How to teach a child money

6 Ways to Teach Kids the Value of Money

It’s never too early to teach your children about the value of money, including how to save, so that when they reach adulthood, they’ll be able to spend wisely. Children must cultivate respect for money even at a young age. Learning the principles of responsible money management will help give kids more opportunities for advancement when they’re older.

Following are six tips to teach your children the value of money:

1. Expand on the basics of math

Once your children start school and learn math basics, educate them about money and provide some practice. Play money games at home, or download them to your computer, mobile phone, or tablet. Identify different coins, count them together and teach your child how to make change. This way, your child will learn how to use cash when that time comes.

2. Get your child a piggy bank

This simple action will teach your children the importance of saving and instill a sense of responsibility towards handling money. Encourage your kids to collect a certain amount in a particular time frame or suggest they save coins of a specific denomination. Turn it into a game to keep it fun and exciting. On a chosen date, open the piggy banks and count the savings. To encourage your children to save more, create a visual record, such as a chart, to teach them the basics of simple record keeping, and they can watch it grow.

3. Familiarize your kids with the bank

Take your children to the bank and open custodial savings accounts in their names. Let them talk to the teller and conduct their business themselves with your support as needed. Make sure they understand the terms and conditions and suggest they commit to depositing regular amounts weekly or monthly. For more convenient banking, nearly all accounts are now accessible online. Having a bank account of their own will give your child a feeling of achievement, which could motivate them to save more. As a further incentive, you may choose to match their savings.

4. Encourage your children to plan how to spend their savings

Planning for future spending motivates your kids to achieve their savings goals. It reminds them that they can buy whatever they want with enough money. Allow your children to dream big, and encourage them to save more to achieve their goals more quickly.

5. Allow your kids to shop for themselves

Give your children their allowances when you go shopping. You can then observe their attitudes towards spending money. Let them spend some of it, be silly, and make their own choices. Part of the fun of having money is spending it. If your kids want to spend more than their allowance, encourage them only to spend what they have and advise them to be more frugal and patient. Don’t loan money against the allowance they will receive. Our boss doesn’t give a paycheck advance; kids need to learn this too. Educate your kids on sensible spending and explain the priorities when shopping. Also, remind them that at the end of the day, the most important thing is that they can buy what they want because they were able to save money.

Also, remind them that at the end of the day, the most important thing is that they can buy what they want because they were able to save money.

A quick tip about providing allowances: Give your child an age-appropriate allowance. For our children, they get half of their age in allowance. So, on their birthday, they always get a 50-cent raise. We provide chores during the summer and expect them to help when needed during the school year. Set some rules for earning the allowance and an amount for your children.

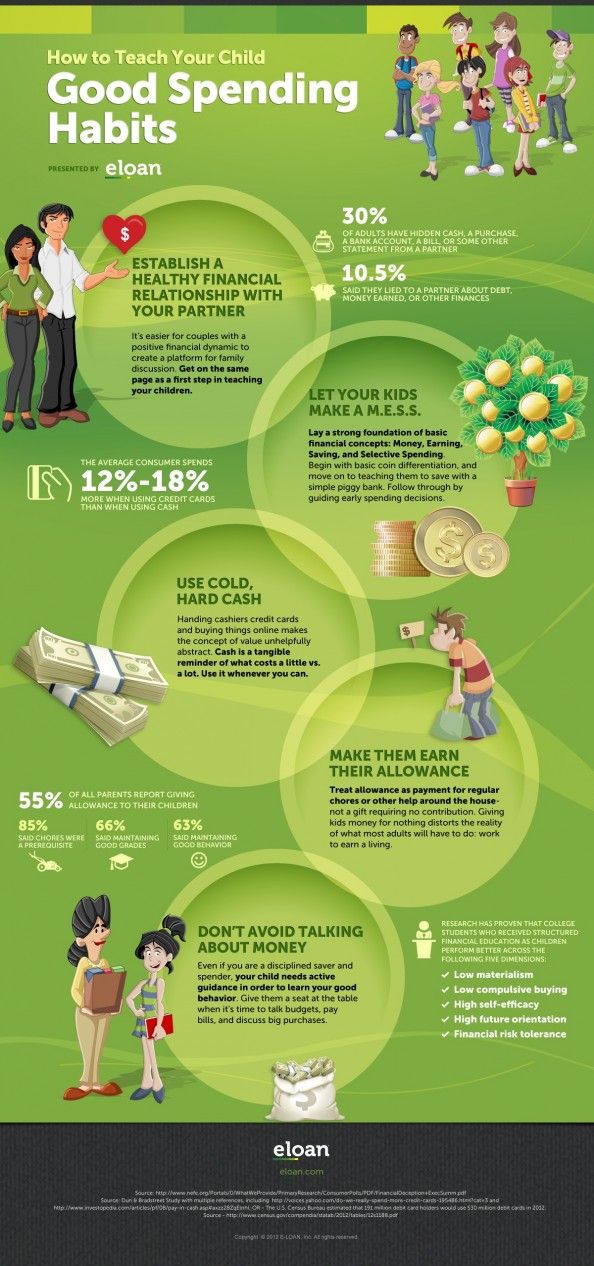

6. Pay in cash

Credit cards are a great temptation to spend money you don’t have, then pay more for the privilege later. Show your kids that the best way to buy items is with the money in their pockets. Try to keep it real at all times – handing over cash is the best way to learn how to use money responsibly.

The best way to teach your kids the value of money and the importance of saving is to lead by example while allowing them some responsibility. Give your children an allowance for the things they might want to buy, and encourage them to save in various ways. Familiarize them with simple record keeping and the way savings accounts work. Leave the credit cards at home when you shop with the kids. These simple but effective steps will help your children learn how to manage money responsibly and prepare them for adulthood.

Give your children an allowance for the things they might want to buy, and encourage them to save in various ways. Familiarize them with simple record keeping and the way savings accounts work. Leave the credit cards at home when you shop with the kids. These simple but effective steps will help your children learn how to manage money responsibly and prepare them for adulthood.

Suggested Resources for You

On The Web:

Financial Security for Tomorrow Starts Today (Info for parents and kids)

Give Our Kids Financial Education

With a Sound Financial Education Kids Avoid Problems

Finance 101 for Kids: Money Lessons Children Cannot Afford to Miss How do we equip the next generation with money management skills that they can carry forth into their adult lives?

One of the most important lessons that you can teach your kids is how to handle their money. Unfortunately, for most parents, giving their kids a sound financial education is an afterthought at best. Frustrated by the lack of resources that apply the concept of finance to real life situations for his own children to learn from, author Walter Andal was inspired to create an informative and entertaining book to help children get on the right path to making smart personal financial decisions. In Finance 101 for Kids, children and parents will explore: * How money started

Unfortunately, for most parents, giving their kids a sound financial education is an afterthought at best. Frustrated by the lack of resources that apply the concept of finance to real life situations for his own children to learn from, author Walter Andal was inspired to create an informative and entertaining book to help children get on the right path to making smart personal financial decisions. In Finance 101 for Kids, children and parents will explore: * How money started

* How to earn and make money

* Saving and investing

* What credit is and the dangers of mishandling credit

* What the stock market is

* Economic forces that can affect personal finance

* What currencies and foreign exchanges are

* The importance of giving back to the community

The Money Class: A Course in Basic Money Management for Teens and Young Adults MONEY MANAGEMENT is a skill the young people of today know very little about. Most young adults leave high school or college faced with debt and not knowing how to make good financial decisions. Their futures depend on knowing the concepts of financial literacy! Money is a part of everyday life, and we need to start teaching our youth about it before they venture out on their own. This book is designed to empower young people (and adults as well) on what money is and how to work with it. It is full of financial basics as well as being a workbook to be used as a tool for teachers, parents, and students. The author’s goal is to give young people the chance for a future of self-reliance and financial freedom.

Their futures depend on knowing the concepts of financial literacy! Money is a part of everyday life, and we need to start teaching our youth about it before they venture out on their own. This book is designed to empower young people (and adults as well) on what money is and how to work with it. It is full of financial basics as well as being a workbook to be used as a tool for teachers, parents, and students. The author’s goal is to give young people the chance for a future of self-reliance and financial freedom.

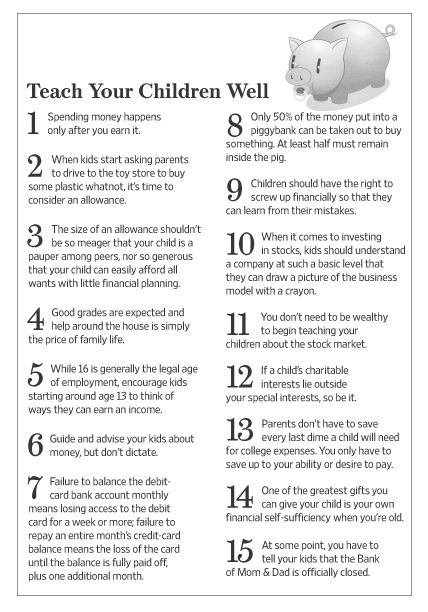

15 Ways to Teach Kids About Money

By Ramsey Solutions

By Ramsey Solutions

If you don’t teach your kids how to manage money, somebody else will. And that’s not a risk you want to take! We’ll show you how to give your kids the head start you wish you had and set them up to win with money at any age.

How to Teach Pre-Schoolers and Kindergartners About Money

1. Use a clear jar to save.

The piggy bank is a great idea, but it doesn’t give kids a visual. When you use a clear jar, they see the money growing. Yesterday, they had a dollar bill and five dimes. Today, they have a dollar bill, five dimes, and a quarter! Talk through this with them and make a big deal about it growing!

When you use a clear jar, they see the money growing. Yesterday, they had a dollar bill and five dimes. Today, they have a dollar bill, five dimes, and a quarter! Talk through this with them and make a big deal about it growing!

2. Set an example.

A study by the University of Cambridge found that money habits in children are formed by the time they’re 7 years old.(1) Little eyes are watching you. If you’re slapping down plastic every time you go out to dinner or the grocery store, they’ll eventually notice. Or if you and your spouse are arguing about money, they’ll notice that too. Set a healthy example for them and they’ll be much more likely to follow it when they get older.

3. Show them that stuff costs money.

You’ve got to do more than just say, “That pack of toy cars costs $5, son.” Help them grab a few dollars out of their jar, take it with them to the store, and physically hand the money to the cashier. This simple action will have more impact than a five-minute lecture.

How to Teach Elementary Students and Middle Schoolers About Money

4. Show opportunity cost.

That’s just another way of saying, “If you buy this video game, then you won’t have the money to buy that pair of shoes.” At this age, your kids should be able to weigh decisions and understand the possible outcomes.

5. Give commissions, not allowances.

Don’t just give your kids money for breathing. Pay them commissions based on chores they do around the house like taking out the trash, cleaning their room, or mowing the grass. Dave and his daughter Rachel Cruze talk a lot about this system in their book, Smart Money Smart Kids. This concept helps your kids understand that money is earned—it’s not just given to them.

6. Avoid impulse buys.

“Mom, I just found this cute dress. It’s perfect and I love it! Can we buy it please?” Does this sound familiar? This age group really knows how to capitalize on the impulse buy—especially when it uses someone else’s money.

Use the best tools to teach your kids about money.

Instead of giving in, let your child know they can use their hard-earned commission to pay for it. But encourage your child to wait at least a day before they purchase anything over $15. It will likely still be there tomorrow, and they’ll be able to make that money decision with a level head the next day.

7. Stress the importance of giving.

Once they start making a little money, be sure you teach them about giving. They can pick a church, charity or even someone they know who needs a little help. Eventually, they’ll see how giving doesn’t just affect the people they give to, but the giver as well.

How to Teach Teenagers About Money

8. Teach them contentment.

Your teen probably spends a good chunk of their time staring at a screen as they scroll through social media. And every second they’re online, they’re seeing the highlight reel of their friends, family and even total strangers! It’s the quickest way to bring on the comparison trap. You may hear things like:

You may hear things like:

“Dad, Mark’s parents bought him a brand-new car! How come I have to drive this 1993 Subaru?”

“Mom, this girl at school got to spend $10,000 on her Sweet 16 party. I want to do that too!”

Contentment starts in the heart. Let your teen know that their Subaru (although not the newest car on the block) is still running well enough to get them from point A to point B. And you can still throw a memorable, milestone birthday party without spending a chunk of your retirement savings funding it!

9. Give them the responsibility of a bank account.

By the time your kid’s a teenager, you should be able to set them up with a simple bank account if you’ve been doing some of the above along the way. This takes money management to the next level, and will (hopefully) prepare them for managing a much heftier account when they get older.

10. Get them saving for college.

There’s no time like the present to have your teen start saving for college. Do they plan on working a summer job? Perfect! Take a portion of that (or more) and toss it in a college savings account. Your teen will feel like they have skin in the game as they contribute toward their education.

Do they plan on working a summer job? Perfect! Take a portion of that (or more) and toss it in a college savings account. Your teen will feel like they have skin in the game as they contribute toward their education.

11. Teach them to steer clear of student loans.

Before your teen ever applies to college, you need to sit down and have the talk—the “how are we going to pay for college” talk. Let your teen know that student loans aren’t an option to fund their education. Talk through all the alternatives out there, like going to community college, going to an in-state university, working part-time while in school, and applying for scholarships now.

While you’re at it, get The Graduate Survival Guide for them. It’s a must-have resource to help your college-bound teen prepare for the next big step in their life.

12. Teach them the danger of credit cards.

As soon as your kid turns 18, they’ll get hounded by credit card offers—especially once they’re in college. If you haven’t taught them why debt is a bad idea, they’ll become yet another credit card victim. Remember, it’s up to you to determine the right time you’ll teach them these principles.

If you haven’t taught them why debt is a bad idea, they’ll become yet another credit card victim. Remember, it’s up to you to determine the right time you’ll teach them these principles.

13. Get them on a simple budget.

Since your teen is glued to their mobile device anyway, get them active on our simple budgeting app, EveryDollar. Now is the time to get your teen in the habit of budgeting their income—no matter how small It is. They should learn the importance of making a plan for their money while they’re still under your roof.

14. Introduce them to the magic of compound interest.

We know what you’re thinking. You can barely get your teen to brush their hair—how in the world are they supposed to become investment savvy? The earlier your teen can get started investing, the better. Compound interest is a magical thing! Introduce your teen to it at an early age, and they’ll get a head start on preparing for their future.

15. Help them figure out how to make money.

When you think about it, teenagers have plenty of free time—fall break, summer break, winter break, spring break. If your teen wants some money (and what teen doesn’t?), then help them find a job. Better yet, help them become an entrepreneur! These days, it’s easier than ever for your teen to start up their own business and turn a profit.

Change Your Family Tree

Teaching your children about money at any stage is going to take time on your part. It won’t always be easy. But if you want your children to know how to successfully manage their money when they get older, taking the time now will be worth it.

One of the best ways to teach your kids about handling money is to give them a chance to make some of their own! With the Teen Entrepreneur Toolbox, you’ll get all the tools you need to help them start their own business and learn real-world skills.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

Children and Money. Or How to teach a child to use money correctly?

Children and Money

Or

How to teach a child to handle money correctly?

How should our children feel about money? How do we want them to feel about money? The question is not idle. A number of more specific questions can be added to it, for example: when to start teaching a child to use money himself? Should family financial problems be shared with children? And if it is not necessary, if you give the child everything he needs, then how will he learn to understand the value of money?

It is clear that we all want our children to have a healthy attitude to this side of life: they would know how to value money, but not worship it, spend it, but not waste it, save money, but not be misers . ..

..

How to teach it? And when do you start teaching?

A popular book in the USA by D. Nelsen "1001 Tips for Raising Children" recommends starting to give coins to a child already two or three years old so that he puts them in a piggy bank. It is argued that thus the habit of saving is developed even before it is realized. And then ... “When the child is 4-6 years old, bring him with a piggy bank to the bank and open an account in his name. Let him make a contribution every three months.”

It is unlikely that such advice will inspire any of our Russian parents to take real action. True, more acceptable advice is given later in the book. You can also invite your child to save money to donate later to those in need. Establish a policy whereby pocket money is given only once a week during family gatherings. If the child spends it earlier, he will have a good opportunity to feel what it means to be without money, and then he will think about how to solve this problem: either do without money, or look for a job to earn extra money.

That's right, but here I would like to recall the statement of the famous teacher and writer S. Soloveichik: “Everything that can be measured or counted has nothing to do with the results of education. For the upbringing of the child, only the spiritual aspirations of the parents are still important.

Nevertheless, the problem of "children and money" has to be solved by almost every family. And many researchers give money a much more complex role in the upbringing of children, even introducing such a concept as “money therapy”.

In relationships between parents and children, money is a symbol of parental love. They transmit from parent to child a sense of strength and power, which increases the possibilities for personal development. Going to the store even with a three-year-old child, give him money, let him buy what he wants. This greatly stimulates a sense of self-confidence in a small person, introduces him to the world of adults.

We can say that the more money is involved in the relationship between children and parents, the deeper and more meaningful these relationships should be. Easy handling of money - without conversations, explanations, disputes, joint work - leads to the fact that money actually crowds out the emotional relationship of the child with his parents - a relationship that is so necessary for children. In fact, parents seduce the child with money, while rejecting him.

Easy handling of money - without conversations, explanations, disputes, joint work - leads to the fact that money actually crowds out the emotional relationship of the child with his parents - a relationship that is so necessary for children. In fact, parents seduce the child with money, while rejecting him.

In addition, a lot of money and the ability to spend it without restrictions is an unbearable burden for a small person. When a child's "I want" is not limited, he develops disorders at the level of psychosis ("give!", "I want!"). Often, the parents themselves become hostages of such upbringing ... The child needs money for development, but there is no need to provoke him with large sums.

Do not plant a special attitude towards money in the child's mind, do not scold the child because of the loss of money more than because of the loss of another object. Never scold a child for wasting money... Let him understand that you still trust him and hope that this is just an unfortunate misunderstanding.

... Do not try to pick up friends for your child "according to their means" . To avoid problems when communicating with children from less wealthy families, try to use the money to support any creative initiatives of the entire team. Your money can create a creative environment for your child in which unfriendly peer relationships are impossible.”

Summing up what has been said, we list what parents have to do when solving the problem of "children and money":

Give the child at least a little independence to satisfy their desires. There will be independence and the possibility of choice - there will be more chances for the emergence of responsibility.

2. Start giving pocket money from the age of 5-6: this will give the little person a sense of independence and independence. To begin with, let it be a trifle: it seems to be a toy, but - it is accepted in the store, you can buy something for it . ..

..

3. Do not encourage preschool children to earn money: firstly, early, and secondly, this may lead to something undesirable.

4. Give your child a piggy bank, while carefully hinting that you can save not only for yourself, but also for a birthday present for your mother.

5. If there are traditions of charity in the family, then the child should be involved in them, then he will form a more correct attitude towards money.

6. To avoid talking about the "rich" and their immeasurable opportunities in front of a child: there is no benefit from such talk, and the feeling of envy that a child may have is not the best of human qualities.

7. Do not hide family financial problems from the child, talk about them out loud, arrange general advice on this matter, involving kids in them from the age of 6-7. By doing this, you will teach children the laws of economics, and it is important that they understand that all good people live by such laws.

Of course, in each family, some circumstances of their own can be added to this list, allowing them to give the “money issue” an educational aspect. But in all cases, the main thing remains: it is necessary to teach the child to treat money as a value, which contains the hard work of his parents.

How to teach a child to handle money? » Office for Family and Childhood of the city of Krasnodar

OFFICE OF ISSUES

FAMILY AND CHILDHOOD

OFFICIAL INTERNET PORTAL

phone (861) 277-30-80 print (861) 251-64-21

Contents of this page

Most of us parents did not teach any rules of money management, so we have to learn everything on our own, from our own mistakes and experience. Therefore, children want to pass on this knowledge in advance so that they do not fall into severe financial accidents. But this must be done competently and accurately. To not be boring notation. How to start teaching financial literacy? At what age should children be given pocket money? When is the best time to start a piggy bank? And how to explain to children the principles of proper disposal of personal funds?

Therefore, children want to pass on this knowledge in advance so that they do not fall into severe financial accidents. But this must be done competently and accurately. To not be boring notation. How to start teaching financial literacy? At what age should children be given pocket money? When is the best time to start a piggy bank? And how to explain to children the principles of proper disposal of personal funds?

The sooner you introduce your baby to money, the sooner he will learn how to handle it properly. But at the same time, it is worth remembering that a 2-year-old child will not be able to understand what these pieces of paper and coins are for. Therefore, the first acquaintance of the baby with money is best to start from 3-4 years.

At this age, children already understand what an exchange is, since they themselves have repeatedly exchanged toys in the sandbox with other children, so parents using this example will be able to explain to them that money can be exchanged for different goods.

Once your little one has learned the basics of arithmetic, you can ask him to calculate how much money he needs to buy bread or other groceries. By the way, children quickly master addition and subtraction while counting coins and paper bills.

Children aged 5-6 can already be trusted to buy something on their own. To get started, give the amount for the calculation so that your baby does not have to count the change, and be sure to follow from the outside how he makes a purchase.

It is important to remember that for some children, due to their nature, this can become a stressful situation, so do not force the baby to buy something if he does not want to do it.

Take your child to the store often. Show him what it costs so that he can navigate what is more expensive and what is cheaper. Be sure to conduct small workouts with him, for example, going up to some product and pointing out the price tag to the baby, ask him if such and such an amount is enough to buy it.

Explain to your little one which goods are essential, such as food, and which can be bought when there is extra money.

This will also help to curb the irrepressible "appetite" of capricious children, as they will understand that parents sometimes simply do not have enough money for the next toy.

After you make sure that your child knows what money is for and what it should be spent on, you can give him a certain amount, which he can use as he pleases. This amount should be minimal so that he can immediately spend it, for example, on buying a chocolate bar or a small toy.

When should I start giving money regularly?

This need arises when the child goes to school, i.e. at the age of 6-7 years. There are certain rules that parents should follow when issuing pocket money.

- To get started, your first grader needs to be given a certain amount for one day so that he can buy himself a school breakfast. After he learns how to handle this money, you can increase the issuance period, for example, give money for 2-3 days, and then for a week in advance.

Thus, the child will learn to calculate how much he can spend every day. In addition, over time, you can start to give money a little with a margin. This means a little more than the amount needed for one day. This will give your student the opportunity to save money to buy what he wants, and at the same time he does not have to save on school lunches and harm his health. As a rule, children collect the amount they need within 2-3 weeks, since at this age most often their desire is to buy another toy.

Thus, the child will learn to calculate how much he can spend every day. In addition, over time, you can start to give money a little with a margin. This means a little more than the amount needed for one day. This will give your student the opportunity to save money to buy what he wants, and at the same time he does not have to save on school lunches and harm his health. As a rule, children collect the amount they need within 2-3 weeks, since at this age most often their desire is to buy another toy. - Children aged 10-11 can be given pocket money for a whole month. But at the same time, it should be made clear that there will be no additional surcharges if they do not calculate and spend the amount issued to them ahead of time. But in order not to leave them without school lunches, you can give a certain amount as an advance for the next month. Children should understand that their parents' money reserves are not endless, and they need to learn how to properly distribute the funds that are given to them.

You can invite them to write down all the expenses in a notebook so that at the end of each week they can calculate all their expenses and how much they managed to save for the thing they liked. In addition, this will give children the opportunity to assess whether they are spending money correctly. After all, buying an extra chocolate bar or harmful chips further alienates them from the desired acquisition. In addition, in this way they will learn to plan their spending.

You can invite them to write down all the expenses in a notebook so that at the end of each week they can calculate all their expenses and how much they managed to save for the thing they liked. In addition, this will give children the opportunity to assess whether they are spending money correctly. After all, buying an extra chocolate bar or harmful chips further alienates them from the desired acquisition. In addition, in this way they will learn to plan their spending. - It is important to explain to children where money comes from in the family, and that in order to receive it, you must first earn it, since most modern children believe that the parent's wallet is bottomless. That is why there are unpleasant cases when a child in front of everyone throws a tantrum because the parents do not want to buy him another toy. To prevent this from happening, give him a good example of what making money is. Let him do some housework for a week, for example, take out the garbage, sweep the floor, etc.

, and at the end of the week, pay him for his work, of course, within reasonable limits. Take your son or daughter to work with you, show what you are doing, what kind of work you are doing. In general, introduce your child to the world of professions.

, and at the end of the week, pay him for his work, of course, within reasonable limits. Take your son or daughter to work with you, show what you are doing, what kind of work you are doing. In general, introduce your child to the world of professions. - Give your teenager the opportunity to earn money by their own work. From the age of 14, a child can work several hours a day with the consent of the parents and the consent of the guardianship and guardianship authority. A teenager can only be entrusted with light work in his spare time (courier, promoter, etc.). Thus, you will not only show what the money is paid for, but you will also be able to educate the child in respect for them. But it’s better not to pay for good grades, as this can lead to the opposite effect, and your child will do everything to get the cherished grade in honest and dishonest ways, but at the same time, his goal will be to get money, not knowledge.

- Once every six months, you can give children a very large amount in the form of a reward for something or just as a gift, but the amount should not exceed 6 months of pocket expenses.

This will help them feel more confident, as they will be able to buy something substantial without having to constantly save money. Children should be able to handle money properly, because in our age this skill is simply indispensable.

This will help them feel more confident, as they will be able to buy something substantial without having to constantly save money. Children should be able to handle money properly, because in our age this skill is simply indispensable.

A person never learns from the mistakes of others - only from his own. It is better for parents to prepare in advance for the fact that the child will spend all pocket money on nonsense at once, it is bad to calculate the cost, forget about mandatory expenses and “go beyond the budget”. But it would be better if he went through all this now. It is much worse if the learning process begins after receiving the first salary and stretches over years of losses, unsustainable loans, unprofitable investments and other costly mistakes. Therefore, a parent in the matter of learning how to properly manage money should become the same patient and understanding mentor as at the beginning of the first steps, the first copybooks, the first deuces and the first knocked down knees of his baby.