How many resp per child

RESP Contribution Limits & Rules

RESP Rules and Contribution Limits

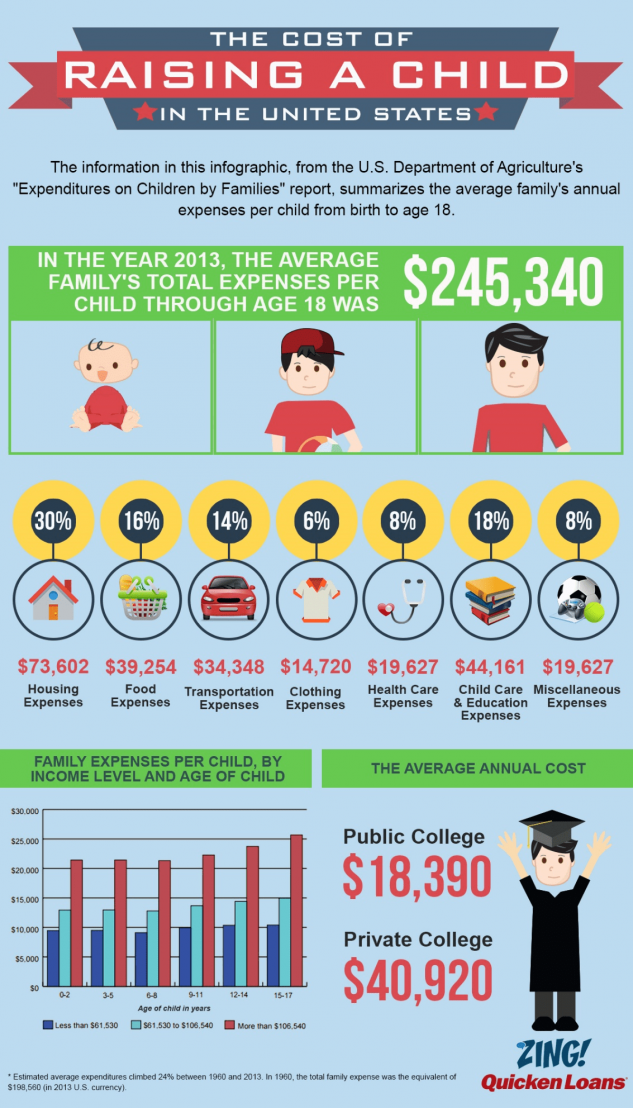

With tuition fees increasing year-over-year, it’s hard to predict the expenses required if or when a child (your child, your niece or nephew, for example), decides to pursue post-secondary education.

Knowing how to get the most out of your Registered Education Savings Plan (RESP) can help you ensure you’re financially prepared to provide a meaningful start to this important phase of the child’s life.

With a wide range of investment options available at TD and with the help of a TD Personal Banker, you’re sure to find an RESP that’s right for you.

Ready to get started? Explore your TD Canada Trust RESP options >

What is an RESP (Registered Education Savings Plan)?

An RESP is a government-registered plan that has been designed to help you save for your beneficiary's post-secondary education by allowing your investments to grow within the RESP tax-deferred until they are withdrawn.

With an RESP, you can grow your beneficiary's education investment on a tax-deferred basis, without incurring taxes on capital gains, interest and dividend payments as long as your money remains in the plan. Plus, your RESP may eligible for several federal and provincial grants, with additional grants for low to middle-income families.

Benefits of investing in an RESP

People choose RESPs as an educational savings vehicle for a variety of reasons. When you contribute to an RESP, you can benefit from:

Tax-deferred growth

Your money grows on a tax-deferred basis while it's in the RESP and you can contribute up to $50,000 per beneficiary. The money that your investment earns while it is in the RESP will not be taxed until money is taken out.

RESP Government Grants

The federal and some provincial governments offer grant and incentive programs to help increase your beneficiary's RESP savings, without impacting your RESP contribution room. For example, with the Canada Education Savings Grant (CESG), the government matches 20% of your contributions, up to $2,500 each year – and up to a lifetime maximum grant amount of $7,200 per beneficiary.

Flexibility

You can decide when and how much to contribute within the lifetime contribution limit of $50,000 per beneficiary. You are also free to decide how you want to invest your funds.

Variety of investment options

Your savings in an RESP can be used to invest in several investment products which include but are not limited to mutual funds, ETFs, GICs, stocks, and bonds. Your investment options will vary depending on the type of RESP plan you choose.

How do RESPs work?

The person that sets up an RESP plan is the only one that can make contributions and withdrawals in the plan and is known as a "subscriber". The subscriber can open a plan for one or multiple “beneficiary(s),” depending on the type of RESP. A beneficiary in an "individual plan" can be your child, grandchild, niece, nephew or family friend. A "family plan", on the other hand, restricts the RESP beneficiaries to people directly related to you by blood (or formal adoption). This includes your children, stepchildren, grandchildren and siblings.

While there are 3 types of RESPs (Individual, Family and Group), TD only offers Individual and Family plans. Both options can help to cover the costs of post-secondary education. For more details, view a list of eligible post-secondary educational institutions.

The RESP can hold a variety of investments including cash, GICs, and mutual funds, which can grow tax-deferred Your contributions to the RESP can be matched by the federal government through the Canada Education Savings Grant (CESG). This grant matches 20% of your contributions up to $2,500 each year. An RESP can remain open for a maximum of 35 years, with a lifetime contribution limit of $50,000 per beneficiary.

When your beneficiary enrolls at an eligible post-secondary institution and you are ready to withdraw the funds for educational purposes, the payments can be made from these funds. Remember that your investments grow in the plan on a tax-deferred basis so they will be taxed upon withdrawal. For more information, review our summary on RESP withdrawal rules.

If the beneficiary does not pursue post-secondary education, your options include but are not limited to: transferring it to another beneficiary if you have a family plan or transferring the RESP to an RRSP, subject to certain restrictions. To find out more, review a summary of your options.

Types of RESPs

You can choose to save for your child's education through a family RESP, an individual RESP, or a group RESP; however, family and individual plans are most popular due to their simplicity and ease of use.

Individual RESP

An individual RESP allows you to save for one beneficiary's education. This plan type is a great option for those who would like to save for a child's education, including non-primary caregivers.

Anyone can open and contribute to an individual RESP.

Family RESP

A Family RESP helps you save for one or more beneficiaries; however, the beneficiary must be related to the subscriber (either by blood or formal adoption. Family RESPs can be a great option for parents who want the flexibility to save for multiple children's education within the same plan.

Family RESPs can be a great option for parents who want the flexibility to save for multiple children's education within the same plan.

All beneficiaries must be under the age of 21 when they are designated for a family RESP.

Group RESP

Group RESPs work differently from individual and family plans, with varying rules around contributions and withdrawals, depending on the provider. We recommend reading group plan rules carefully before signing up. It’s also worth pointing out that group plans are not offered by TD.

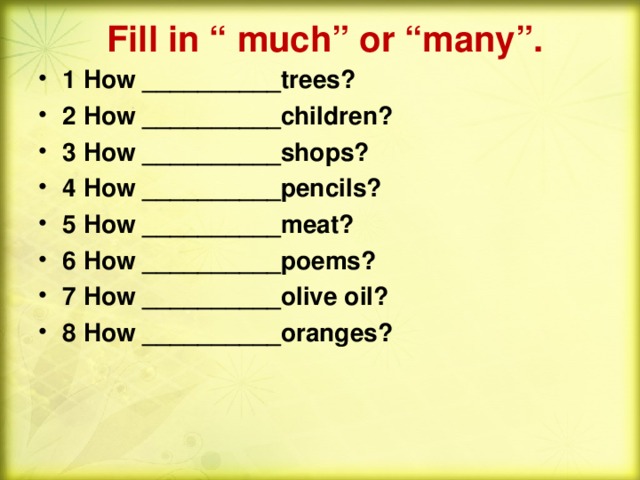

RESP Contribution Rules & Limits

What is the RESP Contribution Limit?

There is no annual RESP contribution limit. However, to maximize your potential annual CESG grant of $500, it’s recommended that you contribute up to $2,500 to your RESP per beneficiary per year. Keep in mind that the lifetime contribution limit for any one beneficiary is $50,000.

You can contribute to your RESP for up to 31 years, and the plan can remain open for a maximum of 35 years.

Are RESP contributions tax-deductible?

You do not get an RESP tax deduction for the money you put into an RESP, but your money can grow tax-deferred while it is in the plan. When funds are withdrawn for educational purposes, tax is applied to the investment income and government grants received when withdrawn from the RESP, not on the contributions you made using your funds. These amounts are taxed in the hands of the student, and this usually means little or no tax will be paid, because students typically fall into the lowest tax bracket. Review our guide on RESP withdrawal rules for more information.

Is there a penalty for overcontributing to an RESP?

When you overcontribute to an RESP, there are tax implications. Each subscriber for that beneficiary is liable to pay a 1% per month tax on their share of the excess contribution (that is not withdrawn by the end of the month). The tax is payable within 90 days after the end of the year in which there is an excess contribution. Payments made to an RESP under the CESG or any Provincial Education Savings Programs are not included when determining whether a beneficiary has an excess contribution.

Payments made to an RESP under the CESG or any Provincial Education Savings Programs are not included when determining whether a beneficiary has an excess contribution.

Start saving for your child's future today

TD Personal Bankers can help with your educational investment needs. We'll work with you to help determine the preferred path forward and help you develop a plan to achieve those goals.

Explore TD's RESP Options to get started.

RESP Rules and Contribution Limits

Skip to main contentA Registered Education Savings Plan (RESP) combines flexibility, tax-deferred investment growth and direct government assistance to help you reach the education goals you have for a child.

Who Qualifies

An RESP can be set up for any “beneficiary,” including your children, grandchildren, nieces, nephews or family friends. Each beneficiary must be a Canadian resident and have a Social Insurance Number (SIN), which can be obtained from a Service Canada Centre (www. servicecanada.gc.ca).

servicecanada.gc.ca).

Contribution Limits

Contribute any amount to an RESP, subject to a lifetime contribution limit of $50,000 per beneficiary. You can contribute to an RESP for up to 31 years, and the plan can remain open for a maximum of 35 years.

Canada Education Savings Grant (CESG) Limits

Under the CESG, the government matches 20% on the first $2,500 contributed annually to an RESP, to a maximum of $500 per beneficiary per year. The lifetime maximum per beneficiary is $7,200, up to age 18. If you don’t contribute enough to qualify for the maximum $500 CESG in a given year, the unused entitlement can be carried forward to the next year. See RESP Grants and Bonds.

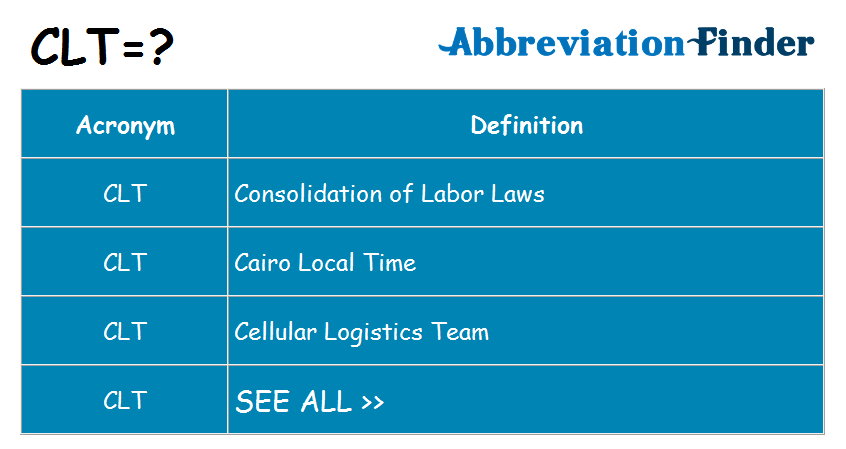

Canada Learning Bond

A $500 Canada Learning Bond (CLB) is provided for children of families who are of modest income and who are born after December 31, 2003. These children also qualify for CLB instalments of $100 per year until age 15, as long as they continue to meet income thresholds. The total maximum CLB payable per child is $2,000. CLBs are allocated to a specific child; unlike CESGs, they cannot be shared with other beneficiaries.

The total maximum CLB payable per child is $2,000. CLBs are allocated to a specific child; unlike CESGs, they cannot be shared with other beneficiaries.

Carry-Forwards

If you don’t contribute enough to qualify for the maximum $500 CESG in a given year, the unused entitlement can be carried forward to the next year.

Withdrawals

There are two types of withdrawal scenarios:

When funds withdrawn are used for education purposes

Once a student is enrolled in a qualifying post-secondary education or training program, the funds within the RESP can be paid out to the student with proof of enrollment. Payments comprised of accumulated income, grants and bonds are called Educational Assistance Payments (EAPs) and the student must claim them as income on their tax return. Contributions can be paid out the beneficiary tax-free.

When funds withdrawn are not used for education

In this case, you can withdraw the initial contribution with no tax consequence since it was made with after-tax dollars. However, any CESG remaining in the plan must be repaid, to a maximum amount equal to 20% of the withdrawal.

However, any CESG remaining in the plan must be repaid, to a maximum amount equal to 20% of the withdrawal.

Investment Options

If an RBC RESP can hold a variety of investments, including Guaranteed Investment Certificates (GICs), mutual funds, portfolio solutions and savings deposits. You can also hold stocks and bonds through RBC Direct Investing™ and RBC Dominion Securities.

Growth potential of mutual funds

When you invest in mutual funds through RBC Royal Bank, you gain access to excellent growth potential:

- RBC Target Education Funds are a portfolio of RBC Funds and feature an asset mix that evolves over time, with a greater weighting in equities in the early years and a more conservative asset mix favouring fixed income investments as your child's target education date approaches.

- The RBC Funds family includes many equity-based investments that work well for longer-term investment goals such as saving for a child’s education.

When a Child Doesn’t Pursue Post-Secondary Education

If an RESP beneficiary decides not to pursue post-secondary education, you have a few options.

Options for the RESP

- If you have a family plan, some of the government incentives received can be used to fund the education payments to another beneficiary on the plan.

- If you have an individual plan, you may be able to name an alternate eligible beneficiary.

- If the beneficiary has reached age 21 and the plan is at least 10 years old, you can withdraw the earnings subject to a withholding tax and a 20% penalty tax unless transferred to an RRSP. The amounts withdrawn will be considered taxable income.

Looking for something else? See our FAQs.

Ready to Invest?

Open or contribute to an RESP today!

Invest in an RESP Purchase a Different Investment

View Legal DisclaimersHide Legal Disclaimers

Please consult your advisor and read the Fund Facts if you are considering purchasing mutual funds before investing. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Mutual fund securities are not guaranteed or covered by the Canada Deposit Insurance Corporation or by another government deposit insurer. For funds other than money market funds, unit values change frequently. For money market funds, there can be no assurances that a fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in a fund will be returned to you. Past performance may not be repeated. Royal Mutual Funds Inc. is licensed as a financial services firm in the province of Quebec.

There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Mutual fund securities are not guaranteed or covered by the Canada Deposit Insurance Corporation or by another government deposit insurer. For funds other than money market funds, unit values change frequently. For money market funds, there can be no assurances that a fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in a fund will be returned to you. Past performance may not be repeated. Royal Mutual Funds Inc. is licensed as a financial services firm in the province of Quebec.

Financial planning services and investment advice are provided by Royal Mutual Funds Inc. (RMFI). RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.

Monthly child allowance paid to parents (adoptive parents)

Monthly child allowance paid to parents (adoptive parents) | Ministry of Labor and Social Protection of the Chuvash RepublicMinistry of Labor and Social Protection of the Chuvash Republic nine0003

Version for the visually impaired

- home

- Activity

- Activities

- Social support of citizens nine0008

- Social support for families and children

- State benefits for citizens with children

- The amount of the monthly allowance for a child paid to parents (adoptive parents)

Activities Ensuring activities Statistics and reports public services nine0003

| MONTHLY CHILD BENEFITS (Law of the Chuvash Republic of November 24, 2004 No.  46 "On state benefits to citizens with children") from 01.01.2022 46 "On state benefits to citizens with children") from 01.01.2022 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Share

Federal data bank on orphans and children left without parental care

Federal data bank on orphans and children left without parental care - Internet project "Adopt. ru" For 17 years our website usynovite.ru has been helping children to find a new home,

ru" For 17 years our website usynovite.ru has been helping children to find a new home, parents, faith in the future, and for guardians and foster parents - parental happiness and new family members. nine0028 During the operation of the site, the number of profiles in the database of orphans has decreased by more than 100,000. parents!

Please note that when providing public services, it is possible to increase the intervals between receptions of citizens due to increased security measures and for the purpose of sanitizing the premises in which citizens are received. nine0003

In order to prevent the spread of coronavirus infection, the Ministry of Education of Russia asks citizens who apply to the federal data bank on children in case of catarrhal phenomena (cough, runny nose), as well as in case of an increase in body temperature on the day of the planned appointment, to refrain from visiting the federal data bank on children. In this case, you need to contact the federal operator of the state data bank on children and agree on a reception for the provision of public services at another time. nine0003

nine0003

Trans-Baikal Territory

Trans-Baikal Territory (Aginsky Autonomous District)

Ivanovo Region

Ingushetia Republic

Irkutsk Region (Ust-Ordynsky AO)

Irkutsk region

Kabardino-Balkarian Republic

Kaliningrad region

Kaluga region

Kamchatka Territory

Kamchatsky Territory

003Kirov region

Komi Republic

Kostroma region

Krasnodar Territory

Krasnoyarsk Territory

Crimea Republic

Kurgan Region

MARSKEY 9000Republic of Mordovia

Moscow

Moscow region

Murmansk region

9200820072006Siblings: Have a brother or sister no

Month of birth: January February March April May June July August September October November December

I consent to the processing of personal data*

Appointment to the data bank

If you have problems finding children, please clear your browser cache

News of the Ministry of Education of the Russian Federation

0339 .

On February 8, the Civic Chamber of the Russian Federation held hearings on the draft law “On Amendments to Certain Legislative Acts of the Russian Federation on the Protection of Children's Rights”. The event was attended by Deputy Minister of Education of the Russian Federation T. Yu. Sinyugina.

In the course of her speech T.Yu. Sinyugina said that the department was ready to submit a draft law on changing the procedure for the adoption of minors to the Government. nine0003

– We met several times over the course of six months. And the reason for our meetings was an interested and indifferent conversation and work on the bill, which today is already ready for us to submit it to the Government, - said T. Yu. Sinyugina.

For reference

In December 2018, members of the Interdepartmental Working Group under the Ministry of Education of Russia prepared a draft law “On Amendments to Certain Legislative Acts of the Russian Federation on the Protection of Children’s Rights”. The bill was posted on the federal portal of draft regulations for wide public discussion. nine0003

The bill was posted on the federal portal of draft regulations for wide public discussion. nine0003

The draft law contains new approaches to the transfer of orphans to families, which will allow developing the guardianship institution, improving the conditions for training people who want to take an orphan child into their family.

For the first time, the draft law proposes to introduce the concept of "escort" into the federal legislation. It is planned that this authority will be vested in authorized regional authorities and organizations, including NGOs.

Special attention in the document is paid specifically to the adoption procedure, there is added a provision on the procedure for the restoration of adoptive parents in the duties of parents, if they were previously deprived of such an opportunity. nine0003

News

All newsSubscribe to news

28 December 2022

The regular "ProfZachet" - a social and educational project on the professional self-determination of orphans and children in difficult life situations, the city of Moscow

13 December 2022 On the side of the child: the best specialists from all over Russia were chosen in Moscow

December 11, 2022

December 12 at 10:00 (Moscow time) Zoya Ordina’s webinar “Substance Addiction.