How to claim a child on taxes with no income

THIS is how (and why) you can file taxes without any income [2022]

Posted by Frank Gogol in Taxes | Updated on November 15, 2022

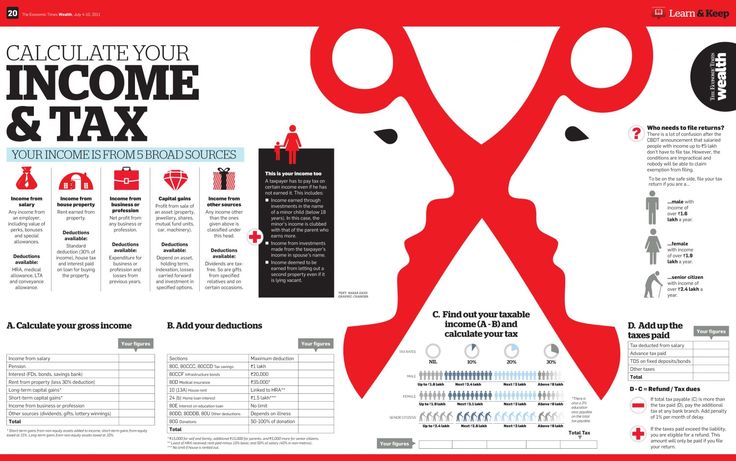

At a Glance: Even if a person has earned no income in a given year, they may still file a tax return and claim tax credits either by mail or online. Depending on the previous year’s tax payments, a zero-income tax return may still result in a refund.

If you haven’t earned any income in the last year, you may be wondering how you can file your taxes. We all know that filing taxes is something you cannot avoid, so you have to make sure you always do it on time.

So, instead of skipping the return just because you didn’t have any income, you must be aware of how to file taxes with no income. This article will teach you what to do in this situation.

Table of Contents

Can I File an Income Tax Return If I Don’t Have Any Income?

Filing a tax return is always important, so you have to make sure you do it before the deadline. But what is the procedure when you didn’t have any income last year?

The good news is that you are not forced to file a return if you didn’t get have any income in the last tax year. Every single year, there are some minimum income requirements imposed by the IRS – they change annually depending on your tax status or inflation.

So, your requirements can change based on whether you file jointly, you’re married but filing separately, you’re single, and so on. So, a tax return is not mandatory if you have no income. Still, you may want to do it regardless, because there are some huge reasons for this.

Filing despite getting no income the last tax year will allow you to claim some refundable tax credits, which can then offer you some tax refund. This applies even if you don’t have a job. Therefore, it is possible for you to qualify for the Additional Child Tax Credit or the Earned Income Tax Credit. They are both refundable tax credits.

Besides, you can also file if you earned very little income last year. This makes it possible for you to recover taxes that were withheld from the last time you paid. It is a scenario that occurs when you had a job, but only for a small part of the last year.

This makes it possible for you to recover taxes that were withheld from the last time you paid. It is a scenario that occurs when you had a job, but only for a small part of the last year.

However, it is also possible in cases when a person goes to college and has very little income. Thus, filing a return will give the individual the opportunity to use the American Opportunity credit.

Meanwhile, things are different for people who are self-employed or have a small business. Basically, if you earned over $400 from this, you have to file a tax return. Some confusion is generated by this type of situation a few times when the income level of the contractor is over $400 but less than the threshold that the W2 employees should file at.

You will also have to file your taxes if you got any health care tax credits or subsidies for the last year. This allows you to receive them from now on too.

Requirements for Filing Income Taxes?

When it comes to who has to file taxes and who doesn’t, the good thing about it is that there are individuals who don’t have to do it.

If you earned income the previous tax year but it was less than the IRS minimum, filing a tax return is not necessary. Whether you are the head of the household, single, claimed as a dependent on another person’s taxes, or filing jointly with your spouse, the minimum varies based on your filing status and age.

Every year, the minimum earned income also gets adjusted by the IRS for inflation. So, people who are under the minimum will still be required to file tax returns if the new circumstances ask for it.

Filing and paying a self-employment tax will be required if you got $400 in earnings from self-employment, for instance.

Meanwhile, if no income was earned, filing taxes is not mandatory.

Getting a Refund with Tax Credits

It is possible to obtain a refund with a tax credit. There are several tax credits offered by the IRS, which can be taken off your taxes and not your income. If the credit you get is higher than the amount you have to pay in taxes, you can sometimes claim this extra credit as a refund.

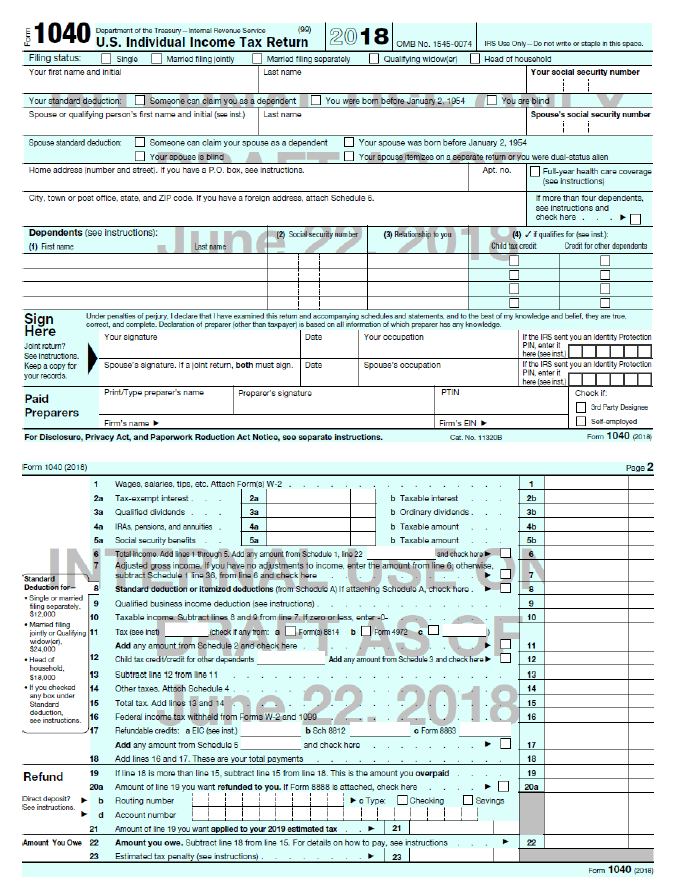

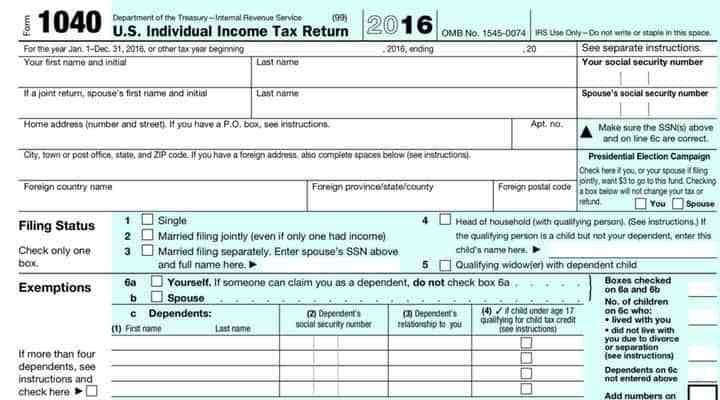

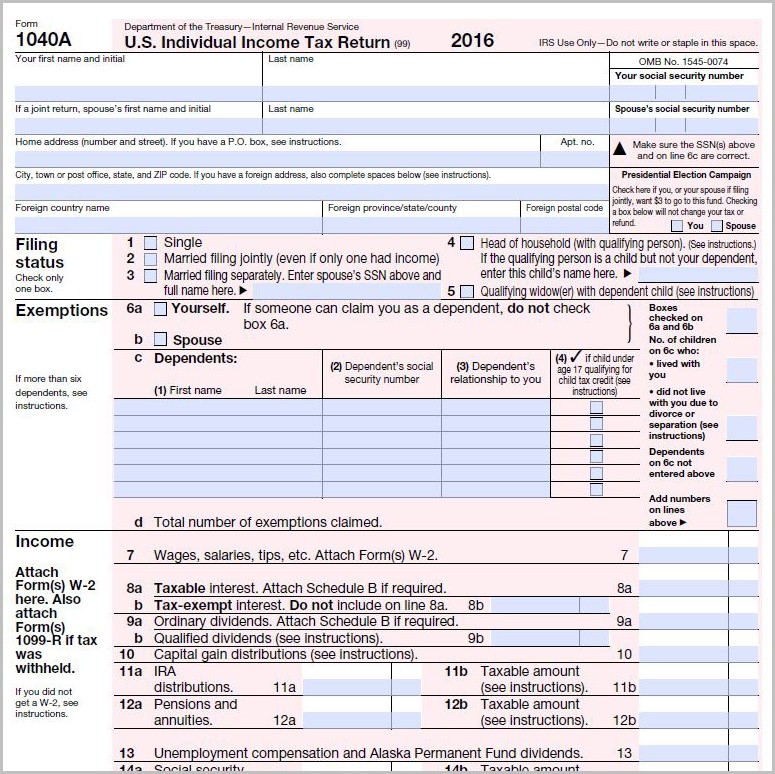

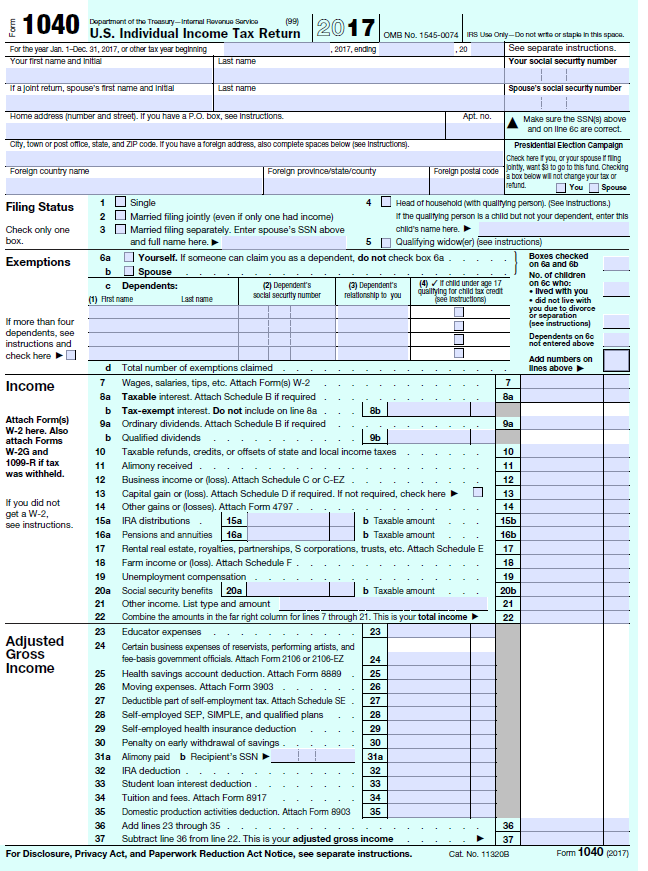

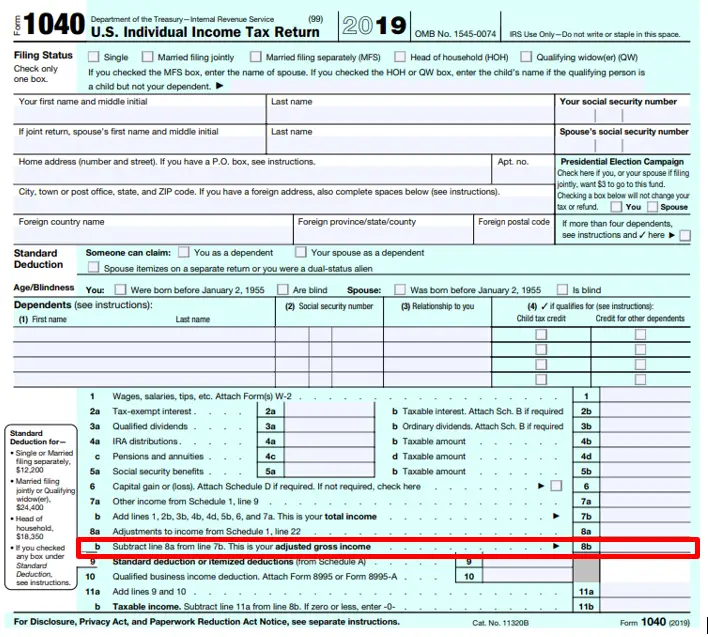

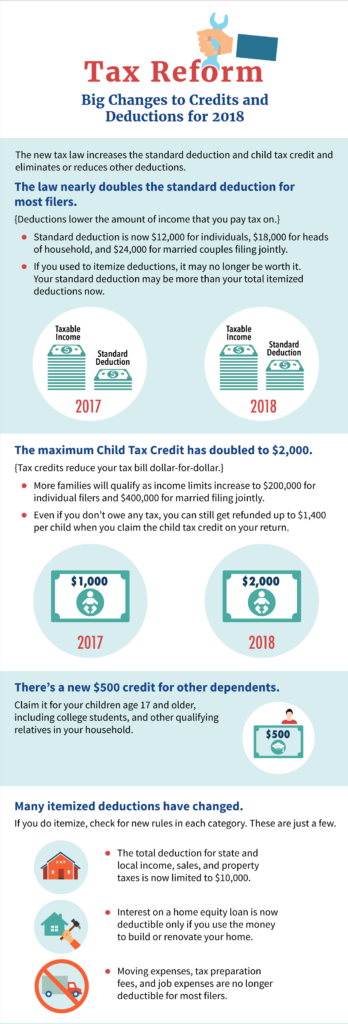

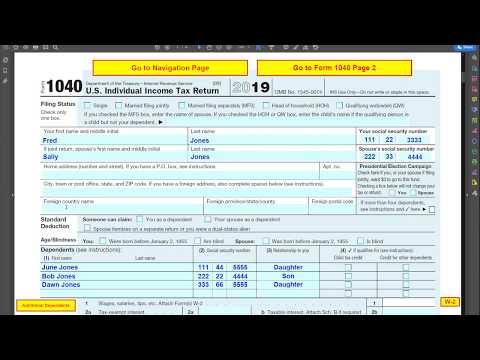

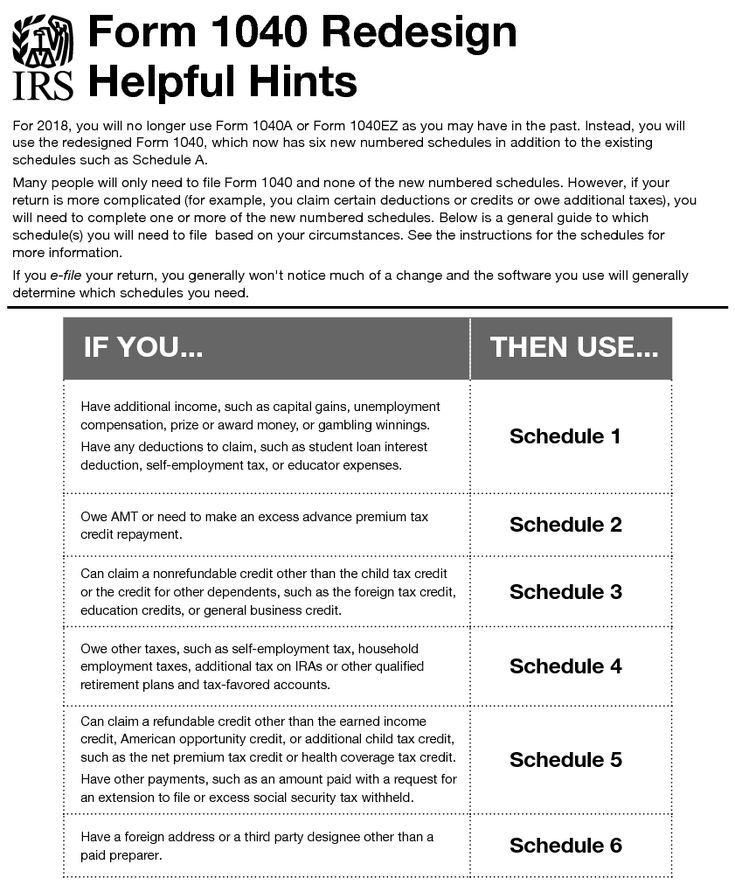

Also, even if your tax is $0, you have the chance to qualify for different tax credits, like the Additional Child Tax Credit or the Earned Income Tax Credit, which will then allow you to get a refund. Just bear in mind that filing the 1040 and other tax forms is necessary if you want to be able to claim the credits.

Furthermore, depending on the age of your child, the American Rescue Plan will boost the per-child credit to $3,000 or $3,600, and this also expands the Child Tax Credit.

As such, you have to consider this for the 2021 tax return that you will have to prepare the next year. You can get a refund of the credit for 2021, and the IRS can send out advance payments for this starting with July, ensuring that people can get their money pretty fast.

File Now so You Can Deduct Later

You cannot claim as much as you want to. It all depends on the IRS. This is because the IRS is the one putting a limit on how much you can claim with certain credits and deductions.

For instance, if a home office deduction would send your business into debt, you will be unable to claim the home office deduction since it’s too large. You will be able to claim zero business income for that year instead, which will then allow you to move into the next year carrying the leftover deduction.

Also, you are unable to claim your credits or deduction that carry over if you have no income. However, you will have to file your taxes to be able to claim them in the following year when you are getting an income.

Protect Against Future Audits

The last thing you want to happen to you is an audit.

In terms of auditing old tax returns, the IRS operates under a statute of limitations. When you make sure that you accurately report your information, they can only go back three years in general. But for the current year, it all starts only when you file the tax return.

Not filing the tax return puts you at risk of having an audit performed by the IRS. So, the IRS says that in situations when you don’t want to file, it’s essential to maintain all important financial records.

So, the IRS says that in situations when you don’t want to file, it’s essential to maintain all important financial records.

Otherwise, you risk dealing with serious problems, and they can get unpleasant instantly.

Filing Taxes With No Income FAQs

Do you have to file taxes if you have no income?

You only have to file taxes if you make above the IRS-imposed income thresholds which vary based on your filing status (single, married, etc.). You can still file your taxes even if you have no income if you choose.

Can you file taxes with no income but have a child or dependent?

If you have no income but have a child/dependent, you can still file your taxes. This may allow you to get a refund if the tax credits you’re eligible for are more than your income.

Do you have to pay taxes if you don’t have a job?

If you don’t have a job, you will have to file taxes if you meet the IRS’ minimum income thresholds. If you have no income, you are not required to file your taxes but there may be benefits to doing so.

If you have no income, you are not required to file your taxes but there may be benefits to doing so.

How can I file a zero-income tax return?

You can file your zero-income tax return just like any other tax return—through the mail or online.

How can I file a zero-income tax return online?

You can file your zero-income tax return online using the IRS’ Free File system or an online tool such as TurboTax.

What is the benefit of filing a tax return even if you don’t have enough money?

Even if you have no or low income, filing your taxes can lead to you receiving a refund if your tax credits are more than your income.

Read More

- Why Was No Federal Income Tax Withheld From My Paycheck?

- Why Do I Owe Taxes?

- Why Do I Owe State Taxes?

- Are You Exempt from Federal Withholding?

- Can You File Taxes Without a W2?

- h2B Taxes: Everything You Need to Know

Conclusion

Having no income makes things very confusing for individuals who filed taxes in the past, and if you are in this situation, you may be unaware of how to file your taxes right now.

While filing taxes when you have no income is not mandatory, there are some benefits in doing it, like getting the chance to claim refundable tax credits.

So, if you’re in this situation, you might want to find out how to file taxes with no income.

Make sure to follow the information in this article and you should be successful when starting the filing process.

Need a Loan? Get One in 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon you’ll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days (some lenders will be as quick as 2-3 business days). Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. (F-1, OPT, H-1B, O-1, L-1, TN visa holders) at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on Google, Yelp, and Facebook or visit us at https://www.stilt.com. If you have any questions, send us an email at [email protected]

Frank Gogol

I’m a firm believer that information is the key to financial freedom. On the Stilt Blog, I write about the complex topics — like finance, immigration, and technology — to help immigrants make the most of their lives in the U.S. Our content and brand have been featured in Forbes, TechCrunch, VentureBeat, and more.

On the Stilt Blog, I write about the complex topics — like finance, immigration, and technology — to help immigrants make the most of their lives in the U.S. Our content and brand have been featured in Forbes, TechCrunch, VentureBeat, and more.

See author's posts

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

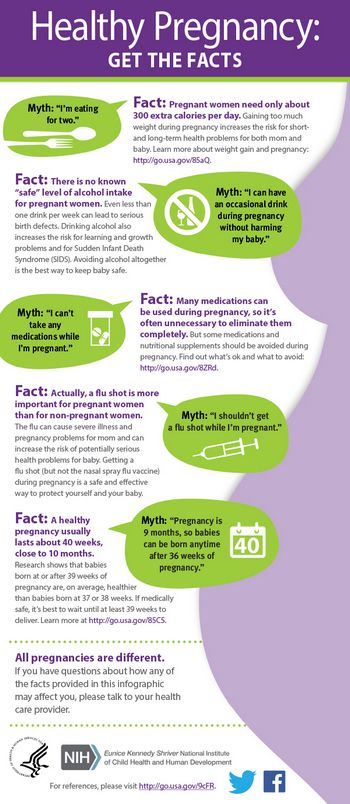

This tax credit helps offset the costs of raising kids and is worth up to $3,600 for each child under 6 years old and $3,000 for each child between 6 and 17 years old. You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return. You can get the tax credit even if you don’t have recent earnings and don’t normally file taxes by visiting GetCTC.org through November 15, 2022 at 11:59 pm PT. Learn more about monthly payments and new changes to the Child Tax Credit.

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

- How to claim the CTC

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 ($150,000 for married couples and $112,500 for heads of households). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

There are three main criteria to claim the CTC:

- Income: You do not need to have earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”. See below for details.

- Taxpayer Identification Number: You and your spouse need to have a social security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be 17 or under on December 31, 2021.

- Residency: The child must live with you in the U.S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

- Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an Individual Taxpayer Identification Number who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes (which you file in 2021) or submitted your info to the IRS through the 2021 Non-filer portal (this tool is now closed) or GetCTC.org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return (which you file in 2022), you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

The latest

By Tysheonia Edwards, 2022 Get It Back Campaign Intern Identity theft happens when…

By Christine Tran, 2021 Get It Back Campaign Intern & Reagan Van Coutren,…

Internet access is essential for work, school, healthcare, and more. The Affordable Connectivity…

Can a non-working person receive a tax deduction - types of deductions without income

To receive deductions and return personal income tax, you must have official income. But are there cases when there is no income, but the right to deduction still arises and can be used? And is it possible to somehow get money from the budget if there is no personal income tax payable now?

But are there cases when there is no income, but the right to deduction still arises and can be used? And is it possible to somehow get money from the budget if there is no personal income tax payable now?

Tell me if such situations are possible.

Natalia

Natalia, there really are such cases. Some types of deductions can be received even without having official or taxable income. I'll tell you about each.

Ekaterina Miroshkina

economist

Author profile

General conditions for tax deductions

A tax deduction is an amount that the state allows to deduct from income when calculating personal income tax. As a result, the tax base and the accrued tax itself are reduced. Further on the situation:

- if the tax was paid before the deduction was applied, an overpayment will appear - it can be returned to your account;

- if the tax is only calculated and it has not yet gone into the budget, the amount payable will be less - it will be possible to save.

It turns out that if there is no income, then it seems that nothing can be deducted from it, even if there are all grounds for the deduction. Because without income and personal income tax is not charged. What is there to reduce and return? But in fact, it is possible to reduce and return the tax.

Standard deductions without income

The standard deduction can be received every month until the income from the beginning of the year exceeds 350,000 R - from this month the deduction is no longer provided. And from next year, everything is new - up to 350,000 R.

For example, a cashier has a salary of 22,000 R and two children. For each - 1400 R of the standard deduction per month. Personal income tax is calculated as follows: (22,000 − 2800) × 13% = 2496 R.

For the year, the cashier's income will not exceed the maximum amount, so the deduction will be provided from January to December. The amount of deductions for 12 months will be: 2800 R × 12 months. = 33,600 R. Total savings on personal income tax - 4368 R per year.

= 33,600 R. Total savings on personal income tax - 4368 R per year.

But the deduction can be received even if the cashier has no income in some months. For example, she will take a vacation at her own expense for three months for family reasons - from July to August inclusive. During these months, the cashier will not have any income, but the standard deductions for them will still be provided. They will be taken into account when calculating the tax in the month when the income appears.

It turns out that according to the results of nine months of the year, the income was only six, and the standard deductions were provided for nine months, including those in which there was no income.

What to do? 05/22/19

How to get a child's deduction for previous years if you haven't thought of it before?

You can apply the standard deduction without income if income still resumes before the end of the year. If the vacation lasts until December 31, standard deductions will apply only in those months when there was income.

Get what's yours from the state!

How to receive deductions, benefits and allowances, we tell in our newsletter once a month. Subscribe!

Property deduction for pensioners

Pension is not subject to personal income tax. Therefore, a pensioner without additional income cannot use tax deductions: he does not pay tax, and there is nothing to return to him from the budget.

But if a pensioner buys an apartment, special conditions begin to work for him: he can receive a property deduction for the year he bought the apartment, and for the previous three. For example, a pensioner bought an apartment in January 2020. And retired in July 2019of the year. He can return the tax for 2019, 2018 and 2017, although he only got the right to deduct for the apartment in 2020, when there was no more income from personal income tax.

Only pensioners have this privilege, and it really works. If you file declarations for three years at once, you can receive up to 260,000 R of previously paid tax on your card in one day.

What to do? 02/12/19

Mom took out a mortgage and died. How to inherit a deduction for an apartment?

In T-Z there is a detailed analysis of how to use this right and transfer the balance of the deduction over the years in declarations.

Property deduction without pension and income

If a person without income from personal income tax buys an apartment, he has the right to a deduction. This right can be exercised even after several years, for example, when there are incomes taxed at a rate of 13%. Home purchase deductions and mortgage interest payments are the only ones whose unused balance is carried over to subsequent years.

Suppose the buyer of an apartment does not have an official salary with personal income tax. A year, three, five passes - still no salary. The right to a deduction will not go anywhere. As soon as income appears, for the same year you can declare a property deduction and return the withheld personal income tax.

/ndfl-za-x-let/

How do I get a deduction for an apartment for the fourth year

And even without official income, you can get a tax deduction when selling property. For example, the cost of an apartment is reduced by actual expenses or by 1,000,000 R. And when selling a car, purchase costs or 250,000 RUR can be deducted from the contract amount. In this case, it is not necessary to work under an employment contract. Even individual entrepreneurs on the simplified tax system and the unemployed can reduce income by expenses when selling property.

Social deductions for treatment and tuition

Unused balance of deductions for treatment or tuition is not carried over to subsequent years. For a year, each person is given a limit - 120,000 R. And if it is not used, then by the next year it will burn out, and the right to deduct will not be transferred.

For example, Eugene spent 100,000 R per year on a driving school and a dentist, but he had no income from personal income tax. The following year, incomes appeared, but last year's expenses within the framework of the social deduction can no longer be declared. Only expenses of the same year are eligible.

The following year, incomes appeared, but last year's expenses within the framework of the social deduction can no longer be declared. Only expenses of the same year are eligible.

But even if there is no official income at the time of payment for treatment and education, there is still a chance to use the social deduction. The main thing is that incomes appear before the end of the same year or be before payment for treatment or study. They can be much later, and earlier than expenses - not a month, but a year should coincide.

For example, Elena quit her job in April. And in August, she paid 50,000 R for the child's education. Although Elena has no official income since April, she can still use the deduction and return 6,500 R of personal income tax, because she paid it before April.

Irina was an individual entrepreneur, but in May she stopped registration. In July, she paid 70,000 R for dental treatment, but by that time she had not had income subject to personal income tax for five years. In November, Irina got a job under an employment contract, and by the end of the year, out of the earned 80,000 R, 10,400 R of personal income tax was withheld from her. Next year, Elena will file a declaration, declare a deduction in the amount of July treatment costs and return the personal income tax that she paid in November and December - 9100 R.

In November, Irina got a job under an employment contract, and by the end of the year, out of the earned 80,000 R, 10,400 R of personal income tax was withheld from her. Next year, Elena will file a declaration, declare a deduction in the amount of July treatment costs and return the personal income tax that she paid in November and December - 9100 R.

What to do? 07/01/19

How can I get a deduction for the treatment of relatives?

Property and social deductions in marriage

Official marriage gives spouses the right to use tax deductions regardless of who actually paid the costs of buying housing, medical treatment and education. And who earned it doesn't matter either. A wife can return her personal income tax on documents in the name of her husband, and vice versa.

For example, Yury earns freelancing without official registration. A few years before marriage, he saved up 2,000,000 RUR for an apartment. And he bought it already in marriage - a month after the wedding. The wife did not invest her savings, the owner according to the documents is Yuri. And he still has no income that is subject to personal income tax. But his wife has such an income. Her official salary is 30,000 R per month.

The wife did not invest her savings, the owner according to the documents is Yuri. And he still has no income that is subject to personal income tax. But his wife has such an income. Her official salary is 30,000 R per month.

The wife will take Yuri's documents for the apartment and declare her property deduction in the amount of 2,000,000 R. Because the spouses can distribute the total expenses as they like, and the wife's right to the deduction will be confirmed by payment documents in the name of her husband and a marriage certificate. And it does not matter that a wife with a salary of 30,000 R could not save 2 million for an apartment in a month after the wedding.

Yuri's wife will be able to return 46,800 R per year, and so on until she uses the entire deduction and returns 260,000 R of tax. This is how Yuri and his family will receive 260,000 R from the budget with the help of a deduction, although Yuri has no official income, and his wife did not pay for the apartment.

If the spouses agree that the apartment will belong only to Yuri, they can conclude a marriage contract, and in the event of a divorce, Yuri will not share the apartment. This will not interfere with the deduction.

/sovet-lubov-ndfl/

What tax deductions can be received in marriage

If you have a question about personal finances, expensive purchases or a family budget, write to We will answer the most interesting questions in the magazine.

Ask a question

Russian oligarchs easily avoid sanctions in Germany, because they must declare their property voluntarily

Topic of the day

- home

- Learn more

- Pcos will i ever get pregnant

- Treating chlamydia while pregnant

- What they use to induce labor

- How to improve hemoglobin in child

- Vaccinations are not immunizations

- Braxton hicks labor

- How to stop child slumping in car seat

- What can i use on cradle cap

- How to check my child benefit claim

- Baby in heat

- How much money do you receive for fostering a child