How to get child support garnished from wages

Child Support Collection: Wage Garnishment & Property Seizure

The most common method of collecting a judgment for overdue child support is wage garnishment.

By Margaret Reiter, Attorney

If you owe unpaid child support, your child's other parent has a number of ways to collect the money from you.

- First, the other parent may go to court and ask a judge to issue a judgment (called a judgment for child support) for the amount of the arrears. Once the parent has a judgment, many collection methods become available, like wage garnishment and property seizure.

- Even without a judgment for past-due child support, other options for collection include automatic wage withholding.

- Finally, both the federal and state governments are also involved in enforcing child support orders—and they can use aggressive tactics to get the money for your kids.

If your child's other parent sues you and gets a judgment against you for unpaid child support, that parent has a whole host of collection methods available—more than without a judgment for child support arrears. And, even if the custodial parent got the judgment in one state and you have since moved to another state, that parent can register the judgment in the second state and enforce it there.

The most common method of collecting a judgment for overdue support is wage garnishment. The custodial parent can also seize your personal property, like your car, motorcycle, or boat.

What Is Wage Garnishment?

A wage garnishment is similar to income withholding. A portion of your wages is removed from your paycheck and delivered to the custodial parent before you ever see it. In many states, the arrears need not be made into a judgment to be collected through wage garnishment.

Procedures for Wage Garnishment

To garnish your wages, the custodial parent obtains authorization from the court in a document usually called a writ of execution. Under this authorization, the custodial parent directs the sheriff to seize a portion of your wages. The sheriff in turn notifies you and your employer.

How Much Can the Court Take?

The amount garnished is a percentage of your paycheck. What you were once ordered to pay is irrelevant. The court simply wants to take money out of each of your paychecks—and leave you with a minimum to live on—until the unpaid support is made up.

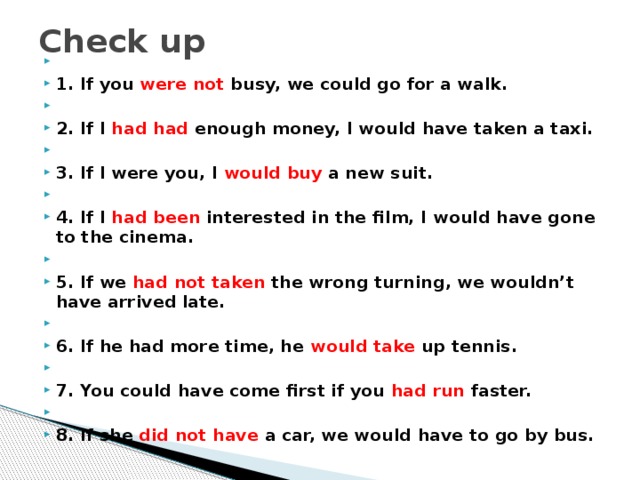

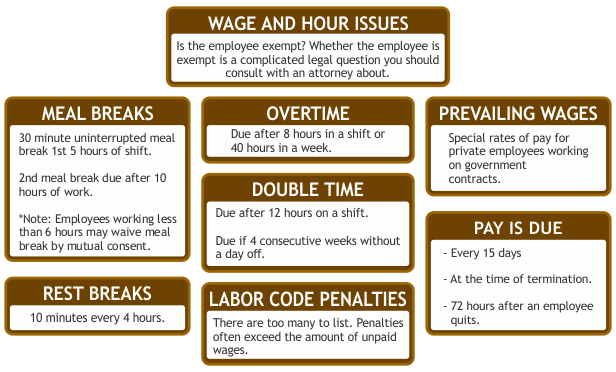

Under federal law, if a court orders that your wages be garnished to satisfy any debt except child support or alimony, a maximum of roughly 25% of your net wages can be taken. For unpaid child support, however, up to 50% of your net wages can be garnished, and up to 60% if you're not currently supporting another dependent. If your check is already subject to wage withholding for your future payments or garnishment by a different creditor, the total amount taken from your paycheck can't exceed 50% (or 65% if you're not currently supporting another dependent and are more than 12 weeks in arrears).

How the Garnishment Is Initiated

To put a wage garnishment order into effect, the court, custodial parent, state agency, or county attorney must notify your employer. Once your employer is told to garnish your wages, your employer tells you of the garnishment.

Once your employer is told to garnish your wages, your employer tells you of the garnishment.

Requesting a Court Hearing

You can request a court hearing, which will take place shortly after the garnishment has begun. At the hearing, you can make only a few objections:

- The amount the court claims you owe is wrong.

- The amount will leave you with too little to live on.

- The custodial parent actively concealed your child, as opposed to merely frustrating or denying your visitation (not all states allow this objection).

- You had custody of the child at the time the support arrears accrued.

Seizing Your Property to Collect Child Support

If the wage garnishment doesn't cover the amount you owe, or you don't have wages or other income to be garnished, the custodial parent may try to get the unpaid support by going after other items of your property. Examples of the type of property that might be vulnerable include:

- cars

- motorcycles

- boats

- airplanes

- houses

- corporate stock

- horses

- rents payable to you, and

- accounts receivable.

In some cases, even spendthrift trusts and your interest in a partnership may be used for payment.

To learn about other ways the government or your child's other parent can collect child support from you, see our Enforcement of Child Support Obligations area.

Talk to a Lawyer

Need a lawyer? Start here.

4 Facts About Child Support and Garnishment

Upsolve is a nonprofit tool that helps you file bankruptcy for free. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

In a Nutshell

If you’ve been ordered to pay child support, you probably have a lot of questions. How did the court determine that you should pay this amount? What happens if you fall behind on payments? Could you go to jail or lose your license for not paying child support? What can you do if you can’t afford to make the payments you’ve been ordered to make? All these questions and more are covered in this article.

Written by Attorney John Coble.

Updated November 11, 2021

If you’ve been ordered to pay child support, you probably have a lot of questions. How did the court determine that you should pay this amount? What happens if you fall behind on payments? Could you go to jail or lose your license for not paying child support? What can you do if you can’t afford to make the payments you’ve been ordered to make? All these questions and more are covered in this article.

How Child Support Is Calculated

State laws determine how to calculate child support orders. Different states use different methods to calculate child support obligations. The state law that applies will be the law of the state where you live. This only applies to the initial establishment of the order. If you move to another state after receiving a child support order, the order from the first state will still be applicable. If both parents leave the state that initially entered the order, it's more complicated, and it's possible for a new state to modify the order.

Don't confuse the calculation of a child support order with child support enforcement. Title IV-D of the federal Social Security Act requires every state to have a child support agency. Any state agency for child support will enforce the child support orders of any other state. The federal government requires every state to publish its child support guidelines. Federal law also requires every child support order include a medical support provision.

States use one of three methods to calculate the required child support payments:

The flat percentage method,

The Melson method, or

The income shares method

All the methods consider the number of children the non-custodial parent (obligor) must support. All states base their calculation on disposable earnings. Earnings are compensation from any source. This includes workers' compensation, bonuses, commissions, and other lump-sum payments. Disposable earnings are what's left after legally required deductions such as taxes are withheld. The flat percentage method considers only the non-custodial parent's income. The income share method considers both parents' income. The Melson method is the same as the income share method, except it includes a standard of living adjustment based on increases in the income of either parent. The Melson formula is more complex than the other methods.

The flat percentage method considers only the non-custodial parent's income. The income share method considers both parents' income. The Melson method is the same as the income share method, except it includes a standard of living adjustment based on increases in the income of either parent. The Melson formula is more complex than the other methods.

Even within states that use the same method, there’s some variance in the factors considered. For example, California is an income share state that considers the time each parent spends in the act of "parenting" in its calculation formula.

Many state child support agencies have calculators on their websites. The following calculators and guidelines are good examples of each formula states use:

The Texas child support calculator is an example of the flat percentage method.

The California child support calculator is an example of the income shares method.

Only Delaware, Hawaii, and Montana use the Melson formula.

This guideline worksheet from Hawaii shows how Hawaii applies the Melson formula.

This guideline worksheet from Hawaii shows how Hawaii applies the Melson formula.

Your state might have an informal dispute resolution system. These systems allow you a hearing before a county caseworker to modify your child support payments. This is much simpler than court hearings.

Minnesota is one state that has such a system. When you need to modify your child support order, it's usually best to seek legal advice from a local attorney with experience in family law. These attorneys know the law for your area as well as the local practices. This is important since law and procedure can vary so much across the nation.

Your Wages Can Be Garnished if You Don’t Pay Child Support

Some states default to using income withholding orders to collect child support payments. California is a state that assigns withholding orders by default. These orders provide withholding for child support just like your taxes are withheld. These income withholding orders can usually be "stayed" if the custodial parent agrees to direct payments.

There's an important technical difference between these income withholding orders and wage garnishments. Wage garnishment orders are only used to enforce payment when child support is in arrears.

This difference is important because it affects how much is taken out of your paycheck for child support. Take Texas for example. That state uses the percentage of income of the non-custodial parent (the obligor) to calculate child support. If there's only one child to support, Texas only takes 20% of the disposable earnings of the obligor. But, Texas would take a higher percentage if it has to collect a child support arrearage.

Unlike most wage garnishments where federal garnishment law caps the maximum amount at 25% of disposable earnings, the Consumer Credit Protection Act at 15 U.S. Code § 1673(b)(2) caps garnishments for child support in arrears at 60%. The law adds another 5% (for a total of 65%) if you're more than 12 weeks behind.

The good news is child support garnishments come before any other income is garnished. There's an exception if the other garnishment is a federal tax garnishment from the IRS or a bankruptcy court order. The 65% limit is an aggregate amount. A private (non-government) creditor can't collect its 25% garnishment causing a 90% (65% + 25%) garnishment. That private creditor's garnishment can't start until the child support garnishment is paid in full.

There's an exception if the other garnishment is a federal tax garnishment from the IRS or a bankruptcy court order. The 65% limit is an aggregate amount. A private (non-government) creditor can't collect its 25% garnishment causing a 90% (65% + 25%) garnishment. That private creditor's garnishment can't start until the child support garnishment is paid in full.

Job losses or other changes in income happen all the time. For this reason, every state has procedures to modify child support orders. It’s better to attempt to modify the order than to allow child support debts to pile up. Child support collection occurs much quicker than most debt collections. Many states allow their child support agencies to garnish your wages without having to get a court's garnishment order. Other creditors don't have this luxury. Child support agencies may also intercept your tax return refunds if you’re behind on payments.

Misa

★★★★★ 6 months ago

It was very easy. They guided me through everything.

They guided me through everything.

Read more Google reviews ⇾

Charles Sullivan

★★★★★ 6 months ago

I am very pleased with the services,and guidence that Upsolve give me

Read more Google reviews ⇾

Cheyenne Neeley

★★★★★ 6 months ago

Amazing

Read more Google reviews ⇾

Get Started with Upsolve

Other Consequences of Not Paying Child Support

Different states have different laws. For purposes of enforcement, Texas will be used as an example. The Texas attorney general's office has many tools to collect child support. They can revoke your driver's license, professional license, hunting license, fishing license, and passport. It may be difficult to get to your job without a driver's license. If you're a doctor or lawyer, you could have your professional license revoked.

Some of these "enforcement methods" make it more difficult to make your child support payments. Texas will report your failure to make child support payments to the credit bureaus. Texas will also put liens on your property and intercept any lump sums such as lottery winnings.

Texas will report your failure to make child support payments to the credit bureaus. Texas will also put liens on your property and intercept any lump sums such as lottery winnings.

All states have laws providing for jail sentences for those who don't make their child support payments. Most states make nonpayment a felony under certain conditions. In some states, failure to pay child support is only a misdemeanor.

In Texas, not paying child support is a felony for which the defendant will spend no more than two years in jail. The Texas law allows no less than 180 days of jail. Texas limits fines to no more than $10,000. Texas also may pursue civil contempt of court charges. This is when a judge orders a fine or days in jail for every late payment or for every day a payment is late. Texas may pursue criminal contempt against the defendant. This allows the defendant to be kept in jail until a certain amount of child support is paid or until the arrearages are completely caught up.

Bankruptcy Won’t Affect Child Support Obligations

Bankruptcy will not discharge your child support obligations. But, bankruptcy can do a lot to make child support payments easier. A Chapter 7 or Chapter 13 bankruptcy can eliminate other unsecured debts. This leaves you more money to pay your child support obligations.

If you file a Chapter 13 bankruptcy, you can catch up on the amount you’re behind on child support through the Chapter 13 Plan. You're still required to make your regular child support payments while in your Chapter 13. If you enter a Chapter 13 repayment plan to catch up child support arrearages, states usually return your licenses. It's best to talk to a local bankruptcy attorney to find out how much bankruptcy can help with child support payments where you live.

After you complete your Chapter 13 Plan, but before the case is discharged, you’ll have to file a statement with the bankruptcy court certifying that you have made all your regular child support payments while you were in the Chapter 13 bankruptcy. Without this certification, you won't receive a Chapter 13 discharge for any debts of any kind.

Without this certification, you won't receive a Chapter 13 discharge for any debts of any kind.

Let’s Summarize...

If you can make your child support payments, you should make every effort to do so. If for some reason it’s impossible for you to continue to make your child support payments, consult with a local attorney to go over your options. Child support arrearages are some of the most difficult debts to deal with.

If you’re already behind, bankruptcy can help, but it can’t eliminate child support debts unless they’re fully paid. The law requires you to support your children when you don’t live in the same household just like you would if you lived in the same house.

↑ Back to topShare Article [⬈]

Written By:

Attorney John Coble

LinkedInJohn Coble has practiced as both a CPA and an Attorney. John's legal specialties were tax law and bankruptcy law. Before starting his own firm, John worked for law offices, accounting firms, and one of America's largest banks. John handled almost 1,500 bankruptcy cases in the eig... read more about Attorney John Coble

John handled almost 1,500 bankruptcy cases in the eig... read more about Attorney John Coble

Read About the Upsolve Team

How to recover child support from a working debtor? - Lawyer in Samara and Moscow

Legislation provides for a different procedure for paying and calculating child support.

1. On the payment of alimony by a parent on a voluntary basis

cash desks. The amount of alimony and the terms of payment are determined and indicated in the application by the parent paying the alimony. The administration will transfer alimony to the specified details or issue them when calculating wages. The payment of alimony in this manner does not apply to cases of deductions from wages for the purposes of labor legislation (clause 1, article 80 of the IC of the Russian Federation; article 137 of the Labor Code of the Russian Federation).

2. On the payment of alimony on the basis of a notarial agreement

The amount of alimony is determined by agreement of the parties, however, it cannot be less than what would be relied on a child in the recovery of alimony in court (clause 1, article 80, art. Articles 99, 103 of the RF IC). The agreement may provide for a different procedure for the payment of alimony: as a percentage of earnings, in a fixed amount of money paid at a time or periodically, etc.

Articles 99, 103 of the RF IC). The agreement may provide for a different procedure for the payment of alimony: as a percentage of earnings, in a fixed amount of money paid at a time or periodically, etc.

on the basis of this agreement in accordance with the stipulated conditions for the timing and amount of payments (Article 109RF SC). Their size is calculated on the basis of wages and income (except for payments from which alimony is not withheld) minus tax payments. The types of income from which alimony for minor children is paid are defined in the List, approved. Decree of the Government of the Russian Federation of July 18, 1996 N 841. Withholding by agreement cannot exceed 70% of earnings (Article 110 of the RF IC; Article 138 of the Labor Code of the Russian Federation). The administration pays or transfers alimony to the beneficiary's account no later than within 3 days from the date of payment of wages to the alimony payer. The costs of paying alimony (for example, a bank commission or a postal order fee) are borne by their payer.

Such an agreement has the force of an executive document, and if the parent does not want to pay alimony voluntarily under a notary agreement, they can be collected forcibly through the bailiff service (clause 3, part 1, article 12, article 30 of the Law of 02.10.2007 N 229-FZ).

The bailiff will calculate the debt for the payment of alimony.

Alimony arrears for the past period can be collected on the basis of an agreement on the payment of alimony within the three-year period preceding the presentation for collection.

If non-payment of alimony was due to the fault of the debtor parent, they can be calculated for the entire past period.

The bailiff calculates the debt based on the terms of the agreement on the payment of alimony and earnings and other income of the person obliged to pay alimony, for the period during which the alimony was not collected (Article 113 of the RF IC).

In case of non-payment of alimony voluntarily and the absence of a notarized agreement on the payment of alimony, alimony can be collected in court.

3. Legal recovery of child support from a parent

There are two ways to recover child support through the courts: on the basis of an application for a court order or filing a claim for the recovery of alimony.

Issuance of a court order is a simplified procedure for the collection of alimony. The judge issues a court order within five days from the date of receipt of the application without a trial, summoning the debtor and the recoverer and hearing their explanations (Article 126 of the Code of Civil Procedure of the Russian Federation).

The judge sends a copy of the court order to the debtor, who, within ten days from the date of receipt of the order, has the right to file objections regarding its execution (Article 128 of the Code of Civil Procedure of the Russian Federation).

The judge cancels the court order if the debtor raises objections regarding its execution within the prescribed period. If no objections are received from the debtor within the prescribed period, the judge issues the second copy of the court order to the recoverer to present it for execution or, at the request of the recoverer, sends it to the bailiff for execution (Article 129, 130 Code of Civil Procedure of the Russian Federation).

A court order cannot be issued in the case of an application for the payment of alimony in a fixed amount of money (clause 11 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of October 25, 1996 N 9).

As a general rule, alimony will be assigned from the moment of applying to the court. In rare cases, if payment evasion is proven, they can be recovered for the past period, but not more than three years (clause 2, article 107 of the RF IC).

Alimony is assigned as a fixed amount or as a percentage of the parent's income.

Assignment of alimony as a percentage of the parent's income

If the parent has one job and a steady income, then alimony can be assigned as a percentage of income - for one child in the amount of one quarter, for two children - one third , for three or more children - half of the earnings and (or) other income of the parent (Article 81 of the RF IC). The court may increase or decrease the size of these shares depending on the financial or marital status of the parties and other circumstances of the case (for example, the disability of family members to whom the party is obliged by law to provide maintenance, the onset of disability or the presence of a disease that prevents the continuation of the previous work, the child's admission to work or engaging in entrepreneurial activity).

On assignment of alimony in a fixed amount of money

Alimony in a fixed amount of money is assigned if there is no agreement between the parents on the payment of alimony and the parent does not have a permanent income, or if there are several sources of income, or if the income is unstable, or if this parent receives earnings and (or) other income in whole or in part in kind or in foreign currency, and in other cases when it is impossible to collect alimony in percentage terms (Article 83 of the RF IC).

A fixed amount of maintenance is also determined taking into account the financial and marital status of the parties and other circumstances worthy of attention in order to maintain the child's previous level of support. Alimony must be set in a fixed amount of money corresponding to a certain number of minimum wages for further indexation (clause 2 of article 117 of the RF IC).

You can collect alimony in a fixed amount of money, for example, if the alimony payer hides his income.

Employer withholds child support based on a court order or court order in the same way as a child support agreement. If a court order or court decision is not executed voluntarily, then their enforcement through the bailiff service is possible. The bailiff will calculate the debt on the basis of a court order or decision in the manner indicated above.

Remember, at any stage of a family dispute, the Legal Center for Family Affairs of Attorney Anatoly Antonov is ready to provide you with legal support. Call us by phone in Samara + 7 (846) 212-99-71 right now and sign up for a consultation at a convenient time for you.

Legal Center for Family Affairs of Attorney Anatoly Antonov provides the following legal services on issues of paying alimony for minor children, as well as other family members:

- legal advice;

- drawing up an agreement on the payment of alimony;

- drawing up a statement of claim for the issuance of a court order;

- preparation of a statement of claim for the recovery of alimony and attachments to it, as well as filing it with the court;

- preparation of objections regarding claims for the recovery of alimony, for a reduction in the amount of alimony;

- familiarization with the materials of the case on the recovery of alimony, on the reduction of the amount of alimony;

- participation in court hearings (possibly without the presence of the principal) for the recovery of alimony;

- obtaining a court decision on the recovery of alimony;

- appeal against the decision of the court in a higher instance.

Original article taken from the website of the Electronic Journal "Azbuka Prava"

Relevance date of the material: 01/06/2016

To make an appointment for a consultation, call the round-the-clock number +7 (846) 212-99-71 or leave a request below

Rostrud recalled the rules for withholding alimony from wages

Rostrud recalled the rules for withholding alimony from wagesNews for an accountant, accounting, taxation, reporting, FSB, traceability and labeling, 1C: Accounting

- News

- Articles

- FAQ

- Videos

- Forum

07/21/2022

Rostrud warned employers that the collection of alimony from wages is carried out after taxes are withheld.

In its letter No. PG/16690-6-1 dated June 30, 2022, the department notes that persons paying the debtor wages and other periodic payments are required to withhold funds from these incomes in accordance with the requirements of the executive document from the day it is received from the recoverer or a copy from the bailiff.