How much tax refund do you get per child

The Child Tax Credit | The White House

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

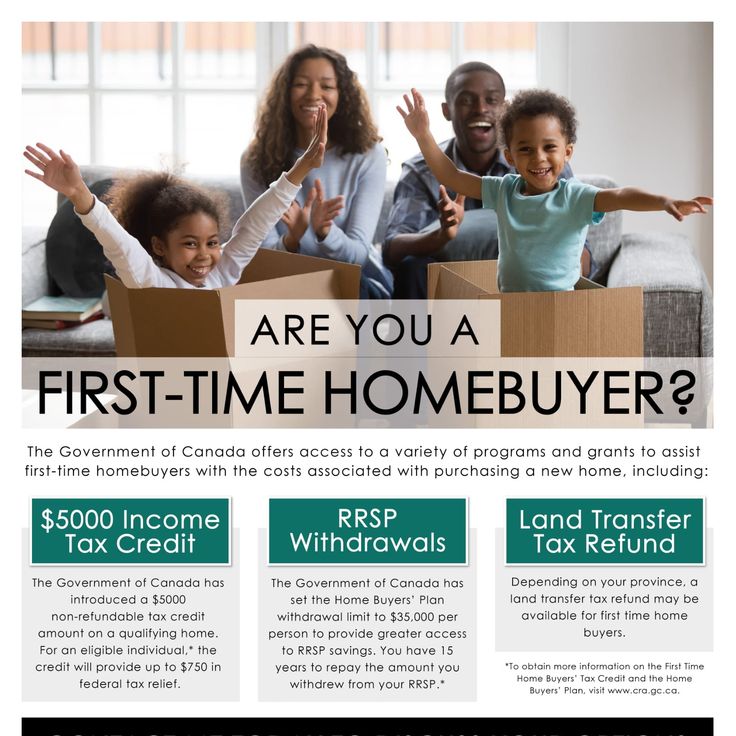

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

2022 Child Tax Credit: Requirements, How to Claim

You’re our first priority.

Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners.

Here is a list of our partners.

Taxpayers may be eligible for a credit of up to $2,000 — and $1,500 of that may be refundable.

By

Sabrina Parys

Sabrina Parys

Content Management Specialist | Taxes, investing

Sabrina Parys is a content management specialist on the taxes and investing team. Her previous experience includes five years as a project manager, copy editor and associate editor in academic and educational publishing. Sabrina earned a master's degree in publishing at Portland State University.

Learn More

and

Tina Orem

Tina Orem

Senior Writer/Spokesperson | Small business, taxes

Tina Orem covers small business and taxes at NerdWallet. She has a degree in finance, as well as a master's degree in journalism and a Master of Business Administration. Her work has appeared in a variety of local and national media outlets. Email: <a href="mailto:[email protected]">[email protected]</a>.

Her work has appeared in a variety of local and national media outlets. Email: <a href="mailto:[email protected]">[email protected]</a>.

Learn More

Edited by Arielle O'Shea

Arielle O'Shea

Lead Assigning Editor | Retirement planning, investment management, investment accounts

Arielle O’Shea leads the investing and taxes team at NerdWallet. She has covered personal finance and investing for 15 years, previously as a researcher and reporter for leading personal finance journalist and author Jean Chatzky. Arielle has appeared as a financial expert on the "Today" show, NBC News and ABC's "World News Tonight," and has been quoted in national publications including The New York Times, MarketWatch and Bloomberg News. Email: <a href="mailto:[email protected]">[email protected]</a>.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

This article has been updated for the 2022 tax year.

The child tax credit is a federal tax benefit that plays an important role in providing financial support for American taxpayers with children. People with kids under the age of 17 may be eligible to claim a tax credit of up to $2,000 per qualifying dependent when they file their 2022 tax returns in 2023. $1,500 of that credit may be refundable

We’ll cover who qualifies, how to claim it and how much you might receive per child.

What is the child tax credit?

The child tax credit, commonly referred to as the CTC, is a tax credit available to taxpayers with dependent children under the age of 17. In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

In order to claim the credit when you file your taxes, you have to prove to the IRS that you and your child meet specific criteria.

You’ll also need to show that your income falls beneath a certain threshold because the credit phases out in increments after a certain limit is hit. If your modified adjusted gross income exceeds the ceiling, the credit amount you get may be smaller, or you may be deemed ineligible altogether.

Who qualifies for the child tax credit?

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Generally, there are seven “tests” you and your qualifying child need to pass.

Age: Your child must have been under the age of 17 at the end of 2022.

Relationship: The child you’re claiming must be your son, daughter, stepchild, foster child, brother, sister, half brother, half sister, stepbrother, stepsister or a descendant of any of those people (e.

g., a grandchild, niece or nephew).

g., a grandchild, niece or nephew).Dependent status: You must be able to properly claim the child as a dependent. The child also cannot file a joint tax return, unless they file it to claim a refund of withheld income taxes or estimated taxes paid.

Residency: The child you’re claiming must have lived with you for at least half the year (there are some exceptions to this rule).

Financial support: You must have provided at least half of the child’s support during the last year. In other words, if your qualified child financially supported themselves for more than six months, they’re likely considered not qualified.

Citizenship: Per the IRS, your child must be a "U.S. citizen, U.S. national or U.S. resident alien," and must hold a valid Social Security number.

Income: Parents or caregivers claiming the credit also typically can’t exceed certain income requirements. Depending on how much your income exceeds that threshold, the credit gets incrementally reduced until it is eliminated.

Did you know...

If your child or a relative you care for doesn't quite meet the criteria for the CTC but you are able to claim them as a dependent, you may be eligible for a $500 nonrefundable credit called the "credit for other dependents." Check the IRS website for more information.

How to calculate the child tax credit

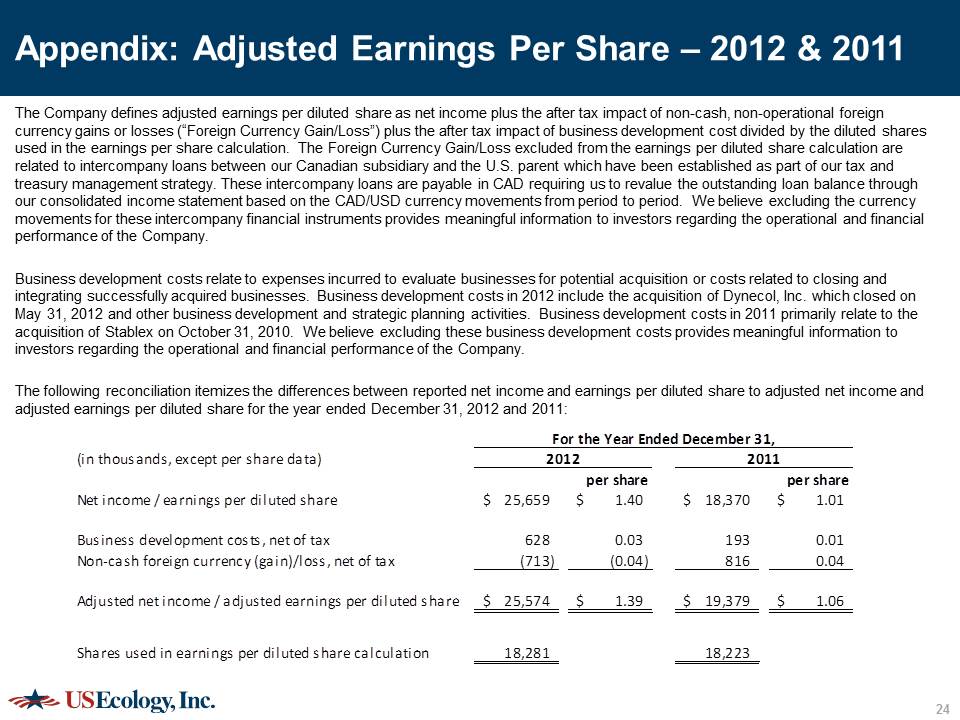

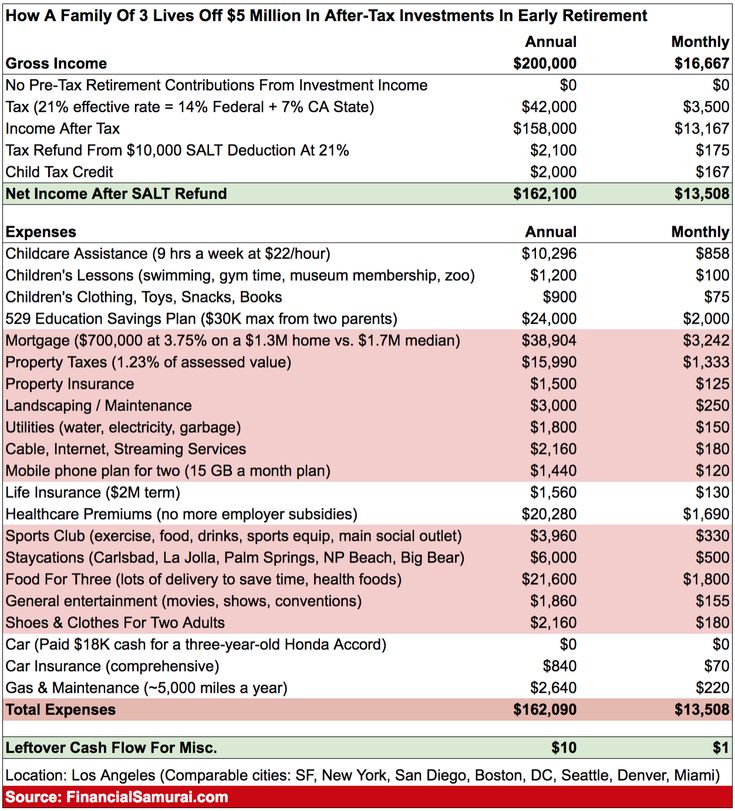

For the 2022 tax year, the CTC is worth $2,000 per qualifying dependent child if your modified adjusted gross income is $400,000 or below (married filing jointly) or $200,000 or below (all other filers). If your MAGI exceeds those limits, your credit amount will be reduced by $50 for each $1,000 of income exceeding the threshold until it is eliminated.

The CTC is also partially refundable; that is, it can reduce your tax bill on a dollar-for-dollar basis, and you might be able to apply for a tax refund of up to $1,500 for anything left over. This partially refundable portion is called the “additional child tax credit” by the IRS.

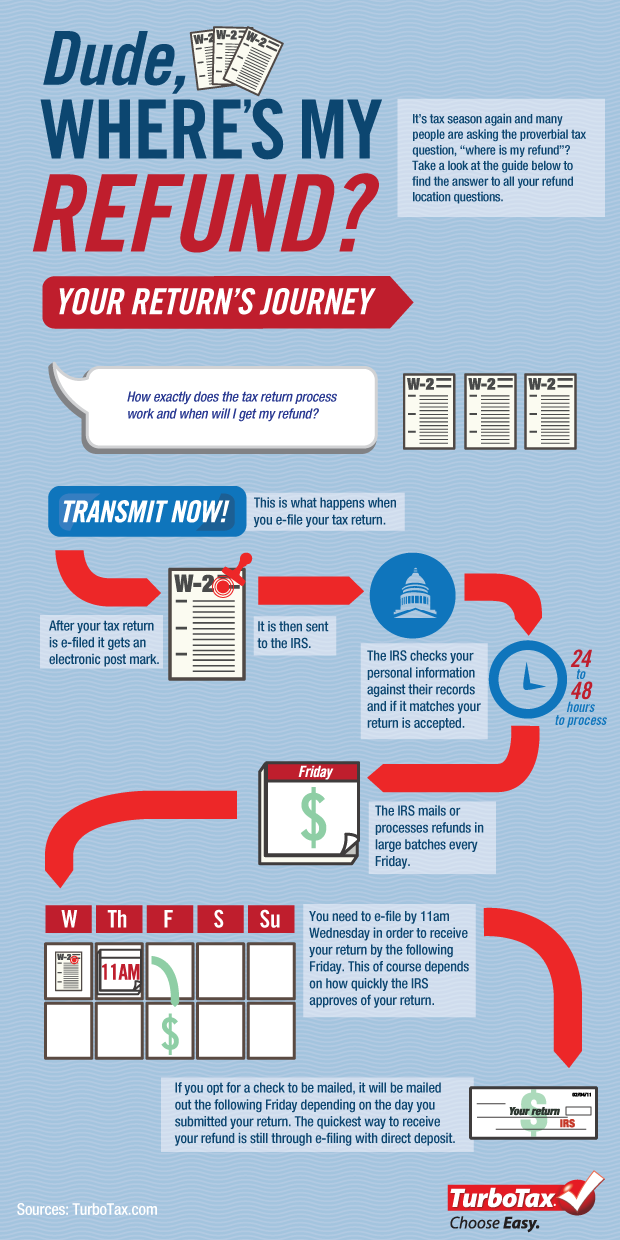

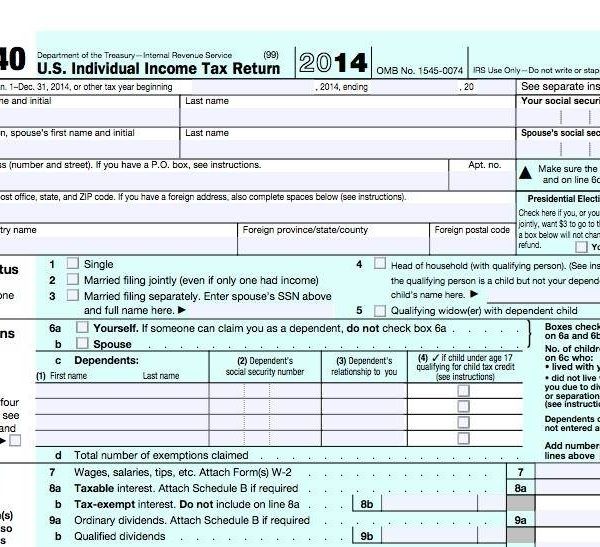

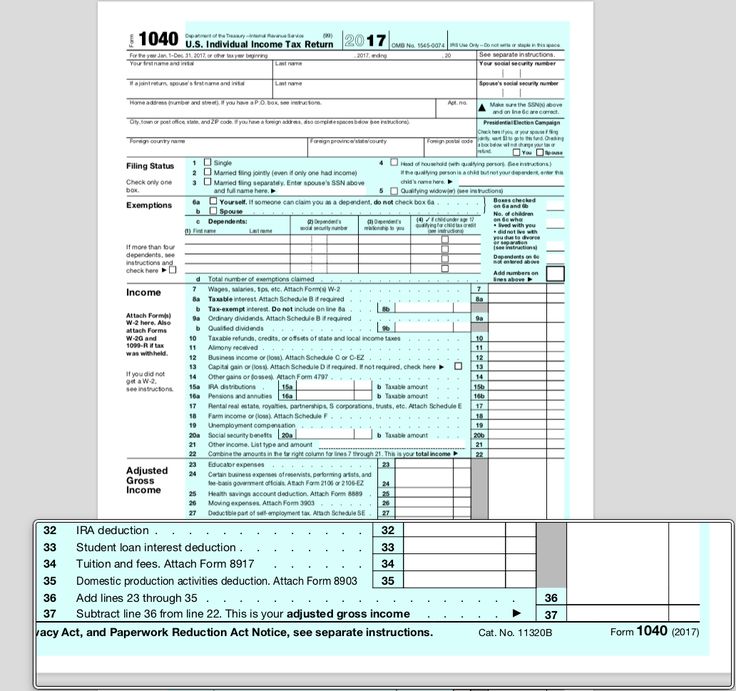

How to claim the credit

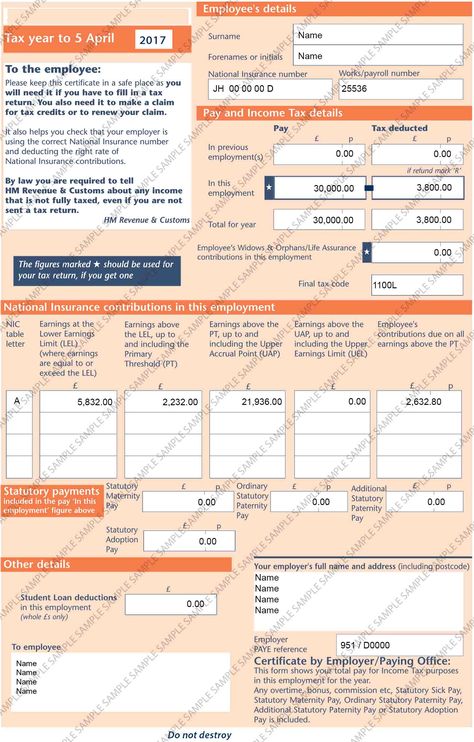

You can claim the child tax credit on your Form 1040 or 1040-SR. You’ll also need to fill out Schedule 8812 (“Credits for Qualifying Children and Other Dependents”), which is submitted alongside your 1040. This schedule will help you to figure your child tax credit amount, and if applicable, how much of the partial refund you may be able to claim.

Most quality tax software guides you through claiming the child tax credit with a series of interview questions, simplifying the process and even auto-filling the forms on your behalf. If your income falls below a certain threshold, you might also be able to get free tax software through IRS’ Free File.

🤓Nerdy Tip

If you applied for the additional child tax credit, by law the IRS cannot release your refund before mid-February.

Consequences of a CTC-related error

An error on your tax form can mean delays on your refund or on the child tax credit part of your refund. In some cases, it can also mean the IRS could deny the entire credit.

In some cases, it can also mean the IRS could deny the entire credit.

If the IRS denies your CTC claim:

You must pay back any CTC amount you’ve been paid in error, plus interest.

You might need to file Form 8862, "Information To Claim Certain Credits After Disallowance," before you can claim the CTC again.

If the IRS determines that your claim for the credit is erroneous, you may be on the hook for a penalty of up to 20% of the credit amount claimed.

State child tax credits

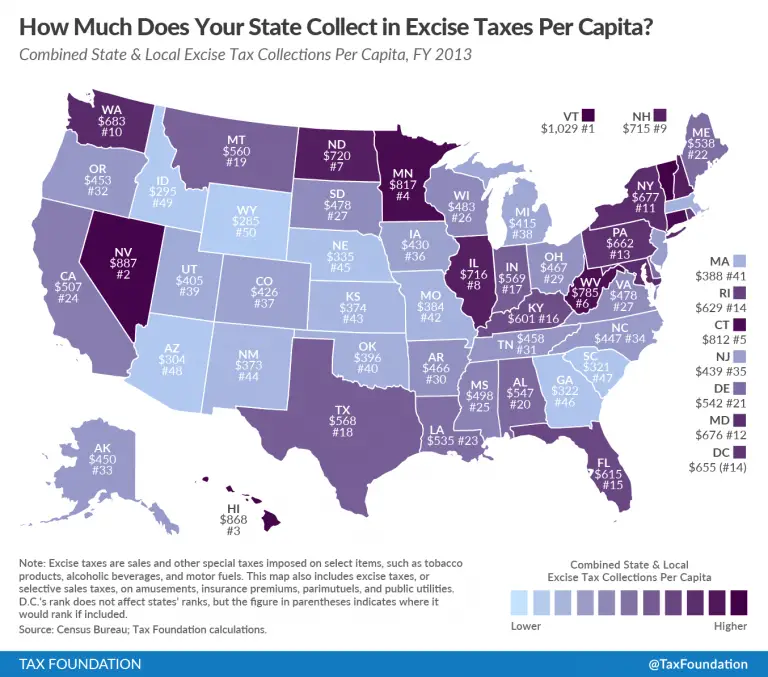

In addition to the federal child tax credit, a few states, including California, New York and Massachusetts, also offer their own state-level CTCs that you may be able to claim when filing your state return. Visit your state's department of taxation website for more details.

History of the CTC

Like other tax credits, the CTC has seen its share of changes throughout the years. In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

In 2017, the Tax Cuts and Jobs Act, or TCJA, established specific parameters for claiming the credit that will be effective from the 2018 through 2025 tax years. However, the American Rescue Plan Act of 2021 (the coronavirus relief bill) temporarily modified the credit for the 2021 tax year, which has caused some confusion as to which changes are permanent.

Here's a brief timeline of its history.

1997: First introduced as a $500 nonrefundable credit by the Taxpayer Relief Act.

2001: Credit increased to $1,000 per dependent and made partially refundable by the Economic Growth and Tax Relief Reconciliation Act.

2017: The TCJA made several changes to the credit, effective from 2018 through 2025. This included increasing the credit ceiling to $2,000 per dependent, establishing a new income threshold to qualify and ensuring that the partially refundable portion of the credit gets adjusted for inflation each tax year.

2021: The American Rescue Plan Act made several temporary modifications to the credit for the 2021 tax year only.

This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.

This included expanding the credit to a maximum of $3,600 per qualifying child, allowing 17-year-olds to qualify, and making the credit fully refundable. And for the first time in U.S. history, many taxpayers also received half of the credit as advance monthly payments from July through December 2021.2022–2025: The 2021 ARPA enhancements ended, and the credit will revert back to the rules established by the TCJA — including the $2,000 cap for each qualifying child.

Frequently asked questions

Does the child tax credit include advanced payments this year?

The American Rescue Plan Act made several temporary modifications to the credit for tax year 2021, including issuing a set of advance payments from July through December 2021. This enhancement has not been carried over for this tax year as of this writing.

Is the child tax credit taxable?

No. It is a partially refundable tax credit. This means that it can lower your tax bill by the credit amount, and if you have no liability, you may be able to get a portion of the credit back in the form of a refund.

Is the child tax credit the same thing as the child and dependent care credit?

No. This is another type of tax benefit for taxpayers with children or qualifying dependents. It covers a percentage of expenses you made for care — such as day care, certain types of camp or babysitters — so that you can work or look for work. The IRS has more details here.

I had a baby in 2022. Am I eligible to claim the child tax credit when I file in 2023?

If you also meet the other requirements, yes. You'll likely need to make sure your child has a Social Security number before you apply, though.

About the authors: Sabrina Parys is a content management specialist at NerdWallet. Read more

Tina Orem is NerdWallet's authority on taxes and small business. Her work has appeared in a variety of local and national outlets. Read more

On a similar note...

Get more smart money moves – straight to your inbox

Sign up and we’ll send you Nerdy articles about the money topics that matter most to you along with other ways to help you get more from your money.

Taxation

In Finland, taxes are withheld from wages and other income. The amount of taxes depends on the amount of your income. If you come to work in Finland from abroad, the form of taxation depends on how long you stay in Finland and whether your employer is a Finnish or foreign company.

- Form of taxation if you come to Finland to work

Taxes are charged on both the income of an individual (ansiotulo) and capital income (pääomatulo). Personal income tax and capital income tax are paid differently. Capital income refers to income that is based on the accumulation of wealth. Other income refers to the income of an individual. nine0003

In Finland, it is necessary to pay taxes not only when receiving wages, but also, for example, in connection with the receipt of the following income:

- compensation for work

- corporate income

- various social benefits, such as unemployment allowance, parental support and study allowance

- pensions

- income from capital, such as income from rent or transfer of property

State and municipalities finance, for example, from taxes:

- healthcare

- education

- pre-school education

- national defense.

Finland uses progressive income taxation. This means that higher wages are taxed more than lower wages. The tax rate (veroprosentti) determines the amount of tax on your income. In Finland, the tax rate is calculated for each individual. Your marriage partner's income does not affect your tax rate. You can calculate your tax rate using the IRS calculator. nine0003

If you receive wages, your employer withholds tax directly from your wages and pays it to the tax authority. To do this, the employer needs your tax card. A tax card (verokortti) is a document that shows your tax rate. At the end of each year, the Tax Administration checks whether you have paid enough income tax. If you have paid more taxes than were actually due, you will receive a tax refund (veronpalautus). If you have not paid the tax amount, you will need to pay the residual tax (jäännösvero). nine0003

For more information, see Tax Return and Notice of Tax Due.

Check your payslip (palkkalaskelma) and tax return (veroilmoitus) to see if your employer withheld tax from your salary and transferred it to the tax authority. Save the payslip.

Save the payslip.

In addition to tax, your employer deducts compulsory insurance contributions from your wages, for example in case of unemployment or sickness.

If you stay in Finland for a maximum of six months and your employer is a foreign company, you do not normally have to pay taxes in Finland. If your employer is a Finnish company or a foreign company with a Finnish branch, you must pay taxes in Finland. You can apply for progressive tax treatment if you live in a country in the European Economic Area, or in a country with which Finland has a tax treaty. Otherwise, you will pay non-resident income tax (lähdevero) of 35% from your salary, for which you need a non-resident tax card. nine0003

If you are health insured in Finland, the Tax Administration will collect the employee's health insurance premium from you. You do not need to pay health insurance premiums in Finland if you have an A1 certificate or other similar certificate that proves that you are insured in your country of residence.

If you move from Finland, you must apply for a change of address to the Digital Information and Population Records Agency within a week of moving. The move must also be separately notified to the Tax Administration. nine0002 FinnishSwedishEnglish

External linkPosti

Move noticeExternal link

FinnishSwedishEnglish

Local information

View information about your municipality

Do taxes make Finns happy? Facts and opinions

Politicians of other states, whatever their ideology, present Finland and the Nordic countries as brilliant examples of either what to do or what not to do. nine0003

They also mention taxes. Listeners of such speeches, most likely, did not have the opportunity to personally visit Finland or talk with Finns about taxation.

Let's start with numbers. Imagine a 30-year-old resident of Helsinki, let's call her Annika. Annika's salary is quite typical for Finland, 3,000 euros per month. On this amount, she pays 17% income tax, deducts 7.15% to the pension fund and 1.25% to the unemployment insurance fund. After all deductions, Annika has 2238 euros left. [When this article was being prepared, the Finnish Tax Authority was revising these figures. At the end of the article you will find links to websites with updated information.]

On this amount, she pays 17% income tax, deducts 7.15% to the pension fund and 1.25% to the unemployment insurance fund. After all deductions, Annika has 2238 euros left. [When this article was being prepared, the Finnish Tax Authority was revising these figures. At the end of the article you will find links to websites with updated information.]

The tax system in Finland is progressive, ie the tax rate is determined by income level. If Annika had earned 66% more, 5,000 euros per month, her income tax would have risen from 17% to 25.5%. Other factors can also affect the tax rate or deductions, such as the municipality of residence or how much a person spends on commuting to work.

Attitude towards taxes

A family in a restaurant in the Finnish city of Tampere. The bill includes a 14% value-added tax.Photo: Laura Vanzo/Visit Tampere

In addition to the contributions that Annika makes from her salary of 3,000 euros, her employer also pays about 600 euros monthly to the social insurance fund, which includes contributions to the pension fund and insurance against unemployment and accidents at work.

Value Added Tax (VAT) is included in the price of many goods that Annika buys in stores, it can be 10%, 14% or 24%. In this way, it contributes to Finland's gross tax revenue, in 2019year reached 70 billion euros (population of Finland - 5.5 million people).

What do Annika herself and other Finns think about this?

Of course, the Finns are not enthusiastic about tax payments - they are people, after all - but very often when discussing this issue they philosophically draw the interlocutor's attention to what a wide range of public services are provided by tax deductions.

For example, the healthcare system functions entirely at the expense of taxes. The Global Burden of Disease study ranks Finland's healthcare system as one of the best and most egalitarian in the world. In 2017, public spending on health was 20.6 billion euros, or 3,742 euros per capita [later data from the National Institute for Health and Welfare not yet available at the time of writing]. For comparison: per capita health care spending this year in the UK was 3366 euros, in Japan 3486 euros, in Canada 4136 euros, in Germany 4459euro, in Sweden 5096 euros, in the USA 8519 euros.

For comparison: per capita health care spending this year in the UK was 3366 euros, in Japan 3486 euros, in Canada 4136 euros, in Germany 4459euro, in Sweden 5096 euros, in the USA 8519 euros.

Tax funds also pay for all levels of education, allowances for the unemployed and the disabled, and a wide range of cultural institutions operate on tax funds, from opera houses to libraries. In 2018, Finland spent about 58 euros per inhabitant on libraries.

Family values

In Finland, all mothers-to-be receive a newborn kit. The kit includes everything you need for a new family member: bed linen, baby hygiene items, clothes for all weather, including for walks in the cold.Photo: Annika Söderblom/Kela

The Finnish taxation system can be described as a nationwide insurance that goes into turbo mode during critical periods in people's lives.

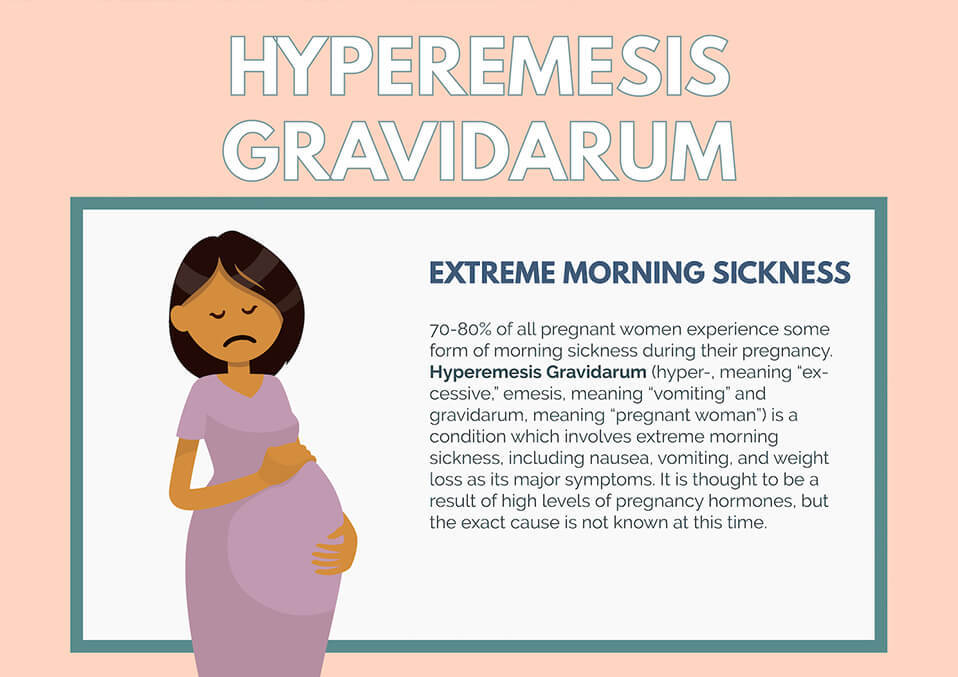

Particular attention is paid to the birth and upbringing of children.

If Annika decides to have children, she will be able to visit the antenatal clinic free of charge throughout her pregnancy, usually 12-15 visits. The first antenatal clinics in Finland were opened in 1922, and the system was legally fixed in 1940s.

The first antenatal clinics in Finland were opened in 1922, and the system was legally fixed in 1940s.

After the birth of the baby, the family regularly visits the children's clinic (usually in the same building as the women's clinic), where specialists monitor the health and growth of the child. Eight visits are provided in the first year of life, four visits in the second and third years, then once a year until the child reaches school age.

Comprehensive support for mothers and babies is the main reason for the low infant mortality rate in Finland: in 2018, this figure was 2.1 cases (deaths under 1 year of age) per 1,000 children. nine0003

In Finland, all mothers-to-be receive a free newborn kit well in advance of the birth. This is a big package with a lot of things that a family starting life with a baby needs, such as bed linen, special baby hygiene products, and clothes for all weather, including for walks in the cold.

Mostly happy taxpayers

Many Finns, like the family in this picture, “value what they get from society and realize that taxes are a way of funding this society,” says researcher Frank Martela. Photo: Pasi Markkanen/Finland Image Bank

Photo: Pasi Markkanen/Finland Image Bank

It may sound strange, but taxes may be one of the reasons why Finland ranked first in the World Happiness Report 2018, 2019 and 2020. Happiness in the report meant general satisfaction with life, associated with security and social cohesion.

Frank Martela works on well-being at Aalto University. “I would say Finns are very happy taxpayers,” he says.

According to a survey organized by the Internal Revenue Service in 2019year, 80% of Finns pay their taxes willingly, 96% consider paying taxes an important civic duty, and 98% consider taxes important for the functioning of Finland's welfare system as a state.

“Finns value what they get from the state and realize that taxes are a way to fund it,” says Frank. – Accordingly, the majority pays taxes surprisingly willingly. For many, the obligation to pay taxes causes not annoyance, but a sense of pride.”

A total of 31% of respondents said they were dissatisfied with how much they had to pay in taxes. In a related survey of corporate taxpayers, 86% of companies said they had a favorable view of taxation, and 95% believed that "one should do the right thing".

In a related survey of corporate taxpayers, 86% of companies said they had a favorable view of taxation, and 95% believed that "one should do the right thing".

Flexibility in life

Paid parental leave is available for both mothers and fathers. This encourages both parents to share the joys and responsibilities of raising children.Photo: Jukka Rapo/Keksi/Finland Image Bank

Even the logistics of paying taxes in Finland are simpler than in many other countries. In the spring, you receive a pre-filled tax return, and if you agree with it and do not want to add anything, then the process is over. You don't have to mail or take anything else. And if you need to change something, it can be done online. nine0003

Every four years parliamentary elections are held in Finland, and one of the issues that interests voters is the relationship between taxes and public services. The government, regardless of its program, operates within the northern tradition of equality and highly organized pragmatism, which means that social services to the population will continue into the future.

Let's go back to Annika and her family. After giving birth in the hospital, Annika, her husband and their baby are surrounded by almost hotel comfort. Mothers and fathers receive paid parental leave: there is a set period during which a mother or father can be on parental leave. nine0003

A mother can stay at home with her child and receive benefits until the child is three years old. Alternatively, the father can stay at home with the baby for about the same time. And if there are problems in the relationship between the spouses, they can contact a specialist for free.

Caring for each other

Very affordable daycare helps Finnish parents balance family life with a career. Pictured are children returning from a walk in the forest.Photo: Pasi Markkanen/Finland Image Bank

Then the child will go to kindergarten, then to school, and in both institutions he will receive free meals. Schooling is free, and for kindergarten, parents pay a very modest amount every month, the amount of which depends on the income level of the family and the number of children who go to kindergarten. (At the time of writing, the maximum monthly fee in Helsinki for upper-income families is €289 for a younger child and €145 for an older sibling. Kindergarten is free for lower-income families.) nine0003

(At the time of writing, the maximum monthly fee in Helsinki for upper-income families is €289 for a younger child and €145 for an older sibling. Kindergarten is free for lower-income families.) nine0003

Finnish schools are a source of national pride and reflect the moral values of the people of the country: classes are mixed according to the level, that is, students are not divided into different groups, and the successful ones help those who are experiencing difficulties. This promotes equity in learning.

Universities and other educational institutions, such as technical schools, are also free of charge, students receive a monthly stipend. If Annika ever wants to change her profession, she will have access to the support and training she needs. nine0003

Like all Finns, Annika knows that by paying taxes, she takes part in caring for others. Everyone benefits when society takes care of all citizens.

These mechanisms work in everyday life, which is why it is so important to pay taxes - no matter how you feel about them.