Child benefit claim how long does it take

Child Benefit: How to claim

Skip to contents of guide

You can claim Child Benefit as soon as you’ve registered the birth of your child, or they come to live with you.

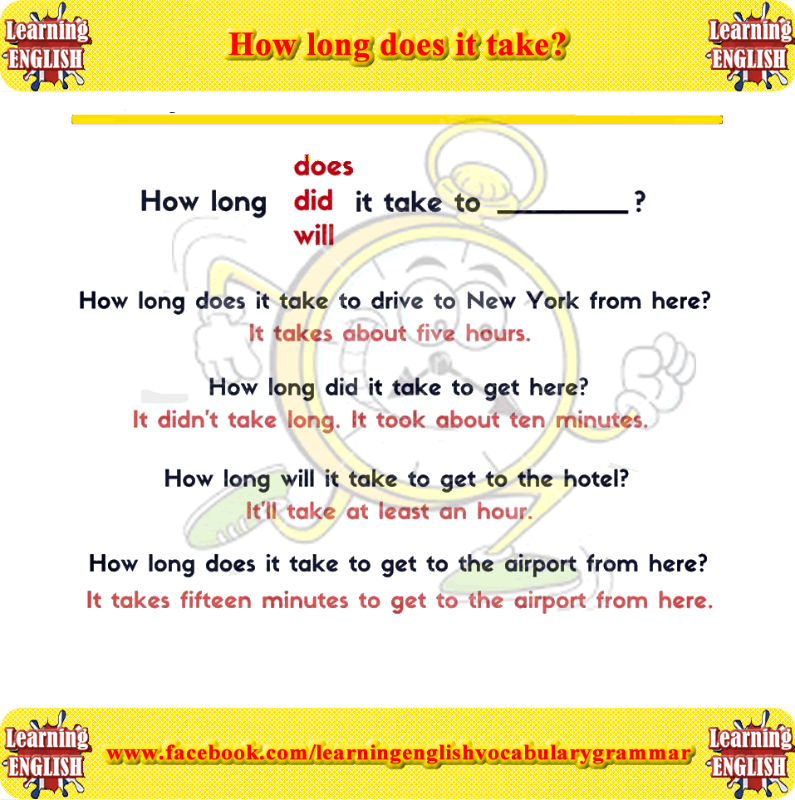

How long it takes

It can take up to 16 weeks to process a new Child Benefit claim (or longer if you’re new to the UK). Child Benefit can be backdated for up to 3 months.

Deciding who should claim

Only one person can get Child Benefit for a child, so you need to decide whether it’s better for you or the other parent to claim. The person who claims will get National Insurance credits towards their state pension if they are not working or earn less than £242 per week.

Make a claim for the first time

Fill in Child Benefit claim form Ch3 and send it to the Child Benefit Office. The address is on the form.

If your child is adopted, send their original adoption certificate with the form. You can order a new adoption certificate if you’ve lost the original.

If you do not have the adoption certificate you need, send your claim form now and send the certificate once you’ve got it.

If your child’s birth was registered outside the UK

When you send your claim form, include your child’s:

- original birth certificate

- passport or travel document used to enter the UK

If you’ve lost the original you can order a new birth certificate.

Your child’s documents will usually be returned within 4 weeks.

Add a child to an existing claim

Call the Child Benefit helpline if all of the following apply:

- your child is under 6 months old and lives with you

- your child was born in the UK

- your child’s birth was registered in England, Scotland or Wales more than 48 hours ago

- you’re a UK or Irish national and you’ve lived in the UK since the start of your claim

When you call, you’ll need your:

- National Insurance number

- child’s birth certificate

Child Benefit helpline

Telephone: 0300 200 3100

Welsh language: 0300 200 1900

Textphone: 0300 200 3103

Outside UK: +44 161 210 3086

Monday to Friday, 8am to 6pm

Find out about call charges

If you’ve already applied to have a child added to your claim but you have not heard back, you can check when you should get a reply.

If you do not meet the criteria to add a child by phone

You’ll need to make a new claim by post. Fill in Child Benefit form Ch3 and send it to the Child Benefit Office. The address is on the form.

If you’re claiming for more than 2 children, also include the ‘additional children’ form.

If you registered the birth in Northern Ireland

You’ll need to send the birth certificate by post when you have it.

HM Revenue and Customs - Child Benefit Office

PO Box 1

Newcastle Upon Tyne

NE88 1AA

United Kingdom

Claiming Child Benefit for someone else

You may be able to manage someone else’s Child Benefit claim.

View a printable version of the whole guide

Claim Child Benefit for one or more children

Guidance

How to make a claim for Child Benefit.

- From:

- HM Revenue & Customs

- Published

- 15 November 2022

- Last updated

- 20 January 2023 — See all updates

If you fill in the form online, there is no limit for how many children you can claim for.

Who can apply

Only one person can claim Child Benefit.

If you are in a couple and one of you does not work or earns less than £242 a week, it is recommended for that person to claim to help protect their state pension. They should make the claim.

You do not need to be the parent of the child to claim Child Benefit.

When to apply

Claim as soon as your baby is born and registered or once a child comes to live with you, including adoption.

To claim, the child must either be under 16 or under 20 and in approved education or training.

Do not delay making your claim as Child Benefit can only be backdated up to 3 months.

Before you start

You’ll need the following documents for any children you are applying for, depending on your circumstances:

- birth certificate

- passport or travel documents used to enter the UK

- adoption certificate

You will also need:

- your bank or building society details

- your National Insurance number

- your partner’s National Insurance number, if you have one

- a printer

Fill in a form online

You can only use the online form if you and your partner have always lived in the UK (unless you or your partner are a member of HM Forces or civil servants abroad).

-

You need to open and complete this form online. As you cannot save your progress, you may want to get all your information together before you start.

-

Fill in form Ch3 online.

-

Print and post your completed form to HMRC, along with any documents you may need to send. We will let you know what those documents are at the end of this form. We will also tell you where to send your form.

Fill in a form by hand

If you are claiming for more than 2 children and are printing the form off and filling it in by hand, you will need to complete both the Ch3 and the Ch3 (CS) forms and return them to HMRC.

Claim for up to 2 children

-

Download and save form Ch3 (PDF, 551 KB, 9 pages) on your computer.

-

Print off and fill in the form.

-

Post your completed form to HMRC, along with any documents you may need to send. Information about which documents you need to send can be found on the form.

We will also tell you where to send your form.

We will also tell you where to send your form.

This file may not be suitable if you use assistive technology — such as a screen reader. If you need a more accessible format email [email protected] and tell us what format you need. It will help if you tell us what assistive technology you use. Read the accessibility statement for HMRC forms.

Claim for more than 2 children

You must also send in a completed Ch3 (CS) form with your Ch3.

-

Download and save form Ch3 (CS) (PDF, 73.4 KB, 1 page) on your computer.

-

Print off and fill in the form.

-

Post your completed Ch3 and Ch3 (CS) forms to HMRC, along with any documents you may need to send. Information about which documents you need to send can be found on the form. We will also tell you where to send your form.

This file may not be suitable if you use assistive technology — such as a screen reader. If you need a more accessible format email [email protected] and tell us what format you need. It will help if you tell us what assistive technology you use. Read the accessibility statement for HMRC forms.

If you need a more accessible format email [email protected] and tell us what format you need. It will help if you tell us what assistive technology you use. Read the accessibility statement for HMRC forms.

Notes to help you complete the form

Read the Ch3 notes (ODT, 20.3 KB) to help you complete the form correctly.

After you have claimed

When you start getting Child Benefit, it is your responsibility to report any changes that affect your Child Benefit.

Published 15 November 2022

Last updated 20 January 2023 + show all updates

-

You can only use the online form if you and your partner have always lived in the UK (unless you or your partner are a member of HM Forces or civil servants abroad).

-

Added translation

Help us improve GOV.UK

To help us improve GOV.UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only 2 minutes to fill in. Don’t worry we won’t send you spam or share your email address with anyone.

Email address

Information for parents on new payments for children from 8 to 17 years old in questions and answers

Presidential Decree[1] introduced a new monthly payment to low-income families for children aged 8 to 17 years from May 1. The PFR Department for St. Petersburg and the Leningrad Region receives many questions from parents. The Pension Fund has prepared answers to the most frequently asked questions about the new allowance.

I made a mistake when applying for benefits. How can I fix this?

If an error is made when filling out the application, the Pension Fund will return it to you for revision without issuing a refusal. Changes must be made within 5 business days.

Changes must be made within 5 business days.

What documents do I need to submit to receive the payment?

To receive a payment, you must submit an application through the Public Services Portal, through the MFC, or contact the PFR customer service at the place of residence.

You will need to provide additional information about income only if the family has military, rescuers, police officers or employees of another law enforcement agency, as well as if someone receives scholarships, grants and other payments from a scientific or educational institution.

How long does it take to receive payment after applying?

Consideration of the application takes 10 business days. In some cases, the maximum period will be 30 working days. If the payment is denied, a notice of this is sent within one business day. Funds are paid within 5 working days after the decision on the purpose of the payment is made. In the future, the transfer of funds is carried out from the 1st to the 25th day of the month following the month for which the allowance is paid.

In the future, the transfer of funds is carried out from the 1st to the 25th day of the month following the month for which the allowance is paid.

Can I receive payment via mail?

Yes, you can. To receive money through the post office, you need to mark the appropriate item in the application for payment, as well as indicate the address of the recipient and the number of the post office.

If you receive money in the bank, then only on the Mir card?

Yes, the new payment will be credited only to Mir bank cards. It is important to remember that when filling out applications for payment, it is the details of the applicant's account that are indicated, and not the card number.

Who is entitled to the monthly payment?

The payment is assigned to low-income families that raise children from 8 to 17 years old, subject to the following conditions:

- monthly income per person in the family does not exceed the regional subsistence minimum per capita;

- family property does not exceed the requirements for movable and immovable property;

- the applicant and children are citizens of the Russian Federation permanently residing in the Russian Federation.

One of the parents, adoptive parent or guardian of the child can apply for payment.

When can I apply for the payment?

You can apply from May 1, 2022 and onwards at any time.

The payment is established for 12 months, but not more than until the child reaches the age of 17 years.

Can I receive a payment if I already receive child support for single parents aged 8 to 17?

Yes, you can apply for a new payment. If, after calculating the average per capita income of the family, the new payment turns out to be more profitable in terms of amount, you will be assigned a new payment in an increased amount, that is, 75% or 100% of the child's regional subsistence level, taking into account the paid amounts of the previous allowance. In this case, the payment of the previous benefit will automatically stop.

Do I need to apply for a new payment if I am already receiving child support from 8 to 17 years as a single parent, but my income is still less than the living wage?

Yes. If the income of families who are already receiving allowance for children from 8 to 17 years as single parents still does not reach the living wage, they need to reapply and start receiving a payment at an increased amount, i.e. 75% or 100% of the regional living wage. minimum, and not 50% as before. In this case, the payment of the previous benefit will automatically stop.

If the income of families who are already receiving allowance for children from 8 to 17 years as single parents still does not reach the living wage, they need to reapply and start receiving a payment at an increased amount, i.e. 75% or 100% of the regional living wage. minimum, and not 50% as before. In this case, the payment of the previous benefit will automatically stop.

My son turned 8 years old in February 2022, will I receive benefits for this period?

No, the allowance is granted from the child's 8th birthday, but not earlier than April 1, 2022.

The Decree of the President says that the allowance is established from April 1, if applications can only be submitted from May 1, then how to get money for April?

For applications submitted before October 1, 2022, the money will be paid for the period from April 1, 2022, but not earlier than the month the child reaches the age of 8 years.

This means that if a family applies for a new payment in the first days of May, then the first payment in May will be for two months at once - for April and May. If the family applies at the end of May, the allowance will be received in June immediately for 3 months - April, May and June.

If the family applies at the end of May, the allowance will be received in June immediately for 3 months - April, May and June.

Is it possible to receive benefits without Russian citizenship?

No.

Does the payment apply to children who are already 17 years old?

The payment is only for children under 17 years of age.

Monthly allowance for each child?

Yes, the allowance is paid for each child from 8 to 17 years old in the family.

The family has two children aged 8 to 17 years. Do I need to write an application for each child?

No, if there are two or more children aged 8 to 17 in the family, one joint application is completed for each of them to receive the monthly payment. Two or more applications are not required in this case.

My application was returned for revision, how long will it take to process it?

The term for consideration of the application is 10 business days. In your case, the deadline has been suspended. If the revised application is received by the FIU within 5 working days, its consideration will be restored from the date of submission.

In your case, the deadline has been suspended. If the revised application is received by the FIU within 5 working days, its consideration will be restored from the date of submission.

What happens if I don't submit the revised application or documents within 5 business days?

In this case, the payment will be denied and you will need to reapply.

How can I find out if a payment is due or not?

When submitting an application through the Public Services Portal, a notification about the status of its consideration will appear there.

If the application was submitted personally at the PFR client service or at the MFC, in case of a positive decision, the funds will be transferred within the period established by law without additional notice.

In the event of a denial, the applicant will be sent a notice within one business day stating the reason for the denial.

How long is the payment?

The benefit is granted for one year and extended upon application. In 2022, applicants who lost their jobs after March 1, 2022 and are registered with employment centers are subject to a special calculation of average per capita income. Such applicants receive benefits for 6 months. After this period, you can apply for benefits again.

In 2022, applicants who lost their jobs after March 1, 2022 and are registered with employment centers are subject to a special calculation of average per capita income. Such applicants receive benefits for 6 months. After this period, you can apply for benefits again.

How long can I receive the payment?

The allowance is paid from the age of eight until the child reaches the age of 17.

Does the payment depend on family income?

Yes, the payment is due to families whose monthly income per person does not exceed the subsistence level per capita in the region of residence. To calculate monthly income, you need to divide the annual family income by 12 months and the number of family members. Also, when assessing means, family property is taken into account and the “zero income rule” is used.

What is the “zero income rule”?

The "zero income rule" implies that the allowance is granted if adult family members have earnings (stipends, income from work or business activities or pensions) or the lack of income is justified by objective life circumstances.

Will the money be withheld if I have a debt under the executive document?

No.

I receive unemployment benefits. Will it be taken into account when calculating the average per capita income?

Yes, they will.

Will a car bought on credit be considered in the property appraisal?

Yes.

Does the payment apply to children left without both parents?

Yes. The payment applies to orphans. In this case, their guardian (custodian) has the right to a monthly allowance, but only if the child is not fully supported by the state.

In order to be granted benefits, guardians must personally submit an application to the PFR customer service at the place of residence or at the MFC.

I am a guardian. Can I receive benefits if the parents of the child have been deprived of parental rights?

Yes, you can.

How can I verify my actual place of residence if I do not have a residence registration?

The place of actual residence is determined by the place where the application for the allowance was submitted.

At what subsistence level will my income be calculated if I have two registrations - at the place of residence and at the place of temporary residence?

In this situation, the subsistence minimum at the place of temporary residence will be taken into account.

When calculating income, will the received alimony be taken into account?

Yes.

My family owns an apartment and a residential building, in total their area exceeds the standard of 24 sq. m. m. per person, will I be denied benefits?

No. Restrictions on square meters apply if the family owns several apartments or several residential buildings. When owning one type of residential property, its area is not taken into account.

I registered with the Pension Fund the care of my husband's 86-year-old grandmother and receive benefits for caring for citizens over 80 years old. Will this allowance be taken into account when calculating my income?

Yes.

Do I have to report to the Pension Fund information about changes in family composition and income if they occurred after the application was submitted?

No. Beneficiaries are not required to report changes in income levels to the Pension Fund during the benefit period.

Can I get benefits only for children aged 8 to 17?

No, not only. It also provides for payments for low-income families for pregnant women who registered early, benefits for children from 0 to 3 years old, as well as benefits for children from 3 to 8 years old.

Will the payment be indexed?

Yes. The monthly payment will be indexed annually from January 1st.

Where can I contact if I have any questions about the purpose of the payment?

If you have any questions about this payment, you can call the Unified Contact Center at 8-800-600-0000. In addition, you can ask your question on the official social networks of the PFR or contact any client service of the fund.

[1] Decree of the President of the Russian Federation of March 31, 2022 No. 175 “On Monthly Cash Payments to Families with Children”

Home

A selection of the most important documents on request Terms of payment of a one-time allowance for the birth of a child (legal acts, forms, articles, expert advice and much more).

- Childbirth allowance:

- Documents for a one-time allowance for the birth of a child

- One-time allowance for the birth of a second child

- Application for a lump-sum allowance for the birth of a child

- Who pays the lump-sum allowance for the birth of a child 905 baby

- Show all →

- Childbirth allowance:

- Documents for a one-time allowance for the birth of a child

- Lump-sum allowance for the birth of a child

- Application for a lump-sum allowance for the birth of a child Who pays a lump-sum allowance for the birth of a child

- Who pays the childbirth allowance

- Show all →

Articles, comments, answers to questions

Register and get trial access

to the ConsultantPlus system for free for 2 days - no more than 10 working days from the date of receipt of information on the state registration of birth contained in the unified register of the registry office. The SFR transfers money through a postal service, credit or other organization specified in the information about the insured person (part 25 of article 13, part 1 of article 15 of Law N 255-FZ).

The SFR transfers money through a postal service, credit or other organization specified in the information about the insured person (part 25 of article 13, part 1 of article 15 of Law N 255-FZ).

Normative acts

Federal Law No. 81-FZ of May 19, 1995

(as amended on November 21, 2022)

"On State Benefits for Citizens with Children" child care allowance, as well as a one-time allowance for the transfer of a child to be raised in a family, are assigned if the application was followed no later than six months, respectively, from the date of the end of the maternity leave, from the date of the birth of the child, from the day the child reaches the age of one and a half years , from the day the court decision on adoption comes into force, or from the day the guardianship and guardianship authority makes a decision to establish guardianship (guardianship), or from the date of the conclusion of an agreement on the transfer of a child for upbringing to a foster family, and a one-time allowance to the pregnant wife of a serviceman undergoing military service by conscription, and a monthly allowance for the child of a soldier undergoing military conscription service, - no later than six months from the date of completion of conscription military service by a military serviceman.

Order of the Ministry of Labor of Russia dated September 29, 2020 N 668n

(as amended on June 21, 2022)

"On approval of the Procedure and conditions for the appointment and payment of state benefits to citizens with children"

(Registered with the Ministry of Justice of Russia on December 23, 2020 N 61741)82 . Pregnancy and childbirth allowance, a one-time allowance for the birth of a child, a monthly allowance for child care, a one-time allowance for transferring a child to a family, a one-time allowance for the pregnant wife of a conscripted military serviceman, and a monthly allowance for a child of a military serviceman undergoing military service conscription service are appointed if they were applied for no later than six months, respectively, from the date of the end of the maternity leave, from the date of the birth of the child, from the day the child reaches the age of one and a half years, from the date the court decision on adoption comes into force (from the day the guardianship and guardianship authority makes a decision to establish guardianship (guardianship), from the day the agreement is concluded on the transfer of the child for upbringing to a foster family), from the day the military serviceman ends his military service on conscription.