How much is the monthly child tax benefit

The Child Tax Credit - The White House

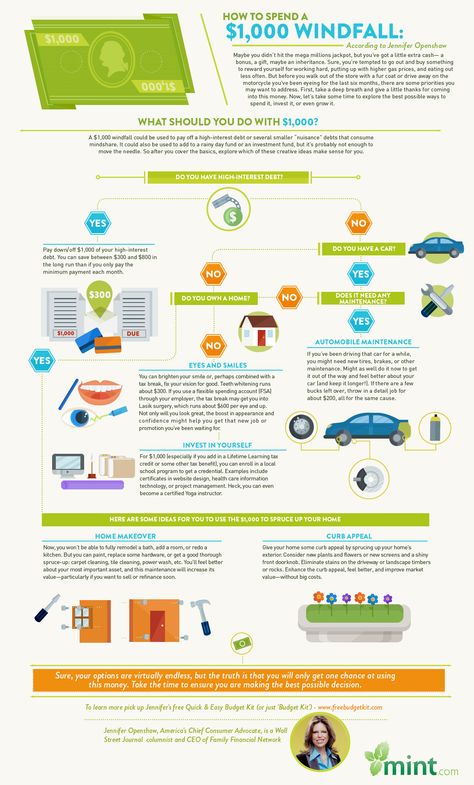

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

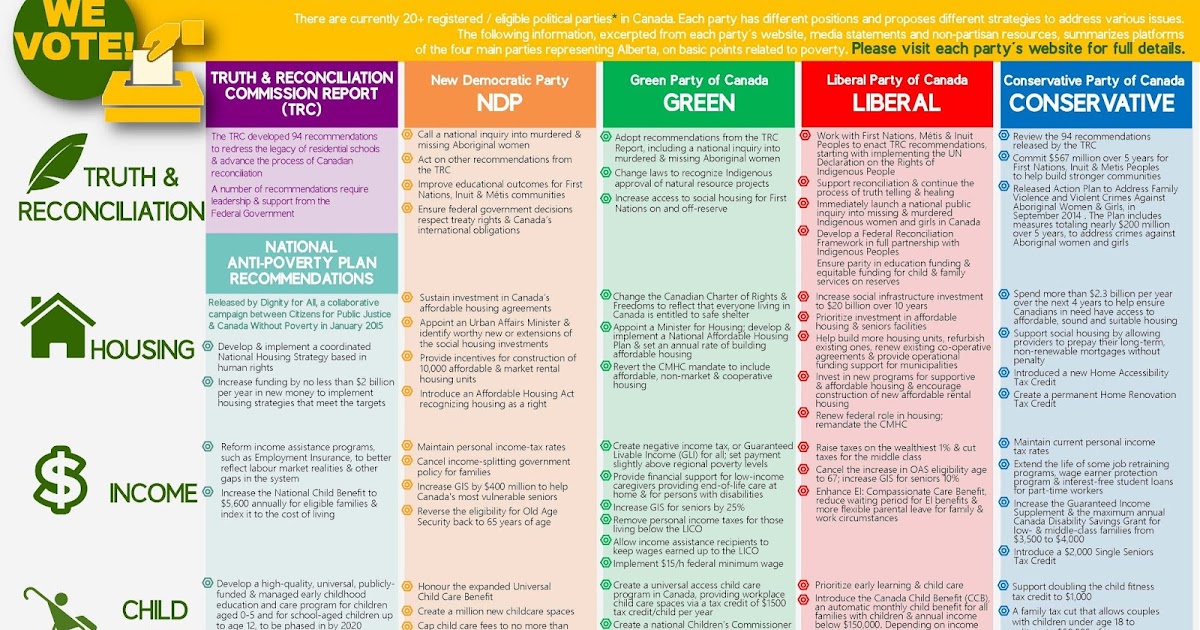

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

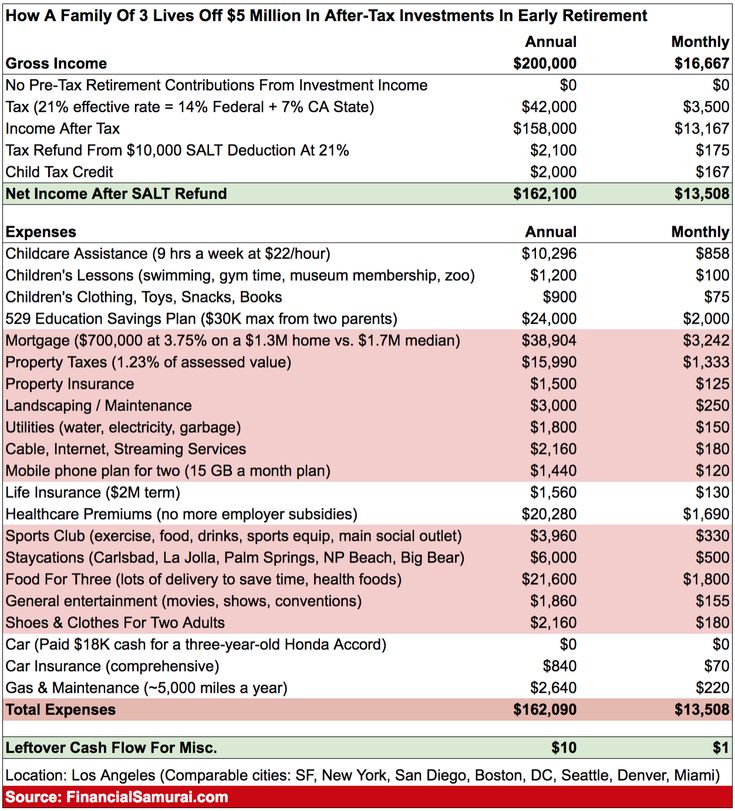

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

Child Tax Credit | U.S. Department of the Treasury

The American Rescue Plan increased the Child Tax Credit and expanded its coverage to better assist families who care for children.

Overview

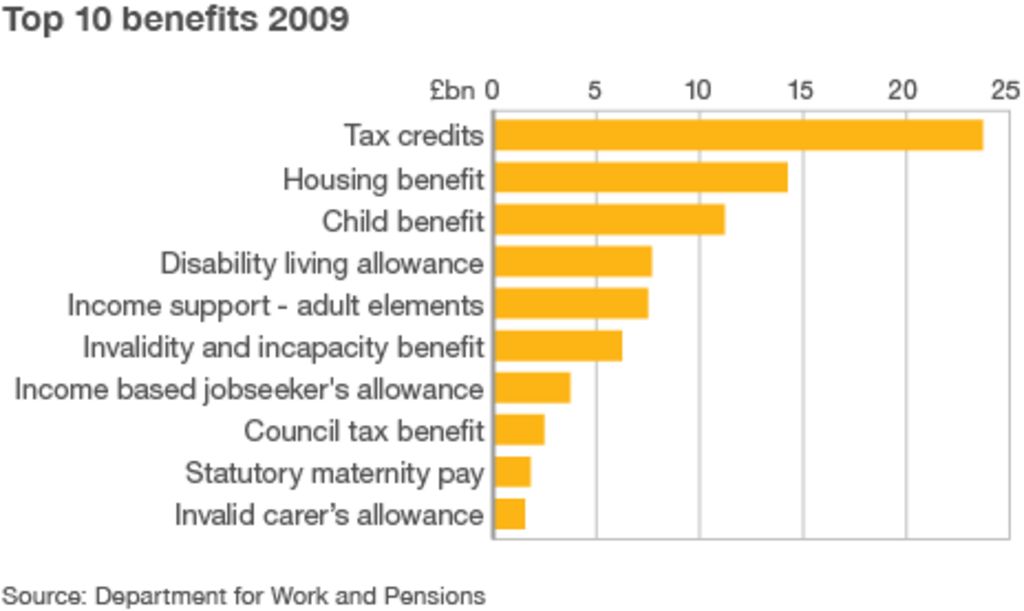

The American Rescue Plan’s expansion of the Child Tax Credit will reduced child poverty by (1) supplementing the earnings of families receiving the tax credit, and (2) making the credit available to a significant number of new families. Specifically, the Child Tax Credit was revised in the following ways for 2021:

- The credit amount was increased for 2021. The American Rescue Plan increased the amount of the Child Tax Credit from $2,000 to $3,600 for qualifying children under age 6, and $3,000 for other qualifying children under age 18.

- The credit was made fully refundable. By making the Child Tax Credit fully refundable, low- income households will be entitled to receive the full credit benefit, as significantly expanded and increased by the American Rescue Plan.

- The credit’s scope has been expanded. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. Previously, only children 16 and younger qualified.

- Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December. Families caring for children were able to receive financial assistance on a consistent monthly basis from July to December 2021, instead of waiting until tax filing season to receive all of their Child Tax Credit benefits.

File your taxes to get your full Child Tax Credit — now through April 18, 2022. Get help filing your taxes and find more information about the 2021 Child Tax Credit.

In addition, the American Rescue Plan extended the full Child Tax Credit permanently to Puerto Rico and the U. S. Territories. For the first time, low- income families residing in Puerto Rico and the U.S. Territories will receive this vital financial assistance to better support their children’s development and health and educational attainment.

S. Territories. For the first time, low- income families residing in Puerto Rico and the U.S. Territories will receive this vital financial assistance to better support their children’s development and health and educational attainment.

Recent Updates

- New and Improved ChildTaxCredit.gov

- This website exists to help people:

- Get the Child Tax Credit

- Understand how the 2021 Child Tax Credit works

- Find out if they are eligible to receive the Child Tax Credit

- Understand that the credit does not affect their federal benefits

- This website provides information about the Child Tax Credit and the monthly advance payments made from July through December of 2021. Every page includes a table of contents to help you find the information you need.

- This website exists to help people:

- Code for America’s Non-Filer Tool

- Code for America partnered with The White House and the Treasury Department to create a website and mobile-friendly tool, in English and Spanish, to assist families claiming their Child Tax Credit and missing Economic Impact Payments.

- The GetCTC tool is currently closed for the season, but you can access information about the Child Tax Credit on the website.

- Community organizations and volunteer navigators seeking to help hard-to-reach clients access the Child Tax Credit or Economic Impact Payments can access training materials and resources on the navigator website.

- Code for America partnered with The White House and the Treasury Department to create a website and mobile-friendly tool, in English and Spanish, to assist families claiming their Child Tax Credit and missing Economic Impact Payments.

- IRS Non-Filer Tool

- Most families will automatically start receiving the new monthly Child Tax Credit payments on July 15th.

- Families who normally aren’t required to file an income tax return should use this Non-Filers Tool to register quickly for the expanded and newly-advanceable Child Tax Credit from the American Rescue Plan.

- Child Tax Credit Portal

- Use this tool to:

- Check if you’re enrolled to receive payments

- Unenroll to stop getting advance payments

- Provide or update your bank account information for monthly payments starting with the August payment

- Use this tool to:

- Child Tax Credit Eligibility Assistant

- Check if you may qualify for advance payments.

- Check if you may qualify for advance payments.

Spread the word

- Key Messaging about the Child Tax Credit

- Child Tax Credit Toolkit: Download all CTC Info Sheets and Social Media slides

- Info Sheet: How Has the CTC Changed This Year

- Info Sheet: How to Make Sure You Get the CTC Payment

- Info Sheet: The Expanded Child Tax Credit: Explained

- Social Media slides: How Has the CTC Changed This Year

- Social Media slides: How to Make Sure You Get the CTC Payment

- Find more information at ChildTaxCredit.gov

RESOURCES

- Child Tax Credit FAQs

- Child Tax Credit Press Release

- Economic Impact Payment Info

- Need to file a tax return? Find free options and information here

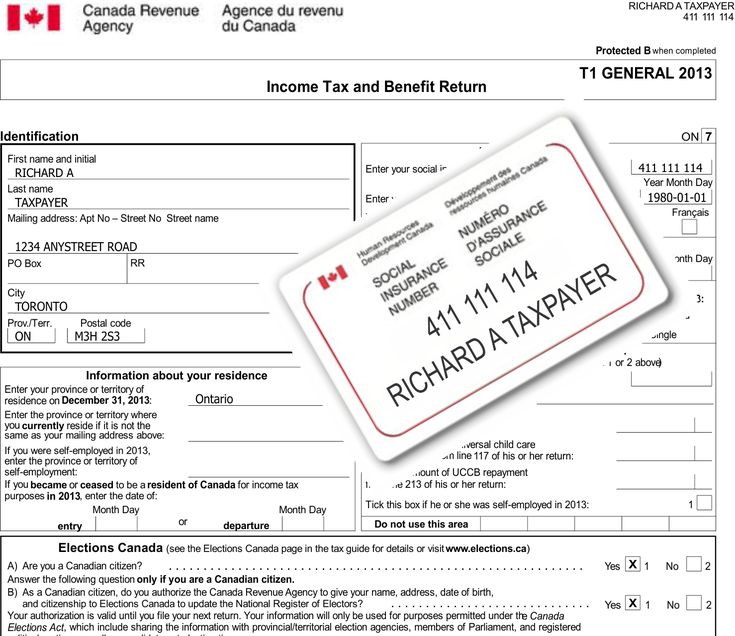

Is the allowance subject to personal income tax up to 1.5 years

The birth of children is a joyful event for the family, but it affects not only parents, but also the organization in which the young mother works. By law, a woman has the right to receive maternity benefits, and can also receive payments while on parental leave after giving birth. Considering the fact that the income of employees as a general rule is subject to taxation, the question arises whether these payments are included in their number - is the allowance up to 1.5 years subject to personal income tax? It is important to know exactly in what form such payments should be displayed and whether this should be done in order to avoid mistakes in the preparation of the relevant documentation.

By law, a woman has the right to receive maternity benefits, and can also receive payments while on parental leave after giving birth. Considering the fact that the income of employees as a general rule is subject to taxation, the question arises whether these payments are included in their number - is the allowance up to 1.5 years subject to personal income tax? It is important to know exactly in what form such payments should be displayed and whether this should be done in order to avoid mistakes in the preparation of the relevant documentation.

Features of taxation

All income is shown in the 2-personal income tax certificate. Child care allowances are an exception in this case. They are subject to other rules that also affect the design of reporting documentation.

Thus, sick leave for temporary disability is usually taxed, but this rule does not apply to maternity benefits. This is spelled out in the legislation, so you can be sure that such payments are not required to be indicated in the 2-NDFL certificate.

If a woman is on leave to care for a child who is not yet 1.5 years old, she also receives the appropriate allowance, which is not taxed and is not reflected in 2-personal income tax.

If an employee works part-time in parallel, she will receive a salary, which, in turn, is already subject to taxation.

See also "Benefits from May 1, 2018 after the increase in the minimum wage: new amounts."

It is worth noting that parental leave is not reflected in 2-personal income tax. But if this is exactly sick leave, then the same rules apply to it as to sick leave for temporary disability. Therefore, if the child fell ill, and the mother received sick leave in connection with this, then tax payments should be deducted.

In some cases, maternity leave may turn out to be less than average earnings. Then the employer can pay some more amount, giving out even more than it should be for the established benefits. Since this money will no longer be considered part of the benefit, it is subject to taxation and is classified as “other income”.

See also "What are the minimum maternity payments in 2018".

Eligibility for benefits

The legislation specifies the circle of those who can receive maternity benefits:

- women who work officially and under an employment contract, as well as those who work as civilian personnel in military formations on the territory of other countries can count on him;

- if a woman does not work, but was fired due to the liquidation of the enterprise, then she can also apply for benefits; the same applies to women who have ceased their activities as individual entrepreneurs;

- full-time students in any educational institution.

It is important that the pregnancy and childbirth allowance is due only to the woman herself. It cannot be issued by other relatives, as is possible in the situation with some other child benefits.

A woman can also receive benefits when adopting a child under 3 months old, which will be credited only to the mother. If in the family that adopted the baby, the father works, but the mother does not, then the allowance will not be transferred.

If in the family that adopted the baby, the father works, but the mother does not, then the allowance will not be transferred.

If a woman officially works in two places at once and has worked in these organizations for the last 2 years, then she can count on the accrual of two benefits at once - from each employer.

Direct payments

In some regions, the FSS project "Direct payments" is operating. It provides that a woman will receive benefits directly through the FSS. In this case, the employer himself submits the documents to the appropriate department, or in some situations the woman can do it herself.

The presence of such a project simplifies the life of accountants of organizations and the employees of the Social Insurance Fund themselves, and a woman receives a guaranteed opportunity to pay in the right amount and on time - regardless of how the financial situation is in the organization where she works. This procedure protects against unscrupulous employers who use the conditions of the crisis as an excuse not to pay employees or delay due payments.

See also SSF Pilot in 2018.

Getting benefits

Payments are made for the time that a woman stays on maternity leave. You can go into it at the 30th week of pregnancy - after 7 months from its onset. If a mother is expecting more than one baby, but several, then she can go on vacation earlier.

To receive payments, you need an appropriate basis, which will be attached to the documentation. This may be a certificate from the antenatal clinic, as well as a birth certificate when the child is already born. These documents are attached to the application, and are also given in the order for the calculation of benefits, which is compiled by the employer after receiving the application.

See also "Early Pregnancy Registration Allowance Order".

Pitzuim, how to get Pitzuim, how to get Pitzuim

Today, thousands of

people live in Israel who have frozen pension funds

Most Israeli citizens pay

monthly contributions to the pension fund.

In most cases, pension contributions

are calculated by the employer immediately from the salary.

Since 2008 all employees,

are obliged to allocate pension savings to the pension fund. The lack of knowledge of

most people has led to the formation of about forty billion shekels in

frozen accounts, or as many call them “nehes awud”

To begin with, let's explain what a pension contribution is.

What is pitzuim?

Pitzuim (compensation) - this is the amount that

the employer transfers to his employee every month to the pension fund

together with the pension program. In fact, pitzuim in Israel is compensation

to an employee for dismissal, it is calculated from the monthly salary that

receives the employee.

What does Pitzuim consist of?

Exclusively from the savings that

accrues the employer to the account of his employee.

Is it taxable?

The most common and erroneous opinion is

that Pitzui are not taxed. In fact, the income tax is

with pizui- 47%. In order to receive full or partial exemption from

Pitzuim tax, you need to have Form 161 (Tofes 161) from employer

or special permission from the tax office. Important - the validity of form 161 is until

of the end of the calendar year.

How to get pizza? What

documents are needed to get picuim?

In order to get pitzim from

insurance company, you need to contact your pension fund and request a withdrawal form

, as well as a list of documents required for withdrawal (confirmation of account

in bank, photo teudat zeuta, tofes 161 etc.). The process of obtaining pizuim can only begin after

dismissal.

Voluntary dismissal

in Israel - the procedure for obtaining Pitzim.

Many people are interested in the question - how to get

pitsui after dismissal and is it possible to pick up pitsui upon dismissal

of your own free will? The answer is yes, it is possible. The new

voluntary termination rules state that your employer must issue you Form 161 at

in any case of dismissal, except for those in which the employer is going to sue

you in court (for example, for theft or damage).

Employee rights in Israel protect your right to compensation (pitzuim) in all

cases, except for litigation.

How to quit and get pizza?

According to the Israeli labor code,

does not have a relationship, who decided to terminate the employment relationship - the employee or

the employer. Unless there are special cases (described above), the worker

has the right to receive tofes 161 within 60 calendar days. The same applies to dismissal for

health reasons.

How to check Pitzuim in Israel?

How to calculate the amount of pitzuim?

We often receive inquiries of this type:

“How to calculate pitzuim correctly?”, “Where can I find the

pitzuim calculator?”, “What does

consist of pitzuim?”, “How to calculate pitzuim?”, ”How is

pitzuim calculated? ? etc. There is no single answer to these questions. Calculation of pitzuim

comes from the base salary of each employee, it depends on the pension fund

and the program for which the client is enrolled. Therefore, each person will calculate

differently.

To take or not to take Pitzuim?

Depends only on your desire. Withdrawal of

pitzuim primarily depends on dismissal. Dismissal in Israel - procedure

is phased. Dismissal documents are issued by the employer within 60 days from

the moment of dismissal, however, the timing of the payment of pitzuima upon dismissal depends on

insurance company.

Retirement in Israel.

The pension in Israel consists of two parts:

The first is payments from the social insurance fund - Bituah Leumi. The second is

payments from private pension funds, to which you have made contributions during your

work experience. In 2008, Israel adopted a law on pension reform

, according to which, each employee is provided with a funded pension

in one of the pension funds. The new pension law in Israel was passed to

provide mandatory contributions to the

pension fund for employees and thereby secure them.

How to choose a pension fund?

Since Israel's pension funds are

private, you can choose which one you want to store your

pension contributions in. Pension funds (keren pension) offer different conditions for keeping your money.

Below are the most popular

reliable, in our opinion, from pension funds in Israel today:

· Arel pension (Ariel Pension)

Betuakha

· Meitav Dash Pension and Gemel

)

It happens that

each of your new employers opens a new cash desk and as a result, you cannot physically

remember all the pension funds in which you keep money. Due

Due

to the fact that there are a lot of pension and insurance companies on the market, most of our

clients contact us with a request to check and search for

pension savings in Israel.

When can I withdraw money from the pension fund ? At what age can I withdraw my pension savings at

Israel? Can I withdraw my pension early?

Any. Provided that you no longer work for someone who makes contributions to you. If you are over 60, congratulations!

You can withdraw your pension savings regardless of where you work. Pre-retirement age is exactly the age when you should think about retirement. We recommend checking.

Where can I check my pension contributions? Where can I find out how much is in the pension fund in Israel?

You can check your pension contributions in several ways:

1.

Register on the website of the Ministry of Finance and submit a request for verification.

It is often mistakenly referred to as a pension fund site.

2.

Find in your body (pay slip) where your savings are deducted, call this fund and find out how much pension you have accumulated. This method is not suitable if you are counting on finding lost pension

savings.

3. Contact us for help. The Maximum Center specializes in finding and exercising rights, including our pension consultants who help our clients in such matters as withdrawing pension savings, calculating pensions, withdrawing and registering pension savings.

Retirement in Israel.

The retirement age in Israel is 67 for men and 64 for women. However, these numbers change in case you want

withdraw money from the pension fund ahead of schedule.

How to withdraw early in Israel? What documents are needed to withdraw pension savings?

Very individual. It all depends on the age, amount of savings, health status and marital status of each person. Of the 90,067 basic documents - teudat zehut, a bank statement, permission to dismiss from work and a withdrawal form.

Tax on the withdrawal of pension contributions.

Automatic tax on pension withdrawals is 35%. However, the Israel Tax Authority allows for the possibility of a

tax rebate due to disability.

How to withdraw pension savings in Israel without tax?

Citizens who have reached the age of 69 can apply for full exemption from tax on pension savings if

the total amount of savings (including pitzuim) does not exceed 95 thousand shekels.

How to return 35% of the tax

One year after the withdrawal, you must submit a request for recalculation to the tax service (mas akhnas), and then, it is possible that

you will be returned part of the savings.

How to apply for a pension in Israel?

Suppose you are not interested in how you can withdraw your pension savings, how to withdraw money from the pension fund, etc.,

and you are interested in a monthly allowance from your savings. How to check

pension savings in Israel for monthly payments? How is

pension calculated in Israel? Any pension consultant in Israel will tell you that

the decision to withdraw your pension savings or apply for benefits primarily depends on the amount

that you managed to save. We already wrote above about how to find and check pension savings

in Israel.

On average, both labor law lawyers in Israel and pension consultants in Israel

tend to think that 100 thousand shekels is the sum of

savings, with which you can start thinking about making monthly payments

. It often happens that people who have accumulated an amount of less than 95 thousand prefer to find

and take away their pension savings, trying to avoid tax.

Getting an Israeli pension abroad.

Let's assume that you had a work experience in Israel, however, after retirement you decided to go to live in another place.

Will this affect your pension in any way? How to withdraw pension savings in Israel if you are abroad?

No, your hard-earned money

stays yours no matter where you choose to live. You can

arrange to receive the entire amount of the pension immediately in Israel before moving, or you can

arrange monthly payments, this will remain at your discretion. Registration is a

Registration is a

laborious process. If you feel that you need a reliable curator in

Israel who will help you find pension savings in Israel, as well as take care of bureaucratic nuances while you are not here, such clients are at a distance. contact the maximum company This company has specialists who supervise

Pitsuim at retirement.

Pitsuim upon retirement can become part of the pension program, and they can also enter your account for a one-time payment

. Everything depends on your desire.

Labor law in Israel and Keren Ishtalmut upon dismissal.

Continuing Education Fund (Keren Ishtalmut) - these are not pension savings, so they are not required to be paid

by the employer. This cash desk is completely exempt from taxes

6 years after opening. However, it can be withdrawn to the account much earlier and without taxes, the labor code

However, it can be withdrawn to the account much earlier and without taxes, the labor code

provides for such an opportunity when applying to mas akhnasu.

In order to check your Keren Ischtalmut, you need to log into your pension fund account. In the same place

you can find out about pitzui and pensions.

Help for the disabled in Israel. Help for pensioners in Israel.

There are many organizations that help people realize their rights. We recommend that you always

check if the organization has the experience you need. Because people who have suffered from the actions of such companies often contact us

, and unfortunately, in

cases of some of them nothing can be corrected.

Survivor's pension in the pension fund

The pension fund is designed not only to guarantee us an income at retirement age, but also to be a safety net for our loved ones. This component is expressed in "survivor's benefit". What is this allowance, how is it calculated and what should you know?

This component is expressed in "survivor's benefit". What is this allowance, how is it calculated and what should you know?

The survivor's pension is a monthly pension paid through a pension fund to survivors who are family members in the event of the death of a family member who contributed to the fund. The rest are clearly defined in the rules of the pension fund as follows:

Widow or widower, including publicly known couples and same-sex couples.

In the event of a divorce, the former spouse will not be considered a widower.

Children, including stepchildren. They will be eligible until they turn 21, except for a disabled child (who will be eligible for the rest of their life).

The calculation of the residual amount of the benefit differs if the insured was an active member of the pension fund or not (active member of the pension fund, i. e. the funds for him are paid into the fund on a permanent basis).

e. the funds for him are paid into the fund on a permanent basis).

If he is an active member, the amount of the benefit will be deducted from the salary determined by the pension fund, as well as from the insurance coverage rate.

Insurance coverage may vary depending on the date of entry into the pension fund. Since June 2018, the “Unified Regulation on Pension Funds” has come into force, which states that men who join the pension fund before the age of 41 and women who join before the age of 67 will be entitled to 100 percent insurance coverage. However, if you joined a pension fund before the introduction of uniform rules, or if you joined at a later age than indicated, you should check your insurance coverage.

In addition, the method of distribution of the allowance in relation to the determining salary is also fixed:

The spouse will be entitled to a monthly allowance of 60% of the fixed salary.

Children - 40% of fixed salary up to age 21 (as stated, including stepchildren. In the case of a child with a disability, for life).

If the deceased is an inactive member, the residual annuity will be calculated according to the fund balance and according to the age of the beneficiaries (depending on the annuity conversion factor). Roughly speaking, you can say that you take the overall child conversion rates and divide them by two - and add the widower conversion rate to the equation. From this number, the relative share of each recipient is calculated - and the result is multiplied by the amount of money in the fund to get the amount of the benefit.

Example: An unemployed colleague who had NIS 100,000 in pension funds died, leaving behind a widow and a 10-year-old child. The widow's pension conversion factor is 270 and the child's is 110. The total factor would be calculated as follows: 110/2 + 270 = 325.

To calculate the widow's relative share, do the following calculation: 270/325 = 83%. Therefore, the share of the child is 17%.

That is, the widow will be entitled to 83,000 shekels and the child to 17,000 shekels, which will be divided into a monthly allowance.

Read more: All about the remaining beneficiaries and heirs of your pension savings

It should be noted that the residual pension is taxable (unless the pension is less than NIS 8510. In this case, the pension is not taxed).

In addition to the monthly allowance, there are cases where you can also receive a lump sum:

a smaller monthly pension in addition to the lump sum.

Similarly, if the amount of the fund is very small, so that the residual allowances do not reach 5% of the average salary in the economy - the allowance can be converted into a lump sum.

In cases where there is no balance at all, it is paid in a lump sum to the beneficiaries identified in the pension fund.

In cases where there is no balance at all, it is paid in a lump sum to the beneficiaries identified in the pension fund.

Widowers can capitalize up to 25% of the total allowance for 5 years, provided that after capitalization their annuity does not fall below the minimum monthly allowance (NIS 4,525 as of 2020).

If there is no widower left and the youngest child is 18 years old, the children can convert the monthly allowance (which was said to be paid until the age of 21) into a lump sum according to the allowance conversion rate.

In conclusion, it can be seen that the nature and amount of the residual benefit depends on many variables; from the number of balances to determining the type of activity of the participant in the pension fund and the amount of insurance coverage.