How to use child care fsa

Dependent Care FSA FAQs | Employee Benefits Corporation

Pro Tips for Using Your Dependent Care Benefit

Your Dependent Care FSA saves you money on eligible dependent care expenses. Understanding these scenarios will help you get the most value out of your benefits.

Changes and Contributions

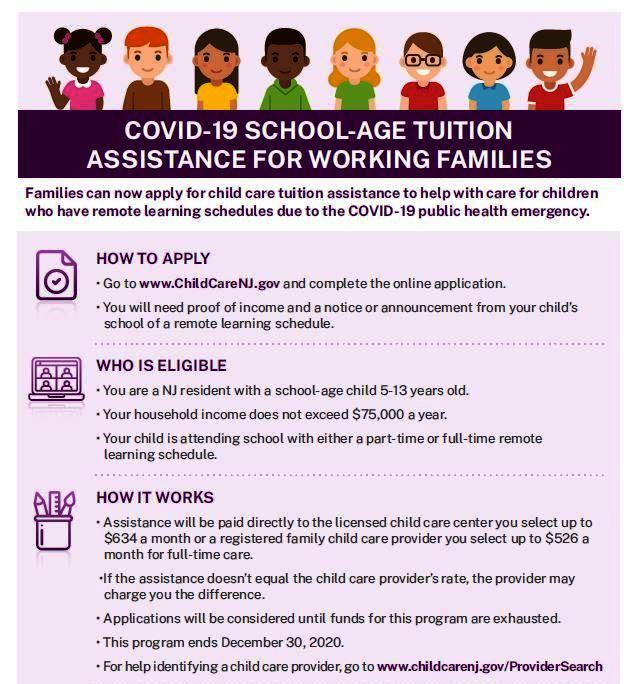

My dependent care situation has changed because of the COVID-19 response. Can I change my deductions?

If you have a Dependent Care FSA and your childcare provider has closed, you’ve had to switch providers, you are now caring for your kids at home, or the cost of care has changed as a result of COVID-19, you can change your election to match the new circumstances. Ask your employer how. Election updates usually must be made within 30 days of the childcare change. When your prior childcare circumstances resume or if there are additional changes in the future, you can update your election again.

When can I change the amount deducted from my paycheck for my Dependent Care FSA?

You can change your Dependent Care FSA contributions any time you experience a permitted election change event. Some events only allow a change if the event causes a change to plan eligibility. These events include a change to your marital status, the number or eligibility of your dependents, your employment status, or your spouse’s employment status.

Dependent Care FSAs are fairly flexible if your dependent care circumstances change and you are allowed to update your election during the year if your care provider changes or they significantly decrease or increase their rates during the plan year. In order for this type of event to permit a change, the provider cannot be your relative.

I’m expecting a baby this year. Should I try to estimate my child care expenses and enroll during open enrollment?

We recommend waiting to enroll in a Dependent Care FSA until after your child is born or adopted and registered with the care provider. This means you need to make sure to sign up within 30 days of the dependent care event so you don’t miss your opportunity!

Life circumstances are not always predictable and your need for dependent care plans may change unexpectedly if your child has unforeseen needs or a family member suddenly volunteers to help out. Once you enroll in the Dependent Care FSA, you are only able to change your election if you experience a new set of circumstances that qualify as a permitted election change event. If you enroll in anticipation of dependent care expenses or even the anticipated addition of a new family member, there is no “change” later in the year to act on.

Once you enroll in the Dependent Care FSA, you are only able to change your election if you experience a new set of circumstances that qualify as a permitted election change event. If you enroll in anticipation of dependent care expenses or even the anticipated addition of a new family member, there is no “change” later in the year to act on.

Claims and Available Funds

How do I use my Dependent Care FSA funds to pay for dependent care expenses?

Pay your provider with your preferred payment method and save your receipts or documentation. You can only be reimbursed for care that has already been received, so wait until the period of care you’ve paid for has passed. Then log into your online account and submit a claim for reimbursement. You will be reimbursed for care received as of that date and documented on the receipts you submitted, up to the dollar amount you have available in your Dependent Care FSA. Make sure to sign up for direct deposit to get your funds fast—they’re electronically deposited in your savings or checking account.

I submitted a claim from my Dependent Care FSA but have not received my reimbursement. Why haven’t I been reimbursed?

There are two reasons why your reimbursement might be delayed–your dates of service have not yet passed or you have not yet contributed enough to your Dependent Care FSA to receive full reimbursement for your claim.

Dependent Care FSA claims are not reimbursed until after the last day of service listed. For example, if you submit a claim that includes an 8 week period of care, your reimbursement will not be sent until the last day of the eighth week. To be reimbursed faster, file each week as a separate claim and you will receive reimbursement as each week passes.

You can only receive reimbursement for Dependent Care FSA claims up to the amount that has already been deducted from your paycheck. If your approved claim is for a dollar amount that is more than the amount actually withdrawn from your payroll to date, reimbursement is sent to you periodically as more funds are deducted from your pay through the year.

How long do I have to wait before submitting my next claim for reimbursement?

You may submit claims as frequently as you would like—weekly, biweekly, or monthly. Remember that your expense is only reimbursed after the service has been provided and all dates of service have concluded. Shorter claim periods result in more frequent reimbursement payments.

I am contributing $2,000 to my Dependent Care FSA this year. May I use the full $2,000 prior to having the funds deducted from my paycheck?

You can only be reimbursed up to the amount of funds you have already contributed to your Dependent Care FSA through payroll deductions. This is different from a Health Care FSA, where you have access to your entire election right away at the start of the plan year.

How long do I have to submit claims for my Dependent Care FSA?

Each Dependent Care FSA has a specific claims submission deadline, after a runout period, which is a timeframe after your benefit plan year ends when you may continue to submit claims for your dependent care expenses that took place during the plan year. Log in to your online account and refer to My Company Plan for details on your runout period.

Log in to your online account and refer to My Company Plan for details on your runout period.

I didn’t end up using all the funds in my Dependent Care FSA. Does any of it roll over to the next year?

No. IRS regulations do not allow Dependent Care FSA funds to carry forward from one year to the next.

Eligible Expenses

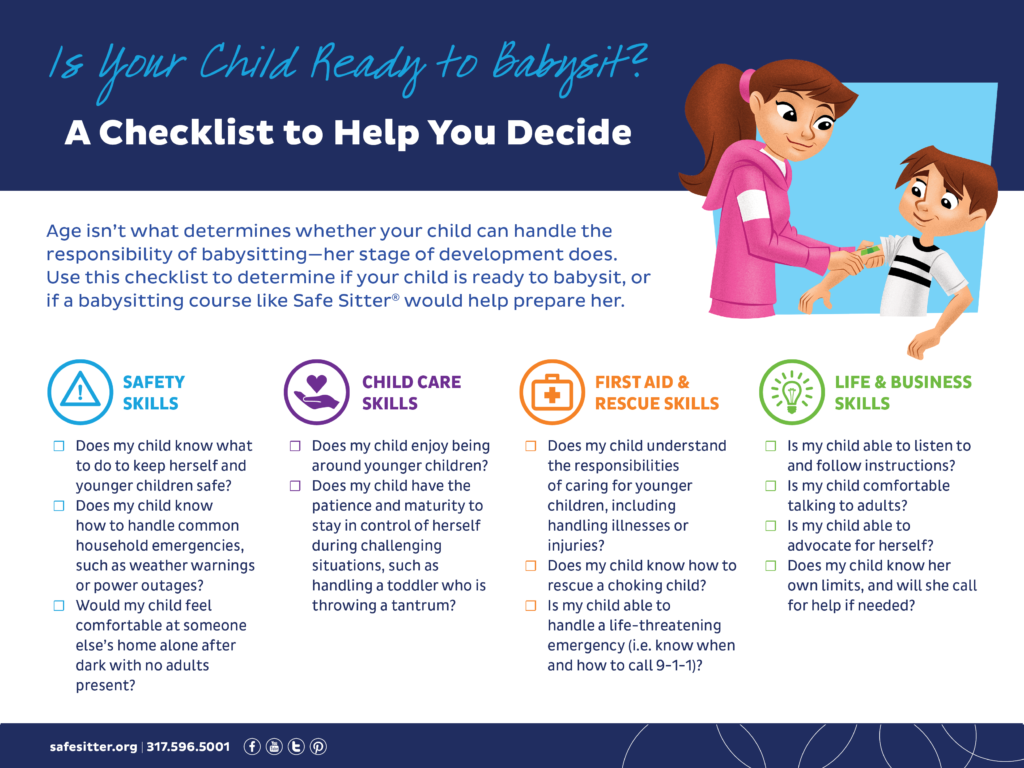

My childcare provider is my child’s grandmother. Can I get reimbursed from my Dependent Care FSA if I pay her for babysitting?

Yes. As long as the relative providing care is not claimed by you or your spouse as a tax dependent, you can be reimbursed for amounts you pay them for care of your dependent. Use caution in these circumstances because to be an eligible expense, the person you are paying for babysitting must claim the amount that you are reimbursed from your Dependent Care FSA as taxable income.

My child’s babysitter is my 17-year-old neighbor. Can I get reimbursed from my Dependent Care FSA if I pay him for the babysitting?

Yes. Your Dependent Care FSA can reimburse you for expenses paid to a babysitter under the age of 19 as long as the babysitter is not the participant’s child, stepchild, foster child, or tax dependent of the participant or spouse. However, the babysitter must provide their Social Security Number, and must claim their earnings as income.

Your Dependent Care FSA can reimburse you for expenses paid to a babysitter under the age of 19 as long as the babysitter is not the participant’s child, stepchild, foster child, or tax dependent of the participant or spouse. However, the babysitter must provide their Social Security Number, and must claim their earnings as income.

My child needs tutoring, so instead of paying for childcare during certain hours, I am now paying for him to be at the tutor. Can I use my Dependent Care FSA funds to pay tutoring expenses?

No. You may not use Dependent Care FSA funds for tutoring because it is considered an educational expense instead of a dependent care expense.

I am sending my child to an Arts & Crafts Day Camp. Can I pay with my Dependent Care FSA?

Yes. Day camp expenses are eligible for reimbursement from Dependent Care FSAs.

I am sending my daughter to overnight summer camp for 5 weeks. Can I pay with my Dependent Care FSA?

No. Overnight camp expenses are not reimbursable by a Dependent Care FSA—even if the camp separates out daytime activities.

Overnight camp expenses are not reimbursable by a Dependent Care FSA—even if the camp separates out daytime activities.

My wife resigned from her position at her job and isn’t looking for another job right now. My two sons really like daycare so we plan to keep them enrolled. Can I continue paying for their daycare expenses with my Dependent Care FSA funds?

No. For a dependent care expense to be eligible for reimbursement from a Dependent Care FSA, the care must be to enable you and your spouse to work, actively look for work, or attend school full-time. Actively looking for work means researching and applying for jobs, attending interviews, or related activities.

My son is 13 years old and I would like to continue the positive relationship he has with his longtime after-school caretaker. Can I continue to pay for this care with my Dependent Care FSA?

No. IRS regulations state that an expense that is eligible for payment from a Dependent Care FSA must be for a dependent child under age 13, unless he is physically or mentally unable to care for himself.

My elderly father is now living with me because he cannot take care of himself. If I take him to an adult day care facility, is it an eligible Dependent Care FSA expense?

Yes. Dependent Care FSA funds may be used for adult day care, provided the adult meets the definition of a “qualifying individual.” This is someone who is both mentally or physically incapable of caring for themselves, and has the same principal place of abode as you for more than half of the year. In addition, to be eligible for care outside of the home, the qualified individual must spend at least eight hours a day in your home.

My father lives with me and cannot care for himself. I have hired a caretaker to visit him in our home for a few hours while I am at work. Is this an eligible Dependent Care FSA expense?

Yes. If you (and your spouse if married) are employed, you can be reimbursed from your Dependent Care FSA for adult day care in your home as long as your father is a qualified individual and the caretaker is providing custodial care for your father.

My father lives with me because he cannot take care of himself. He needs an in-home nurse for his basic care. Can I pay for this nurse with my Dependent Care FSA?

No. A nurse is considered a health care expense instead of a dependent care expense. Health care expenses cannot be reimbursed from a Dependent Care FSA.

Dependent Care Flexible Spending Account (FSA) Benefits

Child and dependent care is a critical issue and a large expense for many American families. Millions of people rely on child care to be able to work, while others are responsible for older parents or disabled family members.

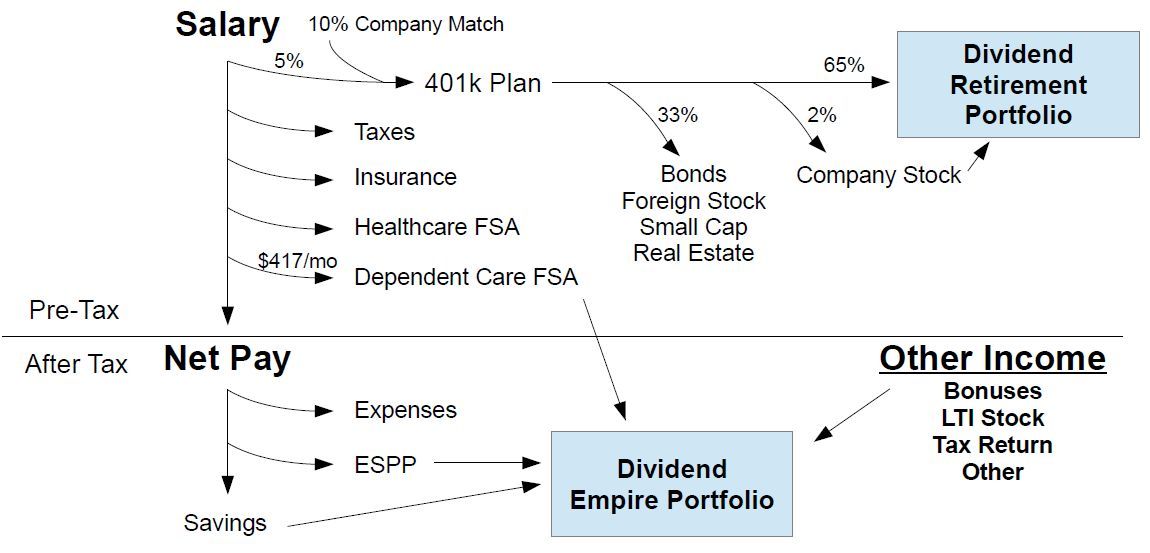

If you care for a child or adult who is incapable of self-care, who lives in your home for at least eight hours each day, and whom you can claim as a dependent on your income taxes, you may be able to take advantage of dependent care through a flexible spending account (FSA).

These accounts allow individuals to pay for qualified child and dependent care expenses while lowering their taxable income.

Key Takeaways

- Dependent care flexible spending accounts (FSAs) are only available to workers who have employers that offer them.

- Employees can withhold agreed amounts from their paychecks to fund their FSAs.

- If you are divorced, only the custodial parent may use a dependent care FSA.

- The most money in 2021 that you can stash inside of a dependent care FSA is $10,500. The limit has returned to $5,000 for 2022.

- FSA contributions cannot be returned in cash. If you don’t use the funds within a specified time frame, then you lose those contributions.

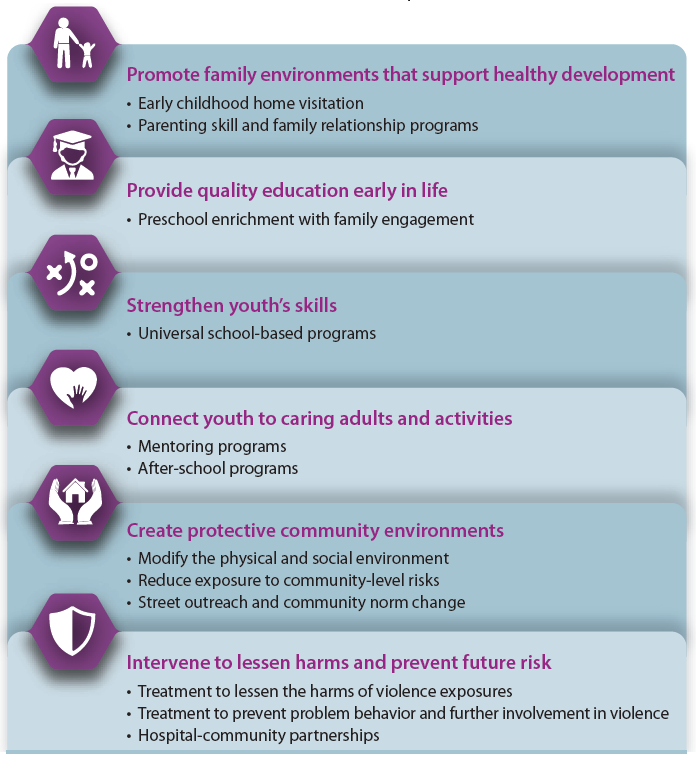

Benefits of a Dependent Care FSA

How Dependent Care FSAs Work

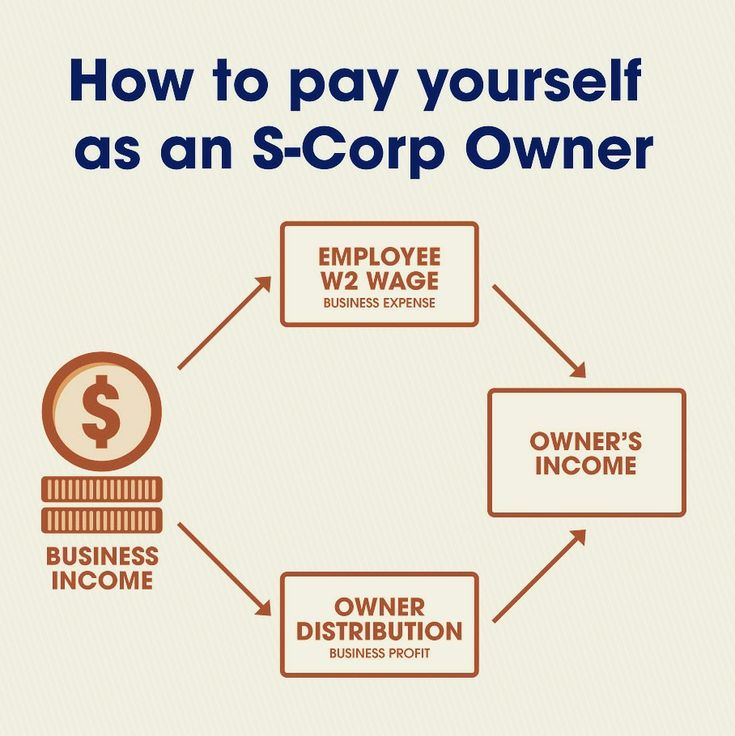

Dependent care FSAs are set up through your workplace. Participants authorize their employers to withhold a specified amount from their paychecks each pay period and deposit the money in an account. Instead of using the FSA money to pay for expenses directly, you pay those costs out of pocket and then apply for reimbursement.

Once you have paid for expenses that qualify for reimbursement from the FSA, you will need to complete a claim form provided by your employer and attach receipts or proof of payment with the form. The receipts must include specific information to prove that the payment was for qualified expenses. Specifically, the receipt must note:

- Patient’s or Child’s Name—the name of the person who received the service

- Provider’s Name—the provider that delivered the service

- Date of Service—the date when services were provided

- Type of Service—a detailed description of the service provided

- Cost—the amount paid for the service

The main benefit of an FSA is that the money set aside in the account is in pretax dollars, thus reducing the amount of our income subject to taxes. For someone in the 24% federal tax bracket, this income reduction means saving $240 in federal taxes for every $1,000 spent on dependent care with an FSA.

Investopedia / Ellen Lindner

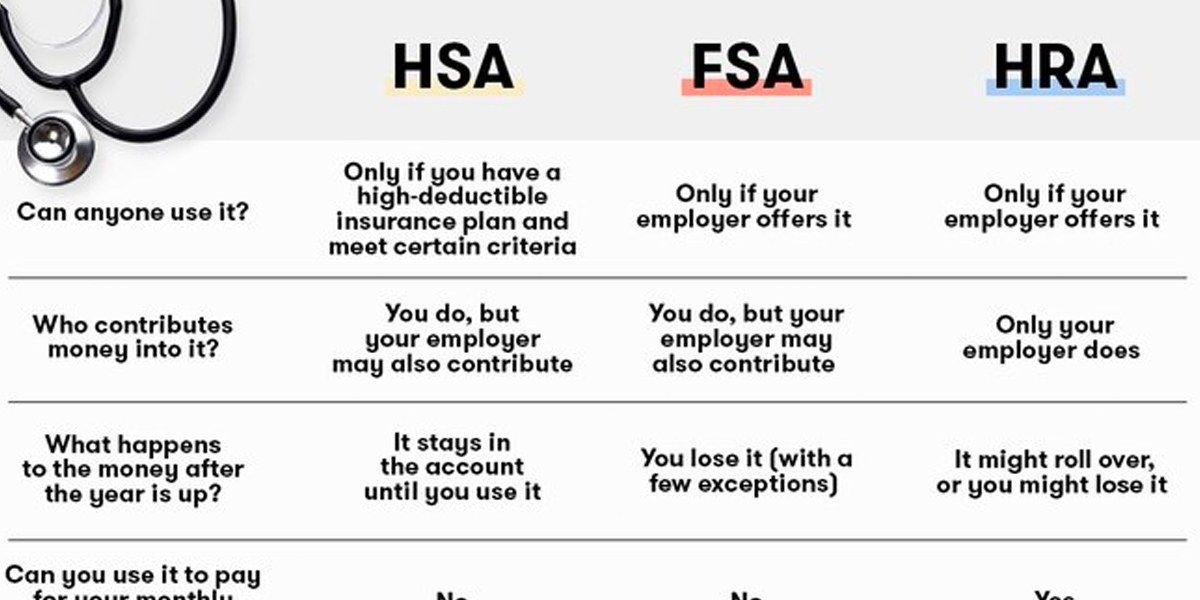

Dependent Care FSA Limits for 2022

The Internal Revenue Service (IRS) limits the total amount of money that you can contribute to a dependent care FSA. The 2021 dependent care FSA contribution limit was increased by the American Rescue Plan Act to $10,500 for single filers and couples filing jointly (up from $5,000) and $5,250 for married couples filing separately (up from $2,500). For 2022, the dependent care FSA limit returns to $5,000 for single filers and couples filing jointly, and $2,500 for married couples filing separately.

Using a Dependent Care FSA

If you and your spouse are divorced, only the parent who has custody of the child(ren) can use FSA funds for child care. If you are married, both you and your spouse must work and earn income to qualify for reimbursement (unless one spouse is between jobs and actively looking, or is disabled and unable to work). If not, then the money you contribute to the account will be forfeited and you will be billed for the taxes due because you did not pay taxes on the amount in the first place.

The Federal Flexible Spending Account Program (FSAFEDS) offers an app to help people with dependent care FSAs manage their receipts and claims. The program’s website provides in-depth information about what these care-specific FSAs can and cannot fund.

The money in your FSA can only be used for expenses for:

- A dependent who is younger than 13

- A spouse who is unable to work and care for himself or herself

- Another adult dependent who is unable to care for himself or herself and for whom you claim the dependent exemption on your taxes

Dependent care FSAs may not be used for private school tuition, but they can be used for summer day camps.

Expenses That Qualify for FSA Reimbursement

Once you deposit money into an FSA, you can begin using those funds toward reimbursement for qualified expenses. You can only use the money for bills that meet the IRS definition of eligible dependent care service. This means that the services must be necessary for you and/or your spouse to work and earn an income.

Qualified expenses include:

- Physical care

- In-home care, such as a nanny, babysitter (if there to cover for a parent who is at work vs. recreational reasons), or au pair, or institutional-setting care, such as child or adult daycare services, by qualified caregivers

- Summer day camps

- Before- and after-school care

- Transportation provided by a caregiver

- Application fees, deposits, etc. required for obtaining care, but only if care is subsequently provided

IRS Publication 503: Child and Dependent Care Expenses outlines expenses that qualify for FSA reimbursement.

The IRS issued a statement notifying taxpayers that at-home COVID-19 tests and personal protective equipment (PPE) such as face masks and hand sanitizer are both considered eligible medical expenses that can be paid or reimbursed under FSAs.

Expenses That Do Not Qualify for FSA Spending

Remember that you can only use FSA money for expenses that are necessary for you and/or your spouse to work and earn an income.

Expenses that do not qualify as FSA-approved and therefore are ineligible in an FSA include:

- Education (i.e. kindergarten, summer school, tutoring, school tuition)

- Overnight summer camps

- Enrichment programs and lessons (i.e., music, sports lessons)

- Meals

- Housekeeping

Special Considerations for FSA Dependent Care

Before creating a dependent care FSA, you should consider the following:

- FSAs are not “pre-funded.” With some healthcare FSAs, the employer fronts the money and is repaid through paycheck withholding. With dependent care FSAs, you pay expenses out of pocket, then receive reimbursement based on how much you have withheld from your paycheck for dependent care expenses.

- Before setting up a dependent care FSA, compare its potential tax benefits with the child and dependent care tax credit.

- FSAs typically operate with a “use it or lose it” policy, meaning that you must use all of the money you deposited into the account for qualified expenses by the end of the plan year or you will lose your money.

However, there are exceptions to this rule. For 2021, due to provisions of the Consolidated Appropriations Act, employers can allow all unused funds to be carried over from 2021 to 2022 and used throughout the year.

However, there are exceptions to this rule. For 2021, due to provisions of the Consolidated Appropriations Act, employers can allow all unused funds to be carried over from 2021 to 2022 and used throughout the year. - You will need to report your FSA contributions on your federal tax return.

- Participation in a dependent care FSA is not automatic—you must reenroll every year by the enrollment deadline.

- You can only change the amount of money that you choose to have withheld from your paycheck for the FSA within a 31-day window following a qualifying event, such as a marriage, the birth or adoption of a child, the death of a dependent, divorce, or a change in your (or your spouse’s) employment.

What is a dependent care flexible spending account (FSA)?

A dependent care flexible spending account (FSA) is a pretax benefit account used to pay for eligible dependent care services, such as preschool, summer day camp, before- or after-school programs, and child or adult daycare.

What expenses can I use a dependent care FSA for?

You can only use the money for bills that meet the Internal Revenue Service (IRS) definition of eligible dependent care service. This means that the services must be necessary for you and/or your spouse to work and earn an income.

What is the dependent care FSA limit For 2022?

For 2022, the dependent care FSA limit is $5,000 for single filers and couples filing jointly, and $2,500 for married couples filing separately.

The Bottom Line

Opening and funding a dependent care FSA can help you plan and pay for the care you need to help you be able to work and earn a living.

Consider looking into a plan offered by your or your spouse’s employer, and learn about how much you could save on taxes by taking advantage of this option.

Dependent Care Flexible Spending Account (FSA) - Financial Encyclopedia

What is Dependent Care Flexible Spending Account (FSA)

Dependent Care Flexible Spending Accounts allow employees to use tax-exempt funds to pay for dependent care expenses children they carry at work. Employees may also use the FSA to cover the cost of caring for eligible adult dependents who live in their home, including spouses and parents. Parents and guardians can save a significant amount of money if they use the FSA instead of after-tax dollars to pay for dependent care costs.

Employees may also use the FSA to cover the cost of caring for eligible adult dependents who live in their home, including spouses and parents. Parents and guardians can save a significant amount of money if they use the FSA instead of after-tax dollars to pay for dependent care costs.

Flexible Dependent Care Account (FSA) overview

Employers take FSA dependent care contributions from employees' paychecks before most taxes, exempting those contributions from federal income tax, payroll tax, and some state taxes . Some states levy income tax on FSA contributions. The maximum FSA contribution for dependent care is $5,000 per year per family, or the amount of earned income reported by the employee or spouse, whichever is less.

Dependent Care FSA Costs and Eligibility

You can use the Dependent Care FSA to cover the cost of day care for a child age 12 or younger. The FSA may cover preschool and summer camps, although you cannot use this account to pay for kindergarten or school for a child age 5 or older. In addition, you cannot use the account to reimburse an older child who looks up to a younger sibling.

In addition, you cannot use the account to reimburse an older child who looks up to a younger sibling.

While many taxpayers use accounts to pay for child day care expenses, you can also use this account to pay for adult day care expenses for other eligible dependents, including elderly family members who live with you. The insurance also covers a spouse who is mentally or physically unable to stay at home alone.

Dependent Care FSA is designed to cover day care expenses that employees incur because they work, so the taxpayer must have earned income to qualify for the FSA. If the taxpayer is married, the spouse must have earned income, be actively looking for a job, or be in full-time education.

Special Considerations for FSA Dependents

As an example, let's say your combined federal, state, and payroll taxes are 30 percent. If you contribute a maximum of $5,000 to the FSA, it will save you $1,500 in taxes. Most employers require you to pay out of pocket for dependent care costs and then apply for reimbursement.

Carefully consider your expected day care costs before deciding how much to contribute to your FSA. If you are unable to use your entire account by the end of the year, you will forfeit the balance. It is also important to note that the $5,000 maximum contribution applies to single applicants and couples applying together. If both spouses are working, couples can put all expenses in one account or split their FSA contributions between two accounts, up to a total of $5,000. If you plan to apply for a child care tax credit, you must deduct any expenses you paid through the FSA.

how does the FSA work? • BUOM

June 17, 2021

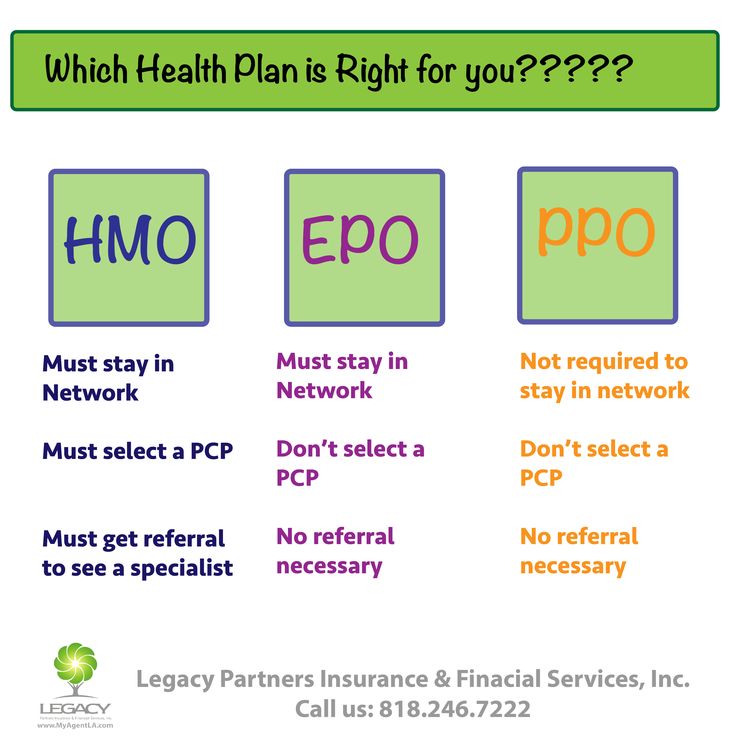

Rising healthcare and dependency care costs have inspired many types of plans and insurances to alleviate these costs. However, some plans still do not cover certain procedures or expenses, such as lost time at work, travel expenses, or rehabilitation costs. The FSA, or Flexible Spending Account, serves as an alternative for employers and employees to ensure that employees can fully cover medical or childcare costs. In this article, we will discuss what the FSA is, how it works, the benefits of using it, and who is eligible.

In this article, we will discuss what the FSA is, how it works, the benefits of using it, and who is eligible.

What is FSA?

An FSA, or Flexible Spending Account, is an account created for employees to which they allocate a portion of their salary for future out-of-pocket healthcare or childcare expenses. It is often part of a benefit package offered by many employers. These accounts allow employees to distribute pre-tax profits into a special account for themselves, their spouse, and their dependents. The FSA helps create a provision for personal expenses that fall outside the employee's insurance coverage or for personal child care expenses. Insurance plans often have maximum payouts and limits for certain procedures or medical needs.

How does the FSA work?

The FSA has certain requirements and restrictions set by the IRS. The following types of FSA accounts may have different rules and processes:

Windows apps, mobile apps, games - EVERYTHING FOR FREE, in our private telegram channel - Subscribe :) employees can contribute up to $2,750 per year from 2021. The IRS may adjust this maximum limit in response to factors such as inflation and a higher cost of living. All money you deposit into an FSA account is tax-free, but belongs to your employer. This means that if you leave the company within a year, you will not get that money back. You usually only have one calendar year to spend your contribution.

The IRS may adjust this maximum limit in response to factors such as inflation and a higher cost of living. All money you deposit into an FSA account is tax-free, but belongs to your employer. This means that if you leave the company within a year, you will not get that money back. You usually only have one calendar year to spend your contribution.

FSAs may occasionally be rolled over to the next calendar year, which means that a portion of any remaining funds are available. The IRS currently allows employees to carry over up to $550 from the previous year's FSA account. Spouses can contribute funds to individual FSA accounts with their respective employers, each with a limit of $2,750 per year and a rollover limit of $550 per year.

FSA dependent care

FSA dependent care requirements are different. Dependents are children under the age of 13. FSA Dependent Care helps cover childcare costs, including childcare and travel expenses. Married parents can add up to $2,500 each for individual dependent care FSAs or up to $5,000 for a joint tax return. This account also allows you to roll over up to $500 annually.

This account also allows you to roll over up to $500 annually.

FSA Dependent Care helps employees reduce their gross income, which may result in a reduction in their tax bracket. This can reduce your tax burden and provide a flexible reserve account for sudden or large child care expenses. Reducing the burden of childcare can also help working parents save more of their income.

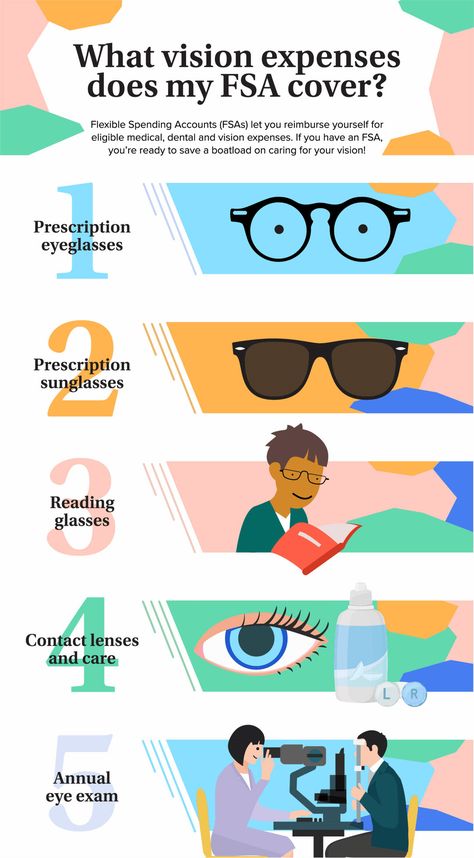

Limited FSA

Limited FSA is a flexible expense account that employees can use to cover dental and vision expenses. Some employers only offer health insurance without dental or eye care coverage, which creates a need for extra money to cover glasses, contact lenses, or dental procedures. An employee can contribute up to $2,750 per year to a limited purpose FSA. An employee must have an HSA or a medical savings account in order to contribute to the restricted FSA.

Employee benefits of the FSA

Employees can benefit from the FSA in many ways. The availability of the FSA varies by organization, but an employee who has access to the FSA benefits from:

Tax-exempt spending options

Employees add funds to the FSA before the employer deducts taxes from their payroll. This tax-free expense account allows employees to ease some of their tax burden. For example, if an employee adds $50 to their FSA every pay period, that's $50 they won't be taxed on. This can help save money in the long run by reducing the total income an employee reports for tax purposes.

This tax-free expense account allows employees to ease some of their tax burden. For example, if an employee adds $50 to their FSA every pay period, that's $50 they won't be taxed on. This can help save money in the long run by reducing the total income an employee reports for tax purposes.

Subsidized medical expenses

The FSA acts as a reserve account for medical expenses. In a sense, the employer helps employees subsidize their medical expenses with this tax-free income. This can be useful for high deductible health plans, unexpected medical expenses, or out-of-coverage expenses. Health plan coverage can vary by health insurance provider, so having a reserve account to cover additional medical expenses can help save money and offset the severity of unexpected expenses.

Subsidized Child Care Expenses

Dependent FSAs allow parents to cover child care expenses and sudden child care expenses. The money is not taxed and is placed in a spending account. Parents can access this account for qualifying child care expenses.

Parents can access this account for qualifying child care expenses.

Usage specifics

Employees may only use the FSA for the specific purpose of the account. This means they cannot withdraw money for unnecessary or other expenses. This helps employees maintain financial discipline and prevents FSA money from being used for online shopping, travel or vacations.

FSA Benefits for Employers

Employers also benefit from the FSA offering to their employees. These benefits can help an employer save money and time. Here are some other benefits:

-

Tax Relief: Employers can avoid the 7.65% IRS payroll tax on any employee contributions to FSA health insurance. This reduces the company's overall tax burden because the FSA program of about $5 per employee is less than the payroll tax percentage.

-

Employee Benevolence: The employer-sponsored FSA offers employers the opportunity to help employees with medical or child care costs.