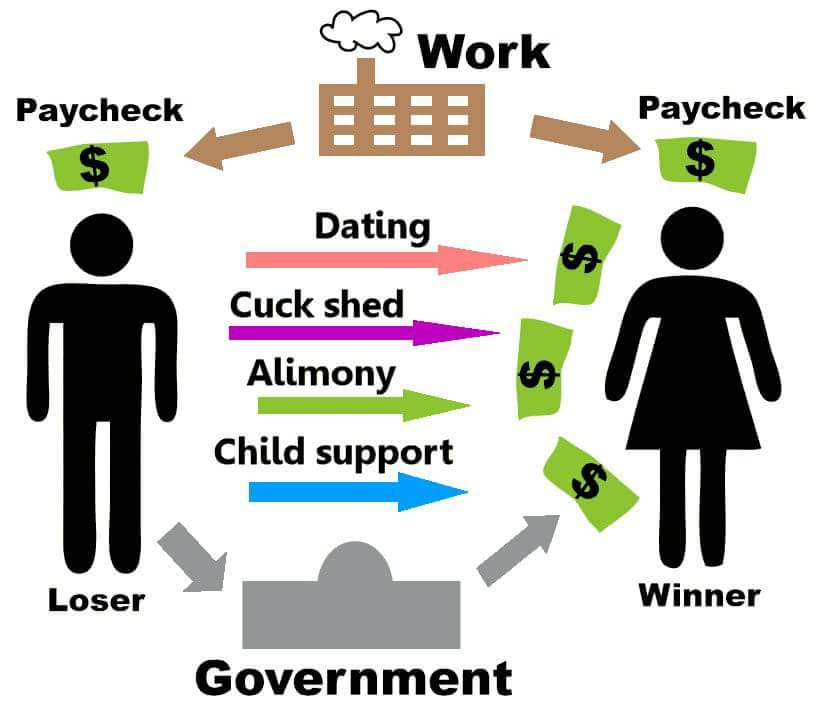

How child support works in texas

Laws, Rates & Payments Explained

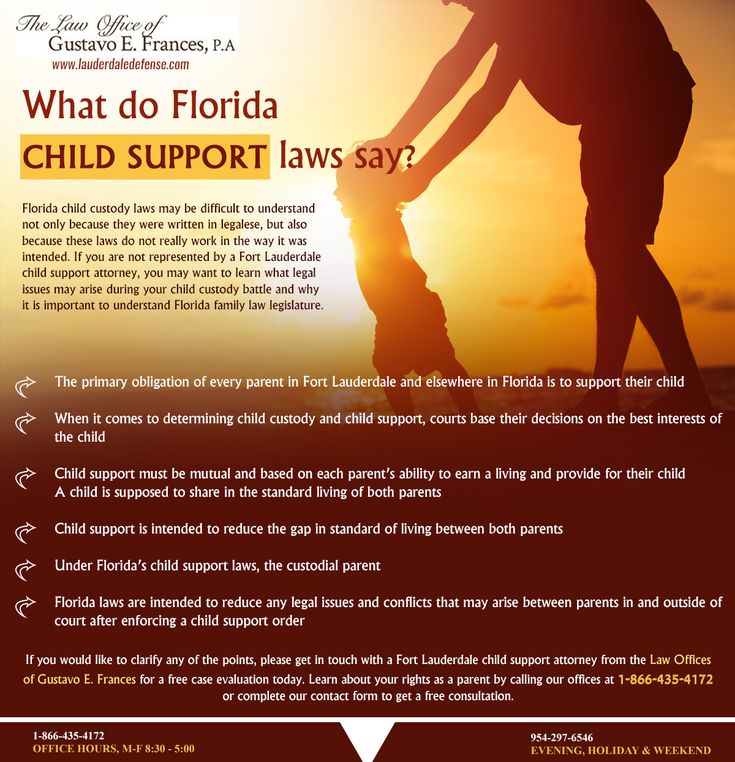

Texas child support not always easy to navigateOur take on child support in Texas basics, challenges and shortcomingsMany divorced parents who pay or receive child support in Texas think it is relatively straightforward. Parents figure out how much child support needs to be paid or received based on the Texas child support laws.

Court orders confirm the amount and method of payment. If parents disagree, there might be a court hearing or required mediation to arrive at the right amount, but eventually, a court-ordered child support payment is made. And that’s that, right?

While child support may be straightforward in some cases, parents often disagree. In addition, how Texas calculates child support is different than other states. We might even argue that the child support formula Texas uses doesn’t make logical sense, with the amount allowed inadequate or unfair to some parents.

It’s also worth noting that child support is “big business” in Texas, In fact, Texas child support is akin to a nearly $4. 4 billion business, the amount collected in 2018—higher than any other state in the nation. Because the system is so large, it can be slow to change and remain stuck with old technology and procedures far longer than anyone would like.

HOW THE PROCESS WORKS: Many people are unaware that parents can apply to open child support cases by requesting application forms and applying online or in person. Afterward, the child support office will schedule a negotiation conference with the other parent. If the parents are unable to agree on visitation or child support issues, the case will be transferred to the government courts. If you have questions about the process, it’s typically best to contact the child support offices Texas makes available to you in the county where you reside.

If neither parent petitions for child support, the Texas Office of the Attorney General (OAG) can still open a legal case once a custodial parent applies for public benefits, such as Medicaid. However, it is worth noting that the OAG has no authority over enforcing visitation rights.

However, it is worth noting that the OAG has no authority over enforcing visitation rights.

HOW THE AMOUNT OF CHILD SUPPORT IN TEXAS IS DETERMINED: In general, child support guidelines in Texas include:

- Noncustodial parents are required to contribute 20 percent of net income for one child and an additional five percent for each subsequent child.

- Noncustodial parents with five or more children on child support are required to contribute at least 40 percent of net income.

- Parents who are unemployed are still required to pay child support.

- Noncustodial parents who have children in multiple households may have their child support order altered accordingly.

In addition, Texas Family Code Chapter 154 does include certain allowances for children with disabilities, special needs and mental health issues, as well as medical coverage. If your child requires special medical care or support, your attorney can help you work out a settlement that addresses those needs.

HOW CHILD SUPPORT PAYMENTS ARE HANDLED IN TEXAS:

- PAYCHECK DEDUCTION: Noncustodial parents who are employed might have the child support payments directly deducted from their paycheck.

- CHECK OR MONEY ORDER: Child support payments can be submitted by check or money order to the State Disbursement Unit.

- ONLINE: Parents can also make the support payments online. The OAG tracks the account records and allows parents to access their payment history through the state’s child support website.

- Systemic problems affect child support payments.

For example, outdated information and other problems in the state’s computer program or system can result in incorrect information. The antiquated system is decades old and updating information is very cumbersome. Inaccurate or delayed information can mean that a parent may be wrongly penalized or a child may lose support.

A project to upgrade the child support technology in Texas is over budget and behind schedule, making it hard to predict when the system will become more effective for parents and state employees. More than $300 million has been spent to upgrade the system but the state’s IT contractor continues running behind and legislators are hesitant to fork over more money.

- Child support payments can be stolen by employers.

Parents who have child support payments withheld from their paychecks are vulnerable to fraud and theft. A father in East Texas thought he was making his child support payments every month through payroll deductions, but found out his employer had pocketed the money intended for his six children. The father calculated that over seven years, $32,000 had been withheld from his paycheck that never reached his children. The employer, who runs a small auto repair business, finally admitted that she had taken the money because “things were tight.”Scenarios like this one are not unique.

More than 70 percent of child support payments are either withheld from paychecks or garnished. According to an attorney quoted by a Tyler, Texas, TV station, there are a growing number of cases involving small-business employers withholding payments but not sending them to the attorney general’s office.

More than 70 percent of child support payments are either withheld from paychecks or garnished. According to an attorney quoted by a Tyler, Texas, TV station, there are a growing number of cases involving small-business employers withholding payments but not sending them to the attorney general’s office. - Interstate child support orders complicate matters.

When a parent receiving child support no longer lives in the state where the order was issued, things can get complicated. For example, a Texas mother who received child support as a result of a court order in Washington stopped receiving child support when her daughter turned 18.The state of Washington said that child support ends at 18 unless a child is in school. The child was being home-schooled under Texas law after her 18th birthday. The mother was told that she had to comply with Washington’s home school law since the support order was issued in Washington.

- Parents use the independent contractor scheme to avoid paying child support.

The most common problem related to collecting child support is that the paying parent disappears, stops working or, in the case of some Texas parents, becomes an independent contractor. When workers become independent contractors, they no longer receive wages—they are no longer employees. - Collecting child support from an independent contractor is not easy.

This arrangement is used by employers that wish to avoid payroll taxes and by parents who wish to stop paying child support. Child support payments cannot be withheld because there are no withholdings for independent contractors.A variation on this theme is the workers who are paid in cash or under the table, making it very difficult to find them. Parents who are supposed to be receiving child support may not have much recourse in situations like these because the system is cumbersome and varies depending on where the parent lives.

Seeking help from a Texas divorce and family law attorney may be the best way to resolve problems with child custody and child support payments.

Attorneys can file suit against nonpaying parents and employers that steal withheld support payments. They can also hire investigators to track down missing parents if needed.

Attorneys can file suit against nonpaying parents and employers that steal withheld support payments. They can also hire investigators to track down missing parents if needed.

Many parents who speak with our Fort Worth family lawyers say child support guidelines in Texas don’t adequately address their children’s needs. Conversely, other parents tell us their paychecks aren’t big enough to cover child support and the rest of their bills.

Do Texas child support guidelines miss the mark? As detailed above, chapter 154 of the Texas Family Code is pretty clear on how much child support the state allows. Unfortunately, those guidelines don’t always serve the best interest of every child—or their parents.

While some parents do have unrealistic expectations about child support, our state’s guidelines don’t make sense for a lot of Texas families either. Here are three reasons we should all take a closer look at child support in Texas.

- The way Texas calculates child support is different than other states (and less logical).

Other states calculate child support based on the amount of time the parent has possession of the child, who is paying for what expenses, and who has access to what resources (financial and otherwise). That brings in a litigation component regarding the child support amount itself, which is great because that’s what should happen realistically.That’s not how it works in Texas. In fact, we’d even go as far as to say that the way other states determine child support is often fairer to parents (and children) than the way it is calculated in Texas.

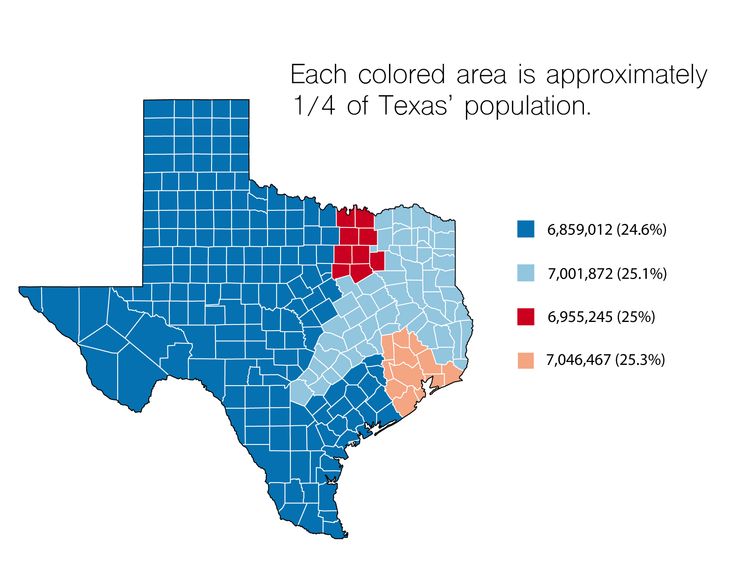

Based on the overriding principle of standard visitation, the state of Texas uses a formula for statutory child support that is based on the number of children a couple has together AND the monthly net resources of the payor. Texas also places a cap on net resources, which is adjusted every six years based on inflation.

Effective Sept. 1, 2019, Texas raised the child support cap from $8,550 to $9,200.

Effective Sept. 1, 2019, Texas raised the child support cap from $8,550 to $9,200.Unfortunately, for people who make under that $9,200 per month threshold of support, especially the ones who make right up to it, it’s typically not a fair process. It’s also not fair when an affluent breadwinner makes well over the threshold amount and gets capped at $9,200.

For example, say you have a husband with a medical surgeon’s income of $1.8 million a year and a spouse who has been a stay-at-home mom during their 15 years of marriage. Based on Texas child support guidelines, she ends up with a little over $1,800 a month for a teenager in private school who participates in all sorts of activities that she’s become accustomed to. It just doesn’t make a lot of sense.

That’s not to say that a wealthy breadwinner won’t provide more money to pay child support because he or she wants what’s best for his or her child. It simply means that the state won’t require the parent to pay more unless the child has special needs.

- The average cost to raise a child in Texas is probably higher than the state estimates.

Texas also bases its threshold level for child support on the USDA annual estimate of families’ expenditures (the most recent estimates are based on 2015 calculations). However, in a 2016 report, the Child and Family Research Partnership (CFRP), operating under the LBJ School of Public Affairs at the University of Texas at Austin, asserts that the state’s estimate is flawed.The CFRP bases that claim on two key facts: The USDA calculations are insufficient for a state “as large and diverse as Texas,” and they don’t account for the additional costs that come into play when you raise a child across two households.

To come up with a better estimate, the CFRP developed the Texas Cost of Raising a Child (CORC) model. According to the CFRP, “The Texas CORC model estimates costs for single-parent and married-parent households, and importantly, across two households and finds that the average annual cost of raising a child across two households ($13,465) is higher than that for both single-parent ($10,616) and married-parent families ($11,004).

”

” - Parents who think they pay too much child support, often underestimate child-rearing costs, too.

Let’s get real. It costs a lot to raise a child. In fact, it usually costs a lot more than most parents realize because they overlook or underestimate expenses, like what it costs for the child to participate in sports, ballet lessons or other extracurricular activities.They also forget about “peer pressure costs”—those extra expenses parents pay for the Air Jordans or designer clothes their kid has to have because all of the other kids do. Something extra always comes up.

And if we’re really getting real here … A lot of parents—men AND women—simply can’t stand the fact that they’re paying money to their ex. Not that they want to begrudge their child food, clothing and a roof overhead. It just stings when they see their ex spend money on themselves (for a vacation, getting nails done, happy hours with the guys, etc.) because they somehow think their child support money is paying for that.

If you feel that way about your ex, it’s time for a reality check. Most parents share the child-rearing expenses, which means they both contribute to the child support coffer in some way. Just because your child support payment went into your ex’s account yesterday, and your ex’s paycheck is going in next week, that doesn’t mean he or she is spending your money on himself or herself today.

One of the biggest causes of division when negotiating a divorce with child support is not taking time to hammer out what the child support will actually cover. One parent may assume it covers extracurricular activities, while the other may not. If you want to avoid conflict down the road, it’s important to classify—in writing—what expenses will be covered by child support and who will be paying for what.

Other parents run into problems when they agree to split heftier expenses like private school tuition. Those expenses can vary greatly depending on which private school a child attends, so it’s important to spell out specifically how much you are willing to pay. School, extracurriculars and other expenses also get more costly as kids get older, so you’ll want to keep that in mind as well.

Those expenses can vary greatly depending on which private school a child attends, so it’s important to spell out specifically how much you are willing to pay. School, extracurriculars and other expenses also get more costly as kids get older, so you’ll want to keep that in mind as well.

While our personal goal at the Sisemore Law Firm in Fort Worth is always to negotiate a child support agreement that best meets our client’s goals, we also believe it’s important to try to reach an agreement that is fair to both sides. People who start getting greedy and ask for too much usually find out that approach backfires. Extending the olive branch can go a long way.

If you live in Tarrant County or surrounding counties like Dallas, Denton, Ellis, Johnson, Parker or Wise County and have more questions about child support options, contact us. Our founder Fort Worth divorce lawyer Justin Sisemore would be happy to meet with you one-on-one to review your case. To schedule a consultation with Justin, call the firm at (817) 336-4444 or visit our contact page to schedule online.

To schedule a consultation with Justin, call the firm at (817) 336-4444 or visit our contact page to schedule online.

Photo Source: Canva.com

Texas Child Support Guidelines | DivorceNet

Find out how to calculate child support in Texas and how you may get the amount of support changed.

Like all states, Texas has child support guidelines for figuring the amount of support that a divorced or unmarried parent should pay for a child or children. The guideline itself is fairly straightforward—it's based on the net income of the parent who will pay support. But the rules can get complicated when it comes to figuring out what goes into net income and when it's appropriate to depart from the guideline.

The Noncustodial Parent Pays Child Support

In Texas, physical custody—the amount of time a parent spends with a child—determines who will make child support payments. Although a judge may order either or both parents to support a child, in most cases the "noncustodial parent" (the parent with the least amount of time with the child or children) pays child support. (This parent is also called the "obligor" in Texas child support laws.)

(This parent is also called the "obligor" in Texas child support laws.)

Just because the noncustodial usually pay child support, that doesn't mean the other parent is off the hook for the costs of raising a child. Instead, the law assumes that the custodial parent support the child by spending money directly on the daily cost of raising the child.

How to Use the Texas Child Support Guidelines

Under the "income percentage" method used in the Texas child support guidelines, the amount of child support is generally based on a percentage of the noncustodial parent's net monthly income.

For a simple estimate of child support in your case, you may use the online Monthly Child Support Calculator provided by the Texas Office of the Attorney General (OAG). But the calculator is designed only for situations when the custodial parent has a single source of income. For all other situations, you'll need to determine net monthly income and the guideline amount of support by following the steps explained below.![]()

Gross Income Included in Calculating Child Support

For child support purposes, income includes:

- all wages and salary, including commissions, military pay, tips, overtime, and bonuses

- self-employment income

- interest and dividends

- net rental income from property the parent owns

Even unemployed parents probably still have some income from sources such as:

- severance pay

- unemployment benefits

- retirement benefits

- veterans' benefits

- disability benefits, or

- workers' compensation awards.

(Tex. Fam. Code § 154.062 (2022).)

If it's appropriate, a judge may also assign an income value to a parent's assets that don't currently produce income (like a second house). For example, if an unemployed parent inherits property that could be sold, the judge might consider the property's market value as part of the parent's income.

When parents are voluntarily unemployed or underemployed to avoid making support payments, judges may impute (attribute) income based on what those parents should be earning.

Net Income for the Texas Child Support Guidelines

To figure the parent's net resources for paying child support, subtract the following costs from the total gross income:

- Social Security taxes or, if the parent doesn't pay those taxes, any mandatory retirement plan contributions

- federal and state income taxes (based on the tax rate for a single person claiming one exemption)

- union dues

- health and dental insurance premiums and other medical expenses for the child(ren) that the judge has ordered the parent to pay.

Parents who already pay child support for another child or children (from a different relationship) may take a credit for those payments. (Tex. Fam. Code §§ 154.062, 154.128, 154.129 (2022).)

Number of Children Requiring Support

Once you've established the noncustodial parent's net monthly income (1/12 of the annual net income), multiply that number by a percentage based on how many children will be included in the child support. When net income isn't above or below a certain threshold, the percentages are as follows:

When net income isn't above or below a certain threshold, the percentages are as follows:

- 1 child = 20%

- 2 children = 25%

- 3 children = 30%

- 4 children = 35%

- 5 children = 40%

- For 6 or more children, the amount must be at least the same as for five children

If the noncustodial parent's net monthly resources are less than $1,000, each of the percentages shown above are reduced five percentage points (so they range from 15% to 35%).

When the noncustodial parent has net monthly resources above a certain level ($9,200 a month, under the adjustment made in 2019), the judge may increase the amount of support, depending on both parents' incomes and the child's needs.The threshold changes every six years to account for inflation.

Health Insurance as Part of Child Support

In addition to the support amount calculated under the guidelines, the parents will also have to cover the child's health and dental insurance. While there is a presumption that the noncustodial parent will provide coverage, that responsibility can easily shift to the other parent if it makes more sense—for instance, if the custodial parent's employer provides health insurance for dependents but the noncustodial parent doesn't have coverage. (Tex. Fam Code §§ 154.008, 154.181, 154.1815 (2022).)

While there is a presumption that the noncustodial parent will provide coverage, that responsibility can easily shift to the other parent if it makes more sense—for instance, if the custodial parent's employer provides health insurance for dependents but the noncustodial parent doesn't have coverage. (Tex. Fam Code §§ 154.008, 154.181, 154.1815 (2022).)

When Child Support May Be Higher or Lower Than the Guideline Amount

The judge will start out by assuming that the amount of child support under the guideline will be in the child's best interests. But the judge may order a different amount of support if applying the guideline would be "unjust or inappropriate" in the specific case. When making that decision, the judge will consider all of the relevant circumstances, including:

- the age and needs of the child

- the parents' ability to support the child

- the time the child spends with each parent

- whether either parent has custody of another child or is paying post-secondary educational expenses for a child

- the custodial parent's net resources

- child care expenses

- alimony (spousal maintenance) that a parent is paying or receiving

- the cost of the child's travel between the parents if they live far apart, and

- extraordinary expenses, such as for health care or education.

In any order for child support that varies from the guideline, the judge must spell out the reasons why the guideline amount would be unfair or inappropriate.

You and your spouse may always agree to an amount of child support that's higher than the guideline amount. But if your agreement provides for an amount that's below the guideline level, you'll need to explain why applying the guideline would be inappropriate. The judge won't approve your agreement unless it's in the child's best interests. (Tex. Fam. Code §§ 154.122, 154.123, 154.124, 154.130 (2022).)

Collecting Child Support in Texas

Establishing child support is only half the battle. You'll also need to collect support. A noncustodial parent must pay the full amount of support each month as ordered. If your order doesn't specify otherwise, a parent may pay child support in the form of cash, check, bank transfer, direct deposit, Zelle, or Venmo.

If you need or want help collecting child support, you may apply for assistance online from the Child Support Division of the Texas Attorney General's Office (OAG), or call the toll-free number (800) 252-8014. Parents may pay support through the OAG by different methods, including online and through a wage withholding.

Parents may pay support through the OAG by different methods, including online and through a wage withholding.

Changing a Texas Child Support Order

Once a child support order is in place, you may request a change (or modification). However, you'll need to show that there's been a substantial change of circumstances that affect the ability to pay support or the need for it. A judge will make a decision about your modification request based on the same legal requirements for an original child support order.

You could work out an agreement with the child's other parent on a modification. But you'll still need to have a court hearing so that a judge may review your agreement and decide whether it's in the child's best interests.

You may also request a modification without a court hearing through the OAG, in what's known as the Child Support Review Process.

Family Law - Sharifov & Associates - Attorneys at Law

division of joint property in New York

Family law is the branch of law that deals with matters relating to the family and family relations. Our family law practice includes representing clients both at the negotiation stage and in court in cases involving domestic violence (usually followed by an order of protection), divorces, separation, residence of children after divorce, and visitation of children. , child and spousal support, property division, domestic violence, prenuptial agreements, and juvenile delinquency lawsuits. We take part in out-of-court negotiations and also conduct court hearings when necessary.

Our family law practice includes representing clients both at the negotiation stage and in court in cases involving domestic violence (usually followed by an order of protection), divorces, separation, residence of children after divorce, and visitation of children. , child and spousal support, property division, domestic violence, prenuptial agreements, and juvenile delinquency lawsuits. We take part in out-of-court negotiations and also conduct court hearings when necessary.

divorce by consent in New York

Frequently Asked Questions:

1. What is the difference between a contested divorce and a non-contested divorce?

When both husband and wife voluntarily agree on all aspects of divorce, including division of joint property, residence and visitation of children, child support and for former spouses, or are able to sign a separation agreement, their divorce is considered a divorce by consent. Arrest for Domestic Violence in New York On the other hand, when spouses cannot agree among themselves on all aspects of divorce and separation, and require the court to make appropriate decisions on the above aspects of divorce, they are forced to deal with a judicial divorce. On the practical side, a legal divorce requires a lot more work, usually takes longer, and tends to cost more.

On the practical side, a legal divorce requires a lot more work, usually takes longer, and tends to cost more.

order of protection in new york

2. How can I get an order of protection in case family violence?

If something threatens your physical or emotional safety or the safety of your children, you should immediately seek the advice of a lawyer or seek the assistance of the Court. You need to take immediate steps to keep you and your children safe. Family courts in all counties in the State of New York are able to make a quick decision on an application for an order of protection; usually, if needed, it can be done within one day. The Summons, Petition and Order of Protection must be delivered to the defendant. This can be arranged through the local police station, privately, or through a professional document delivery agent. The Family Court may order the Sheriff's Department to serve the documents. The case will be rescheduled and the defendant will be subpoenaed to respond to the domestic violence petition. Either by agreement of the parties or after a hearing, the judge may issue a permanent order of protection, limited or complete, for up to 2 years.

Either by agreement of the parties or after a hearing, the judge may issue a permanent order of protection, limited or complete, for up to 2 years.

Sometimes the police refuse to make an arrest during an investigation into domestic violence; however, the police may advise the victim to go to Family Court and ask the Judge to issue an Order of Protection. Both the New York State Criminal and Family Courts have concurrent jurisdiction over certain domestic violence offenses. The difference between the procedure in these two courts is that in Family Court, you, as the plaintiff, are a party to the process, and you have control of the lawsuit against the defendant (the person you accuse committed acts of domestic violence against you). violence). at any time you can reach an agreement with the defendant as closed; case, or you can just pick up your petition. If the police refuse to arrest the person you complained about, you can file a petition with Family Court. The Family Court Judge has jurisdiction to issue an Order of Protection (full or limited), which will have the same effect as an Order issued by a Criminal Court Judge. For the past few months, due to the Coronavirus pandemic, Family Court has operated largely virtual, with court hearings via Skype or Microsoft Teams Meetings, and filing petitions via email or Electronic Document Delivery (" EDDS").

For the past few months, due to the Coronavirus pandemic, Family Court has operated largely virtual, with court hearings via Skype or Microsoft Teams Meetings, and filing petitions via email or Electronic Document Delivery (" EDDS").

The Domestic Violence Petition, in the absence of agreement by both parties, will be decided by the Family Court Judge at the conclusion of the hearing on the merits. The New York State Family Court has jurisdiction over other types of petitions, such as Child Visit and Residence, Child Support, Neglect of a Child, Establishment of Paternity, etc.

Sometimes, after an arrest and first appearance in criminal court, a Domestic Violence Petition is also filed in Family Court, requiring the client to attend both courts for both of the relevant cases. If there are minor children in the family, the Criminal Court will often include such children in the Protective Order, however, making an exception for Family Court modifications of the order. In such a case, the defendant who wishes to maintain a relationship with his children must go to Family Court and register a child visitation petition, asking the Judge to schedule visits to the children. Depending on the circumstances of the original case that led to the Order of Protection, the judge may allow limited visits, supervised visits, or even supervised visits by a welfare agency.

Depending on the circumstances of the original case that led to the Order of Protection, the judge may allow limited visits, supervised visits, or even supervised visits by a welfare agency.

legal guardianship

3. I can't find my spouse, can I file for divorce?

Personal delivery of original divorce papers (Summon Notice or Summons of Complaint) is required by law. However, in the event that the plaintiff (the person initiating the divorce case) cannot find his/her spouse, the plaintiff must obtain court permission for alternative delivery of documents by filing a written petition with the court.

4. When am I officially divorced?

The parties to a divorce proceeding are considered divorced from the moment the judge signs the divorce decree. In the case of a divorce by consent, if a postcard has been filed in advance, the court will notify the final divorce by mail. In the event of a judicial divorce, although the judge may verbally announce during the trial that the parties are divorced, the divorce is officially finalized after the parties' lawyers have submitted the documents to the court and the judge has signed the divorce decree.

5. What is custody and how is the issue of child custody after divorce resolved?

There are two types of custody – legal custody and physical custody. Legal custody essentially means the right to make decisions. During marriage, both parents have rights to raise the child. This includes the right to make decisions about all aspects of a child's upbringing, including religion and education, as long as the parent's decisions do not pose a threat to the child. After a divorce, one of the spouses who has received legal custody of the child makes all decisions independently. You can consult with the other parent, and this is even recommended, however, if you are unable to agree with the other parent or do not wish to consult, you can make your own parenting decisions. Note that the court can always review a parent's decision to raise a child to ensure that the decision is in the best interests of the child. Joint legal custody essentially means that both parents have equal rights to make significant decisions that affect their children's lives. If the parents agreed to joint legal custody, then they essentially agreed to set aside their personal differences in order to effectively raise their children. If the parents are unable to agree on legal custody, then such a decision will be made by the court.

If the parents agreed to joint legal custody, then they essentially agreed to set aside their personal differences in order to effectively raise their children. If the parents are unable to agree on legal custody, then such a decision will be made by the court.

Post-divorce custody means the right of a parent to have a child permanently reside with that parent in the same family and be responsible for their child as long as they live with that parent. If one of the parents received the right to live with the child after the divorce, then the other parent is likely to receive the right to visit the child (visitation). If the parents cannot agree on a visitation schedule for the child, the court will provide such a schedule. Sometimes it is possible to have a joint right of residence of a child with parents in turn in equal shares (joint physical custody). In this case, the child will live half the time in the family of one parent, and half the time in the family of the other.

6.

Will I have less time to visit my child if the other parent has exclusive legal custody?

Will I have less time to visit my child if the other parent has exclusive legal custody? Optional. Legal custody means the right to make decisions, not the right to spend time with the child. The parent with exclusive legal custody has the right to make most parenting decisions if both parents cannot agree on that decision. If the parents agreed to joint legal custody, then they essentially agreed to set aside their personal differences in order to effectively raise their children. Each parent in this case has equal rights to make decisions regarding the child. Regardless of whether your spouse has exclusive legal custody or both of you, you still have the opportunity to see your child as much as his schedule allows. Visitation of a child is usually independent of legal custody.

7. How is child support calculated?

New York State offers a formula for calculating the amount of child support payable by a parent as specified in Family Code section 240(1-b). This is a rather complicated article of law that must be read and interpreted carefully in order to accurately calculate the amount of child support. Usually, after the allowed deductions from the parent's total earnings, a certain percentage is applied to the balance of earnings to calculate basic child support. The percentage depends on the number of dependent children under 21:

Usually, after the allowed deductions from the parent's total earnings, a certain percentage is applied to the balance of earnings to calculate basic child support. The percentage depends on the number of dependent children under 21:

17% per child, 25% for two children, 29% for three children, 31% for four children, and 35% for five or more children;

It is necessary to carefully and carefully interpret the article of the law in order to accurately calculate child support, as there are many factors and conditions prescribed in the law that affect these calculations.

8. Who pays child support?

Generally, the parent with whom the child does not live most of the time will pay child support to the other parent.

child support in New York

9. Will I be able to pay less child support than is legally allowed?

The best chance to achieve this is to negotiate a reduction in child support as part of a common agreement between the parties. Do not forget, however, that the other party is not obliged to agree to this. Only in rare cases does the court find reasons not to apply the formula provided by law.

Do not forget, however, that the other party is not obliged to agree to this. Only in rare cases does the court find reasons not to apply the formula provided by law.

10. What if the children spend a significant part of their time with me, or even 50% of the time?

Once again, if you are unable to negotiate a reduction in child support with the other party, it will be extremely difficult for you to persuade the court not to apply the statutory formula. To illustrate this, note that even if the parents spend the same amount of time with the children, there is case law stating that the parent with the higher income counts as the parent not living with the child for purposes of calculating child support, and such parent would have to pay formula support! ! This shows how much more beneficial it is for clients to take good faith negotiations seriously as the best way to resolve a dispute.

11. Until what age should a parent support a child?

In New York State, a child is entitled to parental support until the age of 21, unless he/she begins independent living earlier. If a child chooses not to attend college and instead joins the military or starts working full-time, then parental support ends when the child reaches 18 years of age.

If a child chooses not to attend college and instead joins the military or starts working full-time, then parental support ends when the child reaches 18 years of age.

12. Will a child be eligible for support if she stays in college after her 21st birthday to complete her studies and earn a bachelor's or graduate degree?

No. If child support continues after his 21st birthday, it will only be as a result of the agreement of both parents. The law does not require parents to continue supporting children after they turn 21, regardless of whether higher education is completed.

OK with this parent?

The Court takes the issue of changing the residence of children very seriously. The main criterion for the court is the issue of the welfare of the children. In attempting to make such a decision, the court will ask the question: "If such a change in the place of residence of the child is allowed, will it significantly change the nature of the relationship between the child and the parent who does not move to a new place with him?" The court will try to find out as much as possible about the nature of the relationship with the parent. (For example, how often do you see your children? Do you go to their school events? Do you meet with your children during the school week? Do you make use of all the visits that you have assigned to your children? How good are your visits to children?) will evaluate all reasons for the expected relocation of children to determine whether the parent with whom the child lives has explored all possibilities to avoid such a relocation. The distance over which the proposed move is made is also an important factor. Is this the distance that will prevent you from regularly visiting your children? The latest trend in jurisprudence is to generally allow moves up to 2 hours by car from the children's previous residence (assuming the parent with whom the children live generally has a good reason for the move). These decisions were determined by the circumstances, so don't try to reassure yourself ahead of time based on what the court has decided in other cases.

(For example, how often do you see your children? Do you go to their school events? Do you meet with your children during the school week? Do you make use of all the visits that you have assigned to your children? How good are your visits to children?) will evaluate all reasons for the expected relocation of children to determine whether the parent with whom the child lives has explored all possibilities to avoid such a relocation. The distance over which the proposed move is made is also an important factor. Is this the distance that will prevent you from regularly visiting your children? The latest trend in jurisprudence is to generally allow moves up to 2 hours by car from the children's previous residence (assuming the parent with whom the children live generally has a good reason for the move). These decisions were determined by the circumstances, so don't try to reassure yourself ahead of time based on what the court has decided in other cases.

14. Will my spouse be required to pay me alimony or maintenance after the divorce, and if so, for how long?

A recent change to the law that went into effect in 2016 provides for a formula on how to calculate temporary alimony, as well as a recommended formula for calculating permanent alimony after divorce and how long it lasts. There are also additional factors that the court must consider when determining the amount and duration of child support.

There are also additional factors that the court must consider when determining the amount and duration of child support.

Here are a few factors that are considered the most significant:

- length of marriage; the age and state of health of each spouse;

- present and future earning potential for each spouse;

- your opportunity to become financially independent;

- reduced or lost earning opportunity due to denial or delay in education, training, employment, or career development during marriage;

- having children in your home;

This is a complex decision and will be influenced by many factors.

15. Can my spouse evict me from our home?

Unless you have physically, verbally, or mentally abused your spouse, or have already found another place to live, it will be extremely difficult for your spouse to evict you from their home. Unless you agree to move out voluntarily, your spouse will have to file a petition with the court for you to be evicted, and the court will give you an opportunity to respond to it.

16. Can I and my children continue to live in our house after the divorce?

Assuming that the children will be living with you, and if you have a child under 18, the court will generally try to keep the child in the home, neighborhood, and school to which the child is already accustomed, assuming that the child is fine in that environment, and also implying that financial circumstances allow it.

17. Am I entitled to a share in the value of the house, even if the title is not in my name?

If the house was purchased during the marriage with funds earned during the marriage (regardless of which spouse earned the money), then it is likely that you will be entitled to a share in the price of the house, even if the house is not registered on you. There are many factors to calculate the size, value and percentage of this share.

18. I bought our house before our marriage with funds I bought before our marriage. Will I have to share the cost of my home with my ex/ex-spouse?

Usually not. However, if the house increased in value during the marriage as a result of your spouse's efforts, or as a result of a joint investment in the house, then your spouse may claim a share of the excess price during the marriage. Please note that if you put your spouse's name on the home title deeds, this may cause your spouse to be able to claim a share of the total value of the home.

However, if the house increased in value during the marriage as a result of your spouse's efforts, or as a result of a joint investment in the house, then your spouse may claim a share of the excess price during the marriage. Please note that if you put your spouse's name on the home title deeds, this may cause your spouse to be able to claim a share of the total value of the home.

19. Will the court force me to sell my house?

If there are no children, and assuming the house is jointly owned, the court will allow each spouse to buy out the other spouse's share. If neither spouse has the ability to buy out the other's share, or is not interested in doing so, the court may order the sale of the house and divide the proceeds from the sale at the discretion of the court.

20. Credit cards: Should they be cancelled?

If you think your spouse will use credit cards beyond justified living expenses, consider closing the account. Most accounts can be closed by either paying off the debt or transferring to another credit card. If your name is first on the account, you can achieve the same goal simply by removing your spouse's name from the account. The final liability for debts will be determined by the court or by agreement. In most cases, it is recommended that you inform your spouse of your actions (after the accounts have already been changed) so that he/she is not unpleasantly surprised or embarrassed when the payment is unexpectedly declined.

If your name is first on the account, you can achieve the same goal simply by removing your spouse's name from the account. The final liability for debts will be determined by the court or by agreement. In most cases, it is recommended that you inform your spouse of your actions (after the accounts have already been changed) so that he/she is not unpleasantly surprised or embarrassed when the payment is unexpectedly declined.

21. Do I have to withdraw money from all joint accounts to protect myself from my spouse taking or hiding the money?

The courts do not approve of either spouse withdrawing all the money from a joint account or withdrawing money without good reason. The husband should think seriously before withdrawing money. Do not forget that the court has the right to demand liability from the spouse if it is proved that he squandered or hid the joint funds.

22. If I own a business or share in a business, will my spouse get a share of the business?

If your business was created during your marriage, or you acquired an interest in a business during your marriage, then your spouse will likely be able to claim a portion of that business or a portion of your interest in the business. If you acquired the business before marriage, or you acquired an interest in the business using funds from an inheritance or a gift, then your spouse may claim an excess (if any) of the value of the business that occurred during the marriage if you or your spouse is actively contributed to the value of the business. Usually an accountant is hired to do this calculation and there are many factors that go into this calculation. Once the overall valuation of the business has been made, it is calculated what percentage of that value should be used to calculate the spouse's share. There are many factors the court will take into account to determine this percentage, including but not limited to the length of the marriage, your spouse's contribution to the business, family earnings or assets invested in the business, etc.

If you acquired the business before marriage, or you acquired an interest in the business using funds from an inheritance or a gift, then your spouse may claim an excess (if any) of the value of the business that occurred during the marriage if you or your spouse is actively contributed to the value of the business. Usually an accountant is hired to do this calculation and there are many factors that go into this calculation. Once the overall valuation of the business has been made, it is calculated what percentage of that value should be used to calculate the spouse's share. There are many factors the court will take into account to determine this percentage, including but not limited to the length of the marriage, your spouse's contribution to the business, family earnings or assets invested in the business, etc.

23. Can my spouse claim the estimated value of my professional license or higher education diploma?

For divorces initiated before 2016, by law, if all or part of a professional license or higher education occurred during marriage and was paid for by joint family funds, then it is likely that the spouse will be able to claim a portion of the assessed value of such a license or diploma. Following recent changes to the New York State Family Code that went into effect in 2016, the court must no longer consider increased earning potential due to a professional license, college degree, celebrity status, or career advancement as part of a family partnership. assets. However, when deciding on an equitable division of joint marital property, the court must take into account each spouse's direct and indirect contribution to enhancing the earning potential of the other spouse. NY Dom. Rel. L. § 236B(5)(d)(7).

Following recent changes to the New York State Family Code that went into effect in 2016, the court must no longer consider increased earning potential due to a professional license, college degree, celebrity status, or career advancement as part of a family partnership. assets. However, when deciding on an equitable division of joint marital property, the court must take into account each spouse's direct and indirect contribution to enhancing the earning potential of the other spouse. NY Dom. Rel. L. § 236B(5)(d)(7).

24. Which courts can hear divorce, custody and alimony cases?

The Supreme Court has exclusive jurisdiction over divorce cases; however, Family Court has concurrent jurisdiction over custody, visitation, and child support matters. If a person wants to get a divorce, he needs to fill out the original documents in the Supreme Court. If the child's parents are not seeking a divorce, or are not married at all, and want to sue for domestic violence, custody, visitation, or child support, they should file an application in Family Court.

25. What is a juvenile delinquency trial?

This is a New York State Family Court lawsuit involving a juvenile delinquency case between the ages of 7 and 16. When such a minor is arrested in New York State, he/she may obtain a subpoena from the police in Family Court in the county where the alleged offense was committed. On the other hand, when the allegations are serious enough and/or the minor child has had previous police referrals, the child may be detained overnight in a special detention center for children and brought to Family Court the next day when the court is open.

When a child comes to court with a parent or guardian, he/she and the parent will be interviewed by a probation officer and, depending on the charges, previous criminal convictions, the wishes of the victim and their parents, if the victim is a minor, the case may be referred to probation department. In this case, the petition against the juvenile delinquent is not filed and the child agrees to follow the rules of the probation department for an initial period of up to 60 days. The child must attend school, report to the probation department when required, write an essay and/or do community service under the direction of a probation officer, and also have no new drives. If the child complies with all this, the case will be dismissed.

The child must attend school, report to the probation department when required, write an essay and/or do community service under the direction of a probation officer, and also have no new drives. If the child complies with all this, the case will be dismissed.

If a juvenile is charged with a felony, or if the victim wants the case to continue, the New York City Law Department, which in such cases acts as a prosecutor, will file a petition against the juvenile delinquent, and the child will be required to appear before judge. A case on juvenile delinquency is similar to a criminal case of an adult in a criminal court, however, there are significant differences: there is no bail for the release of the defendant to freedom for a minor - either he is left in custody or released without bail on bail to the parent / guardian; no right to a jury trial, instead a court hearing before a judge; no criminal conviction - instead, recognition as a juvenile delinquent; punishment options also vary, including case closure, conditional closure, suspended sentences of up to 2 years, or detention with varying degrees of security for an initial period of up to 18 months. For the most serious crimes allegedly committed by minors 13 years of age or older, the prosecutor has the option to refer the case to an adult criminal court.

For the most serious crimes allegedly committed by minors 13 years of age or older, the prosecutor has the option to refer the case to an adult criminal court.

26. What is marriage annulment and how is it different from divorce?

A man and a woman must be legally capable of entering into a legal marriage. If the parties are not authorized to enter into a marriage, such a marriage can be annulled, that is, declared invalid. Grounds for marriage annulment are untraceable disability, minority, lack of consent, or consent obtained through fraud or intimidation, and incurable mental illness for five years.

- If one of the spouses is terminally incapable of sexual activity, the marriage can be annulled.

- Both parties must be over 18 years of age to marry without parental consent. A marriage between persons under the age of 18 may be annulled, at the discretion of the court, if the spouse under 18 wishes to annul the marriage.

- If, after marriage, either partner becomes terminally ill for 5 years or more, the marriage may be annulled.

However, a healthy spouse may be required to maintain a mentally ill spouse for life.

However, a healthy spouse may be required to maintain a mentally ill spouse for life. - The parties must knowingly consent to the marriage. A marriage can be declared invalid if either party consented to the marriage as a result of violence or threats from the other party, or if either party did not understand the meaning and consequences of marriage.

- A marriage may be annulled if the consent was obtained by fraud, provided that the fraud was such as to deceive an ordinary reasonable person and was essential to obtain the consent of the other party. Fraud must be at the heart of the marriage contract. Only the injured party can annul the marriage on the grounds of lack of consent.

27. What is a declaration of invalidity of a marriage and how does it differ from annulment?

Unlike an annulment, where a marriage can be declared invalid, some marriages are invalid from the moment they are contracted. Such marriages include incest and bigamy. In the case of incest, this is a marriage between ancestors and descendants, brothers and sisters (including half blood). In the case of bigamy, one of the parties is already married to another person.

In the case of incest, this is a marriage between ancestors and descendants, brothers and sisters (including half blood). In the case of bigamy, one of the parties is already married to another person.

For more information, please contact our company.

TEL 516-505-2300

TE L 718-368-2800

Email [email protected]

-OUR TEXASAS-RUSSIANNENENERN -Antonio, Austin, Texas

Assume that the spouses have agreed to the impending dissolution of the marriage and are fully satisfied with its terms. However, an agreement alone is not enough: the divorce case must be conducted through the courts. Family law reflects the idea of the sacredness of marriage, in particular, the inadmissibility of frivolous marriages and divorces.

Despite some differences between the laws of different states of the country, the general scheme of divorce is the same everywhere. First of all, the applicant for a divorce is obliged to present good reasons for this and, in his application to the court, provide and explain the facts that would serve as a reason for the dissolution of the marriage. After that, the responding party will receive a notice of the beginning of the divorce proceedings and a summons to court. Difficulties arise if the address of the defendant is unknown, and in this case, the procedure for notification may vary in different states. In Texas, for example, they require you to place an ad in a newspaper.

After that, the responding party will receive a notice of the beginning of the divorce proceedings and a summons to court. Difficulties arise if the address of the defendant is unknown, and in this case, the procedure for notification may vary in different states. In Texas, for example, they require you to place an ad in a newspaper.

If the answer is not received by the court within the prescribed time limit, the court automatically concludes from this that the opposing party is not contesting the terms of the divorce. But even in this case, the other spouse retains the right to counterclaim if he has his own grounds for divorce. A counter-claim is allowed, rather, in order to enable each of the spouses to obtain a divorce on favorable grounds.

The parties may resolve conflict issues peacefully, without the participation of the court. This way is always desirable, because it allows you to avoid additional costs and time. An attempt to peacefully resolve a dispute, for example, on the division of property, is also welcomed by the court itself. If such an agreement is reached, its text is submitted to the court for consideration at a special hearing. The judge will ask the participants a series of questions to make sure that the agreement is voluntary and that the parties accept its terms. By and large, the judge is worried, for example, not that by agreement any real estate is transferred to you (or, conversely, not transferred), but that your decision is not dictated by pressure from the other side.

If such an agreement is reached, its text is submitted to the court for consideration at a special hearing. The judge will ask the participants a series of questions to make sure that the agreement is voluntary and that the parties accept its terms. By and large, the judge is worried, for example, not that by agreement any real estate is transferred to you (or, conversely, not transferred), but that your decision is not dictated by pressure from the other side.

Very often people ask if they can get alimony in a divorce. First of all, let's find out what is alimony?

These are cash payments from one of the former spouses to the other to maintain his financial condition. Alimony is, as it were, an expression of financial obligations taken upon entering into a marriage union. In the old days, for example, in a divorce, the husband was always required by law to pay maintenance to his wife, since he brought income to the house, while the wife took care of the household. But in recent decades, spousal employment procedures and related legal provisions have changed, and, under the laws of most states, alimony can be awarded to both the wife and the husband. In addition, alimony may not be awarded for the rest of your life, but only for a certain period of time after the divorce. Such alimony, for example, will help the ex-spouse to get a profession, which, in turn, will give him (or her) the opportunity to support himself.

In addition, alimony may not be awarded for the rest of your life, but only for a certain period of time after the divorce. Such alimony, for example, will help the ex-spouse to get a profession, which, in turn, will give him (or her) the opportunity to support himself.

It should be noted that in Texas, the court awards child support in very rare cases: when the spouses have been married for more than 5 years, if the spouse has a disability that does not allow him to work, or if the spouse cannot find work for reasons of age and health (when the spouse has not been married for many years worked and is therefore uncompetitive to find a job), or by agreement of the spouses.

The court-ordered support period can be short, such as one year. But it can also be much longer: say, ten years. The length of time will depend on the type of education you will be required to complete, the market demand for your professional skills, your childcare responsibilities, and other factors. If you still haven't found a job by the end of your child support deadline, you can apply to the court to extend the deadline, but you will need to show a good reason why you could not find a livelihood.

If you still haven't found a job by the end of your child support deadline, you can apply to the court to extend the deadline, but you will need to show a good reason why you could not find a livelihood.

If the ex-spouse (ex-spouse) remarries while receiving support, the payment of support is usually terminated, as it is assumed that it is no longer necessary due to new financial circumstances. In addition, the obligation to pay alimony may be suspended if the recipient spouse lives with another person in an actual, civil, although not documented marriage.

The amount of child support is determined by state law. In general, among the factors affecting the amount, the following are taken into account: the age and state of health of both parties, the length of the marriage, the ability of both spouses to feed themselves, the degree of responsibility to minor children, the income of the head of the family and the lifestyle of the family during the marriage. Alimony should provide the former spouse with approximately the same standard of living that this party was used to during the marriage.

If the judge is satisfied with the deal, he approves it and then issues a divorce decree. In the context of the foregoing, it should be borne in mind that the judge may refuse to grant a divorce, even if both spouses agree, if he concludes that there are no good initial grounds for divorce, or, for example, if neither spouse is a resident of this state.

If the spouses fail to reach a compromise, then there will be a trial, the outcome of which will be determined by the judge. Jurors are very rarely involved in such hearings.

A lawyer is not required to handle a divorce case, but is always preferable in divorce cases, as he is more aware of the client's rights in this situation. Often people are driven by the desire to complete such a difficult and unpleasant event as a divorce as soon as possible. But even in this case, you should at least consult a lawyer. Afterwards, when emotions fade into the background, you may regret not doing it, especially if the divorce left you with no funds to claim.

All items of any value constitute property. Property is a house, furniture (including carpets and lamps), household appliances, works of art, means of transportation (such as a car, bicycle or boat), money (in a bank account), stocks, bonds and other securities, pension and retirement accounts, a company (owned by one or both spouses individually or in partnership), etc. In addition, there are some intangible objects of value, such as a patent for an invention or your publicity that can be used for commercial purposes. Usually the most significant part of the property is real estate: land and buildings on it. If you own a home, then your home is real estate, and anything that is separable from real estate is personal property. For example, furniture in a house is personal property.

Most states have an equitable distribution system whereby property acquired by spouses during marriage is jointly owned by both. The concept of justice, however, does not necessarily imply a division exactly in half. Rather, it is based on taking into account all aspects of marriage - such as its duration, the age and state of health of the spouses, their ability to financially secure their future, responsibility towards minor children, etc. The court will take these circumstances into account when deciding on the division of property in a divorce. As for the division of property acquired during the period of marriage, strictly in half, such a system has been adopted in nine states, including California and Texas.

Rather, it is based on taking into account all aspects of marriage - such as its duration, the age and state of health of the spouses, their ability to financially secure their future, responsibility towards minor children, etc. The court will take these circumstances into account when deciding on the division of property in a divorce. As for the division of property acquired during the period of marriage, strictly in half, such a system has been adopted in nine states, including California and Texas.

Regardless of the state's marital property division system, premarital property remains in the separate possession of the spouses and is not subject to division in the event of a divorce. In addition, each spouse may retain personal gifts and inheritances received during the marriage, if care is taken to keep them separate. For example, if you inherited $10,000 and deposited it into a separate personal account, then that money belongs only to you. On the other hand, if you put this amount into a joint marital account, then, in all likelihood, it will be divided upon divorce as joint property.