How to open stock account for child

How to Open an Investment Account For a Child

Investing your time, energy, and love in children is vital for their development and well-being. But investing your money can also be incredibly impactful.

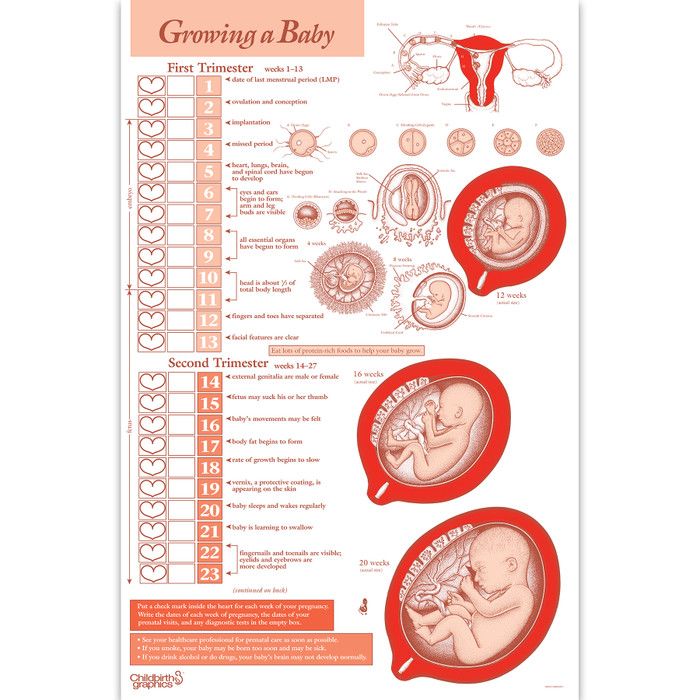

Investing early gives your money more time to grow. Every $1 that is invested for 65 years earning 10% returns will turn into over $490. That means that a single $1,000 investment for a newborn baby would be worth around $490,000 once that child reaches retirement age.

But investing for children is a bit different than investing for yourself. A minor cannot open a standard brokerage account. Instead, an adult must open one for them.

This comprehensive guide will cover how to open an investment account for a child — including information on account types, where to open, what information is needed, and more.

{{cta-1}}

What Is an Investment Account for Children?

An investment account for children is a digital account that allows parents and loved ones to invest on behalf of children. The accounts make it possible to invest in stocks, bonds, ETFs, and potentially other assets, as well.

There are different types of accounts, but each typically must be set up and managed by an adult.

Children generally cannot open their own investment accounts until they become legal adults. Instead, an adult must open the account on behalf of the child. The child becomes the “beneficiary” of the account, while the adult is the “custodian.”

These special types of investment accounts are called custodial accounts.

To open an investment account for a child, an adult must be involved. The adult must open the account, select the investments, manage tax reporting, and continue to manage the account until the child reaches the age of majority. This is usually at age 18 but could be age 21 in select states.

With a custodial account, the child always owns the account — but they won’t actually have control over it until they reach the age of majority.

How to Open an Investment Account For a Child

A legal adult must be involved to open investment accounts for kids. In most cases, this doesn’t necessarily need to be the parent — other family members and trusted friends can also typically serve as the account custodian.

In most cases, this doesn’t necessarily need to be the parent — other family members and trusted friends can also typically serve as the account custodian.

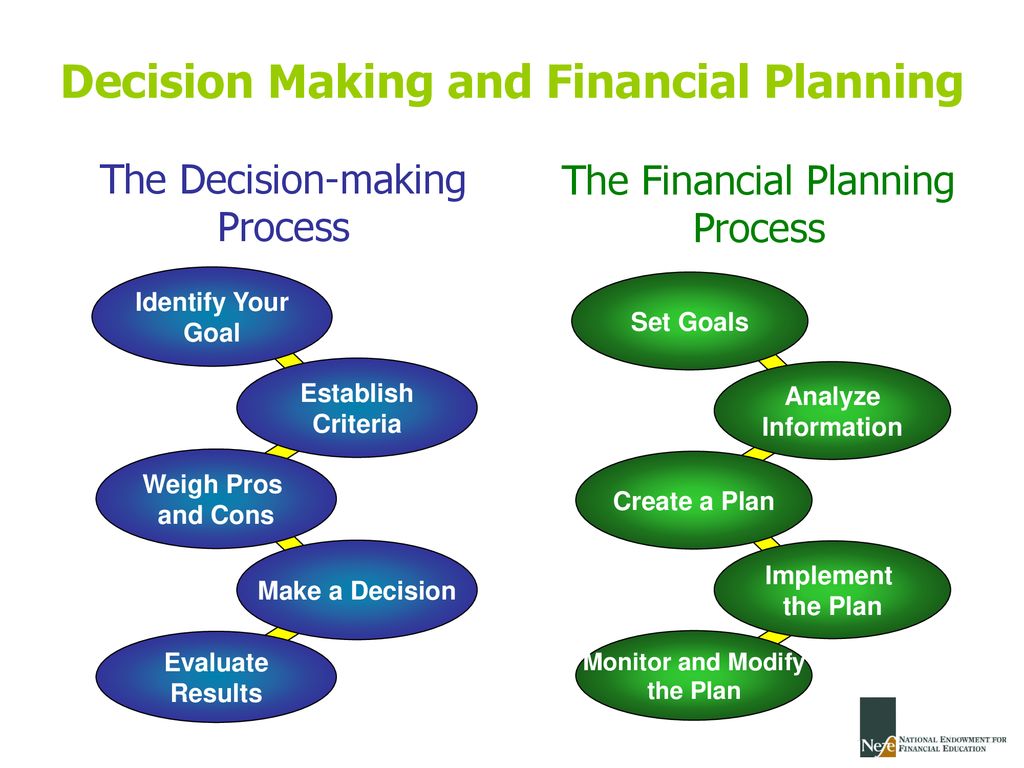

To open a children’s investment account, here are the basic steps:

- Select an account type. This could be a college savings account like a 529, a general-purpose investment account like a UGMA account, or even a retirement account like a Roth IRA.

- Choose where to open the account. Once you know the account type you want, look for stockbrokers and financial services companies that offer that account style. Pay attention to the company’s reputation/reviews, the fees it charges, and the investment options it offers inside the relevant account type.

- Gather information. To open a custodial investment account for a kid, the adult will need the child’s information as well as their own.

Names, addresses, and Social Security numbers will be required.

Names, addresses, and Social Security numbers will be required.

- Open the account. Now you’re ready to actually open the account. Each company will have a slightly different way of doing this (and we’ll walk through what that usually looks like in more detail later on), but the company’s signup process should take you through the required steps.

- Start investing. Now, it’s time to actually start investing. Investors could choose stocks, bonds, mutual funds, ETFs, or any mix of assets. The custodian is responsible for making any investment decisions.

The child can certainly be involved in decision-making if it’s age-appropriate — but ultimately, the custodian must make the investment selections and trades. We’ll give you an overview of the most common investment asset classes below.

What Types of Investment Accounts Can I Open For a Child?

Not all account types are open to children. Here’s an overview of some of the best types of accounts.

Here’s an overview of some of the best types of accounts.

UGMA/UTMA custodial accounts — the most versatile

UGMA or UTMA accounts are two similar types of general-purpose custodial investment accounts. With these, the custodian opens and manages the account until the child reaches the age of majority.

Once the child becomes an adult, they gain full access to the account and can use the money for any purpose. Read about the differences between UGMA and UTMA accounts here.

529 plans — the most tax benefits (if used for college)

529 accounts are specialized savings accounts designed to help families save for college. They offer tax benefits if funds are used for qualifying educational expenses.

Money that is put in a 529 can be invested and grow tax-free until withdrawal. Neither you nor the beneficiary will owe any capital gains tax if the funds are used for qualifying educational expenses.

The downside is that there are penalties if funds are used for anything other than education. For this reason, UGMA custodial accounts are more versatile than 529 accounts.

For this reason, UGMA custodial accounts are more versatile than 529 accounts.

Coverdell ESA — another option for college savings

Coverdell Education Savings Accounts (ESAs) are another way to save for college. They offer tax-free growth as long as the funds are used for qualifying education expenses.

However, ESAs have lower contribution limits than 529s — you can only put up to $2,000 per year into an ESA. Plus, there are income limits, so higher-income families may not be able to contribute. Read about the differences between 529s and ESAs here.

Custodial Roth IRA — a good option for retirement savings

Custodial Roth IRAs are a type of retirement savings account that offers tax-free growth. However, funds are designed to be kept in the account until retirement age, and there may be penalties if money is withdrawn early.

To contribute to an IRA, the child must have earned income from a job or business. Only earned income can be contributed — allowances and gift money does not count.

Overwhelmed by options? The UGMA custodial account is the simplest and most versatile option. It has no restrictions on what the money can be used for, making it the most flexible choice.

Where Should I Open the Account?

Once you select the type of account, your next step is to select a company to actually open that account with. This could be traditional brokers like Fidelity or Vanguard or more modern financial services companies like EarlyBird. Even some banks and credit unions may offer certain types of custodial investment accounts.

Here’s what to consider when selecting a provider for the new account:

Available account types: Does the company support the specific account type that you want to open?

Reputation: Does the company have a good reputation? You can check customer reviews to be sure.

Investment options: What can you actually invest in once you have the account opened? Some companies offer a wide range of investments, while others may be quite limited.

Fees: What fees does the company charge? This could include initial fees to set up the account, monthly service charges, trading/transaction fees, or fees associated with the specific investment products/funds.

Ease of use: Are the company’s services simple to use? Is there a smartphone app, and if so, is it well rated?

Looking for a simple and trusted place to open a child’s investment account? EarlyBird may be exactly what you’re looking for.

EarlyBird is a modern investing app and service that lets loved ones set up UGMA custodial accounts for children. Account setup takes just a few minutes.

Adults can collectively invest in the children they love by sending gifts directly to the child’s EarlyBird account.

No investing experience is required. When you sign up, you’ll answer a few questions about your investment goals and risk tolerance. Then, EarlyBird will recommend a prebuilt portfolio of diversified investments.

EarlyBird focuses on low-cost, simple index funds. You can invest in stocks and bonds, as well as alternative assets like cryptocurrency.

What Information Do I Need to Open a Child’s Investment Account?

Because children’s investment accounts are custodial accounts, you will need the information for both parties (custodian and beneficiary). Here’s what you’ll need:

Custodian (the adult)

- Name

- Address

- Social Security number

- Financial information

- Bank account number and routing number (for deposits)

Beneficiary (the child)

- Name

- Address

- Social Security number

Certain companies may require additional information to verify identity. For instance, you may be asked for your driver’s license number or even a scanned picture of your photo ID or passport.

The Process of Opening An Investment Account

Each broker will have a different process for account opening. But in general, here’s what it will look like:

But in general, here’s what it will look like:

- Navigate to the broker’s website

- Select “open an account”

- Select the type of account you want to open

- Enter personal information, names, SSNs, etc., for you (the custodian) and the child (the beneficiary)

- Transfer money into the account (and ideally, set up a recurring transfer for regular investments)

- Select investments

What Should I Invest In?

Here’s an overview of the most common assets that you can invest in. Note that not all investment options are available in all accounts. Each account type, and each broker/manager, has a different selection of available assets.

(Image Source)Stocks: Stocks represent fractional ownership of companies. If you buy Amazon stock, you own a very small piece of Amazon. Most people who invest in stocks do so by buying diversified index funds, which are a way to invest in hundreds of companies all at once.

Bonds: Bonds are like loans in reverse. Companies and governments sell bonds to investors and promise to pay them back — with interest — after a certain period of time. Investors can buy individual bonds or invest in bond funds that own hundreds of different bonds.

Real estate: Real estate refers to physical houses or commercial property. When it comes to investing for children, the main method would be to buy real estate investment trusts (REITs), which are like mutual funds for real estate.

Cryptocurrency: Cryptocurrency is a type of digital currency — examples include Bitcoin (BTC) and Ethereum (ETH). Crypto can be a volatile asset class, so most experts recommend keeping it a small percentage of your overall portfolio.

Prebuilt portfolios: Some investment platforms (like EarlyBird) offer a simpler approach: Prebuilt investment portfolios with diversified assets. For example, you might select a portfolio that invests 80% in stock market index funds and 20% in bond market index funds.

Deciding what to invest in depends on several factors, including:

- Risk level: How much risk are you willing to take? Assets like stocks and cryptocurrency are higher-risk but have historically been higher-reward. Assets like bonds and cash are lower-risk, lower-reward.

- Time horizon: Is the child a newborn or a teenager? This could alter the investment strategy. For longer time horizons, a higher allocation to aggressive investments like stocks makes sense. For shorter time horizons (like a 14-year-old saving for college), a more cautious asset mix may be optimal.

- Involvement level: Do you want to be actively involved in investment decisions or take a more passive approach? For most investors, passive strategies like investing in index funds make good financial sense.

Conclusion

To open an investment account for a child, you must be a legal adult. You can then open a custodial investment account and assign the child as the beneficiary. From there, you can build investment portfolios for the child and continually contribute money when you can.

You can then open a custodial investment account and assign the child as the beneficiary. From there, you can build investment portfolios for the child and continually contribute money when you can.

The easiest way to open a new investment account for a child is to use EarlyBird. EarlyBird makes it simple for family and friends to collectively invest in the children they love. No investing experience is required.

{{cta-1}}

This page contains general information and does not contain financial advice. All investments involve risk. Any hypothetical performance shown is for illustrative purposes only. Actual investment performance may be different for many reasons, including, but not limited to, market fluctuations, time horizon, taxes, and fees. Please consult a qualified financial advisor and/or tax professional for investment guidance.

Investing for Kids: How to Open a Brokerage Account for Your Child

You’re our first priority.

Every time.

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Investing is for kids, too — and it's never too early to start. You can open a custodial brokerage account for your children and help them select investments.

Written by Arielle O'Shea

Reviewed by

Raquel Tennant

At NerdWallet, we have such confidence in our accurate and useful content that we let outside experts inspect our work.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Investing isn't just for adults: If you want to teach your kids some valuable lessons about money and the power of investment growth, helping them open a custodial brokerage account can be a great start.

Investing for kids

One of the biggest keys to successful investing is a long time horizon for your money to grow — and kids have a lot of time on their side. If they're willing to let their money remain invested for several years, they're likely to see a nice return on their initial investment. Seeing their money grow can encourage them to be good savers and investors as adults.

Here are some things to consider about investing for kids, including which investments are best and how to select and set up your child’s first brokerage account. Brokerage accounts for children are often referred to as custodial accounts. They're labeled as UGMA/UTMA accounts depending on the type of account restrictions.

Decide on an account type

To get your kids started investing, you should first decide which investment account is best for them. That decision largely hinges on whether they have earned income.

If your child doesn't have taxable income or wages: Under the Uniform Gift to Minors Act or Uniform Transfer to Minors Act (UGMA/UTMA)

Social Security Administration

. SI 01120.205 Uniform Transfers to Minors Act.

Accessed Apr 11, 2022.

View all sources

, you can open up custodial brokerage accounts for your kids.

Although the account will initially be in your name, your child will automatically take full control of it once they reach age 18 or 21, depending on state laws. (Learn more about UTMA and UGMA accounts).

Although the account will initially be in your name, your child will automatically take full control of it once they reach age 18 or 21, depending on state laws. (Learn more about UTMA and UGMA accounts).If your child has taxable income or wages: If your children are older and have earned income from a part-time job, such as babysitting, raking leaves, or something similar, you can help them open a custodial IRA. A Roth IRA in particular is ideal for children: The contributions your child makes to the account will grow tax-free. Those contributions can be pulled out at any time, and the investment growth portion can be used for retirement, or tapped for special purposes such as a first-home purchase or higher education expenses. (Here's a full run-down on Roth IRAs for kids.)

Brokerages are also creating new account types geared specifically for teens. Fidelity, for example, offers a Youth Account, which lets teens aged 13 to 17 control the account, but lets parents monitor its activity, trades and transactions, complete with alerts. This is a new type of youth investment account separate from the custodial accounts outlined above.

This is a new type of youth investment account separate from the custodial accounts outlined above.

Advertisement

NerdWallet rating

NerdWallet's ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. 5.0 /5 | NerdWallet rating

NerdWallet's ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. 5.0 /5 | NerdWallet rating

NerdWallet's ratings are determined by our editorial team. 4.7 /5 |

Fees $0 per trade for online U.S. stocks and ETFs | Fees $0.005 per share; as low as $0.0005 with volume discounts | Fees $0 per trade |

Account minimum $0 | Account minimum $0 | Account minimum $0 |

Promotion Get $100 when you open a new, eligible Fidelity account with $50 or more. Use code FIDELITY100. Limited time offer. Terms apply. | Promotion Exclusive! US resident opens a new IBKR Pro individual or joint account receives 0.25% rate reduction on margin loans. Tiers apply. | Promotion Up to $600 when you invest in a new Merrill Edge® Self-Directed account. |

Choose the right broker

No matter which type of brokerage account you decide to open for your kids, you'll need to start by finding a broker that offers custodial accounts. The best investment accounts for kids charge no account fees, and have no minimum initial deposit. This gives your kids the chance to start investing with a small amount of money.

Consider, too, the costs associated with the investments your child plans to choose. For example, for kids who want to practice trading stocks, you should ensure the broker charges low or no trade commissions. If your kids just want their money to grow in a hands-off way, consider looking for brokers with a large selection of low-cost index funds.

If you’re looking for a brokerage account to teach your kids about investing, know that many brokers offer educational content, including online investing tutorials and even practice trading accounts.

Open the account

You can open a custodial account — both a standard brokerage account and a Roth IRA — for your child in under 15 minutes or so. At most brokers, the entire process is completed online.

To speed things up, make sure you have the necessary information ready. The broker will likely ask for both your and your child's Social Security number, as well as dates of birth and contact information. You'll probably have to supply your employment information, and you should be ready to link another bank or brokerage account so you can transfer money to fund the new account.

Help your kid decide what to invest in

Once the custodial account is open and funded, the real fun begins: Investing the money.

Within their brokerage account, your kids will be able to invest in individual stocks, as well as mutual funds, index funds and exchange-traded funds.

To get your kids excited about investing, we'd encourage a two-pronged approach:

1. Help them pick one or two individual stocks. Focus on household names they're familiar with — owning even one share of a brand kids recognize will get them excited about investing.

Help them pick one or two individual stocks. Focus on household names they're familiar with — owning even one share of a brand kids recognize will get them excited about investing.

2. Build the rest of the portfolio with index funds. As your child continues to add money to the investment account, consider skipping additional shares of individual stocks, and instead focus on low-cost index funds or ETFs. These funds bring much-needed diversification to the portfolio, by pooling hundreds of stocks together into one investment. That way, your child can invest in a lot of different companies in one transaction for one price.

To learn more about the investments your child will be able to choose from — and to decide which is most suitable — read our full guide to various types of investments.

Once they've selected and purchased their investments, make a habit of checking their earnings and losses every few weeks and comparing the small fluctuations with the larger long-term changes shown on their quarterly statements. This can spark discussion and inspire kids to become more informed investors.

This can spark discussion and inspire kids to become more informed investors.

Investing for teens

If your teen is asking about investing, a custodial account is still going to be your best place to start. The age requirement to open a brokerage account with the most popular investment apps is 18 (and sometimes older, depending on the state.) So until then, you have the final say in how they invest, and where.

However, some of the investment apps that are most popular with younger generations (such as Robinhood and Webull) don’t offer custodial accounts. So you’ll want to do your research alongside your teen, explaining that if they want to start investing before the age of 18, they’ll have to do it through an institution that offers custodial accounts. Once they’re of age, they can decide if they want to continue with the same brokerage service, or open their own. This can also be a time to explain the benefits of opening multiple investment accounts for various purposes.

Frequently asked questions

How old does my child have to be to buy stocks?

To start investing in stocks on their own, your kid will need a brokerage account, and they must be at least 18 years old to open one. They can start earlier than this, but they’ll need a parent or guardian to open a custodial account for them.

What is a custodial account?

A custodial account is a type of investment account that’s managed by a parent or guardian who opens it for a minor before the age of 18 (or 21, depending on the state.) Once the child turns the age of majority, the parent or guardian loses the ability to manage the account.

Can you withdraw money from a custodial account?

If you’re withdrawing money from the custodial account, it must be used for the benefit of the minor — no raiding the account to pay for your own expenses. Also, contributing to the custodial account is a one-way street; you can’t take back any assets held in the custodial account once you’ve given them to the minor. The account and its assets belong to the child in every way, even if you’re the one managing it.

The account and its assets belong to the child in every way, even if you’re the one managing it.

Who pays taxes on a custodial account?

Considering the account belongs to the minor, technically, they’re the minor’s taxes to pay. However, in general, the first $1,100 of unearned income (such as dividends, interest or earnings from the account) is tax-free. After that, the next $1,100 of unearned income is taxed at the child’s rate. Once the minor’s unearned income rises above $2,200, it will be taxed at the parents’ tax rate.

About the author: Arielle O'Shea is a NerdWallet authority on retirement and investing, with appearances on the "Today" Show, "NBC Nightly News" and other national media. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

How to open an account for a children's investment portfolio

- Broker

Children's briefcase Software Refill Open account online

- About company

Disclosure News Contacts

- Rates

- Old site version

8 800 333 85 85

Client's personal account

nine0004 The procedure for opening an account for the formation of the Children's Investment Portfolio depends on the age of the child. We recommend that you additionally inform the Customer Service Department by calling 8-800-333-85-85 about your intention to open an account for a child, this will speed up the procedure.

We recommend that you additionally inform the Customer Service Department by calling 8-800-333-85-85 about your intention to open an account for a child, this will speed up the procedure.

How to open an account for a child under 14

- First, the parent opens a standard brokerage account in their name on our website. This is a technical procedure. It is necessary for us to create a personal account where you can sign the necessary documents. nine0006

- When the parent account is opened and access to the personal account is received by e-mail, the parent sends us a notarized birth certificate of the child.

- When we receive the document, questionnaires and applications for opening an account in the name of the child will appear in the parent's personal account.

- The parent signs the documents, and in 1 working day we open a children's portfolio with which he can work.

- For an account opened in the name of a child, we will create a separate personal account.

nine0006

nine0006 - You can replenish your account using bank details and using a QR code.

How to open an account for a child after 14 years old

- First, the parent opens a standard brokerage account in their name on our website. This is a technical procedure. It is necessary for us to create a personal account where you can sign the necessary documents.

- The child also opens a standard account on the site by attaching a color passport photo (full pages with a photo and a valid residence permit), as well as a color photo of a birth certificate - this is necessary to go through the identification procedure and establish a documentary relationship between the parent and the child. nine0006

- After opening a brokerage account for a representative (parent), access to a personal account will be created for him, through which Aktiv JSC will send to the representative the questionnaires and applications necessary to open an account in the name of the child based on the results of the application (see clause 2).

- We will notify you individually that the documents are ready for signing in your personal account. The representative (parent) signs the documents received in the personal account with an electronic signature. After signing the documents, an account in the name of the child is opened during the working day and you can work with it. nine0006

- For an account opened in the name of a child, we will create a separate personal account.

- You can replenish your account using bank details and using a QR code.

If you have any questions, you can

8 800 333-85-85

Free of charge in Russia

(812) 635-68-65

At what age can you open a brokerage account for a child and start investing

The bank quite often provides services to minors - for example, children from the age of 14 can open accounts and issue debit cards. Therefore, parents can easily open deposits for their children, issue cards to them and teach them how to manage money on their own. With the growth of financial literacy, such services are increasingly in demand. But brokers are different.

Therefore, parents can easily open deposits for their children, issue cards to them and teach them how to manage money on their own. With the growth of financial literacy, such services are increasingly in demand. But brokers are different.

Formally, there are no prohibitions on investing and opening a child account: the law does not say anywhere that you can use the services of a broker only if the person is 18 years old. But in fact, for a child to gain access to the stock market is difficult and requires effort. nine0005

At what age can children manage money

In terms of financial rights, children are divided into two age groups: under 14 and from 14 to 18.

Until the age of 14, the child himself can only make small household transactions. For example, go to the store and buy something. Such operations should not generate income, but it is possible on the stock exchange. In addition, according to the law, until the age of 14, a person does not bear property responsibility for his unsuccessful decisions. It is carried only by legal representatives - a parent, trustee, guardian. This means that they should make all investments for the child. nine0005

In addition, according to the law, until the age of 14, a person does not bear property responsibility for his unsuccessful decisions. It is carried only by legal representatives - a parent, trustee, guardian. This means that they should make all investments for the child. nine0005

After the age of 14, a person already has more rights. For example, he can independently dispose of the money he personally earned. But other people's finances or risky operations are possible only with the written consent of the parents. This means that from the age of 14 you can open an investment account. But not all brokers provide such an opportunity. For example, at Newton Investments LLC, the minimum age for joining the regulation is 18 years. nine0005 Learn to invest September 04, 2020 How to start investing: 10 steps for beginners 18 minutes nine0004 There is one more complicating moment for exchange transactions - guardianship authorities. Even if the parent gives written consent, trading is considered alienation of someone else's property. In addition, this is a potential deterioration in the financial situation of the child, no matter how old he may be. This means that for any operation, including the payment of commissions, you need to provide the broker with the written consent of both guardianship and the parent. The prices on the stock market for most assets change quickly and unpredictably, which means that a teenager is physically limited in choosing securities. nine0005

Even if the parent gives written consent, trading is considered alienation of someone else's property. In addition, this is a potential deterioration in the financial situation of the child, no matter how old he may be. This means that for any operation, including the payment of commissions, you need to provide the broker with the written consent of both guardianship and the parent. The prices on the stock market for most assets change quickly and unpredictably, which means that a teenager is physically limited in choosing securities. nine0005

Broker restrictions

Brokers are most often worried about the legal purity of transactions. Therefore, they reinsure themselves and do not open accounts even for emancipated minors. The broker has the right to refuse to serve the investor without giving reasons. The exception is children who have inherited securities.

It turns out that, theoretically, a teenager can open a brokerage account and deposit money into it from the age of 14, but it is difficult and time-consuming for minors to conduct transactions.

The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.