down or up.

Parents can agree to pay more than the amount given by the guidelines, but not less, and a court must approve the amount.

How to Calculate the Parents' Adjusted Gross Income

To estimate a child support obligation using the guidelines, you'll need to know the adjusted gross income (AGI) of both parents. A parent's gross income is income from all sources, including:

- salaries and wages

- bonuses

- rents

- income from a trust

- pensions

- military pay

- alimony received from previous marriages

- Social Security benefits

- unemployment compensation, and

- gifts and prizes.

There are a few benefits that don't count as income for child support calculations, such as general assistance, housing subsidies, and welfare benefits. (Utah Code § 78B-12-203 (2022).)

Imputing Income to a Parent

In situations where a parent is purposefully unemployed or underemployed to avoid making support payments, a court can impute a higher income based on the parent's past and current earnings. Income will not be imputed, however, for a custodial parent who stays home to meet a child's specific needs, or if the cost of childcare would be the same as the income this parent would make.

When a parent doesn't have a work history, the court can impute an income at the federal minimum wage for a 40-hour work week.

(Utah Code § 78B-12-203 (2022).)

How to Calculate the Base Combined Child Support Obligation

Once the court has determined the parents' individual incomes, it uses them to calculate a base combined child support obligation. You can use the Utah base combined child support obligation table (found in Utah Code § 78B-12-301) to see what amount the court would assign based on your particular situation. If you're not working with an attorney, the Online Court Assistance Program (OCAP) can also help you calculate your estimated child support obligation.

You can use the Utah base combined child support obligation table (found in Utah Code § 78B-12-301) to see what amount the court would assign based on your particular situation. If you're not working with an attorney, the Online Court Assistance Program (OCAP) can also help you calculate your estimated child support obligation.

Each parent is responsible for a share of the base combined child support obligation in proportion to their adjusted gross income. This is calculated by multiplying the combined child support obligation by each parent's percentage of combined adjusted gross income.

EXAMPLE: Pat makes $2,000 per month. Jordan makes $3,000 per month. Their combined gross monthly income is $5,000. So Pat's income makes up 40% ($2,000/$5,000) of the total, and Jordan's income makes up 60% ($3,000/$5,000). They have two children. Looking up their combined income of $5,000 on the child support obligation table, their base combined child support obligation is $1,175. Pat is responsible for 40% ($470) of the base monthly child support obligation. Jordan is responsible for 60% ($705).

Jordan is responsible for 60% ($705).

Adjustments for Other Expenses

Utah courts can adjust the parents' child support obligations if there are other monthly child-rearing expenses, such as medical expenses or childcare.

Medical Expenses

Utah courts will order that a parent obtain medical insurance if insurance is available to the parent at a reasonable cost. The parents will share the cost of the insurance equally, unless the court orders otherwise. Also, the parents will share equally the cost of other medical care. When a parent incurs medical expenses that aren't covered by insurance, they must submit a written verification of the cost of the care to the other parent within 30 days of payment. (Utah Code § 78B-12-212 (2022).)

Childcare Expenses

Each parent must share equally any reasonable work-related child care expenses. Childcare expense are paid on a monthly basis, so if there isn't a need for childcare every month, the parent making payments doesn't have to pay that expense in the month(s) it's not incurred. (Nor do the parents have to modify the child support order to reflect the changing expense.) (Utah Code § 78B-12-214 (2022).)

(Nor do the parents have to modify the child support order to reflect the changing expense.) (Utah Code § 78B-12-214 (2022).)

How Custody Arrangements Can Affect Utah Child Support

The Utah child support guidelines adjust the amount of child support to account for the parents' child custody arrangement. What matters for purposes of the calculations is how many overnights the child spends in each parent's home. The guidelines accommodate the following situations:

- Joint physical custody. This is when a child spends more than 110 nights a year in the home of each parent.

- Sole physical custody. This is when a child spends over 225 nights a year in the home of one parent.

- Split custody. This is when there are multiple children and some live with one parent and some live with the other parent.

Exactly how these custody arrangements affect the amount of child support can be complicated. However, the Office of Recovery Services' Child Support Calculator will run the numbers for you without having to delve into the exact formulas.

When You Can Deviate From the Utah Child Support Guidelines

Sometimes, the total amount of child support given by the guidelines or the way that number is divided between the parents is unfair or not in the best interests of the child. So, if you think support should be increased or decreased before the court issues the order, you can ask the court to review it.

To deviate from the guidelines, the court must consider all relevant factors, including (but not limited to) the:

- parents' standard of living and situation

- parents' relative wealth and income

- ability of the paying parent to earn

- ability of the receiving parent to earn

- ability of an incapacitated adult child to earn (or the benefits received by the adult child, such as Supplemental Security Income)

- needs of both parents and the child

- parents' ages, and

- whether either parent supports others.

(Utah Code § 78B-12-202 (2022).)

Modifying a Child Support Order in Utah

Utah law allows you to request a modification of an existing child support order when there has been a "substantial change in circumstances," or when it has been three or more years since the order was entered. The Utah courts' Modifying Child Support website contains detailed information about and forms for requesting a child support modification.

The Utah courts' Modifying Child Support website contains detailed information about and forms for requesting a child support modification.

Before you head to court, though, contact the ORS: Although a court must approve a modification, the Utah Office of Recovery Services (ORS) might be able to help with the process by petitioning the court on your behalf.

Modification Due to Substantial Change in Circumstances

When there is a "substantial change in circumstances," you can ask the court to modify the amount of child support in the order regardless of when it was last adjusted.

Under Utah law, a substantial change in circumstances might include material changes to:

- custody

- the relative wealth or assets of the parents

- a parent's income (must be at least a 30% increase or decrease)

- the employment potential and ability of a parent to earn

- the medical needs of the child, or

- the legal responsibilities of either parent for the support of others.

If the court agrees that there has been a substantial change in circumstances, the court will:

- take into account the child's best interest

- determine whether the substantial change in circumstances results in a difference of 15% or more between the payor's ordered support amount and the new, proposed amount, and

- adjust the support amount if:

- there's a difference of 15% or more and

- the difference is not of a temporary nature.

(Utah Code § 78B-12-210(9) (2022).)

Modifications of child support based on a substantial change in circumstances must be requested by filing (or having ORS file on your behalf) a petition to the court that has jurisdiction over your child support order.

Modification Due to the Passing of Three Years or More

You can also request modification of a child support order when it's been more than three years since the order has been issued or modified. To request a modification on this ground, you (or ORS) must make a motion in the court that has jurisdiction over your child support order.

When the court receives the motion, it will determine whether there's a difference between the amount in the current order and the amount that would be required under the current guidelines. Then, if there's a difference, it will take into account the child's best interests and modify the order if the:

- difference is more than a 10% increase or decrease

- difference is not temporary, and

- the new amount won't deviate from the guidelines.

It's not necessary to show a substantial change in circumstances. (Utah Code § 78B-12-201(8) (2022).)

How Child Support Is Paid and Received in Utah

When a child support order is in place, the parent makes payments through ORS. Most Utah child support orders require payments to be made via income withholding, although other methods might be allowed in certain circumstances, such as when a paying parent is self-employed.

Parents receiving child support are paid through ORS. The default way to receive funds is via a Utah Debit MasterCard, but a parent can also set up direct deposit to a bank account.

When Does Child Support End in Utah?

A parent's duty to pay child support in Utah ends when the child turns 18 years old or graduates from high school during the child's normal and expected year of graduation—whichever occurs later. The duty to pay might also end if the child:

- dies

- marries

- becomes a member of the armed forces, or

- is otherwise emancipated under Utah law.

(Utah Code § 78B-12-219 (2022).)

US child support law. A small review of

?Previous Entry | Next Entry

When preparing laws and regulations, our legislators often like to look to the west, and especially to the United States. From there, juvenile justice came to Russia, and now they are lobbying for a law on domestic violence, developed in fact in the United States.

But what about alimony in the West? At least in the USA. In order to answer this question, we turn to open sources.

In order to answer this question, we turn to open sources.

So, on Wikipedia it is stated that the amount of child support depends very much on the state.

For example, in the state of Texas, according to https://www.divorcenet.com/, the duration of alimony payments is:

- five years if the duration of the marriage is less than ten years and the divorce was due to the fault of the husband due to domestic violence;

- five years if the duration of the marriage is between ten and twenty years;

- seven years if the duration of the marriage is between twenty and thirty years;

- ten years if the duration of the marriage is more than thirty years.

Some states, such as Montana, Kansas, Utah, Kentucky, and Maine, have fairly clear child support laws. In a number of states, such as Mississippi and Tennessee, alimony is paid only if the husband and wife have been married for more than 10 years, while in general, alimony is paid for no more than three years, unless special circumstances are determined by the court. Moreover, child support cannot exceed $2,500 per month, or 40 percent of the husband's income. In Kansas, alimony payments cannot exceed 121 months; in Utah, payments cannot exceed the length of the marriage. In Maine, Mississippi, and Tennessee, child support will only be awarded if the marriage has lasted at least 10 years, and the child support will be paid half the length of the marriage, i.e. 5 to 10 years, respectively.

Moreover, child support cannot exceed $2,500 per month, or 40 percent of the husband's income. In Kansas, alimony payments cannot exceed 121 months; in Utah, payments cannot exceed the length of the marriage. In Maine, Mississippi, and Tennessee, child support will only be awarded if the marriage has lasted at least 10 years, and the child support will be paid half the length of the marriage, i.e. 5 to 10 years, respectively.

In a number of states, including California, Nevada, New York, legislation is rather vague, courts set child support payments taking into account many factors.

Now consider interest rates.

For example, in New York, the percentage payments are as follows:

17% - for one child

25% - for two children

29% - for three children

31% - for four children

35% - for five children

In the state Arizona child support amounts are presented here. However, in general, we can conclude that with an income of about three thousand dollars a month, alimony is approximately:

- for one child - 20%;

- for two - 28%;

- for three - 33%.

With an income of about five thousand dollars a month, alimony payments even for six do not exceed 40%!

In the state of Idaho (Idaho) child support rates are as follows:

- 18% - per child;

- 26% - for two children;

- 30% - for three;

- 33% - for four;

- 36% - for five.

In Nevada the rates are as follows:

- 18% per child;

- 25% - for two children;

- 29% - for three;

- 31% - for four, then two percent for each child.

Thus, even a brief analysis of US child support law shows that interest rates in Russia (1/4 for one child, 1/3 for two, 1/2 for three or more) are draconian and repressive.

IMHO

Powered by LiveJournal.com

90,000 up to what age they pay, how much percent of income they can withhold, and what documents are needed to apply for alimony1. Who can apply for child support?

Alimony is maintenance that minor, disabled and/or needy family members are entitled to receive from their relatives and spouses, including former ones.

A child can count on alimony:

- if he is under the age of 18 and has not yet become fully capable by decision of the guardianship or court. Alimony in favor of a child may be filed by his guardian, custodian, adoptive or natural parent with whom the child remains;

- if he is over 18 years of age but has been declared legally incompetent.

One of the spouses can count on alimony if:

- he needs and is recognized Disabled adults who are entitled to alimony are considered disabled people of groups I, II, III and persons who have reached pre-retirement age (55 years for women and 60 years for men) or the generally established retirement age.0060

- wife, including ex, is pregnant or less than three years have passed since the birth of a common child;

- a spouse, including a former one, needs and cares for a common disabled child under 18 years of age or a child disabled since childhood of group I;

- ex-spouse Persons in need are those whose financial situation is insufficient to meet the needs of life, taking into account their age, health status and other circumstances.

marriage or within five years thereafter, and the spouses have been married for a long time.0060

Alimony can also be received by:

- disabled and needy parents, including stepfather and stepmother, from their adult able-bodied children. This rule does not apply to guardians, trustees and adoptive parents;

- disabled and needy grandparents - from their adult able-bodied grandchildren, if they cannot receive maintenance from their children or spouse, including the former;

- minor grandchildren - from their grandparents, who have sufficient funds for this, if they cannot receive alimony from their parents. After the age of majority, grandchildren can count on alimony if they are recognized as disabled and they cannot receive assistance from their parents or spouses, including former ones;

- incapacitated persons under 18 years of age - from their adult and able-bodied brothers and sisters, if they cannot receive them from their parents, and incapacitated persons over 18 years of age - if they cannot receive alimony from their children;

- disabled and needy persons who raised and supported a child for more than five years - from their pupils who have become adults, if they cannot receive support from their adult able-bodied children or spouses, including former ones.

This rule does not apply to guardians, trustees and adoptive parents;

This rule does not apply to guardians, trustees and adoptive parents; - social service organizations, educational, medical or similar organizations in which the child is kept can apply for child support. In this case, alimony can be collected only from the parents, but not from other family members. Organizations can place the funds received in the bank at interest and withhold half of the income received for the maintenance of children.

2.How to apply for child support?

If there is no agreement between the parties on the payment of alimony or the other party refuses to pay them, apply to the court at your place of residence:

- to the justice of the peace, if the recovery of alimony is not related to the establishment, contestation of paternity or motherhood, or the involvement of other interested parties;

- to the district court - in all other cases.

If one of the parents voluntarily pays child support without a notarized agreement, the court can still collect support from him in favor of the child.

You can file for child support at any time as long as you or the person you represent are eligible.

The plaintiff does not pay state duty for consideration of the case on recovery of alimony in court.

3. What documents are needed to apply for child support?

The child support claim must be accompanied by:

- copies of it, one for the judge, the defendant, and each of the third parties involved;

- documents confirming the circumstances that allow you to apply for alimony. Such documents, for example, may be a birth certificate of a child, a certificate of marriage or its dissolution;

- single housing document and certificates of income of all family members;

- calculation of the amount you expect to receive as alimony. The document must be signed by the plaintiff or his representative with a copy for each of the defendants and involved third parties;

- if the claim will not be filed by the plaintiff himself, additionally attach a power of attorney or other document confirming the authority of the person who will represent his interests, for example, a birth certificate.

As a rule, maintenance is ordered from the moment the application is submitted to the court. They can be accrued for the previous period (but not more than three years before the day of going to court) if you provide evidence in court that you tried to contact the other party and agree or the defendant hides his income or evades paying alimony. Such evidence can be letters sent by e-mail, telegrams or registered letters with notification.

4. What is the amount of alimony?

The court determines the amount of maintenance based on the financial situation of both parties. Alimony for the maintenance of minor children, as a rule, is:

- per child - a quarter of income;

- for two children - a third of the income;

- three or more children - half of the income.

These shares can be reduced or increased taking into account the financial and marital status of the parties and other important ones, including the presence of other minor and / or disabled adult children, or other persons whom he is obliged by law to support; low income, health or disability of the support payer or the child in whose favor they are collected.

"> factors. When determining the amount of alimony, the court seeks to maintain the level of financial support that the child had before the divorce or separation of the parents. If each of the parents has children, the court determines the amount of alimony in favor of the less well-to-do of them.

In addition to the share income, the court may order child support or a portion of it in the form of a certain amount of money.As a rule, such measures are resorted to when the defendant hides part of his income and a share of his official income cannot provide the child with the standard of living that he had.

Under exceptional circumstances - illness, disability of the child, lack of suitable housing for permanent residence, etc. - the court may oblige one or both parents to additional expenses.

The amount of alimony is indexed in proportion to the growth of the subsistence minimum (for the population group to which the recipient belongs).

As a general rule, maintenance withheld from the debtor's income for the maintenance of a minor child cannot exceed 70% of his income. In other cases - 50% of income.

5. Who can not pay child support?

Parents are required to support their children after birth and until the age of 18, unless the child gets married earlier or there is no Emancipation - declaring a minor fully capable. It is possible if a minor who has reached the age of 16 works under an employment contract (including under a contract) or, with the consent of his parents (adoptive parents, guardian), is engaged in entrepreneurial activities. The decision on the emancipation of a minor is taken by the guardianship and guardianship authorities with the consent of the parents (adoptive parents, guardian). If there is no consent from the parents, the decision on emancipation can be made by the court.

"> emancipated.