How to pay back child benefit overpayment

Will You Have to Pay Back Your Child Tax Credit Payments?

The IRS sent the final round of 2021 child tax credit payments back in December. Overall, eligible families received up to $1,800 in total monthly payments for each child five years old or younger and up to $1,500 for each kid 6 to 17 years old. (Parents with higher incomes didn't receive that much or were denied the credit altogether.) If you have a large family, that adds up to a pretty hefty chunk of change. But what if the IRS sent you too much money – do you have to pay it back? Well…maybe.

The law authorizing the monthly child credit payments specifically says that any excess amounts must be paid back when you file your 2021 tax return if your income is above a certain amount. There are exceptions to this rule for middle- and lower-income families, but they're limited. Plus, the way the monthly payments were calculated, overpayments could be fairly common. So, this could be a big issue for a lot of families.

Changes to the Child Tax Credit for 2021

Before getting into how you may have ended up with an overpayment and the details of the payback rules, it's probably a good idea to go over some of the changes to the child tax credit that apply for the 2021 tax year (and only for 2021). For the 2020 tax year, the maximum child tax credit was $2,000 per child 16 years old or younger. It was also phased-out if your income exceeded $400,000 for married couples filing a joint return or $200,000 for single and head-of-household filers. For some lower-income taxpayers, the credit was partially "refundable" (up to $1,400 per qualifying child) if they had earned income of at least $2,500 (i.e., you got a refund check for the refundable amount if the credit was more than the tax you owed).

Subscribe to Kiplinger’s Personal Finance

Be a smarter, better informed investor.

Save up to 74%

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

The American Rescue Plan, which was enacted in March 2021, made some major changes to the child tax credit for the 2021 tax year. For one thing, the credit amount was raised from $2,000 to $3,000 for children 6 to 17 years old and to $3,600 for kids 5 years old and younger. The $2,500 earned income requirement was also dropped, and the credit was made fully refundable (which means refund checks triggered by the 2021 credit can be greater than $1,400).

There are also two phase-out schemes in play for families with higher incomes in 2021. The first one can't reduce the credit amount below $2,000 per child. It kicks in if your modified adjusted gross income (AGI) is above $75,000 (single filers), $112,500 (head-of-household filers), or $150,000 (joint filers). The second phase-out is the same $200,000/$400,000 one that applied before 2021.

Finally, the American Rescue Plan required the IRS to pay half of your total credit amount in advance through monthly payments issued from July to December 2021 (you could have opted-out if you wanted to). In most cases, the IRS based the amount of the payments on information it pulled from your 2020 tax return. You can claim the remaining half of the credit when you file your 2021 tax return, which is due April 18, 2022. In practice, this will be done by subtracting every dollar you received from July to December from the total credit you're entitled to claim and then reporting the leftover amount, if any, as a child tax credit on your 2021 return. (Use our 2021 Child Tax Credit Calculator to see how much your monthly payments should have been and what should be leftover to claim as a credit on your 2021 tax return.)

In most cases, the IRS based the amount of the payments on information it pulled from your 2020 tax return. You can claim the remaining half of the credit when you file your 2021 tax return, which is due April 18, 2022. In practice, this will be done by subtracting every dollar you received from July to December from the total credit you're entitled to claim and then reporting the leftover amount, if any, as a child tax credit on your 2021 return. (Use our 2021 Child Tax Credit Calculator to see how much your monthly payments should have been and what should be leftover to claim as a credit on your 2021 tax return.)

For complete coverage of the changes for 2021, see Child Tax Credit FAQs for Your 2021 Tax Return.

How Child Tax Credit Overpayments Can Occur

You may be wondering why the IRS would send you too much money in the first place. If the goal was simply to give you a 50% advance of your total child tax credit over a six-month period, it doesn't seem like that would be too difficult. It's basic math – right?

It's basic math – right?

Well, yes, the math itself is easy…but things change, which may have made it difficult for the IRS to find the right numbers to plug into its computers. For instance, what if your income increased in 2021 to a point where your child tax credit is now partially or completely phased out. The IRS likely looked at your 2020 tax return to calculate the amount of your 2021 monthly payments. If your 2020 income was below the credit's phase-out thresholds, the IRS probably sent you the maximum amount each month. However, because of your higher 2021 income, your 2021 child tax credit is going to be lower than expected…which could create an overpayment.

Since the child tax credit phase-out thresholds are tied to your filing status, a similar situation can arise from a change to your family situation in 2021 (e.g., a divorce). For example, imagine that the IRS based your monthly payments on your 2020 joint return and your 2021 income is lower than the credit phase-out threshold for joint filers. You then use a different filing status on your 2021 return with a lower credit phase-out threshold (e.g., single or head-of-household) that results in a reduced child tax credit amount. That can also generate an overpayment.

You then use a different filing status on your 2021 return with a lower credit phase-out threshold (e.g., single or head-of-household) that results in a reduced child tax credit amount. That can also generate an overpayment.

If you claim the child tax credit for fewer children in 2021 than you did in 2020, that can result in an overpayment, too. This can happen, for instance, if you're divorced and you claimed your child as a dependent on your 2020 tax return, but your ex-spouse claims the child as a dependent for 2021 taxes (a common arrangement). In that case, the IRS probably sent you monthly payments for the child. However, since you don't qualify for the child tax credit on your 2021 return (your ex will), all the money you received from the IRS last year between July and December will be an overpayment.

And here's one more example…your main home had to be in the U.S. for more than half of 2021 to qualify for monthly child tax credit payments. If you satisfied that requirement in 2020, but not in 2021, the IRS most likely sent you monthly payments that you weren't supposed to get. That can result in an overpayment as well.

That can result in an overpayment as well.

Repayment Requirements for the 2021 Child Tax Credit

Now let's talk about what happens if you ended up with a child tax credit overpayment. Depending on your income, you might have to pay some or all of it back as an addition to the tax you owe when you file your 2021 return.

Lower-income people get a good deal. If your modified AGI for 2021 doesn't exceed $40,000 (single filers), $50,000 (head-of-household filers), or $60,000 (joint filers), and your principal residence was in the U.S. for more than half of 2021, you won't have to repay any overpayment amount. That's a win for you!

On the other hand, parents with higher incomes don't get any breaks at all. If your modified AGI for the 2021 tax year is at least $80,000 (single filers), $100,000 (head-of-household filers), or $120,000 (joint filers), you must pay back your entire overpayment. Ouch!

It's a little more complicated for people in the middle. All or part of your overpayment might be forgiven if your modified AGI for 2021 is between $40,000 and $80,000 (single filers), $50,000 and $100,000 (head-of-household filers), or $60,000 and $120,000 (joint filers). To determine how much of your overpayment is wiped out (if any), you first need to calculate what the IRS calls your "repayment protection amount." This is equal to $2,000 multiplied by:

All or part of your overpayment might be forgiven if your modified AGI for 2021 is between $40,000 and $80,000 (single filers), $50,000 and $100,000 (head-of-household filers), or $60,000 and $120,000 (joint filers). To determine how much of your overpayment is wiped out (if any), you first need to calculate what the IRS calls your "repayment protection amount." This is equal to $2,000 multiplied by:

- The number of children the IRS used to calculate your monthly child tax credit payments, minus

- The number of children used to calculate the total credit amount on your 2021 tax return.

If there's no difference between the number of children used to calculate the two amounts, then there's no overpayment reduction, and the full amount must be repaid. If you have a positive repayment protection amount, it's then gradually phased-out as your modified AGI increases within the income range above. The phase-out rate is based on how much your modified AGI exceeds the lower limit of the applicable income range. Once your final repayment protection amount is calculated, it's subtracted from your overpayment to determine how much you need to repay (but your overpayment can't be reduced below zero).

Once your final repayment protection amount is calculated, it's subtracted from your overpayment to determine how much you need to repay (but your overpayment can't be reduced below zero).

Here's an example of how this works: Joe, who is single, claimed a child tax credit for two children on his 2020 tax return (the children were 2 and 4 years old at the end of 2021). As a result, the IRS sent him $3,600 in monthly payments in 2021. However, Joe can't claim the child tax credit on his 2021 return because his ex-wife is claiming the children as dependents on her return. Since his 2021 child tax credit is $0, the entire $3,600 he received from the IRS is an overpayment. Joe's initial repayment protection amount is $4,000 (i.e., $2,000 for each child). If Joe files a 2021 return with a modified AGI of $60,000, his modified AGI exceeds the lower limit of the applicable income range – $40,000 – by 50% ($60,000 - $40,000 / $80,000 - $40,000 = 0.5). As a result, Joe's $4,000 repayment protection amount is reduced by 50% to $2,000. Therefore, Joe only has to repay $1,600 of his $3,600 overpayment ($3,600 - $2,000 = $1,600).

Therefore, Joe only has to repay $1,600 of his $3,600 overpayment ($3,600 - $2,000 = $1,600).

[Note: You may also have to pay back a portion of your overpayment if your modified AGI is less than or equal to $40,000 (single filers), $50,000 (head-of-household filers), or $60,000 (joint filers) and you lived outside the U.S. for at least half of 2021.]

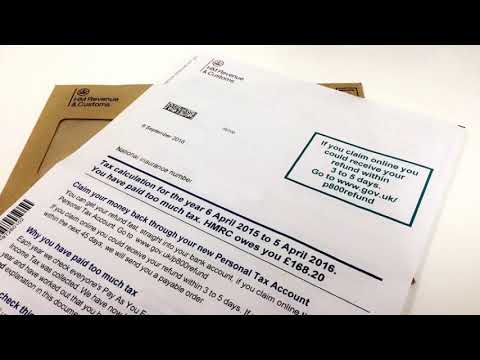

Paying back a working or child tax credits overpayment

If you have a tax credits overpayment you must pay back, you should deal with it as soon as possible.

While having to pay back money can be worrying, there are lots of ways to pay HM Revenue and Customs (HMRC) - including in instalments.

If you’re disputing paying back the overpayment, you might still need to start paying HMRC back. You’ll get this money back if your dispute is successful.

If you have other debts

You should check you’re dealing with the most urgent debts first. Use our get help with your debts tool to work out if you should prioritise other debts before your tax credits overpayment.

How you’ll be asked to pay HMRC

When HMRC wrote to tell you you’ve been overpaid, they’ll have said how they want you to pay the money back.

Usually, HMRC will take the tax credits you owe from your tax credits payments. This means you’ll get less tax credits until you’ve paid off the debt.

They’ll ask you to pay them directly if:

- you no longer get tax credits

- the overpayment was for a joint claim and you’re now making a single claim

- the overpayment was for a joint claim and you’re now making a new joint claim with a different partner

If you can’t find your overpayment letter, call the tax credits helpline to find out how HMRC want you to pay the overpayment back.

HM Revenue and Customs (HMRC) tax credits helpline

Telephone: 0345 300 3900

Relay UK - if you can't hear or speak on the phone, you can type what you want to say: 18001 then 0345 300 3900

You can use Relay UK with an app or a textphone. There’s no extra charge to use it. Find out how to use Relay UK on the Relay UK website.

There’s no extra charge to use it. Find out how to use Relay UK on the Relay UK website.

If you're calling outside of the UK: +44 2890 538 192

Monday to Friday, 8am to 6pm

Telephone (Welsh language): 0300 200 1900

Monday to Friday, 8.30am to 5pm

Your call is likely to be free of charge if you have a phone deal that includes free calls to landlines - find out more about calling 03 numbers.

Make a note of the date and time you call. Also write down the name of the person you spoke to and the HMRC office they work in - for example Preston or Belfast. You might need these details if something goes wrong and your repayments aren’t changed.

If your tax credits have been replaced by Universal Credit (UC)

Without checking with you first, HMRC can ask the Department for Work and Pensions (DWP) to reduce your UC payments to pay back your tax credits overpayment.

You should be sent a letter telling you how much is being taken off your UC. You can contact your local jobcentre to ask the DWP to take off smaller amounts from your UC over a longer period of time.

If you’re happy with how HMRC want you to pay them back

If HMRC are taking the money from your tax credits, and you can manage on the reduced amount, you don’t need to do anything.

Your tax credits will be reduced from the date written on the overpayment letter. They’ll go back to the full amount once the overpayment has been paid.

If HMRC has asked you to pay them directly - known as ‘direct recovery’ - and you can afford the repayments, see GOV.UK for ways to pay. You’ll need to start paying the money back within 30 days of the date on the overpayment letter.

If you want to change how you pay HMRC

You can call the tax credits helpline to ask to change:

- how much you have to pay back in each instalment

- how long you have to pay the money back

- the way you pay the money back

Changing your tax credits repayments is a good idea if you’d find it difficult to manage on what’s left once you’ve paid HMRC.

If you’ve been charged interest on your overpayment, it’s worth making larger payments, if you can. You’ll then pay less interest and save money overall.

You’ll then pay less interest and save money overall.

Changing how much is taken off your tax credits

If it will be difficult for you to pay for food and other essentials, call the tax credits helpline. Ask to pay back the overpayment over a longer period of time. A smaller amount might then be taken off your tax credits each month.

Changing what you pay HMRC directly

You can ask HMRC to reduce or increase your repayments. Use our get help with your debts tool to work out how much you can afford to pay.

You can call the tax credits helpline and suggest an amount that you can pay each month - or ask to repay the money in a single payment.

If you’d struggle to pay HMRC back, ask to pay in smaller instalments over a longer period of time.

You might be contacted by bailiffs if you don’t pay any money back. HMRC can also take money straight from your bank account if you owe them more than £1,000 - and you’d be left with at least £5,000 in your account.

If you’re being chased by bailiffs

Don’t be tempted to ignore a letter from bailiffs. Contact your nearest Citizens Advice to get urgent help. You can also read about ways to stop bailiff action.

Using other benefits to pay back HMRC

If you no longer get tax credits and would find it difficult to put money aside to pay HMRC yourself, you can ask HMRC to take the money off other benefits.

Call the tax credits helpline to ask for the money to be taken from a means-tested benefit.

You’ll need to follow up this call with a letter that gives HMRC permission to take the repayment from the benefit. Make sure it includes:

- the name of the benefit you want the payments to be taken from

- how much you’ve agreed can be taken off your benefit and how often - the maximum is £11.10 a week

- your full name and signature

Send this letter to:

HMRC Tax Credit Office

Preston

PR1 4AT

Paying back HMRC through your income tax

If you don’t get any other benefits, you can pay HMRC back through your income tax. Your tax code will be changed so that more tax is taken off your wages and paid straight to HMRC.

Your tax code will be changed so that more tax is taken off your wages and paid straight to HMRC.

Call the tax credits helpline to ask for more tax to be taken from your wages.

You’ll need to follow up this call with a letter that gives HMRC permission to take the repayment from your income tax. Make sure it includes:

- how much you’ve agreed can be taken off your tax and how often

- your full name and signature

Send this letter to:

HMRC Tax Credit Office

Preston

PR1 4AT

If you can’t pay any money back

You might be able to get HMRC to cancel your overpayment if paying any money would mean you can’t pay for essentials, like rent or electricity.

It’s unusual for HMRC to do this and you’ll need to show it would be very hard for you to pay even a small amount back. For example, if you’ve got a serious health problem that means you won’t be able to return to work.

You can tell HMRC through your personal tax account. You’ll need to fill in the hardship form.

You’ll need to fill in the hardship form.

If you’d prefer to tell them by phone, you can call the HMRC tax credits helpline to explain why you can’t pay back the debt.

You should call the HMRC payment helpline to explain why you can’t pay back the debt. If you need any help, visit your nearest Citizens Advice and ask an adviser to call for you.

If HMRC agree, they’ll cancel your repayment. Otherwise, you can ask them to reduce the repayment amount or pause repayments for a few months.

If HMRC won’t change how you pay

You can make a complaint if you think HMRC have unfairly refused to change your payments.

You can make a complaint on GOV.UK or call the tax credits helpline. They’ll try to sort out your complaint as soon as possible.

Did this advice help?Yes No

Leave this name field blankLeave this address field blank

Why wasn't this advice helpful?It isn't relevant to my situation

It doesn't have enough detail

I can't work out what I should do next

I don't understand

Please tell us more about why our advice didn't help.

You've reached the 3000 character limit.

Did this advice help?

Thank you, your feedback has been submitted.The Supreme Court of the Russian Federation explained in which cases the money paid can not be returned

The Supreme Court of the Russian Federation raised an extremely important topic for citizens when it reviewed the results of the dispute between a citizen and the Pension Fund. Fund officials considered that they paid the person more than they were supposed to, and demanded that everything be returned to the penny plus interest for several years of "using other people's money." But the Supreme Court defended the man, along the way explaining in which case the employees of the Pension Fund can demand a refund, and in which cases they cannot.

For our hero, this story began with a lawsuit filed against him by the regional branch of the Pension Fund. In court, the representative of the plaintiff said that the citizen must return the money and interest for nine years.

In court, the representative of the plaintiff said that the citizen must return the money and interest for nine years.

The gist of the claim is as follows. The citizen has received every month a special payment for his daughter since her birth in 2005. Payments were made under the Law "On the social protection of citizens exposed to radiation as a result of the disaster at the Chernobyl nuclear power plant." Officially, the recipient of payments was considered "permanently residing in the territory of the zone with a preferential socio-economic status." Four years later, dad and daughter moved to a neighboring area. But the man did not report this to the Pension Fund and payments continued to come to him. And in 2018, the Pension Fund found out about this and immediately went to court.

The citizen did not agree with the claim in court. I recalled a special article about this - 1109 of the Civil Code. And he said that there is a statute of limitations for such requirements, which officials have long missed. But the district court decided the dispute in favor of the Pension Fund. The court of first instance indicated that the man lived in a zone with a preferential socio-economic status, so his daughters were paid extra every month. And as soon as she changed her place of residence, she lost such a right. The court also said that a citizen cannot use Article 1109Civil Code, which states what payments a person does not need to return. The defendant himself is to blame - "failed to fulfill the obligation to notify the pension authority." And about the missed statute of limitations, the court stated the following - there is no evidence in the case file that pension officials knew or could find out that the man with the child had left. The appeal agreed with these arguments. But our hero reached the Supreme Court of the Russian Federation. They said that the conclusions of the local courts are based on "an incorrect application of substantive law."

But the district court decided the dispute in favor of the Pension Fund. The court of first instance indicated that the man lived in a zone with a preferential socio-economic status, so his daughters were paid extra every month. And as soon as she changed her place of residence, she lost such a right. The court also said that a citizen cannot use Article 1109Civil Code, which states what payments a person does not need to return. The defendant himself is to blame - "failed to fulfill the obligation to notify the pension authority." And about the missed statute of limitations, the court stated the following - there is no evidence in the case file that pension officials knew or could find out that the man with the child had left. The appeal agreed with these arguments. But our hero reached the Supreme Court of the Russian Federation. They said that the conclusions of the local courts are based on "an incorrect application of substantive law."

And now in detail about the position of the Supreme Court. The court began with the Civil Code. It has article 1102, which says that if a person received something illegally, it must be returned. There is an exception to these rules, and they are listed in another article of the same code - in 1109. It says that it is not necessary to return the money that was given "as a means of subsistence" - wages, pensions, allowances, scholarships, compensation for harm. And in general, money that "is intended to meet needs and the return of which would put a person in a difficult financial situation." There is an exception in the article when a person still has to return - if the receipt of the amounts was the result of a counting error or if it is the result of the bad faith of the recipient himself. Speaking about dishonest behavior, the SC emphasized that it is the duty of the one who demands money to prove such dishonesty.

The court began with the Civil Code. It has article 1102, which says that if a person received something illegally, it must be returned. There is an exception to these rules, and they are listed in another article of the same code - in 1109. It says that it is not necessary to return the money that was given "as a means of subsistence" - wages, pensions, allowances, scholarships, compensation for harm. And in general, money that "is intended to meet needs and the return of which would put a person in a difficult financial situation." There is an exception in the article when a person still has to return - if the receipt of the amounts was the result of a counting error or if it is the result of the bad faith of the recipient himself. Speaking about dishonest behavior, the SC emphasized that it is the duty of the one who demands money to prove such dishonesty.

The local court did not take into account that, under article 1109 of the Civil Code, a person must return overpaid pension money only if his dishonest behavior or due to an accounting error is proved his dishonest behavior will be proven. The court should first of all find out whether there was bad faith on the part of the defendant. When my father applied for payments in 2005, was he informed by officials that not the entire territory of the district is considered a preferential zone, and if he moves a little further, he may lose payments. All this was required by law to prove the officials. But for some reason the court decided that the defendant should do it.

The court should first of all find out whether there was bad faith on the part of the defendant. When my father applied for payments in 2005, was he informed by officials that not the entire territory of the district is considered a preferential zone, and if he moves a little further, he may lose payments. All this was required by law to prove the officials. But for some reason the court decided that the defendant should do it.

The Supreme Court did not agree with the fact that the pension authority did not miss the limitation period. There is an article in the Civil Code - 200, and it says that the statute of limitations in the country is three years. And if it is omitted, the court should have dismissed the claim. Yes, this article says that the period begins from the moment when "the person knew or should have known about the violation of his rights." But according to the Regulations on the Pension Fund, one of its main functions is to control the correct spending of public money. The court was obliged to determine the day when officials learned about the departure of the father and daughter. For some reason, the court did not check the reasons why officials did not control payments for years. It turns out that the pension authority found out that the girl was registered at a different address nine years later, when all the deadlines had expired.

The court was obliged to determine the day when officials learned about the departure of the father and daughter. For some reason, the court did not check the reasons why officials did not control payments for years. It turns out that the pension authority found out that the girl was registered at a different address nine years later, when all the deadlines had expired.

The SC reversed all decisions and ordered a review of the case.

Senator Bibikova reminded in which cases it is necessary to apply for a pension recalculation

A draft on the exemption of working pensioners from insurance contributions has been submitted to the State Duma

Pension funds will be able to provide new services

Rules for the delivery of pensions have changed since January 1

C February, 40 payments and benefits will increase

Along with the increase

Pensions and social benefits will increase in Moscow

Russians will be told about the amount of their funded pensions

How to get back overpaid personal income tax?

Every year, starting from March, Latvian residents have the opportunity to submit an income declaration in order to receive a refund from the state of the overpaid personal income tax in the previous year.

According to the law, this is part of the funds that we paid last year for medical services or education (including children's clubs or hobby education), private pension savings, as well as for a differentiated non-taxable minimum that exceeds the established per month .

Although only a few population groups are required to declare their annual income, it is worthwhile to declare your income voluntarily, especially if there are dependents, there were expenses for education or medical services.

The amounts of money that can be received from the state are different (depending on the year of taxation), in turn, the declaration can be submitted for the previous three years.

Please note that the total refund from the State Revenue Service (VID) cannot be more than the personal income tax paid for a particular year (for which the declaration is submitted).

- Differentiated non-taxable minimum

People who did not work all 12 months during the year and did not use the non-taxable minimum that they are entitled to for the whole year, when submitting a declaration, can return this unused part.

The non-taxable minimum in 2020 is due to residents with a salary of up to 1200 euros before taxes.

Thus, if the total income for the year is below 14,400 euros (12 x 1200), then when submitting a declaration, you can return the share of the overpaid tax for the unused non-taxable minimum for the year. True, it is important to keep in mind that the size of the non-taxable minimum is affected by the amount of additional income, as well as additional tax benefits.

- For each dependent, you can receive benefits in the amount of 250 euros per month, or 3000 euros per year. Dependents can also be registered retroactively and, by declaring income, receive appropriate benefits.

- For the costs of medical treatment and education, donations and gifts made in the amount of 600 euros, each family member can receive overpaid taxes. If the expenses in the corresponding year were higher, they are automatically attributed to the next three years.

It is important that the justified expenses of parents, grandparents, spouse, children, grandchildren and dependents for medical treatment and education can also be included in the declaration. This is possible if these persons themselves do not submit an income declaration.

It is important that the justified expenses of parents, grandparents, spouse, children, grandchildren and dependents for medical treatment and education can also be included in the declaration. This is possible if these persons themselves do not submit an income declaration.

Tax can also be refunded for premium payments under an insurance policy if you bought the policy yourself or if you made an additional payment set by your employer.

In addition, it is important to remember that spending on education is not just spending on education. Part of the tax can also be refunded for tuition to obtain the skills necessary for work, for example, in the case of English language courses, if they are completed according to a state-accredited educational program.

In turn, the parents of the children may receive a refund of the personal income tax on the amount paid for the acquisition of a hobby education program or for classes for children under the age of 18, for example, for music, dance or sports classes.