How much money do you receive for fostering a child

How Much Do Foster Parents Get Paid? - UMFS | Virginia Foster Care | Residential Treatment

The decision to become a foster parent is one of the most impactful choices you’ll make to improve the life and well-being of a foster child or teen. The idea of giving new direction and purpose to another person’s life is powerful and fulfilling.

Although becoming a foster parent is extremely rewarding, there are some financial considerations that many potential foster parents are unaware of when deciding to foster a child or teen.

It’s important that foster parents in Virginia have all of the financial information to help them best provide for their foster child or teen, as well as their own family. All foster parents receive a tax-free monthly maintenance payment from the State of Virginia to cover the basic costs of caring for foster children. The payment amount varies depending on the age of the child. If a child’s needs require additional daily supervision by Foster Parents, the Virginia Enhanced Maintenance Assessment tool (VEMAT) will be utilized to determine a rate of additional reimbursement payments to Foster Parents.

Here is a breakdown of the various areas of reimbursement for a Virginia foster parent.

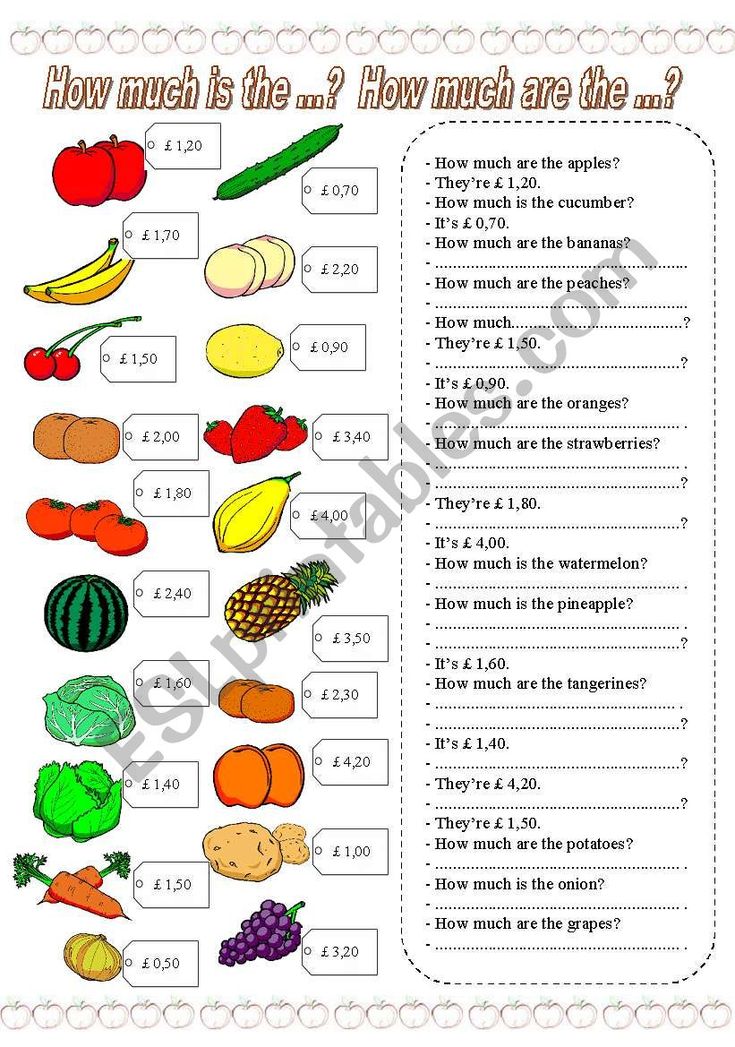

Standard Maintenance Payments & Clothing budgetStandard maintenance payments are afforded to parents to cover some of the basic costs associated with fostering in Virginia. The basic rates for standard maintenance range from $450 to $700 per month depending on the age of the child. Annual clothing allowance is also age-dependent and afforded to foster parents in the amount of $300 to $500 per year.

Enhanced Maintenance PaymentsIf a child’s needs require additional daily supervision, foster parents can request an evaluation of the need for enhanced maintenance payments as compensation for the extra time necessary to care for the child.

In many cases, the Virginia Enhanced Maintenance Assessment Tool (VEMAT) is used to decide the rate for any additional reimbursement payments to foster parents. Other assessment methods are also used to determine eligibility.

The VDSS administers a fund to cover major property damage done by children in foster homes. Information about your insurance coverage, along with multiple stages of approval, is required to be eligible for this contingency fund.

MedicaidAll foster children and teens, regardless of age, placement agency or your own financial status, are eligible for Medicaid.

Free School LunchesIf your foster child or teen is enrolled in a Virginia public school they are eligible for free school meals. The application process varies per school, but the program covers meals, both breakfast (where available) and lunch, offered at your school.

Respite Care for Foster ParentsRespite care is a support service offered to foster parents that allow another provider to temporarily step in and provide care. Circumstances are not limited, but may include scenarios like…

- ensuring separately placed siblings have time together

- giving foster parents and their children a break when necessary

- sustaining children’s relationships with extended family

- enabling foster parents to go on vacation where the child is not legally permitted

- offering foster children and teens in group care with new experiences

- discovering potential placement changes

Additional services and supports are widely available to Virginia foster parents. However, reimbursement of such services is dependent upon the proper documentation indicating issues and challenges affecting the child. Documentation provided to your caseworker for review may include:

However, reimbursement of such services is dependent upon the proper documentation indicating issues and challenges affecting the child. Documentation provided to your caseworker for review may include:

- journals tracking developmental/emotional growth

- clinical reports

- behavioral assessments

Fostering a child or teen is such a rewarding act because it is entirely voluntary. For this reason, it is recommended you be financially secure with your own family before deciding to become a foster parent.

Although financial support is available to foster parents, reimbursement will not meet all of the expenses that come with the responsibility of fostering a child.

Want more information on the financial aspects of being a foster parent? Contact us today!UMFS has 8 locations throughout the state of Virginia, spread conveniently across the Commonwealth. If you are interested in learning what is involved to become a foster parent, we encourage you to send us an inquiry, or contact UMFS at any of these locations:

- Richmond

- Fredericksburg

- Alexandria-Northern Virginia

- Tidewater-Norfolk

- Farmville

- South Hill

- Lynchburg

How much do foster parents get paid in California – Knotts Family Agency

Although parenting is a full-time job, you cannot think of foster parenting as a way to cash out. If you’re in it for the money, then you’re fostering for the wrong reasons. Foster families don’t actually get “paid” for taking care of a child. They receive reimbursements for the money they spend taking care of the child’s needs. This money is not meant to be used to buy a new car or pay for your rent or some other expenses that don’t have anything to do with the immediate essential needs of the foster child. Bear in mind that irrespective of the subsidy or financial assistance you receive, you will still be responsible for providing the essential items needed to adequately care for the child and the financial cost of that will be borne by you. If you’re planning on being approved and serving as a foster parent in California, you’ll probably still want to know how much reimbursement you can expect to receive to help offset some of the costs of raising your foster child. In this article, we answer some of the most common questions prospective foster parents have about much they can expect to get paid, how the amount is determined, and other incentives they might be given to help take some of the weight of raising a foster child off their shoulders.

If you’re in it for the money, then you’re fostering for the wrong reasons. Foster families don’t actually get “paid” for taking care of a child. They receive reimbursements for the money they spend taking care of the child’s needs. This money is not meant to be used to buy a new car or pay for your rent or some other expenses that don’t have anything to do with the immediate essential needs of the foster child. Bear in mind that irrespective of the subsidy or financial assistance you receive, you will still be responsible for providing the essential items needed to adequately care for the child and the financial cost of that will be borne by you. If you’re planning on being approved and serving as a foster parent in California, you’ll probably still want to know how much reimbursement you can expect to receive to help offset some of the costs of raising your foster child. In this article, we answer some of the most common questions prospective foster parents have about much they can expect to get paid, how the amount is determined, and other incentives they might be given to help take some of the weight of raising a foster child off their shoulders.

- How much do foster parents get paid monthly per child: Depending on the county where you’re licensed as a foster parent, the reimbursement package ranges from $25 to $30 per day for each child. This amount increases if you’re fostering a child with additional needs.

- When do the payments start coming in: It usually takes a few weeks for the first payment to arrive, but that depends on the day the child was placed in your home. If you are with a Foster Family Agency (FFA), the counties generally send checks to the FFA around the initial 15 days of the month, so it could be that you have to wait a few weeks. Once the first payment arrives, you can expect to get a paycheck once every month to cover the essential needs of the child(ren) in your home.

- Take advantage of the cost-saving opportunities available to you: We know that bringing up a child today is an expensive affair. The state tries to soften the impact on your finances even further by giving valuable tax breaks to foster parents.

There are also programs offering free stuff like clothing for foster children.

There are also programs offering free stuff like clothing for foster children.

To qualify as a foster parent, you must have a stable and verifiable source of income which you can use to meet your family’s basic needs—food, shelter, and clothing. The reimbursements you get cannot be used as a primary source of income to cater to your family’s financial needs.

1. How much do foster parents get paid monthly per child?

The state of California pays foster parents an average of $1000 to $2,609 per month to help with the expenses from taking care of the child. It is one of the highest-paying states in the nation in this regard. This figure is for each child you take into your home. The highest rates correspond to children with additional needs, because they will require more attention, time, and tending to than other children. Know that you can’t just pocket the payments and take the child to the hospital or to visit other professionals that help with taking care of them. You need to be patient with children, shower them with more attention, listen and learn their needs, and basically find ways to care for them that wouldn’t complicate their situation even further. Children may have been severely neglected, suffered physical/sexual/emotional abuse, and may be carrying around complex emotional issues as a result of what they’ve been through. They may also have some condition—depression, anxiety, autism, or physical disablement—that prevents them from acting appropriately for their age or being able to respond normally to certain situations. Whatever their challenge is, you need to be understanding. Remember that you’re dealing with a person’s life. The child entrusted to your care will come to depend on you for so much, and you cannot afford to do wrong by them. It is also important to identify a foster family agency that is committed to providing you with the ongoing support needed. This will go a long way in ensuring that you are successful as a foster parent.

You need to be patient with children, shower them with more attention, listen and learn their needs, and basically find ways to care for them that wouldn’t complicate their situation even further. Children may have been severely neglected, suffered physical/sexual/emotional abuse, and may be carrying around complex emotional issues as a result of what they’ve been through. They may also have some condition—depression, anxiety, autism, or physical disablement—that prevents them from acting appropriately for their age or being able to respond normally to certain situations. Whatever their challenge is, you need to be understanding. Remember that you’re dealing with a person’s life. The child entrusted to your care will come to depend on you for so much, and you cannot afford to do wrong by them. It is also important to identify a foster family agency that is committed to providing you with the ongoing support needed. This will go a long way in ensuring that you are successful as a foster parent. You need to constantly examine yourself, be open to learning new skills and training that will allow you to communicate better with your foster child, and be an incredible parent to them. Raising a child is a lot to undertake, but it’s one of the most fulfilling things you can do. Even if you decide to adopt your foster child, you’ll still be entitled to receive a small monthly payment to assist with the child’s upkeep. The amount of money you’ll receive will depend on the child’s age and personal needs. The amount you receive in reimbursement depends on the county you reside in or the foster family. In California, the state prescribes a minimum monthly payment, but agencies may provide higher than the minimum. Talk to a foster family agency to learn more about what your foster care reimbursement payments may be. Hopefully, this payment will help make foster care a little less stressful for you and your family.

You need to constantly examine yourself, be open to learning new skills and training that will allow you to communicate better with your foster child, and be an incredible parent to them. Raising a child is a lot to undertake, but it’s one of the most fulfilling things you can do. Even if you decide to adopt your foster child, you’ll still be entitled to receive a small monthly payment to assist with the child’s upkeep. The amount of money you’ll receive will depend on the child’s age and personal needs. The amount you receive in reimbursement depends on the county you reside in or the foster family. In California, the state prescribes a minimum monthly payment, but agencies may provide higher than the minimum. Talk to a foster family agency to learn more about what your foster care reimbursement payments may be. Hopefully, this payment will help make foster care a little less stressful for you and your family.

2. When do the payments start coming in?

Every county or Foster Family Agency has its own timeline for payments, which you’ll be informed of after your application is approved and you’re given the clearance to start fostering. You will need to have some funds available while you wait at least one month before the payments are sent to you. Some counties are better at expediting payment than others, so the time for the first check to arrive may vary. Make sure you have money saved up to cover the childcare costs until the subsidy payments start coming in. In some cases, the county social worker may approve a one-time extra allowance for purchasing clothes for your foster child, but that also takes a while to arrive. So, be prepared to go shopping for clothes for your new ward out of your own pocket. But no need to go overboard with shopping. Like we mentioned earlier, this payment is not meant to cover all of the child’s expenses, only the basic needs. This includes:

You will need to have some funds available while you wait at least one month before the payments are sent to you. Some counties are better at expediting payment than others, so the time for the first check to arrive may vary. Make sure you have money saved up to cover the childcare costs until the subsidy payments start coming in. In some cases, the county social worker may approve a one-time extra allowance for purchasing clothes for your foster child, but that also takes a while to arrive. So, be prepared to go shopping for clothes for your new ward out of your own pocket. But no need to go overboard with shopping. Like we mentioned earlier, this payment is not meant to cover all of the child’s expenses, only the basic needs. This includes:

- Transportation

- Food

- Clothing

- Personal expenses

You won’t have to worry about medical bills because every foster child is covered under the state’s health insurance. Behavioral or mental health needs are also included under their insurance coverage.

Behavioral or mental health needs are also included under their insurance coverage.

3. Take advantage of the cost-saving opportunities available to you

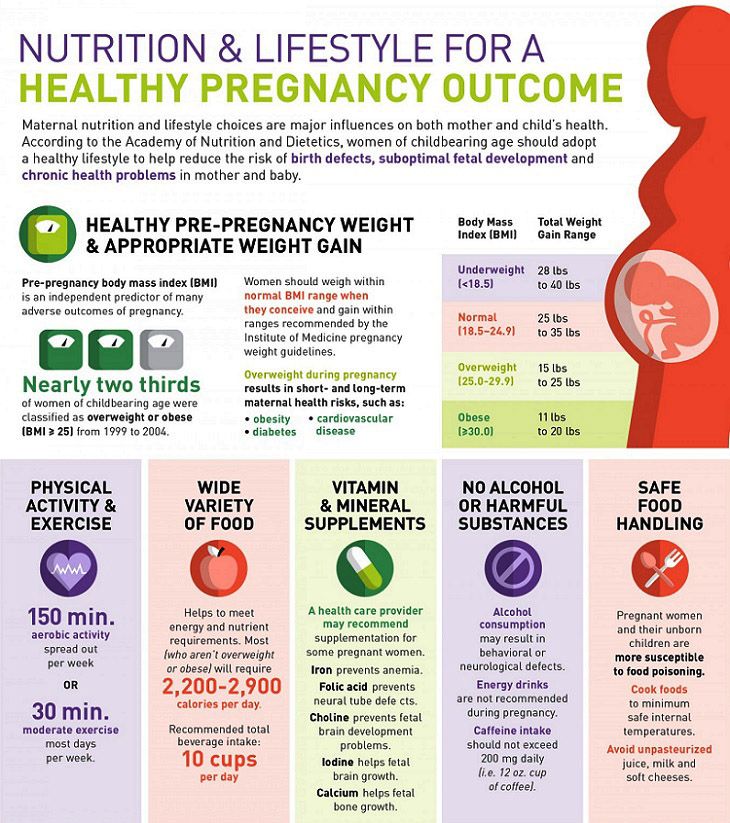

The reimbursement payment you get is not the only financial aid that you can receive as a foster parent. There are a number of other options you can explore as well to help you cut costs such as a tax credit. Although foster children do not qualify for many of the same deductions and credits as biological or adopted children, they’re still eligible for a couple of tax breaks. For starters, the reimbursements you receive from the state are non-taxable so you don’t have to worry about it being cut down any further. Check to see whether your county also provides childcare coverage so you can work while being a foster parent without having to carry the entire cost of childcare alone. This can help you save money that would have been spent on babysitting and other related expenses. There are programs that provide free clothing and gifts for foster children. Signing up for them is another great way to cut down on the costs of foster parenting. Additionally, if your foster child is an infant, toddler, or under the age of 5, they are probably eligible for the Women, Infants, and Children (WIC) special supplemental nutrition program, which is aimed at providing nutritious foods to supplement diets for women and children at nutritional risk. Don’t be ashamed about needing a little extra help to care for the foster child in your care. You’re doing the best that you can to see that they have a good life and that’s all that matters.

Signing up for them is another great way to cut down on the costs of foster parenting. Additionally, if your foster child is an infant, toddler, or under the age of 5, they are probably eligible for the Women, Infants, and Children (WIC) special supplemental nutrition program, which is aimed at providing nutritious foods to supplement diets for women and children at nutritional risk. Don’t be ashamed about needing a little extra help to care for the foster child in your care. You’re doing the best that you can to see that they have a good life and that’s all that matters.

Conclusion

When you take into account the responsibilities that come with being a foster parent, the stipend, it becomes evident that the money received should not be the primary reason for deciding to be a foster parent. Just remember that financial gain is not an incentive to foster. You shouldn’t consider the reimbursement you receive as payment for doing your job because you’re not being paid for providing a service. The payment is to help cover the costs of caring for the child in your home. Your true reward is in being able to help a vulnerable child feel safe, supported, and loved. If after looking at the numbers above and understanding what exactly you’ll be signing up for and you’re still interested in becoming a foster parent in California, all you need to do is contact a reputable foster family agency and get started on your application.

The payment is to help cover the costs of caring for the child in your home. Your true reward is in being able to help a vulnerable child feel safe, supported, and loved. If after looking at the numbers above and understanding what exactly you’ll be signing up for and you’re still interested in becoming a foster parent in California, all you need to do is contact a reputable foster family agency and get started on your application.

"How much do you earn?" What to answer if the child asks.

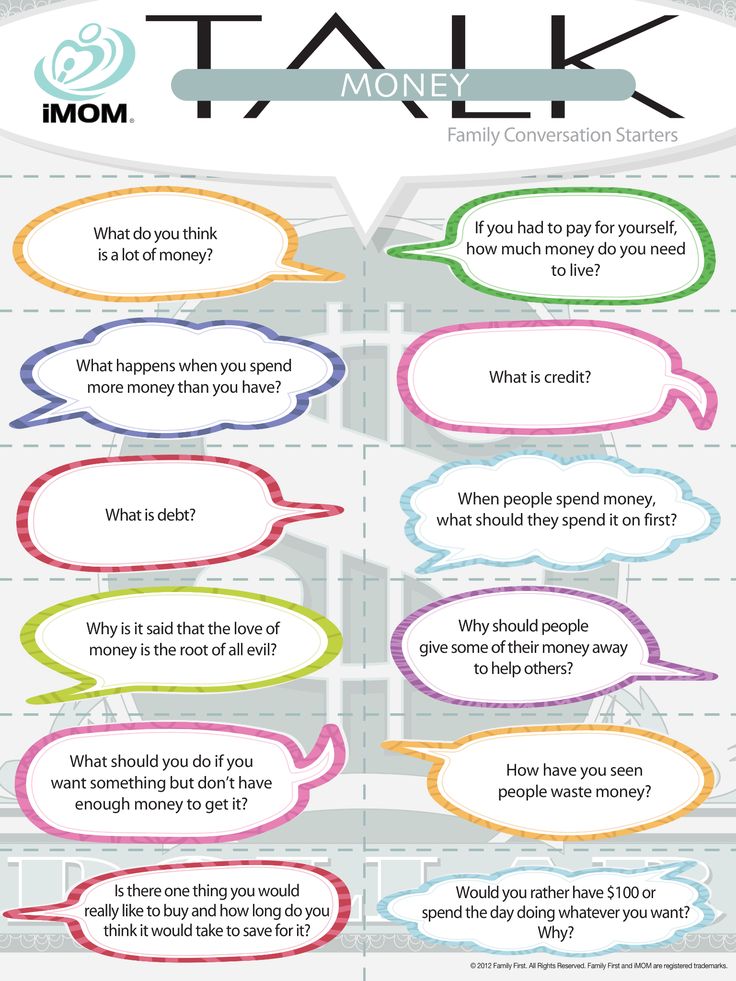

. If you want to raise a personality, a person for whom the topic of money will not be some kind of taboo, and who will be able to calmly discuss financial topics from early childhood, the answer is “It's none of your business!” or “it’s too early for you to know” is not good.

Nevertheless, to name a specific figure until a certain time (up to 12-13 years old according to the recommendations of child psychologists, which I have seen more than once in books, in studies, because I have studied this issue closely) may also not be the most correct option.

And the first thing to do is to understand why the child is asking this question and use this situation as a very important and powerful learning moment.

Ask the child “Why are you asking?”

This will give you time to think about your answer. It will also help you understand what is on the child's mind. Sometimes children just need to make sure that everything is in order in the family. This often happens when they witness money disputes or feel financial stress in the family. Depending on the response you receive, you may only be able to reveal the required piece of information.

Someone doesn't care and calls a number right away. I believe that such sensitive information should be revealed gradually as the child's psyche is ready to perceive it adequately.

By analogy, we do not disclose to children all the information about sex and the birth of children at once, we give it out gradually, as their psyche matures.

So it is with information about money. And I say this for a reason, but I study this issue from time to time, because I have two growing daughters.

Depends on age

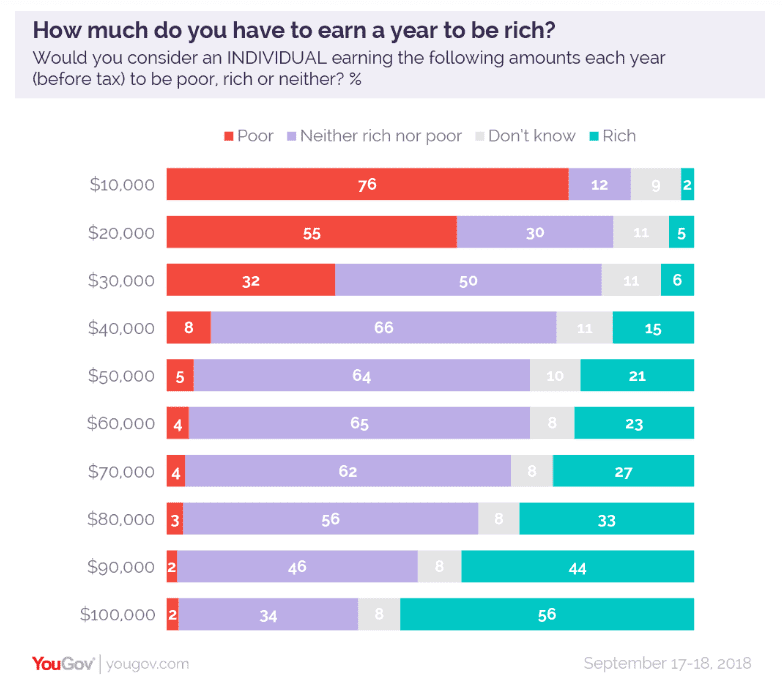

Children, especially small ones, do not fully understand the value of money. It doesn't matter if you earn $1,000, $10,000, or $100,000 - for a child, this can be a huge amount that a child is not able to understand. Therefore, at an early age, instead of a number, you can answer something like “there is enough money to pay for food, clothes, housing, a car, etc.”, “we are not poorer than others, we live well, better than many people, but there are people richer than us.”

If you name a number, tell your child that this information should never go outside the family

The last thing you want is for your child to run around kindergarten or school and brag to other children that your family has a lot of money. Explain to him the very serious consequences of such behavior. Remember that children are recommended to name the number only after 12-13 years.

Explain to him the very serious consequences of such behavior. Remember that children are recommended to name the number only after 12-13 years.

I would recommend explaining to your child that you are not richer than others, even if you are.

Again, it may not be necessary to disclose all of the information to , but this measure will save your child from feeling superior to others.

What information to disclose and when - in addition to age, it also depends on the level of trust gained by the child

fully reveal the numbers.

Forbid your child to brag about money

Such behavior should have very serious consequences, which the child should also be aware of.

Children and Money - A guide for parents with any level of financial literacy, for teaching children of all ages from 4 years old. From a professional financier in collaboration with a practicing family psychologist, author of popular books. Find out more here.

Find out more here.

If you open a figure, be sure to show expenses

If the child is old enough, for example a teenager, show not only income, but also expenses: we pay so much for housing, so much for a car, so much for a communal apartment, for clothes, so much we save for the future and their education, etc. That's what's left and that's what we're doing with it, and for reasons like that. Teenagers should know, for example, that after taxes and other deductions, your salary is much less than your actual salary.

If a child is bored listening to this, then he is NOT ready to find out the income figure!

I read an interesting example in a book when my father brought home 10,000 dollars (his monthly income) in small bills and put everything on the table. It looked as if my father had robbed a bank :))) Then he began to arrange banknotes in other piles: payment for housing, for a car, for tuition, etc.

In the end, there was only a small handful left. According to the revelations of the father, he managed to completely "capture" the attention of his children with this exercise. According to the recollections of the children, they remembered this “visual” lesson for the rest of their lives.

Do not lie or hide

Reveal information in parts, depending on the child's financial background and the trust they have earned. This will help prepare your children for the future. Children of the creature are cunning and one way or another will find this information sooner or later. If it's incomplete, they'll figure out the missing parts themselves. What they end up with in their head can seriously harm them and you.

Anyway, I think it's better not to give answers to any questions is a very bad strategy, it is very wrong. I want my daughters and my wife to be able to always come to me or my wife with any question and that they can get a good answer and advice.

And by the way, you don't always have to answer at lightning speed - you're not on an exam. Not sure what to answer, take your time, study the question, but always come back with an answer.

This question has already arisen in my eldest daughter, who is now 6 years old. I did not name the number, she did not insist YET. But I let her know that we are not poor, that we are average, that there is enough for everything, that we live well. And I have not yet had to dedicate it to the numbers. But soon I'm sure I'll have to disclose information. By the way, I already disclosed some information. My daughter earns pocket money. And sometimes I tell her, look at how many times you have to do such and such a job. And she already perfectly correlates this information with the amount of work. But it works on small amounts

Also download the free PDF! MEMO FOR PARENTS "CHILDREN AND MONEY", in which I will tell you how and what to teach a child at different ages + I will give a list of simple exercises. Is free. After all, there is no better teacher in the world than work. And if a child understands from childhood what labor is, information about earnings and other monetary issues will be perceived on a prepared head and will not be some kind of shock.

Is free. After all, there is no better teacher in the world than work. And if a child understands from childhood what labor is, information about earnings and other monetary issues will be perceived on a prepared head and will not be some kind of shock.

Memo for parents "Children and money" - how and what to teach a child at different ages + a list of simple exercises. "The ability to manage money is one of the most important and valuable skills in life that parents can teach a child!". Free Download! What's going on in Timur's family

▫️ Scientists have proven that parents of successful children do these 10 things our children into poverty

📢 Audio version

Audio version in i-tunes here

👍 If you have learned something useful for yourself, please support the MoneyPapa project and do the following:

0 1️⃣ 2️⃣ Subscribe to me on YouTube, Instagram and Telegram

3️⃣ Like and comment on any post

🙏 You can financially support the MoneyPapa project here

So I will know that my team and I are doing something important and necessary for people! Thanks a lot in advance!

***

👋 And I wish you well-being in finances, in the family and in life!

Timur Mazaev, aka MoneyPapa

ADD_THIS_TEXT

ADD_THIS_TEXT

Financial literacy for preschoolers and teenagers

We live in a material world, and the ability to manage money wisely is an important skill that parents should teach their children. Let's find out at what age to start introducing a child to the world of finance and how to do it right.

Let's find out at what age to start introducing a child to the world of finance and how to do it right.

What is financial literacy?

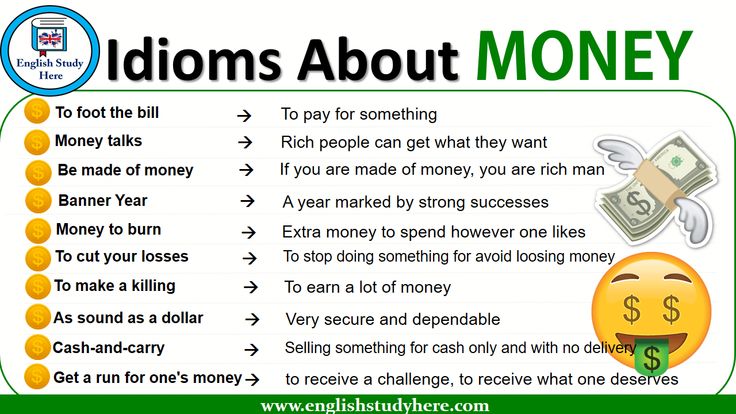

Financial literacy is an understanding of the economic processes taking place in the country and the world and the ability to manage your budget so as not to live at a loss. The lack of financial literacy has a negative impact on a person’s well-being: he takes unnecessary loans, gets into debt, and spends money irrationally.

Money is a medium of exchange, and if a person does not know its value, it will be difficult for him to provide for himself and his family. The capitalist structure of society does not accept an irresponsible attitude towards money. Therefore, people who do not know how to properly manage them will never be successful.

It is necessary to inculcate the basics of financial literacy from childhood. If a child does not learn to plan a personal budget and save money, then as an adult, he will often make mistakes and make unnecessary expenses.

What should a child know about money?

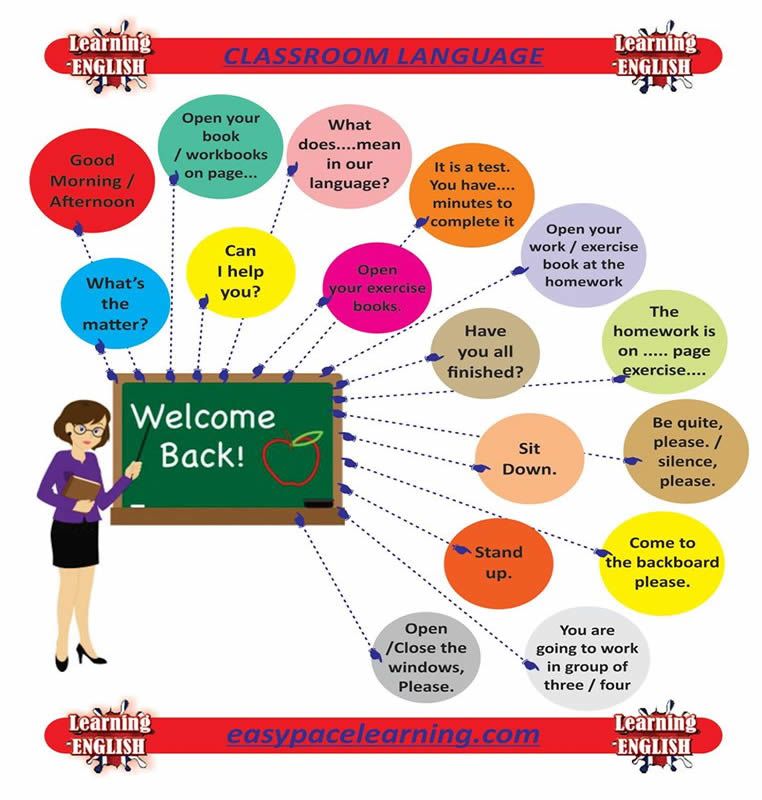

You can introduce your baby to finances from the age of three or four . At this age, he already has basic ideas about life, and he understands that money is needed to purchase goods and services. Tell your child that money is the main medium of exchange in the modern world. People work and are paid for their work in the form of money, and then exchange it for various goods and services. There is no special value in money itself. What is valuable is what you can buy for them.

Show the child bills and coins , tell them where they come from (they are issued by the state and no one except him has the right to print money). Consider banknotes and coins with your child, explain that each of them has its own denomination. Explain that every item has a price. Invite your child to compare the cost of different goods (for example, bread, toys, phone, car).

How to introduce a child to the world of finance?

From an early age, the baby must learn to understand that money is not just pieces of paper that somehow appear in a wallet, but the result of human labor . Tell him about your work and the work of other family members. Let the child know how useful your profession is and what you get paid for. If possible, bring the baby to your work and show what exactly you are doing there. It is much more interesting and useful to visually see the labor process than to hear abstract stories about it.

But don't reduce the whole meaning of work to earnings . Explain to the child that people work not only for the sake of money, but also for the sake of helping others, society. Give examples of professions familiar to the baby (doctor, salesperson, kindergarten teacher, school teacher, bus driver, etc.), explain why they are important and how difficult it would be for people without them.

Raise in your child not only a responsible attitude to finances, but also respect for work. This will teach him in the future to appreciate his work and the work of others. Tell that every person has to work. But before you start doing this, you need to go to school, and then enter a higher educational institution and get a profession. Ask the baby what professions he likes and what he would like to be when he grows up.

It seems to children that their parents earn a lot of money, but they do not want to buy toys and sweets because they are harmful. Explain to your son or daughter what the majority of your income is spent on (paying utility bills, food, gasoline or public transport and other expenses). When the kid understands that parents do not hide their salary and do not spend it on personal “Wishlist”, but spend it for the benefit of the family, he will not be offended by the refusal to buy him another trinket or treat.

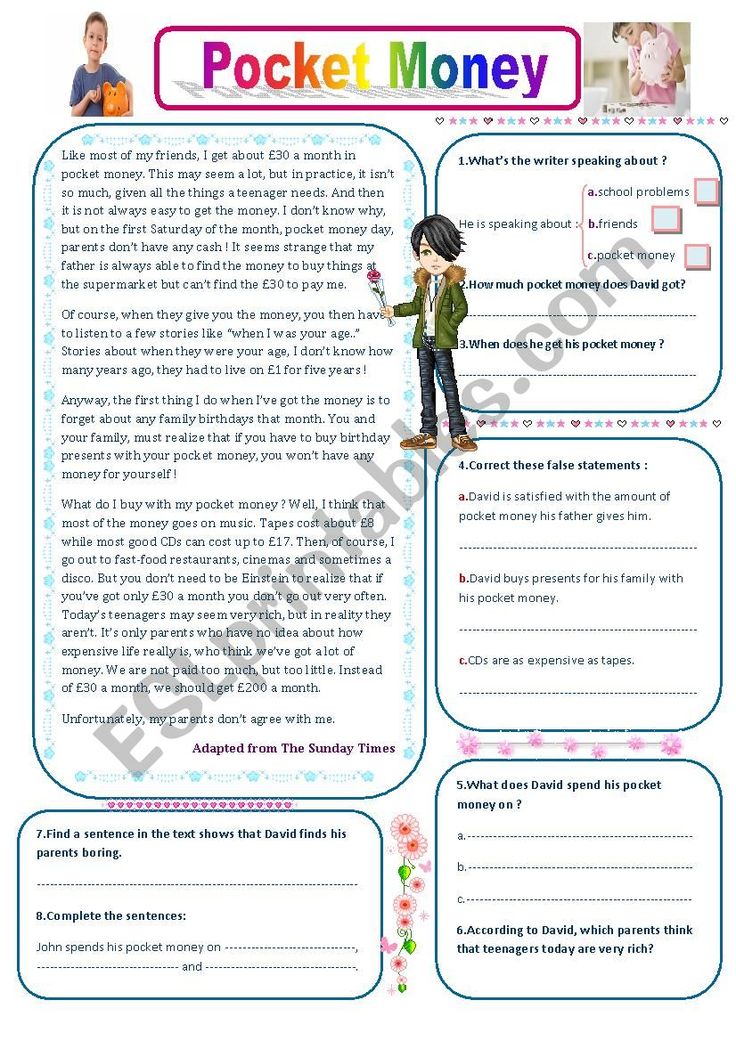

Rules for pocket money

One of the best ways to teach your child how to manage finances is to give him pocket money and keep track of how he spends it. Some parents are afraid to give their children money for personal expenses, and for good reason. The kid will not be able to learn how to properly manage finances if he does not have them on hand. You can tell him all you want about the importance of saving, but he will not be able to learn it without trying it in practice.

Of course, you shouldn't expect reasonable handling of finances from a preschooler. Most likely, having received his first money, he immediately wants to spend it all to the last penny. Don't forbid. Let the baby be convinced from his own experience that senseless spending does not bring benefits. Explain that if he wants to buy some necessary thing, for example, a specific toy, he needs to save up money. And in order to accumulate them, you need to learn to deny yourself momentary temptations.

Many parents are concerned about: How much money can you give a child? Everything here depends on his age and the well-being of his family. Determine the amount that you can allocate to your son or daughter per day / week / month without prejudice to the family budget.

If a child spends money unwisely, do not scold him or threaten to take it away, but advise how best to use it. Financial losses and useless spending is the lesson that a child must go through in order to learn the value of money. Pocket money is a "learning" means on which the baby learns to control his spending. He will inevitably make small mistakes that will help him avoid big mistakes already in adulthood.

If a child diligently saves up for the desired purchase, denying himself temptations, reward him by adding the missing amount. Explain that if there is not enough money for a good thing, it is better to wait and save up than to buy a product of dubious quality. The process of accumulation develops in the child patience, responsibility, purposefulness and the ability to resist momentary desires.

The process of accumulation develops in the child patience, responsibility, purposefulness and the ability to resist momentary desires.

Give your son or daughter a piggy bank. A beautiful figurine of a pig, a cat or a favorite cartoon character, standing in front of the kid's room, will motivate him to save money. Children really like modern piggy banks that “eat” bills and coins or are closed with a combination lock. You can choose a model with the child, so that he is definitely satisfied.

It is not necessary to send all the money that falls into the hands of the baby into the piggy bank. He can set aside part of the funds received, and spend the rest on sweets or trinkets. The main thing is to teach him to replenish the piggy bank regularly, and not from case to case.

How to teach children to control their finances?

From the age of three or four, introduce your child to finances using the example of joint purchases. Explain to him that if you have a certain amount in your wallet, you cannot buy everything you want. You need to learn how to make a choice, refusing unnecessary purchases at the moment.

You need to learn how to make a choice, refusing unnecessary purchases at the moment.

From the age of five or six, you can start teaching your child to shop on their own . Of course, for this you must first teach him to count. For this purpose, a set of magnetic numbers and signs is suitable. They can be mounted on a refrigerator or any other metal surface.

Go shopping together and let your baby buy something in your presence. When he gets older, you can send him shopping himself, having previously made a list of the necessary.

The best way to teach your child how to manage their finances is by example. Children imitate their parents and do the same. If you spend money left and right, do not expect a reasonable approach to finances from your son or daughter.

Learn how to manage a family budget: start a notebook or spreadsheet and write down all income and expenses there. Plan your expenses for the month, distribute them by category (utility payments, groceries, clothes, etc.). Show your notes to the child and explain why you keep them, how they help to avoid unnecessary expenses.

Plan your expenses for the month, distribute them by category (utility payments, groceries, clothes, etc.). Show your notes to the child and explain why you keep them, how they help to avoid unnecessary expenses.

It will be useful for a student to learn about various financial instruments - loans, investments, savings and savings accounts. If you understand this, be sure to tell the child.

You can open a children's account in the bank in the name of the child and deposit small amounts into it. Over time, the child himself may begin to transfer part of his personal money there. Teach your son or daughter how to use payment cards and how to read a bank statement. Be sure to introduce the child to the ATM, show how to withdraw money from it, tell them where they come from.

Helpful resources for children and parents

Introduce your child to finance in a way they can understand. The best way to do this is with the help of thematic literature. There are books that explain to children in simple terms what money is and why it is important to learn how to use it correctly. Here are a few books from domestic and foreign authors:

There are books that explain to children in simple terms what money is and why it is important to learn how to use it correctly. Here are a few books from domestic and foreign authors:

- Sergey Bidenko and Irina Zolotarevich. How to teach kids about money.

- Timur Mazaev and Elizaveta Filonenko. "Children and money".

- Elena Ul'eva. “Where does the money come from? Encyclopedia for kids.

- Joline Godfrey. How to teach a child to handle money.

- Anna Voronina, Tatiana Voronina, Tatiana Popova. "Mathematics and money: buy, sell, change."

- Sergey Fedin. "Financial Literacy".

- Heidi Fiedler. “Instructions for money. An amazingly fun guide to the world of finance."

- Sergey Bidenko and Irina Zolotarevich. “I want to earn. Useful tips for children and teenagers + 60 earning ideas.

- Bodo Schaefer. "A dog named Mani."

- Jerry Bailey and Felicia Lo. How to spend money wisely.

- Sergey Bidenko and Irina Zolotarevich.

"Financial Stories for Teens".

"Financial Stories for Teens". - Jerry Bailey and Felicia Lo. "Your money".

- Igor Lipsits. "Amazing Adventures in the Country Economy".

- Alexey Goryaev and Valeria Chumachenko. "Financial literacy for schoolchildren".

- Vladimir Nikishin. "Money".

You can develop financial literacy not only with the help of books, but also through games. Toddlers love to play "shop" and will be delighted if you allow them to use real coins and small bills instead of paper.

Older children can play the famous economic board game "Monopoly" (analogues - "Manager", "Businessman", "Empire"). Get together in the evening with the whole family and play. This game captivates not only children, but also adults. It encourages thinking, calculating moves and decisions. There are also more complex games: "Cash Flow", "Capital", "Millionaire", "Billionaire", "Antimonopoly". Choose what you and your child like.

If a child wants to save money, install a special mobile application on his phone to control his finances.