How to forgive child support arrears

Can child support arrears be forgiven?

Can child support arrears be forgiven?

Child support back pay cannot be totally forgiven or waived, but there are a few situations that can help you handle it.

- Double-check the amount the court states you are in arrears. You can always ask the court to recalculate this amount to make sure it is correct.

- If your child lived with you for a period that the back pay is referencing, the judge may lessen the child support amount. The court’s judgment will often depend on the amount of time and financial support that was given during the child’s stay.

- Back pay does accrue interest but, in some cases, you may not have to pay all of it.

- You can request a manageable payment schedule. While this doesn’t lessen the amount owed, it can make it so that you don’t fall behind, even more, trying to pay your original balance.

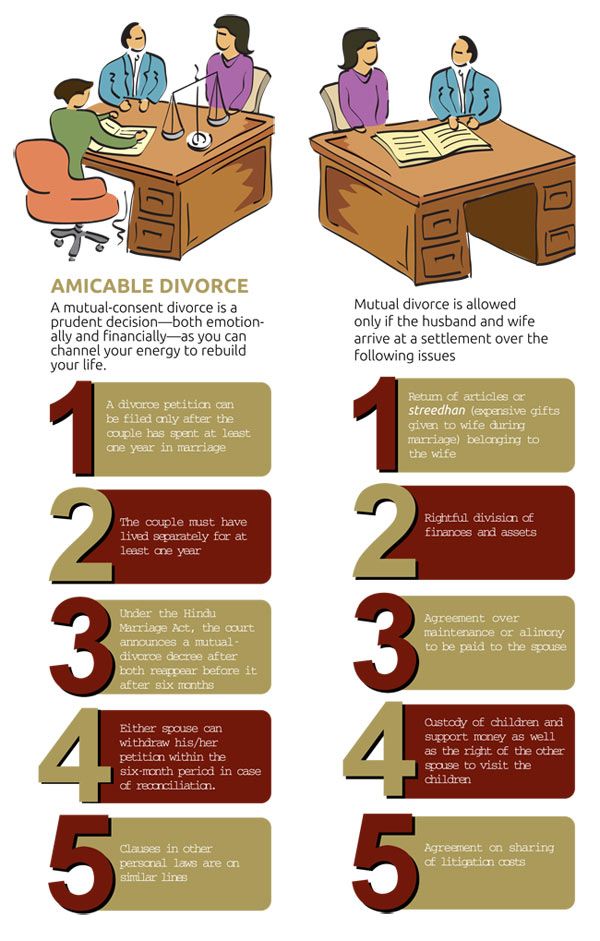

- Reach a settlement with the other guardian. If the debt is just too overwhelming, you may be able to reach a lump-sum settlement with the other guardian.

- You can also get a private loan to pay the back pay in some states. That said, this should always be a last resort since you will owe the loaned money back in the future with interest as well.

How do I pay child support if I don’t have a job or income?

Paying a required amount of money for child support may seem like an impossible task when you are unemployed, but there are a few methods to help lighten this load until you find your next job.

- As always, be sure to tell the courts as soon as possible about any changes to your employment status. By doing this, you can request a temporary suspension or reduction of your payments until you are able to find a job again.

- Apply for unemployment benefits if you are eligible. Child support payments can be deducted from these benefits to keep you from owing money you should have paid earlier (called arrears).

When will I get my tax return for child support?

You will not get a tax return for child support. At this time, child support payments cannot be claimed on your annual taxes. That said, you might be able to claim your child as a dependent on your taxes, depending on your situation, but this normally requires the custodial parent to sign Form 8332 allowing the deduction to you. Either way, your child support will not be legally subtracted from your taxable income.

At this time, child support payments cannot be claimed on your annual taxes. That said, you might be able to claim your child as a dependent on your taxes, depending on your situation, but this normally requires the custodial parent to sign Form 8332 allowing the deduction to you. Either way, your child support will not be legally subtracted from your taxable income.

How much child support is taken from my unemployment, social security or disability benefits?

If you don’t pay your child support, it is considered an outstanding debt. Your arrears are collectible from unemployment, social security or disability benefits that are considered disposable income. The only social security benefit that is exempt from child support garnishments is SSI.

These benefits can pay both your monthly child support and any past due child support you may owe. If you do owe child support arrears, it can be garnished up to the federal limit of 65% depending on factors such as the amount of arrears owed or if you are supporting another family.

What should I do when child support is not being paid?

Whether you are the guardian parent or a noncustodial parent responsible for paying child support, it is frustrating when child support is not being paid.

If this happens, communication is key. Let the courts know what is going on so legal action can be taken. This may mean the required monthly payment will be readjusted so at least some money will make it to the child.

If your situation seems out of the ordinary or you need some help finding out the right direction to take things before speaking to a lawyer, there is a child support hotline that can provide basic guidance on child support issues. Their number is 888-369-0323.

Also, your state may have a similar hotline set up with that will provide you with more knowledge about your specific state’s laws and regulations.

What happens if I don’t pay child support?

Since child support payments are a court order, the nonpayment of child support puts you in contempt of court. In the worst-case scenario, this offense can land you in jail.

In the worst-case scenario, this offense can land you in jail.

Many times, a judge will choose another form of punishment, such as wage garnishments, license suspension, or seizure of tax returns if it means the child support will be paid. One way to avoid any of these punishments is to keep the court aware of your situation.

If you lose your job, become sick for a long time or can’t keep up with the payments, it’s best to tell the court about your situation as soon as possible. Letting the court know what is happening in your life makes it possible for the child support order to be readjusted.

What happens when you go to jail for child support?

Having to go to jail for unpaid child support isn’t that typical, but it is possible. If a judge chooses jail time as your punishment for unpaid support, a few things can happen. Jail time is possible and well as the seizure of your unpaid support. These seizures can include your tax refund, a property lien or bank account liquidations.

You will continue to increase your child support balance while in jail. As a convicted criminal, you will have a public record showing your conviction.

No one wants any of these circumstances stacked on their plate, which is why it is important to work with the courts to avoid jail time and pay child support on time. That said, if you have been to jail for missing child support, your life is not over – it will just add some challenges that you can overcome.

Is not paying child support a felony?

You can receive a felony charge for not paying child support, but most cases don’t. That said, it’s important to understand this is a possibility.

The charge will depend on your violation record and the amount of child support back pay that is owed. Usually, you will be charged as a misdemeanor, which results in immediate payment of the arrears or additional fines.

If you do not pay your child support frequently though, you might receive a felony charge on your record. If this happens, you could spend time in jail.

If this happens, you could spend time in jail.

How much jail time do you get for non-payment of child support?

Child support jail sentences will make you serve less than six months, but some convictions can be up to two years. These sentences are often attached to repeat offenders who owe large amounts of child support back pay. The time given in the sentence comes from what the judge believes is a decent amount of time for the offender to understand their wrongdoing and thus pay the debt.

Do you have to pay child support in jail?

Yes, child support does continue to accumulate while in jail and often comes with interest. Debt like this can increase quickly. This creates child support back pay that will guarantee garnishments on your wages or even the government withholding your property and assets.

If you are in jail and gaining child support arrears, it is beneficial to work out a payment schedule when you are released. This will let the courts know you are trying to get rid of the debt in a reasonable amount of time.

Does child support affect SNAP benefits?

The child support you receive counts toward your income, according to SNAP. This means that child support payments may change your eligibility for SNAP benefits once it is added to other income you receive.

That is not to say you should not try to get child support if you are afraid your benefits will be affected. If you are worried about this, talk with your SNAP office or a lawyer to find out your best option.

If you are on the other side of the fence and are responsible for paying monthly child support, then your child support order can affect your ability to receive SNAP benefits. If you are behind on your child support payments, you may not get the benefits.

How do child support housing benefit work?

Housing benefits and child support can become tricky since each state has its own rules about both child support and housing benefits. In many states, you can’t collect both housing assistance and child support at the same time.

In many cases, if a guardian parent applies for housing benefits and includes a child in the application, the government will first look to see if there is any child support being paid for the child. If there is not, the state will open a child support case to have the noncustodial parent begin paying the child support owed.

From this point, the housing benefit will either be approved or denied. If approved, some states provide the housing benefits but only pay the child a minimum amount in child support instead of the amount a court may calculate. This amount can vary by state but will most likely be less than the monthly child support allowance the court may order. Many times this happens because the housing benefit amount will be much more than child support assistance.

On the flip side, the noncustodial parent is still responsible for paying their child support order (so it is kept up to date if, and when, the child moves off of housing assistance).

When it comes to housing benefits and child support, there are a lot of options to be weighed such as immediate housing needs. In this instance, it may be best to consult a caseworker or local assistance agency to see what option may be best – especially in a housing emergency.

In this instance, it may be best to consult a caseworker or local assistance agency to see what option may be best – especially in a housing emergency.

How do I increase child support benefits?

The economy will always be fluctuating and inflation can play a role in our lives, including on child support. In the lifetime of your child, just as you have seen in your life, the cost of food, clothing, rent, medical care and education will continue to rise. This means your child support should match the current cost of living.

What once may have been enough to support your child’s day-to-day needs now just isn’t enough to cover the current the economy, a move to another area or a change of schools.

This will mean another visit to the courts to have the child support reexamined for an adjustment. This will likely come with some discussion of what the costs are and proof that they have risen. From here it will be up to the judge to determine if and how much the support benefits can be raised.

What happens if I overpay child support?

Overpayment of child support is extremely tricky no matter where you live. There are many factors that can cause your overpayment to be considered a “gift” that you can never get back. When it comes to child support, it is best to tell the court about any changes that have happened that could affect the amount you would be required to pay. These changes can include changes in your employment status, increases or decreases in your salary, marriage or divorce, support of another child, or even changed custody on the supported child.

Any of these examples could drastically affect the payment requirement of your child support. Letting the courts know as soon as possible when one of these changes occurs can help you avoid any overpayments and the headaches that come with trying to get your lost money back.

Child support benefit calculators by state

If you are wondering how much your monthly child support payment may be there are many resources available to help you determine this. By simply searching “child support calculator” and the name of your state, you will find many sites available. Be sure to keep a few things in mind here:

By simply searching “child support calculator” and the name of your state, you will find many sites available. Be sure to keep a few things in mind here:

- These calculators can only estimate your monthly support amount based on the information you provide and your state’s laws. The final amount will be decided by the courts.

- You will want to use the state your child resides in, as this is the state the child support order will originate, and thus follow that state’s rules of child support.

- These calculators often only calculate monthly child support, not back pay child support.

- Not every state has a calculator.

If you are interested in finding out the possible child support garnishments to your paycheck there is a list below with links to each state’s calculators or calculation protocols. Again, these are just estimates and only a judge and determine the final amount to be paid:

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Missouri

- Montana

- New Hampshire

- New Mexico

- New York

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Thanks for reading. As an employment agency, we’ve worked with our share of Teammates and their child support, so we know it can be a confusing process. We hope this post has answered some of your questions. If you’re interested in finding a job with us, call your local Ōnin Staffing to get started.

As an employment agency, we’ve worked with our share of Teammates and their child support, so we know it can be a confusing process. We hope this post has answered some of your questions. If you’re interested in finding a job with us, call your local Ōnin Staffing to get started.

This article is not intended to serve as legal advice. When considering your child support options, you should seek the advice of legal counsel.

How to get child support arrears dismissed in Texas

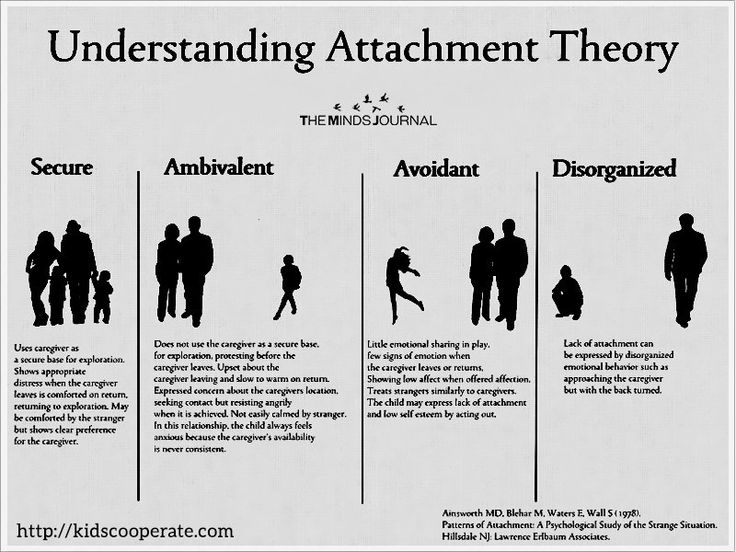

Paying child support is a fact of life for many Texans. If you are reading these blog posts and are yourself a person who is obligated to pay child support, then you likely have mixed emotions over this fact. For one, you may be frustrated to an extent by having to pay an ex-spouse money under any circumstances. Money fights and money problems may have been the root cause of your divorce is having to pay him, or her money after the divorce may be more than annoying to you.

By the same token, you are likely happy to contribute to your child's well-being. Remember that child support is not intended to help your child live an extravagant life but is rather intended to ensure that your child has all the basics as far as a place to live, food to eat, and clothing to wear. If your child spends more of their time with your Co-parent than they do with you, then this is the reason why you have been ordered to pay child support. Child support intends to level the playing field between you and your Co-parent so that each of you shoulders your fair share of the financial burdens of raising a child.

Remember that child support is not intended to help your child live an extravagant life but is rather intended to ensure that your child has all the basics as far as a place to live, food to eat, and clothing to wear. If your child spends more of their time with your Co-parent than they do with you, then this is the reason why you have been ordered to pay child support. Child support intends to level the playing field between you and your Co-parent so that each of you shoulders your fair share of the financial burdens of raising a child.

The past year may have seen you experience some uncertainty when it comes to your finances. That uncertainty may have been centered around the loss of an income or health problems that prevented you from working. The pandemic has taken a dramatic hold of the economy, and only now are we seeing the light at the end of the tunnel. To be sure, if you have experienced economic insecurity over the past few months, then your whole life has been impacted. For this blog post, I would like to focus on your ability to pay child support.

For this blog post, I would like to focus on your ability to pay child support.

At the beginning of the pandemic, Texas was hit by a double whammy of negative news. For one, the pandemic hit our shores, resulting in sickness, and loss of life, in a general disruption to everyone’s daily activities rather abruptly. It seemed like we were all living our lives, and then, all of a sudden, everything came to a screeching halt. We had no opportunity to prepare or make plans to avoid problems when it came to our employees or our personal lives. For the first time that I can remember, nearly everyone in our area was focused on the same subject.

On top of that, the travel restrictions in other pandemic impacts directly led to people traveling much less often. As a result, people needed much less fuel, and oil and gas companies had to store more fuel than normal. As a result, the oil price dropped, and we saw oil and gas companies lay off and furlough workers better pace that was dizzying. Our area's number one employer was knocked to its knees, and the impacts were felt throughout the economy. Not only were oil and gas workers looking for work but those of you who work in areas of the economy that service oil and gas were also taken by surprise, and oftentimes they go from work.

Our area's number one employer was knocked to its knees, and the impacts were felt throughout the economy. Not only were oil and gas workers looking for work but those of you who work in areas of the economy that service oil and gas were also taken by surprise, and oftentimes they go from work.

Needless to say, we are all looking forward to 2021, where not only does the world begin to resemble a pre-pandemic lifestyle but one where the economy begins to bounce back in jobs begin to return. By some estimates, it looks like the economy should bounce back rather quickly. How that plays out, in reality, is another question altogether. In this setting, all we can do is speculate about tiding together with the loss of income to the inability to pay child support after a divorce or child custody case.

If you lost your job as a result of the pandemic, then you likely faced some challenges in paying child support. No matter what, even if you already had a strong commitment to paying child support, then the loss of your income likely caused you to suffer when it came to paying for your essentials and paying child support. If he found that you could not pay child support on time and info, then you likely experienced some of the following conditions in your life.

If he found that you could not pay child support on time and info, then you likely experienced some of the following conditions in your life.

For one, your Co-parent likely reached out to you fairly quickly to see what was going on. The best advice that I could provide you with regarding speaking with your Co-parent about an inability to pay child support would be to address the subject directly. It pays to be honest with your Co-parent to communicate honestly any problems you were having from a financial standpoint. No matter how hard-headed you think that they might be, most people are willing to work with you if you were honest with them. The devastation brought about by the pandemic was so widespread that I can't think of a single person who wasn't impacted in some way by the virus and the government's response to it.

You may have been able to work out a payment plan with your Co-parent as far as how to get back on track once some income was coming into your house. Otherwise, there may have been some problems when it came to getting child support paid while you were working multiple part-time jobs or simply looking for work. Your Co-parent may have even threatened to withhold the Visitation of your children during the time. Those child support payments were not being made. Hopefully, this did not occur as the failure to pay child support cannot be met by withholding Visitation or vice versa.

Your Co-parent may have even threatened to withhold the Visitation of your children during the time. Those child support payments were not being made. Hopefully, this did not occur as the failure to pay child support cannot be met by withholding Visitation or vice versa.

The office of the attorney general child support division has on its website a Ledger where you can keep track of the Child Support payments that you have made. This allows you to keep an accurate and up-to-date total of what your payments were supposed to be and where you are currently as far as having in arrearage reviewed. This is a nice bit of information to have at your disposal as you will not have to rely upon yourself or your Co-parent to determine how much money he is currently outstanding in child support.

Regardless of why you owe child support, it is still a nerve-wracking position to find yourself in. The next question that you may want to ask yourself is, what are the chances you have modifying the amount of child support you owe. As with any modification case in Texas, a substantial or material change but the silver card in your circumstances, those of your Co-parent or one of your children to justify the modification of child support.

As with any modification case in Texas, a substantial or material change but the silver card in your circumstances, those of your Co-parent or one of your children to justify the modification of child support.

If you have lost your job they are currently not working or earning any income, then it is reasonable to decrease the amount of child support you have to pay in the future. For one, even if you are not working, you will still need to pay some degree of child support. Wages based on a person earning minimum wage will be imputed into your case even if you are not working right now. The idea that you will not have to pay child support in the future due to a job loss is not realistic.

However, if you have a master's job or have had a decrease in your income, you may want to consider working with your ex-spouse or with the attorney general directly to reduce the amount of child support you have to pay. If nothing else, even if your child support obligation is not decreased, you may be able to have your arrearage put on hold and not be made to pay anything also until you could get your job back or find steady employment. This will be much better than having your arrearage immediately have to be paid back when you have no income.

If nothing else, even if your child support obligation is not decreased, you may be able to have your arrearage put on hold and not be made to pay anything also until you could get your job back or find steady employment. This will be much better than having your arrearage immediately have to be paid back when you have no income.

As I mentioned a moment ago, the best plan may be to work directly with your co-parent in devising a strategy to have you pay back this money over time. Not only would you not have to pay an attorney to represent you when speaking with your co-parent, but you may be able to have something go into effect sooner rather than later with no delays that are often seen in a court case. This would require you to be able to have a direct conversation with your Co-parent. If you all are not on speaking terms, then this probably is not an option for you. However, if you all can be civil with one another, working with them to develop a strategy for you to pay your child support arrearage overtime may be your best bet in this situation.

Child support is, for many families, the main way that bills are paid, and the ends are kept together each month. For that reason, the Texas family code allows for significant penalties to be assessed against persons who failed to make transport payments on time. If you are wondering, there are no excuses or exceptions made for failing to make child support payments in a timely fashion within the Texas family code. With that said, let's walk through some of those penalties that you could find yourself facing if you failed to make child support payments on time and in full.

First of all, your Co-parent could hire an attorney to file an enforcement lawsuit against you. The enforcement lawsuit would note to a judge that you failed to make your child support payments as agreed to in your final divorce decree is in a suit affecting the parent-child relationship. If you are found to violate your court orders, then you not only could end up having to pay the Child Support arrearage but may also end up facing fines from the court for having violated the prior order and being made to pay your Co-parent's attorneys fees in the process.

A court can also impose jail time or community supervision punishments upon you if you fail to pay child support as ordered. Your tax returns, bank accounts, and other financial instruments may be attacked for The Child Support payments to be made. This means your paychecks, disability payments from the government, and other sources of income may be tapped by a Texas family judge to make sure your arrearages are paid upon in a timely fashion. Especially frustrating can be a situation where the attorney general's office intercepts your paychecks, and a portion of them are allocated for back child support payments.

Finally, a court may order that your licenses may be suspended. These would include driver's licenses, professional licenses, hunting, and handgun licenses. These licenses may be ways that you earn money or generally enjoy your life recreationally, and so the court wants to be able to make you feel the burn, so to speak when it comes to enforcing its prior orders. If you want to continue to operate your business or utilize the licenses provided to you by the state, then staying current on your child support would be a smart move on your part.

Now that we have covered all of these topics regarding child support in Texas, we can then get into the meat and potatoes of today's blog post. Is it possible to have child support arrearages dismissed in Texas?

It will be up to your Co-parent to forgive the amount of child support you owe and have the arrearage dismissed from court. The arrearage can be dismissed either in full or in part. And that process begins by contacting the office of the attorney general child support division. The government will send you a form called a request for a review. That form will need to be filled out and sent back to their offices. A meeting would be set up between you, your Co-parent, and a representative from the attorney general's office. You all, we'll get together to see if a settlement can be negotiated.

Negotiating a settlement on old child support is a little bit like talking to a debt collector. You can work with the representative from the state of Texas to see if a lump sum payment could be acceptable to all parties. So, if you can work extra or pocket a little bit of money before this meeting, that could save you a great deal of time and money in the long run. Remember that agreeing to a settlement in this context is the only way to officially have your child support obligation dismissed if you have an arrearage.

You can work with the representative from the state of Texas to see if a lump sum payment could be acceptable to all parties. So, if you can work extra or pocket a little bit of money before this meeting, that could save you a great deal of time and money in the long run. Remember that agreeing to a settlement in this context is the only way to officially have your child support obligation dismissed if you have an arrearage.

Simply going to your Co-parent and asking her to ignore any child support that is owed still leaves you with an arrearage with the state on an official basis. If you first go to your Co-parent and speak to her about waiving any amount of child support owed, I would then go back to the state to let them know that you have worked out this type of arrangement. You may be able to subsequently set up a meeting to formalize the settlement negotiation that you had just completed with your Co-parent. Either way, you need to communicate well with your Co-parent and with the state about any plans to have your child support arrearage dismissed.

In one of these meetings, you can also ask the state to decrease the amount of child support that you owe every month moving forward. Typically this type of request must be made to a family court judge via a modification case. This process can take time, but if your circumstances have been materially changed since your last order was issued, it is the most direct and simple way to modify your child support downward. For instance, if you have suffered a disability since the time you have your last child support order or have run into another kind of financial problem, then this is a route you should consider, as well.

Questions about the material contained in today's blog post? Contact the Law Office of Bryan FaganIf you have any questions about the material contained in today's blog post, please do not hesitate to contact the Law Office of Bryan Fagan. Our licensed family law attorneys offer free of charge consultation six days a week in person, over the phone, and via video. These consultations are a great way for you to learn more about the world of Texas family law and how your family may be impacted by the filing of a divorce, child custody, or child support case.

These consultations are a great way for you to learn more about the world of Texas family law and how your family may be impacted by the filing of a divorce, child custody, or child support case.

Other Updated Articles you may be interested in:

- When can I stop paying child support in Texas

- Does a father legally have to pay child support

- How is Child Support Calculated in Texas

- A Look at Texas Child Support Orders

- How is Child Support Calculated in Texas?

- How Can a Failure to Pay Child Support Impact Your Vehicle Registration?

- What happens to child support if a parent dies?

- Can You Withhold Visitation if Your Ex Hasn’t Paid Child Support?

- What is considered child support?

- If you have primary custody (custodial parent), you can still be ordered to pay child support?

The Law Office of Bryan Fagan, PLLC, routinely handles matters that affect children and families. If you have questions regarding child custody, it's important to speak with one of our Houston, TX child custody lawyers right away to protect your rights.

If you have questions regarding child custody, it's important to speak with one of our Houston, TX child custody lawyers right away to protect your rights.

Our child custody lawyers in Houston, TX, are skilled at listening to your goals during this trying process and developing a strategy to meet those goals. Contact the Law Office of Bryan Fagan, PLLC by calling (281) 810-9760 or submit your contact information in our online form. The Law Office of Bryan Fagan, PLLC handles child custody cases in Houston, Texas, Cypress, Klein, Humble, Kingwood, Tomball, The Woodlands, Houston, the FM 1960 area, or surrounding areas, including Harris County, Montgomery County, Liberty County, Chambers County, Galveston County, Brazoria County, Fort Bend County, and Waller County.

How to write off alimony debts if the child has reached the age of majority?

Hello, tell me if the alimony debt is written off if the child has reached the age of majority, thank you

Lawyer, Samara

Hello!

Debts are not written off if your child is 18 years old. Do you want to forgive a debt? nine0003

Do you want to forgive a debt? nine0003

Article 114. Exemption from payment of alimony arrears

1. Exemption from payment of alimony arrears or reduction of this debt when alimony is paid by agreement of the parties is possible by mutual agreement of the parties, except in cases of payment of alimony for minor children.

2. The court shall have the right, at the claim of a person obliged to pay alimony, to release him in whole or in part from the payment of alimony arrears, if it establishes that the non-payment of alimony took place due to the illness of this person or for other valid reasons and his financial and marital status does not makes it possible to pay off the resulting debt on alimony. nine0022

Irina Frolova

Lawyer, Stavropol

Expert

Hello, Dmitry!

The payment of alimony is terminated when the child reaches the age of 18 by virtue of Article 120 of the RF IC.

But these provisions do not apply to debt, since you should have paid this amount earlier. Interest may be accrued on this amount in accordance with Article 115 of the RF IC.

Exemption from the payment of alimony is possible in these cases.

According to Article 114 of the RF IC 1. Exemption from payment of alimony arrears or reduction of this debt when alimony is paid by agreement of the parties is possible by mutual agreement of the parties, except in cases of payment of alimony for minor children.

2. The court shall have the right, at the claim of a person obliged to pay alimony, to release him in whole or in part from the payment of alimony arrears, if it establishes that the non-payment of alimony took place due to the illness of this person or for other valid reasons and his financial and marital status does not makes it possible to pay off the resulting debt on alimony. nine0021Good luck!

Alexander Merkulov

Legal company "LLC "YuA "Digest"", St.

Petersburg

Hello!

With the coming of age, the obligation to pay current alimony is removed from the obligation to pay current alimony only

Yours faithfully Alexander

Similar questions

Marriage and divorce

Will there be child support if parental rights are terminated?

Hello. I want to divorce my husband. I live separately in my apartment with my son 1.3 years old, he is with his mother. I started to find bags with some substances. It's drugs, but I don't know which ones. There is no more evidence other than correspondence about this moment. How to apply to the court? Will there be child support if parental rights are terminated? nine0003

, question No. 3553205, Oksana, Moscow

Alimony

Hello, I filed for alimony against my ex-partner for several months He translated

Hello, I filed for alimony against my former partner for For several months, he transferred insignificant amounts, but not the debt that was assigned to him in the amount of 15,000 rubles, he turned to the bailiffs and wrote off the debts, is it possible or not

, question No.

3553031, Svetlana, Moscow

Family law

Child support upon admission to paid

Child support upon admission to paid

, question №3552957, Dmitry, St. Petersburg

Bankruptcy

I want to write off my debts through bankruptcy 800000

I want to write off my debts through bankruptcy 800000

, question No. 3552204, sergey, Penza

Alimony arrears upon receipt of the defendant's obligation to pay the debt

300 ₽

Issue resolved

my ex-husband has not paid alimony for 5 months. bailiffs prepared documents for filing in court. My husband asked me to write a statement that during this period I have no claims to him for alimony, and he, in turn, will write a receipt that he will pay me the alimony arrears. Do I need to certify his receipt with a notary? and whether then this receipt will have legal force if he does not pay the debt, so that it is possible to resume the case on the old debt.

nine0003

, Natalia, Kaluga

debts for alimonyI have no claims for alimony

Alexander Romanov

Lawyer, Moscow

Hello It is not necessary to certify such a receipt with a notary. In the future, it will come in handy as proof of debt, it will have legal force.

Eduard Mirasov

Lawyer, Samara

Hello, Natalia! nine0021

and will this receipt then have legal force if he does not pay the debt,

Natalia

alimony arrears. However, most notaries do not certify such receipts.

If you want to help your ex-spouse and not lose money, then I recommend that you draw up an ordinary promissory note in which your ex-husband borrows money from you and undertakes to return it to you, and in case of delay in payment, state that he is obliged to pay you interest.

nine0003

Marina Boltunova

Lawyer, Moscow You already write and give the bailiffs a statement that he has repaid the debt to you, then the receipt issued by him has no meaning. He will always refer to the specified statement, and say that in fact the debt has been repaid.

It is better to let him write a receipt that he borrowed a certain amount from you, then you can always collect it from the debtor. nine0003

Ivan Agibalov

Lawyer, Moscow

rating 9.8

Expert

Hello. He will still be obliged to pay the debt by virtue of the law and cannot be exempted from paying it, with the exception of some cases provided for by law.

Article 114 of the Family Code of the Russian Federation:

1. Exemption from payment of alimony debt or reduction of this debt when alimony is paid by agreement of the parties is possible by mutual agreement of the parties, except for the payment of maintenance for minor children.

2. The court shall have the right, at the claim of a person obliged to pay alimony, to release him in whole or in part from the payment of alimony arrears, if it establishes that the non-payment of alimony took place due to the illness of this person or for other valid reasons and his material and family the situation does not make it possible to pay off the resulting alimony debt.

Anastasia Naumova

Lawyer, Tomsk

Do I need to certify his receipt with a notary? and whether then this receipt will have legal force if he does not pay the debt, so that it is possible to resume the case on the old debt.

Natalia

Hello.

I would strongly recommend that you do not draw up a document according to which you supposedly received all the money from the alimony payer (because only in this case you can “have no claims”, you cannot simply forgive alimony, because they rely on the child and the debt on alimony is not forgiven).

Subsequently, the payer will refuse to repay this debt, you will go to court and there will be two mutually exclusive documents - one that you have received all the funds and no claims, the second that you have not received. Surely the payer will say that he wrote the second receipt before he transferred all the funds to you on the same day, he has no debt. nine0003

This whole situation is completely unprofitable for you. Hello!

I agree with the opinion of Anastasia Naumova.

and besides, taking a receipt from him for allegedly giving him a loan (as some colleagues advise), you cannot be sure that he will fulfill the borrowed obligations by violating maintenance obligations. nine0003

Violetta Magola

Lawyer, Ramenskoye

Do I need to certify his receipt with a notary?

Nataliano, this is not required, a simple written form

is enough, and will this receipt then have legal force if he does not pay the debt, so that you can resume the case on the old debt.

Natalia

I would not recommend doing anything in his favor. And file a claim for the recovery of a penalty for the amount of the debt. nine0003

Moreover, if the debtor works, then the bailiffs are obliged to send the IL to the place of his work and the employer is obliged to collect up to 70% of the salary to pay off the debt

Similar questions

Civil law

A few years ago, 2 of her friends borrowed a large amount from her without a receipt and still do not repay

Good evening! My mother is retired and has recently lost her sight. A few years ago, 2 of her friends borrowed a large amount from her without a receipt and still do not give it back. It is not possible to resolve the issue peacefully, namely, they do not answer calls, they do not give money back, one of them generally says that she will not give it back. Please tell me how to solve this problem nine0003

, question No.

3553539, Tamila, Serpukhov

Family law

How to draw up documents for alimony in connection with the death of the child's mother?

How to file documents for alimony in connection with the death of the child's mother? the mother who received child support died, how can the father reissue child support for the child himself (the child was an adult at the time of the mother’s death, and the debt is very large, the father could not pay the entire amount before the age of 18), what documents are needed and where to start the father now, if the spouses were officially divorced at the time of the death of the mother of the child nine0003

, question No. 3553258, Ravil, Moscow

Family law

How much alimony should the defendant pay if he gave birth to another child and stays at home?

How much alimony should the defendant pay if he gave birth to another child and stays at home???

, question No.