How much will you get back in taxes with one child

2022 Child Tax Credit: Definition, How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

For the 2022 tax year, taxpayers may be eligible for a credit of up to $2,000 — and $1,500 of that may be refundable.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

This article has been updated for the 2022 tax year.

The child tax credit is a federal tax benefit that plays an important role in providing financial support for American taxpayers with children. For the 2022 tax year, people with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent, and $1,500 of that credit may be refundable.

We’ll cover who qualifies, how to claim it and how much you might receive per child.

What is the child tax credit?

The child tax credit, commonly referred to as the CTC, is a tax credit available to taxpayers with dependent children under the age of 17. In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

You’ll also need to show that your income falls beneath a certain threshold because the credit phases out in increments after a certain limit is hit. If your modified adjusted gross income exceeds the ceiling, the credit amount you get may be smaller, or you may be deemed ineligible altogether.

Who qualifies for the child tax credit?

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Determining your eligibility for the credit begins with understanding which children qualify and what other criteria you need to be mindful of.

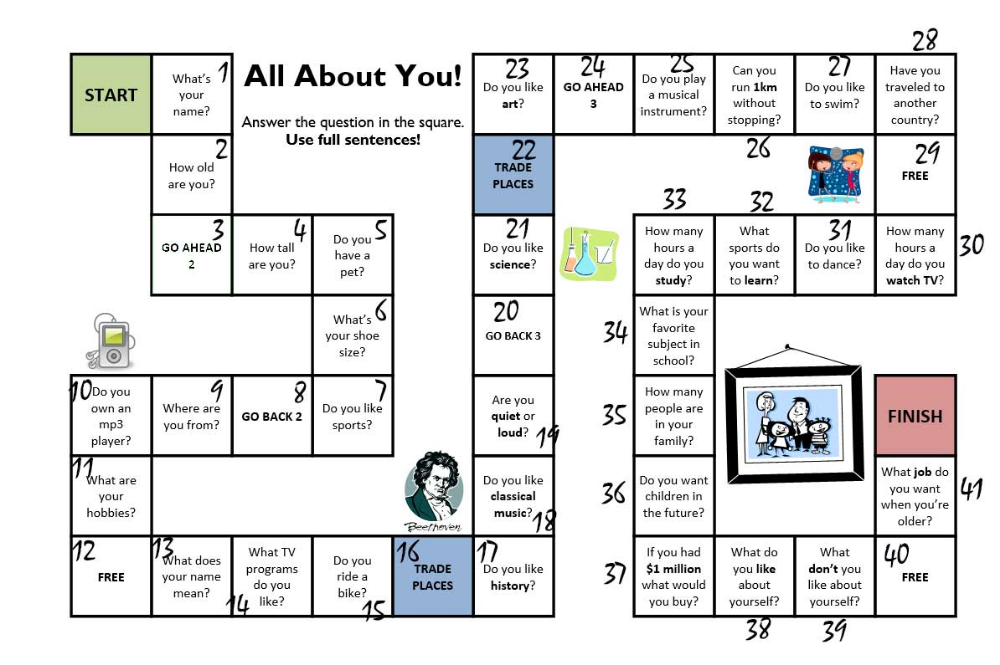

Generally, there are seven “tests” you and your qualifying child need to pass.

Age: Your child must have been under the age of 17 at the end of 2022.

Relationship: The child you’re claiming must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of those people (e.

g., a grandchild, niece or nephew).

g., a grandchild, niece or nephew).Dependent status: You must be able to properly claim the child as a dependent. The child also cannot file a joint tax return, unless they file it to claim a refund of withheld income taxes or estimated taxes paid.

Residency: The child you’re claiming must have lived with you for at least half the year (there are some exceptions to this rule).

Financial support: You must have provided at least half of the child’s support during the last year. In other words, if your qualified child financially supported themselves for more than six months, they’re likely considered not qualified.

Citizenship: Per the IRS, your child must be a "U.S. citizen, U.S. national or U.S. resident alien," and must hold a valid Social Security number.

Income: Parents or caregivers claiming the credit also typically can’t exceed certain income requirements. Depending on how much your income exceeds that threshold, the credit gets incrementally reduced until it is eliminated.

Did you know...

If your child or a relative you care for doesn't quite meet the criteria for the CTC but you are able to claim them as a dependent, you may be eligible for a $500 nonrefundable credit called the "credit for other dependents." Check the IRS website for more information.

How to calculate the child tax credit

For the 2022 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers). If your MAGI exceeds those limits, your credit amount will be reduced by $50 for each $1,000 of income exceeding the threshold until it is eliminated.

The CTC is also partially refundable; that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to apply for a tax refund of up to $1,500 for anything left over. This partially refundable portion is called the “additional child tax credit” by the IRS.

How to claim the credit

You can claim the child tax credit on your Form 1040 or 1040-SR. You’ll also need to fill out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”), which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

Most quality tax software guides you through claiming the child tax credit with a series of interview questions, simplifying the process and even auto-filling the forms on your behalf. If your income falls below a certain threshold, you might also be able to get free tax software through IRS’ Free File.

A word of warning: In the eyes of the IRS, you’re ultimately responsible for all information you submit, even if someone else prepares your return.

🤓Nerdy Tip

If you applied for the additional child tax credit, by law the IRS cannot release your refund before mid-February.

Consequences of a CTC-related error

An error on your tax form can mean delays on your refund or on the CTC part of your refund. In some cases, it can also mean the IRS could deny the entire credit.

If the IRS denies your CTC claim:

You must pay back any CTC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information To Claim Certain Credits After Disallowance," before you can claim the CTC again.

If the IRS determines that your claim for the credit is erroneous, you may be on the hook for a penalty of up to 20% of the credit amount claimed.

State child tax credits

In addition to the federal child tax credit, a few states, including California, New York and Massachusetts, also offer their own state-level CTCs that you may be able to claim when filing your state return. Visit your state's department of taxation website for more details.

History of the CTC

Like other tax credits, the CTC has seen its share of changes throughout the years. In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

Here's a brief timeline of its history.

1997: First introduced as a $500 nonrefundable credit by the Taxpayer Relief Act.

2001: Credit increased to $1,000 per dependent and made partially refundable by the Economic Growth and Tax Relief Reconciliation Act.

2017: The TCJA made several changes to the credit, effective from 2018 through 2025. This included increasing the credit ceiling to $2,000 per dependent, establishing a new income threshold to qualify and ensuring that the partially refundable portion of the credit gets adjusted for inflation each tax year.

2021: The American Rescue Plan Act made several temporary modifications to the credit for the 2021 tax year only. This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.

2022–2025: The 2021 ARPA enhancements ended, and the credit will revert back to the rules established by the TCJA — including the $2,000 cap for each qualifying child.

Frequently asked questions

1. Does the CTC include advanced payments this year?

The American Rescue Plan Act made several temporary modifications to the credit for tax year 2021, including issuing a set of advance payments from July through December 2021. This enhancement has not been carried over for this tax year as of this writing.

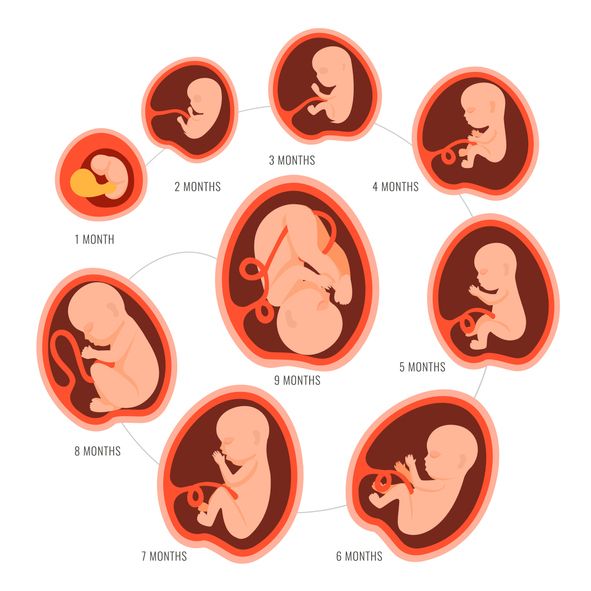

2. I had a baby in 2022. Am I eligible for the CTC?

Yes. You'll likely need to make sure your child has a Social Security number before you apply, though.

3. Is the child tax credit taxable?

No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and if you have no liability, you may be able to get a portion of the credit back in the form of a refund.

4. Is the child tax credit the same thing as the child and dependent care credit?

No. This is another type of tax benefit for taxpayers with children or qualifying dependents. It covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work. The IRS has more details here.

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

What is the Child Tax Credit (CTC)? – Get It Back

What is the Child Tax Credit (CTC)?

This tax credit helps offset the costs of raising kids and is worth up to $3,600 for each child under 6 years old and $3,000 for each child between 6 and 17 years old. You can get half of your credit through monthly payments in 2021 and the other half in 2022 when you file a tax return. You can get the tax credit even if you don’t have recent earnings and don’t normally file taxes by visiting GetCTC.org through November 15, 2022 at 11:59 pm PT. Learn more about monthly payments and new changes to the Child Tax Credit.

Raising children is expensive—recent reports show that the cost of raising a child is over $200,000 throughout the child’s lifetime. The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

The Child Tax Credit (CTC) can give you back money at tax time to help with those costs. If you owe taxes, the CTC can reduce the amount of income taxes you owe. If you make less than about $75,000 ($150,000 for married couples and $112,500 for heads of households) and your credit is more than the taxes you owe, you get the extra money back in your tax refund. If you don’t owe taxes, you will get the full amount of the CTC as a tax refund.

Click on any of the following links to jump to a section:

- How much can I get with the CTC?

- Am I eligible for the CTC?

- Credit for Other Dependents

- How to claim the CTC

Depending on your income and family size, the CTC is worth up to $3,600 per child under 6 years old and $3,000 for each child between ages 6 and 17. CTC amounts start to phase-out when you make $75,000 ($150,000 for married couples and $112,500 for heads of households). Each $1,000 of income above the phase-out level reduces your CTC amount by $50.

If you don’t owe taxes or your credit is more than the taxes you owe, you get the extra money back in your tax refund.

There are three main criteria to claim the CTC:

- Income: You do not need to have earnings.

- Qualifying Child: Children claimed for the CTC must be a “qualifying child”. See below for details.

- Taxpayer Identification Number: You and your spouse need to have a social security number (SSN) or an Individual Taxpayer Identification Number (ITIN).

To claim children for the CTC, they must pass the following tests to be a “qualifying child”:

- Relationship: The child must be your son, daughter, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency.

- Age: The child must be 17 or under on December 31, 2021.

- Residency: The child must live with you in the U.

S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required).

S. for more than half the year. Time living together doesn’t have to be consecutive. There is an exception for non-custodial parents who are permitted by the custodial parent to claim the child as a dependent (a waiver form signed by the custodial parent is required). - Taxpayer Identification Number: Children claimed for the CTC must have a valid SSN. This is a change from previous years when children could have an SSN or an ITIN.

- Dependency: The child must be considered a dependent for tax filing purposes.

A $500 non-refundable credit is available for families with qualifying dependents who can’t be claimed for the CTC. This includes children with an Individual Taxpayer Identification Number who otherwise qualify for the CTC. Additionally, qualifying relatives (like dependent parents) and even dependents who aren’t related to you, but live with you, can be claimed for this credit.

Since this credit is non-refundable, it can only help reduce taxes owed. If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

If you can claim both this credit and the CTC, this will be applied first to lower your taxable income.

There are two steps to signing up for the CTC. To get the advance payments, you had to file 2020 taxes (which you file in 2021) or submitted your info to the IRS through the 2021 Non-filer portal (this tool is now closed) or GetCTC.org. If you did not sign up for advance payments, you can still get the full credit by filing a 2021 tax return (which you file in 2022).

Even if you received monthly payments, you must file a tax return to get the other half of your credit. In January 2022, the IRS sent Letter 6419 that tells you the total amount of advance payments sent to you in 2021. You can either use this letter or your IRS account to find your CTC amount. On your 2021 tax return (which you file in 2022), you may need to refer to this notice to claim your remaining CTC. Learn more in this blog on Letter 6419.

Going to a paid tax preparer is expensive and reduces your tax refund. Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

Luckily, there are free options available. You can visit GetCTC.org through November 15, 2022 to get the CTC and any missing amount of your third stimulus check. Use GetYourRefund.org by October 1, 2022 if you are also eligible for other tax credits like the Earned Income Tax Credit (EITC) or the first and second stimulus checks.

The latest

By Tysheonia Edwards, 2022 Get It Back Campaign Intern Identity theft happens when…

By Christine Tran, 2021 Get It Back Campaign Intern & Reagan Van Coutren,…

Internet access is essential for work, school, healthcare, and more. The Affordable Connectivity…

Tax deduction - Medline Clinic in Barnaul

Have you paid taxes? Take them back to the state!

A significant part of the Russian population pays taxes. However, this amount can be reduced. There is a tax deduction for this. What's this? When making such a deduction, the state reduces the amount from which taxes are paid. It is also called the return of a certain part of the previously paid personal income tax (personal income tax) when buying real estate, spending on treatment or training. It is important to note that you can get a tax deduction not only when paying for your examinations and medicines. The tax is returned even from the amount of expenses for the treatment of close relatives

However, this amount can be reduced. There is a tax deduction for this. What's this? When making such a deduction, the state reduces the amount from which taxes are paid. It is also called the return of a certain part of the previously paid personal income tax (personal income tax) when buying real estate, spending on treatment or training. It is important to note that you can get a tax deduction not only when paying for your examinations and medicines. The tax is returned even from the amount of expenses for the treatment of close relatives

What expenses can be included in the deduction for treatment

The following expenses can be included in the deduction:

- Medical services - tests, examinations, doctor's appointments, procedures in paid clinics. Provided that you paid for it, that is, the services are not under the CHI policy, but at your expense.

- Prescribed medicines. Starting in 2019, you can get a deduction for the cost of any drug, not just those on the government's list.

- Expensive treatment. This is the only type of medical expenses for which there is no limit: any amount is accepted for deduction without restrictions. Types of expensive treatment are in a special list, this is followed by a medical organization when it issues a certificate of the cost of services.

- Contributions under the VHI agreement.

Relatives for which the deduction for treatment is given

The deduction for treatment can be received not only when paying for your examinations and medicines. The tax is returned even from the amount of expenses for the treatment of close relatives, but not any, but only from a limited list.

Here is a complete list of relatives whose treatment can be included in your tax deduction:

- Parents. The deduction will be given only when paying for the treatment of their parents. If you pay for the spouse's parents or adoptive parents, the tax will not be refunded. There are no parental requirements.

They can work under an employment contract, or they can be pensioners, unemployed or self-employed individual entrepreneurs.

They can work under an employment contract, or they can be pensioners, unemployed or self-employed individual entrepreneurs. - Children or wards under 18 years of age. The deduction for treatment is only for your children. If you pay for tests and examinations of your spouse's children, even when they are fully supported, personal income tax cannot be returned. There is also an important condition regarding age: the child must be no more than 18 years old. Moreover, the fact of studying at a full-time university does not extend this age to 24 years: this is possible with education, but with treatment - only up to 18 years.

- Spouses. If a husband pays for his wife, he can get a deduction. And the wife will return the tax when paying for the treatment of her husband. But the marriage must be officially registered. A certificate of payment for medical services and checks for the purchase of drugs can be issued to any spouse: their expenses are still considered general.

You cannot get a deduction for other relatives. Unlike training, there are no siblings on this list. If you pay for dental treatment or surgery for your sister, you will not receive a deduction. For grandparents, common-law spouse, children of the wife from the first marriage, nephews or mother-in-law, the tax cannot be refunded.

The list of relatives is closed and there can be no additional conditions.

How to return money for treatment

How much money can be returned when paying for the treatment of relatives

Cost limit. The deduction for treatment has a limit - 120,000 R per year. This is a general limit for several social deductions, for example, it also includes tuition costs. 120,000 R is a restriction not for each type of expense, but for all.

Here are the expenses that will be included in the limit:

- Training.

- Treatment.

- DMS.

- Voluntary contributions to pensions.

- Voluntary life insurance.

- Additional contributions to the funded part of the pension.

- Independent qualification assessment.

When paying for the treatment of relatives, an additional deduction will not be given: both your own and their expenses must be included in this limit.

120,000 R does not include only the cost of educating children - there is a separate limit of 50,000 R for each child - and expensive types of treatment that are accepted for deduction without taking into account the limit. There is also a social deduction for charity, but it has separate conditions and the limit is calculated as a percentage.

How much money will be returned

The amount of the deduction depends on your salary and the cost of treatment. In any case, the tax office will not return more money than the personal income tax paid for the year. Let's look at an example:

Vasily works as a manager and receives 40,000 R per month. In a year, he earned 480,000 R. He gives 13% of his salary to the state as a tax (personal income tax). For the year he paid 480,000 × 0.13 = 62,400 R.

In a year, he earned 480,000 R. He gives 13% of his salary to the state as a tax (personal income tax). For the year he paid 480,000 × 0.13 = 62,400 R.

In 2015, he spent 80,000 RUR on treatment. Vasily collected documents and applied for a tax deduction. After submitting the application, the tax authority will deduct the amount of treatment from Vasily’s income for the year and recalculate his personal income tax: (480,000 − 80,000) × 0.13 = 52,000 R.

It turns out that Vasily had to pay 52,000 R, but in fact he paid 62,400 R. The tax office will return the overpayment to him: 62,400 − 52,000 = 10,400 R.

The deduction can be made within three years following the year of treatment payment.

This money will go directly to the card, but you will have to wait.

How to draw up documents if you pay for relatives

- For your spouse. When paying for the treatment of a husband or wife, documents can be issued to anyone. The contract and receipts can be in the name of the husband or wife, it does not matter for the deduction.

It is believed that they have everything in common. The same expenses can be deducted by either spouse, but only by one. They can also be divided among themselves, this helps to return more tax, taking into account the limit.

It is believed that they have everything in common. The same expenses can be deducted by either spouse, but only by one. They can also be divided among themselves, this helps to return more tax, taking into account the limit.

- For children and parents. Payment documents must be issued to the person who pays and wants to receive a deduction. If receipts and a certificate are issued to the mother, the son will not be given a deduction for these expenses. Although you can try to resolve this issue with the help of a conventional written power of attorney. The contract for medical services should contain a wording from which it is clear that it is concluded with this person - the one who claims the deduction - for the treatment of this relative. But if this did not work out, this usually does not interfere with the return of the tax. The tax first of all looks at payment documents and a certificate. This is really important.

How to return personal income tax from the costs of treatment for the past year

For the past year, you can return the tax only on the declaration. Through the employer return only in the current year.

Through the employer return only in the current year.

Here is the instruction:

- Get medical bills. This is a special document, it must be issued by the organization to which you paid for the treatment. Now everything is stored electronically, so usually you don’t even need to show receipts. The help will indicate the code - "1" or "2". If it is "1", then you need to take into account the limit, if "2" - the entire amount will be deducted.

- Make copies of documents that confirm your relationship: birth and marriage certificates.

- Fill out the 3-personal income tax declaration in your personal account on the nalog.ru website. It can be filled out in a special program or handed in on paper, but through the site - this is the easiest, fastest and most convenient way that will insure you against mistakes and speed up the verification. Scans or photographs of documents must be attached to the declaration.

To receive documents for a tax deduction, you can apply to the administrator-cashier at our Center or send a request electronically by filling out the form below.

Dear patients, when filling out the form, be sure to indicate:

- contact details

- period for which documents must be submitted

- list of required documents

Tax deduction application form

Sergey

Hello, I was treated at the clinic with my own problem, which was helped by a wonderful surgeon, coloproctologist Galyatin Denis Olegovich. Many thanks to the team of the clinic "Medline". All health!

Vladimir

I want to express my gratitude to Denis Olegovich Galyatin for a successful and easy operation and my quick recovery. A very good center and excellent specialists! Thank you all! I recommend 100% to everyone who has a problem in urology and proctology.

all clinic reviews

taxes: the latest news for today, the latest information | fontanka.

ru

ru All rubrics

All rubricsPoliticsWorkCityIncidentsGovernmentBusinessSocietyConstructionSportHousing and communal servicesPicture PlusReal EstateTourismSpecial opinionOpen letterFinanceBusiness TribuneGood deedDoctor PeterLifestyleTechnologyFinlandAutoCompany news

-

Politics

A child died due to shelling near Belgorod, and residents are being evacuated from Kherson: news around SVO for October 22What happened in the last 24 hours

Lifestyle

Parents, return the money! How to force the state to reimburse the expenses for mugs and sections You will not return everything spent, but the money does not lie on the road

September 18, 2022, 10:51

7 584

Discuss -

Lifestyle

Why is the allowance for children from 8 to 16 years old denied? We calculate the income according to the formula from the stateCheck if you have not been legally assigned a payment Petersburg residents complained about failures in the calculation of transport tax

November 6, 2021, 13:300004

Train to get your money back: how to get a tax deduction for sports

August 28, 2021, 11:03

19 221

9 -

CityBusinessLahta Center

Heavenly accounting.

How many taxes will Gazprom's move bring to St. Petersburg

How many taxes will Gazprom's move bring to St. Petersburg June 10, 2021, 08:04

67,373

19 -

How to get money now?

15 May 2021, 15:00

59 138

9

Company news Petersburgers are invited to concerts at the Manege

MTS presents a series of music concerts and audiovisual performances as part of the MTS Live Sessions(16+) project, which will be held at the Manege Central Exhibition Hall in St. Petersburg. Tosya Chaikina, POLE and Zventa Sventana will perform in the space of one of the largest exhibition halls in Russia. The MTS Live Sessions project is aimed at introducing the mass audience to the versatility and diversity of musical genres and other art forms through live performances of artists at well-known creative venues in Moscow and St. Petersburg. This is the second time the project has been held...

Polis Group was recognized as a reliable developer of Russia 2022 in two regions at once: St. Petersburg and the Leningrad Region. The solemn award ceremony took place within the framework of the annual All-Russian summit of developers and manufacturers of building resources in St. Petersburg. Igor Belov, General Director of the Polis Group of Companies, noted: “For us, this is, first of all, an indicator of responsibility to...

The third apart-hotel of the Avenir chain in St. Petersburg received a conclusion on compliance with

PSK Group completed the construction of the third apart-hotel of the Avenir chain - Moskovsky Avenir near the metro station. m. "Frunzenskaya". The apart-hotel passed the final inspection of the State Construction Supervision Authority and received a conclusion on compliance. The next step is obtaining permission to put the facility into operation.