How do i find out who claimed my child on taxes

What to Do If Someone Claimed Your Dependent

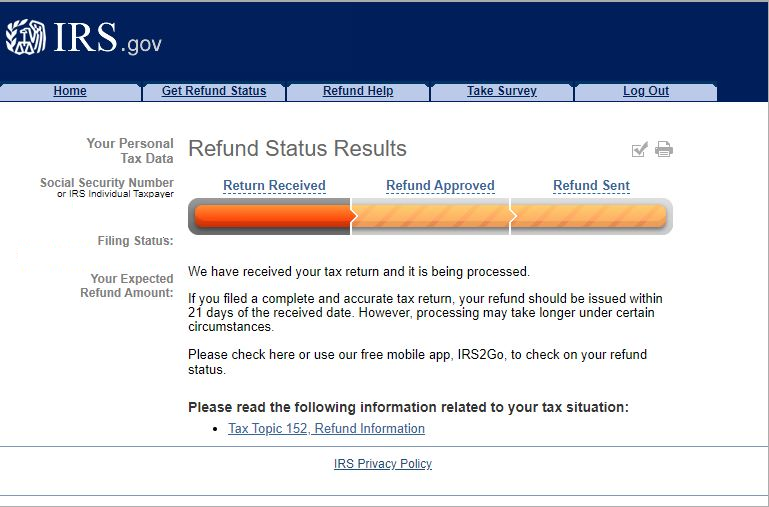

You may have tried to file your tax return and got an e-file rejection message.

Something like: “A dependent on your return has already been claimed (or claimed themselves) on another return.”

Assuming you entered your dependent’s information correctly, it looks like someone else claimed your dependent. Because the IRS processes the first return it receives, if another person claims your dependent first, the IRS will reject your return.

The IRS won’t tell you who claimed your dependent. Usually, you can identify the possibilities and ask (commonly, a former spouse). But if you don’t suspect anyone who could have claimed the dependent, your dependent may be a victim of tax identity theft. Learn how to handle tax identity theft.

If you don’t think that the other person was eligible to claim your dependent, you’ll need to take some steps to protect your right to claim the dependent and your refund.

Here’s what to do

Don’t panic. This doesn’t mean that you can’t correct the situation. First, double check that you meet all of the requirements to claim the dependent. Then, take these steps:

1. File a paper return.

Print out and mail your return, claiming your dependent, to the IRS. The IRS may delay your refund while the IRS looks into the issue, but you should still receive your refund. Note that when you file a paper return, it can take six to eight weeks for the IRS to process.

2. Document your case.

The IRS rules for claiming a dependent can get complicated.

The most important thing to remember is to prove with proper documentation that you are entitled to claim the dependent. This includes things like birth certificates and proof of identity, but also documents that show that your dependent lived with you at the same address for more than half of the year.

Examples are:

- School, medical, daycare, or social service records

- A letter on official letterhead from a school, medical provider, social service agency, or place of worship that shows names, common address and dates

The IRS will ask you to complete this document.

3. Answer when the IRS contacts you.

About two months after you file a paper return, the IRS will begin to determine who is entitled to claim the dependent.

You may receive a letter (CP87A) from the IRS, stating that your child was claimed on another return. It will tell you that if you made a mistake, to file an amended tax return, and if you didn’t make a mistake, do nothing.

The other person who claimed the dependent will get the same letter. If one of you doesn’t file an amended return that removes the child-related benefits, then the IRS will audit you and/or the other person to determine who can claim the dependent.

You’ll get a letter in a few months to begin the audit. In the audit, the IRS will require you to provide proof that you are entitled to claim the dependent. Be sure to reply completely and by the IRS deadline. After the IRS decides the issue, the IRS will charge (or, “assess”) any additional taxes, penalties, and interest on the person who incorrectly claimed the dependent.

You can appeal the decision if you don’t agree with the outcome, or you can take your case to U.S. Tax Court.

It’s always a good idea to discuss claiming children with your family members before a situation like this arises, if possible.

For any dependent dispute, know your options and your rights

Dependent disputes can cause many types of tax problems. Learn more about how to handle an IRS audit – or what to do about tax refund holds and other tax return problems resulting from dependent-related credits.

And for any IRS issue, remember that you have the right to representation. You can outsource the work to a tax pro, who can look into the cause of the issue and deal with the IRS for you.

Learn more about how to research your IRS account or get help from a trusted IRS expert. Or make an appointment for a free consultation with a local tax professional by calling 855-536-6504 or finding a local tax pro.

Someone Claimed Your Child, Dependent; What Can You Do?

Did someone claim your dependent even though you have determined that you are the only person who should claim them? See the steps to take on wrongly claimed dependents. To further protect your family's identities, consider getting an IP-PIN for yourself and your dependents.

To further protect your family's identities, consider getting an IP-PIN for yourself and your dependents.

Claiming a dependent has many ways to save on taxes which is why there are many annual cases of wrongly claimed dependents. These tax benefits include:

- The Child Dependency Exemption (expired 2018 - 2025)

- The Earned Income Tax Credit

- The Child Tax Credit

- The Credit for Other Dependents

- The Child and Dependent Care Tax Credit

- The head of household tax return filing status

- The exclusion for employer-provided childcare benefits.

If someone claimed your dependent on your latest return, find out what you can do below. See also: What if I was wrongly claimed as a dependent?

Generally, only one taxpayer may claim any one person as a dependent on a tax return per tax year (except in the case of a married couple filing jointly). If you file your tax return and someone else has already claimed your dependent, then the IRS will apply the tiebreaker rules - see details below. To avoid any of this conflict, utilize the eFile.com DEPENDucator to determine if you are eligible to claim someone on your 2022 Tax Return, due on Tax Day. You can also eFileIT, including the Multiple Support Declaration Form 2120 - see below.

To avoid any of this conflict, utilize the eFile.com DEPENDucator to determine if you are eligible to claim someone on your 2022 Tax Return, due on Tax Day. You can also eFileIT, including the Multiple Support Declaration Form 2120 - see below.

TaxTip: This is a good reason to e-file early. After a return claiming a particular dependent is accepted, any subsequent return that is electronically filed claiming the dependent will be rejected by the IRS. However, having an IRS accepted return with a dependent is not a confirmation that this taxpayer is qualified to claim this dependent. In other words, if you e-filed your return with the dependents listed on your return, anybody else e-filing their return after you claimed the same dependent(s) will have their return rejected. However, if another return claiming the same dependent(s) is filed manually (mailed in), then the IRS will apply the tie-breaker rules - see details below.

Here are a few key points regarding wrongly claimed dependents:

- When e-filing your return, be sure the SSN for your dependent is being entered correctly. This will prevent you from accidentally claiming someone's dependent - it does happen! - and it will make sure you are not trying to claim the wrong person.

- Additionally, double check your own SSN if your return is rejected by the IRS as a duplicate.

- Only one dependent's SSN can be claimed per tax year.

- The IRS cannot disclose which of your dependents has been claimed nor who claimed them.

- Once your dependent's SSN has been accepted on a return, you can no longer e-file your return and claim them, even if the other party amends their return.

- This is because by the time the IRS processes this amendment, the e-file season will be over.

- If both parties can cooperate, however, it is ideal that the party who wrongly claimed the dependent files an amendment and the second party mails in their return.

- The IRS will send you a notice CP87A, CP75A, or other letter explaining that there is a dispute with your dependent's SSN.

- Both you and the other party generally receive a CP87A. The wrongly claiming party will be asked to comply by amending their return while the correct party is instructed not to take any additional action. Receiving this notice is not the same as being audited by the IRS.

- If you received this notice even though you did not file a tax return claiming a dependent, contact the number listed on the notice - see more IRS contact numbers here.

- The entire process can take 8 - 12 weeks as the IRS gathers information to examine results from both returns.

- Determine who qualifies as your dependent and e-file your return early next year to secure your dependent's information.

Children of Divorced or Separated Parents

Due to the residency test for parents of dependents, generally a child of divorced or separated parents is the qualifying child of the custodial parent. However, the following exceptions might apply and a child will be treated as the qualifying child of the noncustodial parent if all four of the following statements are true.

However, the following exceptions might apply and a child will be treated as the qualifying child of the noncustodial parent if all four of the following statements are true.

A: The parents:

- Are divorced or legally separated under a decree of divorce or separate maintenance

- Are separated under a written separa- tion agreement; or

- Lived apart at all times during the last 6 months of the year, whether or not they are or were married.

2. The child received over half of the child’s support for the year from the parents.

3. The child is in the custody of one or both parents for more than half of the year.

4. Either of the following statements is true.

a. The custodial parent signs a written declaration, discussed later, that they won't claim the child as a dependent for the year, and the noncustodial pa- rent attaches this written declaration to their return. (If the decree or agreement went into effect after 1984 and before 2009, see Post-1984 and pre-2009 divorce decree or separation agreement, later. If the decree or agreement went into effect after 2008, see Post-2008 divorce decree or separation agreement, later.)

If the decree or agreement went into effect after 2008, see Post-2008 divorce decree or separation agreement, later.)

b. A decree of divorce or separate maintenance or written separation agreement prior to 1985 that applies to 2022 states that the noncustodial parent can claim the child as a dependent, the decree or agreement wasn't changed after 1984 to say the noncustodial parent can't claim the child as a dependent, and the noncustodial parent provides at least $600 for the child's support during the year If statements (1) through (4) are all true, only the noncustodial parent can:

Claim the child as a dependent; and

Claim the child as a qualifying child for the child tax credit, the credit for other dependents, or the additional child tax credit.

However, this doesn’t allow the noncustodial parent to claim head of household filing status, the credit for child and dependent care expenses, the exclusion for dependent care benefits, or the earned income credit. For more details see the IRS tiebreaker rules below.

For more details see the IRS tiebreaker rules below.

What to Do If Your Dependent(s) Have Been Claimed

Wrongly claiming a dependent is not considered fraud or tax evasion if the guilty party does not demonstrate willfulness. In other words, if the wrongly claiming person knows they are breaking the law, then this could be fraud; if they mistakenly claim someone's dependent and want to fix this, the IRS does not consider this fraud.

Instead of trying to report this to the IRS, review these steps if you e-filed your tax return and it got rejected by the IRS because somebody, such as an ex-spouse or as a result of identity theft, has already claimed one or more of your dependents on a tax return. Keep in mind, an accepted tax return is not a guarantee to have the right to claim the dependents on that return.

While there are many cases of identity theft of dependents, most cases of wrongly claimed dependents are committed by family members, relatives, and ex-spouses. If your ex claimed your dependent on their return when you had the right to this year, this can lead to legal problems as the dependent benefits cannot be split.

If your ex claimed your dependent on their return when you had the right to this year, this can lead to legal problems as the dependent benefits cannot be split.

If you and your ex alternate years, be sure you both only claim the child as a dependent when it is your year. Otherwise, you will both need to work with the IRS in order to settle the dispute by mailing forms and documents back and forth. When someone claims your dependent with malicious intent (i.e. to take advantage of dependent tax breaks and take them from you), then you are forced to rely on the IRS to handle this. You may be requested to send proof of dependency documents; communicate and work with the IRS to rightfully claim your dependent.

There is no direct way to report the person to the IRS; instead, you will need to file your return on paper to alert them of the matter.

Steps to Take After Somebody Incorrectly or Fraudulently Claimed Your Dependent(s)

Let's say you prepared and e-filed your tax return and the IRS rejected it with the message that one or more dependents have been claimed on another taxpayer's tax return. Or, you received IRS Notice CP87A or CP75A because the IRS received a tax return from somebody claiming a qualifying child as a dependent with the same social security number as a dependent listed on your tax return.

Or, you received IRS Notice CP87A or CP75A because the IRS received a tax return from somebody claiming a qualifying child as a dependent with the same social security number as a dependent listed on your tax return.

The steps below apply if someone incorrectly claimed your dependent(s) or if you claimed dependents incorrectly.

- Find out who qualifies as your dependent by using our free DEPENDucator tool.

- If you used eFile.com when you completed your taxes, a PDF copy of your return is stored in your eFile.com account. Sign in and click on My Account before you download, print, and sign your IRS and state tax returns.

- Gather dependent supporting documents about your dependent(s) and complete Form 866-H-Dep.

- Supporting documents might include daycare records, school records on official letterhead from a school, medical records from the medical provider, social service records from the social service agency, information from the place of worship that shows names, and common addresses and dates.

Include a letter with any other information you think would assist the IRS and get any of these notarized if possible.

Include a letter with any other information you think would assist the IRS and get any of these notarized if possible. - If you have a divorce decree, attach the relevant pages of the decree (including the first and signature pages) to your mailed return.

- Gather your printed tax return, income and deduction forms (W-2, 1099, etc.), and Form 866-H-Dep. Then, mail in all your documents to the IRS based on the address on your tax return. If you also have to send your return to one or more state tax agencies, find the state mailing address here. TaxTip: It is best if you use a U.S. Postal Office tracker to confirm that the IRS has received your documents.

- If you only claimed the Earned Income Tax Credit for your child, but the IRS has sent you an audit letter requesting more information from you, you will need to mail Form 886-H-EIC and attach any documents in the form supporting your EITC claim. Use this EICucator tool.

- Once the IRS has received your documents, they will examine both returns - the return with the claimed dependent(s) and yours - and apply the tiebreaker rules based on the criteria listed below.

The process might take 8-12 weeks or longer.

The process might take 8-12 weeks or longer. - If the IRS contacts you for additional information (CP78A, etc.), respond to their notices as soon as possible.

If you found out that you claimed a dependent incorrectly on an IRS accepted tax return, you will need to file a tax amendment or form 1040-X and remove the dependent from your tax return.

At any time, contact us here at eFile.com or call the IRS support line at 1-800-829-1040 and inform them of the situation. Or, take advantage of low-income tax clinics if this applies to you. Note: if you did not file your latest tax return with us, we will not have specific information regarding your situation.

If you think you are a victim of identity theft, you can request a copy of a fraudulent return via Form 4506-F.

IRS Tiebreaker Rules

There are situations when multiple parties claim the same dependent. For example, in the case of divorced parents, a child may be claimed as a dependent by more than one person. You may alternate years, but you may not both claim the dependent in a single tax year. Generally, only one person (or a married couple filing jointly) may receive the tax benefits derived from claiming any one dependent.

You may alternate years, but you may not both claim the dependent in a single tax year. Generally, only one person (or a married couple filing jointly) may receive the tax benefits derived from claiming any one dependent.

Under the IRS tiebreaker rules, the child is generally considered a qualifying child if the following apply:

- A married couple or parents file a married joint tax return and claim the child a qualifying dependent.

- Only one parent of the couple, who is also the child's parent, claims the child as a qualifying child or dependent.

- If the child has two persons as parents and the two persons do NOT file a married joint return, then the parent with whom the child lived or resided with for the longer time period during a tax year will be qualified to claim the dependent.

- If the child lived or resided with each parent the same amount of time during the tax year, the parent with the highest adjusted gross income or AGI will be able to claim the dependent, if there is no married joint return and both parents claim the child on their respective return.

- If no parent claims the child as a qualifying child, then the person with the highest AGI qualifies over any parent who may have been able to claim the child, such as a qualifying step-parent or relative.

- Because of the second tiebreaker rule (residence), the parent who has legal custody of a child is generally the parent who gets to claim the child in cases of divorced or separated parents. If you are the custodial parent and you wish to relinquish your dependency exemption and assign it to the non-custodial parent, you may do so by filing Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent.

There may be an exception when the splitting of tax benefits for a dependent is detailed in a legal divorce decree. If you have such a decree that was issued after December 31, 2008, you will need to file your tax return on paper and attach the relevant pages of the divorce decree, including the first page and the signature page. If the decree was issued before January 1, 2009, the IRS will not accept it. However, if you are a noncustodial parent claiming the child as a dependent, you have two options:

If the decree was issued before January 1, 2009, the IRS will not accept it. However, if you are a noncustodial parent claiming the child as a dependent, you have two options:

- Multiple Support Declaration: To identify any other eligible person who can claim the dependent, you will need a signed statement from the eligible person waiving his or her right to claim that person as a dependent before you can add Form 2120, Multiple Support Declaration, when you prepare and eFile your tax return on eFile.com. If you already filed your return, you may need to submit Form 2120 via postal mail to the IRS. For situations where the same child may be eligible to be claimed as a dependent or qualifying child by more than one person, the IRS will apply a set of tiebreaker rules to determine who has the right to claim the dependent. Once the IRS receives both returns claiming the same dependent, they will use the tie-breaker rules below.

- Release of Claim to Exemption for Child: You or the other party can transfer the right to claim a child as a dependent. To release a claim of a child as a dependent so that a non-custodial parent can claim the child, or to revoke a previous release to claim a child as a dependent, you can complete Form 8332, Release Revocation of Release of Claim to Exemption for Child by Custodial Parent. The Form 8332 can NOT be e-filed with your tax return on eFile.com. The non-custodial parent in this situation should also obtain a copy of the completed form from the custodial parent and attach it to their tax return, which they will need to paper file. If you change your mind at any time and wish to revoke your release of claim, you can simply file another Form 8332. Include Form 8453, U.S. Individual Income Tax Transmittal when you mail in your tax return with Form 8332 to the IRS.

What if I was Falsely Claimed as a Dependent?

If you e-filed a return and it was rejected by the IRS who stated your social security number has been claimed on a tax return for that year, there are some steps to take, depending on the situation.

If you know who claimed you: You should get in contact with them as soon as possible. If a parent or guardian, for example, claimed you on their return when they were not supposed to, they would have to amend their return. The IRS will have to process their amended return before your SSN can be used on your own return. Likely, to meet the tax day deadline, you will have to prepare and mail your return so you do not face any late penalties. If they amend their return, this goes much quicker than if they refuse.

If you do not know who claimed you or they will not cooperate: You will have to paper file your return. Use your identity as normal and mail in your prepared return. You will want to gather documents that show you do not qualify as a dependent (rent payments showing you pay for your expenses, residency statements, etc.) because, once processed, the IRS will contact you via letter requesting additional information - they will also write to the taxpayer who claimed you. The IRS will request that the return(s) be amended to reflect the actual situation. If the wrongdoing party does not comply, this may result in an IRS audit for both returns. You and the taxpayer who claimed you will have to prove your dependency status.

The IRS will request that the return(s) be amended to reflect the actual situation. If the wrongdoing party does not comply, this may result in an IRS audit for both returns. You and the taxpayer who claimed you will have to prove your dependency status.

The simplest way to prepare all your 2022 forms is by completing your 2022 Tax Return with eFile.com. You can eFile your return or mail it in case it got rejected due to another person claiming your dependents. Make sure you include the appropriate forms with your mail package to the IRS. TaxTip: It is best keep copies of all documents you send to the IRS and use a U.S. Postal Office tracker service to confirm that the IRS has received your documents.

Should you require further assistance, please contact eFile.com support or call the IRS at 1-800-829-1040. You might also be able to take advantage of a low income taxpayer clinic. More details on how low-income taxpayer clinics work.

Additional resources regarding dependents and alimony payments:

- How to claim a dependent on a tax return

- Qualifying for the Child Tax Credit and your personal tax situation

- Qualifying education tax deductions for your dependent

- Education tax credits for your dependent

- Alimony and taxes

- For state tax returns, select the respective state.

TurboTax® is a registered trademark of Intuit, Inc.

H&R Block® is a registered trademark of HRB Innovations, Inc.

Tax holidays for sole proprietors in 2022 | How to apply for tax holidays for IP

⚡ All articles / ⚡ All about taxes

Anastasia Sich

Tax holidays are a legal way to avoid paying taxes. This opportunity is available only to individual entrepreneurs who fall under the requirements of the law.

Content

- How to understand that you have holidays?

- How to switch to tax holidays?

- How to report on tax holidays?

- When will the holidays end?

How do you know that you are on vacation? nine0021

- The authorities in your region have introduced tax holidays.

- You registered as an individual entrepreneur for the first time.

- Registered an individual entrepreneur after the introduction of holidays in your region.

- You apply a simplified taxation system or a patent.

- You are included in the list of preferential activities in the industrial, social, scientific fields or in the field of personal services to the population. The list is approved in the regional law - find yours in the table. nine0012

- Comply with the conditions set by the local law. Some regions impose restrictions on the number of employees and the amount of revenue.

- Income from privileged activities is at least 70% of your total income.

If you are in doubt as to whether you qualify for the holiday, call your tax office.

How to switch to tax holidays?

If you are on the STS and fall under tax holidays, simply do not pay tax, and at the end of the year, submit a declaration at a rate of 0%. There is no need to submit special applications. nine0003

There is no need to submit special applications. nine0003

If you want to switch to a patent, , in the application for its receipt, indicate the 0% rate and the article of the regional law that introduced holidays for your business. Article "How to fill out an application for a patent."

New IP - the year of the Elbe as a gift

Year of online accounting at the Premium rate for sole proprietors under 3 months

Try for free

How to report on tax holidays? nine0021

Submit a declaration to the simplified tax system once a year: indicate the 0% tax rate and all income and expenses that you received.

Everything is quite simple on a patent: you don’t need to pay or report.

Important: do not forget to pay insurance premiums for individual entrepreneurs, tax holidays do not exempt them.

When will the holidays end?

You apply holidays for two tax periods, as long as you fall under the requirements of the law. But the tax holidays have an end date - December 31, 2023, after which the federal program may be curtailed. nine0003

But the tax holidays have an end date - December 31, 2023, after which the federal program may be curtailed. nine0003

For example, if you registered an individual entrepreneur in March 2022 and fell under a tax holiday, then do not pay tax until the end of 2023.

The article is relevant to

Continue reading

All articles

How to calculate depreciation

Insurance contributions IP

nine0002 How to reduce tax USNEven more useful

Newsletter for business

Digest about laws, taxes, reports twice a month

Social network

News and videos - in simple terms, with business in mind

should a minor child pay personal property tax

I recently paid tax for an apartment and realized that it should also be charged for children's shares. But I do not receive any letters from the tax office and do not know how much to pay. I personally do not really want to go to the tax office. nine0003

But I do not receive any letters from the tax office and do not know how much to pay. I personally do not really want to go to the tax office. nine0003

Do I have to pay tax on these shares and how can I find out how much?

Irina Polovodova

lawyer

Author profile

As soon as you allocated shares to the children, they became the same owners of the apartment as you are. An apartment is a taxable property, and property tax is charged for all its owners, regardless of age.

You may not have received a child wealth tax notice because you allocated shares in 2021: tax for the year is paid until December 1 of the following year. That is, you will see accruals for 2021 in 2022. If you allocated shares in 2020 or earlier, but did not receive anything, then there is also an explanation for this. nine0003

I'll tell you more about how the system works, how to find out about children's taxes and how to pay them correctly.

Why a child must pay taxes

A child cannot know about property taxes and pay them. But formally, if a share in property is registered to him, he is considered a taxpayer at any age.

Art. 400 of the Tax Code of the Russian Federation

At the same time, it does not matter whether the parents received a certificate of assignment of a TIN to the child or not. As soon as the tax office receives information from Rosreestr that the child has become the owner of the property, the TIN appears automatically. nine0003

There is no direct obligation of adults to pay property tax for a child in the law, but there is a broader rule: any taxpayer can act through his representative. In the case of a child, parents, adoptive parents, guardians can pay taxes.

Art. 45 of the Tax Code of the Russian Federation

The legislation divides children into two groups: minors, that is, up to 14 years old, and from 14 to 18 years old. Parents manage the property of a minor, which means that you still have to pay tax on his behalf. Children from 14 to 18 years old, with the consent of their parents, can independently manage their property and pay taxes. nine0003

Children from 14 to 18 years old, with the consent of their parents, can independently manage their property and pay taxes. nine0003

Art. 26, 28 of the Civil Code of the Russian Federation

If the property tax is not paid, then it does not matter at what age the child is: the tax office will send a demand to pay the debt to parents, guardians or adoptive parents.

When a child may not pay property tax

There are situations when a child may not pay property tax.

So, children with disabilities, including from childhood, and recipients of a pension, for example, for the loss of a breadwinner, may not pay tax on one piece of real estate. If such a child owns several objects - for example, a share in the parents' apartment and the grandmother's apartment - property tax needs to be paid only for one share of choice. nine0003

Who can not pay taxes on property and land or pay less: 7 categories of beneficiaries

This is called a tax benefit. To receive it, you need to send an application to the tax office and attach documents that confirm the benefit.

Art. 407 of the Tax Code of the Russian Federation

Regions have the right to independently expand the list of tax benefits. Information about this can usually be found on the website of the Federal Tax Service if you select your subject.

Letter of the Federal Tax Service of Russia dated May 13, 2020 No. BS-4-2-21/779

How to find out about the amount of taxes for a child

There is a concept of tax secrecy, and the tax office is not entitled to transfer data on children's taxes to third parties. That is, children's taxes will not be reflected in notifications for adults, and they may not talk about accruals over the phone either. That is why you will not see the amounts of taxes for children in your personal account on the website of the tax authority or in notifications that come to your name.

Taxes on the child's property will be in notifications that the Federal Tax Service will by default send to the name of the child at the address of his registration. But the most convenient way to receive tax payments for a child is to register a personal taxpayer account for him and receive notifications there. nine0003

But the most convenient way to receive tax payments for a child is to register a personal taxpayer account for him and receive notifications there. nine0003

There are two ways to do this:

- apply to any tax office with a passport and a child's birth certificate. The tax office will immediately issue a username and password from the child's personal account;

- register a child for public services. After that, through public services, it will be possible to automatically enter the taxpayer's personal account. You don’t have to go to the tax office, but to register for public services, you need to go through the identity verification procedure - through the MFC or online banking. This method is suitable when the child is already 14 years old or more. nine0012

/newborn-documents/

What documents do newborns need

What to do if you don't receive a tax notice

Notices of the need to pay property taxes are sent out in August-September. You need to pay before December 1, and the tax service must notify all payers no later than 30 days before this deadline. So, if the notification has not arrived by November 1, it is better to find out for yourself where it is and how much you owe.

You need to pay before December 1, and the tax service must notify all payers no later than 30 days before this deadline. So, if the notification has not arrived by November 1, it is better to find out for yourself where it is and how much you owe.

Art. 52 NK RF

The indicated deadlines are the same for all types of notifications - both paper and electronic. As soon as you have registered a taxpayer's personal account, notifications stop coming by mail automatically. Rarely, but it happens that notifications do not come to your personal account either - as a rule, this is the result of some kind of error.

/zabral-dengi-za-imuschestvo/

How to save on property taxes

0011 in person at the tax office. Take your passport and child's birth certificate. The notification must be issued immediately against receipt;

You will have to come to the MFC twice: to write an application and then receive a notification.

You will have to come to the MFC twice: to write an application and then receive a notification. There is only one case when a tax notice should not officially come, although property tax is charged, if the tax amount for the year is less than 100 R. For example, children have very small shares in an apartment, and the tax for them is also small. The receipt will be sent when taxes accumulate for a large amount or after three years. nine0003

What to do? 10/27/17

There are no letters from the tax office, what should I do?

If you have a taxpayer's personal account, but you want to receive additional paper receipts, file an application for this with the tax office. This function in the taxpayer's personal account is called "Notification of the need to receive documents on paper". It can be found in the section "Life situations" → "Other situations" → "Receive paper documents"How to pay property taxes for a child

Taxes for a child must be paid in the same way as for an adult. You can do this in the taxpayer's personal account, on the portal of the Federal Tax Service, public services, at banks, at the post office, at the MFC or through a payment terminal.

You can do this in the taxpayer's personal account, on the portal of the Federal Tax Service, public services, at banks, at the post office, at the MFC or through a payment terminal.

The fastest way to pay is by UIN, barcode or QR code. All of them are unique for each payment, and you do not need to enter details, payment amounts and payer data.

In the personal account of the child taxpayer, all payment and payer data will also be generated automatically, so it is impossible to make a mistake. nine0003

/deadline/

Pay your property tax

If you pay otherwise, it's important not to make the payment in your name. Otherwise, the money will go to the adult's taxes, and the child's property tax will not be paid. In such cases, the purpose of the payment indicates: "Payment of tax for ..." and indicate the data of the child.

Knowing the UIN, you can pay taxes even without notification. To obtain a UIN, an application is made on the website of the Federal Tax Service, where they indicate their and the child's data and ask to issue a UIN. The tax authorities should send the number 9 in response0020 What happens if you do not pay property tax

The tax authorities should send the number 9 in response0020 What happens if you do not pay property tax The deadline for paying property taxes is no later than December 1. This is what threatens if you do not pay the tax on time.

Fines for each day of delay from December 2. Although the interest rate on taxes is small - 1/300 of the key rate of the Central Bank, which is 7.5% per annum as of November 2021 - it still increases the defaulter's debt. For example, with a debt of 5000 R per month, about 40 R will run up.

Art. 45, 69, 70 Tax Code of the Russian Federation

Claim for debt payment. IFTS will issue a claim within three months after December 1. The document will come by mail. It must be completed within 8 business days.

Court order. The tax office will receive an order - and the children's debt will be collected from parents, guardians or adoptive parents in a simplified court order. The judge will consider the documents without calling the parties and satisfy the requirement of the Federal Tax Service. The money will be written off from the accounts of both parents, adoptive parents or guardians, because according to the law they are equally responsible for the child. nine0003

The judge will consider the documents without calling the parties and satisfy the requirement of the Federal Tax Service. The money will be written off from the accounts of both parents, adoptive parents or guardians, because according to the law they are equally responsible for the child. nine0003

cl. 1 art. 61, paragraph 1 of Art. 80 SK RF

art. 1 of Law No. 45-FZ

Previously, the tax office filed a lawsuit against the representatives of the debtor child and thus returned the debt.

For example, in June 2015, the tax inspectorate of the Ryazan region sued the parents of a child who had 1/2 share of non-residential premises. The family did not pay the tax, although they received notices and requests to pay it. The court recovered from the parents the child's tax debt, late payment interest and court costs, dividing everything equally. nine0003

What is the result

In your situation, I would recommend doing this:

- Go to the tax office and take the username and password to access the personal account of the child taxpayer.