How to freeze credit for child

Child Identity Theft: How to Protect Your Child's Credit

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Put up strong barriers to child identity theft by freezing your child's credit and safeguarding their data.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

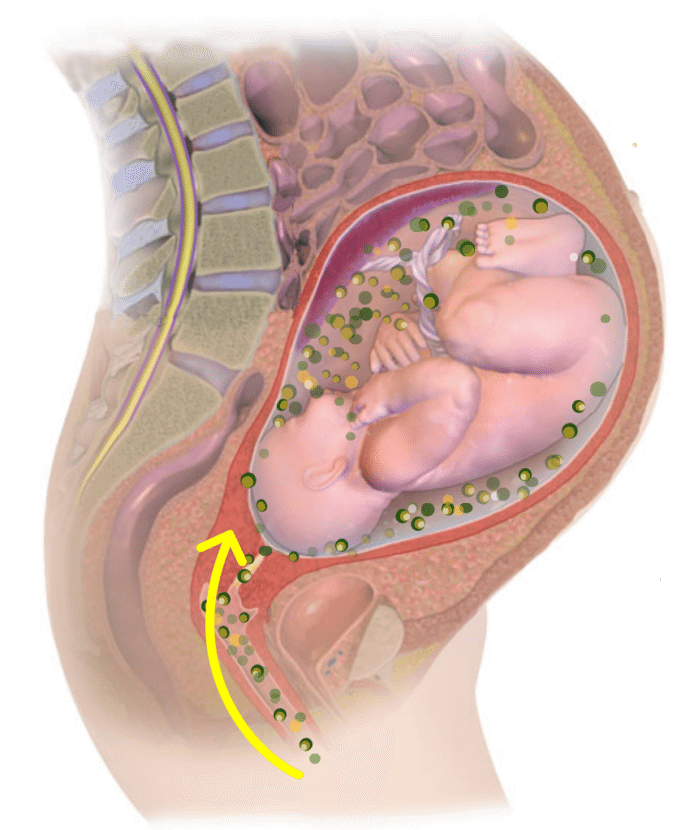

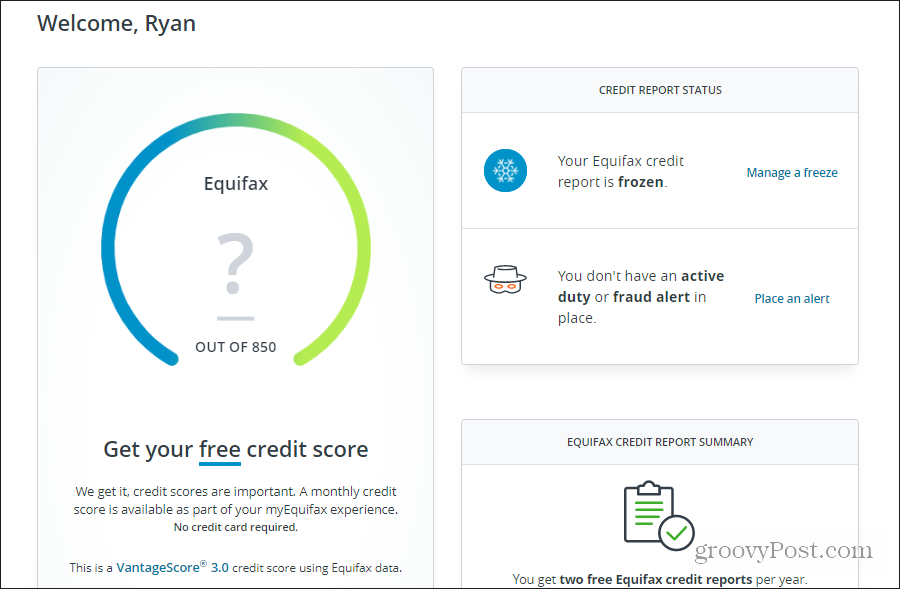

Parents and guardians can now freeze the credit for children younger than 16. The credit bureaus must create a credit file for the child if none exists — which should be the case — and freeze it. Sixteen- and 17-year-olds may request freezes themselves.

Credit bureaus don't knowingly create credit files for minors. But they have no way of verifying that a Social Security number actually belongs to the person using it, according to the Identity Theft Resource Center, a nonprofit that helps with ID theft prevention and recovery. Thieves may even “create” a consumer by blending a child’s Social Security number with a different name, address and birthdate, a practice called synthetic identity theft. Because parents have little reason to check whether a credit record exists for their child, the crime can go undetected for years.

Eva Casey Velasquez, president and CEO of the Identity Theft Resource Center, says she “absolutely” recommends that parents freeze their children’s credit. That will prevent criminals from using the child’s personal data to take out credit, creating a mess the family must clean up. (And don't forget to freeze your own credit, too, to stop scammers from opening new credit accounts in your name.)

Here's a simplified way to freeze a child's credit, and some tips to protect against child identity theft.

How to freeze a child’s credit

1. Gather the needed documents

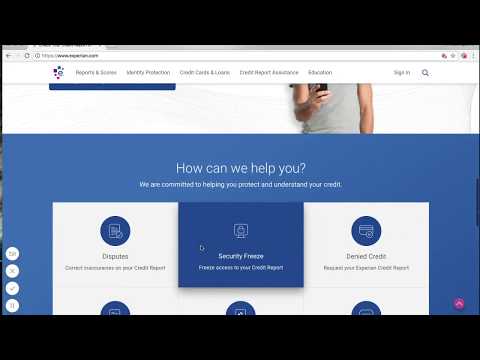

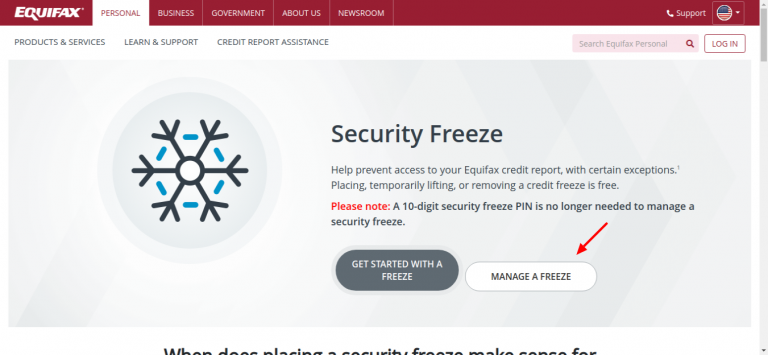

The three major credit bureaus (Experian, Equifax and TransUnion) have slightly different requirements. But to make the process simple and streamlined, simply send the same set of documents to each one. Each bureau will disregard extra documentation.

Here’s what you need to cover all three bureaus’ requirements. Make three sets of copies for each; don't send originals:

Your government-issued ID (usually a driver’s license).

Your birth certificate.

Your child’s birth certificate or other document showing you have the authority to act on the child’s behalf (foster care certification, power of attorney or court order).

Your Social Security card.

Your child’s Social Security card.

A utility bill or bank or insurance statement with your name and address on it.

Sort the copies into three piles, one for each credit bureau.

2. Print out child freeze request forms

If you're requesting freezes for more than one child, you'll need to fill out a form for each one. You can download the necessary forms from Equifax and Experian.

TransUnion doesn't have a form, but you can download this letter to fill out seeking a “protected consumer freeze” for your child.

3. Mail the request and document copies

You will send each form or letter, along with one set of documents, to each credit bureau. Equifax and Experian list their mailing addresses on their freeze request forms. TransUnion’s address is P.O. Box 380, Woodlyn, PA 19094.

Equifax and Experian list their mailing addresses on their freeze request forms. TransUnion’s address is P.O. Box 380, Woodlyn, PA 19094.

Either regular or certified mail is acceptable. Because you are mailing sensitive personal information, NerdWallet suggests using certified mail.

4. Wait for confirmation, then store it securely

You will receive confirmation in the mail that a freeze has been placed, and the correspondence will include your child’s PIN. That number is necessary for unfreezing your child’s credit, so keep that in a safe place (a fireproof safe is ideal). You might also want to store it electronically by using a secure password manager service, for example.

The freeze will remain in place until your child unfreezes it later to apply for a credit card, car loan, student loans or other credit.

How to protect your child from identity theft

Freezing your child’s credit will keep a criminal from opening credit in your child’s name, but it doesn't protect your child from identity theft entirely.

You can adopt habits to guard against child identity theft and teach your child to do the same.

Protect Social Security numbers by leaving forms requesting them blank until and unless you are told why they are necessary and how they will be protected.

Pay attention to mail. While credit preapproval offers in your child’s name don't always indicate identity theft, they are worth investigating. Correspondence from a collection agency addressed to your child is a huge red flag.

Keep your child’s documents locked away. Birth certificates and Social Security cards shouldn't be in your purse, wallet or car. Safeguard anything with that information in your own home. That means keeping paperwork with Social Security numbers inaccessible, possibly in a home safe or locked file cabinet, inaccessible to service people and visitors.

Monitor health insurance claim information. A claim that doesn't make sense to you can indicate that your child’s personal information has been used to access health insurance benefits.

Parents and other guardians also need to understand that a child’s data is not theirs to use, even if a child is in their care, Velasquez says. Parents or foster parents have sometimes used children’s unblemished records with noble intentions, say, to get utilities connected or to set up mobile devices so that they can keep in touch with the family. But such actions constitute identity theft.

Guarding personal data isn’t the ultimate solution, but it’s what we can do now.

“A Social Security number should not be used as a verifier,” says Chi Chi Wu, staff attorney at the National Consumer Law Center. “We need a better way to verify identity. Ultimately, that’s the solution.”

See your free credit report

Know what's happening with your free credit report and know when and why your score changes.

About the author: Bev O'Shea is a former credit writer at NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere. Read more

Read more

On a similar note...

How To Protect Your Child From Identity Theft

Learn what child identity theft is, how to detect it, how to protect your child’s personal information, and what to do if someone steals your child’s identity.

- What Is Child Identity Theft?

- How To Protect Your Child’s Personal Information

- How To Know if Someone Is Using Your Child’s Personal Information

- What To Do if Someone Is Using Your Child’s Personal Information

What Is Child Identity Theft?

Child identity theft happens when someone takes a child’s sensitive personal information and uses it to get services or benefits, or to commit fraud. They might use your child’s Social Security number, name and address, or date of birth. They could use the stolen information to

- apply for government benefits, like health care coverage or nutrition assistance

- open a bank or credit card account

- apply for a loan

- sign up for a utility service, like water or electricity

- rent a place to live

How To Protect Your Child’s Personal Information

Here’s what you can do to protect your child from identity theft.

Ask questions before giving anyone your child’s Social Security number

If your child’s school asks for your child’s Social Security number, ask these questions:

- Why do you need it?

- How will you protect it?

- Can you use a different identifier?

- Can you use just the last four digits of the Social Security number?

Protect documents with personal information

If you have documents with your child’s personal information, like medical bills or their Social Security card, keep them in a safe place, like a locked file cabinet.

When you decide to get rid of those documents, shred them before you throw them away. If you don’t have a shredder, look for a local shred day.

Delete personal information before disposing of a computer or cell phone

Your computer and phone might contain personal information about your child. Find out how to delete that information before you get rid of a computer or a cell phone.

How To Know if Someone Is Using Your Child’s Personal Information

In addition to taking steps to safeguard your child’s personal information, keep an eye out for warning signs that someone is using your child’s personal information. Here are a few:

- You’re denied government benefits (like health care coverage or nutrition assistance) because someone is already using your child’s Social Security number to get those benefits.

- Someone calls you and says your child has an overdue bill, but it’s not an account you opened for the child.

- You get a letter from the IRS that says your child didn’t pay income taxes. This could happen if someone used your child’s Social Security number on tax forms for a new job.

- You’re denied a student loan because your child has bad credit. This could happen if someone used your child’s Social Security number to get a credit card, open a cell phone account, or set up a utility service and has not paid the bills on time or at all.

Signs of Child Identity Theft

- Turned down for government benefits

- Calls about bills in your child’s name

- Letter from the IRS about taxes your child owes

- Child’s student loan application is denied

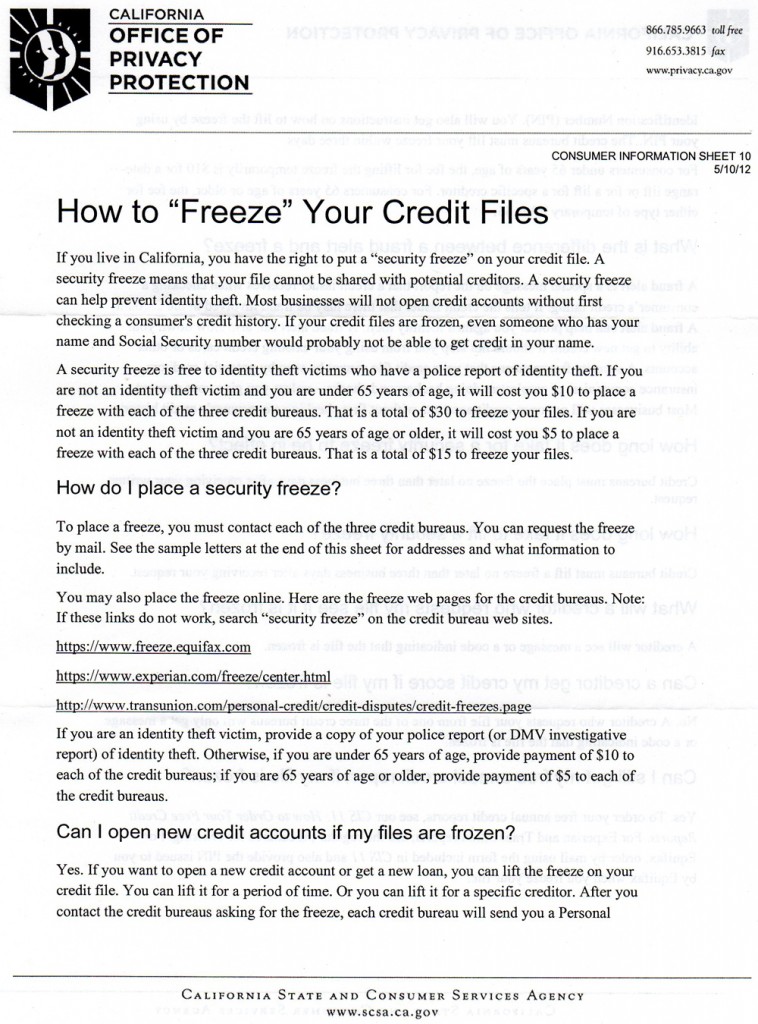

Check if your child has a credit report

Generally, a child under 18 won’t have a credit report unless someone is using his or her information for fraud. A good way to find out if someone is using your child’s information to commit fraud is to check if your child has a credit report. To do that, contact the three credit bureaus (find their contact information at IdentityTheft.gov) and ask for a manual search for your child's Social Security number. You may have to give the credit bureaus a copy of

- your driver’s license or other government-issued identification card

- proof of your address, like a utility bill, or a credit card or insurance statement

- your child’s birth certificate

- your child’s Social Security card

If you’re not the child’s parent, you may have to give the credit bureaus a copy of documents that prove you are the child’s legal guardian.

When Your Child Turns 16

When your child turns 16, you may want to check if there’s a credit report in his or her name. This could help you spot identity theft, since children under 18 usually don’t have a credit report. If there’s inaccurate information in your child’s credit report, you’ll have time to correct it before he or she applies for a job, a college loan, a car loan, or a credit card, or tries to rent a place to live.

What To Do if Someone Is Using Your Child’s Personal Information

If you discover that someone is using your child’s personal information, here’s what to do right away:

Step 1: Report and close the fraudulent accounts

Contact the companies where fraud happened. Tell each company’s fraud department that someone opened an account using your child’s information, and ask them to close the account. Ask for written confirmation that says that your child isn’t responsible for the account.

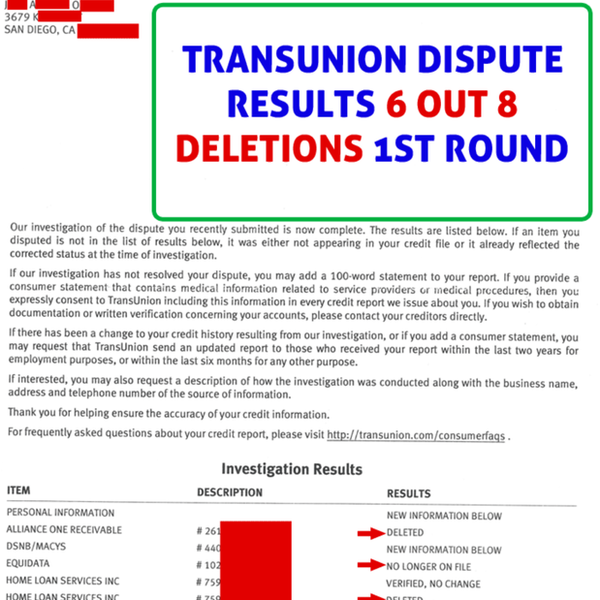

Contact the three credit bureaus. Tell each credit bureau that someone opened an account using your child’s information. Ask them to remove any fraudulent accounts from your child’s credit report.

Step 2: Freeze your child’s credit report

If your child is under 16, you can request a free credit freeze, also known as a security freeze, to make it harder for someone to open new accounts in your child's name. The freeze stays in place until you tell the credit bureaus to remove it. (Minors who are 16 or 17 can request and remove a security freeze themselves.)

To activate a credit freeze, contact each of the three credit bureaus. Find their contact information at IdentityTheft.gov.

Step 3: Report child identity theft

Report the child identity theft to the Federal Trade Commission at IdentityTheft.gov. Include as many details as possible.

Child Identity Theft - What to Know, What to Do

This brochure for parents explains what child identity theft is and what to do if it happens to your child.

Order free copies

What is a deferred payment on a loan and how to take a loan holiday in a bank

Sometimes a person for some reason cannot make another loan payment due to life circumstances - for example, loss of a job or serious illness. In this case, you should never shy away from communicating with the bank. If the reason for non-payment is valid, the bank will offer options for resolving the situation. One of them is deferred payment, or credit holidays.

However, it is not always possible to get credit holidays. Not every bank is ready to give a deferment, and it does not work for all customers. You will learn how credit holidays work, who can get them and how to apply for them in this article.

Summary of the article

How to delay a loan:

- Make sure that there are no delays on the loan, more than 3-6 months are left until its repayment, and the contract provides for loan holidays

- Report the situation to the bank and wait for a preliminary decision

- Fill out an application and submit documents confirming the reason for receiving vacation

- Wait for a response from the bank

- If the decision is positive, sign an additional agreement to the contract and receive a new payment schedule

- If required, pay a fee for the service

Conditions for obtaining a loan holiday

A deferment of the monthly payment provided by the bank when it is impossible to repay the debt is called a loan holiday. Such a delay is usually granted for a period of up to 1-3 months, less often - up to six months. During this period, the repayment of the loan body and the accrual of interest are stopped. During the loan holidays, the borrower will be able to solve the problem that does not allow repaying the debt on time. Credit history does not deteriorate from this.

Such a delay is usually granted for a period of up to 1-3 months, less often - up to six months. During this period, the repayment of the loan body and the accrual of interest are stopped. During the loan holidays, the borrower will be able to solve the problem that does not allow repaying the debt on time. Credit history does not deteriorate from this.

Credit holidays can only apply to the body of the loan, to interest or to the entire amount of the payment. It depends on the period for which they are provided, and the total amount of overpayments.

The main condition for granting a deferment for a consumer loan is the presence of a sufficiently serious reason that does not allow repaying the loan. These reasons usually include:

- Loss of a job for reasons beyond the employee's control, such as layoffs or the closure of the employing company

- Maternity leave for pregnancy or care of a child under the age of one and a half years

- Need for long-term treatment of severe illness

- Survivor

- Call to the army for military service

- Loss of property or health due to an accident - fire, robbery, natural disaster or other

Another important condition is a sufficient level of borrower's reliability. The bank is more likely to approve a deferment if you have previously made all payments on time and have a good credit history. Active use of other bank services, such as credit cards, will be an advantage.

The bank is more likely to approve a deferment if you have previously made all payments on time and have a good credit history. Active use of other bank services, such as credit cards, will be an advantage.

At the same time, the bank will most likely refuse to grant you a grace period if:

- You were dismissed of your own free will or due to disciplinary violations

- You make large delays, including in other credit institutions, and have a bad credit history

- You were employed unofficially - it becomes more difficult to prove the fact of employment and dismissal

- Less than three months remain after the loan is issued or before its full repayment

- You are suspected of intentionally evading payments - such actions are considered fraud

Loan deferment without good reason is not available in all banks and is usually paid.

How to apply for a loan deferment?

First of all, in case of problems, contact the bank as soon as possible - report your problem and find out if it is possible to take a deferment in such a situation. You need to do this before the due date of the mandatory payment, otherwise the bank may fix the delay. It is best to contact the bank in person, but you can also ask for a delay by phone.

You need to do this before the due date of the mandatory payment, otherwise the bank may fix the delay. It is best to contact the bank in person, but you can also ask for a delay by phone.

Next, study the loan agreement. It may set out the conditions and procedure for granting a deferment. If there are no such conditions, then check them with the support service. Most likely, your organization provides this service on a case-by-case basis or, more rarely, does not provide it at all.

Then prepare documents that will support the reason why the vacation is required. Depending on the situation, this may be a work book with a mark of dismissal, medical certificates, sick leave and others. You will also need a passport and a loan agreement with a payment schedule. The bank may also request other documents - for example, a plan for solving a problem with a loan.

If the reason for the inability to repay the debt was the loss of a job, then you will also need a certificate from the employment center - it will confirm your status as unemployed.

After you collect the package of documents, contact the bank and fill out an application for a loan holiday. You can check the application form with the organization. The bank will consider your application within a few days and study the situation that does not allow you to repay the loan. If the reason is serious enough, he will make a positive decision. In this case, you will conclude an additional agreement with the bank to the loan agreement and, if required, pay a commission.

After signing the agreement, you will receive a new payment schedule, drawn up in accordance with the deferment. Credit holidays will finally come into force.

Pros and cons of a loan holiday

In a difficult situation, a loan holiday is a good solution if you are unable to pay off your loan. This service has several advantages:

- During the grace period, you will have enough time to resolve the situation and start paying off the debt again according to the previous schedule

- Loan holidays do not harm the credit history, for the duration of their validity, the accrual of fines and penalties is terminated

- If the vacation is incomplete, then you can slightly reduce the overpayment by repaying part of the body of the loan or interest on it

However, the disadvantages of such a solution must also be taken into account:

- You can usually get a loan holiday only once for one loan - this restriction is necessary so that people do not take a deferment too often

- Sometimes interest continues to accrue on the amount owed during the holidays - the amount you need to repay after the grace period will increase

What other ways are there to ease the burden of credit?

Sometimes, instead of a credit holiday, the bank may offer other options for solving a problem with loans. Such methods usually involve changing the payment schedule or transferring debt repayment obligations to a third party. Consider the ways to reduce the credit burden, which are used most often.

Such methods usually involve changing the payment schedule or transferring debt repayment obligations to a third party. Consider the ways to reduce the credit burden, which are used most often.

Refinancing . It applies if you have taken out several loans in different banks. In this case, a new loan is issued, which is used to pay off debts on previous ones. Payments are reduced as you only need to pay to one bank. If the loan is issued on security, then the encumbrance is removed from the property - it can be sold or donated.

Benefits of refinancing:

- Refinancing is available for many types of loans - consumer loans, car loans, mortgages and credit cards

- When refinancing, the interest rate is reduced and the maturity of the debt is increased

- You can also receive an additional amount that can be spent for any purpose

Disadvantages of refinancing:

- The number, amount and types of loans for which refinancing can be issued are limited

- It is usually not possible to refinance debts that are in arrears

- Some banks issue refinancing only for third-party loans

- If the refinancing is for a mortgage, then you will not be able to receive a property tax deduction

Restructuring . It implies a complete revision of the loan repayment schedule. During the restructuring process, a new schedule is drawn up, in which the size of the regular payment will be reduced. Sometimes the bank may change the debt repayment scheme from annuity to differentiated or reduce the interest rate.

It implies a complete revision of the loan repayment schedule. During the restructuring process, a new schedule is drawn up, in which the size of the regular payment will be reduced. Sometimes the bank may change the debt repayment scheme from annuity to differentiated or reduce the interest rate.

Advantages of restructuring:

- It will be easier for you to repay the debt if the amount of the mandatory payment decreases

- Restructuring does not worsen the borrower's credit history

Cons of restructuring:

- Restructuring will not help if you have lost your job or ability to work for a long time

- It is difficult to issue restructuring if there are open delays

Assignment agreement (assignment of debt) . In this case, the obligation to repay the loan is transferred to a third party - the assignee. With him, the bank concludes a separate agreement, which specifies the terms of the new loan. The person to whom the obligations are transferred must meet the requirements of the bank.

The person to whom the obligations are transferred must meet the requirements of the bank.

Advantages of the assignment agreement

- You will have no obligations to the bank - they will all be transferred to the new borrower

- Both individuals and (less often) legal entities can act as an assignee

Disadvantages of the assignment agreement

- It is necessary to find a person who will agree to take over the debt and will meet the requirements

- If the assignment is for a car loan or mortgage, then the right to acquired property also passes to the assignee

- Banks very rarely offer this solution to the problem due to the complexity of its execution

Redemption by collateral, surety or insurance . It is available only when applying for a loan secured or surety, as well as when applying for insurance of the borrower. If the loan is secured by collateral, then the mortgaged property is sold, and the proceeds will be used to pay off the debt. If a guarantee is issued, then the obligation to repay passes to the guarantor. If there is insurance, then the insurance company will pay off the loan.

If a guarantee is issued, then the obligation to repay passes to the guarantor. If there is insurance, then the insurance company will pay off the loan.

Advantages of such repayment:

- The loan amount, including interest on it, will be repaid in full or transferred to another person

- If you have insurance, then not only you, but also your relatives can receive compensation (for example, after the death of the borrower)

Disadvantages of such repayment:

- When registering a pledge, your rights to use the pledged property are limited. Loss of valuable property (car or home) can be serious

- The guarantor may waive his obligations if he can confirm the reason for the refusal

- Getting insurance can be very expensive (need to pay insurance premiums regularly). In addition, it will be necessary to confirm the fact of the insured event

Conclusion

Banks are interested in borrowers repaying loans without significant problems. In litigation with debtors, they will lose more than in granting a deferral or restructuring. Therefore, do not be afraid to apply for credit holidays if necessary - if you can confirm your reliability, you can easily get an installment plan.

In litigation with debtors, they will lose more than in granting a deferral or restructuring. Therefore, do not be afraid to apply for credit holidays if necessary - if you can confirm your reliability, you can easily get an installment plan.

Try to apply for a loan holiday only if there are no other options for repaying the debt. If you try to get a vacation without a good reason, the bank will begin to trust you less. Don't forget about other ways to ease the load, such as restructuring and refinancing. Perhaps in your situation they will be more convenient than deferred payment.

So, if you have problems with paying off your debt, you can take advantage of a deferred payment for several months - credit holidays. For this you need:

- Check if your loan agreement allows deferrals

- Make sure you have a good reason (layout due to redundancy, maternity leave or disability)

- Submit an application and documents confirming the reason to the bank

- Conclude an additional agreement to the loan agreement

Credit holidays will give you time to eliminate the problem that interferes with repayment, but you can get out of it only under certain conditions. In addition to them, there are other options for easing the debt burden - refinancing, restructuring and debt assignment (cession).

In addition to them, there are other options for easing the debt burden - refinancing, restructuring and debt assignment (cession).

Have you ever used a credit holiday? You can tell us about your experience with applying for a loan by installments in the comments.

Sources

- fineexpert24.com: Deferred loan payment (loan holidays)

- rg.ru: What you need to know for those who decide to go on a loan vacation

- Official website of Sberbank

how to get it at birth and in other cases

Mortgage agreement is concluded for 25-30 years . During this time, no borrower is immune from unforeseen situations, life difficulties, force majeure. Therefore, there is a need to change the date of payment, credit conditions.

When is a delay possible?

How can I get a deferment?

How long can I get an installment plan?

Why can they refuse?

When is a delay possible?

It should be understood that the lender is always ready to meet the client, he does not need loans with overdue debts in the loan portfolio. This affects the fulfillment of standards by banks, an increase in reserves for possible losses on loans. Therefore, credit organizations support customers by offering optimal solutions.

This affects the fulfillment of standards by banks, an increase in reserves for possible losses on loans. Therefore, credit organizations support customers by offering optimal solutions.

If it is impossible to pay the debt, the borrower must first inform the lender and try to work out a mutually beneficial solution to the problem. If possible, this should be done in advance if the borrower knows about the approach of any event: the birth of a child, receiving a notice of reduction from the employer, etc. Here the problem lies in the fact that any changes to the mortgage agreement must be properly registered, on it takes time, and the deadline must be postponed before the due date, otherwise a delay cannot be avoided.

There are certain categories of borrowers who can definitely count on receiving a deferment. For example, if one family member died, debtors who were left without work, when a serious illness was discovered, if a woman is on maternity leave, etc.

Each case is considered in a separate order and the bank's decision depends on a number of reasons: Credit history of the borrower;

It must be understood that the deferment only applies to the payment of the principal debt and does not apply to the payment of interest. They are payable in any case.

Birth of a child

When a child is born, special postponing conditions apply. For example, in Sberbank, at the birth of the first child, payments can be deferred for up to a year, when the second and then the baby is born, the transfer of the period is possible from 3 to 5 years.

Families with a second child are legally allowed to repay part of the loan with maternity capital.

Maternity leave

loses the source of income from which she repays the loan.

She can arrange credit holidays for a period of 6 months to a year, if such a program is implemented by the lender. They will allow you not to pay the debt on the loan, the amount of the monthly payment will not be large (interest).

Difficult financial situation

This group of borrowers includes debtors who lost their jobs against their own will: reduced, if the employer declared itself bankrupt, liquidated when the borrower is forced to move to a low-paid position due to company restructuring, etc.

Data cases are the most vulnerable in terms of decision-making by banks. The lender must be reassured that, when due (after the grace period has been granted), the borrower will be able to service the debt in a timely manner. When the debtor was laid off at work, no one can guarantee his quick employment with sufficient income.

If the debtor resigns of his own free will, the bank's decision depends on its individual characteristics, but most likely will be negative.

Other options

Other reasons that may allow you to get a mortgage repayment deferral include:

- Loss of a breadwinner;

- The need for long-term treatment of the borrower or members of his family;

- Loss of income for business owners due to unstable economic situation.

If in the first two cases the borrower can provide supporting documents, in the third case the debtor must prove to the creditor that he can repay the debt after some time.

How can I get a deferment?

The borrower can restructure debt with the help of AHML. As a result, the monthly installment on the loan will decrease, and the loan term will increase.

Reasons for possible restructuring:

- The average per capita family income is less than the subsistence level prevailing in the region;

- When the acquired housing is the only one for the family, they live in it and there is no other property in the property;

- If the family does not have savings to pay off the mortgage.

But first of all, you should contact the creditor bank.

What do you need to provide?

To apply to a credit company, you will need to collect a package of documents:

- Certificates confirming the existence of circumstances that make it impossible to service the debt in a timely manner: birth certificate of a child, sick leave on maternity leave or illness, an agreement with a healthcare institution for an operation, a certificate health status, layoff order, etc.

- Certificates confirming the actual income of the borrower / co-borrowers on the loan, the amount of pension, if the debtor is registered with the labor exchange, a supporting document is also required.

- Extract from the USRN confirming that the borrower has no other real estate (if necessary).

Procedure

The procedure is as follows:

- The borrower draws up an application with a request for a deferral of debt repayment in 2 copies, attaches the collected documents to it. The application must contain a reference to the loan agreement, justification of the reason for the impossibility of timely payment, the required grace period. The application form is developed by the creditor bank. Pattern:

- The application can be sent by registered mail with notification or submitted through a representative of a credit company at a bank branch. On the second copy of the document, the authorized employee must put the date of acceptance and signature.