How to fill out an incident report child care

Professional Guide to Daycare Incident Reports

No matter how rigid your monitoring of children in your daycare center is, accidents and injuries are inevitable. Filing a daycare incident report is one of the most important steps you must take after a child is injured.

What is a daycare incident report?

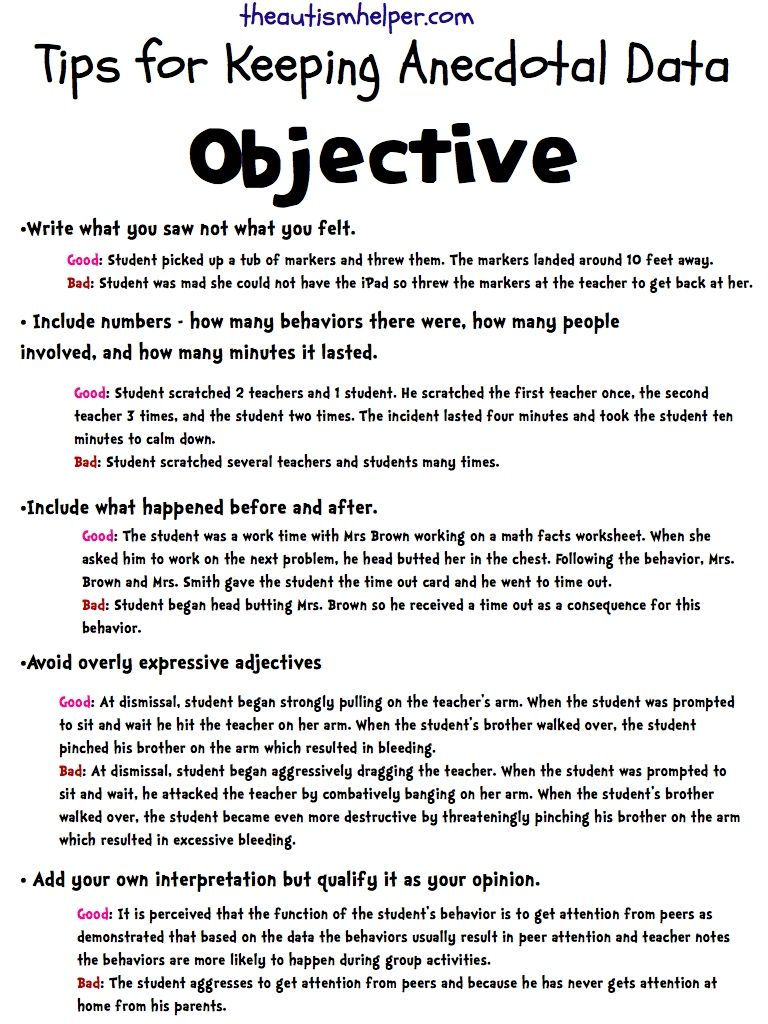

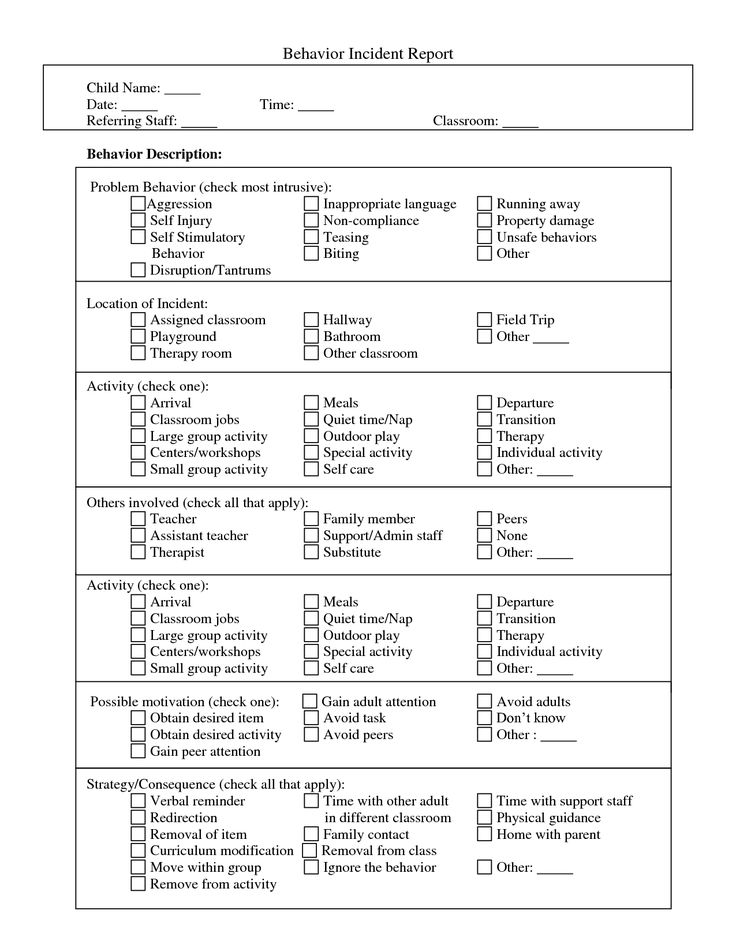

A daycare incident report is a record of an accident, injury, behavior, or other incident that requires a child to stop normal activity and receive first aid or medical attention. They also cover instances of neglect, like a child being left without proper supervision, aggressive or unusual behavior, suspicion of abuse, and errors in following through with directives from caregivers. Don’t be hesitant or cautious to generate an incident report; they’re essential documentation for your daycare business’ operations. Even when you aren’t sure a report is necessary, having one is always more beneficial than not.

Incident reports are meant to be comprehensive in case they need to be referred back to later and provide a detailed, objective record of a situation. It may also be one report of an isolated incident or an ongoing report of a continuous issue. All additional reports related to a prior incident should be equally as thorough and include the context of the previous reports.

Why are incident reports essential?

Daycare incident reports inform parents and guardians about their child's health and safety. Incident reports also help remove ambiguity after an incident by documenting what happened, when and how the incident occurred, and the staff member responsible for taking care of the child. Incident reports should be completed as soon as possible after the event.

As a childcare provider, you’re responsible for compliance with childcare laws and regulations. Daycare incident reports help hold your business accountable. They highlight repeat issues facing your facility and allow you to analyze how situations occur to prevent them in the future. Also, if any lawsuit is filed against your daycare, proper documentation is essential for those proceedings.

Your daycare’s purpose is to provide high-quality care to the children you serve. Because incident reports improve the effectiveness of your facility, they also improve the care you provide. Having detailed records of situations helps identify where the children’s needs aren’t being met. They also provide information that may be important for parents and caregivers, doctors, therapists, or future teachers.

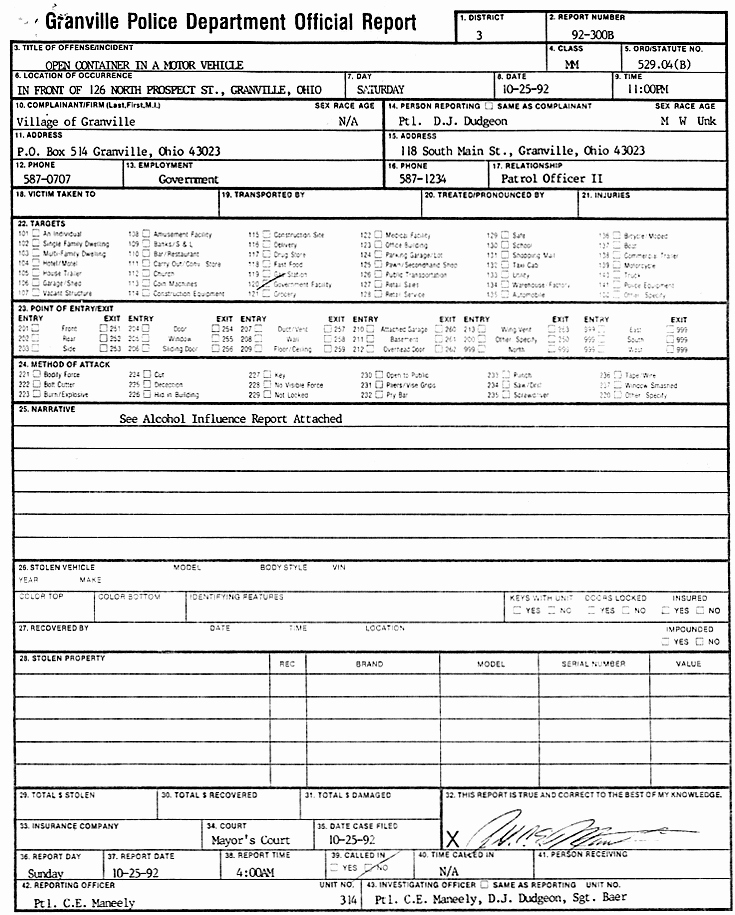

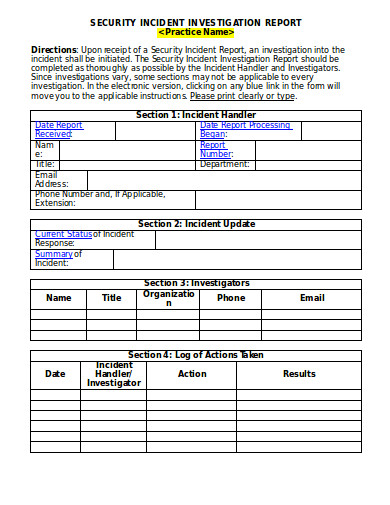

How to write a daycare incident report

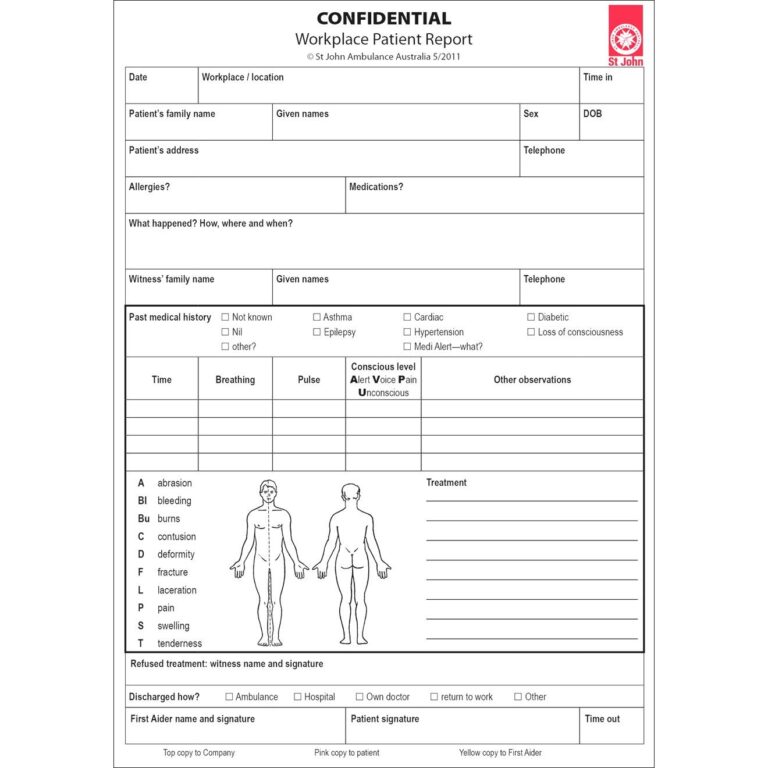

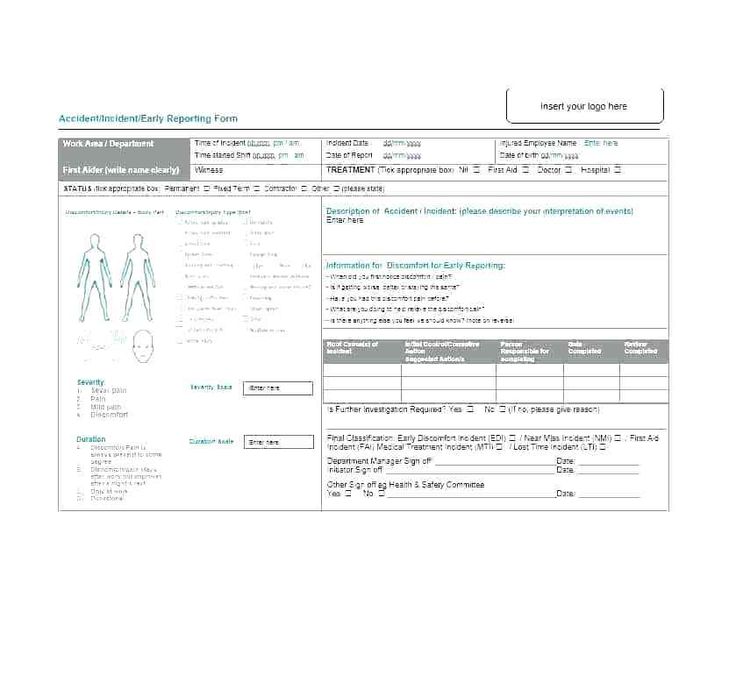

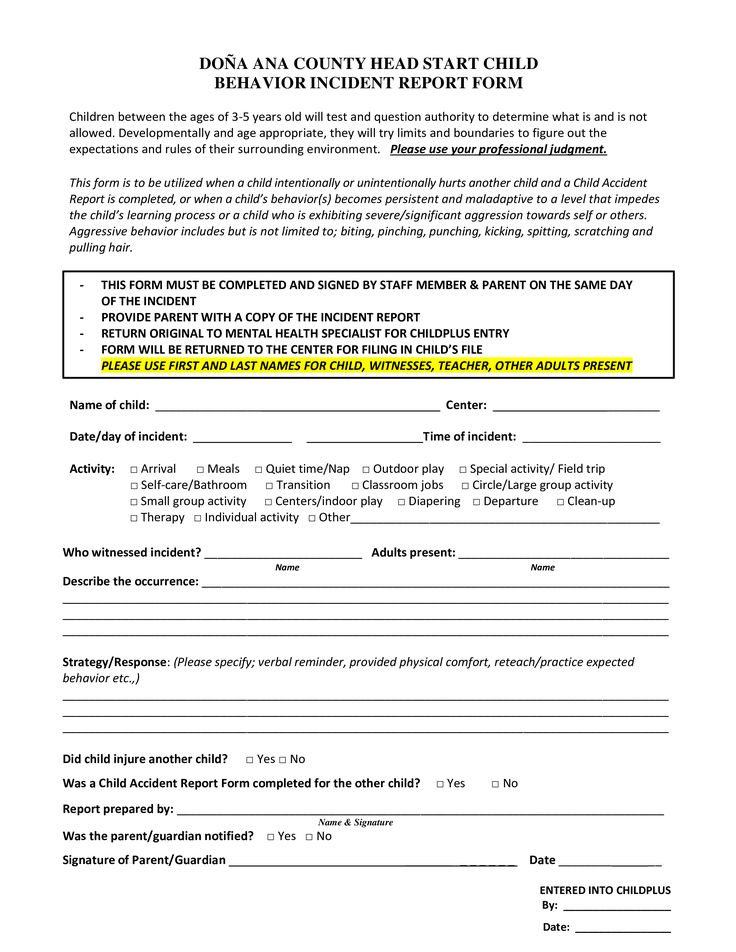

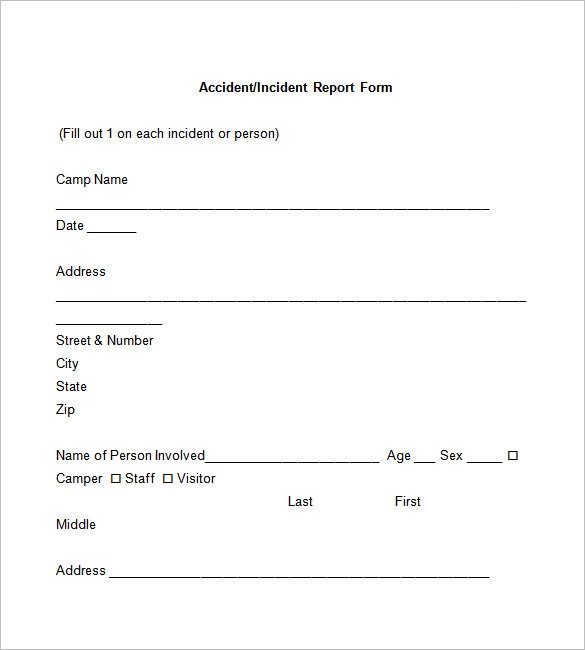

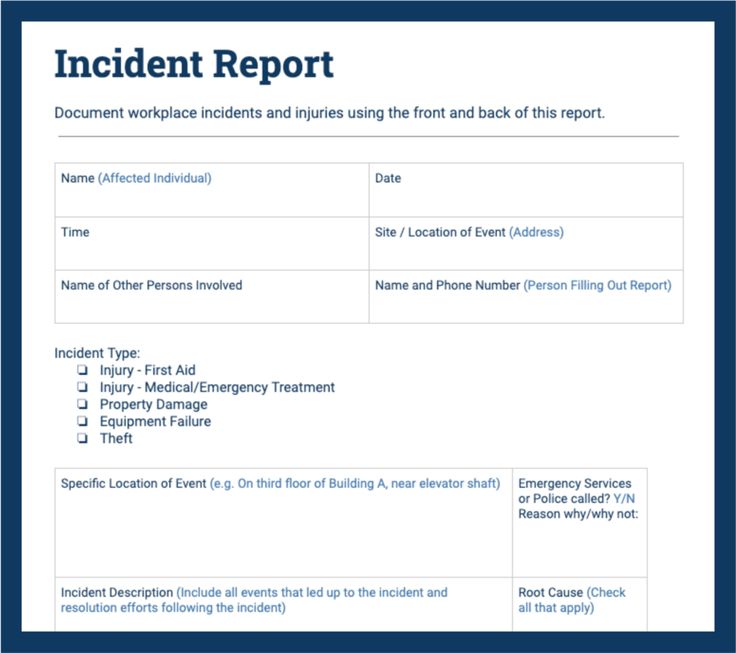

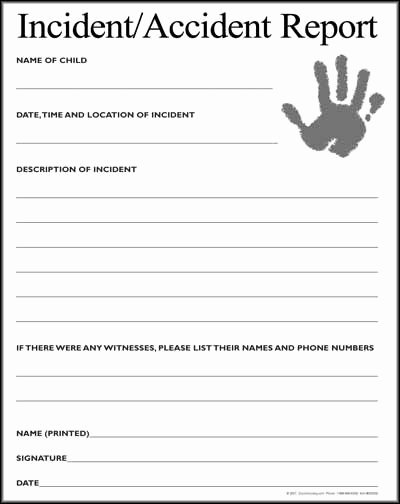

Daycare incident reports need to include specific information about the incident, the child that was involved in the incident, and the action that was taken after the incident occurred.

What should be included in a daycare incident report?

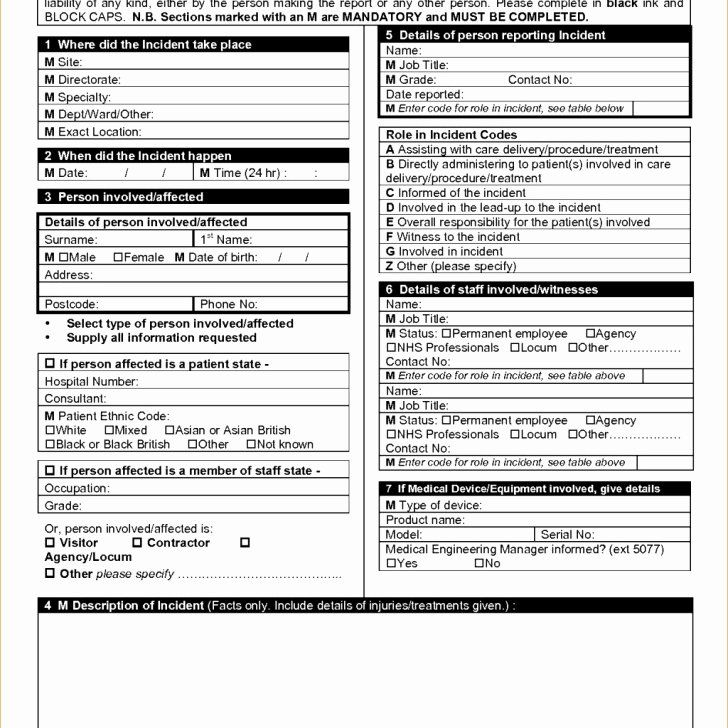

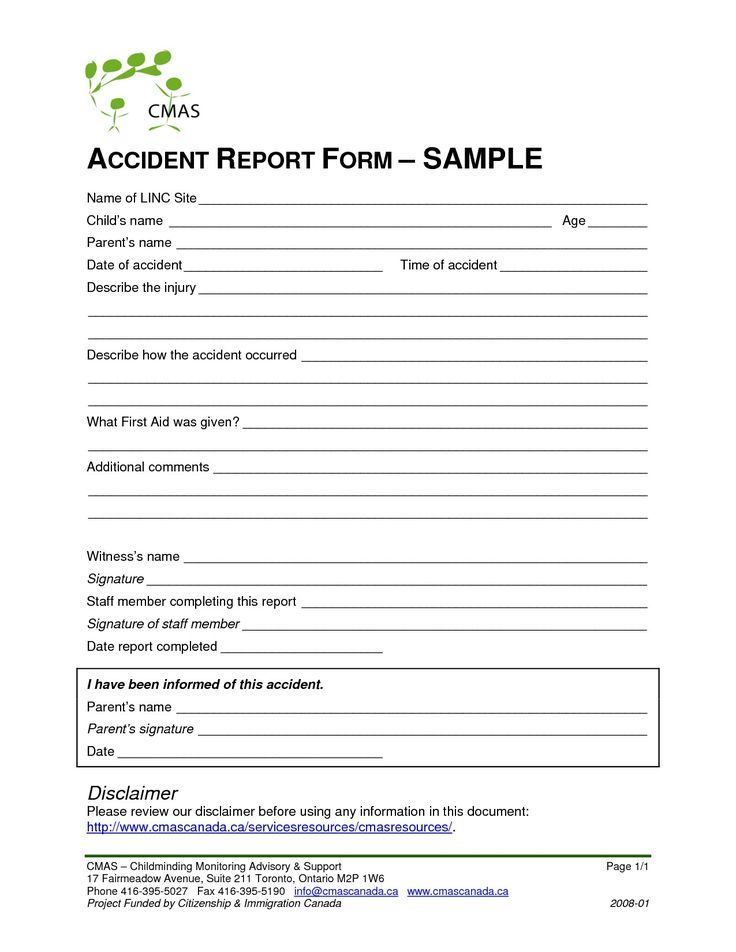

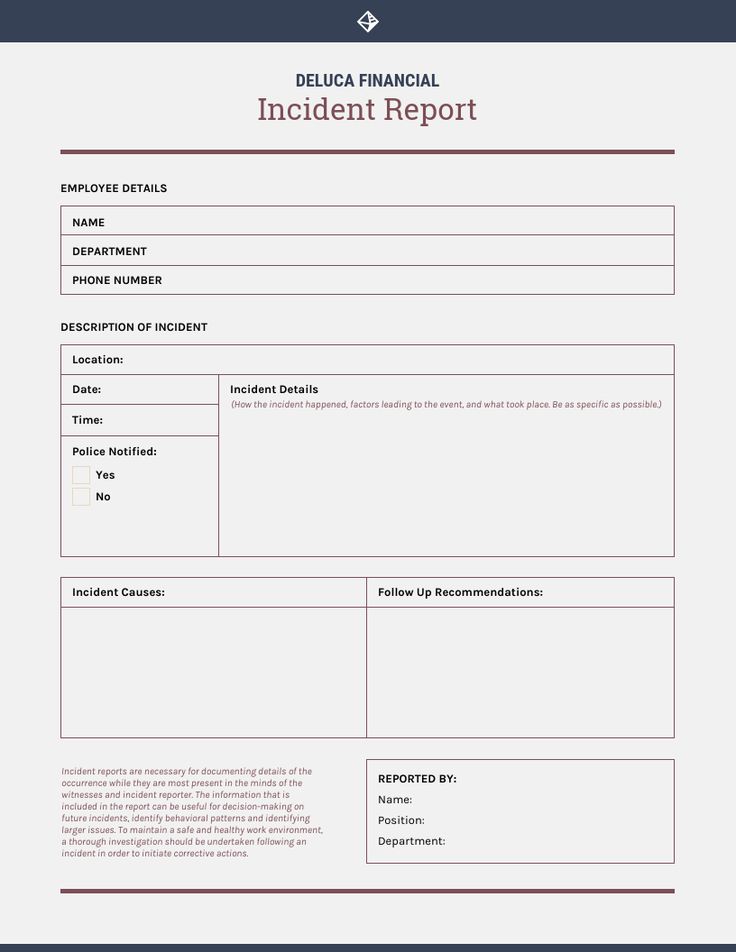

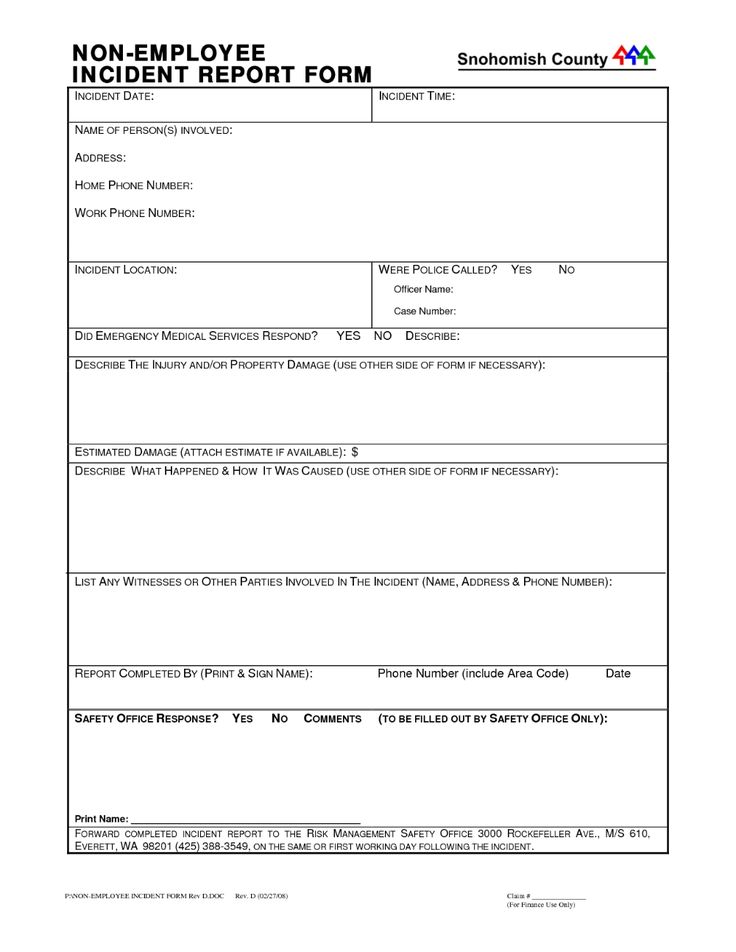

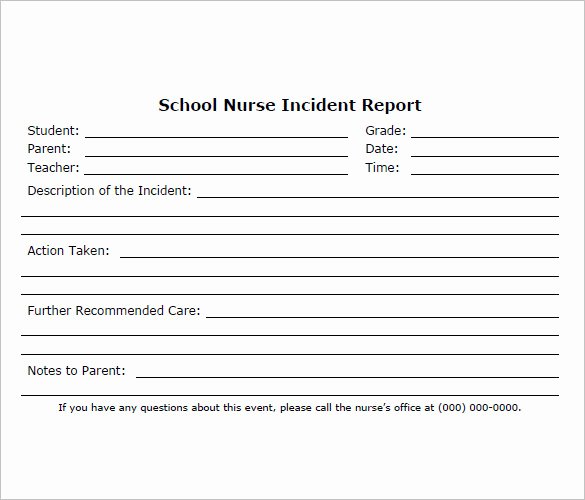

A daycare incident report should include:

- The name of the daycare

- The childcare consultant

- The injured child's name and age

- The cause of the injury

- The date, time, and location of the incident

- The locations of any injuries the child suffered

- The types of injuries the child suffered

- Medical treatment that the child received

- The name of the medical facility (if the child was taken off-site to receive treatment)

- The name of a staff member who witnessed the incident

- The equipment involved in the incident (toys, playground equipment, furniture, medication)

- The steps taken to prevent the incident from reoccurring

After the incident report is completed, it should be signed and dated by the child's parent or guardian and the employee who completed the form. The form should also note the method used to contact the child's parent or guardian, the name of the employee who contacted them, and the date and time the parent or guardian was contacted.

The form should also note the method used to contact the child's parent or guardian, the name of the employee who contacted them, and the date and time the parent or guardian was contacted.

Storing and sharing incident reports

Procedures for storing and sharing daycare incident reports vary by state. Most states require you to maintain copies of all incident reports at your center for a certain period of time and give a copy to the child's family. Other states require you to file a copy of the incident report with the state's licensing agency. Consult your state's Department of Human Services to learn more about its legal requirements regarding record keeping.

Legal requirements of incident reporting

Laws regarding reporting daycare incidents vary by state. Childcare.gov provides websites and phone numbers that can be used to report childcare incidents in every U.S. state and territory.

Incident reporting by state

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana (PDF)

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana (PDF)

-

Maine

-

Maryland

- Massachusetts (PDF)

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire (PDF)

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island (PDF)

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas (PDF)

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

Easily create and download incident reports

The brightwheel app is an all-in-one-solution that allows you to operate your program with ease and confidence. With brightwheel, your childcare employees can quickly log incidents from their phones or tablets, allowing you to easily create and share incident reports with families and guardians.

With brightwheel, your childcare employees can quickly log incidents from their phones or tablets, allowing you to easily create and share incident reports with families and guardians.

How to Write Incident Reports in Childcare

Of all the documentation you wish you didn’t have to do as a childcare provider, incident reports aka ouch reports could be sitting right at the top of the list. When a parent entrusts their child in your care, it is not the most pleasant of things to report back to them that their child was injured while being under your supervision.

Though it may seem easier to ignore the minor injuries and squabbles, it's important that you document the incidents (no matter how small they are) and make sure the parents are notified about it. Instead of harming your reputation, it can, in fact, reflect positively on your accountability and competence as a childcare provider.

As long as you've assessed the risks in your setting and taken the necessary precautions to ensure the safety of the children, it is normal for children to suffer minor falls and injuries as they explore their boundaries. Little bumps and scrapes are a natural part of growing up, and most parents would acknowledge the fact as well.

Little bumps and scrapes are a natural part of growing up, and most parents would acknowledge the fact as well.

Why is it important to maintain incident reports in childcare?

1.Legal Compliance

It is a regulatory requirement in most countries to retain an up to date record of accidents and incidents along with relevant signatures. For instance, in the UK, it’s mandatory for all childcare providers to maintain incident reports, inform parents and get their signatures on the reports, no matter how small the injury.

More serious incidents would, however, require you to notify the parents immediately and inform the authorities as soon as reasonably possible. You can find more information on informing the authorities in our article on reporting accidents and incidents to Ofsted.

If you are in the U.S, the childcare laws and regulations are more diverse and would vary from one state to the other and sometimes among various regions within a state. Make sure you check with the relevant authorities to ensure what the regulations are in your region.

Make sure you check with the relevant authorities to ensure what the regulations are in your region.

2.Requirement for Insurance

As a childcare provider, you could be held liable for compensation and legal costs if a child in your care has a serious accident as a result of your negligence. Maintaining accurate incident reports could be a requirement for your insurance policy depending on the cover you have opted for.

3.Identification of Potential Hazards within the Premises

Regular incidents when using a particular toy or equipment or playing in a certain area could be an indicator of a risk or hazard that has been lying low within your premises. Keeping track of the incidents can help you identify patterns and flag any source of danger which might have gone undetected in your risk assessments.

4. Help with the Diagnosis of Developmental Disorders

If a child seems to be especially prone to accidents, it could be pointing towards a developmental disorder related to spatial processing, balance or vision. Incident reports can help doctors and occupational therapists identify patterns and diagnose any underlying developmental or behavioural disorders.

Incident reports can help doctors and occupational therapists identify patterns and diagnose any underlying developmental or behavioural disorders.

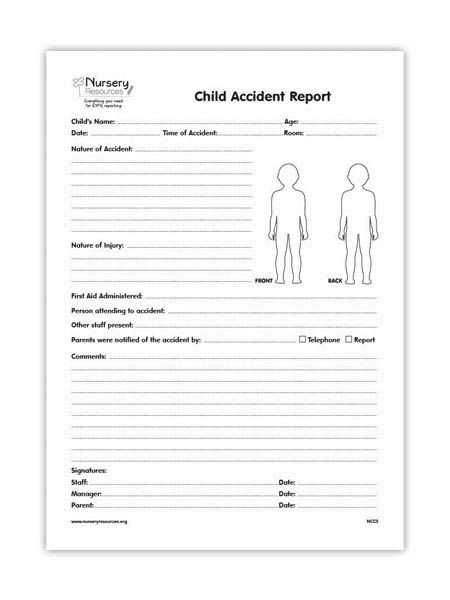

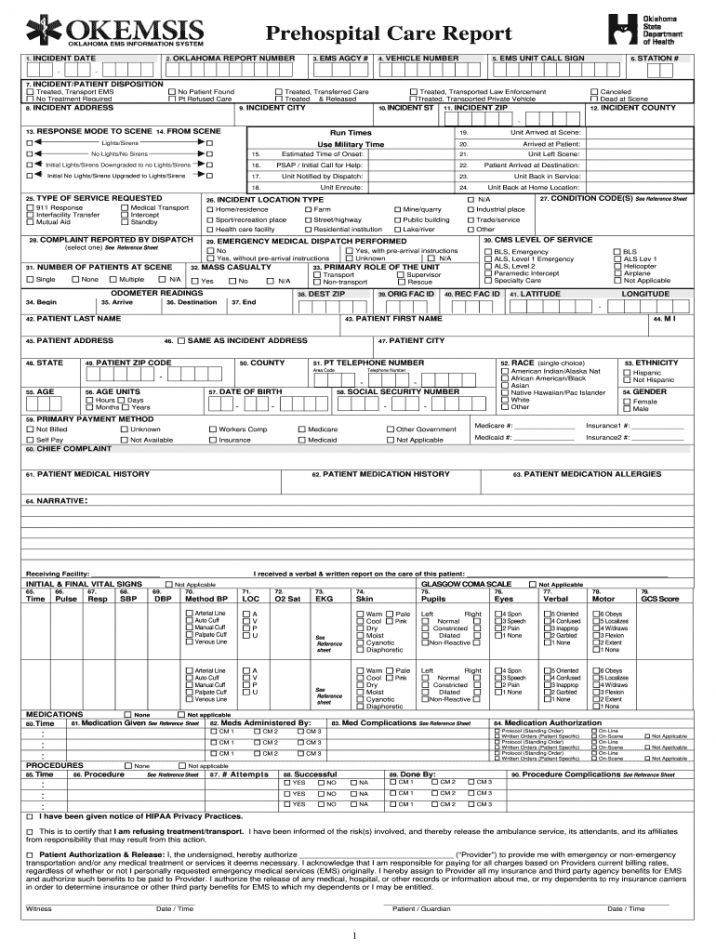

What are the details to include when writing an incident report?

Depending on the legal requirement in your region, you would be required to either use an official incident reporting form or create one for yourself. You can create your own incident forms using our free customisable template for incident reports. The important details to include in your report are:

- Name and address of the child

- Date and time of the incident

- Nature of the injury

- Description of the incident

- Details about any treatment or first aid administered

- Witnesses if any

- Name and signature of the person who attended to the injury

- Name and signature of the person who the accident was reported to

- Signature of the parent

In case you use a digital platform like Cheqdin at your centre, you can record the incidents in your digital reports, notify the parents digitally and print off the document later, as required. However, regardless of how you choose to record the incident, make sure you get the signature of the parents on the document and give them a copy of the signed report at pick up.

However, regardless of how you choose to record the incident, make sure you get the signature of the parents on the document and give them a copy of the signed report at pick up.

And most importantly, remember to retain a copy of the report for your own records and keep it filed away safely with the child’s documents.

You might also like:

8 Reasons why pre-schools and after-school clubs should use direct debit >View Article

How to get parents to pay their childcare fees on time? >View Article

Tags: after school clubs childcare software nursery management software starting your own childcare business childcare legislation early years childcare providers childminder out of school programs cyber security measures childminders gdpr craft ideas holiday clubs after school club safety for children staff clock in-out eeg ofsted ofsted going digital ofsted inspections nursery management cheqdin marketing tips for out of school clubs ways to promote your after school club cloud based childcare software saas childcare software saas solutions for childcare management how to increase occupancy rate for nursery montessori activities for kids edible christmas craft ideas edible craft ideas marshmallow snowman pretzel reindeers strawberry santa business plan templates for nurseries cheqxster free templates menu planning tips cloud base childcare software out of school clubs accident and incident reporting reporting injury to ofsted billing and invoicing grit growth mindset online safety for children business plan for childcare business childcare digest direct debit activity clubs coronavirus updates for childcare providers online registration cheqdin 2. 0 occupancy planner online booking protips how to increase the occupancy of your childcare centre sensory play scaffolding creche management software mental health climate change childcare

0 occupancy planner online booking protips how to increase the occupancy of your childcare centre sensory play scaffolding creche management software mental health climate change childcare

Disability compensation | Tervisekassa

Compensation for incapacity for work paid by the employer and the Health Insurance Fund

A doctor can issue a certificate of incapacity for work to a person who has health insurance through the employer. The question of the eligibility of issuing a sick leave depends on the decision of the doctor and the state of health of the person.

The question of the eligibility of issuing a sick leave depends on the decision of the doctor and the state of health of the person.

On the basis of a certificate of incapacity for work, the employer and the Health Insurance Fund pay the person sickness compensation, the purpose of which is to partially compensate the employee for the wages lost during the illness.

The Health Insurance Fund usually pays compensation within a few working days from the moment the information is provided by the employer. The deadline for processing sheets is extended if, for example, the bailiff has issued a seizure order, the employer is late in providing insurance data, etc.

Doctoral benefits, parental benefits and other social taxes are not taken into account when calculating disability compensation paid by rural municipality, city or creative associations.

You can check the information about sick leave certificates and, if necessary, make an extract on the state portal www. eesti.ee in the service "Compensation for temporary disability"

eesti.ee in the service "Compensation for temporary disability"

Pay attention! The current temporary sick leave compensation system, according to which employees receive payment from the second day of illness, will be extended until June 30, 2023. one or more arrest warrants, the Health Insurance Fund is obliged to withhold the amount to be seized from your temporary disability benefit and transfer this amount to the account of the bailiff who sent the arrest warrant.

If you find that your income and dependents are not included in the arrest, contact the bailiff in charge of the enforcement proceedings. The order of retention can be changed by the bailiff. Contact details of bailiffs can be found on the website of the Chamber of Bailiffs and Bankruptcy Managers.

Information about enforcement proceedings against you can be viewed on the State Portal "Executive cases against me"

Additional information:

- Change of personal data

- FIECTION OF UNSEMENT OF INSTALLED income

Compensation for sick leave

| Duration of payment for one insurance event | ||||

| Illness (including domestic injury from 06/30/2022) | 1 | Sick leave due to illness | The employer pays compensation from the 2nd to the 5th day of the sick leave. The Health Insurance Fund pays from the 6th day, the amount of compensation is 70%. The Health Insurance Fund pays from the 6th day, the amount of compensation is 70%. | Up to 182 days (in case of tuberculosis up to 240 days) |

| Domestic injury (not valid from 30.06.2022) The Health Insurance Fund pays from the 6th day, the amount of compensation is 70%. | to 182 days | |||

| injury, which occurred as a result of a traffic accident

Constitution/disease, which occurred due to a traffic accident | 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000

18 | Sick leave due to illness | The employer pays compensation from the 2nd to the 5th day of illness. The Health Insurance Fund pays from the 6th day, the amount of compensation is 70%. | Up to 182 days |

| Quarantine | 10 | Sick leave due to sickness | The employer pays compensation from the 2nd to the 5th day. The Health Insurance Fund pays from the 6th day. The amount of compensation is 70%. The Health Insurance Fund pays from the 6th day. The amount of compensation is 70%. | Until the end of quarantine |

| Occupational disease | 2 | Sickness certificate | The Health Insurance Fund pays compensation from the 2nd day of illness, the amount of compensation is 100%. | Up to 182 days |

| Accident case at

Accident case that occurred due to road conveying

arising from the accident complication/disease | 9000 5 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 9000 6

7 | Sick leave due to illness | The Health Insurance Fund pays compensation from the 2nd day of illness, the amount of compensation is 100%. | Up to 182 days |

| Injury while defending the interests of the state or society or preventing a crime | 8 | Sickness certificate | The Health Insurance Fund pays compensation from the 2nd day of illness, the amount of compensation is 100%. | Up to 182 days |

| Transfer to an easier job | 17 | Sick leave due to sickness | light work less than his average income for the previous calendar year. If a person is released from work in the absence of easier work, then from the 2nd day they are paid compensation in the amount of 70%. | Until the mother receives parental benefit or until 182 days |

| Illness or injury during pregnancy | 19 | Sick leave due to sickness | The Health Insurance Fund pays the amount of compensation from the 20th day of illness | Up to 182 days |

| Caring for a child under the age of 12 or an insured person under the age of 19 who has a disability. | 14 | Leaves for nursing disability | The Health Insurance Fund pays compensation from the first day of release from work, the amount of compensation is 80%. NB! The insured person has the right to receive compensation for disability on the basis of a certificate of incapacity for work in case of caring for a child under the age of 12 for a period of up to 60 consecutive days, if the cause of the disease is a malignant tumor and the treatment of the child begins in a hospital. | Up to 14 days |

| Caring for a sick family member at home | 12 | Nursing sick leave | The Health Insurance Fund pays compensation from the first day of release from work, the amount of compensation is 80%. | Up to 7 days |

| Caring for a child under the age of 3 or a disabled child under the age of 16 if the mother of the child is ill or has childbirth services | 13 | Certificates of incapacity for work for caregivers | The Health Insurance Fund pays compensation from the first day of release from work, the amount of compensation is 80%. | Up to 10 days |

| Adoption leave for a child under the age of 10 | 16 | Adoption sheet | The Health Insurance Fund pays compensation from the first day of release from work, the amount of compensation is 100%. | 70 days |

| Organ or bone marrow donation | 20 | Sick leave | The Health Insurance Fund pays compensation from the first day of release from work, the amount of compensation is 100%. | Up to 182 days |

Calculation of compensation for temporary disability

- receipt of annual income;

- annual income is divided by 365 to obtain the average income for one calendar day;

- To obtain the compensation amount, the daily income is multiplied by the corresponding compensation percentage rate, and then the resulting amount is multiplied by the number of days to be compensated.

- 20% income tax is also withheld from the compensation amount.

Person working under an employment contract or in the public service | Member of the management body of a legal entity, a person who receives payment for work or services provided on the basis of a contract under the law of obligations | ||||||||||||||||||||||

| Calculation of the average income for one calendar day based on the income of the previous calendar year | ||

| income, calculated on the basis of a social tax paid by the insured person in the calendar year, preceding the start of the disability sheet / 365 | , calculated on the basis of social tax, paid by the built -up person itself paid for it in the calendar year preceding the start of the disability certificate / 365 | Income calculated on the basis of social tax, paid by the insured person or paid for him in a calendar year preceding the start of the disability sheet / 365 |

| Calculation of the average income for one calendar day if the income in the previous calendar year was not 9000 | Base salary divided by 30. If the base salary is higher than the minimum wage, the allowance is calculated based on the minimum wage. | Benefit is calculated based on the monthly social tax rate | If the self-employed person is required to pay advance social tax payments, the benefit is calculated according to the monthly social tax rate If the self-employed person is not required to pay advance social tax payments, the benefit is not paid005 |

| Calculation of the average income per calendar day if the average income for the previous calendar year is less than the minimum wage | Calculation of the average income per calendar day, if the average income of the previous calendar year is less than the monthly social tax rate | Calculation of the average income per calendar day, if the average income of the previous calendar year is less than the monthly social tax rate |

If the base wage is higher than the minimum wage, then the minimum wage is divided by 30 to obtain a calendar day's income. If both the base salary and the average income for the previous calendar year are less than the minimum wage, then the income per calendar day is calculated at a rate more favorable to the individual. | Income calculated on the basis of paid social tax divided by 365. | Income calculated on the basis of paid social tax divided by 365. |

illness until the day of recovery indicated on the sick leave, but not more than 240 consecutive calendar days in case of tuberculosis or 182 consecutive calendar days in case of other diseases.

A doctor can also issue a sick leave for a longer period, only the period of payment of compensation is limited. Restrictions apply only for the period of payment of compensation, and not for the duration of the sick leave.

Calculation of compensation for temporary disability

| The employee calculates compensation for disability: | Cashcom of Health calculates compensation for temporary disability: |

| Based on the average monthly salary for the last six months. | on the basis of information received from the Tax and Customs Board on the person's social tax calculated or paid in the previous calendar year. Detailed information on the State Portal www.eesti.ee under the heading "Disability compensation" |

consecutive calendar days in case of tuberculosis or 182 consecutive calendar days in case of other diseases.

A doctor can also issue a sick leave certificate for a longer period, only the compensation period is limited.

Restrictions apply only for the period of payment of compensation, and not for the duration of the sick leave.

Korduma kippuvad kusimused - KKK

During the period of absence from work, the doctor prepares an electronic disability certificate for the employee and sends it to the database of the Health Insurance Fund electronically. If the doctor completes the sick leave, notify your employer!

In order for the Health Insurance Fund to assign and pay compensation on the basis of a certificate of incapacity for work, the employer must submit the data of the certificate of incapacity for work issued by a doctor to the Health Insurance Fund in electronic form on the State Portal www. eesti.ee. After the employer has submitted the data to the Health Insurance Fund and the data of the disability certificate no longer needs to be clarified, the compensation will be transferred to your bank account within a few working days.

eesti.ee. After the employer has submitted the data to the Health Insurance Fund and the data of the disability certificate no longer needs to be clarified, the compensation will be transferred to your bank account within a few working days.

You can check information about your disability certificates on the State Portal www.eesti.ee under the heading "Disability compensation".

A health insured person is entitled to receive compensation in case of illness or injury until the day of recovery indicated on the sick leave, but not more than 240 consecutive calendar days for tuberculosis or 182 consecutive calendar days for any other illness. The period of sick leave is not limited, if necessary, the doctor can issue a sick leave for a longer period than the reimbursement period.

The total number of days paid to the insured in a calendar year is not limited, i.e. in the event of one illness, sickness benefit is paid up to 182 consecutive days. If the person falls ill again, he or she will again receive benefits for up to 182 consecutive days.

The Health Insurance Fund pays sickness benefit to the individual from the sixth day of being off work. Sickness benefit is not paid to the PPF for the first five days after being released from work.

According to the Employment Contracts Act, an employee has the right to suspend, postpone or terminate leave early for important reasons for the employee.

The employee has the right to claim the unused part of the vacation immediately after the circumstance preventing the vacation or at another time by agreement of the parties. The employee is obliged to inform the employer about the circumstances that interfere with the vacation as soon as possible.

If the employee does not interrupt the vacation, he is not entitled to disability benefits.

A certificate of incapacity for work is issued to an employee in case of illness or injury on the basis of calendar days, and opens from the day when the employee cannot start performing work duties.

Retroactively (also starting from a weekend or holiday) a certificate of incapacity for work may be opened if the insured person falls ill or the need for care or care for the sick occurs on a weekend, public holiday or holiday, and the person informs the health worker about it by means of communication or upon admission on the next working day and if an illness entry has been made in the health information system of the insured person.

Compensation for temporary disability is calculated based on the amount of income subject to social tax. Compensations are calculated on the basis of the amount of social tax, data on which the Health Insurance Fund receives from the Tax and Customs Board.

According to the Health Insurance Act (§55(1)) doctoral allowances, parental benefits and other benefits paid by rural municipality, city or creative associations and social taxes paid on them are not taken into account when calculating disability compensation.

To obtain the compensation amount, the compensation limit is calculated based on the average income for one calendar day of the employee and then multiplied by the number of days to be compensated. Income tax is also withheld from compensation.

Income tax is also withheld from compensation.

The procedure for paying compensation for temporary disability depends on the type and reason for issuing a certificate of incapacity for work. You can read more about the procedure for assigning and paying compensation on the website "Compensation for incapacity for work".

If there was no income subject to social tax in the previous calendar year, the compensation is calculated based on the salary agreed with the person and the minimum salary. More information about this can be found on the website of the Health Insurance Fund.

The Health Insurance Fund pays compensation for temporary incapacity for work within 30 calendar days from the date when the employer of the insured person entered the relevant data in the electronic disability certificate or documents on paper income forms in the database of the Health Insurance Fund.

The employer must pay disability benefits on the day of salary, but not later than within a period of 30 calendar days after the doctor duly fills out the sick leave certificate on the State Portal www. eesti.ee.

eesti.ee.

Yes, maybe. You can change your bank account details:

- on the state portal www.eesti.ee using the service “My data in the register of the Health Insurance Fund”;

- by sending a digitally signed application to info [at] tervisekassa.ee;

If the certificate of incapacity for work and subsequent certificates were opened during the validity of the employment contract, the Health Insurance Fund will pay for them, regardless of whether the employment relationship has ended in the meantime.

A certificate from a foreign doctor must be presented to your employer, who will send it to the Health Insurance Fund along with the necessary additional documents. If you need to be granted leave from work for a longer period that extends beyond the end date of the leave from work indicated on the certificate issued by a foreign doctor, consult your family doctor within five days after the end date of the leave from work indicated on the certificate. The family doctor may issue you an additional certificate of incapacity for work after the certificate issued by a foreign doctor is entered into the database of the Health Insurance Fund as an initial certificate of incapacity for work.

The family doctor may issue you an additional certificate of incapacity for work after the certificate issued by a foreign doctor is entered into the database of the Health Insurance Fund as an initial certificate of incapacity for work.

In order to pay sickness benefit to a person treated in Estonia on the basis of health insurance in a Member State of the European Union, the doctor must fill in the box “Medical examination result”.

The doctor must print the document, sign it and give it to the person. With this document, a person applies to his employer or to a state institution that pays compensation in the country in which he is insured as an employee.

The following option is also allowed - the person submits the original of the relevant document along with the completed application (“Application for disability benefits in an EU member state” can be found at https://www.haigekassa.ee/ru/partneram/zayavleniya -dlya-partnera) to the Health Insurance Fund and after that the Health Insurance Fund itself sends the documents to the foreign insurance company.

To resolve labor disputes, please contact the Labor Inspectorate https://www.ti.ee/et/node/9646. It is also possible to apply to the court

Report on the use of funds for the payment of a monthly allowance for child care to persons who actually care for a child and are not subject to compulsory social insurance, in accordance with the Federal Law "On State Benefits for Citizens with Children"

Approved

By Decree

of the Social Insurance Fund

of the Russian Federation

dated 12.01.2007 N 2

List of amending documents

(as amended by Resolution of the FSS of the Russian Federation dated 03.25.2008 N 66)

(see text in the previous edition 9005) .this form in MS-Excel.

Compiled by the body of social protection of the population

subjects of the Russian Federation for the reporting period

in rubles and kopecks and submitted

to the regional branch of the Social Insurance Fund of the Russian Federation

Periodicity - monthly until the 10th day of the month

following the month that has expired

Codes

OKPO │

_______________________________________________ ├─────┬──────

TIN/KPP │ │

_____________________________________________ ├─────┴───────

protection of the population) ├────────────

_____________________________________________ According to OKVED │

_______________________________________________ ├────────────

OKDP │

_____________________________________________ ├──────┬───────

(address of social protection authority OKOPF/OKFS │ │

population) ├─────┴──────

Registration │

number │

Treaty of _______ n _________ insured │

└─────── parade

______________________________ ( REPORT

on the use of funds

to pay a monthly allowance for the care of a child

to persons actually caring for a child

and not subject to compulsory social insurance

, in accordance with the Federal Law

"On state benefits to citizens,

having children"

for ___________________ 200_

(month)

──┬────────────┬────────────────┐

│ Code │ Name of articles │ TOTAL │ Incl. payments │

payments │

│ lines │ │ allowances for │ over the established │

│ │ │ care for │ │ │ │ │

│ │ │ child │ citizens, subject-0

│ │ │ lines that are not the same for the pervasion │

│ │ │ │ Providing radia-│

│ │ │ accident insurance │

│ │ │ │ │

│ 1 │ 2 │ 3 │ 4 │

├──────┼─── ────────────────────────────────────────────────────── ──────────────┤

│ 1 │Balance at the beginning of the reporting period │ │ │

│ │period │ │ │

├──────┼───── ───────────────────────────────────────────────┼─── ─────────────┤

│ 1.1 │ including those located in │ │ │

│ │ federal postal organizations │ │ │

│ │ communications ──────────────────────────────────────────────────── ───────┤

│ 2 │Funds received from regional │ │ │

│ │ Social Fund │ │ │

│ │ Field of the Russian Federation in │ │ ───┼────────────────────────────────────────────── ─────┼────────────────┤

│ 3 │Paid childcare benefits│ X │ X │

──────────┼───────────────┤

│ 3. 1 │ Sum, total (p. 3.1.1 + 3.1.2) │ │ │

1 │ Sum, total (p. 3.1.1 + 3.1.2) │ │ │

─────────┼───────────────┤

│3.1.1│ including: │sum │ │ │

│ │after the first ├─

│ │ │ number of children │ │ │

──────────┼───────────────┤

│3.1.2│after the second and │sum │ │ │

│ │following ├──

│ │ │number of children │ │ │

─────┼───────────┼────────────────┤

│ 3.2 │Number of recipients for reporting │ │ │

│ │period │ │ │

├─────┼────────────────────────────────── ─────┼───────────┼───────────────┤

│ 4 │Shipping and delivery costs │ │ X │

│ │ allowances │ │ │

├───────────────────────────────────────────────────────────── ────┼────────────┼───────────────┤

│ 5 │Total expenses (p. 3.1 + 4) │ │ │

──────────┼───────────────┤

│ 6 │Wrongly incurred expenses for │ │ │

│ │payment of monthly care allowance │ │ │

│ │for a child (pp. 6.1 + 6.2)

│ 6.1 │v including: │ │ │

│ │after the first │ │ │

├─────┼────────────────────────────────── ──────┼────────────┼───────────────┤

│ 6.