How does child support work for self employed

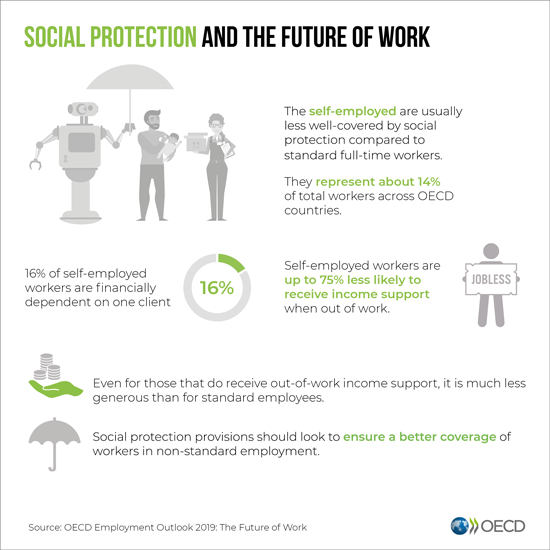

How Self-Employment Affects Child Custody And Support Obligations

According to the latest U.S. Census Bureau report, 14.6 million Americans, or one-tenth of the nation’s workforce, identifies as self-employed. With more people working for themselves than ever, calculating child support payments is becoming more complicated. If you or your former spouse is self-employed, be aware of how the court will use employment information to calculate support payments.

Self-Employment Income

Child support and spousal support payments depend heavily on a person’s reported income. While it is easier to calculate the support requirements of a person who receives a regular salary, an accurate accounting of self-employment income is possible when the self-employed person is forthright about his or her income and expenses.

A person who owns a business or is in business for themselves is not required to pay support based solely on how much money he or she earns. Self-employed parents are allowed to deduct business expenses from their gross profits, and their income will be calculated based on their net earnings.

Usually, self-employment income will be calculated based on a person’s tax returns, which must list the amount of income and expenses a person’s business earns each year. Additional information, like bank account statements, profit and loss statements, business ledgers, or financial affidavits can be used to create an accurate financial picture for the court. Often, a person who is self-employed will have to submit to a deposition, and answer questions about his or her financial state of affairs.

Hidden Self-Employment Income

Unfortunately, some self-employed parents will manipulate their income in order to make it appear as if they earn less money than they actually do. For example, a person could inflate their business expenses to make it seem as if they earned less net profit than they should have; other times, a business owner may list personal assets or other expenses in the company’s name, which will also confuse the calculations.

When a self-employed person attempts to hide assets or income, often his or her former spouse is the best resource to uncover the deception. Most people have a good understanding of their spouse’s standard of living—if the numbers change drastically once the marriage ends, there is a good chance that income is being hidden or expenses are being padded.

Most people have a good understanding of their spouse’s standard of living—if the numbers change drastically once the marriage ends, there is a good chance that income is being hidden or expenses are being padded.

If a self-employed spouse is not being truthful about his or her income, there are multiple legal options which can be used to create accurate numbers. In some cases, the self-employed person may be required to turn over financial documents, bank statements, and tax returns in order to justify his or her income. In other cases, attorneys for the spouse seeking support may hire investigators to search for hidden assets, or forensic accountants to search for mistakes or omissions.

Help For Spouses

If you are self-employed, and are unsure about how to accurately report your income for child support purposes, it is important to speak with an attorney about your obligations. Failing to report all of your income could result in several serious consequences, like fines, contempt of court, or being ordered to pay attorneys’ fees.

Alternatively, if you think that your self-employed spouse is hiding assets or lying about his or her income, consult with your attorney as soon as possible. At Pacific Northwest Family Law, we believe that all parents have an obligation to support their children as fully as possible, and will help you hold your spouse responsible for his or her fair share.

At Pacific Northwest Family Law, our attorneys are experienced with high-conflict divorces, and know how to hold deceptive spouses accountable. If you are getting a divorce or are navigating a complicated child custody matter you need to know what your options are. Call us at 360-926-9112 to schedule your appointment.

Collecting Child Support from a Self-Employed Parent

February 19, 2020

Child Support, Legal Blog

Custodial parents in North Carolina have the right to receive child support. This ensures both parents are financially supporting the child, and the burden does not fall entirely on one parent’s shoulders.

However, child support is not always straightforward.

If your child’s other parent is self-employed, you can run into several obstacles. This includes having a difficult time knowing the other parent’s true income and collecting the full amount. For instance, when a mother or father is a freelancer or runs their own business, it is easy to hide income and hard to garnish their wages.

Despite this, you have the right to collect support from a self-employed parent. And there are methods to do so. To learn more, contact a North Carolina child support lawyer at Breeden Law Office right away.

With over 15 years experience and offices in Raleigh, Garner, Angier, and Smithfield, attorney Breeden can help. Call (919) 205-5254 today or contact us online to schedule a consultation.

Calculating a Self-Employed Parent’s Child Support

The first step to collecting child support from a self-employed parent is getting an accurate accounting of their income. This can be difficult since he or she may receive income from several sources. In addition, how much they make could vary drastically. However, they likely keep track of how much they make.

In addition, how much they make could vary drastically. However, they likely keep track of how much they make.

Once the court knows how much the other parent makes, minus their ordinary expenses, it has the necessary amount to calculate child support.

The other parent must provide their income to the court. However, if the other parent refuses or you believe their information is inaccurate or incomplete, we can take steps to access the other parent’s tax return and bank account information.

Enforcing Child Support Orders From the Self-Employed

Very often, it is not the child support calculation that is the most difficult issue with a self-employed parent. Instead, the bigger problem is receiving the support you are entitled to.

When a parent is not receiving child support, wage garnishment is usually the first enforcement option. However, a self-employed parent does not necessarily have a steady paycheck to garnish.

Child Support Enforcement Options

If withholding income from their employer is not possible, then you can work with North Carolina Child Support Enforcement or return to court to pursue other options.

There re several options to obtain child support or pressure the other parent into paying:

- Seek child support payments directly from the other parent’s personal or business bank accounts.

- Petition to seize their tax refunds.

- Put a lien against their bank accounts, assets, or payments from their clients.

If these steps are not enough, and your child’s other parent becomes months behind, you can seek to have their driver’s license and professional credential revoked. This is a serious career limitation for doctors, nurses, lawyers, barbers, plumbers, electricians, and other licensed professionals.

Ultimately, if the other parent continues not to pay support, a judge can order them to be arrested and jailed for contempt. Your child’s other parent may be held in jail until the child support debt gets paid.

Let Our North Carolina Child Support Lawyers Help

Many self-employed parents are happy to work with the court or North Carolina Child Support Services to calculate and pay child support. However, others use their employment situation to their advantage, trying to make it seem like they do not make much money or intentionally not sending payments.

However, others use their employment situation to their advantage, trying to make it seem like they do not make much money or intentionally not sending payments.

If you are dealing with a self-employed parent who refused to pay court-ordered support, contact Breeden Law Office at (919) 205-5254 right away.

Alimony from self-employed citizens of the Russian Federation in 2022

Alimony from self-employed citizens of the Russian Federation in 2022 is withheld in the manner prescribed by the Family Code. In the article we will tell you how self-employed citizens in Russia pay alimony, what needs to be done in order for the child to receive a payment, and what will change if a self-employed person gets a permanent job under an employment contract.

Alimony from the self-employed: what the law says

A self-employed citizen is an individual who is a tax payer on professional income. The essence of self-employment is simple: if the taxpayer has income, he pays tax on it. If there is no income, there is no tax to pay. This tax regime is designed specifically for those who do not have regular customers and receive money irregularly - in case of downtime, you will not have to make mandatory payments from your own pocket.

If there is no income, there is no tax to pay. This tax regime is designed specifically for those who do not have regular customers and receive money irregularly - in case of downtime, you will not have to make mandatory payments from your own pocket.

The question arises: how can a self-employed person pay child support? He does not have a stable income, which means that it will not be possible to establish alimony as a percentage of the income received - in months without income, the child may be left without money. In this case, you should be guided by the rules of Art. 83 of the RF IC - it provides the possibility of collecting alimony in a fixed amount of money.

How the amount of alimony is calculated

The amount of alimony is determined by the court. The basis for the calculation is the subsistence minimum established in the region where the child lives - a certain percentage of this amount will be paid as alimony.

When calculating, the amount of mandatory expenses for a child is taken into account - they should be indicated in the statement of claim. If the child needs regular expensive treatment or additional education, the court may increase the amount of the payment. In addition, the court takes into account the standard of living of the payer - the higher it is, the greater the alimony will be assigned.

If the child needs regular expensive treatment or additional education, the court may increase the amount of the payment. In addition, the court takes into account the standard of living of the payer - the higher it is, the greater the alimony will be assigned.

The subsistence minimum is quarterly adjusted by the regional authorities - the amount of alimony for the self-employed changes after it.

Assignment of child support

ConsultantPlus has many ready-made solutions, including how to collect child support for minor children. If you don't have access to the system yet, sign up for a trial online access for free. You can also get the current K+ price list.

Alimony from self-employed citizens in a fixed amount of money is assigned in court (clause 1, article 83 of the RF IC). To do this, the parent with whom the child remains must file a lawsuit with the relevant requirement in court. In it, according to Art. 131 Code of Civil Procedure of the Russian Federation, you must specify:

- name of the court to which the plaintiff applies;

- information about the plaintiff and the defendant - full name, address, contact phone number;

- description of the circumstances of the current situation, information about the child, grounds for going to court;

- a request for a fixed amount of support due to the fact that the defendant is self-employed and has irregular, fluctuating earnings;

- list of documents attached to the claim.

If the parents were able to agree on the amount of alimony

If the parents were able to independently determine the amount that one of them will transfer to the other to meet the needs of the child, you can not go to court. The agreement must be sealed with an agreement (clause 1, article 80 of the RF IC). The agreement must be certified by a notary - otherwise it will be considered invalid (clause 1, article 100 of the RF IC).

The agreement must include the following information:

- procedure for calculating the amount of alimony;

- frequency and timing of money transfers;

- enumeration method.

How money is transferred

A self-employed person can transfer money to pay child support in the following ways:

- personally into the hands of the other parent with whom the child lives;

- by transfer to a bank account;

- postal order.

Documents confirming the transfer of money should be kept. If disputes arise in the future, it will be much easier to prove your good faith as a payer of alimony. If the money is transferred in cash, it is worth taking a receipt from the other parent for receiving it.

If disputes arise in the future, it will be much easier to prove your good faith as a payer of alimony. If the money is transferred in cash, it is worth taking a receipt from the other parent for receiving it.

What to do if a self-employed person does not pay alimony

If the alimony payer refuses to fulfill his obligations, the other parent (with whom the child remains) can apply to the bailiffs or to the bank where the payer has an account. Unpaid money will be forcibly withheld. But to receive payments through the employer (this is often done by bailiffs, sending a writ of execution to the accounting department of the enterprise) will not work, because the self-employed does not have an employer.

You need to apply to the bailiffs with a writ of execution - it is issued by the court. If there was no court, and the amount of alimony was established by an agreement on the payment of alimony, certified by a notary, submit this agreement to the bailiffs - it also has the force of a writ of execution (clause 2, article 100 of the RF IC).

If the self-employed person has taken up employment

If the self-employed person has entered into an employment contract, but has not ceased to be a payer of professional income tax, the amount of alimony may be recalculated. The payout will be calculated in one of the following ways:

- as a percentage of the payer's income - 25% for one child, 33% - for two children, 50% - for three or more children;

- by the combined method - part of the payment will be calculated as a percentage of the payer's permanent income, and part will be accrued as a fixed amount.

In order to recalculate, you will have to reapply to the court - it will take into account the circumstances that have arisen and establish a new procedure for calculating the amount of alimony.

Results

So, self-employed citizens do not have a permanent income, so the alimony they must pay is assigned in a fixed amount of money - for this you will have to go to court. If the parents of the child were able to agree on the amount of alimony on their own, you don’t have to go to court - it’s enough to conclude an agreement, fix the amount of the monthly payment in it and certify it with a notary.

If the parents of the child were able to agree on the amount of alimony on their own, you don’t have to go to court - it’s enough to conclude an agreement, fix the amount of the monthly payment in it and certify it with a notary.

how to use the application, how to register and pay taxes, how to generate and cancel a check, issue an invoice, withdraw money and close self-employment

Ekaterina Miroshkina

economist

Author profile

To become self-employed, all you need is a smartphone. You don’t have to go to the tax office, write an application and pay something.

The mobile application "My Tax" is available for the self-employed. It is necessary for those who want and can use the new special regime "Tax on professional income".

If you don't know what it is yet, read our articles:

- What is the self-employed tax.

- How the professional income tax deduction works.

- How to use special mode in different situations.

- 45 questions with short answers.

- Difficult questions on NAP.

- 10 myths you can't believe.

- Duties of the self-employed.

- Self-employed rights.

The Professional Income Tax Law came into force on January 1, 2019. In order to pay tax at preferential rates and work without a cash desk, you need to register - for this you need the My Tax application and a self-employed person's personal account.

- Source:

- Federal Tax Service

Here is the most detailed instruction on how to use all this.

What is the application "My tax" and how it works

"My tax" is an official application from the Federal Tax Service. Through it, the self-employed remotely interacts with the tax office.

The mobile application replaces the cash register and all reporting. Through it, self-employed people can register, accept payments from clients, generate checks and invoices, pay taxes, and request certificates from the tax office. There you can also apply to the pension fund and voluntarily pay insurance premiums to accrue pension points.

There you can also apply to the pension fund and voluntarily pay insurance premiums to accrue pension points.

Analytics tools are available in the My Tax application to evaluate your performance. For example, you can track how income has changed over the past months.

The app is available on Epstore and Google Play. Don't run into scammers: there are already fake apps on the Internet. Here are the correct links from the Federal Tax Service:

- "My tax" in Epstore.

- "My tax" in Google Play.

How to register as self-employed

Only those who apply through the application or web office and receive confirmation from the tax office will be able to apply the new special regime "Tax on professional income". You don’t need to fill out any paperwork and submit it to the tax office - everything is only via the Internet. There is no state duty for registration.

Through the My Tax application there are two ways to register - with a passport and with the help of a taxpayer's personal account. To register through your personal account, you will need a TIN and a password that is given in the tax office - you enter it to check property taxes. To register according to the document, you need to take a photo of your passport, take a selfie and send an application to the tax office for registration.

To register through your personal account, you will need a TIN and a password that is given in the tax office - you enter it to check property taxes. To register according to the document, you need to take a photo of your passport, take a selfie and send an application to the tax office for registration.

How to get a password from personal account

Registration through personal account will be faster, but you can also use your passportThe system will offer to confirm the phone number using the code from SMS. Without a code, the number will not be confirmed and registration will not pass. If you are already registered as self-employed, then after entering your phone number you will automatically be taken to your personal account.

Confirm phone number Then select a region. It does not take into account the place of residence, but the place of business. You can live in Orel, and provide services to a customer from Moscow. Professional income tax is valid throughout Russia. You decide which region to choose, but there should be only one.

You decide which region to choose, but there should be only one.

| Specify the place of business | You will not have to enter data, the application will scan documents and fill out the application itself |

| Check the details in the application for registration. If orange labels appear, they can be corrected manually. Sometimes you have to scan documents again |

If the photo is not recognized, you need to repeat everything. Sometimes you need to take a photo three times - be patient If the registration is successful, you will receive an SMS message and an notification will appear in the application If the registration is successful, you will receive an SMS message and an notification will appear in the application

If the photo is not recognized, you need to repeat everything. Sometimes you need to take a photo three times - be patient If the registration is successful, you will receive an SMS message and an notification will appear in the application If the registration is successful, you will receive an SMS message and an notification will appear in the application Then confirm the registration. If you agree, you will now become self-employed. At the very least, get access to the app's features: you can send checks and keep track of tax accruals.

You are one step away from legal work without a cash register and declarations. You can not confirm anything, then there will be no registration If the registration is successful, an SMS message will come and a notification will appear in the application If the registration is successful, an SMS message will come and a notification will appear in the application You also need to enter a PIN for access. Next, set up fingerprint or face ID login, depending on your phone. But this does not affect the operation of the application.

But this does not affect the operation of the application.

You can also register in the application with an account on public services.

Sometimes, after registration, a message appears that you have test access. This means that the tax checks the data. She has six days to do so. But checks can be generated and sent to customers right now. Keep an eye on the status: if something goes wrong, registration may be denied.

/guide/kak-stat-samozanyatym/

How to become self-employed

Through the web office for self-employed. The nalog.ru website has a taxpayer's personal account, which everyone already knows about. But - attention! - this is not the personal account through which the self-employed register. They have their own service and a separate personal account.

Here is the correct link for access and registration: https://lknpd.nalog.ru/

Through the web office, you can register only by TIN and password. You can't with a passport. But this option is suitable for those who do not have a smartphone or who do not want to download the application. The personal account for the special regime "Tax on professional income" is available from a desktop computer, even if you have a push-button telephone. The My Tax app won't come in handy here.

You can't with a passport. But this option is suitable for those who do not have a smartphone or who do not want to download the application. The personal account for the special regime "Tax on professional income" is available from a desktop computer, even if you have a push-button telephone. The My Tax app won't come in handy here.

When registering through the site, you also need to confirm your phone number and select a region.

You can register through the application, and send checks through the site - and vice versa. When you become self-employed, you can use any service. Income information is also available everywhere.

Registration with a password for public services is also available in the web account. If you have a verified account, you can use it to enter your personal account. But here you need to be very careful: at the first authorization in this way, automatic registration as a self-employed person will occur.

In the web account of the self-employed, everything is the same as in the applicationOptions for entering the personal account

By login and password. The TIN of the self-employed person serves as the login. Enter the password that is used in the personal account of an individual on the website of the Federal Tax Service. There is no separate password for the self-employed.

The TIN of the self-employed person serves as the login. Enter the password that is used in the personal account of an individual on the website of the Federal Tax Service. There is no separate password for the self-employed.

By phone number. Enter the phone number you provided when registering for self-employment. It will receive a message with a confirmation code.

Through public services. For access, you will need a login and password from a public services account.

How to reset your password if you forgot it. The web account does not have the usual "Recover password" button, because you enter using your phone number or password from the account of an individual or public services. Therefore, one of them will have to be restored.

How to use the My Tax application

Register, accept payments, receive notifications, generate certificates, pay taxes - all this can be done remotely through the My Tax mobile application. Next, we will tell you more about its capabilities.

Next, we will tell you more about its capabilities.

How to issue an invoice

According to the invoice, the customer or buyer transfers money to a self-employed person and takes the transfer into account in his accounting. First of all, legal entities request invoices, since they have more requirements for accounting.

To issue an invoice, select the "New Sale" section on the main page of the application. Then enter the name of the service or product, as well as the cost in rubles.

| If you are invoicing to an individual, please provide your full name and email address. If an individual entrepreneur or legal entity, enter its TIN and the name of the organization | The invoice can be saved in PDF format or immediately printed on paper |

How to generate and send a check

You need to generate a check for each receipt from customers. How you got the money doesn't matter. To a bank account, in cash or on a card - it's up to you. You create the check yourself.

You create the check yourself.

This must be done through the application or on the website.

Click the "New Sale" button Specify the amount, who paid for what. If the money is from a company or individual entrepreneur, you must specify the TIN. Indicate the amount, who paid for what and for what. If the money is from a company or individual entrepreneur, you must specify TINChoose a descriptive name for the service or product you are selling. Not “For an apartment”, but “For renting an apartment from January 1 to January 31”. This is important for both you and the client.

You can send a check in any way. For example, print it on paper and hand it in person or send it in a messenger.

Send a check by SMS or email to the client. Or let me read the QR code from your phone. At the same time, the tax office will also receive this checkHow to cancel a check

If there is an error in the check or the client had to return the money, the check can be canceled or corrected. The adjustment is carried out by reissuing a check: first you cancel the old one, and then generate a new one for the same date. Simply making changes to an already generated receipt will not work.

The adjustment is carried out by reissuing a check: first you cancel the old one, and then generate a new one for the same date. Simply making changes to an already generated receipt will not work.

The terms within which checks can be canceled are not specified in the law.

In the My Tax application, you can cancel any check - starting from the day you registered self-employment. You can also create checks retroactively: the system will allow.

The program cancels the check, recalculates the amount of income and tax from it. The result will immediately be displayed in your personal account. The check will still be visible with a note that it has been canceledHow to find out how much tax has been accrued

You do not need to calculate taxes yourself. Everything happens automatically. The rate depends on who you indicated on the check. If the money came from an individual, the tax will be charged at a rate of 4%. From a company or individual entrepreneur - at a rate of 6%. Taking into account the deduction of the bets, they come out less, but all this is also considered without your participation.

Taking into account the deduction of the bets, they come out less, but all this is also considered without your participation.

You can immediately see the accrued tax in the application or in your personal account. That is, you do not have to wait for the next month - you can immediately monitor how much money you have to pay to the budget from each sale.

| All checks and accrued taxes are visible in the application | Provisional charges from each sale are displayed immediately, and not only at the end of the month not only at the end of the month Provisional tax is what you accrued during the month. You do not need to pay this amount right away. The payment deadline is the 25th of the following month. So what? 09/23/19 How to confirm income for the self-employed when applying for a loan Debt is something that it was time to pay. Penalties are charged on this amount. How to pay taxes through "My tax" The application will automatically calculate the final payment amount no later than the 12th day of the next month. Tax can be paid in two ways:

How to confirm the status of self-employedFor this, a separate certificate is generated - also in the My Tax application or on the website from a computer. On the part of the tax inspectorate, it is signed with an electronic signature and has the same legal force as a paper one. In the web office, it is already possible to generate a certificate. This is confirmation that you are self-employed. The same can be done from the phone.

|

You will receive a notification about the need to pay off the debt.

You will receive a notification about the need to pay off the debt.  The card can be unlinked at any time.

The card can be unlinked at any time.  Taxes will have to be paid in other regimes. An individual entrepreneur, for example, has only 20 days to choose another special mode. You don’t automatically switch to simplified taxation - you can suddenly find yourself on the general taxation system and get on VAT.

Taxes will have to be paid in other regimes. An individual entrepreneur, for example, has only 20 days to choose another special mode. You don’t automatically switch to simplified taxation - you can suddenly find yourself on the general taxation system and get on VAT.  Technical work will be reported on the website of the Federal Tax Service.

Technical work will be reported on the website of the Federal Tax Service.