How to pay off arrears child support

Debt Reduction - HRA

There is one aspect of the Child Support Program that is barely discussed: child support debt. This issue is large in scale and complexity and mostly owed by people with little to no recorded income. Child Support debt is owed to the government or to the child's other parent, and in some cases to both.

People owe child support to the government because money is retained by the government to pay back public cash assistance (most commonly, TANF benefits) received by that parent’s child. Overwhelmingly, it is low-income fathers, a very large percentage of them Black or Latino, who feel the greatest effects of this policy and the indebtedness that it creates.

The New York City Office of Child Support Services (OCSS) understands that debt from any source can have a negative effect on an individual’s mental and physical health, but research suggests that it can also affect whole families. When that debt comes from unpaid child support, it can even undermine the primary goal of the program—getting children the financial support they need—by potentially discouraging employment among noncustodial parents and causing them to disengage from their children’s lives.

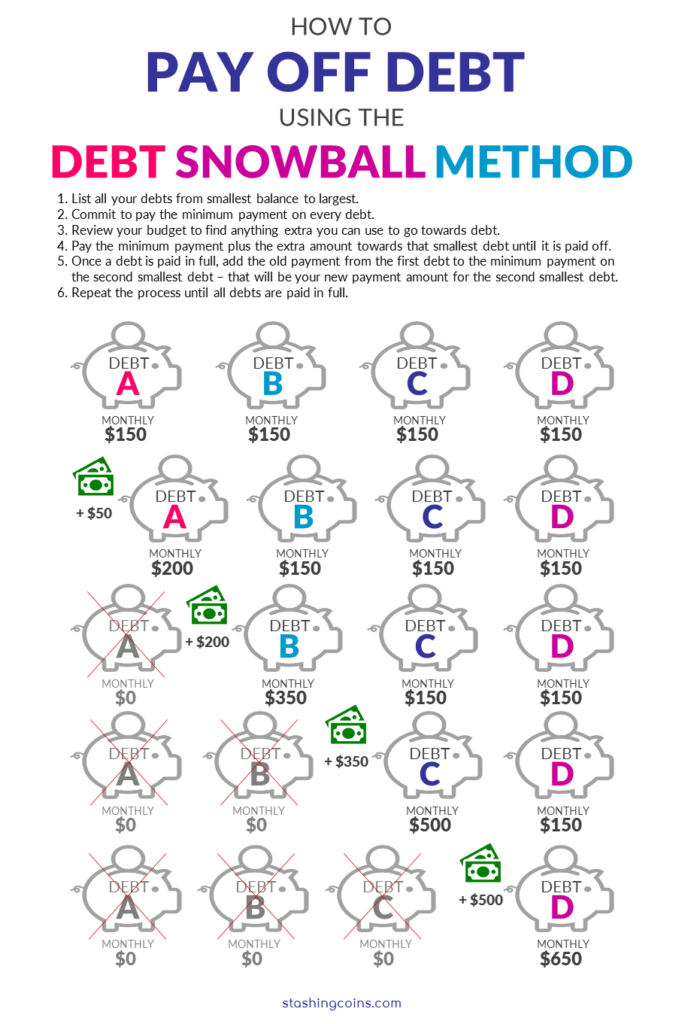

Noncustodial parents who owe DSS child support arrears can improve their future, and their children's, by taking the necessary steps to lower their debt or to bring their child support order into line with their income. Many parents qualify for the programs described below but few take advantage of them. To date, OCSS has reduced over $225 million of debt owed to the government and what we have seen is that reducing debt leads to increased child support payments.

For noncustodial parents with debt owed to the child’s other parent, free or low-cost mediation services can help both parents work out an agreement on whether they want to reduce the arrears and under what conditions.

If you have questions about any of these programs, email us at [email protected] with the program’s name, for instance, “MOTS” or “Arrears Cap,” in the email subject line.

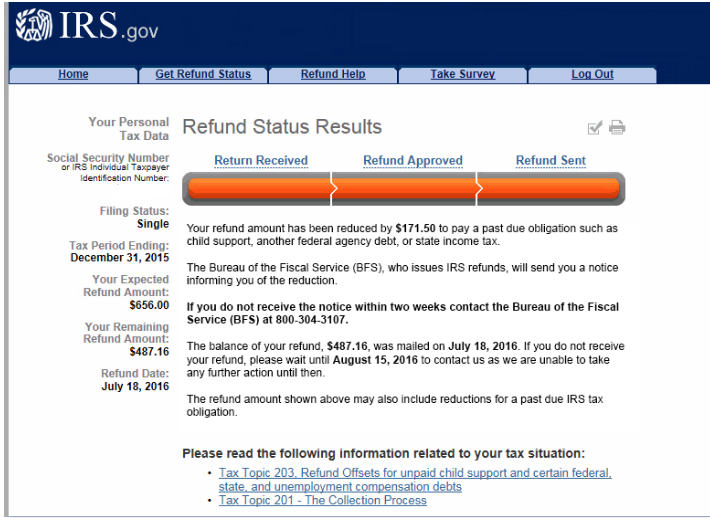

In addition, the Earned Income Tax Credit (EITC) helps low- to moderate-income parents get a tax break on their federal tax return. The City offers free financial counseling through the Department of Consumer and Worker Protection. One-on-one professional counselors can help with managing money and minimizing debt.

The City offers free financial counseling through the Department of Consumer and Worker Protection. One-on-one professional counselors can help with managing money and minimizing debt.

Arrears Cap can put a limit on the amount of child support debt that a noncustodial parent owes to the government. The amount of arrears can be reduced to as low as $500. To qualify, noncustodial parents must owe child support debt to the NYC Department of Social Services (DSS). The parent's income must have been below the federal poverty level when their DSS arrears accumulated. Noncustodial parents can apply by mail.

The Arrears Credit Program is open to noncustodial parents who owe DSS child support arrears and do not have more than $3,000 in the bank or more than $5,000 in property. Parents can qualify for a yearly credit of up to $5,000 on their DSS debt. They can also take advantage of this program up to three years – for a credit of up to $15,000 on DSS debt for each eligible case. There are two ways to participate: 1) by paying the full amount of child support owed each month for one year, or 2) for those without a current order, by paying the full amount of the last child support order each month for one year toward the debt owed on the account. Noncustodial parents can apply by mail.

There are two ways to participate: 1) by paying the full amount of child support owed each month for one year, or 2) for those without a current order, by paying the full amount of the last child support order each month for one year toward the debt owed on the account. Noncustodial parents can apply by mail.

The new Parent Success Program is designed to help noncustodial parents by supporting their well-being and strengthening their ability to provide for their children. In the first phase of the program, parents can eliminate up to $10,000 in DSS child support debt by completing a qualifying substance use treatment program. The treatment program must be certified by the New York State Office of Alcoholism and Substance Abuse Services (OASAS). Once parents have completed the course, they must submit a completion certificate or letter from their service provider to OCSS to qualify for the Parent Success Program's DSS debt reduction.

Pay It Off is a time-limited program that enables noncustodial parents to pay off New York City DSS child support debt twice as fast – by matching their payments that total a minimum required amount (up to the amount of DSS child support arrears they owe). This year, the program is offered October 17 - 31, 2022.

This year, the program is offered October 17 - 31, 2022.

Modifying Orders Through Stipulation (MOTS) gives parents the opportunity to discuss modifying their order with an OCSS worker and to enter into an agreement voluntarily before an appearance in court. For a stipulated agreement:

- An OCSS worker drafts the agreement using the same guidelines as the court and helps the parents gather the required documents.

- The approved stipulated agreement package is filed in court for a hearing to be scheduled.

- Usually only one court appearance is required for the Support Magistrate to make sure the parents understand their rights and responsibilities and to issue a modified order on consent.

State Child Support Agencies With Debt Compromise Policies

Skip Map

Alabama

An interest rebate law allows for forgiveness of interest owed to the state and custodial parent (if the custodial parent agrees), in cases where current support is paid consistently for at least 12 months.

Source: Code of Alabama §30-3-6.1 Visit disclaimer page

Back to top

Alaska

The state offers debt forgiveness for noncustodial parents who have accrued at least $1,500 in state-owed child support arrears and meets other eligibility criteria. If the parent complies with the arrears forgiveness agreement, state-owed debt will be forgiven in stages over a 6-year period.

Source: 15 AAC 125.650 Visit disclaimer page

Back to top

Arizona

The Division of Child Support Services (DCSS) Settlement Program assists noncustodial parents who may have a large arrears balance on their child support case. It provides an opportunity to pay off past-due balances.

If you are limited in your ability to pay, you may offer to settle your arrears balance by paying either a lump sum or by making monthly installments that can be accepted for up to three months.

To participate in the program:

- Think about how much you would like to offer to settle the past due amount.

- Stop by a local DCSS office or contact the DCSS Customer Service Center at 602-252-4045 or 1-800-882-4151, or email the DCSS Settlement Team at [email protected] to submit your settlement offer.

Note: The state’s role is not to advocate the amount of the settlement, but to facilitate whatever offer is appropriate for the state and the parties involved in the case. The DCSS cannot require a custodial parent to accept a settlement offer.

Source: Arizona Parents who Pay Child Support Visit disclaimer page

Back to top

Arkansas

Does not have a program.

Back to top

California

The California Department of Child Support Services’ Debt Reduction Program aims to increase support collected for families and resolve uncollectable debt that is owed to the state of California. The Debt Reduction Program allows for the acceptance of a partial-pay offer in exchange for compromising the remainder of permanently assigned arrears owed by a participant.

Source: Child Support Reduction Program Visit disclaimer page

Back to top

Colorado

County child support offices have the ability to offer arrears compromise for assigned child support arrears. It is up to the counties to determine if they want to implement an arrears compromise program and, if so, what criteria they wish to use.

Source: State

Back to top

Connecticut

Connecticut has implemented two arrears programs. The first one, the Arrears Adjustment Program, is designed to reduce state-owed debt as well as encourage the positive involvement of NCPs in the lives of their children and to pay current support. The second program, the Arrears Liquidation Program, is designed to liquidate state-owed arrears by allowing obligors to pay off arrears in a lump-sum payment at a discounted rate.

Source: Regulations of Connecticut State Agencies §17b-179b-1 to §17b-179b-4 Visit disclaimer page

Back to top

Delaware

Does not have a program.

Back to top

District of Columbia

The Fresh Start program allows for a portion of Temporary Assistance for Needy Families (TANF) arrears to be forgiven in return for successfully making consecutive timely payments on the current support obligation or making a lump sum payment towards arrears. The Child Support Services Division must invite noncustodial parents to participate in the program.

Qualifications are:

- At least $1,000 owed in TANF arrears

- No voluntary payment in at least 12 months

- Previous unsuccessful enforcement efforts

- Valid addresses for both parties

- Failure to pay support must not be due to bad faith

- Responding interstate cases are not eligible for the program

Source: District of Columbia Fresh Start Program Visit disclaimer page

Back to top

Florida

Does not have a program.

Back to top

Georgia

A state statute gives the child support program the authority to waive, reduce, or negotiate the payment of state-owed arrears for administrative child support orders if it is determined that there is good cause for nonpayment or that enforcement would result in substantial and unreasonable hardship to the parent or parents responsible for the support. Courts have discretion in applying or waiving past-due interest owed on arrears.

Courts have discretion in applying or waiving past-due interest owed on arrears.

Source: O.C.G.A. § 19-11-5, § 7-4-12.1; Ga. Comp. R. & Regs. r. 290-7-1-.20

Back to top

Hawaii

Does not have a program.

Back to top

Idaho

Does not have a program.

Back to top

Illinois

Project Clean Slate provides opportunities for low‐income noncustodial parents to apply for forgiveness of assigned arrears in exchange for making regular, ordered payments of current support to the custodial parent for six months. The noncustodial parent must have demonstrated that they were unable to pay the assigned support at the time it was owed due to unemployment, incarceration, or serious illness. The noncustodial parent must also meet low‐income standards.

Source: Clean Slate Program Visit disclaimer page; Illinois Public Aid Code §5/10-17.12; 89 Illinois Administrative Code Section 160.64.

Back to top

Indiana

Does not have a program.

Back to top

Iowa

The Promoting Opportunities for Parents Program assists parents in overcoming the barriers which interfere with fulfilling their obligations to their children. In order to encourage parent participation, Iowa’s Child Support Recovery Unit may partner with community providers and resources and offer incentives. The incentives include satisfactions of arrears due to the state for payment of court-ordered child support.

Source: Iowa CSRU Customer Handbook Visit disclaimer page

Back to top

Kansas

The updated incentive program returned January 1, 2021, with an effective date of September 1, 2020. The focus of the updated incentive program is to work with payors to achieve stable employment. The primary incentive remains: a reduction of state-owed arrears only, with a lifetime maximum of $2500 and an additional incentive of $1000 for those payors who complete their GED or high school diploma. So, the lifetime maximum for those who obtain a GED is $3500.

There are three different categories in the incentives:

1) Career enhancement: Enables a payor to progress in their career, $2000 cap (HVAC certificate, barbershop or cosmetology license, forklift driver certificate, etc.)

2) Education: $1000 cap (GED or high school equivalent)

3) Personal enhancement: $500 cap (fatherhood or parenting class, finance class, addiction class, etc.)

The incentives are capped by their category. For example, the completion of an addiction class and a financial class will only result in one $500 incentive. Completion of both the HVAC and Welding certificate programs will only result in one $2000 incentive. In addition, if a payor has already received the maximum amount under prior versions of the incentive program, they will not receive additional incentives. If, however, a payor only received $500 previously, they could be eligible for additional incentives under this program.

Beginning January 1, 2021, all incentives program requests with their appropriate documentation (certificates of completion, attendance logs, etc. ) must be sent to [email protected] for consideration and approval of credit.

) must be sent to [email protected] for consideration and approval of credit.

Back to top

Kentucky

Does not have a program.

Back to top

Louisiana

Does not have a program.

Back to top

Maine

Does not have a formal program. The state considers debt forgiveness on a case-by-case basis only for assigned arrears. Factors considered are:

- Ability to pay (present and future)

- Partial or continuing payments for current or partial debt

- Reduction in state owed arrears

- Potential case closure

Back to top

Maryland

The Payment Incentive Program encourages the noncustodial parent to make consistent child support payments by:

- Reducing state-owed arrears by half if the noncustodial parent makes full child support payments for a year.

- Eliminating the balance owed if the noncustodial parent makes full child support payments for two years.

The noncustodial parent will receive credit for uninterrupted court-ordered payments made immediately prior to participation in the program. Consideration will be given for periods of unemployment due to seasonal work and no-fault termination.

Source: Maryland Payment Incentive Program Visit disclaimer page

Back to top

Massachusetts

Massachusetts child support regulations allow for the settlement of interest, penalties, and arrears, as well as equitable adjustment of arrears. The Child Support Commissioner may waive all or a portion of the interest and penalties owed to the Commonwealth if the Commissioner determines such waiver is in the best interest of the Commonwealth and will maximize collection of current and past‐due child support.

The Commissioner may also accept an offer in settlement that is less than the full amount of state‐owed arrears, where there is serious doubt as to liability or collectability of such arrearages. The Commissioner may also equitably adjust the amount of child support arrearages owed to the Commonwealth when the obligor has no present or future ability to pay the full arrearages.

Source: 830 CMR 119.A.6.2 Visit disclaimer page

Back to top

Michigan

Several laws allow for adjustment of arrears and interest.

- In some cases, the Department of Human Services or its designee may use discretion to settle and compromise state-owed arrears (MCL 205.13).

- Other laws allow noncustodial parents who do not have the ability to pay the arrearage in full, presently, or in the near future to request a payment plan (for a minimum of 24 months). At the completion of the payment plan, the court may waive any remaining arrears owed to the state (MCL 552.605e).

- Additionally, noncustodial parents may request a payment plan as a means to have the surcharge (interest) waived or reduced if regular payments are made (MCL 552.603d).

Source: MCL 205.13 Visit disclaimer page, MCL 552.605e Visit disclaimer page, MCL 552.603d Visit disclaimer page

Back to top

Minnesota

State statute gives the parties (including the public authority with assigned arrears) the authority to compromise unpaid support debts or arrearages owed by one party to another, whether or not docketed as a judgment.

Source: Minn. Stat. §518A.62 Visit disclaimer page

Back to top

Mississippi

Does not have a program.

Back to top

Missouri

Does not have a program.

Back to top

Montana

Does not have a program.

Back to top

Nebraska

Does not have a program.

Back to top

Nevada

Nevada will only consider arrears-only cases where there is no money owed to the custodian. The noncustodial parent must apply and provide supporting documents. Each application is reviewed, and a recommendation is provided to the Administrator of the Division of Welfare and Support Services who has authority to forgive state debt.

Source: State

Back to top

New Hampshire

The New Hampshire Division of Child Support Services does not have a formal debt compromise policy. Child support workers do have some discretion to negotiate agreements to secure current support that may include forgiveness of assistance debt owed to the state that accrued prior to the establishment of a child support order and which was based on imputed income. Any such agreement must be approved by the child support worker’s supervisor. Check with the state for more information.

Any such agreement must be approved by the child support worker’s supervisor. Check with the state for more information.

Source: State

Back to top

New Jersey

Occasionally, the New Jersey Child Support Program will offer a time-limited match on payments made towards the child support case and credit the same amount towards the arrears balance owed to the state. The program is announced yearly and is based on availability of funds.

Source: New Jersey Arrears Match Program Visit disclaimer page

Back to top

New Mexico

New Mexico’s Child Support Arrears Management Program, Fresh Start, supports the needs of today’s modern family by reviewing cases to focus on right-sized court orders, resulting in more payments and less debt. This program may provide an option for the noncustodial parent to reduce the amount of assigned arrears by providing a lumpsum payment or consistent monthly payments to the custodial parent. To be eligible, the noncustodial parent must have over $1,000 of state-owed arrears and meet other additional criteria outlined on the Fresh Start Arrears Management Program Visit disclaimer page.

Source: State

Back to top

New York

New York State offers several debt compromise programs to noncustodial parents who owe the state. The program varies depending on the local district. Interested persons must confirm with the local district where their order was issued if the service is available.

- Arrears Cap: a limit on the amount of child support debt owed to the government.

- Arrears Credit Program: open to noncustodial parents who owe Department of Social Services child support arrears and do not have more than $3,000 in the bank or more than $5,000 in property.

- Parent Success Program: designed to help noncustodial parents by supporting their well-being and strengthening their ability to provide for their children by completing a substance-use treatment program.

- Pay It Off: a time-limited program that enables noncustodial parents to pay off NYC DSS child support debt twice as fast. See the website for more information about each program.

Source: New York Debt Reduction Visit disclaimer page

Back to top

North Carolina

To be eligible the obligor must:

- Owe a minimum of $15,000 in state‐owed arrears

- Agree to make 24 consecutive monthly payments for current support and an amount toward arrears

- Comply with the agreement.

Source: NC General Statute, Chapter 110, Section 135 (§ 110-135) Visit disclaimer page (PDF)

Back to top

North Dakota

North Dakota has three goals for its debt compromise program:

- Motivate obligors to comply with long-term payment plan

- Eliminate uncollectible debt

- Facilitate case closure where appropriate

Compromise of assigned arrears is permitted if an offer is received for at least 95% of the outstanding arrears balance (after subtracting all negotiable interest) or 90% with IV-D Director approval.

Interest may be compromised when an obligor enters into a payment plan to avoid license suspension or other enforcement remedies or when an obligor has been making payments on a regular basis.

In both cases, interest is not charged while regular payments are made and, after one year of regular payments, any unpaid interest that had accrued before that date can be compromised.

Interest can also be considered uncollectible under certain circumstances. Some situations are pre-approved, such as an obligor is receiving Supplemental Security Income. In these cases, a worker may prevent interest from accruing on the case and can request an adjustment to the payment record for any unpaid interest that has already accrued.

In situations that are not pre-approved, the worker cannot suspend interest or have it waived as uncollectible without IV-D Director approval.

Source: State

Back to top

Ohio

Permanently assigned arrears can be reduced if/ when the obligor satisfies all the terms and conditions of a waiver, installment plan compromise, lump sum compromise, or a family support program.

Source: Ohio Administrative Code: Rule 5101:12-60-70 Visit disclaimer page

Back to top

Oklahoma

The state permits a waiver of some or all child support arrears with court approval, provided the parents mutually agree (or the state agrees when the debt is owed to the state).

Settlements of past support may include an agreement that the noncustodial parent make a lump-sum partial payment or a series of payments toward the total amount of past support.

Settlements also may include an agreement for the noncustodial parent to pay a specified number of current child support payments or in-kind payments in the future.

In addition, the state has established an amnesty program for accrued interest owed to the state. The state attorney in the local district must approve all settlements of state-owed interest.

Source: 43 O.S. §112 Oklahoma Administrative Code 340:25-5-140 56 O.S. §234 Visit disclaimer page

Back to top

Oregon

The Oregon Child Support Program/ Division of Child Support does not have a formal program, but forgiveness is used in appropriate situations. The program considers the family’s best interest and may satisfy all or any portion of child support arrears that are assigned to the State of Oregon or to any other jurisdiction if:

- The arrears are a substantial hardship to the paying parent

- A compromise will result in greater collections on the case; or

- The paying parent enters into an agreement with the program to enhance the parent’s ability to pay or their relationship with the children for whom the parent owes arrears.

Source: OAR Rule 137-055-6120 Visit disclaimer page

Back to top

Pennsylvania

Per Pennsylvania Supreme Court Rule, any compromise of state-owed debt must be approved by the court.

Source: State

Back to top

Rhode Island

The Office of Child Support Services has the discretion to compromise state-owed arrears.

Source: State

Back to top

South Carolina

Does not have a program.

Back to top

South Dakota

South Dakota Division of Child Support (DCS) does not have a formal debt compromise policy.

Child support workers do have some discretion to negotiate a lump sum settlement of 75% of state-owed arrears. If the parents agree to a lump sum settlement for arrears owed to the family, DCS has a forgiveness of arrears form, which the parties can sign. The form is submitted to the court for approval. If the court approves the settlement, DCS will remove the arrears from the case.

Source: State

Back to top

Tennessee

With the approval of the court, the parties have the right to compromise and settle child support arrears owed directly to the person owed support (family-owed arrears). State-owed debt cannot be forgiven.

State-owed debt cannot be forgiven.

Source: Public Chapter 200, amending Tennessee Code Annotated, Section 36-5-101(f) Visit disclaimer page (PDF)

Back to top

Texas

The child support agency may establish and administer a payment incentive program to promote payment by noncustodial parents who are delinquent in satisfying child support arrearages assigned to the child support agency under Section 231.104(a).

The program must provide to a participating noncustodial parent a credit for every dollar amount paid on interest and arrearage balances during each month of the NCP’s voluntary enrollment in the program.

Source: Texas Family Code 231.124 Visit disclaimer page

Back to top

Utah

The Prisoner Forgiveness Program targets recently released prisoners and forgives state‐owed arrears for those who are approved for the program and pay 12 consecutive months of current support plus a nominal amount toward arrears.

Utah also targets obligors in treatment programs and forgives state‐owed arrears for those who are approved for the program and pay 12 consecutive months of current support and/or arrears.

Source: UT Admin. Code Rule R527‐258

Back to top

Vermont

The court may limit the child support debt, taking into consideration the criteria of 15 V.S.A. § 659.

Source: 33 VSA §3903 Visit disclaimer page

Back to top

Virginia

The Division of Child Support Enforcement's Temporary Assistance for Needy Families (TANF) Debt Compromise Program is available to parents who owe TANF debt under a Virginia court or administrative order.

The program is designed to encourage consistent child support payments by offering eligible parents a debt reduction in TANF debt. There are three tiers of participation based on your ability to pay. For more information on how much you may be eligible to save, call 800-468-8894 or visit your local district office.

Source: State Child Support TANF Debt Visit disclaimer page

Back to top

Washington

The Child Support Department may accept offers of compromise of disputed claims and may grant partial or total charge-off of support arrears owed to the state.

The state established an administrative dispute resolution process through its Child Support Conference Boards to hear parents’ request to reduce the amount of arrears and make determinations based on the individual circumstances.

Source: Rev. Code of Washington 74.20A.220 Visit disclaimer page, Washington Admin. Code 388-14A-6400 through 388-14A-6415 Visit disclaimer page

Washington Child Support Conference Boards Visit disclaimer page (PDF)

Back to top

West Virginia

This program allows forgiveness of interest for obligors who pay off all arrears within 5 years/60 months. This is a voluntary program and requires all parties to voluntarily agree to forgive the interest.

Source: West Virginia Code §48‐1‐302 (c) Visit disclaimer page

Back to top

Wisconsin

Local child support agencies may forgive all or part of the state-owed arrears under a variety of circumstances, including when the obligor is unable to pay the arrearage based on income, earning capacity, and assets, or the obligor has a long-term disability.

Source: Child Support Bulletin # CSB 20-06

Back to top

Wyoming

Does not have a program.

Back to top

Puerto Rico

Does not have a program.

Back to top

Virgin Islands

Does not have a program.

Back to top

American Samoa

Does not have a program.

Back to top

Commonwealth of the Northern Mariana Islands

Does not have a program.

Back to top

Guam

Does not have a program.

Back to top

Federated States of Micronesia

Does not have a program.

Back to top

Republic of the Marshall Islands

Does not have a program.

Back to top

Republic of Palau

Does not have a program.

Back to top

Alimony arrears from July 1 will be considered in a new way

On average, more than 120 people daily turn to bailiffs with a request to forcibly collect alimony. As a rule, this is due to the fact that the former spouses are in no hurry to pay money for the maintenance of their child, so alimony debt is formed. From July 1, the procedure for its calculation will change. Innovations will affect only those debtors who did not work or did not submit documents confirming their earnings, BelTA writes.

From July 1, the procedure for its calculation will change. Innovations will affect only those debtors who did not work or did not submit documents confirming their earnings, BelTA writes.

As Yulian Misyukevich, consultant of the Main Department of Compulsory Enforcement of the Ministry of Justice, explained, changes in the system for calculating alimony arrears are provided for by the Law of the Republic of Belarus "On amendments to laws" dated December 18, 2019. This document also amends the Marriage and Family Code. Starting next month, child support arrears for the period when the debtor did not work will be calculated based on the living wage budget. For one child, the amount of payments will be 50%, for two children - 100%, for three or more children - 150% BPM.

Now the debt is determined based on the income of the parent-debtor for the period during which he did not pay. If a person did not work at that time, the amount is calculated based on the amount of wages at the last place of work. In the event that more than three months have passed since the dismissal or there is no relevant information on income, the average salary of employees in the republic is taken into account.

In the event that more than three months have passed since the dismissal or there is no relevant information on income, the average salary of employees in the republic is taken into account.

As of July 1, there is also another change regarding child support. It refers to debtors who did not pay money for the maintenance of a child during their stay in the Armed Forces of Belarus, other troops and military formations in military service, performing alternative service. In this case, the debt is determined in the following amounts: per child - 25%, for two children - 33%, for three or more - 50% of the actual income received. However, these features will not apply if the amount of alimony is determined by a marriage contract, an agreement on children, or an agreement on the payment of alimony.

The issue of collecting alimony from debtors who live abroad, in particular in Russia, remains topical. In this regard, the Ministry of Justice has initiated some changes aimed at simplifying this procedure as much as possible. As expected, they will be included in the agreement on the procedure for the mutual execution of court decisions in cases of alimony, concluded in 2015 between Belarus and Russia.

As expected, they will be included in the agreement on the procedure for the mutual execution of court decisions in cases of alimony, concluded in 2015 between Belarus and Russia.

According to Yulian Misyukevich, at one time this agreement made it possible to significantly simplify the procedure for collecting alimony on the territory of the two countries. At present, judgments in such cases do not need a special recognition procedure. Based on the claimant's application, the documents are sent for execution through the authorized bodies of one country to the authorized bodies of another country. On the Belarusian side, such bodies are the enforcement departments of the main departments of justice of the regional, Minsk city executive committees, on the Russian side - territorial bodies of the Federal Bailiff Service.

“Today, active work is being carried out to develop this agreement. In particular, the Belarusian side came up with the initiative to make changes to it aimed at further simplifying the procedure. income on the territory of another state. While this issue is being worked out. Therefore, it is too early to say that this will definitely work" ," said the headquarters consultant.

income on the territory of another state. While this issue is being worked out. Therefore, it is too early to say that this will definitely work" ," said the headquarters consultant.

According to the Ministry of Justice, in 2018, bailiffs received 45,246 enforcement documents for the recovery of alimony, which is 1.8% of all received by the enforcement authorities. In 2019, this figure was 44,533 documents, or 1.9%. This year, about 18,000 documents, or 2.1%, have already been submitted for execution. It turns out that, on average, more than 120 people daily turn to bailiffs with a request to forcibly collect alimony.

In order for the rights of a minor child not to be infringed, it is important for a bailiff to promptly receive the necessary information about the financial situation of the debtor. The Ministry of Justice has done significant work in this direction, which has increased the efficiency of enforcement agencies. In particular, communication with information resources of state bodies and organizations has been established.

"Already today, the bailiff, by pressing one button, receives real-time information about the financial situation of the debtor, for example, about his place of work, income received, bank accounts, vehicles, real estate. This contributes to the timely adoption of enforcement measures requirements contained in the executive document" , - noted Yulian Misyukevich.

Today, a bailiff can take sufficiently serious measures to induce the debtor to repay the debt. It is not only about putting him on the wanted list and calling him for a conversation. Various restrictions can be applied to a person who evades his duties: seize money in accounts, other property, including vehicles, real estate, restrict certain rights - to travel outside the republic, drive a car, visit gambling establishments, use of communication services, the Internet, etc.

If a debtor fails to pay alimony for more than three months during a year, he may be held criminally liable. In this case, such penalties as correctional, community service, restriction or imprisonment can be applied. By the way, in 2019 the victims under Art. 174 of the Criminal Code recognized more than 5 thousand minors. In other words, the measures of this article were applied to their parents for evading the payment of alimony by a court order.

In this case, such penalties as correctional, community service, restriction or imprisonment can be applied. By the way, in 2019 the victims under Art. 174 of the Criminal Code recognized more than 5 thousand minors. In other words, the measures of this article were applied to their parents for evading the payment of alimony by a court order.

To enforce the recovery of alimony, you must apply for the initiation of enforcement proceedings to the enforcement authorities at the place of residence of the debtor, attaching to it a writ of execution issued by the court. Based on the results of consideration of the package of documents, the bailiff will decide on the initiation (refusal) of enforcement proceedings or on the return of documents.

Information provided - “SB. Belarus today”

If alimony debts have accumulated...

Veronika Salnikova

Lawyer, partner at Yakovlev & Partners

June 16, 2021

Tips

Pay attention to the date of publication of the material: the information may be outdated due to changes in legislation or law enforcement practice.

How to collect them, what threatens the parent-debtor and in what case will he be released from liability?

Through which court to collect alimony from a father with many children?

“In 2018, the Magistrate's Court ruled to collect alimony from her husband for the maintenance of two minor children. In 2020, we had twins. Currently, the marriage is not dissolved. Tell me where to apply (to the world or district court) and how to file an application to collect alimony for twins?

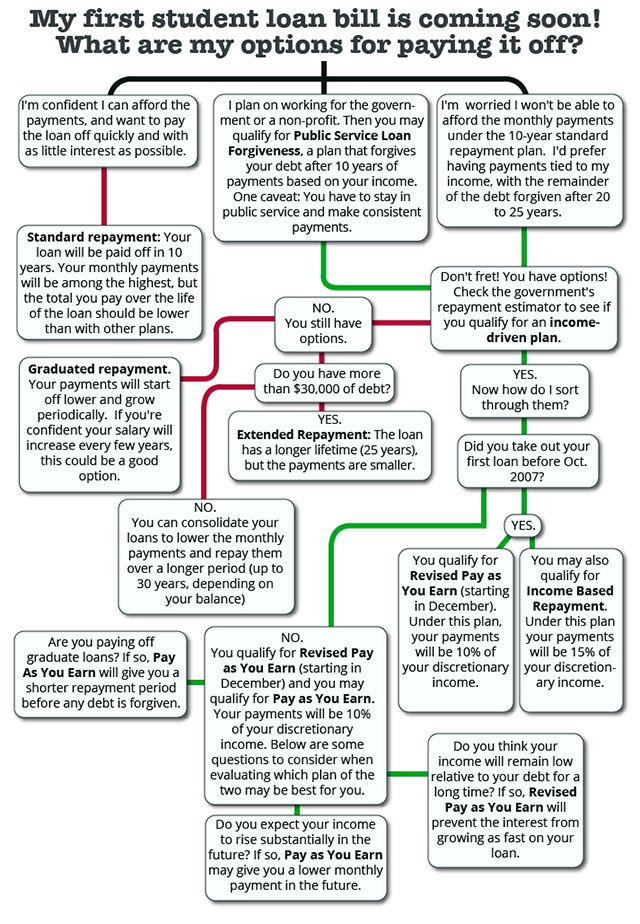

Alimony (funds for the maintenance of minor children) can be collected through the court in the order of writ or action proceedings. Writ proceedings are a simplified procedure for collecting alimony in the Magistrate's Court. When filing an application, the court issues a court order without summoning the plaintiff and the defendant. Claim proceedings are carried out in the district court with the summons of the parties.

As a general rule, if the parent-debtor already pays child support, then they should be collected on other children through the district court. The mother of twins needs to apply to the district court at her place of residence or the defendant.

The mother of twins needs to apply to the district court at her place of residence or the defendant.

You can file a claim with an attorney. In addition, sample applications are often placed in courts. You can use this sample, detailing your situation and attaching supporting documents.

(Answers to other questions of alimony recipients and their payers can be found in the articles "On child support - in detail", "On the payment of alimony - on real examples", "Cross-border alimony").

What threatens a parent for non-payment of alimony?

For late payment or non-payment of alimony in full, the debtor parent may be held liable - administrative (Article 5.35.1 of the Code of Administrative Offenses of the Russian Federation) or criminal (Article 157 of the Criminal Code of the Russian Federation).

Bailiffs bring to administrative responsibility negligent parents. This is possible in the event of non-payment without good reason of funds for the maintenance of children according to a judicial act, a court order or an agreement on the payment of alimony. The court already attracts criminal liability for malicious evasion from the fulfillment of maintenance obligations of parents.

The court already attracts criminal liability for malicious evasion from the fulfillment of maintenance obligations of parents.

On April 27, 2021, the Plenum of the Supreme Court of the Russian Federation approved a resolution stating that “violation of a judicial act or agreement on the payment of alimony should be understood as non-payment of alimony in the amount, on time and in the manner established by this decision or agreement.” Partial payment of alimony cannot exclude the application of liability measures (read about this also in the news “The Plenum of the Supreme Court clarified the nuances of administrative responsibility for non-payment of alimony”) .

In which case will the debtor parent be released from liability, despite the maintenance debt?

If the parent-debtor has good reasons for which he cannot pay child support in the prescribed amount, he has the right to go to court and ask to change the procedure for collection. In the presence of such reasons, the debtor may be released from liability.

Valid reasons may be recognized such circumstances in which non-payment of alimony occurred regardless of the will of their payer: his illness (incapacity for work), his military service on conscription, force majeure circumstances, the fault of other persons, for example, non-payment of wages by the employer, delay or incorrect transfer bank of funds to the recipient of alimony.

The list of reasons that may be recognized as valid for exemption from liability is not exhaustive. In all cases, the judge must assess whether specific circumstances can be attributed to the number of good reasons for non-payment of alimony.

How do bailiffs force persistent non-payers to fulfill maintenance obligations?

If the parent does not just evade the payment of alimony, but hides and prevents their collection, i.e. becomes a malicious defaulter, the bailiffs start the procedure for searching for the debtor. But they can do this only if there is a statement from the alimony claimant. During the search, bailiffs try to locate the debtor and his property in order to bring him to justice and force him to fulfill maintenance obligations. How do they do it?

During the search, bailiffs try to locate the debtor and his property in order to bring him to justice and force him to fulfill maintenance obligations. How do they do it?

Bailiffs are endowed with special powers. They have the right:

- receive personal data from the internal affairs authorities, tax authorities, the Pension Fund, registry offices, traffic police;

- check information through the customs authorities;

- check in banks information about accounts, deposits, securities;

- to interview relatives, friends, colleagues - everyone who has information about the non-payer;

- to travel to the location of the debtor's property for its examination and evaluation;

- use information obtained through the involvement of a private detective bureau or from open sources, including those posted on personal pages on social networks.

When conducting search and search activities, the bailiff interacts with employees of other units of the FSSP, the traffic police, and the police to use the information they have.