How to fill out child support guidelines worksheet

The Child Support Guidelines Worksheet

Judges use the Child Support Guidelines Worksheet to figure out how much child support to order.

To fill out the Worksheet you need to have income and expense information for both parents. Use the other parent’s Financial Statement if you have it. If you do not know the other parent’s information, put in what you think it is.

On the Worksheet, the parent who receives the child support is called the “Recipient,” and the parent who pays the child support is called the “Payor.”

You can get the Child Support Guidelines Worksheet from the Court website. Save the form to your computer first and then open.

If you use a computer to fill out the Worksheet, the Worksheet does all the math for you. You can use our instructions to:

- Fill out the Worksheet by hand, and

- Understand how the Worksheet applies the Child Support Guidelines to your situation.

Section 1 Age, Number, and Parenting of Children

Line 1a is the number of children you think should be covered by the child support order

Line 1b is about where your children live

Check the box that applies to the children to be covered by the order. Check one box only.

Check Box 1 if the children live with you and the other parent about the same amount of time. And you and the other parent share financial responsibility for the children.

Check Box 2 if the children live with one parent at least 2/3 of the time. This is the box you check if one parent is mainly responsible for the children.

Check Box 3 if more than one child is covered by the order and they do not all live with the same parent. For example one child lives mostly with one parent and the other children live with the other parent. This is the box you check if you split responsibility so that each parent provides the main home for at least one of your children.

Line 1c is each parent’s name

If you checked Box 2 in Line 1b above, put the name of the parent with whom the children primarily live in the column for Parent A, and the other parent’s name in the column for Parent B. If you checked Box 1 or 3, it does not matter which column you use for each parent’s name.

If you checked Box 1 or 3, it does not matter which column you use for each parent’s name.

Line 1d is the number of your children under 18 to be covered by the order

If you checked Box 1 shared parental responsibility above, put the number of children from 1a in the column for each parent.

If you checked Box 2 above put the number of children from 1a in the column for Parent A and put 0 in the column for Parent B.

If you checked Box 3 split parental responsibility above put the number of children that lives with each parent in that parent’s column.

Line 1f is the total number of children to be covered by the order

- Add 1d and 1e in each column.

- Put the answer in 1f of each column.

Section 2 Income

Lines 2a – 2f are for figuring out each parent’s “available income.”

“Gross Weekly Income” is your income before taxes and deductions are taken out. It does not include public assistance like welfare, TAFDC, SSI, and Food Stamps SNAP.

It does not include public assistance like welfare, TAFDC, SSI, and Food Stamps SNAP.

Note

If you get a Social Security dependency benefit for your child, do not include that benefit in the Line 2a Gross weekly income boxes. You put the amount of the Social Security dependency benefit in Line 2b.

Put the total gross weekly income of each parent in Line 2a of the Worksheet.

If the parent receives the income once a month, divide by 4.3 to get the weekly amount.

If the parent receives the income every other week, divide by 2 to get the weekly amount.

If you do not know the other parent’s income, you can:

- Put in what you think it is,(be prepared to explain why you think this is their income or

- Use the other parent’s Financial Statement if you have it.

Lines 2b and 2c are used to figure out the amount of your Gross weekly income that comes from a Social Security dependency benefit

Use weekly amounts. Divide the monthly benefit by 4.3 to get the weekly amount.

Divide the monthly benefit by 4.3 to get the weekly amount.

If neither parent gets a Social Security dependency benefit, put ‘0’ in all the boxes on lines 2b and 2c.

If a disabled or retired parent has a Social Security dependency benefit for a child to be covered by the child support order, they can use it toward meeting their child support obligation. The amount of a parent’s Social Security dependency benefit sent directly to the Recipient parent will count as a credit for the Payor parent.

On line 2b put the total weekly amount of Social Security dependency benefit of each parent.

On line 2c put the weekly amount of Social Security dependency benefit sent directly to each parent.

On line 2d put existing court-ordered or voluntary payments each parent makes for a child, spouse, or former spouse not involved n this case.

Line 2e is the cost of individual or family health care coverage. Put the weekly amount each parent actually pays for individual or family health care coverage.

Put the weekly amount each parent actually pays for individual or family health care coverage.

Line 2f is the cost of dental and vision insurance for the children. Put the weekly amount each parent actually pays for dental and vision insurance.

Line 2g is for work-related child care expenses. Put the weekly amount each parent actually pays for work-related child care or child care so they can get work-related training and education. Put the amount for each child up to $355 per week, per child covered by the order.

Child care costs of up to $355 per week, per child for the children covered by the child support order and due to gainful employment of either parent are considered reasonable and are shared by the parents in proportion to their share of combined available income.

- Add the weekly child care expense amounts for each child and put the answers in the Line 2g Total.

- Add the weekly child care expense amounts for each parent and put the answers in the column for each parent.

- If there are special reasons why child care costs more than $355 a week, such as a child has special needs, the judge can be asked to allow higher child care costs.

Section 3 Gross Support Amounts

This section of the Worksheet shows each parent’s share of child support before you make any adjustments and it shows how to change the support amount for 1 child to cover all the children in the order.

Line 3a is each parent’s available income

“Available income” is income that is available for child support. For each parent, add 2b + 2c. Then subtract the expenses 2d - 2e - 2f. Put the answer in 3a in each parent’s column. If the answer is less than $0, put in $0.

Line 3b is the parents’ combined available income

Add Parent A 3a + Parent B 3a and put the answer in 3b.

Line 3c is each parent’s share of their “combined available income.”

For each parent divide 3a ÷ 3b. Each parent’s share is a percentage of their combined available income.

Parent A’s share

- Divide Parent A’s “Available Income” 3a by the “Combined Available Income” 3b.

- Multiply by 100.

- Use the nearest whole number. You do not need any numbers to the right of the decimal point.

- Put the answer in Line 3c in the Parent A column.

Parent B’s share

- Divide Parent B’s “Available Income” 3a by the “Combined Available Income” 3b.

- Multiply by 100.

- Use the nearest whole number. You do not need any numbers to the right of the decimal point.

- Put the answer in 3c in the Parent B column.

Note

If you use a computer, the Worksheet calculates each parent's "share of combined available income" for each parent automatically.

Line 3d is the parents’ combined income that is “available” for child support.

Put the amount in 3b or $7,692, whichever is less.

Line 3e is the parents’ combined support amount for 1 child

Use:

- Table A at the bottom of the Worksheet to calculate the amount, or

- The 2021 Child Support Guidelines Chart to look up this amount, or

- Your computer, to have the Worksheet put the amount in 3e for you.

Note

If you use the Guidelines Chart and the “combined available income” for 1 child falls between 2 rows, use the row with the lower amount.

Put the combined support amount in 3e.

Line 3f is the number you use to multiply the support amount for 1 child to cover all the children in the order

Use:

- Table B at the bottom of the Worksheet, or

- Your computer to have the Worksheet put the amount in 3f for you.

If you use Table B, get the “adjustment factor” from Table B next to the number of children you put in 1f.

If you checked Box 1 shared responsibility or Box 3 split responsibility in 1b, put the adjustment factor in 3f for Parent A and Parent B.

If you checked Box 2 in 1b because Parent A is mainly responsible for the children:

- Put the adjustment factor in 3f for Parent A.

- Leave 3f for Parent B blank.

Line 3g is each parent’s combined support amount

If you checked Box 1 shared responsibility or Box 3 split responsibility in 1b:

- Multiply the support amount for one child in 3e for each parent by the adjustment factor for the number of children in 3f.

- Put the answer in 3g for Parent A and Parent B.

If you checked Box 2 in 1b because Parent A is mainly responsible for the children:

- Multiply the support amount for one child in 3e for Parent A by the adjustment factor for the number of children in 3f.

- Put the answer in 3g for Parent A.

- Leave 3d for Parent B blank.

Note

If you use a computer, the Worksheet puts the answers in 3c and 3d for you.

Important

- The Guidelines formula is for fewer than 6 children.

- The Guidelines say the order for more than 5 children should equal or be more than the amount for 5 children.

- The Guidelines say both parents must contribute to their children’s support.

Section 4 Adjustment for Children 18 Years or Older

This section of the Worksheet adjusts the combined support amount if any child to be covered by the order is 18 or older.

Line 4a is the percentage you use to adjust each parent’s share of child support

Use:

- Table C at the bottom of the Worksheet, or

- Your computer to have the Worksheet put the amount in 3c for you.

If you use Table C

For each parent:

- In the column under the words "children under 18," find the number you put in 1d and put your finger on it.

- Under the words “children 18 or older,” find the number you put in 1e and put a finger from the other hand on it.

- Drag your fingers across and down until they meet.

- Where they meet is a percentage.

If you checked Box 1 shared responsibility or Box 3 split responsibility in 1b, put the percentage in 4a for Parent A and Parent B.

If you checked Box 2 in 1b because Parent A is mainly responsible for the children, put the percentage in 4a for Parent A. Leave 4a for Parent B blank.

Line 4b is the adjustment for children 18 or older

If you checked Box 1 shared responsibility or Box 3 split responsibility in 1b, multiply 3d the combined support amount by the percentage in 4a, and put the answer in 4b for Parent A and Parent B.

If you checked Box 2 in 1b because Parent A is mainly responsible for the children, multiply 3d the combined support amount by the percentage in 4a, and put the answer in 4b for Parent A. Leave 4b for Parent B blank.

Note

To multiply a number by a percentage. Multiply the 2 numbers. Divide by 100. That is your answer.

Line 4c is the adjusted combined support amount for each parent

For each parent, subtract 4b from 3g and put the answer in 4c. If 3g and 4b are blank, leave 4c blank.

Section 5 Proportional Support Amounts

This section of the Worksheet shows:

- Each parent’s share of the combined support amount, and

- The other parent’s share of support using the low-income payer adjustment in the Guidelines.

Line 5a is each parent’s share of support

Parent A’s share of support

If you checked Box 2 in 1b because Parent A is mainly responsible for the children, leave 5a and 5b for Parent B blank.

- Multiply Parent A’s share of combined available income in 3c by Parent A’s adjusted combined support amount in 4c.

- Put the answer in Parent A’s column in 5a.

Parent B’s share of support

If you checked Box 2 in 1b because Parent A is mainly responsible for the children, leave 5a for Parent B blank.

If you checked Box 1 or Box 3 in 1b:

- Multiply Parent B’s share of combined available income in 3c by Parent B’s adjusted combined support amount in 4c.

- Put the answer in Parent B’s column in 5a.

Line 5b is the other parent’s share of child support

Parent A’s “other parent’s share of support” is Parent B’s share of support:

- Subtract Parent A’s 5a share of support from Parent A’s 4c adjusted combined support amount.

- Put the answer in Parent A’s 5b other parent’s share.

Parent B’s “other parent’s share of support” is Parent A’s share of support.

If you checked Box 2 in 1b because Parent A is mainly responsible for the children, leave 5b for Parent B blank.

If you checked Box 1 or Box 3 in 1b:

- Subtract Parent B’s 5a share of support from Parent B’s 4c adjusted combined support amount.

- Put the answer in Parent B’s 5b other parent’s share.

Line 5c shows the “other parent’s share of support” using the low-income payer adjustment in the Guidelines

If you checked Box 2 in 1b, put $0 for Parent B, and for Parent A:

- If Parent B 3a is more than $249, put the amount in 5b.

- If Parent B 3a is less than or equal to $249, put the amount from the shaded area of the Guidelines Chart for Parent B 3a.

If you checked Box 1 or Box 3 in 1b, for each parent:

- If the other parent's 3a is more than $249, put the amount in 5b.

- If the other parent's 3a is less than or equal to $249, put the amount from the shaded area of the Guidelines Chart for the other parent's 3a.

Section 6 Adjusted Support Amounts

This section of the Worksheet is used to

- Take into account each parent’s child care expenses to figure out their “adjusted support amounts,”

- Figure out which parent will be the Payor and which will be the Recipient,

- Figure out how to adjust the Payor’s share of support if the Recipient receives a Social Security dependency benefit, and

- Figure out how much to adjust the Payor’s share of support.

Line 6a says the amount of each parent’s child care expenses that can be used to figure out their child care credit.

Reasonable child care costs of up to $355 per week per child for the children covered by the child support order and due to either parent’s working are shared by the parents in proportion to their share of combined available income.

- For each child with an amount in 2g:

- If the total child care cost paid by both parents (in the third row of 2g) is less than or equal to $355, use the actual amounts in 2g for each parent.

- If the total child care cost paid by both parents is more than $355, for each parent: divide $355 by the total child care cost paid by both parents and multiply the answer by the amount in 2g for that child.

- If child care costs are over $355 because of the special needs of the child, you will have to ask the judge if you can put in the higher cost.

- Add up the resulting amounts for all of the children and enter each parent's overall child care cost into that parent’s column in 6a.

Line 6b shows the “other parent’s share” of the child care expenses.

For Parent A: Multiply 3c Parent B’s “share of available income” 3c times Parent A’s child care amount 6a. Put the answer in Parent A’s column in 6b.

For Parent B: Multiply Parent A’s “share of available income” 3c times Parent B’s child care amount 6a. Put the answer in Parent B’s column in 6b.

Line 6c shows the “other parent’s adjusted share of support” taking into account the other parent’s share of the child care expenses from 6b.

For Parent A: Add 5c (“other parent’s share of support”) plus 6b. Put the answer in Parent A’s column in 6c.

For Parent B: Add 5c (“other parent’s share of support”) plus 6b. Put the answer in Parent B’s column in 6c.

Line 6d shows the percentage of each parent’s available income to be used for child support

Parent B’s support as a percentage of Parent A’s income

If you checked Box 2 main responsibility in 1b, put N/A Not Applicable in Parent A’s 6d.

If you checked Box 1 shared responsibility or Box 3 split responsibility in 1b:

- Only work in Parent A’s column.

- Divide the other parent’s share of support in Parent A’s column 6c by Parent A’s available income 3a.

- To get the percentage, multiply that number by 100.

- Use the nearest whole number. You do not need any numbers to the right of the decimal point.

- Put your answer in 6d. This is Parent B’s share of child support as a percentage of Parent A’s available income.

- If 3a = $0, put 100%.

Parent A’s support as a percentage of Parent B’s income

If you checked Box 2 main responsibility in 1b, leave Parent B’s 5c blank.

If you checked Box 1 shared responsibility or Box 3 split responsibility in 1b:

- Only work in Parent B’s column.

- Divide the other parent’s share of support in Parent B’s column 6c by Parent B’s available income 3a.

- To get the percentage, multiply that number by 100.

- Use the nearest whole number. You do not need any numbers to the right of the decimal point.

- Put your answer in 6d. This is Parent A’s share of child support as a percentage of Parent B’s available income.

- If 3a = $0, put 100%.

Line 6e shows the other parent’s adjusted share of support.

6e adjusts each parent’s share of support when there is a big difference between your incomes. But the adjustment is limited.

6e lowers your share of support when your share is less than 10% of the other parent’s available income. But it limits how low your share can go. Your share must be at least $12.

- If 6d is equal to or more than 10% of the other parent's available income, or is N/A, put the amount in 6c for each parent.

- If 6d is less than 10% of the other parent's available income, put whichever is less:

- 6c, or

- add 6d plus 10%.

Multiply the answer times the other parent’s income 3a, but not less than an amount from the shaded area of Table A in the Guidelines Chart.

Multiply the answer times the other parent’s income 3a, but not less than an amount from the shaded area of Table A in the Guidelines Chart.

Line 6f tells you which parent pays child support and which parent gets it

The parent who pays child support is the “payor”.

The parent who gets child support is the “Recipient”.

If you checked Box 2 in 1b, put “Recipient” for Parent A and “Payor” for Parent B.

If you checked Box 1 shared responsibility or Box 3 split responsibility in 1b, put:

- “Recipient” in the column with the higher amount in 6e and

- “Payor” in the other column.

If 6e is the same in both columns, put ”Recipient” in one column and “Payor” in the other column. It does not matter which column you use.

Line 6g is the Payor’s adjusted share of support

Line 6g adjusts the payor’s share of support when the Recipient gets a dependency benefit directly from Social Security.

If the Recipient does not get a dependency benefit directly from Social Security, subtract Payor’s 6e from Recipient’s 6e. Put the answer in the 6g.

If you checked Box 1 or Box 3 in 1b and the Recipient gets a dependency benefit directly from Social Security in 2b:

- If you are using the electronic Child Support Guidelines Worksheet on Mass.gov, the worksheet automatically checks the box on 6g and calculates the correct amount in 6g.

- If you are doing the worksheet by hand, fill out a new worksheet and replace the Recipient’s amount in 2b with the recipient’s amount from 2c. Keep all other figures the same, and check the box on 2g in the new worksheet.

Section 7 Payor’s net support obligation

Section 7:

- Calculates the amount the Payor will pay the Recipient, and

- Gives the Payor credit for the amount of any dependency benefit Social Security sent directly to the Recipient because the Payor retired or has a disability.

Judges use this section of the Worksheet to adjust the Payor’s weekly child support amount where the Recipient has a relatively high income and the Payor has a relatively low income.

Note

If you use a computer, the Worksheet calculates the adjusted weekly support amount automatically and puts the answer in Line 7b.

Line 7a is the Payor’s share of support as a percentage of the Recipient’s available income.

If you checked Box 1 or Box 3 in 1b put N/A.

If you checked Box 2 in 1b,

- Divide 6g, Payor’s adjusted share of support, by 3a Recipient’s available income.

- If 3a Recipient’s available income is $0, put 100% in 7a.

- If 3a Recipient’s available income is more than $0

- Multiply the number you get after dividing 6g by 3a by 100.

- Use the nearest 'whole number'. You do not need any numbers to the right of the decimal point.

- Put that final 'whole number' in 7a.

Line 7b adjusts the Payor’s support obligation if there is a great income disparity.7b changes the Payor’s weekly support amount only in cases where the Recipient has a relatively high income and the Payor has a relatively low income.

If 7a is N/A, put the amount in 6g in 7b.

If 7a is less than 10%, put whichever is less:

- 6e,

- 6g, or

- 7a plus 10%. Multiply the answer times the Payor’s 3a, but not less than the amount from the shaded area of Table A in the Guidelines Chart.

Line 7c is for a credit for Social Security dependency benefits paid

7c gives the Payor credit for the amount of any dependency benefit that Social Security sent directly to the Recipient because the Payor is retired or has a disability.

In 7c, put the amount from 2c, any dependency benefit that Social Security sent directly to the Recipient because the Payor is retired or has a disability.

If 2c is blank, put $0.

Line 7d is the Payor’s final support obligation.

If 7b is greater than 7c, subtract 7c from 7b.

Put the answer in 7d.

If 7b is not greater than 7c put $0.

The amount in 7d is the amount of child support the Payor pays the Recipient each week.

Line 7e the Payor’s final support obligation as a percentage of the Payor’s available income.

Line 7e is used to find out if the support amount is so high that:

- There is a substantial hardship for the Payor. And

- The judge should consider ordering a different amount than the guidelines amount, also known as 'deviating' from the guidelines amount.

To get the percentage for 7e:

- Multiply the number in 7d by 100.

- Use the nearest 'whole number'. You do not need any numbers to the right (payor available income) of the decimal point.

- Put the 'whole number' you get in 7e.

In 7e:

- If the Payor’s 3a = 0, put 100%.

- If 7e is 40% or more, put the percentage in 7e and check the box.

Section 8 Additional Income Above $7,692.

Judges use this section if they decide to change the child support amount when the parents’ have a combined additional income of more than $7,692 per week.

Note

If you use a computer, the Worksheet calculates each parent’s share of their “combined additional income” automatically and puts the answer in 8b.

Line 8a is the amount of combined available income over $7,692 per week

Subtract $7,692 from 3b. Put the answer or $0, whichever is more, in 8a

Line 8b is each parent’s share of the combined additional income available for child support.

- Multiply 8a by the percentage in the Recipient’s column of 3c.

- Put the answer in the Recipient’s box in 8b, Recipient’s “share of combined additional income.”

- Multiply 8a by the percentage in the Payor’s column of 3c.

- Put the answer in the Payor’s box in 8b, Payor’s “share of combined additional income.

The judge can use each parent’s share of additional income for child support.

See How to Fill Out a Financial Statement

Explanation of a Florida Child Support Guidelines Worksheet

- Legal F.A.Q.

- Child Support

- Explanation of a Florida Child Support Guidelines Worksheet

Transcript of Video:

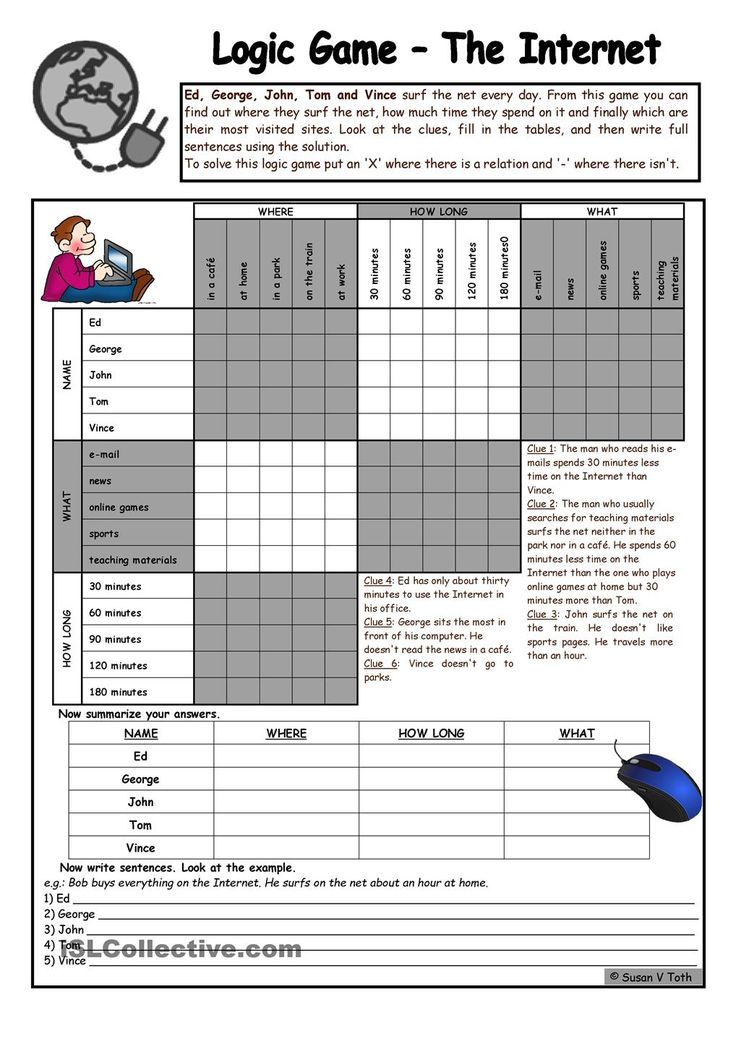

I’m going to walk through what all these numbers mean in a Child Support Guidelines Worksheet. Hopefully so you can better understand what is going on here. There are a lot of numbers. Only a very few are actually input into the system.

This is a sample worksheet, not an actual client’s worksheet. But this is more in line with what you will see at a court hearing, rather than the Child Support Guidelines Worksheet that the Supreme Court of Florida puts on their website.

The first thing to notice is the number of children. The combines number of children. Here we have two (2) children. And they are living primarily with the Wife. Zero of the children living with the Husband. The next data that is input in the first section up here is in the income section. It shows a Wife with $3109 of monthly income, and a Husband with $5400 of monthly income. It totals these numbers up to $8509. These other lines here are for other ways you can make money. Basically they are all treated the same except for non-taxable income – which generally only comes up in a military context (but there are others). So the difference between the $8509 and the $7285 are the various deductions and this is what the rest of this side of the worksheet is talking about. It lists the various deductions – alimony payments, taxes, and other main ones union – dues, mandatory retirement plans, parent’s health insurance cost (but not the children’s, that is treated somewhere else). But the parent’s health insurance cost as well as child support that is ordered and paid in other cases – not this case, but is ordered and paid in other cases.

The combines number of children. Here we have two (2) children. And they are living primarily with the Wife. Zero of the children living with the Husband. The next data that is input in the first section up here is in the income section. It shows a Wife with $3109 of monthly income, and a Husband with $5400 of monthly income. It totals these numbers up to $8509. These other lines here are for other ways you can make money. Basically they are all treated the same except for non-taxable income – which generally only comes up in a military context (but there are others). So the difference between the $8509 and the $7285 are the various deductions and this is what the rest of this side of the worksheet is talking about. It lists the various deductions – alimony payments, taxes, and other main ones union – dues, mandatory retirement plans, parent’s health insurance cost (but not the children’s, that is treated somewhere else). But the parent’s health insurance cost as well as child support that is ordered and paid in other cases – not this case, but is ordered and paid in other cases.

Each parent’s net income is calculated and then it’s added up to the $7285 – and that’s the number that is reflected on the next screen with the minimum child support need of $1921.

OK, so to review, the only numbers input on the left side of the screen were the number of children, the income of the Wife, the income of the Husband – nothing was input as any alimony payment made by either party. The taxes are calculated automatically, and there are no other deductions used. The numbers here at the bottom are all automatically calculated. And that gets us to the other side where we initially see the minimum child support need of $1921.

So starting on this side, the numbers that are input are simply …. the number of overnights that the children are going to have with the Husband. Based on the minimum child support need of $1921, the two (2) next numbers get divided up based on the percentages of income. So, in this situation, the Husband would typically pay $1108 a month in child support. That’s not going to be the case here because of the number of nights [with the children]. The law requires a reduction in his child support if he spends more than 20% of the nights with the children. Here is shows you his percentage – 27.4%. So that will provide, due to some interesting math provided by the statute, a pre-adjustment transfer – so that’s his base child support amount based on his number of nights and his income – of $873.

That’s not going to be the case here because of the number of nights [with the children]. The law requires a reduction in his child support if he spends more than 20% of the nights with the children. Here is shows you his percentage – 27.4%. So that will provide, due to some interesting math provided by the statute, a pre-adjustment transfer – so that’s his base child support amount based on his number of nights and his income – of $873.

Next we go down to a couple of expenses that are counted in a child support calculation. First, this hypothetical couple pays $450 a month in day care costs and $350 a month in medical. And here you can see that the Wife pays the child care and the Husband pays the medical . Each is responsible for only a portion of those numbers even though they pay the entire amount of each one. The Wife is responsible for 42.3% of both costs. And the Husband is responsible for 57.7% of both costs. So instead of the having the Wife pay some money to the Husband and the Husband paying some money to the Wife, there’s only one transfer and that’s the $111. 68 that the Husband pay in additional child support due to these expenses. We add that to the pre-adjustment transfer and you have him final child support amount of $985.06.

68 that the Husband pay in additional child support due to these expenses. We add that to the pre-adjustment transfer and you have him final child support amount of $985.06.

in Child Support

Did this article answer your question?

Related Articles

Site map

Site maphome Actual

|

|

In which court to file an application for the collection of alimony debt? At your place of residence or the place of residence of the defendant? (there is a writ of execution.

The defendant pays less). - Lawyer in Samara and Moscow

The defendant pays less). - Lawyer in Samara and Moscow HomeFAQFamily Law In which court should I apply for the recovery of alimony debt? At your place of residence or the place of residence of the defendant? (there is a writ of execution. The defendant pays less).

Hello. In which court should I apply for the recovery of alimony debt? At your place of residence or the place of residence of the defendant? (there is a writ of execution. The defendant pays less).

Lawyer Antonov A.P.

Good afternoon!

Art. 29 of the Code of Civil Procedure, a claim against a defendant whose place of residence is unknown or who does not have a place of residence in the Russian Federation may be brought to court at the location of his property or at his last known place of residence in the Russian Federation.

A claim against an organization arising from the activities of its branch or representative office may also be brought to the court at the location of its branch or representative office.

Claims for the recovery of alimony and the establishment of paternity may also be brought by the plaintiff to the court at his place of residence.

On the application of legislation by the courts when considering cases related to the recovery of alimony, see Resolution of the Plenum of the Supreme Court of the Russian Federation of December 26, 2017 N 56

a minor or for health reasons, the departure of the plaintiff to the place of residence of the defendant is difficult for him.

Claims for compensation for harm caused by mutilation, other damage to health or as a result of the death of the breadwinner may also be brought by the plaintiff in court at the place of his residence or the place where the harm was caused.

Claims for the restoration of pension and housing rights, the return of property or its value, related to compensation for losses caused to a citizen by unlawful conviction, unlawful prosecution, illegal use of detention as a preventive measure, undertaking not to leave, or unlawful imposition of an administrative penalty in form of arrest, may also be presented to the court at the place of residence of the plaintiff.

Claims for the protection of the rights of the subject of personal data, including for damages and (or) compensation for non-pecuniary damage, may also be brought to the court at the place of residence of the plaintiff.

Claims for the termination of the issuance by the search engine operator of links allowing access to information on the Internet information and telecommunication network may also be brought to the court at the place of residence of the plaintiff.

Claims for the restoration of labor rights may also be brought to the court at the place of residence of the plaintiff.

Claims for the protection of consumer rights may also be filed in court at the place of residence or place of residence of the plaintiff or at the place of conclusion or place of performance of the contract.

Claims for compensation for damages caused by collision of ships, recovery of wages and other amounts due to members of the ship's crew for work on board the ship, repatriation costs and social insurance contributions, recovery of remuneration for rendering assistance and rescue at sea may also be brought in court at the location of the defendant's ship or the ship's port of registry.

Claims arising from contracts, including labor contracts, in which the place of their execution is indicated, can also be brought to the court at the place of execution of such an agreement.

The choice between the several courts that have jurisdiction under this section belongs to the plaintiff.

Thus, in this case, you can file a claim at your place of residence.

Sincerely, Attorney Anatoly Antonov, Managing Partner of Antonov & Partners Law Office.

Still have questions for a lawyer?

Ask them right now here, or call us by phone in Moscow +7 (499) 288-34-32 or in Samara +7 (846) 212-99-71 (round the clock), or come to our office for a consultation ( by appointment)!

Relevance date of the material: 06/20/2019

To sign up for a consultation, call the round-the-clock number +7 (846) 212-99-71 or leave a request below

Leave your feedback about our work here!

Site search

Antonov & Partners Law Office - high-quality legal assistance throughout Russia.

Practice

Practice