How much is child tax credit in canada

What is the Canada Child Benefit?

Raising kids can be expensive, but qualifying families can receive tax-free monthly payments from the government to help with some of the costs.

Known as the Canada Child Benefit, the amount your family gets will depend on factors like household income, family size, and province or territory of residence. Fortunately, the process of applying for this assistance is straightforward and quick.

What is the Canada Child Benefit?

In 2016, the Canada Child Benefit, or CCB, replaced the Canada Child Tax Benefit, or CCTB. The government made this change to make more money available to parents with lower incomes.

The CCB is a tax-free monthly payment made directly to families with children under 18 years old. It’s handled by the Canada Revenue Agency (CRA), but you don’t need to include it on your income tax return — you just need to file your income taxes every year.

If you’re eligible, the CCB payments you receive may include additional benefits for your children, including a child disability benefit and provincial and territorial benefits.

» MORE: What Canadian employees should know about T4 slips

How much is the Canada child benefit?

Monthly CCB payments are based on:

- The number of children in your care.

- The age of the children.

- Your marital status.

- Your adjusted family net income (AFNI) from the previous year’s tax return.

If your AFNI is less than $32,028, you can receive up to the following amounts per child:

- Under six years of age: $6,833 per year ($569.41 per month)

- Six to 17 years of age: $5,765 per year ($480.41 per month)

Since the CCB is meant to deliver assistance to lower-income families, payments start to decrease if your AFNI exceeds $32,028. Additionally, if you’re over this income threshold, the CCB is reduced for each additional child you have.

Admittedly, CCB calculations and adjustments can be a bit complicated. However, the Government of Canada has an online CCB calculator that can help you estimate exactly how much CCB you’ll receive each month.

Payments are recalculated every July based on the previous year’s tax return. The government also adjusts the maximum payout for the CCB every year to account for inflation.

There’s also a young child supplement that’s paid out four times a year to families with children under the age of six. To get this benefit, you must file your income taxes.

» MORE: What is a kids bank account?

Canada child benefit eligibility

To qualify for the CCB, you, your spouse, or your common-law partner must be a Canadian citizen, permanent resident, protected person, or an Indigenous person as defined under the Indian Act. You may also qualify as a temporary resident in Canada for the past 18 months who has a valid permit with resident status for the following month.

You must also meet the following conditions:

- You live with at least one child under the age of 18.

- You’re the person primarily responsible for the child’s care.

- You’re a Canadian resident for tax purposes.

If you have a foster child or care for a child under a kinship or close relationship program, you would only get the CCB if you’re not receiving funds from the Children’s Special Allowances, or CSA, program.

Only one person — the individual primarily responsible for the child’s care — should apply for the CCB. To determine who fills that role in a household with two parents or guardians, ask yourself the following:

- Who takes care of the child’s daily activities and needs?

- Who makes sure the child’s medical needs are met?

- Who arranges child care when needed?

If two individuals share the responsibilities equally and one of them is female, the CRA assumes she is primarily responsible for the child’s care. Therefore, the female parent should apply for the CCB. The female parent can sign a letter stating that the other parent is primarily responsible, however, in which case, the other parent would apply for the CCB.

In the case of same-sex parents, one parent should apply for the CCB for all the children.

If you’re in a joint custody situation, the CRA will calculate how much each parent qualifies for based on your custody arrangement.

» MORE: How does Canada’s Registered Disability Savings Plan (RDSP) work?

How to claim the Canada Child Benefit

You can apply for the CCB as soon as a child is born or starts to live with you, or you begin to meet the eligibility requirements.

For example, you can apply for the CCB when you register the birth of your newborn child, usually at the hospital or birthing centre. As long as you provide your consent and social insurance number (SIN), the CRA will get your information.

If you didn’t apply when the child was born, you can apply online via My Account (your personal CRA account) or by mail.

CCB payments are made monthly via direct deposit or cheque. As long as you file your taxes every year and continue to meet the eligibility requirements, you’ll continue to get the CCB.

What is the Canada Child Benefit?

December 2021 – 15 min read

Key takeaways

What’s in this article?

- An intro to the Canada Child Benefit (CCB)

- Who can claim the CCB?

- CCB payments explained

- How to apply for the CCB

- What's next?

An intro to the Canada Child Benefit (CCB)

The CCB is a government benefitOpens in a new window that helps families in Canada with the costs of raising children.

Administered by the Canada Revenue Agency (CRA), it was introduced in July 2016 to replace the Universal Child Care Benefit (UCCB). The CCB provides eligible parents with children under the age of 18 a monthly, tax-free payment. The CCB could include the Child Disability Benefit (CDB)Opens in a new window and is payable on top of any other child benefits that might be offered at provincial or municipal level.

Who can claim the CCB?

You could be eligible to receive the CCB if you meet all the following criteria:

- You’re a resident of Canada for tax purposes

- You live with a child under 18 years of age

- You have primary responsibility for the child’s care and upbringing

You could be eligible to receive the CCB if you or your spouse or common-law is:

- A Canadian citizen or permanent resident

- A temporary resident who has lived in Canada for the previous 18 months

- A protected person

- An indigenous person

About primary responsibility

You should apply for the CCB if you’re considered “primarily responsible” for raising your child. That means being responsible for things such as:

That means being responsible for things such as:

- Supervising the child's everyday activities

- Taking care of their daily needs

- Taking care of any medical needs

- Arranging childcareOpens in a new window

Only 1 parent can apply for the CCB, and which parent does so will depend on your own family situation.

CCB payments explained

Based on CCB payments in 2021, you could receive a maximum of:

- $6,833 per year ($569.41 per month) for each eligible child under the age of 6

- $5,765 per year ($480.41 per month) for each eligible child aged 6 to 17

However, the amount you actually receive will depend on several factors, such as whether your child lives with you full or part time, your net family income, and the number of eligible children you have. You can use the government’s CCB calculatorOpens a new website in a new window - Opens in a new window to get an idea of what your payments might be.

Payments are recalculated every July. This is to account for inflation, as well as your family net income from the year before. For example, if there was a change in your income in 2021, this will be reflected in your payments starting in July 2022. If your total benefit amount for the year is less than $240, you’ll receive this as 1 lump sum payment in July instead of receiving it monthly.

This is to account for inflation, as well as your family net income from the year before. For example, if there was a change in your income in 2021, this will be reflected in your payments starting in July 2022. If your total benefit amount for the year is less than $240, you’ll receive this as 1 lump sum payment in July instead of receiving it monthly.

How to apply for the CCB

You should apply for the CCB as soon as any of these events happen:

- Your baby is born

- Your child starts to live with you after a period of living elsewhere

- Your custody arrangements change, or you are granted custody of a child

- You or your spouse or partner start to meet the criteria and become eligible

You can apply at the same time you register the birth of your baby with the province or territory, or afterwards using your CRA online account. You can also download and complete Form RC66, Canada Child Benefits ApplicationOpens a new website in a new window - Opens in a new window, and return this via mail along with any additional documents and forms required.

Your payments will start within 8 weeks of the government receiving your online application, or within 11 weeks of sending a paper application through the mail. The payments will stop when your child turns 18, or when your net family income exceeds the threshold of $120,000.

What’s next?

This material is for information purposes only and shouldn’t be construed as providing legal or tax advice. Every effort has been made to ensure its accuracy, but errors and omissions are possible. All comments related to taxation are general in nature and are based on current Canadian tax legislation and interpretations for Canadian residents, which are subject to change. For individual circumstances, consult with your tax, legal or accounting professionals. This information is provided by The Canada Life Assurance Company and is current as of date of publication.

Related articles

What is inflation and how does it impact Canadians?

RRSP withdrawal rules

How to manage the cost of living in Canada

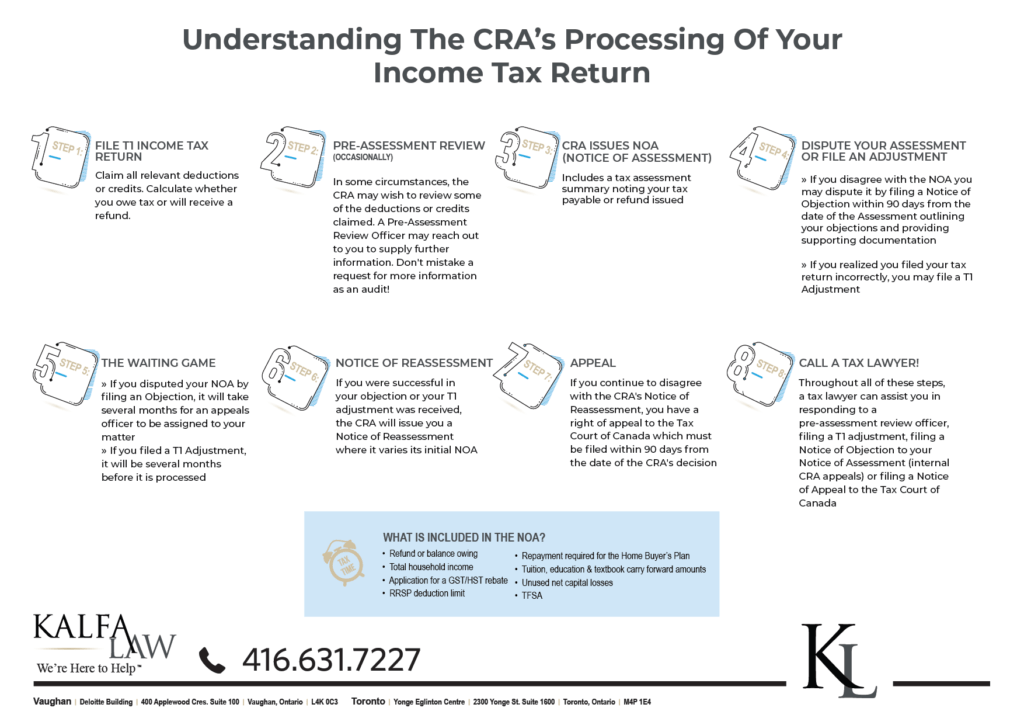

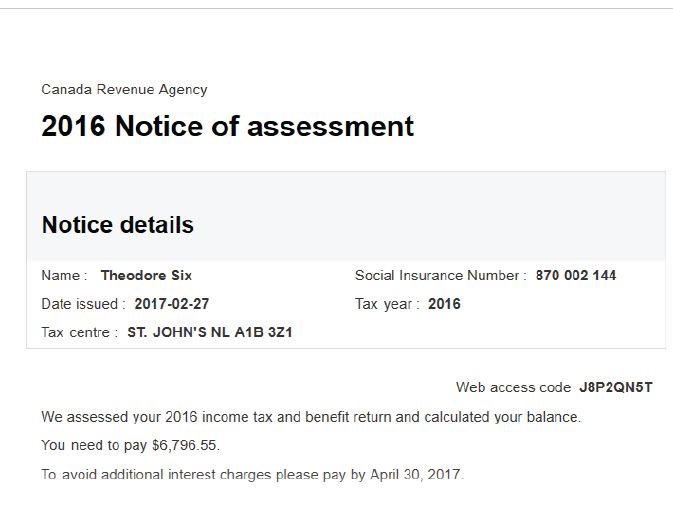

Taxes in Canada.

income tax in Canada.

income tax in Canada. Submit an application

Submit your request now and get

a personalized offer!

I agree with the company's rules for the processing and storage of personal data.

Taxation of personal income

For a person to be liable to pay income tax in Canada, they must:

- be a Canadian citizen or reside in the country for at least 183 days a year;

- receive cash income during the year above the established minimum of 11,327 Canadian dollars.

For citizens of Canada, it does not matter in which country they received their income - in any case, they will pay taxes on the entire amount. At the same time, for foreign citizens, the object of taxation is only funds received in Canada: salary, business income, capital gains, and so on.

The main tax payment for individuals is income tax, which in this country is called the federal tax, which already indicates its significant role in the structure of fiscal revenues to the state budget. As in other developed countries, income tax in Canada has a progressive payment scale at the following rates in 2017:

As in other developed countries, income tax in Canada has a progressive payment scale at the following rates in 2017:

- from $11,300 to $45,900 — 15%;

- from $45,900 to $92,000 - 20.5%;

- from $92,000 to $142,300 - 26%;

- from $142,300 to $202,800 - 29%

- from $202,800 - 33%.

It is important that in different provinces the rate of regional income tax can vary significantly. For example, in the largest province - Ontario - the maximum rate is 13.16% for incomes over 220 thousand dollars, while in Quebec - 25.75% for incomes over 103 thousand dollars (similar income in Ontario would be taxed at rate 9,fifteen%).

One might get the impression that the tax burden in Canada on a working or self-employed person is no less, and even more than in Western European countries. Indeed, for an individual who earns more than 220 thousand a year and lives in the province of Quebec, the total income tax rate will be 58.75% (33% + 25. 75%), and this is without taking into account contributions to pension funds (4.95%, but not more than 2.5 thousand per year) and social insurance (1.88%, but not more than 0.9 thousand per year), which are also included in income tax in Canada.

75%), and this is without taking into account contributions to pension funds (4.95%, but not more than 2.5 thousand per year) and social insurance (1.88%, but not more than 0.9 thousand per year), which are also included in income tax in Canada.

However, there are many tax deductions:

- married people pay less than single people, because the former have a higher level of inevitable costs: expenses for kindergarten, school, college for a child;

- if the husband or wife is an unemployed person, regardless of the reason;

- when the payer maintains disabled relatives or persons of retirement age;

- if the family's total medical expenses are more than 3% of the income of the member who earns the least;

- when buying a first home;

- when paying bills for renting real estate or tax payments on it.

As a result, you can significantly reduce the tax burden for an individual in Canada if you are aware of all possible fiscal credits. The easiest way to do this is for a person with a low income - without significant effort, the real rate (federal + local part - tax deductions) will be approximately 10-15%, and most average Canadians give the state 20-25% of their annual income.

The easiest way to do this is for a person with a low income - without significant effort, the real rate (federal + local part - tax deductions) will be approximately 10-15%, and most average Canadians give the state 20-25% of their annual income.

our clients

payment methods

master card

visa electron

maestro

Alfa Bank

Western Union

moneygram

Skrill

bitcoin

litecoin

cashless payments

Our Partners

Switch to Desktop

Switch to Mobile

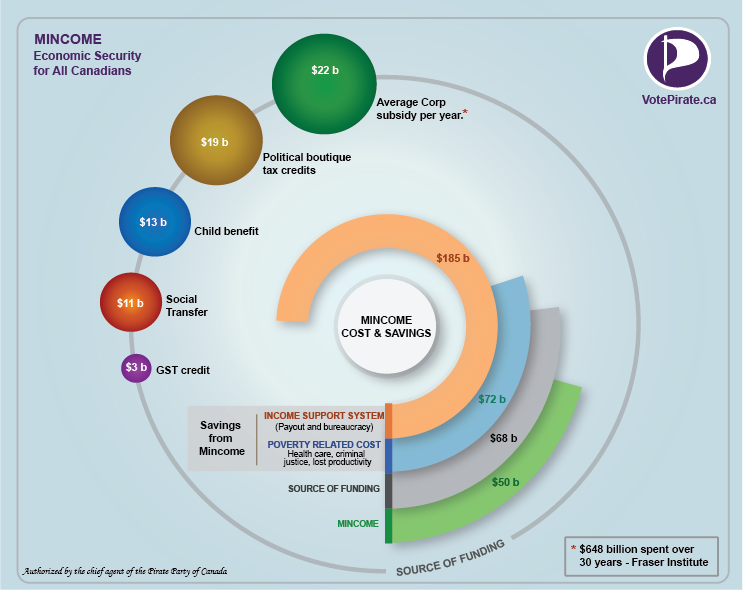

Canada Child and Family Benefits

Child and family benefits in Canada include:

- Canada child benefit;

- Goods and services tax/harmonized sales tax (GST/HST) credit;

- Allied provincial and territorial programs;

- Tax deduction for working parents;

- Other federal programs.

The purpose of these benefits is to provide financial assistance to individuals and families. Payouts are administered by the Canada Revenue Agency (CRA). Are you eligible for benefits and want to apply? Select the link below for more information about the benefit, loan or program.

| Learn whether you have the right to benefit or credit | |||||||

| | , there are children younger than 18 years old | years | Married or cohabiting, no children | Single and 1 Goods and services tax/harmonized sales tax (GST/HST) credit The GST/HST credit is a tax-free quarterly payment that helps low-income individuals and families offset some or all of the GST or HST they pay. You no longer need to apply for a GST/HST loan. The Canada Revenue Agency will automatically make you eligible when you declare your income and benefits from tax year 2014 onwards.

The last regular payments for these benefits for prior years were made in June 2016. What to do after applying? You do not need to apply for these benefits and loans every year. But you must each year:

| |||

If you are a new resident of Canada and wish to apply for a GST/HST loan, please complete Form RC151, GST/HST Credit Application for Individuals Who Become Residents of Canada for the year you became a resident of Canada. If you have a spouse or common-law partner, only one of you can receive these benefits. The loan will be paid to the one of you whose data is processed earlier, but the amount will be the same, regardless of who in the pair will issue payments. You may also be eligible for other benefits. Disability Child Benefit This is a tax-free benefit for families caring for a minor child who is eligible for the disability tax credit. Working Parents Tax Credit This is a tax credit for working individuals and low-income families who are already in the labor force. The purpose of this tax is also to encourage Canadians to enter the labor market. Special Child Benefits This program provides payments to federal and state agencies and agencies that care for children (such as children's aid societies).

If you are a new resident of Canada and wish to apply for a GST/HST loan, please complete Form RC151, GST/HST Credit Application for Individuals Who Become Residents of Canada for the year you became a resident of Canada. If you have a spouse or common-law partner, only one of you can receive these benefits. The loan will be paid to the one of you whose data is processed earlier, but the amount will be the same, regardless of who in the pair will issue payments. You may also be eligible for other benefits. Disability Child Benefit This is a tax-free benefit for families caring for a minor child who is eligible for the disability tax credit. Working Parents Tax Credit This is a tax credit for working individuals and low-income families who are already in the labor force. The purpose of this tax is also to encourage Canadians to enter the labor market. Special Child Benefits This program provides payments to federal and state agencies and agencies that care for children (such as children's aid societies). Are you expecting a baby? If you are the birth mother of a newborn, you can use the Automated Benefits Application on the birth registration form when you register your newborn child in your province. This will allow you to apply for your child's assistance under Canada child benefit, GST/HST credit, and similar provincial and territorial programs. How do I get child support for previous years? If you qualify and are raising a child under age 18 as of July 2016, you can still apply for these benefits:

Are you expecting a baby? If you are the birth mother of a newborn, you can use the Automated Benefits Application on the birth registration form when you register your newborn child in your province. This will allow you to apply for your child's assistance under Canada child benefit, GST/HST credit, and similar provincial and territorial programs. How do I get child support for previous years? If you qualify and are raising a child under age 18 as of July 2016, you can still apply for these benefits: