How to enforce child support in florida

Child Support Enforcement in Florida

Learn how child support is enforced and overdue payments are collected in Florida.

By Aaron Thomas

Each parent has a duty to provide for the basic needs of his or her child. When parents divorce or separate, usually the parent not living with the child (the noncustodial parent) will pay money to the custodial parent to help support the child. Sometimes, the noncustodial parent refuses to pay child support, and the custodial parent must ask the courts or state agencies for help collecting payments.

This article will explain how Florida courts enforce child support orders. If you have additional questions after reading this article, you should consult a local family law attorney for help.

Establishing Child Support in Florida

In order to enforce child support, you must have a child support order signed by a judge and filed with a court clerk's office. If you don't already have a court-approved child support order on file, you'll need to take steps to legally establish child support.

You can establish child support by filing a "Petition for Support" in the circuit court clerk's office for the county where you and your children live. You can file for child support:

- on your own, using this form petition for support

- with the help of a private attorney, or

- by applying for the services of the Florida Department of Revenue's Child Support Enforcement Program - as long as you have a child that needs child support, you are eligible for their help.

Once you file the petition for support, the court will set a hearing date. Bring evidence of your income and your child's financial needs to the hearing.

If you and the other parent agree on a monthly amount of child support, and the judge approves that amount, the judge will sign a child support order formalizing your agreement. If you and the other parent don't agree, the judge will decide the amount of child support and include it in the order.

Enforcement of Child Support in Florida

Compared to other states, Florida has very strict laws to ensure that noncustodial parents pay child support.

Motion for Civil Contempt

Civil contempt is used when a person violates a court order. The most common way to enforce a child support order is by filing a "motion for civil contempt." Filing this motion (written request) tells the court that you have a valid child support order in place, and the noncustodial parent is behind on payments.

You can file a motion for civil contempt on your own, with an attorney's help, or by asking Florida Child Support Enforcement to file the motion on your behalf. If you are filing the motion for civil contempt on your own, you can use this form.

To prove your child's other parent is in contempt of the child support order, you'll have to show the following:

- you have a valid child support order that has been approved and signed by a judge

- the other parent hasn't paid child support according to the order, and

- the other parent has the ability to pay.

- the court will assume the other parent has the ability to pay; it's up to the other parent to show they can't pay if they want to avoid being held in contempt.

- the court will assume the other parent has the ability to pay; it's up to the other parent to show they can't pay if they want to avoid being held in contempt.

The judge will decide whether the other parent is in contempt at a hearing you both have to attend. If a judge believes you've proven your case, he or she will hold the noncustodial parent in contempt and issue an order stating how and when the parent should pay overdue support. The judge may also include other penalties for the delinquent parent in the order, such as fines or even jail time.

Court Orders to Collect Child Support

Once your child's other parent has been held in contempt of the child support order, the judge can order several different remedies to help you collect overdue and future support. The judge's order can:

- establish a payment plan for the other parent to follow

- withhold income from a delinquent parent's paychecks

- intercept federal or state tax refunds when $500 or more is owed

- intercept lottery winnings of more than $600

- garnish (take directly) money from financial accounts when more than $600 or 4 months' of child support is owed

- place liens on vehicles and force their sale when $600 or more is owed

- place liens on real or other personal property and order their sale

- claim and sell a delinquent parent's abandoned or unclaimed property

- freeze a home equity line for a parent to prevent potential child support money from being spent

- intercept worker's compensation funds owed to a delinquent parent, and

- incarcerate a delinquent parent up to a year until overdue child support is paid.

Additionally, a court can order delinquent parents to reimburse the custodial parent's attorney's fees and other expenses related to the contempt motion, including travel expenses to the court and expert witness costs.

Florida Child Support Enforcement (CSE) can also help you enforce child support orders with the following services:

- Financial Institution Date Match program: CSE can check all Florida financial records (for example, records for bank accounts and money market accounts) to see if delinquent parents have funds that could be used to pay child support.

- Driving privilege revocation: the Department of Motor Vehicles can suspend delinquent parents' driver's licenses and car registrations until they pay overdue support or agree to a payment plan.

- Professional license and certificate suspension: Florida can suspend delinquent parents' professional, occupational, or recreational licenses until they pay overdue support or agree to a payment plan.

Other Penalties for Nonpayment of Child Support in Florida

Florida law also has other methods that do not directly obtain child support from delinquent parents, but instead punish those parents for nonpayment:

- Florida may freeze delinquent parent's financial accounts when they are behind at least $600 or 4 months' child support.

- Florida Child Support Enforcement may report delinquent parents to consumer reporting agencies (credit bureaus) when they are behind by 15 days on child support.

- Florida reports parents behind by $2500 or more on child support to the U.S. Department of State to have their passport revoked or passport application denied.

If you have any other questions about enforcing child support in Florida, contact a local family law attorney for advice.

Talk to a Lawyer

Need a lawyer? Start here.

Frequently Asked Questions for Child Support Enforcement Division

Wednesday, November 2, 2022

Related Information

- QHow can the Child Support Program help me and my children?

- A

- They can:

-

- Locate missing parents for child support purposes

- Establish paternity when needed

- Establish medical and financial support orders

- Enforce support orders

- Modify support orders

- QWhat are the address, telephone number and hours of operation?

- AChild Support Program

Overtown Transit Village, South Tower

601 NW 1ST COURT, 12th FLOOR

MIAMI, FLORIDA 33136

(786) 530-2600 - Child Support Program - Office of Miami-Dade State Attorney Katherine Fernandez Rundle (miamisao.

com)

com) -

The hours of operation are 8:00 AM - 5:00 PM, Monday through Friday.

- QWhat is a "parent who owes support"?

- A parent who owes support is the parent who does not live with the child and is ordered to provide support. According to Florida law, every child under the age of 18 has the right to the support of both parents, including the parent who owes support.

- QCan the Child Support Program help locate the parent who owes support?

- A

Yes. They must know where to find the parent responsible for support. If this is not known, the Child Support Program will search for him or her through a variety of local, state, and federal location resources. It is very important for you to provide any information about the parent who owes support, so that he or she can be located. Otherwise, your case cannot move forward.

- QWhat is the application process and how much does it cost?

- A

There is no fee for this service.

If you are a parent receiving public assistance, you are automatically referred to the Child Support Program and you must cooperate with efforts to obtain support.Failure to respond to requests for information, or missing appointments and court hearings may result in sanctions being imposed, causing your benefits to be reduced or canceled.

If you do not receive public assistance, you need to complete an application for services.

To apply for the services of the Child Support Program, please do so online at Florida Dept. of Revenue - Apply For Child Support Services (floridarevenue.com)

- QHow is a child support order obtained?

- A

- If the location of the parent who owes support is not known, the Child Support Program will first need to find him or her before your case can be processed.

Once he or she has been located, the Child Support Program will send you correspondence to obtain preliminary information needed to begin processing your case.

Once the Child Support Program has obtained all the necessary information from you, your case will be referred to the Legal Department. The parent who owes support must then be served (notified of the action against him/her). The service process includes providing the parent who owes support with copies of the documents you have signed. Once he or she is served, a court date can be scheduled.

- QHow long does it take to obtain an order?

- A

- The time it takes to obtain a child support order varies depending on the facts in your case, how much information you can provide, and other factors. These factors, which include successfully locating and then serving the parent who owes support with the case documents, actions taken by the opposing attorney, requests for paternity tests, the need for certified copies of existing support orders, etc., may delay the results. You can help speed the process by cooperating fully.

- QHow are support orders enforced?

- A

- The Enforcement Unit works hard to ensure you receive child support payments on a regular basis.

Some methods used are:

Some methods used are: -

- Income Deductions - Payments are deducted from the non-custodial parent's paycheck.

- IRS Intercepts - Tax refunds can be intercepted to collect delinquent child support.

- Freezing Bank Accounts – A computer search is done for non-custodial parents who have bank accounts with participating financial institutions. If a match is found, the bank account may be frozen.

- Lottery Intercepts - Winnings of $600 or more from the Florida Lottery can be intercepted to pay delinquent child support.

- Liens - In certain cases, courts can place liens on real estate and personal property for non-payment of child support.

- Consumer Reporting Agencies - Information about delinquent child support is given to credit reporting agencies, possibly affecting the non-custodial parent's credit rating.

- Suspension of Licenses - Driver's license, vehicle registration, and professional licenses can be suspended or denied for not complying with a court order for child support.

- Referral for Contempt - Court action can be taken if the non-custodial parent does not pay the child support as ordered by the court. He/she could face potential penalties, such as jail time.

- Passport Denial – NCPs can be denied U.S. passports if their certified past due amount exceeds $2,500.

- QHow are the support payments processed?

- A

- All child support payments must be sent to the State of Florida Disbursement Unit, PO Box 8500, Tallahassee, Florida, 32314-8500. Official court records are created of payments and disbursements to allow accurate enforcement and monitoring of your child support case. For this reason, you must not take payments directly from the parent who owes support.

If you do not receive public assistance, a check will normally be mailed from Tallahassee within two working days of receipt of the payment. If you do receive public assistance, support payments may be kept by the State of Florida as reimbursement for the public assistance you are receiving from the state.

- QHow is paternity (fatherhood) established?

- A

- When a child is born to parents who are not married, fatherhood must be determined before any other action can take place. The alleged father may voluntarily admit that he is the father of the child(ren). In cases where he does not admit paternity, a court hearing and/or paternity test is scheduled. When a paternity test is necessary, the child's mother, the alleged father and the child are tested.

- QHow much child support will be ordered?

- A

- The amount ordered is based on guidelines set by Florida law which take into account the children's needs and the income of both parents. Childcare costs, health insurance costs, and other children are also considered.

- QI already have a child support order, but I am having problems with the payments. Can the Child Support Program help me?

- A

- Yes. If you already have an order for child support and/or medical insurance, the full force of the law will be used to enforce that order so that you can receive regular payments.

- QCan I get help if I don't have a child support order?

- A

- Yes. If you don't have a court order, legal proceedings will be used to establish child support and medical support obligations so that you can begin to receive payments from the parent who owes support.

- QCan the Child Support Program help me with visitation, custody or alimony matters?

- A

- The Child Support Program does not enforce visitation or custody rights. Nor does it enforce alimony obligations, unless there is an ongoing child support enforcement matter which is being handled by the Child Support Program.

- QHow can I modify the amount of child support?

- A

- Once the support order is established, it may be modified if there is a significant change in your financial situation or that of the parent who owes support. If you request a modification, the amount will be recalculated based upon guidelines set by Florida law.

Normally, a modification petition is filed with the court only if the guidelines show the amount should change by at least 15% or $50 monthly, whichever is greater. If this is an interstate case (involving another state), there may be additional restrictions. Once the process is started, we are required to pursue it to completion even if it means the parent who owes support will pay less.

Normally, a modification petition is filed with the court only if the guidelines show the amount should change by at least 15% or $50 monthly, whichever is greater. If this is an interstate case (involving another state), there may be additional restrictions. Once the process is started, we are required to pursue it to completion even if it means the parent who owes support will pay less.

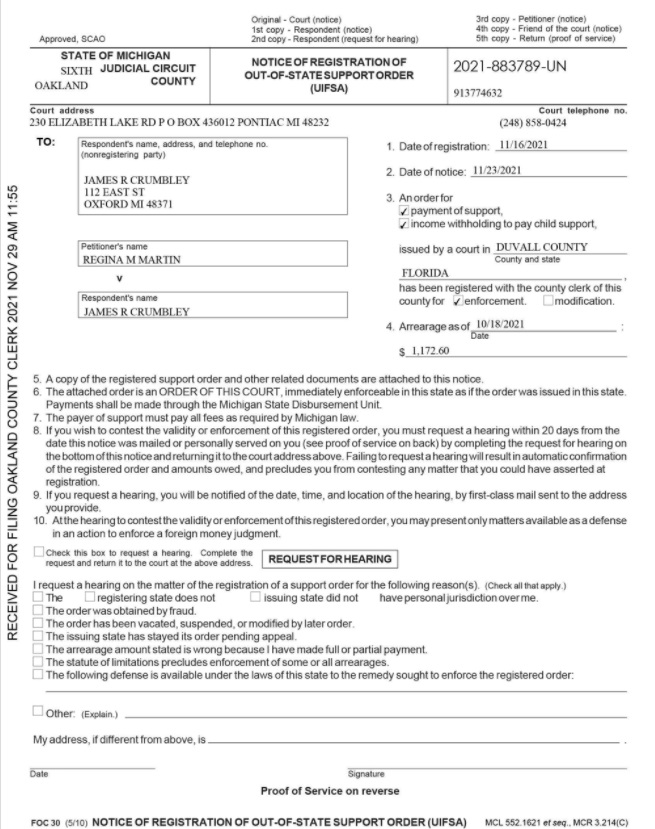

- QWhat happens if the parent who owes support lives in another state?

- A

- When the parent due support and parent who owes support s live in different states, the Child Support Program works with child support offices in other states. When this type of case is referred to another state, that state's child support enforcement office and court system must be allowed to process the case within their applicable time frame.

The United State and the State of Florida have also entered into international agreements with various foreign countries for the establishment and enforcement of child support obligations.

The State of Florida has also entered into international agreements with various foreign countries for the establishment and enforcement of child support obligations.

- QHow can I find out the status of my case?

- A

- You can check on the status of your case by registering for eServices at https://childsupport.floridarevenue.com

You may also contact our Call Center at (305) 530-2600

- QWho do I contact if I am a person with a disability who has been noticed, and needs assistance, to participate in a court hearing?

- A

- Please contact ADA Coordinator, at:

Voice Mail: (305) 349-7175

TDD: (305) 349-7174

Fax No:. (305) 349-7355

Email:. [email protected]

How to collect child support if the ex-husband has income abroad

Karina, hello! We recommended that you contact us as a lawyer with experience working with the States. All right? My ex-husband, married to me, purchased several apartments in the United States in the name of his company, namely in New York and Florida. We divorced five years ago in Russia. Since then, for the second time, he has filed for revision of penny alimony. We both live in Russia, only business connects him with the States. How can I make a request to the States to get an answer for the court, does he have real estate there now or does he work where or receives income from renting out apartments, being a co-owner or owner of a company? Do you have a bank account and is there any movement of money through it? I have his old account number. The ex-husband hides and hides everything, does not want to voluntarily pay or share anything. In 2015, I received documents for these apartments and information that he was just a manager in the company that owns these apartments. That he's just a hired hand. It was not possible to use this information in Russia. Everything related to foreign property is unfamiliar and scares the judges. It would be nice to share what he owned at the time of the divorce and alimony to collect decent alimony for the children.

We divorced five years ago in Russia. Since then, for the second time, he has filed for revision of penny alimony. We both live in Russia, only business connects him with the States. How can I make a request to the States to get an answer for the court, does he have real estate there now or does he work where or receives income from renting out apartments, being a co-owner or owner of a company? Do you have a bank account and is there any movement of money through it? I have his old account number. The ex-husband hides and hides everything, does not want to voluntarily pay or share anything. In 2015, I received documents for these apartments and information that he was just a manager in the company that owns these apartments. That he's just a hired hand. It was not possible to use this information in Russia. Everything related to foreign property is unfamiliar and scares the judges. It would be nice to share what he owned at the time of the divorce and alimony to collect decent alimony for the children. From open sources, last year I was told that they are now co-owners of this company 50/50. We do not live together, and I don’t know what has happened since the divorce. What document and where to ask the RF court to make it as part of the next process to reduce the amount of alimony?

From open sources, last year I was told that they are now co-owners of this company 50/50. We do not live together, and I don’t know what has happened since the divorce. What document and where to ask the RF court to make it as part of the next process to reduce the amount of alimony?

!

Reply

As part of the child support reduction case, in your situation, I would suggest that you counter-sue for an increase in child support, citing the fact that the debtor has additional income abroad that was not taken into account in determining the amount alimony. The basis for going to court in your case, as well as in the case of your ex-husband, is Article 119 of the Family Code of the Russian Federation, which provides that if the financial or marital status of one of the parties has changed, the court has the right, at the request of either party, to change the established amount alimony. When changing the amount of alimony or when exempting from paying them, the court may also take into account other noteworthy interests of the parties. At the same time, Article 83 of the Family Code of the Russian Federation establishes that if a parent obliged to pay alimony has an irregular, fluctuating income, or if this parent receives income wholly or partly in foreign currency, the court has the right to determine the amount of alimony collected on a monthly basis in a fixed amount of money or simultaneously in shares and in a fixed amount of money. The types of income that parents receive in rubles or in foreign currency and from which alimony is deducted are determined by Decree of the Government of the Russian Federation No. 841 of 07/18/1996, including from income from the lease of property (paragraph 1 "i"), and from income from participation in the management of the organization's property (paragraph 1 "k").

At the same time, Article 83 of the Family Code of the Russian Federation establishes that if a parent obliged to pay alimony has an irregular, fluctuating income, or if this parent receives income wholly or partly in foreign currency, the court has the right to determine the amount of alimony collected on a monthly basis in a fixed amount of money or simultaneously in shares and in a fixed amount of money. The types of income that parents receive in rubles or in foreign currency and from which alimony is deducted are determined by Decree of the Government of the Russian Federation No. 841 of 07/18/1996, including from income from the lease of property (paragraph 1 "i"), and from income from participation in the management of the organization's property (paragraph 1 "k").

In accordance with the law, each party must prove the circumstances to which it refers as the basis for its claims and objections. At your request, the court is required to ask your ex-husband to provide additional evidence, in your case this is:

- a document from the US tax authority (IRS) that your ex-husband is registered as a taxpayer? If so, what is his tax number?

- tax returns for the last 2-3 years or a certificate of their absence.

Documents submitted from the USA must comply with Art. 71 of the Code of Civil Procedure, Part 4 of the Code of Civil Procedure of the Russian Federation, namely, that a document received in a foreign state is recognized as written evidence in court if its authenticity is not refuted and it is legalized in the prescribed manner.

If a party evades submission of evidence, the court has the right to recognize certain facts as established or refuted.

Information about which companies your ex-husband owns, as well as information about his property in the USA, you can get in open sources. Information about firms and businesses is available on the website of the Secretary of the relevant state, information about property - at the county clerk's office where the property is located. You need to remember that the mere fact of owning apartments does not prove the existence of income. The firm may face significant costs. Therefore, I would not focus my attention on this, and would not spend significant funds to obtain this information.

As for information about bank accounts, this information is quite difficult to obtain. Even if a Russian court could make a direct request to American banks, it is almost impossible to get a reliable answer due to the huge number of banks operating in the United States. In addition, based on the initial data, he personally does not own anything, which means that all the money goes through bank accounts owned by the business. I think that this information will not be useful to you. However, you can ask the court to order the court to provide information about an account you have information about. Of course, if this account still exists and money is stored on it.

I think you should focus on your ex-husband's personal income by insisting that he submit his tax returns to the court. Of fundamental importance for the correct resolution of this case is the fact that your ex-husband, having income in foreign currency, hid this information from the court. As a result, the court, when making its decision, did not take into account the facts and circumstances of significant importance.

And one more important detail. The apartments, as you indicated, were purchased during marriage. This means that you have the right to demand the division of property. To divide American apartments, you need to apply to the court at the location of these apartments, to the American court through an American lawyer. You will have complete freedom in this court, since the American judge, as part of the consideration of the case in his jurisdiction, can demand absolutely any information that you, in turn, can later use in the Russian court as part of the alimony case, in addition to the fact that through the American court you will receive your share in the matrimonial property.

Features of paying child support in the USA - who pays whom and how much? Everything you need to know about divorce in the USA

Peculiarities of filing a divorce with minor children in America

Divorce causes only negative emotions, because it is almost always accompanied by stress, depression, waste of money, nerves and time. And of course the United States is no exception.

And of course the United States is no exception.

Here the average duration of marriage is 18 years, and the divorce rate is 53%, which is 2% more than in Russia. The number of divorced in different states of America is somewhat different.

Thus, in Nevada the largest percentage (14.7) was recorded, and in New York the smallest (7%), most likely due to the fact that here citizens decide to marry at a more conscious age. Despite the unpleasant procedure of divorce, it often turns out that discord occurs in the family due to misunderstanding, lack of money, bored life, betrayal and many other reasons. Then the spouses see only the dissolution of the marriage as a constructive way out.

Dissolution of a marriage must take place in court. The party applying for a divorce must state in court the good reasons for their decision and present facts that prove that the marriage no longer makes sense and it would be better to dissolve it.

Divorce causes only negative emotions, because it is almost always accompanied by stress, depression, waste of money, nerves and time. And of course the United States is no exception.

And of course the United States is no exception.

Here the average duration of marriage is 18 years, and the divorce rate is 53%, which is 2% more than in Russia. The number of divorced in different states of America is somewhat different.

Thus, in Nevada the largest percentage (14.7) was recorded, and in New York the smallest (7%), most likely due to the fact that here citizens decide to marry at a more conscious age. Despite the unpleasant procedure of divorce, it often turns out that discord occurs in the family due to misunderstanding, lack of money, bored life, betrayal and many other reasons. Then the spouses see only the dissolution of the marriage as a constructive way out.

Dissolution of a marriage must take place in court. The party applying for a divorce must state in court the good reasons for their decision and present facts that prove that the marriage no longer makes sense and it would be better to dissolve it.

The court then notifies the other party of the motion. If there is no response after 30 days, the court will consider that both parties agree to a divorce. The divorce period becomes much more difficult and unpleasant if there are children in the family, especially minors.

If there is no response after 30 days, the court will consider that both parties agree to a divorce. The divorce period becomes much more difficult and unpleasant if there are children in the family, especially minors.

Then you need to decide with whom the child will live after the divorce. If the spouses cannot resolve the issue on their own, then they deal with the court.

Usually preference is given to those who spent more time with the child, took better care of him, with whom a closer relationship was established. If the child is over 12 years old, then he has the right to choose a parent. In the United States, divorce proceedings are a very expensive “pleasure”.

Lawyers here value their services at a tidy sum, besides, divorces usually drag on for a long time. And this entails significant additional costs. Therefore, when entering into marriage, it is recommended to conclude a contract, where all the conditions will be specified to the smallest detail.

If the ex-wife of an American citizen was a foreigner, she can file for alimony both at her place of residence and her husband. But due to the possibility of non-enforcement of foreign laws in the United States, lawyers advise choosing the latter option.

Alimony in Russia and the USA: who pays whom and how much?

Moreover, it is established for a sufficiently long period. Usually, the termination of the obligation occurs after the former spouse remarries. Women often take advantage of this, slowly formalizing new family relationships officially.

There are cases when husbands manage to claim funds for their maintenance from ex-wives. But the percentage of such cases is small.

More often, men literally beg competent officials to release them from the need to allocate money in the interests of their ex-wife, they try to prove that the spouse is well enough provided for and simply enriches herself at the expense of her ex-husband. Summing up all the above, we can say that alimony legal relations in the United States are based on fairly understandable and logical principles that are typical for alimony obligations in many countries of the world.

Summing up all the above, we can say that alimony legal relations in the United States are based on fairly understandable and logical principles that are typical for alimony obligations in many countries of the world.

American divorce. How is child support dealt with in the states?

Despite the fact that the plaintiff in the case will not be a resident of the state under whose law the issue is being considered. But in relation to the defendant, "native" laws will be applied. Nevertheless, it is easier to apply local law to the debtor than foreign law.

Thus, answering the question of how to obtain legal alimony from a US citizen, we can identify the most potentially successful option:

- Find a legal specialist working in America with Russian-speaking citizens who specializes in family matters.

- Entrust him with the authority to collect funds, based on US laws.

About the peculiarities of collecting money for dependents in the USA As already mentioned, case law is strong in America. Free in lawmaking and individual states. And they use it. Alimony laws, for example, Florida and Texas will be different.

Free in lawmaking and individual states. And they use it. Alimony laws, for example, Florida and Texas will be different.

US child support procedures

About 25% of children in the US live in single parent families. The spouse who lives alone with the child (in the overwhelming majority of cases, this is the wife) has the right to collect alimony from the former spouse.

Child benefits until age 21, although in some states up to 18 years.

The procedure for collecting alimony takes place in court.

The alimony applicant submits a statement of claim to the court, then a decision is made according to which the defendant becomes officially obliged to financially help his former family.

Amount of maintenance payments in the USA

On average, a US citizen is assigned maintenance in the amount of 10-30% of income. They vary depending on the defendant's income, the larger they are, the greater the percentage charged, as well as the state, because each of them has its own laws.

However, there is a general rule that says that alimony depends on the total income of the spouses. The lower the wife's income, the greater the amount recovered from the defendant.

If the child alternately lives with his mother and then with his father, the child who spends less time with him pays the alimony. For example, with a father, a son and / or daughter are 30%, and with a mother, 70%. Then alimony is collected from the father, but the amount of payments is assigned much less than if he did not live with his children at all.

In the United States, as in many other countries, including Russia, there are bodies that monitor the execution of a court decision on the recovery of alimony. But there is also a peculiarity in this country, it consists in covering the wages of alimony by employers, because. the collection of alimony spoils the reputation of the employee and, accordingly, the organization.

On average, a US citizen is assigned maintenance in the amount of 10-30% of the amount of income. They vary depending on the defendant's income, the larger they are, the greater the percentage charged, as well as the state, because each of them has its own laws.

They vary depending on the defendant's income, the larger they are, the greater the percentage charged, as well as the state, because each of them has its own laws.

However, there is a general rule that says that alimony depends on the total income of the spouses. The lower the wife's income, the greater the amount recovered from the defendant.

If a child alternately lives with his mother and then with his father, then the child who spends less time with him pays the alimony. For example, with a father, a son and / or daughter are 30%, and with a mother, 70%. Then alimony is collected from the father, but the amount of payments is assigned much less than if he did not live with his children at all.

In the United States, as in many other countries, including Russia, there are bodies that monitor the execution of a court decision on the recovery of alimony. But there is also a peculiarity in this country, it consists in covering the wages of alimony by employers, because. the collection of alimony spoils the reputation of the employee and, accordingly, the organization.

the collection of alimony spoils the reputation of the employee and, accordingly, the organization.

Here you can find many examples when a citizen who did not want to pay alimony hid his income (not without the help of the employer).

However, in America there are tough measures to combat alimony: from deprivation of the right to drive a car to imprisonment. For example, in 2013, about 20 thousand American citizens were imprisoned here for non-payment of alimony.

It follows that the benefit received as a result of evading maintenance obligations is not comparable with the punishment. Therefore, it is better to conscientiously fulfill your duties before the law, your ex-wife and child.

How is alimony paid to a wife in the USA?

In the US, the ex-spouse is required to pay maintenance not only for the child, but also for his mother. The amount and timing of payments depends on a number of circumstances.

Let's take a closer look at the possible circumstances:

- the duration of a broken marriage.

The longer the marriage lasted, the longer the period of payments the ex-wife can count on. For example, if the family broke up no earlier than 10 years later, then payments can be assigned for life;

The longer the marriage lasted, the longer the period of payments the ex-wife can count on. For example, if the family broke up no earlier than 10 years later, then payments can be assigned for life; - if the former spouse earned more, and the wife got used to the level of family income that has developed in marriage, then the alimony will be appropriate;

- if the wife had a disease, the treatment of which was paid for by the husband, being married to her, then even after the divorce he is obliged to allocate material resources to her for this;

- the ex-wife ran the household and took care of the children, not being able to work, and the man was the only breadwinner in the family. Perhaps during the time spent in marriage, he was able to increase his level of income. In this case, the former spouse will also receive alimony. She is given some time until she gets a job and can earn on her own. This may go on for a year or two. But do not forget about the duration of the marriage, if it was quite long, then the alimony payments can be for life;

- also, a spouse who paid for his wife's studies during family life is not released from this responsibility until the end of his studies and after the dissolution of the marriage.

Many women in the US after a divorce are in no hurry to re-tie themselves to family ties. The fact is that the ex-wife marries another person, the obligations of the alimony are terminated. The only exceptions are those cases when he must pay alimony for life. For example, if the marriage lasted a very long time.

Alimony payments are also mandatory for the following circumstances:

- if the ex-wife is disabled or pregnant;

- raises a child up to 3 years old or a disabled child.

Of course, if after a divorce the children stay with the father, then on the contrary, alimony for his maintenance can be collected from the wife. But in practice, such situations rarely occur.

Alimony payments are also mandatory for the following circumstances:

- if the ex-wife is disabled or pregnant;

- raises a child up to 3 years old or a disabled child.

Of course, if after a divorce the children stay with the father, then on the contrary, alimony for his maintenance can be collected from the wife. But in practice, such situations rarely occur.

Thus, in the United States, the alimony is obliged to support his former family in full, paying money to support not only the child, but also his wife. And for non-fulfillment of their duties, the law provides for various penalties, up to imprisonment.

Income

One of the main guidelines for determining child support is income. This takes into account the gross or net income of both parents, and from the percentage is calculated the amount that each parent must pay as alimony.

Deductions

If one of the parents has already been ordered by the court to pay child support and pays it regularly, then the amount of this child support is subject to deduction when determining his income for the purposes of determining the amount of new support. However, this rule is valid only for the establishment of new alimony, it is not possible to revise the previous established amount of alimony taking into account new alimony.

However, this rule is valid only for the establishment of new alimony, it is not possible to revise the previous established amount of alimony taking into account new alimony.

Childcare expense

The government also determines the amount that parents must spend on childcare. Usually, this amount is calculated taking into account the mandatory taxes that the parent pays. However, some states provide benefits to parents who pay child support and exempt them from taxes on their income.

Health care expense

Among other things, when determining the amount of child support, great attention is paid to the coverage of the child's health insurance. When support is approved, the amount needed to pay off health insurance is included in the main amount of support. Some states also account for emergency medical expenses as well as incidental medical expenses.

Other expenses

The amount of support can also be increased taking into account other expenses. Other expenses usually include specific expenses that are specific to each individual case. Such expenses include the cost of educating children with disabilities or gifted children. Usually such expenses are divided between the parents proportionally and are included in the amount of alimony.

Other expenses usually include specific expenses that are specific to each individual case. Such expenses include the cost of educating children with disabilities or gifted children. Usually such expenses are divided between the parents proportionally and are included in the amount of alimony.

Shared Custody and Visitation

The judge tries to take into account the amount of time the child spends with either parent when setting the amount of child support. The more a parent is allowed to spend with a child, the more child support is assigned. For example, if a child is assigned joint custody, the amount of child support will be significantly less than if the child has a single guardian for short visits.

The use of guidelines in determining the amount of alimony is not only aimed at protecting the rights and interests of children, but also calculated on the fair distribution of material responsibilities between parents. However, there are situations in which the amount of child support established is greater than or less than the amount determined by the guidelines. In this case, litigation is required to establish mitigating factors.

In this case, litigation is required to establish mitigating factors.

A good reason

For a few more years in New York State, for example, to get a divorce, you had to admit one party was guilty and the other was offended. One of the spouses had to confess to treason, drunkenness, beatings ...

When nothing like that really happened, someone had to take the crime against the family. And only in 2010 there was adopted a law on the possibility of divorce "without anyone's fault", although the rest of America has long done it.

Divorce, where both parties are not to blame, is based on two main reasons: people “have not lived together for a hundred years” (in fact, they have not lived for at least a year and a half) or they are separated by irreconcilable contradictions.

The first progressive "no fault" divorce law was passed in Oklahoma in 1953, and 17 years later the State of California performed the same feat. Then the governor there was Ronald Reagan - the future president of America. It is no coincidence that it was he who had a hand in the liberalization of family law. Reagan is the only one of all 44 US presidents who had a divorce in his biography, which did not prevent him from making his second wife, Nancy , the first lady of the country.

It is no coincidence that it was he who had a hand in the liberalization of family law. Reagan is the only one of all 44 US presidents who had a divorce in his biography, which did not prevent him from making his second wife, Nancy , the first lady of the country.

Emancipation, however!

I am not a feminist, so I am not horrified when a woman after a divorce receives alimony from her ex-husband. But the way men fight for their wives' money is amazing. The client of a lawyer friend of mine, an engineer by profession, pays her husband three thousand dollars a month, literally half of what she earns.

They haven't made any children, and the engineer doesn't understand why she has to feed someone else's grown-up child - her ex, who doesn't work and is just going to study design or business, what exactly, he hasn't decided yet. But recently the engineer was lucky: she unearthed a terrible secret. It turns out that a 22-year-old girl, an aspiring fashion designer, has been living in the house of her ex-husband for four months now.

This became the reason for a new trial: the ex-wife was spotted and, turning to the judge, said that she did not have the strength to feed two creative people. The husband justified himself that the designer girl was like a daughter to him, but the judge did not heed this argument and the amount of alimony decreased, however, not significantly. The ex-husband was also advised to look for work, bring documentary evidence of mailing his resume to employers and attending interviews. The man left the courtroom gloomy and "robbed."

Still, on a nationwide scale, women who pay child support are not yet common, in 2010 only 3% of all divorcing husbands received payments from ex-wives, although, according to experts, the number of such men is growing rapidly.

Is money more valuable than love?

In most states, child support is paid until the former spouse marries or remarries. But in the state of Florida, for example, not so long ago they limited the terms of payments. The judge sets a time limit, let's say 2 years, since he believes that this time is enough for a woman who did not work in marriage after a divorce to learn how to get her own bread. The amount of alimony depends on how long the marriage was or not. If you have been married for less than 11 years, this is not considered a long time in Florida. Supporters of a limited period of alimony payments are sure that these payments are “harmful” and often slow down the start of a new life: women do not remarry and even support their lonely state in every possible way, because money is more precious than love. And the financially more prosperous half, in order not to pay alimony, goes to deceit and sometimes to the complete collapse of their career.

The judge sets a time limit, let's say 2 years, since he believes that this time is enough for a woman who did not work in marriage after a divorce to learn how to get her own bread. The amount of alimony depends on how long the marriage was or not. If you have been married for less than 11 years, this is not considered a long time in Florida. Supporters of a limited period of alimony payments are sure that these payments are “harmful” and often slow down the start of a new life: women do not remarry and even support their lonely state in every possible way, because money is more precious than love. And the financially more prosperous half, in order not to pay alimony, goes to deceit and sometimes to the complete collapse of their career.

In general, it is enough to go to the site of divorced and divorced people once and read their stories to understand that all these people are unhappy.

In seven US states, a husband or wife can sue a lover or mistress who caused a divorce. And the “razluchniki” will answer according to the law for invading someone else's territory.

And the “razluchniki” will answer according to the law for invading someone else's territory.

Men also cry

One pensioner, 67 years old, left the state of Massachusetts, according to the laws of which he had to pay large alimony to his ex-wife, with whom he had been married for 34 years. In 2009he lost his job as a pharmacist, and never found a new one, owed his wife 20 thousand, for which he served four days in prison, until friends and relatives made up the shortfall for him.

After that, the ex-husband went to live on an Indian reservation, since he was a quarter of the Cherokee. Now he sits there and says: I'm already old, release me from lifelong alimony to my ex-wife, but we are completely on an equal footing with her.

But in Massachusetts there is no such law that the old ex-husband can not pay alimony to the ex-wife. And in some others, laws have already been passed under which the payment of alimony is suspended after reaching retirement age.

Who is in profit

The longer a divorce lasts, the more expensive it is. Half of the spouses during this time are united in a common feeling of dislike for lawyers. Lawyers here are called bees that collect honey from divorce flowers, and the longer they collect, the better for them.

The average time for which you will be divorced is from one to three years. The lawyer takes for such cases as for heart surgery, if the case is complex, and if it is simple, then as for appendicitis, which is also a lot.

An amazing coincidence: of the four female divorce lawyers I know, three are not married and never have been and never intend to. And I don’t even mentally ask them why…

Collection problems

There are quite a lot of such problems:

- Search for the defendant in the case. A US citizen can easily move around the territory of his native state, hiding from the claimant. For the plaintiff, the mother of the child, it is quite difficult to enter the country.

There is a visa regime between Russia and America, and not everyone is allowed to enter the States. Solving the problem at a distance is extremely difficult. Finding a competent representative in a foreign country is also not easy.

There is a visa regime between Russia and America, and not everyone is allowed to enter the States. Solving the problem at a distance is extremely difficult. Finding a competent representative in a foreign country is also not easy. - Language barrier. Ideally, if you can find a Russian-speaking representative. Because to understand an already complicated matter without knowing the language is doubly difficult.

- Competition norms. Under what legislation is alimony collected in America?

Which law to apply?

Note that the family and civil legislation of the Russian Federation allows the claimant for alimony to independently determine the jurisdiction of the case. That is:

- you can apply to a Russian court;

- can be applied to the US courts.

It would seem that the choice is obvious. It is quite simple to file a claim with the Russian judicial authority. You can even do without the help of a lawyer. A sample application can be found on the Internet, “spy” in the reception of the court building, where similar samples are hung out. You can also contact a child support specialist.

You can also contact a child support specialist.

But there is a problem with the execution of the Russian judicial act in the United States. The thing is, there is no money back guarantee. It may take a long time to prove that the decision of the Russian court is completely legal in America.

Meanwhile, lawyers specializing in international law note that in most cases Russian decisions are recognized in the United States. Moreover, in a number of states there are local statutes, we would call them regional, which establish that a foreign judgment may well be enforced in America.

It seems that it is not worth the risk, relying on Russian legislation, it is better to resolve the issue according to local laws. Despite the fact that the plaintiff in the case will not be a resident of the state under whose legislation the issue is being considered.

On the other hand, “native” laws will apply to the defendant. Nevertheless, it is easier to apply local law to the debtor than foreign law.

Thus, answering the question of how to get legal alimony from a US citizen, you can identify the most potentially successful option:

- Find a legal specialist who works in America with Russian-speaking citizens, specializing in family matters.

- Entrust him with the authority to collect funds, based on US laws.

Rebellious Parents

Non-custodial parents who evade their child support obligations are sometimes referred to as rebellious parents. Parents who share an equal role in raising children are much more likely to comply as support compliance exceeds 90% when the payer states that he (or he) believes he (or he) has a relatively equal role in raising children .

The US Department of Health and Human Services estimates that 68% of child support cases were in arrears in 2003, up 15% from 53% in 1999. Some of these cases of debt are said to be related to administrative practices such as income imputation. parents where none exist and issuing support orders by default.

parents where none exist and issuing support orders by default.

According to one study, the reasons for not paying child support were as follows:

| Reason | Percentage |

|---|---|

| Inability to pay | 38% |

| Protesting against not attending | 23% |

| No liability | 14% |

| I prefer to give up the child | 13% |

| Paternity denied | 12% |

According to another study, 76% of California's $14.4 billion in child support debt is due to parents who are unable to pay. The "naughty" parents had an average annual income of 6,349$9,447 owed and $300/month ongoing support because 71% of orders were set by default.

Imprisonment

Most courts considering imprisonment for insufficient child support, since the U.S. Supreme Court ruling in Lassiter v. Department of Human Services, 452 US 18 (1981), have held that an assigned attorney is required if the freedom of the debtor is at stake. In March 2006, the New Jersey Supreme Court upheld this principle in Ann Pasqua et al. v. Hong. Gerald Council et al. As of August 2006, at least four states (New Hampshire, Pennsylvania, Virginia, and South Carolina) do not permanently appoint attorneys in enforcement proceedings. As of 2011, lawsuits were pending in Pennsylvania and New Hampshire.

In March 2006, the New Jersey Supreme Court upheld this principle in Ann Pasqua et al. v. Hong. Gerald Council et al. As of August 2006, at least four states (New Hampshire, Pennsylvania, Virginia, and South Carolina) do not permanently appoint attorneys in enforcement proceedings. As of 2011, lawsuits were pending in Pennsylvania and New Hampshire.

On March 23, 2011, the United States Supreme Court heard Turner v. Rogers, concerning whether South Carolina was legally required to provide an assigned attorney for Turner, who was imprisoned for non-payment of child support.

The right to trial by jury is limited in criminal denial of support cases when the defendant is charged with a misdemeanor without support. The judge may imprison the debtor for contempt of court for a period of time, presumably until the balance is brought into order, similar to the debtors' prisons of previous eras. Prison makes it harder to pay child support, so some states suspend sentences and introduce probation during which payments must be made and/or job searches are conducted, with prison reserved for uncooperative offenders.

About the peculiarities of collecting money for dependents in the USA

As already mentioned, case law is strong in America. Free in lawmaking and individual states. And they use it. Alimony laws, for example, Florida and Texas will be different. Albeit slightly.

But it is possible to single out the general features of alimony legal relations that are characteristic of any state. Some comparison can also be made with Russian collection rules.

- If in Russia from 25 to 50% of the payer's income for the maintenance of minors is collected, then in the USA the amount of funds collected is on average 10-30% of the income. The size is smaller, but the income is generally higher. Moreover, the money is collected in a fixed amount.

- All the circumstances of a particular case are taken into account in one and in the other country. But if in Russia it is important with whom exactly the minor lives, then in the USA it is with which of the parents he communicates more.

This approach seems to be quite fair. Indeed, in the process of communication, the parent often allocates money for the needs of the child on a voluntary basis.

This approach seems to be quite fair. Indeed, in the process of communication, the parent often allocates money for the needs of the child on a voluntary basis. - In America, there are special enforcement agencies. In Russia, this is done by bailiffs.

- The Russian Federation provides for criminal liability for evading the payment of alimony. In the USA, too, you can go to jail if you do not allocate money to meet the needs of your son or daughter.

Statistics show, however, that the percentage of debtors in both countries is quite high.

In general, the mentality of the country is as follows: children from adolescence should begin to learn to provide for themselves. Therefore, the United States does not pay such great attention to the protection of the material interests of minors, as in Russia.

It is in our country that a “child” can live with his parents until he is quite mature. In America, things are different.

Paternity fraud, non-adopted, non-biological children

Paternity issues that complicate the child support issue may be due to misinformation, fraudulent intent, or default decisions. Paternity fraud mainly affects four groups of people: the deceived party forced to pay child support for a child who is not biologically his, a child potentially deprived of a relationship with his biological father, a biological father who may have lost a relationship with his child, and the mother of the child in question. child.

Paternity fraud mainly affects four groups of people: the deceived party forced to pay child support for a child who is not biologically his, a child potentially deprived of a relationship with his biological father, a biological father who may have lost a relationship with his child, and the mother of the child in question. child.

The non-biological father may be liable for support even if paternity fraud is proven, as some jurisdictions limit the amount of time allowed to dispute paternity. In most jurisdictions, courts can declare a man acting as the father of a child as the father through fair estoppel procedure. Once a man declares a child to be his offspring and lives with him for a certain period of time, the court can transfer all parental responsibilities to the putative father, even if the child is not biologically his.

Fines

In 2000, the state of Tennessee revoked the driver's license of 1,372 people who collectively owed more than $13 million in child support. In Texas, noncustodial parents who ask for more than three months in support payments may receive court-ordered payments deducted from their wages, may have federal income tax refund checks, lottery winnings, or other money that may be owed from the state. or federal sources. is intercepted by child support enforcement, licenses (including hunting and fishing licenses) can be suspended, and a judge can sentence non-paying parents to prison and rule on overdue child support. Some consider such punishments to be unconstitutional. 4 September 19In 1998, the Alaska Supreme Court upheld a law allowing government agencies to revoke driver's licenses from parents who are in serious violation of child support obligations. And in United States of America v. Sage , U.S. Court of Appeals (2nd Circuit, 1996), the court upheld the constitutionality of a law allowing federal fines and imprisonment of up to two years for a person who willfully fails to pay more. $5,000 in child support for a year or more if said child resides in a state other than that of the noncustodial parent.

In Texas, noncustodial parents who ask for more than three months in support payments may receive court-ordered payments deducted from their wages, may have federal income tax refund checks, lottery winnings, or other money that may be owed from the state. or federal sources. is intercepted by child support enforcement, licenses (including hunting and fishing licenses) can be suspended, and a judge can sentence non-paying parents to prison and rule on overdue child support. Some consider such punishments to be unconstitutional. 4 September 19In 1998, the Alaska Supreme Court upheld a law allowing government agencies to revoke driver's licenses from parents who are in serious violation of child support obligations. And in United States of America v. Sage , U.S. Court of Appeals (2nd Circuit, 1996), the court upheld the constitutionality of a law allowing federal fines and imprisonment of up to two years for a person who willfully fails to pay more. $5,000 in child support for a year or more if said child resides in a state other than that of the noncustodial parent.

The US law, commonly known as the Bradley Amendment, was passed in 1986 to automatically trigger an indefinite lien on delinquent support payments. The law removes any state's statute of limitations; deprives judges of discretion, even bankruptcy judges; and requires that payment amounts be retained without regard to the physical ability of the person receiving the alimony ( debtor ) to make a notice or taking into account his knowledge of the need to make a notice. The lender can forgive such debts.

When late maintenance is owed to the state as a result of paid social security, the state can forgive some or all of it under what is known as a compromise offer.

Final Judgment

Under the United States Constitution Article Fours, full faith and credit is granted in every state in the public acts, records, and proceedings of any other state. The courts have used this article to enforce final judgments that have been registered in the state. Usually a decision must be final before it can be registered. Conflict Confirmation (Second) on "Protection from Recognition and Enforcement" states that a judgment rendered in one State should not be recognized or enforced in a sister State, as the judgment remains subject to modification. The local court has the power to recognize or enforce the decision, which can be changed in accordance with local law.

Conflict Confirmation (Second) on "Protection from Recognition and Enforcement" states that a judgment rendered in one State should not be recognized or enforced in a sister State, as the judgment remains subject to modification. The local court has the power to recognize or enforce the decision, which can be changed in accordance with local law.

Child support orders are considered such decisions. To ensure full trust and confidence, the local law of the state of transfer will be applied to determine whether the judgment can be changed, especially in relation to past and future financial obligations.

Desertion and Withdrawal of Support Uniform Law

In 1910, the National Conference of Uniform Commissioners approved the Uniform Desertion and Withdrawal of Support Act. Under this act, it is a punishable offense to leave a husband, willfully neglect or refuse to provide for the support and maintenance of his wife in poor or necessary circumstances, or failure by parents to fulfill the same duty towards their child under 16 years of age. age. Law 1910 sought to improve the execution of support duties, but he did not take into account payers who fled the jurisdiction. With increasing population mobility, welfare departments had to support disadvantaged families because the extradition process was inefficient and often unsuccessful.

age. Law 1910 sought to improve the execution of support duties, but he did not take into account payers who fled the jurisdiction. With increasing population mobility, welfare departments had to support disadvantaged families because the extradition process was inefficient and often unsuccessful.

Uniform Reciprocal Support Enforcement Act (URESA)

In 1950, the National Conference of Commissions on Uniform State Laws promulgated the Uniform Reciprocal Support Enforcement Act (URESA). The Commission stated that "The aims of this law are to improve and expand, by means of mutual legislation, the enforcement of support duties and to unify the law in this regard." URESA sought to enforce these provisions in two ways: criminal and civil. Criminal authorities relied on the creditor state to demand extradition from the debtor, or the debtor to surrender. Civil law enforcement relied on the creditor to bring proceedings in his/her state. The originating State will determine whether the debtor had a support obligation.