How much is current child tax credit

The Child Tax Credit | The White House

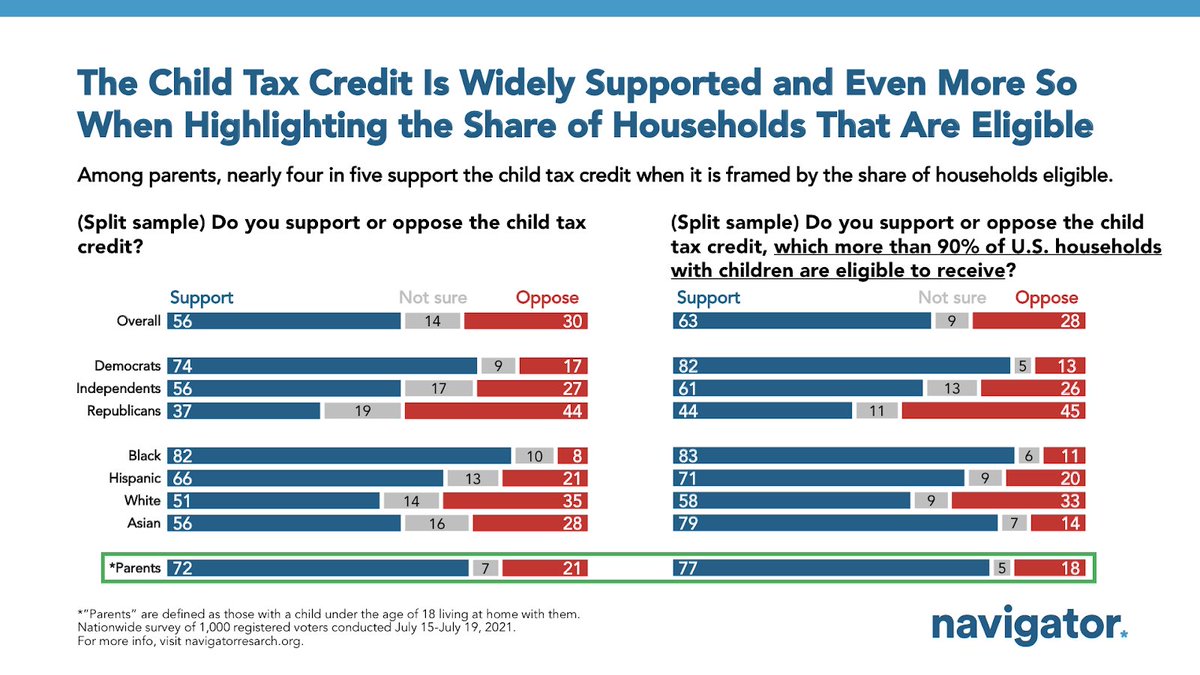

To search this site, enter a search termThe Child Tax Credit in the American Rescue Plan provides the largest Child Tax Credit ever and historic relief to the most working families ever – and as of July 15th, most families are automatically receiving monthly payments of $250 or $300 per child without having to take any action. The Child Tax Credit will help all families succeed.

The American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000 to $3,600 for children under the age of six, and raised the age limit from 16 to 17. All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent (also called Head of Household).

Major tax relief for nearly

all working families:

$3,000 to $3,600 per child for nearly all working families

The Child Tax Credit in the American Rescue Plan provides the largest child tax credit ever and historic relief to the most working families ever.

Automatic monthly payments for nearly all working families

If you’ve filed tax returns for 2019 or 2020, or if you signed up to receive a stimulus check from the Internal Revenue Service, you will get this tax relief automatically. You do not need to sign up or take any action.

President Biden’s Build Back Better agenda calls for extending this tax relief for years and years

The new Child Tax Credit enacted in the American Rescue Plan is only for 2021. That is why President Biden strongly believes that we should extend the new Child Tax Credit for years and years to come. That’s what he proposes in his Build Back Better Agenda.

Easy sign up for low-income families to reduce child poverty

If you don’t make enough to be required to file taxes, you can still get benefits.

The Administration collaborated with a non-profit, Code for America, who created a non-filer sign-up tool that is easy to use on a mobile phone and also available in Spanish. The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November 15 deadline, you can still claim the full credit of up to $3,600 per child by filing your taxes next year.

See how the Child Tax Credit works for families like yours:

-

Jamie

- Occupation: Teacher

- Income: $55,000

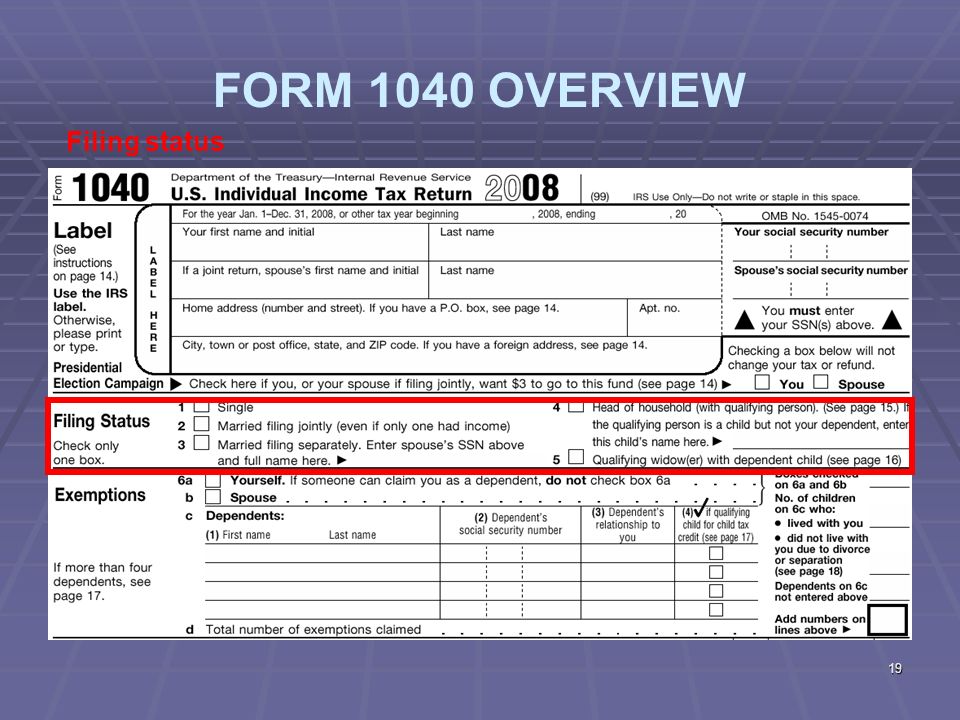

- Filing Status: Head of Household (Single Parent)

- Dependents: 3 children over age 6

Jamie

Jamie filed a tax return this year claiming 3 children and will receive part of her payment now to help her pay for the expenses of raising her kids. She’ll receive the rest next spring.

- Total Child Tax Credit: increased to $9,000 from $6,000 thanks to the American Rescue Plan ($3,000 for each child over age 6).

- Receives $4,500 in 6 monthly installments of $750 between July and December.

- Receives $4,500 after filing tax return next year.

-

Sam & Lee

- Occupation: Bus Driver and Electrician

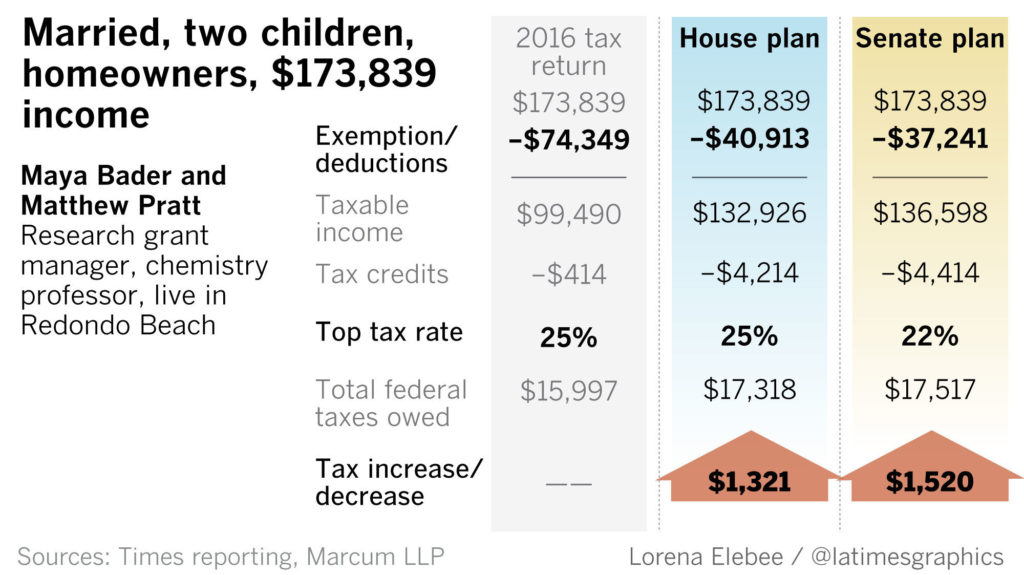

- Income: $100,000

- Filing Status: Married

- Dependents: 2 children under age 6

Sam & Lee

Sam & Lee filed a tax return this year claiming 2 children and will receive part of their payment now to help her pay for the expenses of raising their kids. They’ll receive the rest next spring.

- Total Child Tax Credit: increased to $7,200 from $4,000 thanks to the American Rescue Plan ($3,600 for each child under age 6).

- Receives $3,600 in 6 monthly installments of $600 between July and December.

- Receives $3,600 after filing tax return next year.

-

Alex & Casey

- Occupation: Lawyer and Hospital Administrator

- Income: $350,000

- Filing Status: Married

- Dependents: 2 children over age 6

Alex & Casey

Alex & Casey filed a tax return this year claiming 2 children and will receive part of their payment now to help them pay for the expenses of raising their kids.

They’ll receive the rest next spring.

They’ll receive the rest next spring.- Total Child Tax Credit: $4,000. Their credit did not increase because their income is too high ($2,000 for each child over age 6).

- Receives $2,000 in 6 monthly installments of $333 between July and December.

- Receives $2,000 after filing tax return next year.

-

Tim & Theresa

- Occupation: Home Health Aide and part-time Grocery Clerk

- Income: $24,000

- Filing Status: Do not file taxes; their income means they are not required to file

- Dependents: 1 child under age 6

Tim & Theresa

Tim and Theresa chose not to file a tax return as their income did not require them to do so. As a result, they did not receive payments automatically, but if they signed up by the November 15 deadline, they will receive part of their payment this year to help them pay for the expenses of raising their child. They’ll receive the rest next spring when they file taxes.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13294673/lift_harris_bill.png) If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.

If Tim and Theresa did not sign up by the November 15 deadline, they can still claim the full Child Tax Credit by filing their taxes next year.- Total Child Tax Credit: increased to $3,600 from $1,400 thanks to the American Rescue Plan ($3,600 for their child under age 6). If they signed up by July:

- Received $1,800 in 6 monthly installments of $300 between July and December.

- Receives $1,800 next spring when they file taxes.

- Automatically enrolled for a third-round stimulus check of $4,200, and up to $4,700 by claiming the 2020 Recovery Rebate Credit.

Frequently Asked Questions about the Child Tax Credit:

Overview

Who is eligible for the Child Tax Credit?

Getting your payments

What if I didn’t file taxes last year or the year before?

Will this affect other benefits I receive?

Spread the word about these important benefits:

For more information, visit the IRS page on Child Tax Credit.

Download the Child Tax Credit explainer (PDF).

ZIP Code-level data on eligible non-filers is available from the Department of Treasury: PDF | XLSX

The Child Tax Credit Toolkit

Spread the Word

Child Tax Credit | U.S. Department of the Treasury

The American Rescue Plan increased the Child Tax Credit and expanded its coverage to better assist families who care for children.

Overview

The American Rescue Plan’s expansion of the Child Tax Credit will reduced child poverty by (1) supplementing the earnings of families receiving the tax credit, and (2) making the credit available to a significant number of new families. Specifically, the Child Tax Credit was revised in the following ways for 2021:

- The credit amount was increased for 2021. The American Rescue Plan increased the amount of the Child Tax Credit from $2,000 to $3,600 for qualifying children under age 6, and $3,000 for other qualifying children under age 18.

- The credit was made fully refundable. By making the Child Tax Credit fully refundable, low- income households will be entitled to receive the full credit benefit, as significantly expanded and increased by the American Rescue Plan.

- The credit’s scope has been expanded. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit. Previously, only children 16 and younger qualified.

- Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December. Families caring for children were able to receive financial assistance on a consistent monthly basis from July to December 2021, instead of waiting until tax filing season to receive all of their Child Tax Credit benefits.

File your taxes to get your full Child Tax Credit — now through April 18, 2022. Get help filing your taxes and find more information about the 2021 Child Tax Credit.

In addition, the American Rescue Plan extended the full Child Tax Credit permanently to Puerto Rico and the U. S. Territories. For the first time, low- income families residing in Puerto Rico and the U.S. Territories will receive this vital financial assistance to better support their children’s development and health and educational attainment.

S. Territories. For the first time, low- income families residing in Puerto Rico and the U.S. Territories will receive this vital financial assistance to better support their children’s development and health and educational attainment.

Recent Updates

- New and Improved ChildTaxCredit.gov

- This website exists to help people:

- Get the Child Tax Credit

- Understand how the 2021 Child Tax Credit works

- Find out if they are eligible to receive the Child Tax Credit

- Understand that the credit does not affect their federal benefits

- This website provides information about the Child Tax Credit and the monthly advance payments made from July through December of 2021. Every page includes a table of contents to help you find the information you need.

- This website exists to help people:

- Code for America’s Non-Filer Tool

- Code for America partnered with The White House and the Treasury Department to create a website and mobile-friendly tool, in English and Spanish, to assist families claiming their Child Tax Credit and missing Economic Impact Payments.

- The GetCTC tool is currently closed for the season, but you can access information about the Child Tax Credit on the website.

- Community organizations and volunteer navigators seeking to help hard-to-reach clients access the Child Tax Credit or Economic Impact Payments can access training materials and resources on the navigator website.

- Code for America partnered with The White House and the Treasury Department to create a website and mobile-friendly tool, in English and Spanish, to assist families claiming their Child Tax Credit and missing Economic Impact Payments.

- IRS Non-Filer Tool

- Most families will automatically start receiving the new monthly Child Tax Credit payments on July 15th.

- Families who normally aren’t required to file an income tax return should use this Non-Filers Tool to register quickly for the expanded and newly-advanceable Child Tax Credit from the American Rescue Plan.

- Child Tax Credit Portal

- Use this tool to:

- Check if you’re enrolled to receive payments

- Unenroll to stop getting advance payments

- Provide or update your bank account information for monthly payments starting with the August payment

- Use this tool to:

- Child Tax Credit Eligibility Assistant

- Check if you may qualify for advance payments.

- Check if you may qualify for advance payments.

Spread the word

- Key Messaging about the Child Tax Credit

- Child Tax Credit Toolkit: Download all CTC Info Sheets and Social Media slides

- Info Sheet: How Has the CTC Changed This Year

- Info Sheet: How to Make Sure You Get the CTC Payment

- Info Sheet: The Expanded Child Tax Credit: Explained

- Social Media slides: How Has the CTC Changed This Year

- Social Media slides: How to Make Sure You Get the CTC Payment

- Find more information at ChildTaxCredit.gov

RESOURCES

- Child Tax Credit FAQs

- Child Tax Credit Press Release

- Economic Impact Payment Info

- Need to file a tax return? Find free options and information here

Tax deduction for children - Raiffeisenbank R-Media Blog

The state returns part of the income tax paid to parents. Every child under 18 is entitled to a standard tax deduction. For the first and second child - 1,400 ₽ per month, for subsequent children - 3,000 ₽. Article 218 of the Tax Code of the Russian Federation

For the first and second child - 1,400 ₽ per month, for subsequent children - 3,000 ₽. Article 218 of the Tax Code of the Russian Federation

can be received until he is 24 years old.

By law, older children are counted on a priority basis. For example, you have two older adults and independent children, for whom you no longer receive a deduction, but for a third schoolchild, the deduction will still be 3,000 ₽.

If the spouses have a child from early marriages, then their joint child will be considered the third.

Who is entitled to the deduction

Citizens who officially support children can receive a tax deduction:

- blood parents,

- stepfather / stepmother,

- adoptive parents,

- guardians,

- trustees,

- parents deprived of parental rights if they continue to participate in the maintenance of the child - letter of the Federal Tax Service dated 13.01.2014 No. BS-2-11/13@.

Each parent can exercise the right to the deduction. A necessary condition for this is official income, from which 13% income tax is paid.

A necessary condition for this is official income, from which 13% income tax is paid.

Non-working mothers, students, pensioners, individual entrepreneurs on the simplified tax system, UTII or patent do not pay income tax, therefore they will not be able to use the tax deduction. And individual entrepreneurs on the general taxation system pay personal income tax, therefore they have the right to a deduction.

Double deduction

Single parent, guardian, adoptive parent, custodian or adoptive parent receives double the deduction. The basis for double deduction will be:

- death of a parent;

- legal fact of missing;

- the actual absence of the father since the birth of the child: a dash in the column "father" in the birth certificate or an entry from the words of the mother;

- deprivation of the second parent of parental rights if he does not participate in the maintenance of the child.

But divorced parents are not entitled to a double deduction even in case of non-payment of alimony.

Deduction for a disabled child

If you are raising a child with a disability of the first or second group, then the amount of the tax deduction is higher:

- 12,000 ₽ - if you are a parent, parent's spouse or adoptive parent;

- 6000 ₽ - if you are a guardian, guardian, foster parent, spouse of a foster parent.

Increased and basic deductions are summed up. This means that if your second child is disabled, then the tax deduction for him will be: 1400 + 12,000 = 13,400 ₽.

If a disabled child was born the third or subsequent, then the amount of the deduction for him: 3,000 ₽ + 12,000 ₽ = 15,000 ₽, and the total deduction for three children will be: 1,400 ₽ + 1,400 ₽ + 15,000 ₽ = 17,800 ₽.

How much will I save

The law provides not for the return of the indicated amounts, but for the reduction of the taxable base by these amounts. This means that each parent can save per month:

- per child: 1,400×13% = 182 ₽

- for two children: (1,400 + 1,400) x 13% = 364 ₽

- for three children: (1,400 + 1,400 + 3,000) x 13% = 754 ₽

- for four children: (1,400 + 1,400 + 3,000 + 3,000) x 13% = 1144 ₽

- for the first or second disabled child: (12,000 + 1,400) x 13% = 1,742 ₽

- for a third or subsequent disabled child: (12,000 + 3,000) x 13% = 1,950 ₽

Example.

Evgenia has three children - 11, 8 and 5 years old. Her salary is 40,000 ₽. If she has not filed an application for a tax deduction for children, then the employer calculates personal income tax at 13% of the total amount of income: 40,000 ₽ x 13% = 5,200 ₽, and will pay 34,800 ₽ in her hands.

If Evgenia has submitted an application and documents for a child deduction, then the tax will be calculated not from the entire amount, but minus the tax-free amounts for children:

personal income tax = (40,000 ₽ - 1400 ₽ - 1400 ₽ - 3000 ₽) % = 4446 ₽.

Evgeny will receive 35,554 ₽, which is 754 ₽ more.

How to get a deduction

It's not difficult. Write an application to the employer for a standard tax deduction for children and attach copies of documents for the deduction:

- passport;

- birth or adoption certificate of a child;

- certificate of the child's disability, if necessary;

- certificate from an educational institution stating that the child is a full-time student if the child is a student.

If you are a single parent:

- death certificate of the other parent;

- extract from the court decision on recognizing the other parent as missing;

- certificate of the birth of a child, compiled from the words of the mother at her request in the form No. 25 - Decree of the Government of the Russian Federation of 10/31/1998 No. 1274.

If you are a guardian or guardian:

- decision of the guardianship and guardianship authority or an extract from the decision to establish guardianship or guardianship over the child;

- agreement on the implementation of guardianship or guardianship;

- agreement on foster family.

The deduction can only be made with one employer, even if you work at several jobs at the same time. The application is submitted once. Only a certificate of a child's full-time education at an educational institution is updated annually if he is already 18 years old.

Maximum amount for deduction

The law protects the interests of low-income citizens, therefore, it contains a limitation - the deduction for children is provided until the amount of your income for the current year exceeds 350,000 ₽.

Example.

The amount of 5800 ₽ will be deducted from Evgenia's salary before taxation from January to August inclusive. In August, taxable income for the current year will reach 350,000 ₽, so from September until the end of the year, tax will be calculated on the entire amount. And from the new year, Evgenia will again receive a deduction.[/framegrey]

How to get a deduction back if you didn’t get one

If you didn’t receive your deductions or received them in a smaller amount than you were due, you can return them when you file your tax return with the tax office in your place of residence, but only for the last three of the year.

Submit to the tax authority at the place of residence a completed tax return with an application for a standard tax. At the same time, you need to:

At the same time, you need to:

- At the end of the year, fill out a tax return in the form 3-NDFL.

- Obtain a certificate from the accounting department at the place of work on the amounts of accrued and withheld taxes for the required years in the form 2-NDFL.

- Attach copies of documents confirming the right to receive a deduction for children.

A desk audit will take 3 months. If the decision on the application is positive, then the amount of overpaid tax will be returned within a month to the bank account you specified in the application.

Things to remember

- A child tax deduction can be received from birth until the age of 18 or until the age of 24 if the child continues full-time education.

- Adult children for whom you no longer receive a deduction are still counted in the queue.

- You will receive a deduction for children until the amount of income for the current year exceeds 350,000 ₽.

- Each parent is entitled to deductions.

- An application for a deduction is submitted to the accounting department once - next year the deduction will be calculated automatically.

- If you did not receive a deduction for children, then it can be returned when filing a tax return, but only for the last three years.

Tax deduction - Medline Clinic in Barnaul

Have you paid taxes? Take them back to the state!

A significant part of the Russian population pays taxes. However, this amount can be reduced. There is a tax deduction for this. What's this? When making such a deduction, the state reduces the amount from which taxes are paid. It is also called the return of a certain part of the previously paid personal income tax (personal income tax) when buying real estate, spending on treatment or training. It is important to note that you can get a tax deduction not only when paying for your examinations and medicines. The tax is returned even from the amount of expenses for the treatment of close relatives

The tax is returned even from the amount of expenses for the treatment of close relatives

What expenses can be included in the deduction for treatment

The following expenses can be included in the deduction:

- Medical services - tests, examinations, doctor's appointments, procedures in paid clinics. Provided that you paid for it, that is, the services are not under the CHI policy, but at your expense.

- Prescribed medicines. Starting in 2019, you can get a deduction for the cost of any drug, not just those on the government's list.

- Expensive treatment. This is the only type of medical expenses for which there is no limit: any amount is accepted for deduction without restrictions. Types of expensive treatment are in a special list, this is followed by a medical organization when it issues a certificate of the cost of services.

- Contributions under the VHI agreement.

Relatives for which the deduction for treatment is given

The deduction for treatment can be received not only when paying for your examinations and medicines. The tax is returned even from the amount of expenses for the treatment of close relatives, but not any, but only from a limited list.

The tax is returned even from the amount of expenses for the treatment of close relatives, but not any, but only from a limited list.

Here is a complete list of relatives whose treatment can be included in your tax deduction:

- Parents. The deduction will be given only when paying for the treatment of their parents. If you pay for the spouse's parents or adoptive parents, the tax will not be refunded. There are no parental requirements. They can work under an employment contract, or they can be pensioners, unemployed or self-employed individual entrepreneurs.

- Children or wards under 18 years of age. The deduction for treatment is only for your children. If you pay for tests and examinations of your spouse's children, even when they are fully supported, personal income tax cannot be returned. There is also an important condition regarding age: the child must be no more than 18 years old. Moreover, the fact of studying at a full-time university does not extend this age to 24 years: this is possible with education, but with treatment - only up to 18 years.

- Spouses. If a husband pays for his wife, he can get a deduction. And the wife will return the tax when paying for the treatment of her husband. But the marriage must be officially registered. A certificate of payment for medical services and checks for the purchase of drugs can be issued to any spouse: their expenses are still considered general.

You cannot get a deduction for other relatives. Unlike training, there are no siblings on this list. If you pay for dental treatment or surgery for your sister, you will not receive a deduction. For grandparents, common-law spouse, children of the wife from the first marriage, nephews or mother-in-law, the tax cannot be refunded.

The list of relatives is closed and there can be no additional conditions.

How to return money for treatment

How much money can be returned when paying for the treatment of relatives

Cost limit. The deduction for treatment has a limit - 120,000 R per year. This is a general limit for several social deductions, for example, it also includes tuition costs. 120,000 R is a restriction not for each type of expense, but for all.

This is a general limit for several social deductions, for example, it also includes tuition costs. 120,000 R is a restriction not for each type of expense, but for all.

Here are the expenses that will be included in the limit:

- Training.

- Treatment.

- DMS.

- Voluntary contributions to pensions.

- Voluntary life insurance.

- Additional contributions to the funded part of the pension.

- Independent qualification assessment.

When paying for the treatment of relatives, an additional deduction will not be given: both your own and their expenses must be included in this limit.

120,000 R does not include only the cost of educating children - there is a separate limit of 50,000 R for each child - and expensive types of treatment that are accepted for deduction without taking into account the limit. There is also a social deduction for charity, but it has separate conditions and the limit is calculated as a percentage.

How much money will be returned

The amount of the deduction depends on your salary and the cost of treatment. In any case, the tax office will not return more money than the personal income tax paid for the year. Let's look at an example:

Vasily works as a manager and receives 40,000 R per month. In a year, he earned 480,000 R. He gives 13% of his salary to the state as a tax (personal income tax). For the year he paid 480,000 × 0.13 = 62,400 R.

In 2015, he spent 80,000 RUR on treatment. Vasily collected documents and applied for a tax deduction. After submitting the application, the tax authority will deduct the amount of treatment from Vasily’s income for the year and recalculate his personal income tax: (480,000 − 80,000) × 0.13 = 52,000 R.

It turns out that Vasily had to pay 52,000 R, but in fact he paid 62,400 R. The tax office will return the overpayment to him: 62,400 − 52,000 = 10,400 R.

The deduction can be made within three years following the year of treatment payment.

This money will go directly to the card, but you will have to wait.

How to draw up documents if you pay for relatives

- For your spouse. When paying for the treatment of a husband or wife, documents can be issued to anyone. The contract and receipts can be in the name of the husband or wife, it does not matter for the deduction. It is believed that they have everything in common. The same expenses can be deducted by either spouse, but only by one. They can also be divided among themselves, this helps to return more tax, taking into account the limit.

- For children and parents. Payment documents must be issued to the person who pays and wants to receive a deduction. If receipts and a certificate are issued to the mother, the son will not be given a deduction for these expenses. Although you can try to resolve this issue with the help of a conventional written power of attorney. The contract for medical services should contain a wording from which it is clear that it is concluded with this person - the one who claims the deduction - for the treatment of this relative.

But if this did not work out, this usually does not interfere with the return of the tax. The tax first of all looks at payment documents and a certificate. This is really important.

But if this did not work out, this usually does not interfere with the return of the tax. The tax first of all looks at payment documents and a certificate. This is really important.

How to return personal income tax from the costs of treatment for the past year

For the past year, you can return the tax only on the declaration. Through the employer return only in the current year.

Here is the instruction:

- Get medical bills. This is a special document, it must be issued by the organization to which you paid for the treatment. Now everything is stored electronically, so usually you don’t even need to show receipts. The help will indicate the code - "1" or "2". If it is "1", then you need to take into account the limit, if "2" - the entire amount will be deducted.

- Make copies of documents that confirm your relationship: birth and marriage certificates.

- Fill out the 3-NDFL declaration in your personal account on the nalog.

ru website. It can be filled out in a special program or handed in on paper, but through the site - this is the easiest, fastest and most convenient way that will insure you against mistakes and speed up the verification. Scans or photographs of documents must be attached to the declaration.

ru website. It can be filled out in a special program or handed in on paper, but through the site - this is the easiest, fastest and most convenient way that will insure you against mistakes and speed up the verification. Scans or photographs of documents must be attached to the declaration.

To receive documents for a tax deduction, you can apply to the administrator-cashier at our Center or send a request electronically by filling out the form below.

Dear patients, when filling out the form, be sure to indicate:

- contact details

- period for which documents must be submitted

- list of required documents

Tax deduction application form

Galina Vasilievna

Happy New Year, glorious "Aibolites"! Honor and respect to you! Let doing what you love brings inspiration and joy. Special thanks to Victoria Alexandrovna Tsyganova: Be happy and loved! May success accompany you. And in the profession, protected by God, I wish you strength, good luck! Thank you for the atmosphere of kindness, participation and professional help.

Special thanks to Victoria Alexandrovna Tsyganova: Be happy and loved! May success accompany you. And in the profession, protected by God, I wish you strength, good luck! Thank you for the atmosphere of kindness, participation and professional help.

Marina

Hello, June 19 - Day of the Medic and I, the patient of "Medline", wanted to congratulate all the staff of the clinic and say "thank you" for your work, which is very necessary for us (we do it so rarely today, taking everything for granted). How many cured people? A lot - work goes on every day. You save us from the pain that many live with for years... I was treated with my "delicate problem" by Victoria Alexandrovna for several months - thanks to this real Doctor for his professionalism, competent and clear treatment plan, attentive attitude and respect. I would like to wish your clinic to keep such a high level of treatment and service. All the best to you in your work and personal life.